Weekly Current Affairs (22nd to 31st July 2024) Part - 1 | General Test Preparation for CUET UG - CUET Commerce PDF Download

GS3/Defence & Security

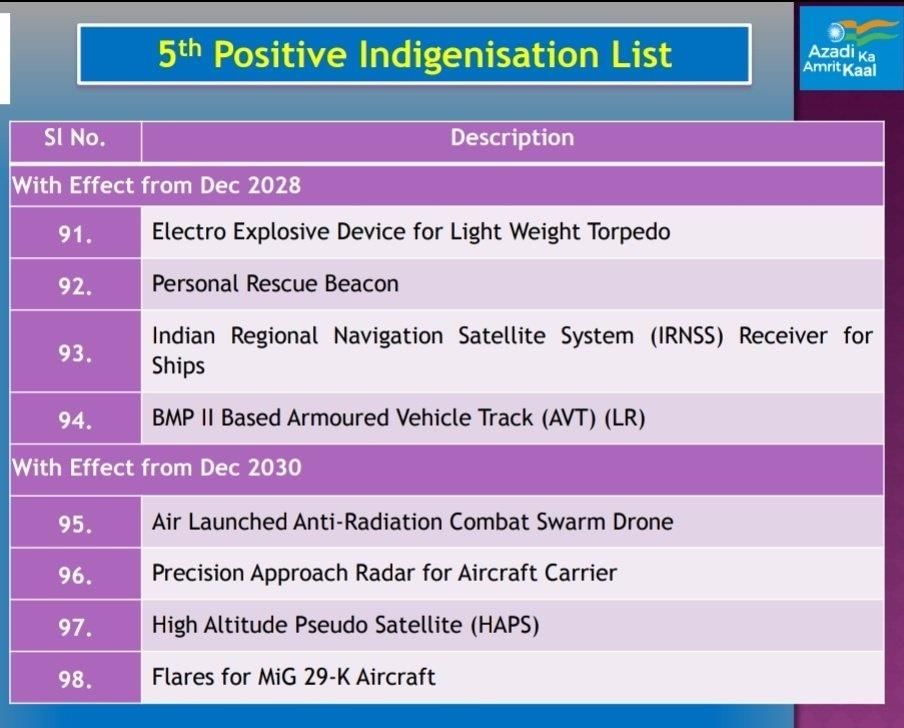

5th Positive Indigenisation List

Why in news?

Why in news?

- The Ministry of Defence (MoD) has recently notified a fifth Positive Indigenisation List (PIL) comprising defence items, aimed at boosting self-reliance and minimising imports and encouraging the domestic defence sector.

Key Highlights of the Fifth Positive Indigenisation List

Purpose and Scope:

- The fifth PIL comprises 346 items aimed at advancing Aatmanirbharta (self-reliance) in defence and reducing import dependence by Defence Public Sector Undertakings (DPSUs).

- Items include strategically important Line Replacement Units (LRUs), systems, sub-systems, assemblies, sub-assemblies, spares, components, and raw materials.

Implementation:

- The list is available on the MoD’s Srijan portal which provides a platform for DPSUs and service headquarters (SHQs) to offer defence items for indigenisation to private industries.

- DPSUs like Hindustan Aeronautics Limited (HAL), Bharat Electronics Ltd (BEL), Bharat Dynamics Ltd (BDL), and others have initiated processes for issuing Expressions of Interest (EoIs) and Requests For Tender or Proposals (RFPs).

Impact:

- The indigenisation of these items is expected to have an import substitution value worth Rs 1,048 crore.

- The initiative provides assurance to the domestic defence industry, encouraging them to develop defence products without the risk of competition from imports.

Future Goals:

- The MoD aims to continue expanding the list annually up to 2025, further increasing the number of items to be indigenised.

- This incremental approach supports the long-term goal of achieving greater self-reliance in defence production.

Need for Indigenisation of Defence in India

Import Dependency:

- India continues to hold the title of the world's largest arms importer, despite ongoing efforts to bolster its defence-industrial base.

Strategic Autonomy:

- Heavy reliance on foreign arms imports compromises India's strategic autonomy.

- Indigenous production enhances national security by ensuring uninterrupted supply and availability of defence equipment during crises.

Economic Benefits:

- Indigenisation supports the domestic economy by creating jobs, fostering innovation, and stimulating industrial growth.

- It reduces the outflow of foreign exchange, contributing to economic stability.

Sustainable Development:

- Indigenisation promotes sustainable development by ensuring that the defence industry grows in harmony with national interests and environmental considerations.

Status of Indigenisation Defence Sector

Rise in Exports:

- In FY 2023-24, defence exports reached a record Rs 21,083 crore (approx. USD 2.63 Billion), showing a 32.5% increase from the previous fiscal year.

- Over the last 10 years, there has been a 31-fold increase in defence exports compared to FY 2013-14.

Achievements:

- The Indian defence sector has seen the production of several advanced systems, including the 155 mm Artillery Gun 'Dhanush', Light Combat Aircraft 'Tejas', INS Vikrant: Aircraft Carrier, and various other platforms and equipment.

Reduction in Import Dependency:

- The expenditure on foreign defence procurement has decreased from 46% to 36% over the past four years, demonstrating the impact of indigenisation efforts in reducing reliance on imports.

Growth in Domestic Procurement Share:

- The share of domestic procurement in total defence procurement has risen from 54% in 2018-19 to 68% in the current year, with 25% of the defence budget allocated for procurement from private industry.

Value of Production:

- The value of production by public and private sector defence companies has increased from Rs 79,071 crore to Rs 84,643 crore in the past two years, reflecting significant growth in the sector's capacity and output.

