Economic Development: July 2024 UPSC Current Affairs | Indian Economy for UPSC CSE PDF Download

India’s Pharmaceutical Industry

Why in news?

Why in news?

Recently, approximately 36% of pharmaceutical manufacturing units inspected by the Indian drug regulator were closed due to non-compliance with quality standards following risk-based inspections by the Central Drug Standards Control Organisation (CDSCO) since December 2022.

What are the Incidents Highlighting Quality Control Failures?

- Data integrity issues were prevalent, including falsified data, improper cohort distribution, questionable sample reanalysis practices, and poor systemic quality management.

- In October 2022, the World Health Organisation (WHO) issued an alert linking four products from India's Maiden Pharmaceuticals to acute kidney injury and 66 child deaths in Gambia due to contamination with toxic chemicals diethylene glycol and ethylene glycol.

- In December 2022, there was an investigation regarding the death of 18 children in Uzbekistan allegedly linked to a cough syrup manufactured by Indian firm Marion Biotech.

- The US Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (USFDA) raised concerns over a drug-resistant bacteria strain allegedly linked to eye drops imported from India.

- In January 2020, 12 children in Jammu died after consuming contaminated medicine found to contain diethylene glycol, leading to kidney poisoning.

What is the Status of the Indian Pharmaceutical Industry?

- India is one of the biggest suppliers of low-cost vaccines globally and the largest provider of generic medicines worldwide, holding a 20% share in global supply by volume.

- India accounts for 60% of global vaccine production, making it the largest vaccine producer globally.

- The pharmaceutical industry in India is the largest in the world in terms of volume and value, contributing around 1.72% to the country’s Gross Domestic Product (GDP).

Market Size & Investments

- India is among the top 12 destinations for biotechnology globally and the 3rd largest destination for biotechnology in the Asia Pacific region.

- The Indian pharmaceutical industry has witnessed significant growth in recent years and is projected to reach about 13% of the size of the global pharma market while focusing on enhancing quality, affordability, and innovation.

- Up to 100% Foreign Direct Investment (FDI) has been permitted through automatic routes for Greenfield pharmaceutical projects.

- For Brownfield Pharmaceuticals projects, FDI up to 74% is allowed through automatic routes and beyond that with government approval.

Exports:

- Pharmaceuticals are among the top ten attractive sectors for foreign investment in India.

- Pharmaceutical exports from India reached over 200 countries worldwide, including highly regulated markets such as the USA, Western Europe, Japan, and Australia.

- India's drugs and pharmaceuticals exports stood at USD 22.51 billion in FY24 (April-January), showing a strong year-on-year growth of 8.12% during the period.

What are the Major Challenges with India’s Pharma Sector?

- Violation of IPR Rules: Indian pharmaceutical companies have faced allegations of violating Intellectual Property Rights (IPR) laws, resulting in legal disputes with multinational pharmaceutical companies.

- Pricing and Affordability: India's generic drug manufacturing capabilities have contributed to affordable healthcare globally, but ensuring affordable medicines while maintaining profitability for pharmaceutical companies is a challenge.

- Healthcare Infrastructure and Access: Despite the strong pharmaceutical industry in India, access to healthcare remains a challenge for a significant portion of the population due to inadequate healthcare infrastructure and low health insurance coverage.

- Overdependence on Imports: The Indian pharma sector heavily relies on imports for Active Pharmaceutical Ingredients (APIs), and disruptions in the global supply chain can lead to shortages and price hikes.

Way Forward

- Legislative Changes and Centralised Database: Amendments to the Drugs and Cosmetics Act (1940) and the establishment of a centralised drugs database can enhance surveillance and ensure effective regulation across all manufacturers.

- Promote Continuous Improvement Programs: Encourage pharmaceutical companies to implement voluntary quality management systems and self-improvement initiatives. This can be facilitated through industry associations and government incentives.

- Transparency and Public Reporting: Increase transparency in regulatory actions and public reporting of quality control failures through designated government portals for sharing inspection reports and drug recalls.

- Focus on Sustainable Manufacturing Practices: Emphasize sustainable manufacturing practices such as green chemistry, waste reduction, and energy efficiency to enhance environmental sustainability and reduce costs.

- Digital Drug Regulatory System (DDRS): Implementation of the DDRS can streamline pharmaceutical regulations, while the SUGAM portal is being enhanced to integrate the activities and functions of the CDSCO and other relevant agencies.

- Strengthening Pharmacovigilance: Enhance post-marketing surveillance of drugs to promptly identify and address adverse effects, aligning with recommendations for stricter quality control measures.

Mains Question

Critically analyze the current challenges faced by the Indian pharmaceutical sector. Discuss the implications of these challenges on public health and the economy.

Boosting Lighthouse Tourism in India

Why in news?

The Union Minister of Ports, Shipping & Waterways has revealed plans to enhance lighthouse tourism under the Maritime India Vision (MIV) 2030 and Maritime Amrit Kaal Vision 2047. This declaration occurred during a stakeholders meeting held by the Directorate General of Lighthouses and Lightships in Vizhinjam, Kerala.

What is a Lighthouse?

- A lighthouse is a structure crafted to emit light, aiding mariners in navigation by marking perilous coastlines, shoals, reefs, and safe harbor entries.

- Role of Modern Lighthouses in India

- India presently upholds 194 lighthouses along its coastal boundaries and islands.

