UPSC Mains Answer PYQ 2023: Economics Optional Paper 2 | Economics Optional for UPSC PDF Download

Important Note: Answers are written such that they can be produced in the exam like situation in the given time and word limit.

Q1(a): Land system during the British rule was responsible for sustained poverty and stagnant growth in India. Comment.

Ans: The British land revenue system created issues that contributed to ongoing poverty and stagnant economic growth in India.

Issues associated with British land revenue system

Disruption of traditional mechanism: Under the new system, landlords gained property rights over the land within their control, displacing the tillers who became tenants with little security. This change drove many tenants into severe poverty.

Growth of ABSENTEE LANDLORDISM

Rent payment in money format led to growth of moneylenders. Moneylenders used to charge high interest rate. It reduced surplus for farmers and led to lower investments in agriculture.

Prevented growth of capitalist farming in India

It led to decline in productivity. According to Blyn growth rate was just 0.72%. Thus India has to resort to food import.

Reasons

- Small size of landholdings because large landowners leased out their holdings to many small farmers;

- Zamindar didn’t invest because his land could be confiscated on non-payment of rent

- Tenant didn’t invest because of frequent transfer of land and all benefits accruing to the land owner

Due to high rents, many farmers shifted from cultivating food crops to growing cash crops such as cotton and sugarcane, which contributed to famines. Consequently, the land system during the British period was a key factor in the persistent poverty and stagnant growth of the Indian economy.

Q1(b): How did V. K. R. V. Rao improve upon the earlier national income estimates of India?

Ans: V.K.V. Rao's The National Income of British India, 1931-32 is a renowned study that became a key reference for estimating national income in pre-independence India.

He departed from the then prevalent trend of excluding services from national income accounting. He presented a practical application of Marshall and Pigou’s synthesis that advocated taking everything into account that has money price including services.

He was able to make the best use of all the data available at that time. For calculating Gross Income, he used the ‘inventory method’ for agriculture and the ‘income method’ for services and industry.

During that period, data was only available for the large-scale sector, requiring indirect calculations for other industrial incomes. With much of the economy being unmonetized, estimation and conjecture were crucial. His method offered more accurate estimates compared to earlier approaches.

Q1(c): Examine the impacts of Green Revolution on production and productivity in the agriculture sector.

Ans: The Green Revolution, starting in the 1960s, transformed Indian agriculture into a modern industrial system through the adoption of advanced technologies, including high-yielding variety (HYV) seeds, mechanized equipment, irrigation systems, pesticides, and fertilizers.

Impact On Production

- Between 1967-1970 food production rose by 35%.

- Food grain production increased from 75mt to 105mt in 1971.

- Agriculture growth increased from 0.8% to 3%.

- India became self-sufficient in food production. Our current food grain production is 330mt.

- Wheat output grew, too, from 12 MT (1970) to 48MT in 1986

- High Yield Variety use was extended to rice. Thus rice production increased to 64 mt in 1986, up from 37 mt in 1964.

- However, its success was limited to cereals. Pulses production dropped from 61mg per capita to 42 mg per capita now.

Impact on Productivity

- The introduction of HYV seeds led to substantial increases in yields.

- Mechanization increased labor productivity.

- The yield per hectare for rice went from about 1.2 tons in the early 1960s to 3.3 tons by the early 2000s.

- Also after 2005 growth of agriculture is more or less stagnant. Agriculture growth is stagnant at 3%.

- It is seen that in pulses MP is the highest producer still its productivity is much lesser than countries like China.

- India has more net crop area than China still its food production is much higher than India.

In recent times, agricultural growth has stagnated. It showed that the increase in the productivity of agriculture as a result of the Green Revolution was only short-term.

Q1(d): Deceleration and structural retrogression have been the key features of the industrial sector in India during 1965-80. Give reasons.

Ans: From 1960 to 1980, industrial growth slowed significantly, dropping from 6.3% to 4.1%. The capital goods sector experienced a sharp decline, falling from 16% to 6% annually, while manufacturing growth decreased from 8.5% to 4.5%.

Causes for deceleration in Industrial growth

More regulations

- Monopolistic and Restrictive Trade Practice Act, 1969 put a hold on the growth of firms.

- Foreign exchange regulation act impacted import and export.

- Labor is an essential factor of production. Contract Labor Act, 1970 disallowed contractual hiring. It increased the cost of production.

- Over 800 items reserved for SSI. It led to missing middle syndrome.

- No industry was allowed in municipality areas. These areas are major markets, thus industries were put at a disadvantage.

Other reasons

- War with China and Pakistan had negative impacts on the economy.

- Oil shock of 1970 increased the cost of production for industries.

It can be seen that majorly government policies combined with some external factors caused deceleration and structural retrogression in industrial growth during the mid-1960s to mid-1980s.

Q1(e): Examine the factors responsible for the acceleration in the growth of national income in the decade of the 1980s as against the 1960s and 1970s.

Ans: The acceleration in national income growth in India during the 1980s, compared to the 1960s and 1970s, can be attributed to several key factors:

- Economic Liberalization: Early moves towards deregulation and less government control over businesses fostered a more favorable environment for private enterprise and investment.

- Green Revolution: Agricultural advancements from the Green Revolution significantly increased productivity, leading to higher rural incomes and improved food security.

- Industrial Growth: A boost in industrial activity, especially in small and medium-sized enterprises, was fueled by government policies that supported modernization and growth.

- Public Sector Investment: Substantial investment in infrastructure and heavy industries by the public sector boosted economic activities and employment.

- Technological Advancements: The implementation of new technologies and modernization across sectors like agriculture and manufacturing enhanced efficiency and productivity.

- External Borrowing and Aid: Significant external aid and loans were utilized for developmental projects and infrastructure, providing a much-needed economic boost.

These factors collectively contributed to the higher growth rates in national income observed in India during the 1980s.

Q2(a): Explain the main features of money and credit policies in India during the pre-Independence era.

Ans: In the pre-Independence era, India's monetary and credit policies were influenced by colonial priorities and economic goals designed to benefit British interests.

Main Features of Money and Credit Policies in Pre-Independence India

Silver-Based Currency:

- Early Establishment: Historically, India used a silver-based currency system from Mughal times, which the British upheld by keeping the rupee as the main currency, linked to silver.

- Open Minting Policy: Initially, under the British, there was an open minting policy where anyone could convert silver into currency at government mints, ensuring a flexible money supply tied to the availability of silver.

