Types of Environmental Accounting | UGC NET Commerce Preparation Course PDF Download

| Table of contents |

|

| Types of Environmental Accounting |

|

| Components of Environmental Accounting |

|

| Significance of Environmental Accounting |

|

| Environmental Accounting Strategies |

|

Types of Environmental Accounting

The following are the different types of environmental accounting simplified for better understanding:

- Financial Environmental Accounting: This type involves evaluating the costs and benefits of a company's actions on the environment and assigning a monetary value to them. It's like putting a price tag on the environmental impact, which helps in integrating this information into financial reports. Companies can utilize this data to identify ways to decrease environmental costs (such as pollution fines) and enhance benefits (like energy conservation).

- Physical Environmental Accounting: Unlike financial accounting, this approach focuses on quantifying the physical aspects that influence the environment. It's akin to monitoring the amount of water consumed or the volume of waste generated. This type of accounting is comparable to tracking the steps taken during a hiking trip. Companies can leverage this data to comprehend their environmental footprint and implement strategies to reduce it.

- National Environmental Accounting: This type offers a comprehensive overview of how an entire country's economy impacts the environment. It's akin to maintaining a national diary detailing all companies' interactions and impacts on nature. Governments use this holistic data to devise policies that incentivize businesses to operate in a more environmentally sustainable manner.

Components of Environmental Accounting

Below are the detailed components of environmental accounting presented in a simplified manner:

- Environmental Costs: Imagine you are starting a garden. Just like how you need to buy seeds, soil, and tools, these are the costs involved. In environmental accounting, these represent the expenses a company incurs due to its environmental impact. This includes tasks like cleaning pollution, paying fines for environmental damage, or investing in greener technologies. It's akin to the price tag associated with maintaining the garden.

- Environmental Benefits: Think about the delicious fruits and vegetables harvested from your garden. These represent the benefits. In environmental accounting, these are the rewards a company reaps from being environmentally conscious. It encompasses saving money on energy bills, avoiding fines, or enhancing their reputation as an eco-friendly entity. It's like the payback received for nurturing the garden.

- Environmental Impacts: Visualize the effects of your garden on its surroundings, such as attracting bees or enhancing the soil quality. In environmental accounting, these depict the alterations a company's activities bring about in the environment. This includes metrics like the volume of greenhouse gases released, water consumption, or waste generation. It's akin to the ecological footprint your garden leaves on the earth.

- Environmental Policies and Regulations: Picture yourself as part of a gardening club with specified rules like not using harmful pesticides. In environmental accounting, companies must adhere to these laws and guidelines to safeguard the environment. This involves aspects such as emission limits or regulations on waste disposal. It acts as the rulebook guiding the care of the garden.

- Environmental Management Systems: Consider how you strategically plan and organize your garden, such as deciding where to plant each crop or how frequently to water them. In environmental accounting, companies employ these strategies and plans to mitigate their environmental impact. This includes setting objectives to reduce waste or implementing energy-efficient measures. It serves as the game plan for nurturing the garden.

The components of environmental accounting are analogous to the elements of a garden. They assist companies in comprehending the costs, benefits, and impacts of their actions on the environment, thereby aiding them in making informed decisions. Similar to a well-maintained garden, a company that fulfills its environmental responsibilities can prosper and grow sustainably.

Advantages of Environmental Accounting

The merits of environmental accounting have been stated below.

Better Decision Making:

- Environmental accounting provides companies with valuable information for making informed decisions, similar to how a hiking diary assists in choosing trails based on past experiences.

Improved Reputation:

- Utilizing environmental accounting showcases a company's commitment to environmental care, enhancing its reputation among customers, investors, and stakeholders, akin to earning respect from fellow hikers.

Cost Savings:

- Environmental accounting helps companies identify cost-saving opportunities by optimizing energy use, water consumption, and waste management, much like finding the most efficient gear for hiking through past experiences.

Compliance with Regulations:

- Environmental accounting assists companies in adhering to environmental laws and regulations, ensuring that they avoid fines or penalties, similar to following trail guidelines to stay out of trouble.