Initiatives Related to Indigenisation in the Defence Sector

Defence Procurement Policy (DPP), 2016:

- DPP 2016 has introduced the "Buy-IDDM" (Indigenous Designed and Manufactured) Developed category of acquisition and accorded it the top most priority.

Defence Acquisition Procedure (DAP) 2020:

- It aims to promote Atmanirbhar Bharat Abhiyaan in the defence manufacturing sector.

- It includes features such as PIL, priority to indigenous procurement, reservation for MSMEs and small shipyards, increased indigenous content, and introduction of new categories to promote 'Make in India' initiative.

Industrial Licensing:

- The licensing process has been streamlined with extended validity, facilitating easier investment in the defence sector.

Foreign Direct Investment (FDI):

- FDI policy now allows up to 74% under the automatic route, promoting foreign investment in defence manufacturing.

Make Procedure:

- "Make" procedure in the Defence Procurement Procedure (DPP) promotes indigenous design, development, and manufacturing of defence equipment.

Defence Industrial Corridors

- Two corridors, in Uttar Pradesh and Tamil Nadu, have been established to attract investments and build a comprehensive defence manufacturing ecosystem.

Innovative and Supportive Schemes

Mission DefSpace:

- Launched to advance space technology for defence applications.

Innovations for Defence Excellence (iDEX):

- This scheme, launched in April 2018, supports innovation in defence by engaging start-ups, MSMEs, and research institutions.

SRIJAN Portal:

- Launched to facilitate indigenisation, the SRIJAN portal has listed 19,509 previously imported items for local production.

- To date, 4,006 items have attracted interest from the Indian industry.

Research and Development (R&D):

- 25% of the R&D budget is allocated for industry-led R&D, fostering technological advancement and innovation in the defence sector.

Mains Question:

- Q. Evaluate the progress and achievements of the Positive Indigenisation Lists since their inception. How have these lists influenced India's defence procurement strategy?

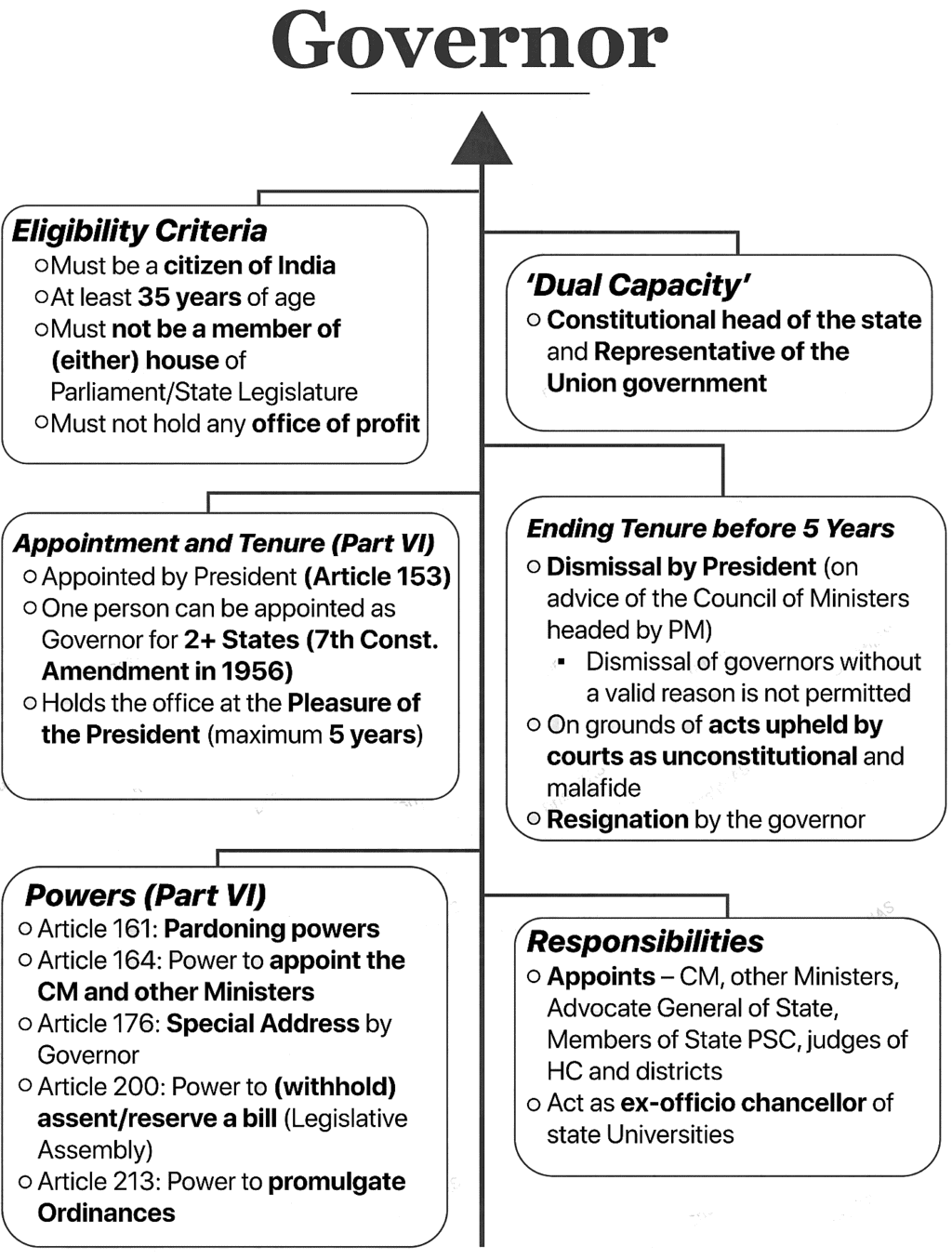

GS2/Polity

SC to Examine Governor’s Immunity

Why in News?

