Karnataka Budget Analysis 2023-2024 | KPSC KAS Preparation: All subjects - KPSC KAS (Karnataka) PDF Download

Budget Estimates for 2023-24

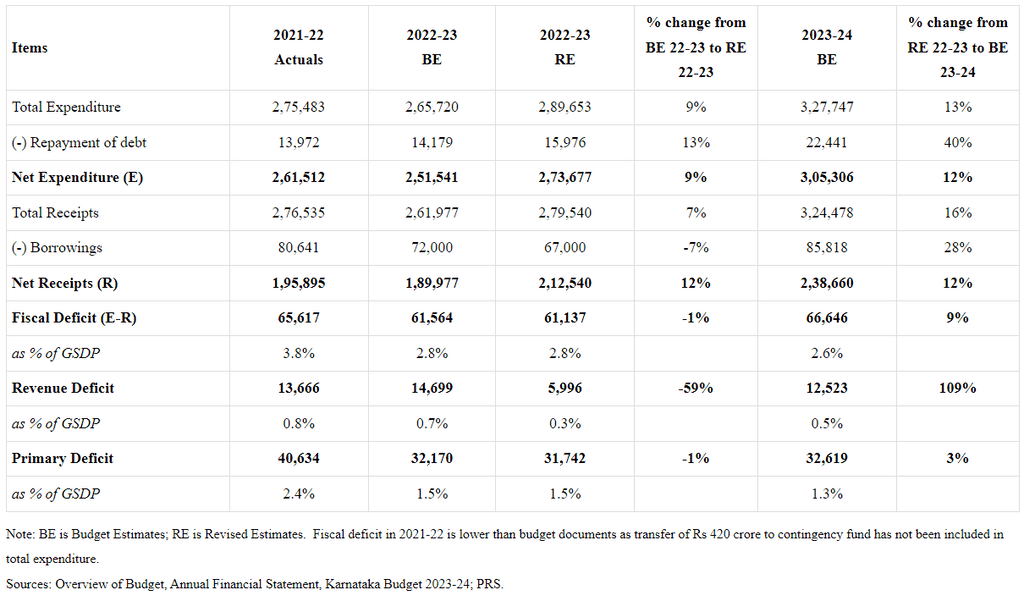

- The total expenditure (excluding debt repayment) for 2023-24 is projected at Rs 3,05,306 crore, marking a 12% increase over the revised estimate for 2022-23. This expenditure is expected to be covered by receipts (excluding borrowings) of Rs 2,38,660 crore and net borrowings of Rs 63,377 crore. Total receipts for 2023-24 (excluding borrowings) are anticipated to rise by 12% compared to the revised estimates for 2022-23.

- The revenue deficit for 2023-24 is estimated to be 0.5% of GSDP (Rs 12,523 crore). In 2022-23, the revised estimate for the revenue deficit is expected to be 0.3% of GSDP (Rs 5,996 crore), which is lower than the budget estimate of Rs 14,699 crore (0.7% of GSDP). The fiscal deficit for 2023-24 is targeted at 2.6% of GSDP (Rs 66,646 crore), staying within the 3.5% GSDP limit set by the central government (with 0.5% of GSDP available upon undertaking power sector reforms).

- In 2022-23, both the revenue and fiscal deficits are expected to be lower than the budget estimates. This may be due to receipts (excluding borrowings) being 12% higher than the budget estimate, while expenditure (excluding debt repayment) is estimated to be 9% higher.