Shift towards Gold Standard:

- Transition Period: In the late 19th century, influenced by global economic trends, there was a gradual shift towards the gold standard. This transition aimed to stabilize exchange rates and integrate India more closely with British monetary policies.

- Impact on Economy: The shift to the gold standard impacted inflationary and deflationary trends in India by linking the rupee's value to global gold prices as well as silver, which affected trade and economic stability.

Economists and historians, such as R.C. Dutt and Dadabhai Naoroji, argue that the shift towards the gold standard and the closure of Indian mints were measures imposed to ensure India’s economic subservience to Britain, rather than promoting indigenous economic growth.

Furthermore, the reliance on silver and later gold standards limited India’s ability to independently manage its monetary policy to suit domestic economic conditions, leading to periodic economic disruptions and challenges in managing inflation and exchange rate stability.

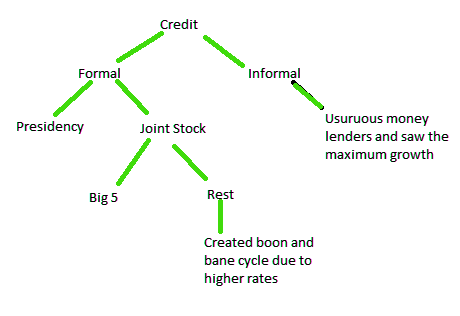

Credit Policies and Banking System:

- Formal Sector: During colonial times, India’s banking system was largely controlled by presidency banks like the Bank of Bengal, Bank of Bombay, and Bank of Madras, which mainly catered to European commercial interests and the financial requirements of the British administration.

- Informal Sector: Rural credit was largely provided by indigenous moneylenders, who played a crucial role in financing agriculture and small-scale trade. This sector operated outside formal regulatory frameworks, leading to high interest rates and limited access to credit for rural peasants.

The pre-Independence era saw India’s monetary and credit policies heavily influenced by colonial economic imperatives, resulting in a dualistic financial system with implications for economic growth, stability, and independence.

Q2(b): What are the factors contributing towards shift in sectoral composition in Gross National Product (GNP) in India during the pre-economic reform period? Discuss.

Ans: Between 1951 and 1990, changes in the sectoral composition of India’s Gross National Product (GNP) were influenced by strategic economic planning, regulatory policies, and external market conditions.

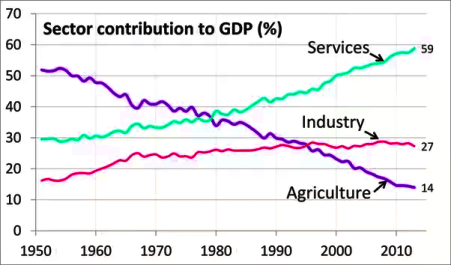

1951-1965: Industrialization Focus

Following independence, India adopted a planned economy with an emphasis on heavy industries, as outlined in the First and Second Five-Year Plans. This led to a reduction in agriculture’s GDP share and an increase in contributions from capital-intensive industries. Despite this industrial focus, agricultural employment remained high at around 70%, while the industrial and service sectors employed 13% and 17%, respectively. Economist Amartya Sen noted that these policies were designed to establish a strong industrial base for long-term growth.

1965-1990: Industrial Stagnation and Service Sector Growth

This period saw inward-oriented policies like the Monopolies and Restrictive Trade Practices Act (MRTP) and the Foreign Exchange Regulation Act (FERA) that created inefficiencies and slowed industrial growth. Economist Jagdish Bhagwati criticized these protectionist policies for leading to stagnation in manufacturing and a slowdown in productivity. Conversely, the service sector began to grow due to increased global demand for outsourcing. During this time, agricultural employment decreased to 66%, and service sector employment rose to 21%.

Deepak Nayyar highlighted the inefficiencies caused by excessive regulation and lack of competition. Dani Rodrik and Arvind Subramanian observed that while these policies hindered industrial growth, the service sector’s growth in the 1980s reflected a shift towards more productive economic activities driven by global outsourcing trends and pro-business reforms.

The period from 1951 to 1990 illustrates how initial successes in industrialization were eventually undermined by inefficient regulations, leading to significant growth in the service sector.

Q2(c): Explain the main reasons for deceleration in agricultural growth in India during the post-economic reform period.

Ans: From 1990 to 1996, India experienced robust economic growth and increased food demand, leading to an annual agricultural GDP growth rate of about 3.7%. However, from 1996 to 2005, growth slowed to approximately 2% per year across all agricultural sub-sectors. Since 2005, agricultural growth has stagnated at around 4% annually.

Reasons for Deceleration in Agricultural Growth in India During the Post-Economic Reform Period

- Regional Concentration: The Green Revolution’s benefits were concentrated in specific regions of India (Western UP, Haryana, and Punjab), and its effects diminished in other areas.

- Technological Stagnation: According to S. Chand, the technological advancements of the Green Revolution plateaued post-reforms. Lack of innovation and adoption of modern practices hindered further productivity gains. Investment in agricultural R&D remained at 0.3% of agricultural GDP, compared to 2-3% in Western countries.

- Global Crisis: Post-1991, exports surged but declined due to the East Asian Crisis and a sharp drop in global commodity prices.

- Infrastructure and Irrigation Constraints: Poor irrigation and infrastructure challenges, noted by Gulati and others, remain significant. Much of the agricultural land depends on monsoon rains, making crops vulnerable to climate variability and reducing productivity.

- Policy Instability and Market Distortions: Chand highlighted that inconsistent policies and market distortions, such as price controls and subsidies, created uncertainty for farmers. Fluctuating global commodity prices exacerbated these issues, affecting profitability and investment.

- Public Investment: Post-reform emphasis on subsidies negatively impacted public investment in agriculture. Bhalla identified this as a key reason for the deceleration in agricultural growth.

- Structural Issues and Land Fragmentation: Chand pointed out that land fragmentation due to inheritance laws and population growth reduced economies of scale and productivity, making farming less profitable.

- Environmental Degradation: According to Gulati, unsustainable practices like excessive use of fertilizers and pesticides have led to soil degradation and reduced fertility, impacting yields.

Addressing these challenges requires ongoing policy reforms, increased investment in agriculture, adoption of advanced technologies, and promotion of sustainable farming practices.

