Trends in FDI | Crash Course for UGC NET Commerce PDF Download

Trends in Foreign Direct Investment

Foreign direct investment (FDI) plays a crucial role in the global economy by facilitating capital flows, international trade, and technology transfer. Over recent decades, the volume and patterns of FDI have experienced significant shifts due to economic, political, and technological developments. Below are the key trends in FDI:

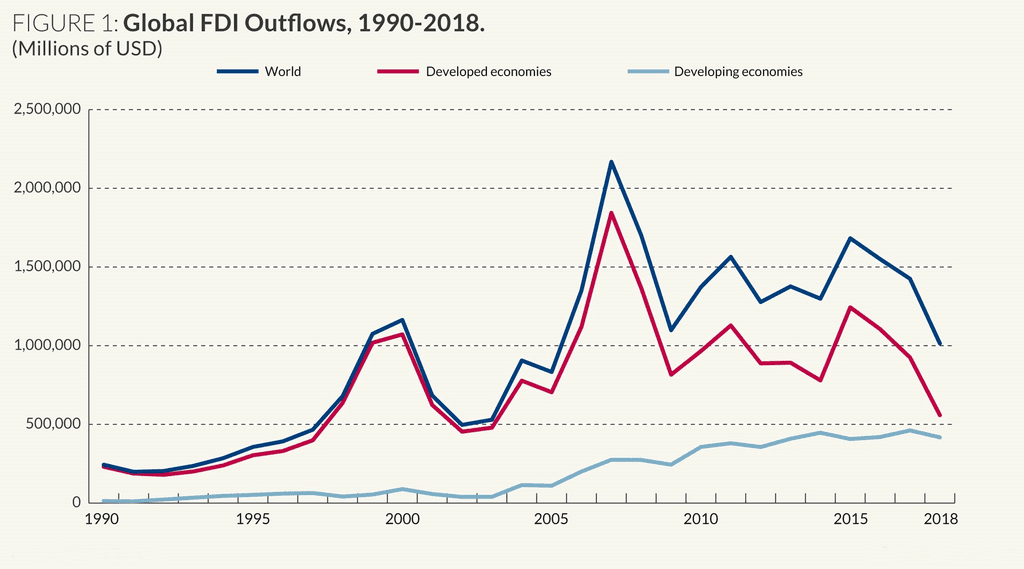

Rising FDI Flows: Global FDI inflows and outflows have seen a substantial increase, growing from $59 billion in 1990 to $1.5 trillion in 2019. Developing countries, in particular, have experienced rapid FDI growth.

Shift Towards Services: Traditionally, FDI was concentrated in manufacturing. However, there has been a notable shift towards the services sector, including finance, telecommunications, and logistics, reflecting the growing importance of the service economy.

Mega-Mergers and Acquisitions: Cross-border mergers and acquisitions have become a significant channel for FDI, especially among large firms. This trend enables rapid expansion into new markets and the acquisition of advanced technologies.

Rise of South-South FDI: FDI flows between developing countries have grown substantially, with China’s investments in Africa and Latin America serving as prime examples. This trend contributes to the global spread of production networks.

Intra-Firm FDI on the Rise: Increasing amounts of FDI are being directed towards cross-border investments within the same multinational groups, optimizing global value chains.

FDI in High-Tech Industries: A growing share of FDI is being funneled into high-tech sectors such as biotechnology, computer software, and telecommunications, driven by the global technology boom.

Sustainability Evolving as Critical: Investors are increasingly focused on the environmental and social impacts of FDI projects, leading to the anticipated growth of sustainable FDI.

Rise of Greenfield FDI Projects: There has been an uptick in new Greenfield FDI projects, where companies establish new facilities from scratch, signaling investor confidence in host economies.

Growing Importance of Intangible Assets: An increasing proportion of FDI is aimed at acquiring intangible assets such as brands, intellectual property, proprietary technology, and expertise, enabling faster growth and market dominance.

Focus on Emerging Markets: Large emerging markets like China, India, Brazil, and Indonesia are attracting a significant portion of global FDI due to their expanding consumer base and growth potential.

Shift Towards Robotics and Automation: More FDI is being directed towards industries utilizing robotics, artificial intelligence, and automation, reflecting the onset of the Fourth Industrial Revolution.

Increasing Role of E-Commerce: The growth of e-commerce giants and their international expansion through FDI is reshaping global trade and retail landscapes, with online platforms facilitating cross-border flows of goods, services, and investments.

Rising Strategic FDI: Many governments are leveraging FDI policies to achieve strategic objectives, such as acquiring critical technologies, building capabilities in priority sectors, and securing access to natural resources.

Interest in Frontier Markets: Investors are increasingly exploring options in smaller and frontier markets, attracted by their higher growth prospects and potential for outsized returns, despite the associated risks.

Sectoral Trends in FDI

FDI flows vary across different sectors of the economy, depending on growth and profitability opportunities. Here are the key sectoral trends in FDI:

FDI flows vary across different sectors of the economy, depending on growth and profitability opportunities. Here are the key sectoral trends in FDI:

Services Sector: The services sector, including finance, telecommunications, business operations, and real estate, has become the largest recipient of global FDI, with its share rising from about 40% in the 1990s to over 65%.

Manufacturing: Although manufacturing, particularly in labor-intensive industries, was once the primary recipient of FDI, its share has declined due to rising costs. However, high-tech manufacturing continues to attract significant FDI.

Natural Resources: Extractive industries such as mining, oil, and natural gas continue to attract large FDI inflows in resource-rich developing countries. However, these projects are increasingly scrutinized for their environmental and social impacts.