Table 1: Budget 2023-24 - Key figures (in Rs crore)

Expenditure in 2023-24

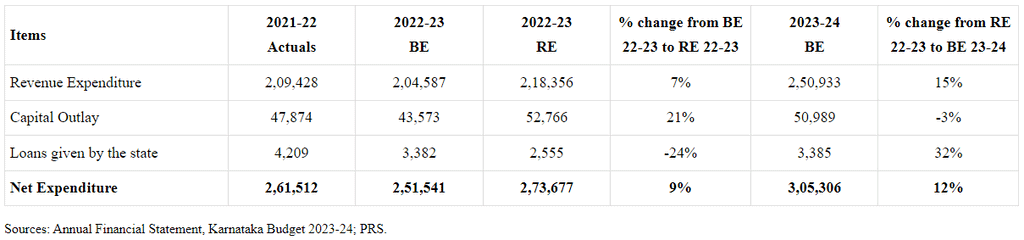

- Revenue expenditure for 2023-24 is proposed at Rs 2,50,933 crore, reflecting a 15% increase over the revised estimate for 2022-23. This expenditure covers salaries, pensions, interest, grants, and subsidies. For 2022-23, revenue expenditure is expected to be 7% higher than the budget estimate.

- Expenditure on Five Guarantees in 2023-24:

- Starting from 2023-24, the state government will implement five guarantees, with an estimated annual cost of Rs 52,000 crore. For the period from July to March 2023-24, the state has budgeted Rs 39,825 crore for these schemes, representing 16% of Karnataka’s budgeted revenue expenditure for the year.

- The Gruha Lakshmi scheme, which provides Rs 2,000 per month to the woman head of a family, is expected to cost Rs 17,500 crore in 2023-24, accounting for 44% of the total budgeted expenditure on the five schemes. The Annabhagya scheme, aimed at providing additional foodgrains, has been allocated Rs 10,275 crore.

- Capital outlay for 2023-24 is proposed at Rs 50,989 crore, which is a 3% decrease from the revised estimate for 2022-23. Capital outlay refers to the expenditure for asset creation. In 2022-23, the capital outlay is estimated to be 21% higher than the budget estimate.

Table 2: Expenditure budget 2023-24 (in Rs crore)

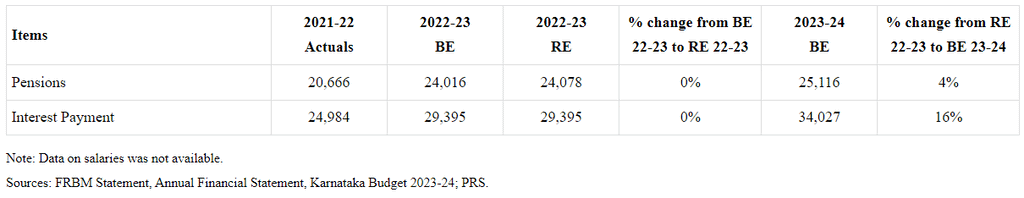

Committed Expenditure: Committed expenditure for a state generally includes spending on salaries, pensions, and interest payments. A higher allocation towards committed expenditure reduces the state's flexibility to prioritize other spending areas, such as capital outlay. In 2023-24, Karnataka is expected to allocate 14% of its revenue receipts to interest payments and 11% to pensions.

Table 3: Committed Expenditure in 2023-24 (in Rs crore)