Q3(a): Discuss the role of D. R. Gadgil in economic planning and development in India.

Ans: Dhananjaya Ramchandra Gadgil, widely known as D. R. Gadgil, was a significant Indian economist whose contributions greatly influenced the country’s economic planning and development.

1. His Idea of Planning: Gadgil opposed the notion that planning in a developing country should initially focus on consumer goods industries, as advocated by Vakil. He believed that building a foundation with basic industries was crucial for lasting economic progress. He proposed promoting consumer goods-producing small-scale industries for employment generation, while the state should invest in heavy industries.

2. Influence on Planning Commission: Gadgil played a key role in shaping the Planning Commission of India. He advocated for a balanced regional development approach to reduce disparities between different regions.

3. Gadgil Formula: In 1969, Gadgil introduced the Gadgil Formula, which aimed to allocate central assistance for state plans more equitably. This formula considered factors like population, per capita income, and states’ performance in implementing development programs, ensuring a fair distribution of resources.

4. Emphasis on Rural Development: Gadgil was a strong advocate for rural development, emphasizing the need for comprehensive planning that included agriculture, rural industries, and infrastructure to uplift rural areas and alleviate poverty.

5. Advocate of Decentralized Planning: Gadgil supported decentralized planning, advocating for greater involvement of local bodies and state governments to make planning more effective and responsive to local needs.

6. Role in Industrial Policy: Gadgil contributed to formulating industrial policies that aimed at promoting balanced industrial growth across regions, ensuring that industrialization benefits reached various parts of the country.

D. R. Gadgil’s contributions laid a solid foundation for India’s economic planning and development, emphasizing inclusivity and balanced regional growth. His ideas and policies continue to influence economic planning in India, marking him as a pivotal figure in the country’s economic history.

Q3.(b) Explain the role of public sector in the Indian economy. Also point out its main problems faced during the period between 1970 to 1980.

Ans:

Role of Public Sector in the Indian Economy

The public sector has been a key player in India's economic growth since independence. It has been essential in fostering industrialization, constructing vital infrastructure, and overseeing strategic sectors such as defense, atomic energy, and telecommunications. By delivering critical services like railways, power generation, and banking, the public sector has sought to promote fair resource distribution and facilitate regional development. Additionally, it has served as a balance to private sector monopolies, ensuring wider access to goods and services.

Economists such as Amartya Sen and Jagdish Bhagwati have argued that the public sector's role extended beyond economic growth to encompass social objectives like poverty alleviation and rural development, laying the groundwork for inclusive growth.

Main Problems Faced by the Public Sector during 1970-1980

During the 1970s and 1980s, the public sector in India faced several challenges that affected its efficiency and effectiveness:

- Bureaucratic Inertia: Public sector enterprises (PSEs) often experienced bureaucratic red tape and procedural delays, which impeded decision-making and operational agility.

- Technological Obsolescence: Many PSEs struggled with outdated technology and insufficient investment in research and development, limiting their global competitiveness.

- Financial Strain: Persistent losses and inefficient resource allocation strained government finances, resulting in reliance on subsidies and bailouts to sustain operations. In the 1980s, PSE profits declined sharply, causing a fall in public savings from 3.5% in 1980-81 to 1% in 1990-91.

- Labor Issues: Strikes, labor disputes, and overstaffing were common, disrupting production and escalating operational costs.

- Policy Constraints: Frequent changes in public sector policies driven by political considerations impacted long-term planning and strategic initiatives.

- Inefficient Pricing: According to Nagraj, inadequate pricing of utilities and infrastructure services, along with insufficient recovery of user charges, was a significant issue (the ratio of price deflators for public sector output and GDP was only 85 in 2011).

Economists such as T.N. Srinivasan and Sukhamoy Chakravarty have emphasized the importance of structural reforms to boost public sector efficiency, alleviate fiscal pressures, and enhance competitiveness. These reforms were essential for updating public sector enterprises (PSEs), optimizing their operations, and aligning them with market conditions to foster sustainable economic growth.

Q3.(c) Explain the concept of ceiling on agricultural landholding in India. Examine its rationality with respect to equity and efficiency.

Ans:

Concept of Ceiling on Agricultural Landholding in India

In India, the ceiling on agricultural landholding imposes legal limits on the maximum amount of land that an individual or entity can own and farm. This policy is designed to promote equitable land distribution among farmers, alleviate rural poverty, and prevent the accumulation of agricultural wealth in the hands of a few. Established through land reform legislation since the 1950s, it requires the redistribution of surplus land to support landless or marginal farmers. Since land management falls under state jurisdiction, different states have implemented their own specific ceiling limits.

Rationality of Land Ceiling

From an equity standpoint, the land ceiling policy is considered essential for promoting social justice. By reallocating excess land to landless or marginal farmers, it aims to lessen inequalities in land ownership and improve the economic conditions of the rural poor. This redistribution is intended to offer disadvantaged groups a fair opportunity to engage in agriculture, secure credit, and enhance their living standards. Economists such as Amartya Sen suggest that fair land distribution can foster social stability and inclusive growth by empowering marginalized rural communities. Studies by Besley and Burgess have indicated that it has helped reduce poverty.

Critics argue that land ceilings may impact agricultural efficiency by promoting land fragmentation, limiting economies of scale, and hindering technological adoption. However, in West Bengal, where land reform laws were implemented rigorously, no negative relationship between land reform and productivity was observed.

Historically, the Zamindari system resulted in absentee landlordism, with landlords disinterested in investing in agriculture. Transferring land ownership to tenants could encourage investment and enhance productivity. Amartya Sen (1964) showed that smaller farms can be more productive per hectare, challenging the notion that larger, capital-intensive farms are more efficient.

Land ceilings can cause fragmentation, but this negative effect can be mitigated through land consolidation, which provides economies of scale in agriculture.

Q4.(a) Explain the main causes of inequality in income distribution in India and examine how it affects welfare of the society.

Ans: In India, income inequality is driven by several entrenched factors, increasing disparities across different regions and demographic groups. By 2018, the top 10% of the population controlled roughly 77% of the nation's total wealth, highlighting the substantial disparities in asset ownership (Oxfam India, 2020).

Causes of Inequality in Income Distribution in India

- Thomas Piketty’s Concept of “r > g”: This concept highlights how returns on capital (r) tend to exceed economic growth (g) over time, leading to wealth concentration among a few. In India, this phenomenon is intensified by historical factors like unequal land distribution and skewed asset ownership.