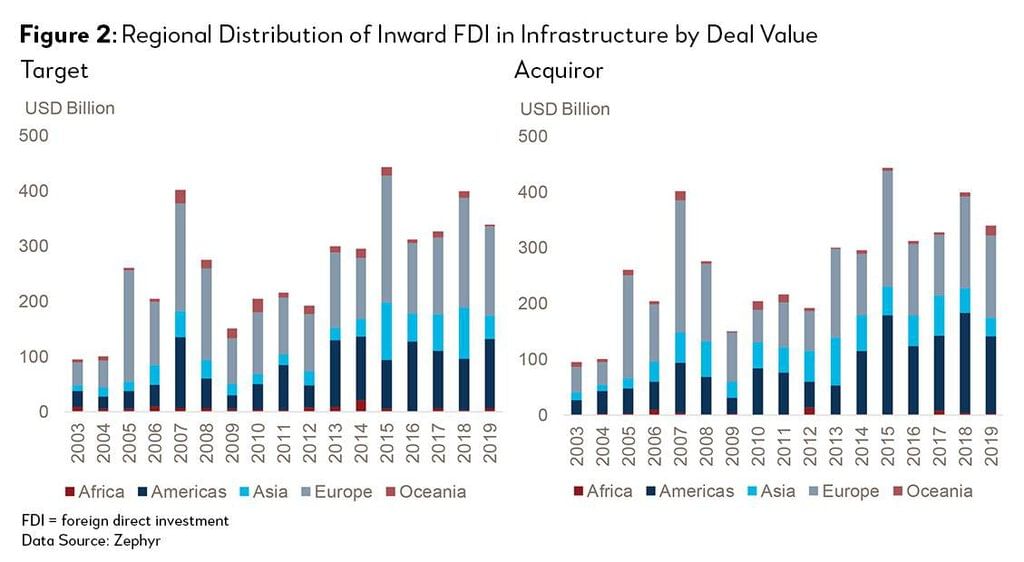

Infrastructure: FDI in infrastructure sectors like transportation, power, and telecommunications has steadily increased as countries develop critical assets, often supported by government incentives and subsidies.

Agriculture: FDI in agriculture, particularly in commercial farming and agro-processing, has been growing in recent years. While this can boost productivity and farm incomes, it also raises concerns about the impact on small farmers.

Technology: The technology sector, including computer software, e-commerce, and semiconductors, has emerged as a major FDI magnet, with tech firms leading many cross-border mergers and acquisitions.

Real Estate: Foreign investment in commercial and residential real estate markets has been growing, particularly in emerging cities, driving up property prices in some areas.

Retail: The organized retail sector is increasingly opening up to FDI in more countries, enabling global supermarket and hypermarket chains to expand into new markets.

Overall, global FDI flows continue to play a critical role in the development of sectors such as manufacturing, natural resources, infrastructure, and technology. However, governments need to carefully assess the costs and benefits of FDI in different sectors to maximize potential gains. Appropriate regulations and incentives can help optimize sectoral FDI for growth.

Global FDI Trends

FDI trends can vary annually and are influenced by factors such as economic conditions, government policies, trade agreements, geopolitical events, and technological advancements. Here are some general global FDI trends and considerations as of the latest available data:

Global FDI Flows: FDI flows experienced a downturn during the early stages of the COVID-19 pandemic in 2020 but saw some recovery in 2021 as the global economy began to stabilize.

Regional Shifts: Asia has become a major FDI destination, with significant investments in countries like China, India, and Southeast Asian nations. Africa is also emerging as an attractive FDI region, driven by its growing population, natural resources, and improving business environments in some countries. North America and Western Europe continue to attract substantial FDI, especially in technology and innovation sectors.

Key Sectors: Technology and digital industries have seen significant FDI, particularly in areas such as e-commerce, artificial intelligence, and renewable energy. The healthcare and pharmaceutical sectors have also attracted increased investment due to the COVID-19 pandemic. Additionally, renewable energy and sustainable practices have drawn substantial investments as countries work towards climate goals.

Policy Changes: Some countries have adjusted their FDI policies to protect sensitive industries, especially in national security and critical infrastructure areas. Many governments have also offered incentives to attract FDI, including tax breaks, grants, and streamlined regulations.

Geopolitical Factors: Geopolitical tensions and trade disputes can impact FDI trends, with tensions between major economies like the U.S. and China affecting cross-border investments.

Sustainability and ESG: Environmental, Social, and Governance (ESG) considerations are becoming increasingly important for investors, leading to more FDI being directed towards sustainable and responsible investments.

COVID-19 Pandemic: The pandemic accelerated trends in e-commerce, remote work, and digitalization, shifting FDI towards technology-related sectors.

Bilateral and Regional Agreements: Trade and investment agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) have influenced FDI patterns.

Conclusion

As global FDI volumes continue to rise, the composition, drivers, and implications of these flows are shifting significantly. Strategic FDI policies that align with these emerging trends will be essential for countries seeking to optimize the benefits of cross-border investments. By implementing appropriate frameworks and institutions, countries can attract inbound investments that support their socio-economic objectives and maximize the gains from the ongoing transformation of global capital and investment flows.

|

157 videos|236 docs|166 tests

|

FAQs on Trends in FDI - Crash Course for UGC NET Commerce

| 1. What are some key sectoral trends in Foreign Direct Investment (FDI)? |  |

| 2. How have global FDI trends evolved in recent years? |  |

| 3. What factors influence trends in FDI? |  |

| 4. How does the COVID-19 pandemic impact trends in Foreign Direct Investment? |  |

| 5. What are some strategies that countries can adopt to attract more Foreign Direct Investment? |  |