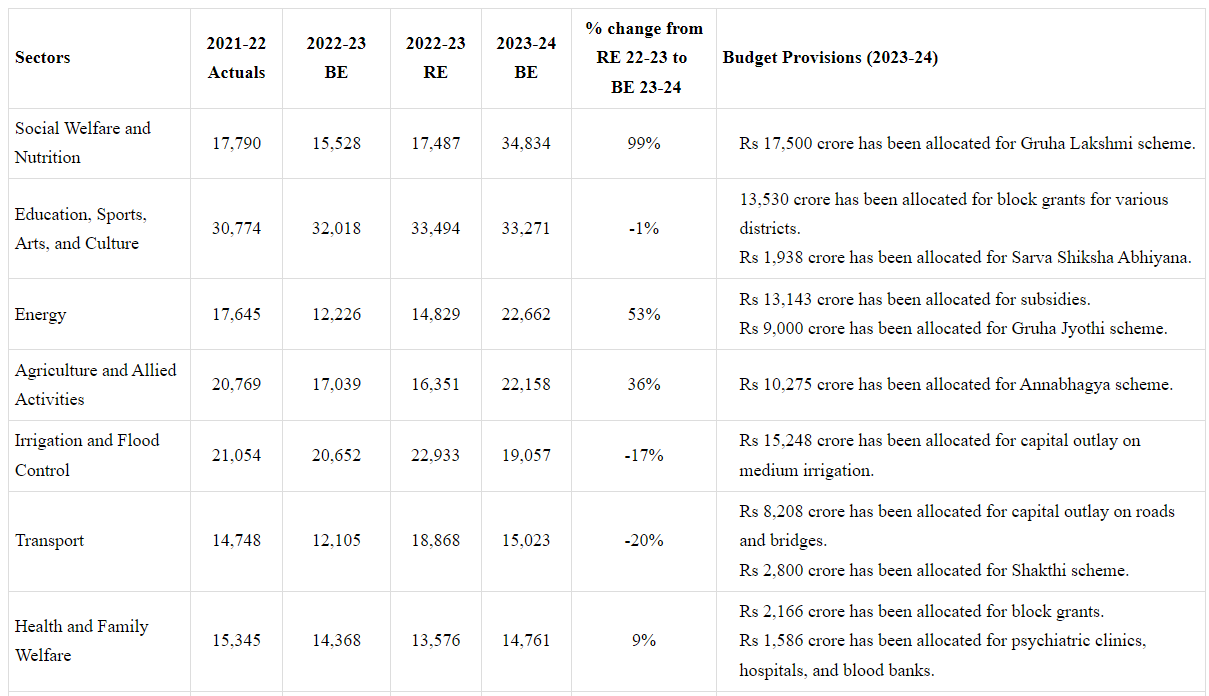

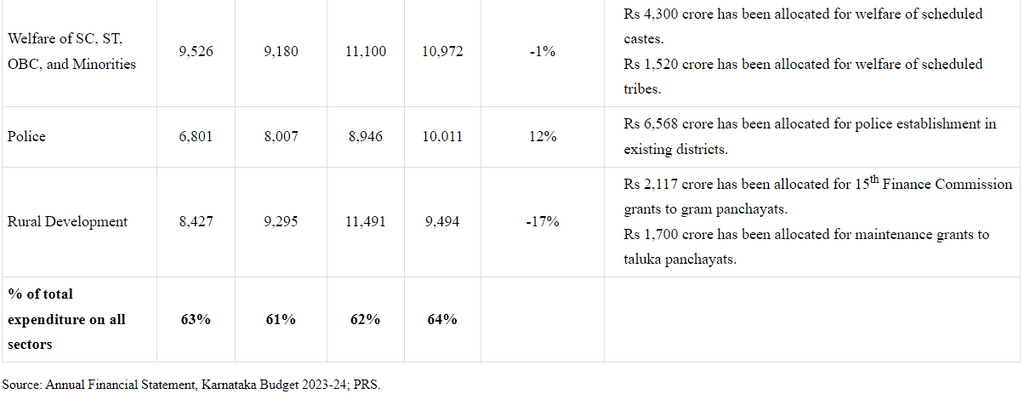

Sector-wise Expenditure: The sectors outlined below represent 64% of the total sector-wise expenditure by the state for 2023-24. Annexure 1 provides a comparison of Karnataka’s spending on key sectors with that of other states.