- Maritime India Vision 2030 (MIV 2030)

- Definition and Purpose: A comprehensive ten-year blueprint for India's maritime sector, launched during the Maritime India Summit in November 2020.

- Overview: Aims to boost India's status in the global maritime sector by concentrating on waterways, shipbuilding, and cruise tourism

Key Objectives

- Sectoral Development: Focuses on enhancing waterways and cruise tourism, surpassing the Sagarmala initiative.

- Strategic Themes:

- Emphasizes brownfield capacity augmentation.

- Mega Ports development.

- Transhipment hub in Southern India.

- Infrastructure modernization.

- Export Growth: Targets a 5% share in global exports, with a focus on enhancing maritime capabilities and Ease of Doing Business (EoDB).

- Infrastructure Development:

- Encompasses over 200 port connectivity projects.

- Technology adoption.

- Smart port initiatives to boost logistics efficiency and reduce costs.

- Governance and Regulations:

- Enhances governance mechanisms.

- Amends laws.

- Strengthens Maritime and Coastguard Agency (MCA).

- Promotes PPPs and fiscal support.

- Human Resource Development

- Seafaring Leadership: Aims to become a leading seafaring nation by enhancing education, research, and training for seafarers.

- Competitiveness: Focuses on research, innovation, and creating a conducive environment for seafarers and port capability development.

- Environmental Sustainability

- Renewable Energy: Aims for 40% national energy from renewables by 2030, aligning ports with International Maritime Organization (IMO) sustainability goals.

- Green Ports:

- Implements measures like renewable energy adoption.

- Emissions reduction.

- Water usage optimization.

- Waste management.

- Safety initiatives.

- Centralized monitoring.

Conclusion

Maritime India Vision 2030 delineates ambitious goals to transform India into a global maritime leader through strategic development in infrastructure, governance, human resources, and environmental sustainability, ensuring sustainable growth and competitiveness in the maritime sector.

Push for Hybrid Electric Vehicles

Why in News?

Recently, the state government of Uttar Pradesh announced the waiver of registration fees for strong hybrid and plug-in hybrid electric vehicles (EVs). This move aligns Uttar Pradesh with Tamil Nadu and Chandigarh, which also offer incentives to promote cleaner alternatives to petrol and diesel vehicles.

What is a Hybrid Electric Vehicle (HEV)?

- About Electric Vehicle: An Electric Vehicle (EV) is defined as a vehicle that can be powered by an electric motor, draws electricity from a battery, and is capable of being charged from an external source.

- Types of Electric Vehicles (EVs):

- Battery Electric Vehicle (BEV): These are fully powered by electricity. They are more efficient compared to hybrid and plug-in hybrids.

- Fuel Cell Electric Vehicle (FCEV): Electric energy for EVs is produced from chemical energy. For Example, a Hydrogen FCEV.

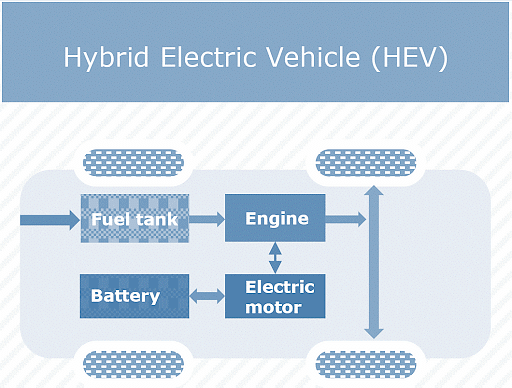

- Hybrid Electric Vehicle (HEV): Also called Strong Hybrid EV. The vehicle uses both internal combustion (usually petrol) engine and the battery-powered motor powertrain. The petrol engine is used both to drive and charge when the battery is empty. These vehicles are not as efficient as fully electric or plug-in hybrid vehicles.

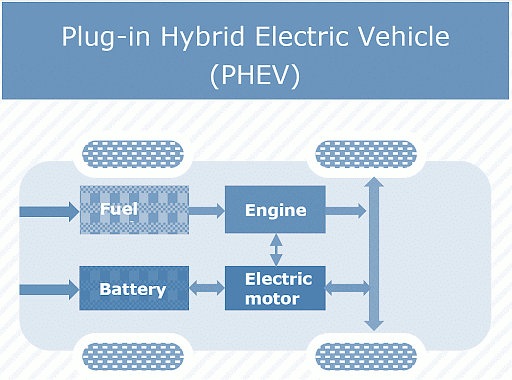

- Plug-in Hybrid Electric Vehicle (PHEV): Use both internal combustion engine and a battery charged from an external socket (they have a plug). Vehicle’s battery can be charged with an external electricity source only and not by engine. PHEVs are more efficient than HEVs but less efficient than BEVs. PHEVs can run in at least 2 modes: Hybrid Mode, in which both electricity and petrol/diesel are employed, and All-electric Mode, in which the motor and battery provide all the car’s energy.

Significance of Hybrid EVs

- Practicality in the Medium Term (5-10 years): Since they do not require an external charging infrastructure, hybrids are seen as a practical and viable option for the medium term as India gradually moves towards full electrification of its vehicle fleet. This transition is expected to take 5-10 years.

- Cost of Ownership Perspective: Hybrids are considered cost-effective as several state governments are giving waivers on registration fees, RTO fees, etc. For example, UP government has announced a 100% waiver on registration fees for strong hybrids, potentially saving buyers up to Rs 3.5 lakh. Hybrid cars have better fuel economy compared to conventional fuel cars leading to cost savings for drivers over time.