Why in News?

- Recently, the Supreme Court (SC) of India agreed to examine the question of immunity Governors from any kind of criminal prosecution, granted under Article 361 of the Constitution. This came after the Chief Justice of India heard a plea from a female Raj Bhavan employee who filed a sexual harassment complaint against the West Bengal Governor.

What are Immunities Provided to the Governor under Article 361?

Origin of Governor’s Immunity: It is linked to the Latin maxim "rex non potest peccare," or “the king can do no wrong.” During the Constituent Assembly's discussion on Article 361, member H V Kamath questions the extent of criminal immunity for the President and Governors, particularly regarding the initiation of proceedings against them for criminal acts. Despite these concerns, the article was adopted without further debate.Immunities under Article 361:

- Non-Answerable to Courts: Article 361(1) states that the President or the Governor of a State is not answerable to any court for the exercise of their powers and duties, or for any act done in the exercise of those powers and duties. Article 361 is an exception to Article 14 (Right to Equality).

- Protection from Criminal Proceedings: Under Article 361(2), no criminal proceedings whatsoever shall be instituted or continued against the President, or the Governor of a State, in any court during his term of office.

- No Arrest: Article 361(3), no arrest or imprisonment processes can be issued against the President or Governor during their term of office.

- Protection from Civil Proceedings: Article 361(4), no civil lawsuits can be filed against the President or Governor of a State during their term of office for any personal acts until two months after giving written notice. The notice must include the nature of the proceedings, the cause of action, the party filing the lawsuit, and the relief being sought.

How has the Courts Interpreted Article 361?

- Dr SC Barat And Anr vs. Hari Vinayak Pataskar Case, 1961: In this, a distinction was made between the Governor's official and personal conduct. While complete immunity is granted for official actions, civil proceedings can be initiated with the prior notice of 2 months for the Governor’s actions.

- Rameshwar Prasad vs. Union of India Case, 2006: The Supreme Court acknowledged the Governor's “complete immunity” under Article 361(1) for constitutional actions but allowed judicial scrutiny for malafide actions. This case established that while official actions are protected, there are mechanisms for accountability.

- Madhya Pradesh High Court, 2015: In the Vyapam scam case, the court ruled that Governor Ram Naresh Yadav had “absolute protection” under Article 361(2) from malicious publicity while in office. His name was removed from the investigation to prevent undue legal harassment, maintaining the integrity of the office.

- State of UP vs. Kalyan Singh Case, 2017: The Supreme Court held that Kalyan Singh, then Governor of Rajasthan, was entitled to immunity under while in office. Charges related to the Babri Masjid demolition would proceed once he ceased to be Governor, reinforcing the protection of the Governor’s duties and dignity.

- Telangana High Court Judgment (2024): In this, HC observed that “there is no express or implicit bar in the Constitution which excludes the power of judicial review in respect of an action taken by the Governor”. Further, the court stated that Article 361 immunity is personal does not exclude judicial review.

What are the Recommendations Regarding Reforms in the Office of the Governor?

Sarkaria Commission (1988):

- The Governor should be appointed by the President after consulting the Chief Minister of the respective state.

- The Governor should be an individual of eminence in public life and should not belong to the state where they are appointed.

- The Governor should not be removed before the completion of their term, except under rare and compelling circumstances.

- The Governor should serve as a bridge between the Centre and the state rather than acting as an agent of the Centre.

- Discretionary powers should be exercised sparingly and judiciously, avoiding any actions that might undermine the democratic process.

Venkatachaliah Commission or National Commission to Review the Working of the Constitution (NCRWC) (2002):

- The appointment of Governors should be entrusted to a committee comprising the prime minister, the home minister, the speaker of the Lok Sabha, and the chief minister of the concerned state.

- The governors should be allowed to complete their five-year term unless they resign or are removed by the President on the grounds of proven misbehavior or incapacity.

- The central government should consult the Chief Minister before taking any action to remove the governor.

- The Governor should not interfere in the day-to-day administration of the state. He should act as a friend, philosopher, and guide to the state government and use his discretionary powers sparingly.

Punchhi Commission (2010):

- The Commission recommended the deletion of the phrase “during the pleasure of the President” from the Constitution, which suggests that a Governor can be removed at the will of the central government.

- It proposed that a Governor should only be removed by a resolution of the state legislature, thereby ensuring greater stability and autonomy for states.

Mains Question:

Examine the necessity of re-evaluating the governor’s immunity provisions under Article 361 of the Indian Constitution.

GS3/Economy

Economic Survey 2023-24

Why in News?

Why in News?

- The Economic Survey for 2023-24 was recently presented by the Union Minister for Finance in the parliament. It provides a detailed overview of India's economic performance and future prospects.

Key Takeaways from the Economic Survey 2023-24

State of the Economy

- India's real GDP grew by 8.2% in FY24, surpassing the 8% mark in three out of four quarters.

- Retail inflation decreased from 6.7% in FY23 to 5.4% in FY24.

- The Current Account Deficit improved to 0.7% of GDP in FY24 from 2.0% in FY23.

Tax Revenue and Capital Spending

- Direct taxes contributed 55% of total tax revenue.

- Capital expenditure was increased, and free food grains were provided to 81.4 crore people.

Monetary Management and Financial Intermediation

- The RBI maintained a steady policy repo rate at 6.5% throughout FY24.

- Credit disbursal by Scheduled Commercial Banks reached Rs 164.3 lakh crore.

Banking Sector and Insolvency

- Gross and non-performing assets are at multi-year lows.

