UPSC Exam > UPSC Notes > Current Affairs & Hindu Analysis: Daily, Weekly & Monthly > The Hindu Editorial Analysis- 24th July 2024

The Hindu Editorial Analysis- 24th July 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Union Budget 2024-25 No Signs of Learning

Why in News?

The Union Budget for the financial year 2024-25 was tabled in the Parliament by Finance Minister Nirmala Sitharaman earlier yesterday. This was the seventh budget presented by the current FM and the first one of Prime Minister Narendra Modi-led government's third term.

- "India's economic growth stands out and will continue to do so in the future," stated the Finance Minister during her budget speech.

- The world economy is doing better than anticipated but faces uncertainties in policies.

- There are notable risks to growth and inflation may rise, according to her.

- The Finance Minister outlined nine key areas of focus for the current and upcoming years:

- Improving productivity and resilience in farming

- Enhancing employment opportunities and skill development

- Promoting inclusive human resource development and social justice

- Boosting manufacturing and services

- Advancing urban development

- Ensuring energy security

- Developing infrastructure

- Fostering innovation and research

- Implementing next-generation reforms

- This strategy aims at creating jobs and increasing consumer spending, which could benefit industries like consumer goods, real estate, and automobiles.

- Despite this, there were no significant alterations in personal income tax, disappointing many employed individuals.

- "This budget emphasizes job creation, skill development, support for micro, small, and medium enterprises (MSMEs), and the middle class," mentioned the Finance Minister.

From income tax to employment benefits, let's take a look at the 14 key highlights of the 2024 Budget:

Capex

For the financial year 2025, the government has set aside ₹11.11 lakh crore for capital spending, which is 3.4% of India's GDP. This amount was planned in February and is higher than last year's revised estimate of ₹9.5 lakh crore.

Tax

- Income Tax: The Finance Minister has proposed changes in the new tax system - the standard deduction is set to increase to ₹75,000 from ₹50,000.

- In the new tax structure, tax rates will be adjusted as follows:

- (in ₹) 0-3L - Zero

- 3-7L - 5%

- 7-10L - 10%

- 10-12L - 15%

- 12-15L - 20%

- 15L & above - 30%

- Under the new tax system, salaried employees can save up to ₹17,500 in income tax, according to the Finance Minister.

- Capital gains tax: Long-term capital gains on all assets will now face a 12.5% tax, up from the previous 10%. Short-term capital gains tax has been raised to 20% from 15%. The exemption limit for capital gains will be ₹1.25 lakh per year.

- For Futures and Options (F&O), the STT rate has been doubled from 0.01% to 0.02%, impacting traders who deal in equity and index.

- The government has announced the elimination of Angel Tax.

Customs Duty

- The Finance Minister proposed reducing Basic Customs Duty (BCD) on mobile phones, mobile PCDA, and mobile charges to 15% due to the maturity of the Indian mobile industry.

- Customs duty on gold and silver will be lowered to 6%, and on platinum to 6.4%.

- BCD will increase from 10% to 15% on printed circuit board assemblies for specific telecom equipment.

- Customs duties have been exempted on 25 crucial minerals, with reduced BCD on two of them.

Employment and Skilling

- The Finance Minister introduced a PM Package with five schemes worth ₹2 lakh crore to enhance employment and skill development, with ₹1.48 lakh crore allocated for education, employment, and skilling.

- Job Creation:

- Three schemes will be implemented to provide employment-linked incentives, focusing on EPFO enrollment and support for first-time employees.

- New hires can receive up to ₹15,000 in direct benefit transfers in three installments, with a salary cap of ₹1 lakh per month.

- Employers will be reimbursed up to ₹3,000 per month for two years for each new employee, aiming to create 50 lakh new jobs.

- A program will also offer internships to one crore youths over five years, and rental housing for industrial workers will be facilitated in PPP mode.

Women Empowerment

- Increasing women's workforce participation is a top priority.

- Over \u20b93 lakh crore is allocated for programs benefiting women and girls.

- This involves establishing hostels and developing specialized skilling programs for women.