- Amartya Sen’s Capability Approach: Sen posits that inequality extends beyond income disparities to include unequal opportunities and fundamental capabilities. In India, gaps in education, healthcare, and infrastructure disproportionately impact marginalized groups, limiting their ability to enhance their socioeconomic conditions.

- Jobless Growth: India has experienced jobless growth due to disproportionate expansion in the service sector compared to labor-intensive industries, increasing inequalities.

- Joseph Stiglitz’s Critique: Stiglitz critiques policies that benefit the wealthy through tax incentives and regulatory loopholes, which exacerbate income inequality.

- Crony Capitalism: This system has favored a few individuals or groups over the broader welfare of society.

Effect on the Welfare of Society

- High levels of income inequality can erode social cohesion and trust within a society.

- Lower-income groups may face barriers in accessing quality healthcare and education, leading to poorer health outcomes and reduced opportunities for social mobility.

- Excessive inequality can hinder economic growth and productivity. When a large segment of the population lacks adequate resources and opportunities, it limits their potential contribution to economic activities.

- High levels of inequality can concentrate economic and political power in the hands of a few wealthy individuals or groups.

- Research suggests a correlation between income inequality and higher crime rates. Economic disparities can create resentment and alienation among disadvantaged groups.

In presence of imperfect financial and capital markets, inequality leads to under investment in physical and human capital. (Mishra 2012)

According to Deaton & Dreze, Indian poverty would have been 0.7% less (1.5% less in urban areas) had there been no rise in inequality.

Reducing income inequality is essential for enhancing societal welfare and promoting sustainable development.

Q4.(b) Describe the pattern and trends in national income in India during the pre-economic reform period

Ans: From independence in 1947 to the early 1990s, the patterns and trends in national income in India during the pre-economic reform period exhibited several notable features.

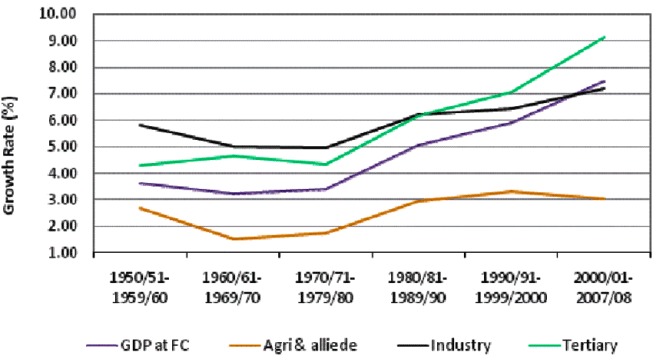

1951 – 1965

Following independence, India implemented a planned economy strategy emphasizing the development of capital-intensive industries. Public Sector Undertakings (PSUs) were crucial in advancing industrial growth. Consequently, agriculture's share of GDP diminished while capital industries’ contribution rose. During this period, the GDP growth rate was around 4%.

1965-1980

This phase was characterized by inward-oriented policies and industrial stagnation. The importance of agriculture was recognized, and the Green Revolution policy was introduced, making India self-sufficient in food grains. However, policies such as the MRTP, FERA, and reservations for small-scale industries created inefficiencies, leading to stagnation in industrial growth. Consequently, the GDP growth rate remained at around 3.5%.

Graph of National Income Trend

Graph of Sectoral Composition of National Income

1980-1990

During this period, growth rates began to surpass the 5% mark. According to Subramaniam, changes in the pro-business attitude and reforms such as MRTP relaxation and tax law adjustments contributed to economic growth. Panagaria referred to this era as a time of significant structural change. The service sector started to dominate national income.

Overall, the pre-economic reform period in India was marked by a state-led, protectionist approach with slow and steady growth, a dominant agricultural sector, and gradual industrialization. The limitations of this approach eventually led to comprehensive economic reforms in the 1990s, aimed at liberalizing the economy and accelerating growth.

Q4(c): Explain the development of cotton industry in India during pre-Independence era. Also point out its growth constraints.

Ans: The cotton textile industry was a significant sector in India, with strong linkages to both urban and rural areas.

Development of the Cotton Textile Industry in India during British Period

Phase 1: Till 1860

Before British rule, India was self-sufficient in cotton products. However, during British rule until 1860, the Indian cotton textile industry saw a decline.

Problems Faced:

- Loss of Royal Patronage: The cotton textile industry lost its royal patronage.

- High Cotton Imports: Increased imports of cotton from India led to a shortage of raw materials for domestic industry.

Phase 2: 1860 to Pre-war Period

During this period, the cotton textile industry began to recover. In Bombay, the number of cotton textile mills grew from 4 in 1862 to 49 by 1885. By 1914, India had 270 mills. Notably, in 1878, India's cotton yarn exports to China surpassed those of Britain.

Problems Faced:

- Currency Reforms of 1893: These reforms ended benefits that the Indian cotton industry had due to devaluation.

- Countervailing Duty of 1894: Under pressure from Lancashire, a 5% countervailing excise duty was imposed on Indian exports.

Phase 3: World War I

The war reduced imports into India, enabling the Indian industry to grow. Additionally, movements such as Swadeshi and non-cooperation increased domestic demand for Indian cotton textiles.

Problems Faced:

- Reduced Supply of Machinery: The supply of machinery, chemicals, and other materials decreased due to the war, hampering industry growth.

Phase 4: World War I till Independence

By the time of independence, 60% of the cotton textile industries in India were owned by Indians. The rise of nationalism and the promotion of Khadi by nationalist leaders played a key role in the Indianization of the cotton textile industry.

Problems Faced:

- Competition from Cheap Imports and Falling World Prices: Indian industries faced challenges from cheap imports and declining global prices.

- Increased Competition from Japan: Competition from Japanese textiles grew.

- Supply Issues During World War II: Similar to World War I, the supply of machinery was affected during World War II.

The Indian cotton textile industry had both economic and social significance, reflecting its gradual growth and development.

Q5(a): Distinguish between explicit and implicit subsidies. Explain the trends in explicit subsidies on irrigation and fertilizer in India during post-economic reform period

Ans: Explicit subsidies are direct financial support from governments to specific sectors or individuals, including cash transfers, price reductions, or grants.

In contrast, implicit subsidies come from indirect methods such as regulatory policies or tax incentives, which provide financial advantages without direct budgetary spending.