- Critical for Decarbonisation Drive: Hybrid vehicles play a role in India's decarbonisation efforts. Hybrid vehicles have lower total (well-to-wheel, or WTW) carbon emissions than both electric and traditional ICE vehicles for similarly sized vehicles. They emit 133 g/km of CO while EVs emit 158 g/km. This translates to hybrids being 16% less polluting than the corresponding EV.

What are the Challenges in the Adoption of Electric Vehicles in India?

- Higher Cost: High upfront cost is a primary barrier for electric vehicles compared to conventional internal combustion engine (ICE) vehicles. The cost of batteries, which is a significant portion of an EV's price, remains high, making EVs less affordable for many consumers, especially in a price-sensitive market like India.

- Lack of Clean Energy: Much of India's electricity is generated from burning coal, thus relying on coal to generate power for all the EVs would defeat the purpose of reducing carbon emissions through EV adoption.

- Supply Chain Issues: Global supply chain issues for lithium-ion batteries are significant, with over 90% of lithium production concentrated in countries like Chile, Argentina, Bolivia, Australia, and China.

- Underdeveloped Charging Infrastructure: India's current charging infrastructure is not sufficient for the increased demand for EVs, with only 12,146 public EV charging stations mostly in urban areas, it lags far behind China, which has 1.8 million electric charging stations.

- Suboptimal Battery Technology: Current EV batteries have limited capacity and voltage, which hinders driving range. This, along with limited charging stations, aerodynamic drag, and vehicle weight, makes it difficult for drivers to travel long distances without recharging.

- Persistent Resistance to Change: Indian consumers persistently resist adopting EVs due to lack of awareness and general reluctance to embrace new technologies, especially in rural areas, despite the long-term economic and environmental benefits.

Way Forward

- Addressing Cost Concerns: Government needs to focus on providing demand incentives and targeted subsidies, especially for middle-income and budget segments, developing a network of battery swapping stations to reduce charging time and alleviate range anxiety and more focus on promoting the adoption of electric two-wheelers to create a larger EV user base.

- Enhancing Charging Infrastructure: There is a need to prioritise the installation of fast-charging stations along major highways and urban centres, and to integrate renewable energy sources like solar and wind power to ensure EVs contribute to reduced emissions.

- Boosting Battery Technology and Supply Chain: Incentivize the establishment of domestic lithium-ion cell manufacturing facilities to reduce import dependence and implement efficient battery recycling programs to address environmental concerns and reduce reliance on virgin raw materials.

- Promoting Consumer Awareness and Education: Targeted public awareness campaigns should be conducted to address misconceptions and highlight the benefits of EVs. There should be a focus on rural outreach programs to promote the adoption of electric two-wheelers and three-wheelers for agricultural and transportation needs.

India’s Ambitious Airport Expansion Plan

Why in News?

India has set an ambitious goal to increase its operational airports to 300 by 2047, a significant jump from the current numbers. This development is in response to the expected surge in passenger traffic.

Factors Driving the Expansion of India's Aviation Sector

- Infrastructure Development and Upgradation: The Airports Authority of India (AAI) plans to upgrade 70 airstrips into airports capable of handling narrow-body aircraft, improving connectivity.

- New Greenfield Airports: Locations like Kota, Parandur, Kottayam, Puri, Purandar, Car Nicobar, and Minicoy are earmarked for new airport constructions.

- UDAN Scheme: The UDAN scheme has enhanced connectivity to tier-II and tier-III cities, linking underserved destinations.

Projected Growth in Passenger Traffic

- Massive Increase in Passenger Traffic: Anticipated growth from 376 million passengers to 3-3.5 billion by 2047 due to economic factors.

- International Traffic Growth: Projections indicate 10-12% of the growth will be in international traffic.

Economic Factors

- Economic Growth: Expected robust economic growth leading to increased accessibility to air travel.

- Disposable Income: Rising incomes making air travel affordable for more people, especially the expanding middle class.

Cargo Sector Expansion

- Growing Air Cargo Demand: Focus on expanding air cargo due to e-commerce growth and India's aspirations in global air freight.

- Enhanced Cargo Infrastructure: New airports will have improved cargo-handling capacities to meet rising demand.

International Hub Development

- Hub Development Strategy: India aims to establish major airports as international hubs to attract global airlines and boost tourism.

Under-Penetration of Air Travel

- Low Air Travel Penetration: Despite being a large aviation market, India's air travel penetration is relatively low.

Projected Growth Opportunity

- Rising incomes are expected to drive increased air travel demand.

Challenges for India's Aviation Sector

- Land Acquisition and Urbanization: Urbanization challenges impacting airport expansion due to land shortages.

- Financial Requirements: High costs associated with airport development pose funding challenges.

- Saturation of Existing Airports: Existing airports, including key hubs, are reaching saturation levels.

- Air Navigation Services (ANS) and Infrastructure: Investments needed in ANS and infrastructure to enhance operational efficiency.