- The Gross Non-Performing Assets ratio declined to 2.8% in March 2024.

Capital Markets and Insurance

- Primary capital markets facilitated capital formation of Rs 10.9 lakh crore.

- India is poised to become one of the fastest-growing insurance markets globally.

Medium-Term Outlook

Growth Strategy

- To sustain a 7%+ growth rate, a tripartite compact involving the Union Government, State Governments, and the private sector is essential.

Key Focus Areas

- Job and skill creation, agriculture, MSME bottlenecks, green transition, and addressing the education-employment gap are crucial for medium-term growth.

Climate Change and Energy Transition

Renewable Energy

- Non-fossil sources accounted for 45.4% of installed electricity generation capacity by May 2024.

Investment in Clean Energy

- The clean energy sector attracted investments of Rs 8.5 lakh crore between 2014 and 2023.

Social Sector Benefits

Welfare Expenditure

- Welfare expenditure grew at a CAGR of 12.8% between FY18 and FY24.

Healthcare

- Over 34.7 crore Ayushman Bharat cards have been issued.

Employment and Skill Development

Unemployment Rate

- The unemployment rate declined to 3.2% in 2022-23.

Net Payroll Additions

- Net payroll additions under EPFO have more than doubled in the past five years.

Agriculture and Food Management

Agricultural Growth

- The sector registered an average annual growth rate of 4.18% over the last five years.

Credit and Micro Irrigation

- Credit disbursed to agriculture amounted to Rs 22.84 lakh crore, and 90 lakh hectares were covered under micro-irrigation.

Industry Overview

Industrial Growth

- Industrial growth is supported by an industrial growth rate of 9.5%.

Pharmaceutical and Clothing Sectors

- India's pharmaceutical market is the world's third-largest by volume, valued at USD 50 billion.

Services Sector

Sector Contribution

- The services sector accounted for 55% of the economy in FY24 and grew by 7.6% during the year.

Digital Services

- India's share in global digitally delivered services exports increased to 6% in 2023.

Infrastructure Development

National Highways

- The pace of construction increased significantly from FY14 to FY24.

Railways

- Capital expenditure on Railways increased by 77% over the past five years.

Climate Change and India

Current Global Strategies

- Current global strategies for climate change are flawed and not universally applicable.

India's Ethos

- India's ethos emphasizes a harmonious relationship with nature, contrasting with the culture of overconsumption in other parts of the developed world.

Major Challenges and Recommended Solutions

Key Challenges Identified

- Global Headwinds and FDI challenges

- China Dependency issues

- AI Threat in telecommunications and BPO sector

- Tepid Private Investment concerns

- Employment Imperative for the growing workforce

Recommended Solutions

- Job Creation by the Private Sector

- Lifestyle Changes by the Private Sector

- Revitalising the Farm Sector

- Removing Regulatory Bottlenecks

GS3/Economy

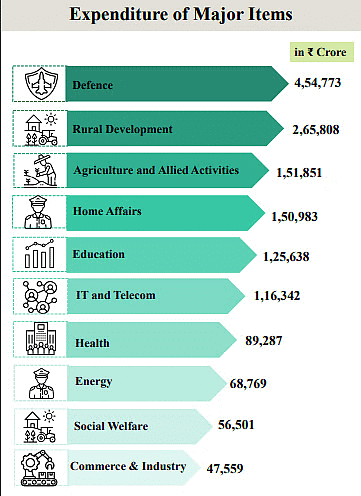

Union Budget 2024-2025

Why in News?

- Recently, the Union Budget for 2024-25 was presented in the Parliament. It was the first general budget of the 18th Lok Sabha.

What are the Major Highlights of the Union Budget 2024-25?

Focus Area:

- As outlined in the Interim Budget, the focus of the budget remains on four major groups: 'Garib' (Poor), 'Mahilayen' (Women), 'Yuva' (Youth), and 'Annadata' (Farmers).

Budget Theme:

- The budget emphasizes employment, skilling, support for MSMEs, and the middle class. A significant allocation of Rs 1.48 lakh crore is earmarked for education, employment, and skilling.

Budget Priorities:

- The budget prioritizes nine areas including agriculture, employment, human resource development, manufacturing, services, urban development, energy security, infrastructure, innovation, research & development, and next-generation reforms.

Priority 1: Productivity and Resilience in Agriculture

- Measures include releasing new 109 high-yielding crop varieties, promoting natural farming among 1 crore farmers, establishing 10,000 need-based bio-input centers, and enhancing production, storage, and marketing of pulses and oilseeds.

Priority 2: Employment & Skilling

- The budget introduces schemes like Employment Linked Incentive and initiatives to boost skilling with a focus on skilling 20 lakh youth over a 5-year period and upgrading 1,000 Industrial Training Institutes.

Priority 3: Inclusive Human Resource Development and Social Justice

- Enhanced support for economic activities among marginalized groups, including tribal communities and women entrepreneurs, is emphasized.

Priority 4: Manufacturing & Services

- The budget emphasizes support for labor-intensive manufacturing, with a new self-financing guarantee fund offering up to Rs 100 crore per applicant.

Priority 5: Urban Development

- PM Awas Yojana Urban 2.0 has been allocated Rs 10 lakh crore to address housing needs of urban poor and middle-class families.

Priority 6: Energy Security

- PM Surya Ghar Muft Bijli Yojana aims to install rooftop solar plants for free electricity to households.

Priority 7: Infrastructure

- Government will try to maintain strong fiscal support for infrastructure over the next 5 years with Rs 11,11,111 crore capital expenditure allocated this year.

Priority 8: Innovation, Research & Development

- The government will establish the Anusandhan National Research Fund to support basic research and prototype development, allocating Rs 1 lakh crore to spur private sector-driven research and innovation at a commercial scale.