Table 4: Sector-wise expenditure under Karnataka Budget 2023-24 (in Rs crore)

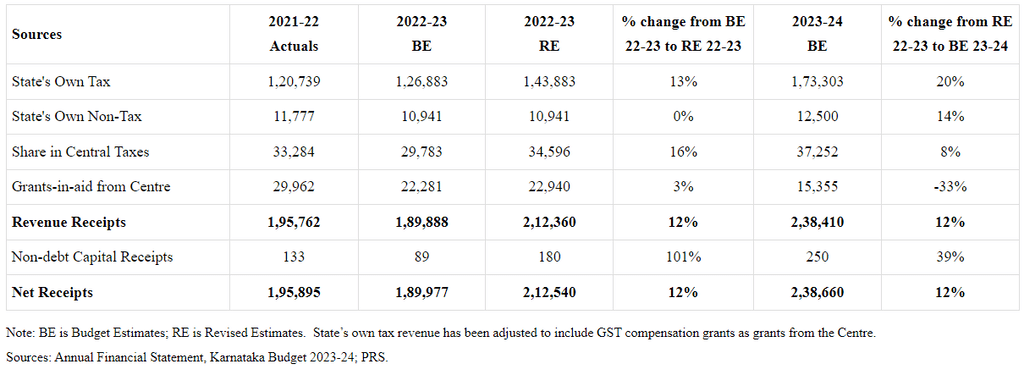

Receipts in 2023-24

- Total Revenue Receipts: For 2023-24, total revenue receipts are projected to be Rs 2,38,410 crore, marking a 12% increase over the revised estimate for 2022-23. Of this amount, Rs 1,85,803 crore (78%) will be generated through the state’s own resources, while Rs 52,607 crore (22%) will come from the central government. The central resources will consist of the state's share in central taxes (16% of revenue receipts) and grants (6% of revenue receipts).

- Devolution: The state's share in central taxes for 2023-24 is estimated at Rs 37,252 crore, which represents an 8% increase over the revised estimate for 2022-23.

- Grants from the Centre: Grants from the central government for 2023-24 are estimated at Rs 15,355 crore, a 33% decrease from the revised estimates for 2022-23. This decline may be due to a reduction in GST compensation grants, which are expected to fall by 78% in 2023-24 compared to the revised estimate for 2022-23. In 2022-23, GST compensation grants were revised to Rs 10,548 crore, up from the budget estimate of Rs 5,000 crore. Excluding GST compensation grants, grants from the Centre are expected to decrease by 28% at the revised estimate stage compared to the budget estimate. Under the Jal Jeevan Mission, Karnataka is anticipated to receive only Rs 10 crore in 2022-23 as per the revised estimate, compared to the budget estimate of Rs 1,500 crore.

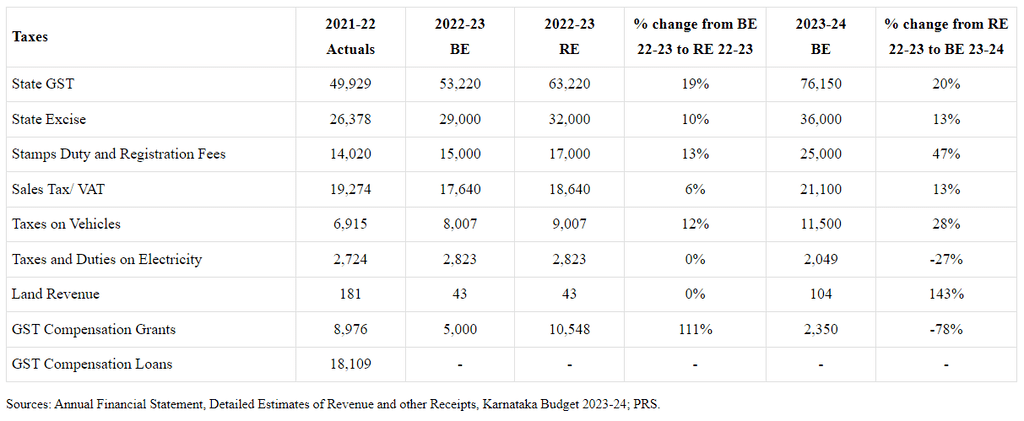

- State’s Own Tax Revenue: Karnataka’s total own tax revenue for 2023-24 is estimated at Rs 1,73,303 crore, a 20% increase over the revised estimate for 2022-23. The own tax revenue as a percentage of GSDP is projected to be 6.8% in 2023-24. For 2022-23, this ratio was initially estimated at 5.8%, but revised estimates suggest it will be higher at 6.6%. In 2021-22, the ratio of own tax revenue to GSDP was 7%.

