PIB Summary- 24th July, 2024 | PIB (Press Information Bureau) Summary - UPSC PDF Download

Union Budget 2024-25

Context

Recently, Union Budget 2024-25 was presented in the Parliament. It was the first general budget of the 18th Lok Sabha.

Budget Theme

Focus Areas:

- Employment

- Skilling

- MSMEs

- Middle Class

Prime Minister’s Package:

- Schemes: 5 initiatives to support employment and skilling

- Target: 4.1 crore youth over 5 years

- Central Outlay: ₹2 lakh crore

- Allocation for 2024-25: ₹1.48 lakh crore for education, employment, and skilling

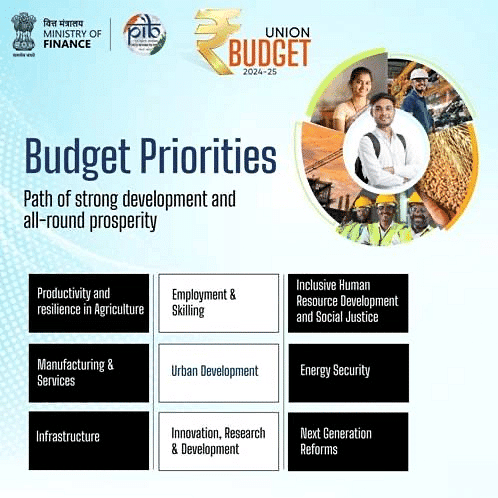

Budget Priorities

Priority 1: Agriculture Productivity and Resilience

Review:

- Comprehensive evaluation of agricultural research to boost productivity

New Varieties:

- Release of 109 high-yielding, climate-resilient crop varieties (32 field and horticulture crops)

Natural Farming:

- Introduce 1 crore farmers to natural farming over 2 years

- Certification and branding support

Bio-Input Resource Centers:

- Establish 10,000 centers

Self-Sufficiency in Pulses and Oilseeds:

- Enhance production, storage, and marketing of mustard, groundnut, sesame, soybean, and sunflower

Digital Public Infrastructure (DPI):

- Implement DPI in agriculture with state partnerships over 3 years

Funding for 2024-25:

- ₹1.52 lakh crore for agriculture and allied sectors

Priority 2: Employment & Skilling

Employment Schemes:

- 3 schemes under the Prime Minister’s package focusing on EPFO enrollment, first-time employees, and support for employers and employees

Women Workforce:

- Establish working women hostels and creches in collaboration with industry

Skilling Initiatives:

- New scheme for skilling 20 lakh youth over 5 years

- Upgrade 1,000 Industrial Training Institutes

- Revise Model Skill Loan Scheme: Loans up to ₹7.5 lakh

Higher Education Support:

- Loans up to ₹10 lakh for higher education in domestic institutions

- E-vouchers for 1 lakh students annually with 3% interest subsidy

Priority 3: Inclusive Human Resource Development and Social Justice

Economic Support:

- Enhance schemes for craftsmen, artisans, self-help groups, SCs, STs, women entrepreneurs, and street vendors (e.g., PM Vishwakarma, PM SVANidhi, National Livelihood Missions, Stand-Up India)

Purvodaya Plan:

- Development of eastern region (Bihar, Jharkhand, West Bengal, Odisha, Andhra Pradesh)

Pradhan Mantri Janjatiya Unnat Gram Abhiyan:

- Improve socio-economic conditions for tribal communities in 63,000 villages, benefiting 5 crore people

Banking Expansion:

- Set up 100 India Post Payment Bank branches in the North East

Funding for 2024-25:

- ₹2.66 lakh crore for rural development and infrastructure

Priority 4: Manufacturing & Services

Support for MSMEs:

- Guarantee fund up to ₹100 crore for MSMEs

- Enhanced credit assessment and support during financial stress

Mudra Loans:

- Increase limit to ₹20 lakh for successful borrowers

Food Irradiation and Quality Testing:

- Support for 50 multi-product food irradiation units and 100 quality testing labs

E-Commerce Export Hubs:

- Establish in PPP mode to assist MSMEs and artisans

Internships:

- Provide internships in 500 top companies to 1 crore youth over 5 years

Priority 5: Urban Development

Urban Housing:

- PM Awas Yojana Urban 2.0: Address housing needs of 1 crore families with ₹10 lakh crore investment

- Central assistance of ₹2.2 lakh crore over 5 years

Water Supply and Sanitation:

- Promote projects in 100 large cities with state and multilateral support

PM SVANidhi Scheme:

- Develop 100 weekly ‘haats’ or street food hubs annually

Priority 6: Energy Security

PM Surya Ghar Muft Bijli Yojana:

- Install rooftop solar plants to provide free electricity up to 300 units per month for 1 crore households

- Over 1.28 crore registrations and 14 lakh applications received

Nuclear Energy:

- Significant role in future energy mix

Priority 7: Infrastructure

Capital Expenditure:

- ₹11,11,111 crore allocated (3.4% of GDP)

Pradhan Mantri Gram Sadak Yojana (PMGSY):

- Phase IV to provide all-weather connectivity to 25,000 rural habitations

Irrigation and Flood Management:

- Financial support for Bihar, Assam, Himachal Pradesh, Uttarakhand, and Sikkim for flood management and irrigation projects

- Includes Kosi-Mechi intra-state link and other schemes

Priority 8: Innovation, Research & Development

Anusandhan National Research Fund:

- Support for basic research and prototype development with ₹1 lakh crore financing pool

Space Economy:

- Expand space economy by 5 times in the next 10 years

- Set up ₹1,000 crore venture capital fund

Priority 9: Next Generation Reforms

Economic Policy Framework:

- Formulate framework for economic development and next-generation reforms

Labour Reforms:

- Integrate e-shram portal with other services

- Revamp Shram Suvidha and Samadhan portals

Climate Finance:

- Develop taxonomy for climate finance to enhance capital availability

Foreign Investments:

- Simplify rules for FDI and overseas investments

NPS Vatsalya:

- Plan for minor’s contributions, convertible to normal NPS account

New Pension Scheme (NPS):

- Review and evolve solution maintaining fiscal prudence

Budget Estimates 2024-25

Receipts and Expenditure:

- Total receipts (excluding borrowings): ₹32.07 lakh crore

- Total expenditure: ₹48.21 lakh crore

Net Tax Receipts:

- Estimated at ₹25.83 lakh crore

Fiscal Deficit:

- Estimated at 4.9% of GDP

Market Borrowings:

- Gross borrowings: ₹14.01 lakh crore

- Net borrowings: ₹11.63 lakh crore

Fiscal Consolidation:

- Aim to reduce deficit below 4.5% next year

Budget 2024-25: Tax Reforms and Simplification

Review and Simplification of Taxes

Direct and Indirect Taxes:

- The Union Budget 2024-25 aims to review and simplify both direct and indirect taxes within the next six months.

- Focus includes reducing tax incidence and compliance burdens and broadening the tax base.

- Comprehensive rationalization of GST and review of Customs Duty rates to improve the tax base and support domestic manufacturing.

Income Tax Act Review:

- The Income Tax Act will be reviewed to minimize disputes, reduce litigation, and make the Act clearer and more concise.

- Simplification efforts have been well-received, with over 58% of corporate tax revenue coming from the simplified regime in 2022-23.

- More than two-thirds of taxpayers have shifted to the new personal income tax regime.

Standard Deductions and Tax Regime Changes

Standard Deduction:

- Increased from ₹50,000 to ₹75,000 for salaried employees opting for the new tax regime.

- Deduction for family pensioners raised from ₹15,000 to ₹25,000.

Assessment Reopening:

- Assessments can be reopened up to 5 years from the end of the assessment year if escaped income exceeds ₹50 lakh.

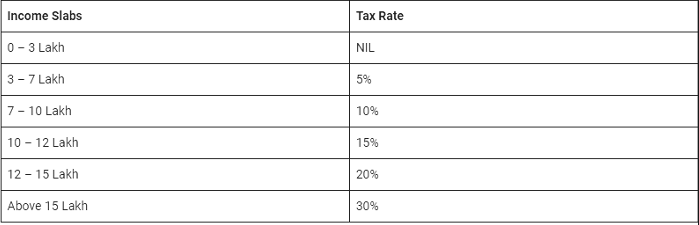

Revised Tax Rates:

- New tax regime structure offers potential benefits up to ₹17,500 for salaried employees. Tax rates are as follows:

Support for Investment and Employment

Angel Tax:

- Abolished for all investors to boost the start-up ecosystem.

Foreign Shipping Companies:

- Proposed a simpler tax regime for domestic cruise operations.

Foreign Mining Companies:

- Safe harbor rates introduced for selling raw diamonds in India.

Corporate Tax Rate:

- Reduced from 40% to 35% for foreign companies to attract foreign capital.

Simplification of Tax Regime

Charities:

- Two tax exemption regimes for charities to be merged into one.

- TDS rates streamlined: 5% TDS to be merged into 2%, and 20% TDS on mutual fund repurchases withdrawn.

TDS and Capital Gains:

- TDS on e-commerce reduced from 1% to 0.1%.

- Credit of TCS allowed on TDS from salary.

- Decriminalization of TDS payment delays up to the due date of filing.

- Short-term capital gains tax at 20% and long-term gains at 12.5%.

- Capital gains exemption limit increased to ₹1.25 lakh per year.

GST and Customs Duties

GST:

- Acknowledged as a significant success for reducing tax incidence and compliance burden.

- Plans to simplify and expand GST coverage to more sectors.

Custom Duties:

- Three cancer medicines exempted from custom duties.

- Reductions in Basic Customs Duty (BCD) for various items including mobile phones, rare earth minerals, and seafood.

- Duty increases for certain items like ammonium nitrate and PVC flex banners to support domestic industries and environmental concerns.

Dispute Resolution and Litigation Reduction

Vivad se Vishwas Scheme 2024:

- Proposed for resolving income tax disputes.

- Increased monetary limits for appeals in High Courts, Supreme Courts, and tribunals.

- Expansion of safe harbor rules and streamlining of transfer pricing assessment procedures to reduce litigation and provide clarity in international taxation.