Priority 9: Next Generation Reforms

- Plans for an Economic Policy Framework, labor reforms, and simplification of FDI regulations are outlined to spur economic growth.

Other Highlights

Economic Policy Framework:

- The government will formulate a framework to guide economic development and reforms for enhancing employment.

Labor related reforms:

- Implementing comprehensive labor reforms through integrated portals like e-shram portal, Shram Suvidha, and Samadhan portals.

Foreign Direct Investment and Overseas Investment:

- The rules and regulations for investments will be simplified to facilitate foreign direct investments and promote opportunities for using the Indian Rupee as a currency for overseas investments.

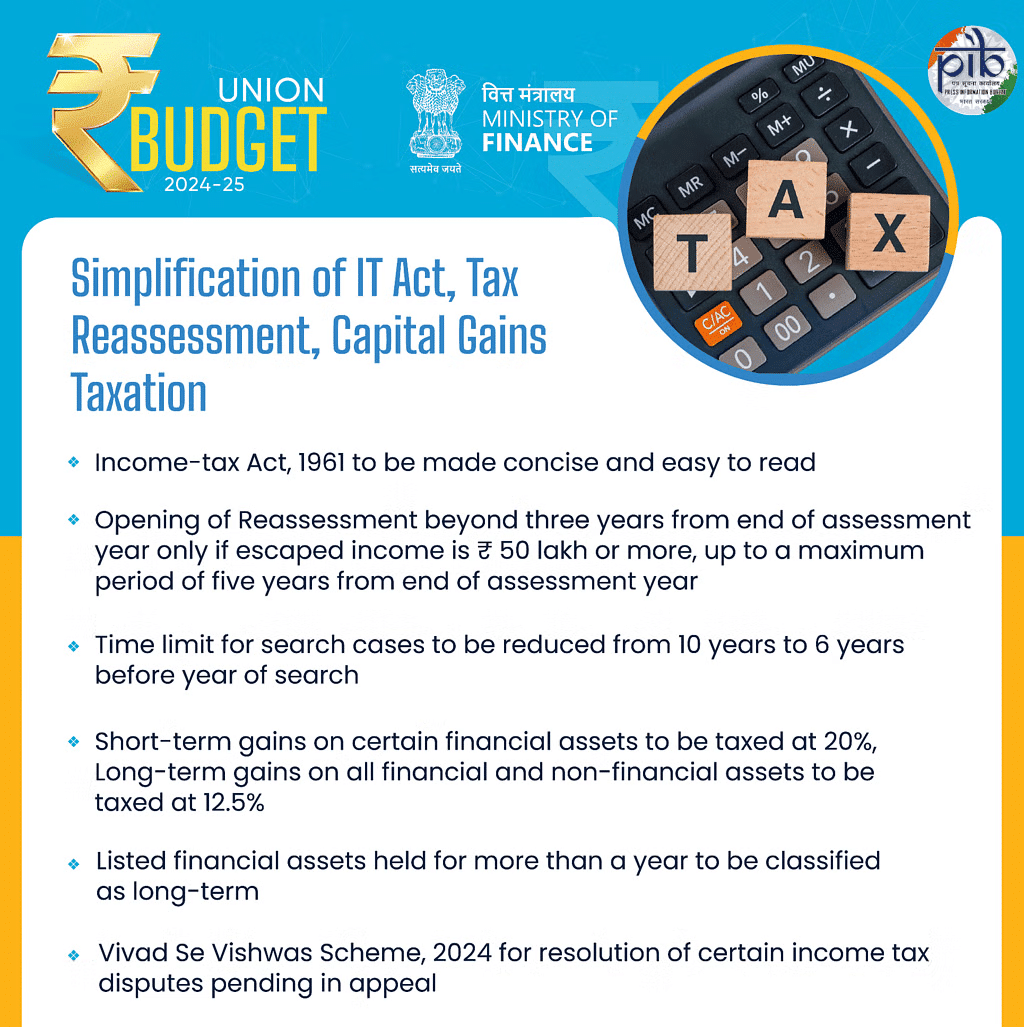

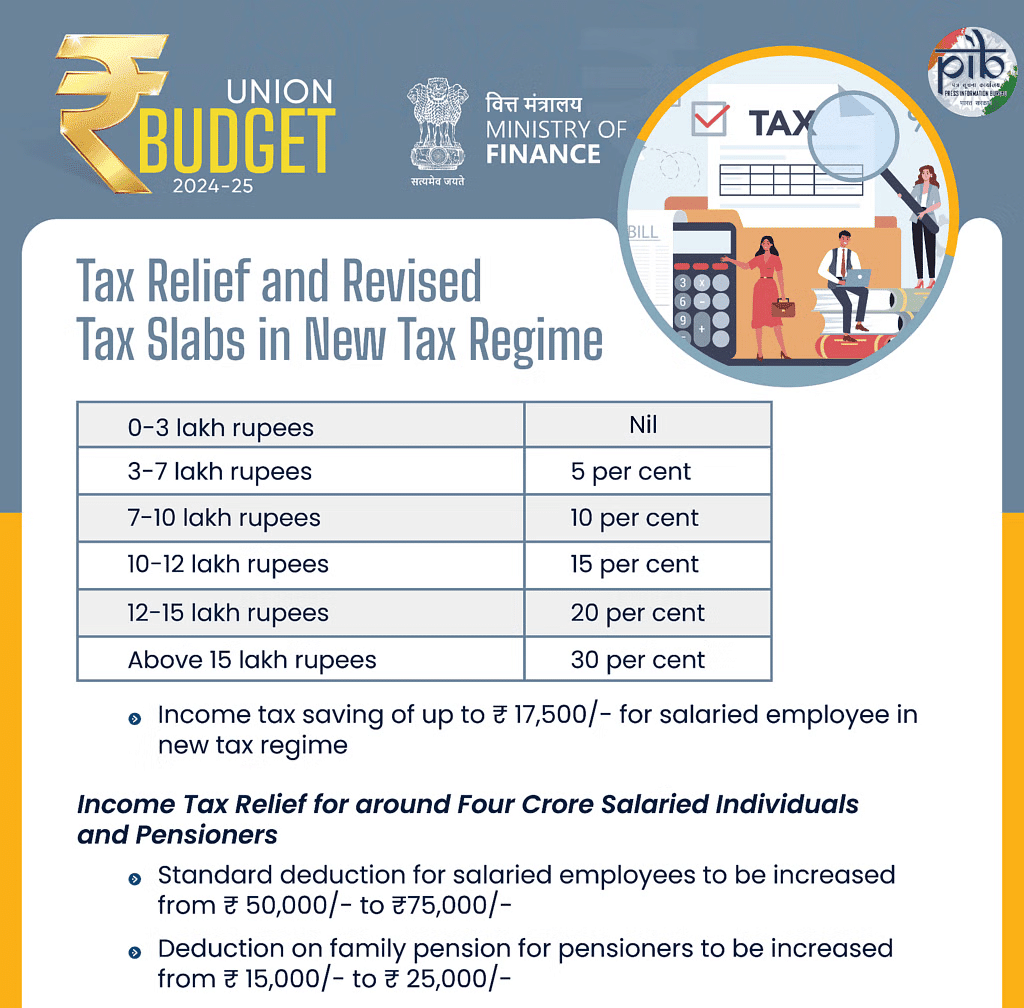

Direct Tax Reforms:

- Comprehensive review and simplification of direct and indirect tax regimes are proposed, including changes in income tax slabs and deductions.

Custom Duty Reforms:

- Rationalization of GST and custom duty rates, exemptions for essential medicines and critical minerals, and measures to promote domestic manufacturing are highlighted.

Dispute Resolution:

- Initiatives like Vivad se Vishwas Scheme, increased monetary limits for appeals, and measures to streamline transfer pricing assessments are aimed at reducing litigation and providing tax certainty.

Mains Question

Discuss the constitutional provisions related to Budget in India. How does the constitutional framework ensure parliamentary control over financial matters and expenditure?

GS2/International Relations

Neighbourhood First in MEA’s Aid Allocation

Why in news?

- In the recently announced Union Budget 2024-25, the Ministry of External Affairs (MEA) has outlined its development assistance plans, focusing on strategic partners and neighbouring countries. It is geared towards promoting regional connectivity, cooperation, and stability in line with India’s Neighbourhood First Policy.

How is the Development Aid Distributed Among Countries?

- Bhutan: It received the highest aid at Rs 2,068.56 crore, though slightly less than last year’s Rs 2,400 crore.

- Nepal: It was allocated Rs 700 crore, up from Rs 550 crore last year.

- Maldives: It maintained a consistent allocation of Rs 400 crore, despite a higher revised amount of Rs 770.90 crore for the previous year.

- Sri Lanka: Rs 245 crore, an increase from Rs 150 crore last year.

- Afghanistan: Afghanistan receives Rs 200 crore, illustrating India's role in aiding the country's stability and development amidst ongoing challenges.

- Iran: Chabahar Port Project continues to receive Rs 100 crore, unchanged for the past three years.