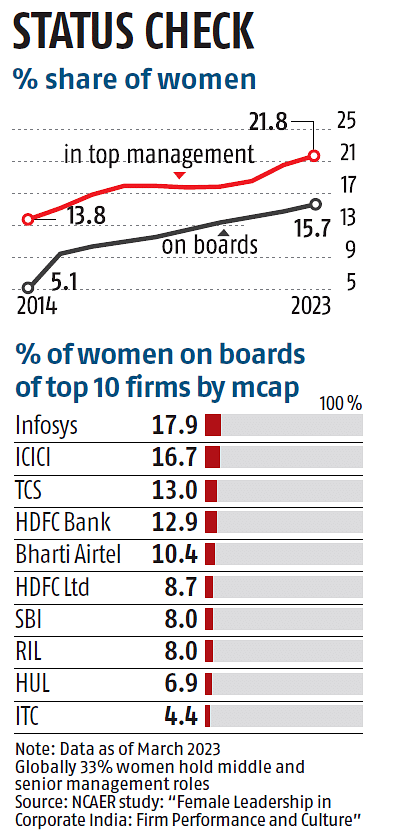

Women's Representation in Corporates

Why in News?

Recently, a report by the National Council of Applied Economic Research (NCAER) has revealed that women's representation in top management and company boards in India has increased but still lags behind the global average. In another study by the World Bank, it has been highlighted that India needs to assign a specific priority sector tag for women-led rural enterprises for easier access to credit.

Key Findings of NCAER on Women's Representation in Indian Corporates

- The share of Women in Top Management Positions increased from nearly 14% in FY14 to about 22% in FY23.

- The share of Women on Company Boards in India around 5% nearly 16%

- The share of Women in Middle and Senior Management Roles in India is only 20% with a global average of 33%

- Share of Women Representation in NSE Listed Firms: Almost 60% of the firms studied, including 5 of the top 10 NSE-listed firms by market capitalization, did not have any women in their top management teams as of March 2023. About 10% of the firms had just one woman

Key Recommendations of the World Bank on Boosting Employment Opportunities for Women in India

- Assign Priority Sector Tag for Women-led Rural Enterprises: study found that loans to women's micro-enterprises are not prioritised separately. It suggests creating a new sub-category within the micro-enterprise sector to cater specifically to women-owned ventures with high growth potential.

- Bridging the Digital Divide: The report emphasised the need to equip women entrepreneurs with digital literacy, training programs for digital bookkeeping and payment systems to enhance their financial management capabilities.

- Graduation Programs for Sustainable Growth: The report suggests implementing graduation programs to help micro-loan borrowers transition to mainstream commercial finance. It also advocates for the strategic use of district-level data analytics by stakeholders, including banks, to make informed decisions and effectively promote women's entrepreneurship in rural India.

- Strengthening the Institutional Ecosystem: The report recommends decentralising incubation centres in rural areas for mentorship and business support. It also suggests developing women's entrepreneur associations to foster community and peer learning.

Mains Question

Discuss the state of Women's workforce participation in Indian corporates. Also, suggest measures to enhance their participation in the workforce.

Financial Stability Report June 2024

Why in News?

The Reserve Bank of India has released the 29th issue of the Financial Stability Report (FSR).

Global Economic

- Heightened Global Risks: The global economy is encountering significant challenges, including:

- Geopolitical Tensions: Political conflicts and disagreements between countries that impact global stability.

- Elevated Public Debt: High levels of national debt that pose risks if countries struggle with repayment.

- Slow Disinflation Progress: Gradual decrease in prices of goods and services affecting economic stability.

- Resilience: Despite these risks, the global financial system remains robust and stable.

Indian Economy and Financial System

- Robust and Resilient: India’s economy and financial system are strong and capable of withstanding shocks.

- Banking Sector Support: Banks and financial institutions are in good shape and continue to lend, supporting economic activities.

Financial Metrics for Scheduled Commercial Banks (SCBs)

- Capital Ratios:

- Capital to Risk-Weighted Assets Ratio (CRAR): At 16.8%, indicating the bank has 16.8 units of capital for every 100 units of risk.

- Common Equity Tier 1 (CET1) Ratio: At 13.9%, showing a strong base of high-quality core capital.

- Asset Quality:

- Gross Non-Performing Assets (GNPA) Ratio: At 2.8%, representing the percentage of loans that are not being repaid.

- Net Non-Performing Assets (NNPA) Ratio: At 0.6%, indicating the percentage of loans in trouble after accounting for provisions.

Macro Stress Tests for Credit Risk

- Stress Scenarios and Projections:

- Baseline Scenario: Banks are expected to have a CRAR of 16.1% by March 2025 under normal conditions.

- Medium Stress Scenario: CRAR is projected to be 14.4% by March 2025 under moderate stress.

- Severe Stress Scenario: CRAR is expected to be 13.0% by March 2025 under severe stress.

- Interpretation: These stress tests assess how banks might perform under varying economic conditions, ensuring they are prepared for challenging situations.

Health of Non-Banking Financial Companies (NBFCs)

- CRAR: NBFCs have a CRAR of 26.6%, indicating strong financial health.

- GNPA Ratio: At 4.0%, showing that 4% of their loans are not being repaid.

- Return on Assets (RoA): At 3.3%, demonstrating that NBFCs are generating solid profits from their assets.

Cooperatives and Their Evolution in India

Why in News?

Recently, the Union Home Minister and Minister of Cooperation addressed the 'Sahkar se Samriddhi' (Prosperity through Cooperation) program organised on the occasion of the 102 International Day of Cooperatives in Gujarat.

How did Cooperatives Evolve in India?