Table 5: Break-up of the state government’s receipts (in Rs crore)

- In 2023-24, State GST (SGST) is expected to be the largest source of Karnataka’s own tax revenue, contributing 44% of the total. SGST revenue is projected to increase by 20% compared to the revised estimate for 2022-23. For 2022-23, SGST revenue is anticipated to be 19% higher than the budget estimate at the revised estimate stage.

- State excise is expected to account for 21% of Karnataka’s own tax revenue in 2023-24 and is projected to grow by 13% compared to the revised estimate for 2022-23.

- Revenue from stamp duty and registration fees, sales tax/VAT, and taxes on vehicles is estimated to rise by 47%, 13%, and 28%, respectively, in 2023-24 compared to the revised estimates for 2022-23.

Table 6: Major sources of state’s own-tax revenue (in Rs crore)

Deficits, Debt, and FRBM Targets for 2023-24

The Karnataka Fiscal Responsibility Act (KFRA), 2002 sets annual targets to progressively reduce the state's outstanding liabilities, revenue deficit, and fiscal deficit.

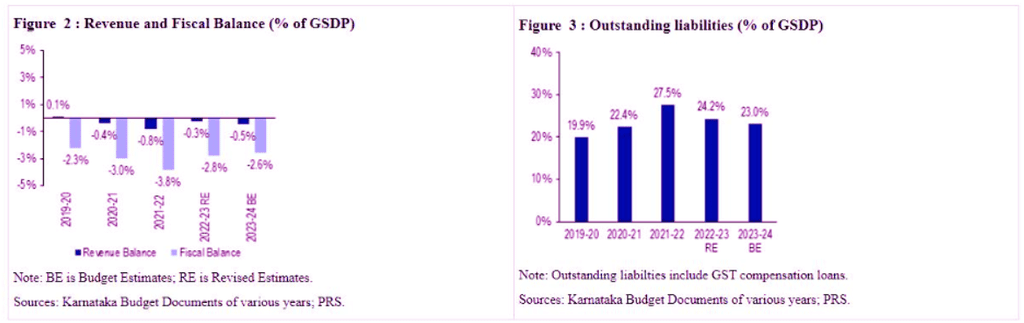

- Revenue Deficit: This is the difference between revenue expenditure and revenue receipts. A revenue deficit indicates that the government needs to borrow to cover expenses that do not increase assets or reduce liabilities. The KFRA required the state government to eliminate the revenue deficit by 2006. Since 2020-21, Karnataka has consistently reported a revenue deficit. For 2023-24, the revenue deficit is estimated at Rs 12,523 crore (0.5% of GSDP). In 2022-23, the revised estimate for the revenue deficit is Rs 5,996 crore (0.3% of GSDP), which is lower than the budgeted deficit of Rs 14,699 crore (0.7% of GSDP).

- Off-Budget Borrowings: These are borrowings by government-owned entities like special purpose vehicles and public sector enterprises, with debt servicing covered through budgetary resources. This practice can understate debt and deficit figures. As of March 31, 2022, Karnataka’s off-budget borrowings were Rs 16,682 crore. The highest off-budget borrowings were by Krishna Bhagya Jala Nigam Ltd (Rs 6,252 crore), followed by Karnataka Neeravari Nigama Ltd (Rs 3,673 crore) and Cauvery Neeravari Nigama Limited (Rs 2,768 crore). The 15th Finance Commission advised against off-budget borrowings, noting they compromise fiscal transparency and sustainability, and urged timely clearing of these obligations by mobilizing additional resources.