- Africa: African countries collectively, showcasing India's expanding influence and engagement with the continent.

- Seychelles: It receives Rs 40 crore, up from Rs 10 crore.

What are the Benefits of Development Aid Granted to Neighbouring Countries?

- Strengthening Diplomatic Relations: By providing aid to neighbouring countries, India enhances diplomatic ties, fostering stronger political and economic relationships.

- Promoting Regional Stability: Financial support helps stabilise neighbouring countries, which can lead to a more secure and stable region, benefiting India's strategic interests.

- Supporting Economic Development: Aid contributes to infrastructure projects, development programs, and other initiatives that can boost economic growth in recipient countries, creating a more prosperous region.

- Encouraging Trade and Investment: Improved infrastructure and economic conditions in neighbouring countries can lead to increased trade and investment opportunities for India.

- Enhancing Strategic Influence: Providing aid allows India to exert influence and build alliances, ensuring that neighbouring countries have positive engagements with India and align more closely with its interests.

- Addressing Humanitarian Needs: Aid often addresses urgent humanitarian needs, such as health care, education, and disaster relief, improving the quality of life in recipient countries.

- Strengthening Soft Power: By investing in neighbouring countries' development, India bolsters its soft power and reputation as a responsible regional leader.

Why is the Neighbourhood First Policy Important for India?

- Terrorism and Illegal Migration: India faces terrorism and illegal migration threats, including the smuggling of weapons and drugs, from its immediate neighbours.

- Relations with China and Pakistan: Relations with China and Pakistan are strained, particularly due to terrorism linked to engaging in multilateral organisations.

- Investment in Border Infrastructure: There is a deficiency in border infrastructure and the need to stabilise and develop border regions.

- Monitoring Line of Credit (LOC) Projects: To neighbours increased significantly, with 50% of global soft lending going to them.

- Defence and Maritime Security: Defense cooperation is crucial, with joint military exercises conducted with various neighbours.

- Development in the North-Eastern Region: North-Eastern region’s development is crucial for the Neighbourhood First and Act East Policies.

- Tourism Promotion: India is a major source of tourists for and a destination for Nepali religious tourism.