About Cooperatives:

- These are people-centred enterprises owned, controlled, and run by and for their members to realize their common economic, social, and cultural needs and aspirations.

- India has one of the world's largest cooperative networks with over 800,000 cooperatives spread across various sectors like agriculture, credit, dairy, housing, and fisheries.

Cooperatives in Pre-Independence Era:

- First Cooperative Act in India: Indian Famine Commission (1901) led to the enactment of the first Cooperative Credit Societies Act in 1904 followed by the (amended) Cooperative Societies Act, 1912.

- Maclagan Committee: In 1915, a committee headed by Sir Edward Maclagan, was appointed to study and report whether the cooperative movement was proceeding on economically and financially sound lines.

- Montague-Chelmsford Reforms: Through the Montague-Chelmsford Reforms of 1919, cooperation became a provincial subject which gave further impetus to the movement.

- Post Economic Depression, 1929: Various committees were appointed in Madras, Bombay, Travancore, Mysore, Gwalior, and Punjab to examine the possibilities of restructuring the Cooperative societies.

Gandhian Socialist Philosophy:

- Cooperation according to Gandhiji was necessary for the creation of a socialistic society and complete decentralization of power.

- In South Africa, Mahatma Gandhi instituted the 'Phoenix Settlement' as a cooperative in a socialistic pattern.

- He established the Tolstoy Farm as a rehabilitation cooperative settlement for the families affected by the South African freedom struggle during the period.

Cooperatives in Post-Independence India:

- First Five-Year Plan (1951-56): Highlighted the promotion of cooperatives for comprehensive community development.

- Multi-State Co-operative Societies Act, 2002 Provides for the formation and functioning of multi-state co-operatives.

- Multi-State Co-operative Societies (Amendment) Act, 2022 introduced the Co-operative Election Authority to oversee board elections in multi-state co-operative societies.

- 97 Constitutional Amendment Act of 2011: Established the right to form cooperative societies as a fundamental right (Article 19).

Impact of Cooperatives:

- Empowering Marginalised Communities

- Boosting Agricultural Productivity and Marketing

- Facilitating Access to Essential Services

- Promoting Inclusive Growth and Job Creation

What are the Challenges Faced by the Cooperatives?

- Governance Challenges: Cooperatives struggle from the challenges of lack of transparency, accountability, and democratic decision-making processes. Limited member participation, inadequate representation of marginalized communities, and concentration of power within a few individuals can undermine the inclusive nature of cooperative enterprises.

- Limited Access to Financial Resources: Many cooperatives, particularly those serving marginalized communities, face challenges in accessing financial resources. They often lack collateral or formal documentation required by traditional financial institutions, making it difficult to obtain loans.

- Socio-economic Disparities and Exclusion: Cooperatives often face issues related to lack of inclusivity, existence of structural inequalities, etc.

- Infrastructural Constraints: Infrastructural constraints and lack of connectivity affect their efficiency and effectiveness leading to limited outreach.

- Lack of Technical and Managerial Capacities: Lack of training and skill development initiatives is another challenge that leads to outdated human resources.

- Social and Cultural Factors: Lack of awareness about the cooperative model and its benefits among potential members limits their participation. In some cases, social hierarchies and caste-based divisions create barriers for equitable participation and representation within cooperatives.

Way Forward

- Implement digital platforms for financial reporting, conduct regular audits, and encourage member participation in decision-making processes.

- Establish cooperative development funds with flexible collateral requirements to cater to the needs of marginalized communities.

- Encourage cooperatives to explore crowdfunding, social impact bonds, and other innovative financing solutions.

- Design outreach programs to educate and attract members from marginalized communities, addressing specific needs and challenges.

- Advocate for government investment in rural infrastructure development, improving connectivity and access to markets for cooperatives.

- Partner with government agencies and training institutions to offer skill-building workshops for cooperative members and managers.

- Launch targeted awareness campaigns in local languages to educate potential members about the benefits and principles of cooperatives.

Mains Question

Discuss the major challenges faced by the cooperative sector in India. How can these challenges be addressed to strengthen the cooperative movement in India?

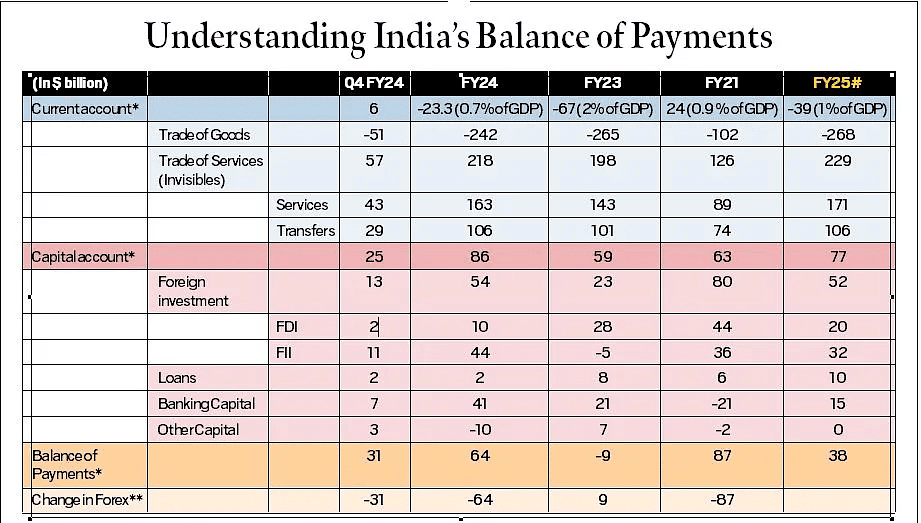

India's Balance of Payments

Why in News?