- Fiscal Deficit: This is the difference between total expenditure and total receipts, which is filled by government borrowings and increases total liabilities. For 2023-24, the fiscal deficit is estimated at 2.6% of GSDP. The central government has allowed a fiscal deficit of up to 3.5% of GSDP for states in 2023-24, with 0.5% of GSDP available only if power sector reforms are implemented. According to revised estimates, the fiscal deficit for 2022-23 is expected to be 2.8% of GSDP, slightly lower than the budget estimate of 2.82% of GSDP.

- Outstanding Liabilities: These represent the total borrowings accumulated by the end of a financial year, including any public account liabilities. By the end of 2023-24, outstanding liabilities are projected to be 23% of GSDP, down from 27.5% of GSDP in 2021-22.

- Outstanding Government Guarantees: Outstanding liabilities of states do not account for certain contingent liabilities that may need to be honored under specific circumstances. State governments often guarantee borrowings of State Public Sector Enterprises (SPSEs) from financial institutions. As of March 31, 2022, Karnataka had outstanding guarantees amounting to Rs 33,192 crore, which is 1.9% of GSDP.

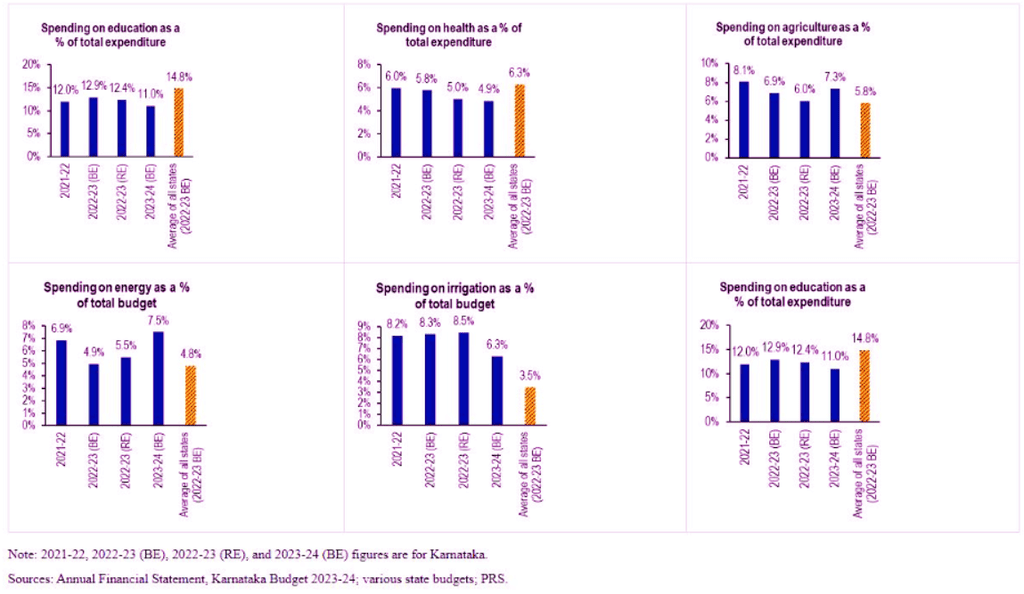

Annexure 1: Comparison of states’ expenditure on key sectors

The graphs below compare Karnataka’s expenditure in 2023-24 across six key sectors as a percentage of its total expenditure on all sectors. The average for each sector reflects the expenditure by 31 states, including Karnataka, based on their budget estimates for 2022-23.

- Education: Karnataka has allocated 11% of its expenditure to education in 2023-24, which is below the average allocation of 14.8% by states in 2022-23.

- Health: Karnataka has dedicated 4.9% of its total expenditure to health, lower than the average allocation of 6.3% by states.

- Agriculture: Karnataka has allocated 7.3% of its expenditure to agriculture, which is above the average allocation of 5.8% by states.