- Multilateral Organisations: India’s engagement with neighbours is driven by regional mechanisms like SAARC and BIMSTEC.

What are the Challenges in India's Relationship with its Neighbouring Countries?

- Border Disputes: Disagreements over borders, especially with, lead to tensions and conflicts.

- Terrorism: Pakistan has continuously provided support, safe havens, and funding to various militant groups.

- Trade Imbalances: Economic issues and trade barriers with neighbours like Pakistan, Bangladesh, and Nepal affect relations.

- Water Disputes: Conflicts over sharing river waters strain ties with.

- Internal Conflicts: Political instability or disputes in neighbouring countries impact bilateral relations.

- Environmental Issues: Natural disasters and environmental problems require joint efforts and can affect relations.

- Regional Cooperation: Disagreements within regional organisations can hinder effective cooperation.

Way Forward

- Strengthening Diplomatic Engagement: Establish and maintain regular diplomatic dialogues and high-level meetings to address and resolve issues.

- Enhancing Economic Cooperation: Negotiate and implement fair trade agreements that address imbalances and promote mutual benefits.

- Promoting Security and Stability: Coordinate on regional security initiatives to address common threats like terrorism and illegal migration.

- Fostering People-to-People Connections: Increase educational and tourism initiatives to build mutual understanding and goodwill among populations.

- Addressing Environmental and Humanitarian Issues: Synergize on natural disasters and environmental problems using joint efforts and regional plans.

- Strengthening Regional Organisations: Actively participate in regional organisations like SAARC and BIMSTEC to address regional issues and improve their mechanisms for decision-making and implementation.

- Addressing Internal and External Factors: Ensure that domestic policies do not adversely impact relations with neighbouring countries.

GS3/Science and Technology

UNAIDS Global AIDS Update

Why in news?

- Recently, the 2024 Global AIDS Update, titled "The Urgency of Now: AIDS at a Crossroads", presented a critical overview of the current state of the HIV/AIDS epidemic and the global response to it.

What are the Key Highlights of the Reports?

- The report underscores the potential to end as a public health threat by 2030, emphasising the necessity of addressing inequalities, increasing access to prevention and treatment, and ensuring sustainable resources.

Progress and Challenges:

- There has been a 39% reduction in new HIV infections globally since 2010, with sub-Saharan Africa achieving the steepest decline (56%).

- In 2023, fewer people acquired HIV than at any point since the late 1980s, and almost 31 million people were receiving antiretroviral therapy (ART).

- AIDS-related deaths have decreased to their lowest level since the peak in 2004, largely due to increased access to ART.

Regional Disparities:

- While sub-Saharan Africa has seen significant progress, regions such as Eastern Europe, Central Asia, Latin America, and the Middle East and North Africa have experienced rising numbers of new HIV infections.

- For the first time, more new HIV infections occurred outside sub-Saharan Africa than within it.

Key Affected Groups:

- Key populations, including sex workers, men who have sex with men, people who inject drugs, transgender people, and people in prisons, continue to face high risks of HIV infection due to inadequate prevention programs and persistent stigma and discrimination.

- Community-led interventions are critical but often underfunded and unrecognized.

Prevention and Treatment Gaps:

- HIV prevention efforts are falling short, with notable deficiencies in access to services like pre-exposure prophylaxis (PrEP) and harm reduction for people who inject drugs.

- About 9.3 million people living with HIV are not receiving ART, with children and adolescents particularly affected.

What is HIV/AIDS?

- HIV/AIDS is a viral infection that attacks the immune system, specifically the CD4 cells (T cells), which help the immune system fight off infections.

- AIDS is the final stage of HIV infection when the immune system is severely damaged and can no longer fight off infections.

Causes of HIV/AIDS

- HIV infection is caused by the human immunodeficiency virus (HIV). The virus is transmitted through contact with infected bodily fluids, such as blood, semen, vaginal fluids, rectal fluids, and breast milk.

Symptoms of HIV/AIDS

Clinical Latent Infection:

- HIV is still active but reproduces at very low levels. People may not have any symptoms or only mild ones.

Acute HIV Infection:

- Symptoms can resemble those of the flu, including fever, swollen lymph nodes, sore throat, rash, muscle and joint aches, and headache.

- Symptoms of AIDS are severe and include rapid weight loss, recurring fever or profuse night sweats, extreme and unexplained tiredness, etc.

Diagnosis of HIV/AIDS

HIV antibody/antigen tests:

- These tests detect antibodies or antigens produced by the virus and are usually done on blood or oral fluid.

Nucleic acid tests (NATs):

- These tests look for the virus itself and can detect HIV infection earlier than antibody tests.

Treatment and Management

Antiretroviral therapy (ART):

- ART involves taking a combination of HIV medicines every day. ART can't cure HIV, but it can control the virus, allowing people with HIV to live longer, healthier lives and reducing the risk of transmitting the virus to others.

Pre-exposure prophylaxis (PrEP):

- PrEP is a daily pill for people who don't have HIV but are at risk of getting it. When taken consistently, PrEP can reduce the risk of HIV infection.

What are the Key Suggestions From the Report?

Accelerating HIV Prevention:

- The report emphasises the need to expand access to HIV prevention services, particularly for key populations including sex workers, men who have sex with men, people who inject drugs, transgender people, and people in prisons.

Enhancing Treatment and Care:

- Ensure that 95% of people living with HIV are on ART by 2025. Currently, only 77% of people living with HIV are receiving ART.

- Improve the diagnosis and treatment of children with HIV. Only 48% of children living with HIV are receiving ART, compared to 78% of adults.

Addressing Inequalities and Stigma:

- Remove harmful laws that criminalise HIV transmission, exposure, and non-disclosure, as well as those targeting key populations. Currently, punitive laws are prevalent in most countries.