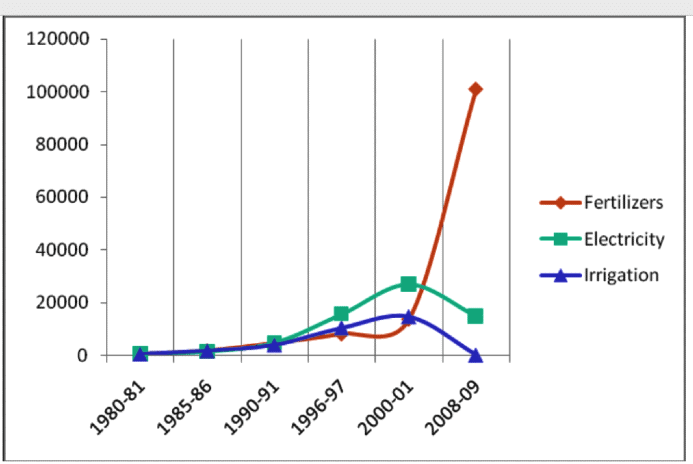

Trends in explicit subsidies on irrigation & Fertilizers

In India, explicit subsidies on irrigation and fertilizer have undergone significant changes post-economic reforms. Kaur and Sharma, 2012 have analyzed these trends.

Irrigation subsidies rose until 2000-2001 and then began to decline. Government data reveals a transition from broad-based subsidies to more targeted programs such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), which emphasizes efficient water management technologies. For the fiscal year 2022-23, the budget for PMKSY was INR 7,620 crore.

Irrigation subsidies rose until 2000-2001 and then began to decline. Government data reveals a transition from broad-based subsidies to more targeted programs such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), which emphasizes efficient water management technologies. For the fiscal year 2022-23, the budget for PMKSY was INR 7,620 crore.

On the other hand, there was a gradual increase in fertilizer subsidies until 2000-2001, followed by an exponential rise. Government data indicates a transition from universal subsidies to more targeted approaches, such as the Nutrient-Based Subsidy (NBS) scheme for fertilizers. The NBS scheme links subsidy rates to the nutrient content of fertilizers, aiming to promote balanced fertilizer use and improve soil health.

Q5.(b) Examine the salient features of the Action Plan for Disinvestment, 2009.

Ans: The Action Plan for Disinvestment, 2009, initiated by the Government of India, was designed to simplify and expedite the process of divesting in public sector enterprises (PSEs).

Salient Features of the Action Plan

- Profitable CPSEs that are already listed but do not meet the required 10 percent shareholding must become compliant through an "offer for sale" by the government or by issuing new shares, or a combination of both methods.

- Unlisted CPSEs with no accumulated losses and having earned net profit in three preceding consecutive years are to be listed.

- Follow-on public offers would be considered taking into consideration the needs for capital investment of CPSEs, on a case-by-case basis and government could simultaneously or independently offer a portion of its equity shareholding.

- The Department of Disinvestment is responsible for identifying Central Public Sector Enterprises (CPSEs) in collaboration with relevant administrative ministries and presenting proposals to the government for cases where a sale of government equity is necessary.

- Retaining majority shareholding of 51% & management control in strategically important sectors.

- Strategic disinvestment of identified PSUs with more than 50% equity sale & simultaneous transfer of management control.

The Action Plan for Disinvestment, 2009, represented a significant policy shift towards reducing government intervention in business operations while leveraging private sector efficiencies and capital for economic growth. Its implementation aimed to balance fiscal objectives with strategic considerations for PSEs in India.

Q5(c) What do you mean by horizontal fiscal disequilibrium in a federal setup and how did the XIIth Finance Commission correct such imbalance in India?

Ans: Horizontal fiscal disequilibrium occurs when different regions or states have varying abilities to generate revenue and different expenditure needs. This imbalance can result in some areas having more financial resources than others, causing disparities in the quality of services and economic development.

The Twelfth Finance Commission (XIFC) Provisions to Correct Imbalance:

- Increased Tax Devolution: Increasing the states’ share of central taxes from 29.5% to 30.5% to provide them with greater fiscal autonomy.

- Revised Formula: Adjusting the formula for allocating devolved taxes to focus on fiscal need and performance metrics such as per capita income, population, and tax effort.

- Special Category Grants: Continuing grants for states facing unique challenges, such as difficult terrain or low resource base.

- Performance-Based Incentives: Rewarding states for fiscal reforms and improved management with additional grants.

While the XIIFC’s measures made strides towards equitable resource distribution, horizontal fiscal imbalance remains a complex issue requiring ongoing attention and adaptation in India’s evolving economic landscape.

Q5(d): Show how Liquidity Adjustment Facility (LAF) in India emerged as an effective monetary policy instrument to control market fluctuations in the short run.

Ans: A liquidity adjustment facility (LAF) is a tool used by the Reserve Bank of India (RBI), allowing banks to borrow money through repurchase agreements (repos) or to make loans to the RBI through reverse repo agreements.

Repo Rate

The repo rate is the interest rate at which the RBI provides short-term funds to commercial banks against government securities. It serves as the policy rate, indicating the RBI’s monetary policy direction. When the repo rate is increased, liquidity tightens as borrowing costs for banks rise, helping to control inflation. Conversely, lowering the repo rate makes borrowing more affordable, boosting economic activity by expanding the money supply. The RBI determines the repo rate considering various economic factors such as inflation, growth, and global trends.

Reverse Repo Rate

The reverse repo rate is the rate at which the RBI absorbs excess liquidity from the banking system by borrowing funds from commercial banks. An increase in the reverse repo rate encourages banks to deposit surplus funds with the central bank, thereby reducing the money supply and helping to control inflation. On the other hand, a decrease in the reverse repo rate discourages banks from depositing with the RBI, prompting them to lend more and thereby increasing market liquidity.

LAF is regularly used by the RBI to manage short-term liquidity. For instance, during the COVID-19 crisis, the RBI aggressively lowered repo rates and used LAF to inject liquidity, ensuring credit availability and mitigating economic impact.

Q5(e): Examine the effectiveness of universal basic income as an approach to poverty alleviation in India.