Recently, the Reserve Bank of India (RBI) data revealed that India's current account registered a surplus in the fourth quarter (Jan-Mar) of the 2023-24 financial year. This was the first surplus in 11 quarters. This achievement underscores the significance of Balance of Payments (BoP) highlighting its impact on currency exchange rates, sovereign ratings, and overall economic health.

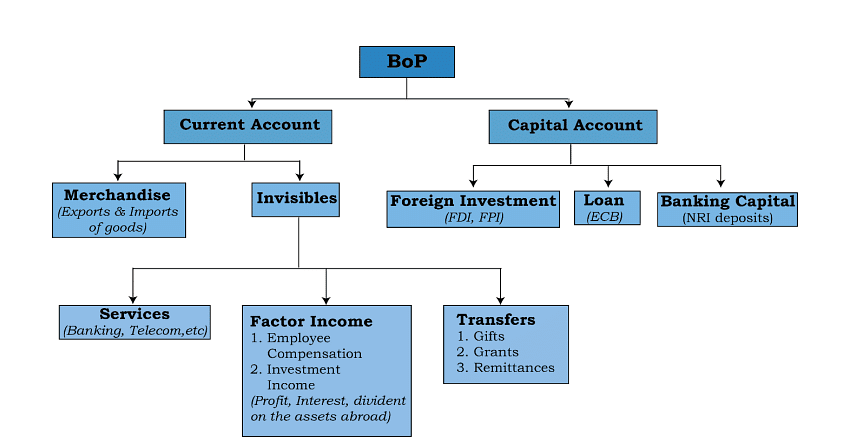

What is Balance of Payments?

About:

The BoP serves as a crucial economic indicator, detailing all financial transactions between India and the rest of the world. This comprehensive ledger tracks the inflow and outflow of money where inflows are marked positive and outflows negative, reflecting the country's economic interactions globally. It measures the relative demand for the rupee against foreign currencies, crucially influencing exchange rates and economic stability.

Constituents of BoP

Current Account:

- Trade of Goods: Tracks physical imports and exports, indicating the balance of trade. A deficit suggests higher imports than exports.

- Trade of Services (Invisibles): Includes sectors like IT, tourism, and remittances, contributing positively to India's current account surplus despite trade deficits. Net of these two components determines the current account balance. In Q4 of 2023-24, India registered a surplus on the current account, with a surplus in invisible but a deficit in the trade account.

Capital Account:

- Captures investments such as Foreign Direct Investment (FDI), Foreign Institutional Investments (FII), essential for economic growth and stability. The capital account flow reflects factors such as commercial borrowings, banking, investments, loans, and capital. In Q4 of 2023-24, India showed a net surplus of USD 25 billion on the capital account.

- Disequilibrium: A disequilibrium in the balance of payment means its condition of Surplus or deficit. A BoP surplus occurs when a country's earnings from exports, services, and investments exceed its expenditures on imports and external obligations. Conversely, a deficit indicates higher expenditures than earnings, necessitating external financing or asset sales to cover the shortfall.

Challenges:

- BoP calculations include errors and omissions due to complexities in recording international transactions accurately.

- Persistent deficits can strain a nation's economic stability, potentially requiring external borrowing or assistance from international financial institutions like the IMF.

- Contrary to popular perception, deficits aren't inherently negative nor surpluses unequivocally positive. A deficit can signify strategic investments, while a surplus may stem from reduced imports rather than robust economic health.

Managing BoP:

Foreign Exchange Reserves:

- RBI manages BoP fluctuations by adjusting foreign exchange reserves through market interventions and by using tools such as adjusting interest rates, open market operations and influencing borrowing and spending.

Policy Interventions:

- Governments implement trade policies and regulatory measures to stabilize BoP dynamics, ensuring sustainable economic growth.

Deflation:

- Deflation is the deliberate reduction of money supply or aggregate demand. It can result in lower domestic prices, which may make exports more competitive, and reduced consumption, including of imports. However, it also poses risks such as economic slowdown or recession and increased unemployment.

Foreign Investment Promotion:

- Promoting foreign investment to enhance the capital account by offering tax incentives, improving infrastructure, business environment, and streamlining regulations for foreign businesses. This can attract foreign capital and technology, leading to potential improvement in export capacity.

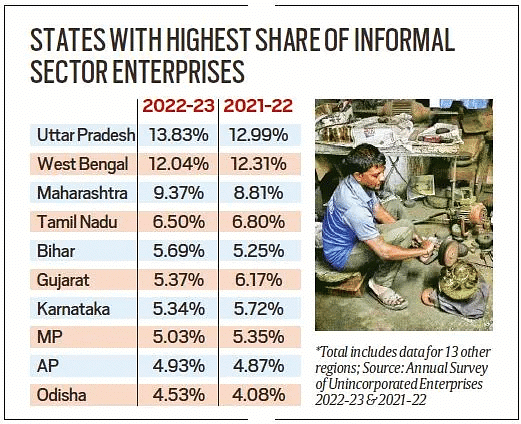

Annual Survey of Unincorporated Enterprises (2022-23)

Why in news?