Agriculture and Rural Development

- Agricultural Sector: ₹1.52 lakh crore will be dedicated to farming and related areas. An extensive assessment of farming research will be carried out to boost output and create varieties that can withstand climate challenges.

- Rural Development: ₹2.66 lakh crore will be allotted for initiatives in rural development.

- Effort to introduce 1 crore farmers to organic farming within 2 years.

Bihar and Andhra Pradesh

- Assistance for Bihar: The budget will speed up the Bihar government's request for help from global development banks. New airports, healthcare centers, sports facilities, and ₹26,000 crore for roads in Bihar will be financially supported.

- Financial Support for Andhra Pradesh: ₹15,000 crore will be set aside for Andhra Pradesh, with more funds in the future to aid the Pollavaram irrigation project and other investments for economic progress.

MSME and Manufacturing

- A new plan is set to aid small and medium-sized enterprises (MSMEs) in securing loans for purchasing machinery and equipment without needing collateral.

- A fund of about ₹100 crore will be established to provide credit guarantees for MSMEs operating in the manufacturing sector.

- There will be a technology support package introduced to assist MSMEs.

- SIDBI is planning to inaugurate 24 additional branches to cater to clusters of MSMEs.

Financial Initiatives

- Mudra Loans: The limit for Mudra loans will be increased to ₹20 lakh from ₹10 lakh for those who have previously availed and repaid their loans.

- Higher Education Loans: Financial support for loans up to ₹10 lakh for higher education will be provided, with the government giving e-vouchers directly to 1 lakh students each year, including a 3 percent interest subsidy.

- Insolvency and Bankruptcy Code (IBC): A single tech platform will be established to improve outcomes under the IBC, ensuring more consistency, transparency, and better supervision. The IBC has resolved more than 1,000 companies, recovering ₹3.3 lakh crore for creditors and settling 28,000 cases involving over ₹10 lakh crore prior to admission.

- FDI rules to be further simplified: The Finance Minister mentioned that rules and acknowledgment for Foreign Direct Investments (FDIs) will be made clearer to encourage their influx.

Infra and Development

- Infrastructure: An extra ₹26,000 crore will be dedicated to projects improving road connections.

- Critical Mineral Mission: A new plan will be created for reusing important minerals and acquiring them from abroad. The first set of offshore areas for mining will be auctioned.

- Affordable Housing: A sum of ₹10 lakh crore will be used to cater to the housing requirements of 1 crore urban poor and middle-class households. The PM Surya Ghar Muft Bijli Yojana will set up rooftop solar panels for 1 crore homes.

- Nuclear and Space: The government will collaborate with private businesses to establish Bharat small reactors, research and develop Bharat small modular reactors, and explore new technologies for nuclear energy. The Finance Minister mentioned a sustained focus on expanding the space sector by fivefold in the upcoming decade. To support this objective, a venture capital fund of ₹1,000 crore will be initiated.

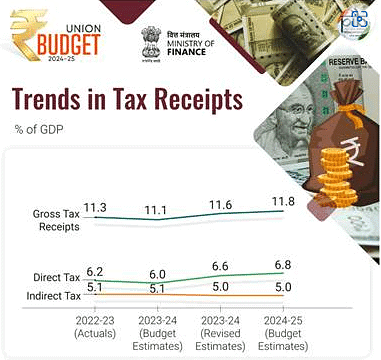

Budget estimates for FY25

- Fiscal deficit estimate reduced to 4.9% of GDP from 5.1% in the temporary Budget.

- Finance Minister aims to achieve a fiscal deficit below 4.5% by FY26.

- Market borrowing has been cut to ₹14.01 lakh crore from ₹15.43 lakh crore for FY24.

- Projected receipts for FY25 amount to ₹32.07 lakh crore.

- Expected expenditure for FY25 stands at ₹48.21 lakh crore.

The document The Hindu Editorial Analysis- 24th July 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC is a part of the UPSC Course Current Affairs & Hindu Analysis: Daily, Weekly & Monthly.

All you need of UPSC at this link: UPSC

|

38 videos|5293 docs|1118 tests

|

Related Searches