Ans: Universal Basic Income (UBI) is a regular cash payment provided unconditionally to all citizens. It has been proposed as a strategy for poverty alleviation in India. Supporters, including economist Pranab Bardhan, believe that UBI can serve as a safety net, offering basic financial security and helping to reduce poverty. A 2017 study by the Economic Survey of India indicated that UBI could potentially lower poverty rates from 22% to 0.5% if properly implemented.

However, critics highlight potential challenges. Economist Jean Drèze cautions that UBI might divert funds from essential public services like health and education, which are crucial for long-term poverty reduction. The financing of such a large-scale program also raises concerns about fiscal sustainability.

Pilot projects, such as those in Madhya Pradesh, have shown promising results in improving household welfare, nutrition, and economic activity. Nonetheless, scaling UBI nationally requires careful consideration of fiscal constraints, potential inflationary impacts, and ensuring it complements rather than replaces existing welfare programs.

Q6(a): Discuss the characteristic features of Agreement on Agriculture (AOA) under Uruguay Round of GATT and examine its impact on Indian agriculture.

Ans: The Agreement on Agriculture (AoA) aimed to reform international trade in the agricultural sector. The AoA has three main pillars:

1. Market Access: It required member countries to convert non-tariff barriers to tariffs (tariffication) and commit to reducing them over time.

2. Domestic Support: The agreement classified domestic subsidies into different "boxes" according to their impact on trade. The "Amber Box" held measures that required reduction due to their trade-distorting effects, the "Blue Box" contained subsidies linked to production-limiting programs, and the "Green Box" included non-trade-distorting subsidies, such as those for environmental protection and research.

3. Export Subsidies: The AoA sought to reduce export subsidies that distort agricultural trade.

Impact on Indian Agriculture:

Positive Impacts:

- The emphasis on reducing trade barriers opened up new markets for Indian agricultural exports.

- Economist Ashok Gulati notes that India’s agricultural exports grew significantly post-AoA, driven by greater market access and competitiveness in certain sectors like fruits, vegetables, and rice.

- This agreement has helped India increase its agricultural export. India has $20 billion in agri exports and could potentially help India more in the future.

Challenges:

- The reduction in domestic support in developed countries was slow, leading to continued dumping of subsidized agricultural products in global markets, affecting Indian farmers adversely.

- Critics, such as economist Devinder Sharma, contend that the AoA failed to sufficiently address the imbalance between heavily subsidized developed countries and developing nations.

- TRIPS provisions related to plant varieties have affected Indian farmers. For example, the recent PepsiCo case.

- Developed countries are enforcing phytosanitary regulations on agricultural exports. For instance, the export of Alphonso mangoes was banned in Europe.

Overall, present WTO provisions are in favor of developed countries. India is consistently focusing on having fair WTO provisions that benefit every country in the world.

Q6(b): State the key features of the Targeted Public Distribution System (TPDS) in India. Do you believe that TPDS has been successful in achieving its objectives? Justify your answer.

Ans: The Targeted Public Distribution System (TPDS) is a food security program in India.

Key features of the Targeted Public Distribution System (TPDS)

- The TPDS covers a significant portion of the Indian population, with 90.2 crore beneficiaries.

- Beneficiaries are divided into three categories: Antyodaya Anna Yojana (AAY), Below Poverty Line (BPL), and Above Poverty Line (APL).

- AAY and BPL families receive 35 kg/family/month, while APL families receive 15-35 kg/family/month.

- AAY households receive food grains at the most subsidized rates (Rs. 3/kg for rice, Rs. 2/kg for wheat, and Re. 1/kg for coarse grains).

- The central government provides state-wise population estimates for coverage under the TPDS, and the states are responsible for identifying eligible households based on these estimates and their own criteria.

- The Centre procures, allocates, transports grains to states, and states deliver to beneficiaries.

TPDS has successfully contributed to reducing poverty and hunger in India, with a decline in people below the poverty line from 47% in 1993 to 22% in 2011, and undernourishment from 36% to 14% in the same period. However, it faces criticisms for inefficiencies, corruption, and exclusion of eligible beneficiaries. Despite being a mixed success, TPDS has played a role in improving food security. Later, through the NFSA 2013, various shortcomings of TPDS were addressed.

Q6.(c) State the salient features of the Foreign Exchange Management Act (FEMA), 1999 in India. To what extent it deviates from the Foreign Exchange Regulation Act (FERA), 1979?

Ans: The Foreign Exchange Management Act (FEMA) of 1999 represents a significant change in India’s handling of foreign exchange transactions, moving away from the more restrictive framework established by the Foreign Exchange Regulation Act (FERA) of 1973.

Key Features of FEMA:

- Liberalised Framework: FEMA adopts a market-oriented approach, prioritizing facilitation of external trade and payments over rigid controls.

- Current Account Convertibility: It allows full current account convertibility, enabling free conversion of rupees for permissible transactions like trade, travel, and remittances.

- Capital Account Liberalisation: While not fully convertible, FEMA provides a structured path for gradual liberalization of capital account transactions, promoting foreign investment.

- Enforcement and Adjudication: It creates the Directorate of Enforcement to conduct investigations and a quasi-judicial Appellate Tribunal for handling appeals, ensuring a fair and balanced system.

- Compounding Provisions: It allows for the compounding of specific contraventions, offering an alternative to prosecution and encouraging voluntary compliance.

Key Deviations from FERA:

- Regulatory Philosophy: FERA’s draconian controls aimed at conserving foreign exchange are replaced by FEMA’s focus on facilitating legitimate transactions and economic growth.

- Legal Framework: FEMA replaces FERA's primarily criminal approach with a civil framework, decriminalizing most offenses and fostering a less punitive environment.

- Capital Controls: Under FEMA, FERA's strict capital controls are eased, enabling increased capital flows and better integration with global markets.

- Enforcement: FERA’s multiple agencies for enforcement are consolidated under the Directorate of Enforcement in FEMA, streamlining the process.

- Compounding: The inclusion of compounding provisions in FEMA offers a quicker and more efficient way to resolve certain contraventions.

Although FEMA has greatly liberalized India’s foreign exchange regime, certain restrictions on capital account transactions persist to ensure macroeconomic stability. Nonetheless, the act’s emphasis on liberalization and facilitation has played a crucial role in attracting foreign investments, boosting exports, and integrating India into the global economy.

Q7(a): Briefly explain the growth and structure of India’s foreign trade in the post-liberalization period.

Ans: Following liberalization, India’s foreign trade has experienced a dramatic transformation, characterized by substantial growth and structural changes.