Recently, the Ministry of Statistics and Programme Implementation (MoSPI) has released the Annual Survey of Unincorporated Enterprises for 2022-23.

What is the Scenario of Informal Workers According to the Survey?

- Uttar Pradesh, West Bengal, and Maharashtra had the highest share of informal sector enterprises in both rural and urban areas.

- The share of informal sector enterprises decreased in the post-pandemic year 2022-23 in states such as Gujarat, Haryana, Karnataka, Kerala, Madhya Pradesh, Tamil Nadu, and West Bengal.

- Delhi topped among major states with an increase in the number of unincorporated non-agricultural enterprises.

Share of Informal Sector Enterprises (in 2022-23 as compared to 2021-22)

- Uttar Pradesh: Increased by 0.84% (from 12.99% to 13.83% of total informal sector enterprises).

- West Bengal: Decreased by 0.27% (from 12.31% to 12.04% of total informal sector enterprises).

- Maharashtra: Increased by 0.56% (from 8.81% to 9.37% of total informal sector enterprises).

- Delhi: Increased by 0.79% (from 0.64% to 1.43% of total informal sector enterprises).

Informal sector workers (in 2022-23 as compared to 2021-22)

- Uttar Pradesh: 0.27 crore (from 1.30 crore).

- West Bengal: 0.03 crore (from 1.02 crore).

- Maharashtra: 16.19 lakh.

Total Workers in Unincorporated Non-Agricultural Sector

- During 2022-23: 1.17 crore workers (from 9.79 to 10.96 crore).

- Urban Workers: 0.69 crore workers (from 5.03 to 5.72 crore).

- Rural Workers: 0.48 crore workers (from 4.76 to 5.24 crore).

Mains Question

Examine the necessity of transitioning the informal sector into the formal economy and outline strategies to facilitate this structural transformation more effectively.

Social Security for Gig Workers

Why in news?

Recently, Karnataka became the second state after Rajasthan to come up with legislation for gig workers. Through a draft version of the law (Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill), the government aims to regulate the social security and welfare of platform-based gig workers in the state by creating a board, welfare fund, and grievance cell among the mechanisms.

Key Highlights of the Karnataka Bill

- Creation of Welfare Board: Board comprising Karnataka labour minister, two aggregator officials, two gig workers, and one civil society member to be formed.

- Two-level grievance redressal mechanism for workers, and more transparency with regards to the automated monitoring and decision-making systems deployed by platforms has been envisaged by the draft bill.

- Timely Payment: The draft mandates aggregators to make payments at least every week and to inform the worker about the reasons for any payment deductions.

- Unique ID: Gig workers can apply to receive a unique ID applicable across all platforms upon registration with the board.

- Social Security and Grievance Redressal: Access to general and specific social security schemes based on contributions along with a grievance redressal mechanism for gig workers.

- Autonomy and Contractual Rights: The Bill aims to provide greater autonomy to the gig workers to terminate contracts and resist being overworked by employers.

- The aggregator shall not terminate a worker without giving valid reasons in writing and prior notice of 14 days.

- Work Environment and Safety: There is a mandate for aggregators to maintain a safe working environment for gig workers.

- Welfare Fund: Proposed fund financed by a welfare fee from aggregators along with state and worker contributions.

- Penalties: Basic penalty of Rs 5,000 extendable up to Rs 1 lakh for aggregators violating conditions under the Bill.

Who are Gig Workers?

- Gig Workers: As per the Code on Social Security 2020, a person who performs work or participates in a gig work arrangement and earns from such activities outside of traditional employer-employee relationship.

- Gig Economy: Free market system in which temporary positions are common and organisations contract with independent workers for short-term engagements.

Need to Provide Social Security Benefits to Gig Workers

- Frequent Termination: The instances of blacklisting workers or terminating them from work without hearing out their side have increased.

- Economic Security: The sector depends on demand which leads to job insecurity and income uncertainty highlighting the necessity of providing social security benefits such as unemployment insurance, disability coverage, and retirement savings programs.

- Health Insurance: Lack of access to employer-sponsored health insurance and other healthcare benefits leaves gig workers vulnerable to unexpected medical expenses.

- Level Playing Field: Exemption from traditional employment protections creates disparities where gig workers face exploitative working conditions and inadequate compensation. Providing social security benefits will level the playing field.

- Long-term Financial Security: Without employer-sponsored retirement plans, gig workers may struggle to save enough for their future like for post-retirement needs.

Main Challenges in Providing Social Security Benefits to Gig Workers

- Classification and Excess Flexibility: The gig economy is characterised by its flexibility, allowing workers to choose when, where, and how much they work. Designing benefits that accommodate this flexibility and meet the diverse needs of gig workers is a complex task.

- Funding and Cost Distribution: Traditional systems depend on employer and employee contributions, with employers typically bearing a significant portion of the costs. In the gig economy, where workers are often self-employed, identifying appropriate funding mechanisms becomes complex.

- Coordination and Data Sharing: Efficient data sharing and coordination among gig platforms, government agencies, and financial institutions are necessary to accurately assess gig workers' earnings, contributions, and eligibility for various social security programs. However, as gig workers often work for multiple platforms or clients, it becomes challenging to coordinate and ensure proper coverage.

- Education and Awareness: Many gig workers may not fully understand their rights and entitlements regarding social security benefits. Raising awareness and providing education about the importance of social security, eligibility criteria, and the application process is a challenging task.