- Implement programs to reduce stigma and discrimination in health care and community settings. Ensure legal protection and support for people living with HIV and key populations.

Community-Led Responses:

- Strengthen the role of community-led organisations in delivering HIV services. The goal is for these organizations to deliver 30% of testing and treatment services and 80% of HIV prevention services for high-risk populations.

Sustainable Financing:

- Address the significant shortfall in funding for HIV programs. An estimated additional USD 9.5 billion is needed by 2025 to meet the targets.

- Explore new funding sources and mechanisms to sustain the HIV response, especially in low- and middle-income countries.

Mains Question:

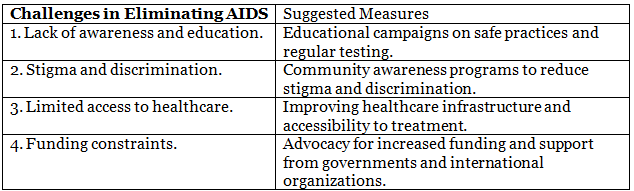

Discuss the major challenges in eliminating AIDS in developing countries like India. Suggest measures to address these challenges.

GS1/History & Culture

Amravati as a Buddhist Site

Why in News?

Why in News?

- Recently, the Finance Minister announced Rs 15,000 crore in financial support for Andhra Pradesh to build its capital city, and boost other development activities in the state. This has brought back focus on Amravati, a site of immense historical and spiritual significance in Andhra Pradesh that remains relatively unrecognised.

What are the Key Facts About Amravati and Andhra Buddhism?

Historical Evolution:

- In the late 1700s, Raja Vessareddy Nayudu unknowingly discovered ancient limestone ruins in Andhra's Dhanyakatakam village, which he and the locals used for construction, leading to the renaming of the village to Amravati. The systematic destruction of the ruins continued until 1816, when Colonel Colin Mackenzie's intensive survey, despite causing further damage, led to the rediscovery of the grand Amravati Stupa. In 2015, the Andhra Pradesh Chief Minister announced the new capital, Amaravati, inspired by the historic Buddhist site, aiming to develop it into a modern city akin to Singapore.

Amravati and Andhra Buddhism:

- Buddhism, which emerged in the fifth century BCE in the ancient kingdom of Magadh (present-day Bihar), made its way to Andhra Pradesh mainly through trade routes. Buddhism was founded by Siddhartha Gautama, who attained enlightenment and became known as the Buddha. The first significant evidence of Buddhism in Andhra Pradesh dates back to the 3rd century BCE when Emperor Ashoka set up an inscription in the region, providing a major impetus to its spread. Monks from Andhra were present at the first Buddhist council held in 483 BCE at Rajgir, Bihar. Buddhism thrived in the region for nearly six centuries until the 3rd century CE, with isolated sites like Amravati, Nagarjunakonda, Jaggayapeta, Salihundam, and Sankaram continuing to practice the religion until the 14th century CE. Historians note that Buddhism's presence in Andhra coincided with its first urbanisation process, significantly aided by oceanic trade, which facilitated the religion's spread.

Difference Between the Nature of Northern Buddhism and Andhra Buddhism:

- Merchant Patronage: In Andhra, merchants, craftsmen, and wandering monks played a crucial role in the spread of Buddhism, contrasting with the royal patronage seen in North India. Influence on Political Rulers: Traders' success and their association with Buddhism influenced Andhra's political rulers, who issued inscriptions supporting the Buddhist sangha, suggesting a bottom-up spread of Buddhism. Integration of Local Practices: Buddhism in Andhra integrated local religious practices, such as megalithic burials, and Goddess and Naga worship, into its doctrines, reflecting a unique adaptation of Buddhism to regional traditions.

Significance of Amravati in Buddhism:

- Amravati is renowned for being the birthplace of Mahayana Buddhism, one of the major branches of Buddhism that emphasizes the path of the Bodhisattva. Acharya Nagarjuna, a prominent Buddhist philosopher, lived in Amravati and developed the Madhyamika philosophy, focusing on the concept of emptiness and the middle way. From Amravati, Mahayana Buddhism spread across South Asia, China, Japan, Korea, and Southeast Asia.

Factors Leading to the Decline of Buddhism in Andhra Pradesh:

- Rise of Shaivism: One of the primary factors contributing to the decline of Buddhism in Andhra Pradesh was the rise of Shaivism. By the seventh century CE, Chinese travellers noted the decline of Buddhist stupas and the thriving Shiva temples, which received patronage from aristocrats and royals. The growing influence of Shaivism offered a more structured and socially integrated religious framework that appealed to the local populace and rulers, drawing support away from Buddhist institutions. Decline of Urbanisation: During the third century BCE, the region experienced significant urbanisation and trade, which supported Buddhism's spread due to its emphasis on a casteless society. However, six centuries later, economic degradation led to a decline in patronage for Buddhist institutions. By the fourth century CE, Buddhist institutions found themselves without much patronage. Arrival of Islam: With the arrival of Islam, the Islamic rulers, who were generally more inclined towards supporting Islamic institutions, withdrew royal patronage from Buddhist establishments.

What are the Key Features of the Amravati School of Art?

- About: During the post-Mauryan period, the Amravati school of art from the ancient Buddhist site of Amravati in Andhra Pradesh emerged as one of the three most significant styles of ancient Indian art, alongside the Mathura and Gandhara schools. Historical Context and Influences: Amravati Stupa, a grand Buddhist monument, was the centrepiece of the Amravati School of Art. This site became a hub of artistic and architectural activity, significantly contributing to the development of Buddhist art in India.

|

201 videos|842 docs|2245 tests

|