- Energy: Karnataka has allocated 7.5% of its total expenditure to energy, surpassing the average allocation of 4.8% by states.

- Irrigation: Karnataka has earmarked 6.3% of its total expenditure for irrigation, higher than the average allocation of 3.5% by states.

- Roads and Bridges: Karnataka has allocated 3.4% of its total expenditure to roads and bridges, which is lower than the average allocation of 4.5% by states.

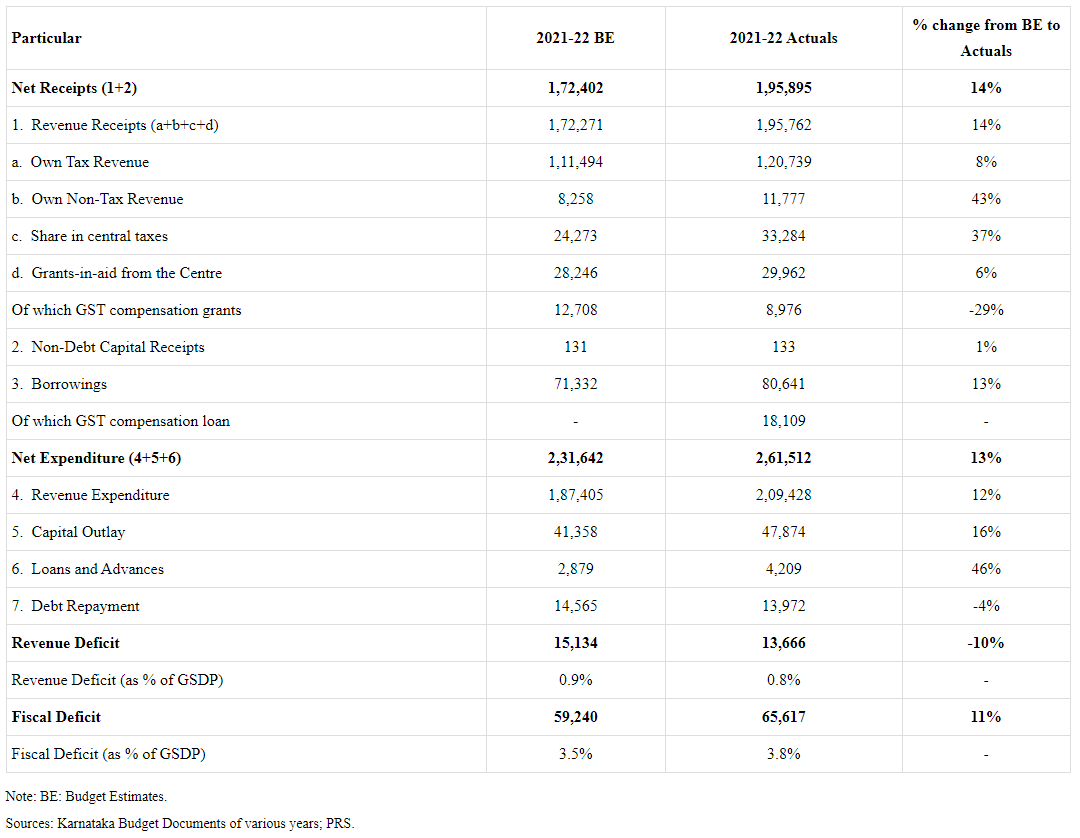

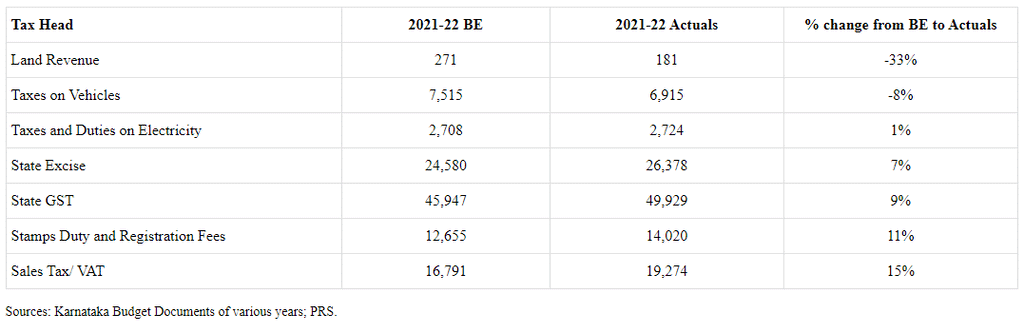

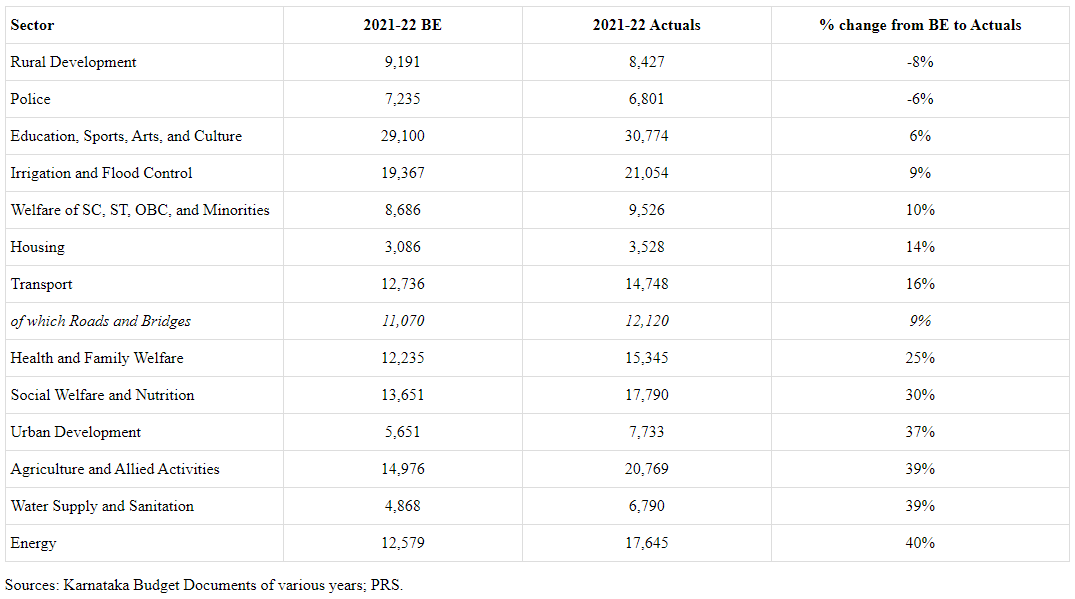

Annexure 2: Comparison of 2021-22 Budget Estimates and Actuals

The following tables compare the actuals of 2021-22 with budget estimates for that year.

Table 7: Overview of Receipts and Expenditure (in Rs crore)

Table 8: Key Components of State's Own Tax Revenue (in Rs crore)

Table 9: Allocation towards Key Sectors (in Rs crore)

|

82 videos|83 docs

|

FAQs on Karnataka Budget Analysis 2023-2024 - KPSC KAS Preparation: All subjects - KPSC KAS (Karnataka)

| 1. What are the key highlights of Karnataka's Budget Analysis for 2023-24? |  |

| 2. What is the significance of understanding Fiscal Deficit in Karnataka's Budget Analysis for 2023-24? |  |

| 3. How does Karnataka's Budget 2023-24 address the benefits for gig workers? |  |

| 4. What are the key components of Revenue Expenditure in Karnataka's Budget 2023-24? |  |

| 5. How does the Capital Outlay in Karnataka's Budget 2023-24 contribute to the state's development goals? |  |