Actions to Ensure Social Security of Gig Workers

- Implementing Code on Social Security, 2020: Although the Code contains provisions for gig workers, the rules are yet to be framed by the States and not much has moved in terms of instituting the Board. These should thus be taken up expeditiously by the government.

- Expanding Employer Responsibilities: Strong support for gig workers should come from the gig companies that themselves benefit from this agile and low-cost work arrangement. The practice of classifying gig workers as self-employed or independent contractors needs to be eliminated. Companies must be provided equal benefits as that of a regular employee.

- Education and Training: The government should invest in education and training programs for gig workers to improve their skills and increase their earning potential.

- Government Support: Collaboration between governments, gig platforms, and labour organisations to establish fair and transparent mechanisms for sharing the responsibility of providing social security benefits. For example, schemes similar to Ayushman Bharat should be extended to cover gig workers with cost-sharing with the employer.

- Adopting International Examples: UK has instituted a model by categorising gig workers as "workers," which is a category between employees and the self-employed. This secures them a minimum wage, paid holidays, retirement benefit plans, and health insurance. Similarly, in Indonesia, they are entitled to accident, health, and death insurance.

- Linking Women Empowerment with Gig Economy: There is a need to build the right physical and social infrastructure that supports the engagement of women in the gig workforce.

Mains Question

Discuss the need and challenges associated with providing social security for gig workers in India. Also, highlight steps taken by centre and state governments in this context.

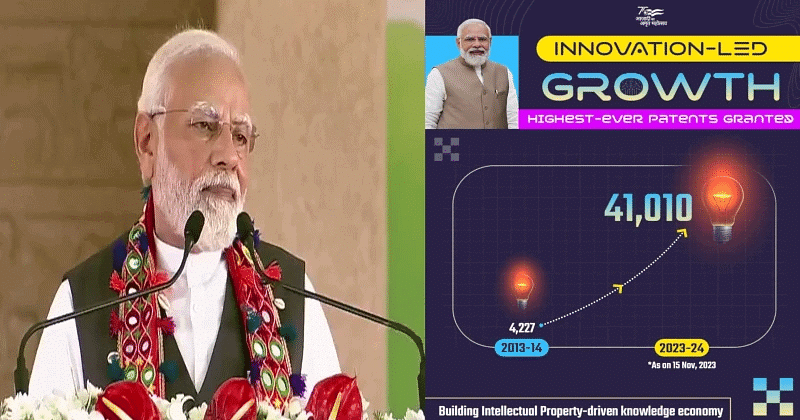

India Grants Record Patents in 2023-24

Why in News?

Recently, the Indian Patent Office (IPO) has granted the highest number of 41,010 patents till November 2023. In the fiscal year 2013-14, 4,227 patents were granted. According to a World Intellectual Property Organization (WIPO) report, patent applications by Indians grew by 31.6% in 2022, extending an 11-year run of growth unmatched by any other country among the top 10 filers. The surge in patent grants in India reflects the country's progress in innovation, technology, and competitiveness. It also impacts society, economy, and the youth by addressing challenges, creating opportunities, and nurturing talent.

What is a Patent?

About:A Patent is a statutory right for an invention granted for a limited period of time to the patentee by the Government, in exchange for full disclosure of their invention, excluding others from making, using, selling, or importing the patented product or process for producing that product without consent.

The patent system in India is governed by the Patents Act, 1970, as amended by the Patents (Amendment) Act, 2005, and the Patents Rules, 2003.

- Term of a Patent: The term of every patent granted is 20 years from the date of filing the application. For applications filed under the national phase under Patent Cooperation Treaty (PCT), the term of the patent will be 20 years from the international filing date under PCT.

- Criteria of Patentability: An invention is considered patentable subject matter if it is novel, has inventive steps, is capable of industrial application, and does not attract the provisions of sections 3 and 4 of the Patents Act 1970.

- Scope of Patent Protection: Patent protection is a territorial right and is effective only within the territory of India. There is no concept of a global patent. Filing an application in India enables the applicant to file a corresponding application for the same invention in convention countries or under PCT within or before the expiry of twelve months from the filing date in India.

- Patents Act, 1970: This principal law for the patenting system in India came into force in the year 1972, replacing the Indian Patents and Designs Act 1911. The Act was amended by the Patents (Amendment) Act, 2005, extending product patents to all fields of technology including food, drugs, chemicals, and microorganisms.

Way Forward

- It is crucial to strengthen the innovation ecosystem by increasing investments in research and development, establishing and supporting innovation hubs and incubation centers.

- Simplifying patent procedures and enhancing the capacity of the Indian Patent Office are vital to encourage innovators to seek protection for their innovative ideas.

- Empowering innovators, especially the youth, through education on Intellectual Property Rights (IPR) and conducting training programs can simplify the patent filing process, fostering a culture of innovation and protection.

|

173 videos|487 docs|159 tests

|

FAQs on Economic Development: July 2024 UPSC Current Affairs - Indian Economy for UPSC CSE

| 1. What is the current status of India's Pharmaceutical Industry? |  |

| 2. How is India boosting lighthouse tourism? |  |

| 3. What is the push for hybrid electric vehicles in India? |  |

| 4. What is India's ambitious airport expansion plan? |  |

| 5. How is women's representation in corporates evolving in India? |  |