Growth:

- Trade-to-GDP Ratio: A crucial measure of trade openness, India’s trade-to-GDP ratio increased dramatically from 15.6% in 1991-92 to 48.8% in 2021-22, highlighting the country’s deeper integration into the global economy. Economist Jagdish Bhagwati emphasized that liberalization was instrumental in boosting India’s trade and enhancing its global economic integration.

- Export & Import Growth: Both exports and imports saw significant increases over the years. Merchandise exports grew from USD 18.1 billion in 1991-92 to USD 422 billion in 2022-23, while merchandise imports expanded from USD 24.1 billion to USD 616 billion during the same period.

- Service Sector Boom: Service exports, notably IT and BPO, experienced remarkable growth, accounting for over 40% of total exports in recent years. Arvind Panagariya emphasized the need for further reforms, particularly in the manufacturing sector, to enhance India’s export competitiveness.

Structure:

- Export Composition: The composition of exports shifted from primary commodities to manufactured goods and services. Engineering goods emerged as a leading export category, contributing 27% to merchandise exports in 2022-23. Pharmaceuticals, chemicals, and gems & jewellery also witnessed significant growth.

- Import Composition: Although petroleum products continue to dominate India’s imports, the proportion of capital goods, raw materials, and intermediates has risen, indicating the expansion of domestic manufacturing. C. Rangarajan warned against over-reliance on imported oil and urged the implementation of strategies to enhance domestic energy security.

- Geographical Diversification: India’s trade has diversified geographically, with an increasing share of trade involving developing countries, particularly in Asia. The UAE, China, and the US are among India’s leading trading partners.

India’s foreign trade has achieved impressive growth and diversification since liberalization. However, challenges remain, including the need to reduce import dependence, enhance export competitiveness, and ensure equitable distribution of trade benefits.

Q7(b): Critically examine the contribution of Special Economic Zones (SEZs) in promoting foreign trade in India.

Ans: Special Economic Zones (SEZs) in India were created under the Special Economic Zones Act of 2005 to enhance exports, draw in foreign investment, and stimulate industrial growth.

Positive Contributions:

- Export Growth: SEZs have made a major impact on India's export growth. In the fiscal year 2020-21, exports from SEZs amounted to ₹7.59 lakh crore (US$102.24 billion), representing a large portion of India's overall exports. This increase is due to several factors, such as tax incentives, simplified customs procedures, and enhanced infrastructure within SEZs.

- Foreign Direct Investment (FDI): SEZs have attracted significant FDI inflows. As of December 2022, cumulative investments in SEZs reached ₹6.17 lakh crore (US$83.12 billion). This has not only boosted export-oriented industries but also generated employment opportunities.

- Employment Generation: SEZs have generated a significant number of jobs, both directly and indirectly. By 2021, over 2.3 million individuals were employed in SEZs, aiding in skill development and job creation.

- Economists like Bibek Debroy argue that SEZs have played a crucial role in promoting exports and attracting FDI.

Criticisms and Challenges:

- Land Acquisition Issues: The acquisition of land for SEZs has often faced resistance from local communities, leading to delays and disputes.

- Tax Revenue Losses: The tax incentives granted to SEZs have raised concerns about potential revenue losses for the government. Some economists contend that these incentives have not always delivered proportional benefits to the economy.

- Uneven Distribution: The distribution of SEZs in India has been uneven, with certain states reaping more benefits than others. This disparity has raised concerns about regional imbalances and unequal development.

- Environmental Concerns: The establishment of SEZs has also raised environmental concerns due to potential pollution and loss of biodiversity.

- Comparison with China: Compared to SEZs in China, Indian SEZs have not delivered.

- Jayati Ghosh has expressed concerns about their social and environmental impact and questioned their overall economic benefits.

Although SEZs have certainly played a role in India’s foreign trade, their effectiveness remains a topic of discussion. To fully realize their potential, the recommendations of the Baba Kalyani committee should be taken into account.

Q7(c): Discuss the salient features of India’s New Foreign Trade Policy, 2023.

Ans: India’s New Foreign Trade Policy (FTP) 2023, introduced in March 2023, represents a major change in the nation’s strategy towards global trade.

Salient Features of India’s New Foreign Trade Policy 2023:

- Target: An ambitious target of US$ 2 trillion exports of goods and services by 2030 has been set.

- Focus on Exports and Job Creation: FTP 2023 transitions from an incentives-based approach to one focused on remission and entitlement-based systems.

- Ease of Doing Business: Reduction in transaction costs and e-transactions to improve ease of doing business for exporters. It will simplify procedures.

- Emerging Areas: The policy emphasizes emerging areas such as dual-use high-tech items, green hydrogen and green energy exports, and the promotion of e-commerce exports, aiming to broaden India’s export base.

- District as Export Hubs: Developing district export hubs to identify and promote exports of each district.

- Sourcing from India for Exports: Promoting merchanting trade under Export Promotion of Capital Goods (EPCG) Scheme.

- Facilitation: Making the issuance of Registration-cum-Membership Certificate (RCMC) faceless, online, and paperless.

- Amnesty Scheme: One-time Amnesty Scheme to close the old pending authorizations and start afresh.

- Streamlining Schemes: The policy includes streamlining the Advance Authorization and EPCG schemes to make them more trade-friendly.

It is an ambitious policy to increase India’s exports. Experts caution about potential challenges in implementing the policy effectively. There is a need to focus on effective implementation, addressing challenges, and ensuring that the benefits reach all segments of the export sector.

Q8(a): State the main provisions of the 73rd and 74th Constitutional Amendment Act, 1992. Do you agree that this Act has been successful in promoting the democratic decentralization in India? Justify your answer.

Ans: The 73rd and 74th Constitutional Amendment Acts of 1992 were landmark legislations in India aimed at strengthening local self-governance.

73rd Amendment:

- Institutional Framework: It mandated the establishment of Panchayats at the village, intermediate, and district levels.

- Regular Elections: Elections to the Panchayats were to be held every five years.

- Reservation of Seats: It reserved seats for Scheduled Castes, Scheduled Tribes, and women (one-third of the seats) to ensure inclusivity.

- State Election Commissions: The amendment created State Election Commissions to oversee Panchayat elections.

- State Finance Commissions: These were to be established every five years to recommend measures to improve Panchayat finances.

74th Amendment:

- Urban Local Bodies: It mandated the creation of Municipalities in urban areas, encompassing Nagar Panchayats, Municipal Councils, and Municipal Corporations.

- Municipal Governance: The act mandated the constitution of Ward Committees in municipalities with a population above 300,000.

- Empowerment and Autonomy: The amendment sought to transfer greater power, responsibilities, and financial resources to Urban Local Bodies (ULBs), ensuring their independent operation.

- Reservation of Seats: Similar to the 73rd Amendment, it also provided for the reservation of seats for SCs, STs, and women in ULBs.

- Constitutional Status: Both amendments conferred constitutional status to PRIs and ULBs, making them integral parts of the governance system.

- District Planning Committees (DPCs): Required to consolidate the plans created by Panchayats and Municipalities and develop a draft development plan for the district

Effectiveness in Promoting Democratic Decentralization in India:

The reservation of seats for women, Scheduled Castes (SCs), and Scheduled Tribes (STs) has significantly boosted their involvement. By 2020, more than 1.3 million women had been elected to the Panchayati Raj system, strengthening political empowerment. This approach has also promoted the transfer of funds and responsibilities to local bodies, allowing them to better meet local needs. Research indicates that empowered local bodies are associated with enhanced service delivery in sectors such as health, education, and sanitation.

Despite the introduction of these acts, their implementation has varied significantly across states, leading to disparities in the extent of power and autonomy granted to local bodies. James Manor contends that state governments have been hesitant to transfer authority and resources, which undermines the intended decentralization. Additionally, there are concerns about insufficient capacity building for elected representatives and bureaucratic obstacles that impede the efficient operation of local bodies.

While the amendments have promoted democratic decentralization, continuous efforts and political commitment are necessary to realize their full potential.

Q8(b): Explain the reasons for sluggish growth in employment in India during the post-economic reform period.

Ans: In India’s post-reform period, despite strong economic growth, employment opportunities have grown sluggishly, a phenomenon referred to as “jobless growth.” The Periodic Labour Force Survey (PLFS) 2019-20 reported an unemployment rate of 4.8%, underscoring the continued presence of unemployment despite overall economic expansion.

Reasons for Sluggish Growth in Employment in India during the Post-Economic Reform Period:

- Capital-Intensive Growth: Economic reforms encouraged capital-intensive industries, resulting in greater automation and decreased demand for labor. Additionally, strict labor laws further incentivized the preference for capital over labor. Jayati Ghosh emphasized the negative effects of capital-intensive growth and recommended policies that support labor-intensive sectors and provide social safety nets for vulnerable workers.

- Service Sector Growth: Employment elasticity of the Service sector is less. However, India’s growth is dominated by the service sector. The employment elasticity of growth declined from 0.16 during 1999-2004 and further to 0.01 during 2004-09.

- Agriculture Stagnation: The agricultural sector is experiencing disguised unemployment. Ajit Ghose criticized the neglect of agriculture and called for policies to rejuvenate the sector and create more employment opportunities in rural areas.

- Informal Sector Dominance: The informal sector, characterized by low productivity and wages, absorbed a large portion of the workforce but failed to offer quality employment with decent working conditions and social security.

- Skill Mismatch: The education system’s failure to impart relevant skills resulted in a mismatch between the skills demanded by the industry and those possessed by the workforce. According to the India Skill Report, only 47% of graduates are employable.

- Regulatory Barriers: Strict labor laws and bureaucratic obstacles have hindered job creation in the formal sector. Concerns about stringent regulations have led companies to avoid hiring additional employees, favoring informal and contractual employment instead.

Addressing the issue of jobless growth in India requires a multi-pronged approach encompassing labor-intensive manufacturing, agricultural revitalization, skill development, and labor market reforms.

Q8(c): Explain the changes in wage structure in India in the post-economic reform period.

Ans: The 1991 economic reforms represented a major shift in India’s economic policies, resulting in significant alterations to the wage structure across different sectors.

Post-reforms, India experienced a mixed trend in wage growth. There was significant wage growth in the organized sector, particularly in IT, finance, and services, while the unorganized sector lagged. The informal sector, which employs a large part of the workforce, saw sluggish wage growth. The informal nature of employment led to lower bargaining power for workers and less wage security.

Economist Kaushik Basu highlights that wage disparity widened, with skilled workers seeing higher wage increases compared to unskilled labor. The demand for skilled labor increased, leading to a rising skill premium. Educated workers, particularly those with technical skills, commanded higher wages than their unskilled counterparts.

Reforms led to sectoral shifts in employment, with a decline in agricultural employment and a rise in manufacturing and services. According to the National Sample Survey Office (NSSO), the average daily wage rate in the agricultural sector grew from ₹42 in 1993-94 to ₹277 in 2017-18. However, wages in the service sector increased more sharply, from ₹125 to ₹765 during the same period.

Despite overall wage growth, the gender wage gap remains significant. The Periodic Labour Force Survey (PLFS) 2018-19 reports that male workers earned on average 30% more than female workers in both rural and urban areas. Post-reform, there has been an increased focus on minimum wage legislation. However, implementation remains inconsistent across states, affecting wage growth in the lower segments.

According to the Labour Bureau, the real wage growth (adjusted for inflation) has been modest. The average real wage index for rural workers increased from 100 in 1993-94 to 190 in 2018-19, indicating a moderate rise in purchasing power.

Economist Jean Drèze points out that while reforms spurred economic growth, they also led to greater wage inequalities. He emphasizes the need for stronger labor regulations and social safety nets to ensure inclusive growth.

Post-economic reforms, India witnessed varied trends in wage growth across sectors, with significant disparities based on skill, gender, and sector. Addressing these disparities requires focused policy interventions to ensure equitable wage distribution and improved labor conditions.

|

66 videos|237 docs|73 tests

|

FAQs on UPSC Mains Answer PYQ 2023: Economics Optional Paper 2 - Economics Optional for UPSC

| 1. What are the key topics covered in the UPSC Economics Optional Paper 2? |  |

| 2. How can candidates best prepare for the UPSC Economics Optional Paper 2? |  |

| 3. What is the marking scheme for the UPSC Economics Optional Paper 2? |  |

| 4. Are there any recommended books for UPSC Economics Optional Paper 2 preparation? |  |

| 5. What are common mistakes to avoid while attempting the UPSC Economics Optional Paper 2? |  |