Enhanced Environmental Performance:

- Through environmental accounting, companies can continuously improve their environmental performance by setting goals and tracking progress, resembling setting personal records and striving to become a better hiker based on past experiences.

|

Test: Environmental Accounting

|

Start Test |

Significance of Environmental Accounting

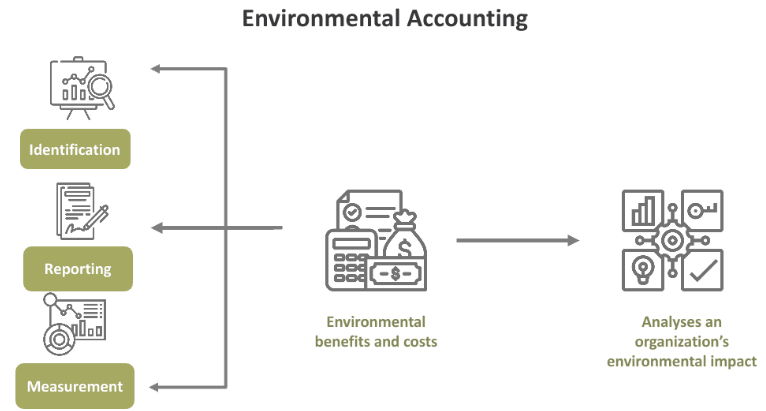

Environmental accounting is a specialized branch of accounting that focuses on the identification, measurement, and reporting of environmental costs and impacts associated with an organization's activities. Its significance has grown significantly in recent years due to several key factors:

Environmental Accounting and Sustainability:

- As environmental awareness and the need for sustainability grow, organizations face increasing pressure from various stakeholders to address and disclose their environmental impacts. Environmental accounting aids in evaluating environmental performance and showcasing dedication to sustainability.

Regulatory Compliance:

- Governments worldwide have implemented environmental regulations and reporting mandates. Organizations are required to follow these regulations, often involving the disclosure of environmental data. Environmental accounting assists in monitoring and reporting compliance, mitigating the risk of legal and financial penalties.

Resource Management:

- Recognizing the importance of efficient resource management, businesses are utilizing environmental accounting to pinpoint areas for reducing resource consumption, cutting waste generation, and optimizing energy usage. These initiatives can result in cost savings and improved operational efficiency.

Risk Management:

- Environmental risks like climate change, water scarcity, and environmental incidents can have significant financial and reputational repercussions. Environmental accounting helps in identifying and addressing these risks by recognizing potential liabilities, allocating reserves for environmental contingencies, and developing risk mitigation strategies.

Investor and Shareholder Expectations:

- Investors and shareholders now consider environmental, social, and governance (ESG) factors when making investment choices. Environmental accounting enables organizations to offer transparent and credible ESG disclosures, attracting responsible investors and positively influencing the company's stock valuation.

Competitive Advantage:

- Organizations embracing environmental accounting and sustainable practices often gain a competitive edge. Consumers increasingly base their purchasing decisions on a company's environmental and ethical practices. Demonstrating commitment to sustainability through environmental accounting can lead to enhanced customer loyalty and market share.

Supply Chain Management:

- Environmental accounting goes beyond an organization's boundaries to evaluate the environmental impacts of its supply chain. Companies that understand and manage these environmental risks and opportunities can bolster their resilience and reputation.

Long-Term Planning:

- Environmental accounting offers crucial data for long-term strategic planning. It enables organizations to establish sustainability goals, monitor progress, and adjust strategies in response to changing environmental conditions and stakeholder expectations.

Corporate Social Responsibility (CSR):

- Environmental accounting is a fundamental aspect of an organization's CSR initiatives. Demonstrating a commitment to environmental stewardship through transparent reporting enhances the company's reputation for social responsibility.

Innovation and Technology Adoption:

- The pursuit of sustainability often drives innovation and adoption of new technologies. Environmental accounting can pinpoint areas where technology investments can yield both environmental and financial benefits.

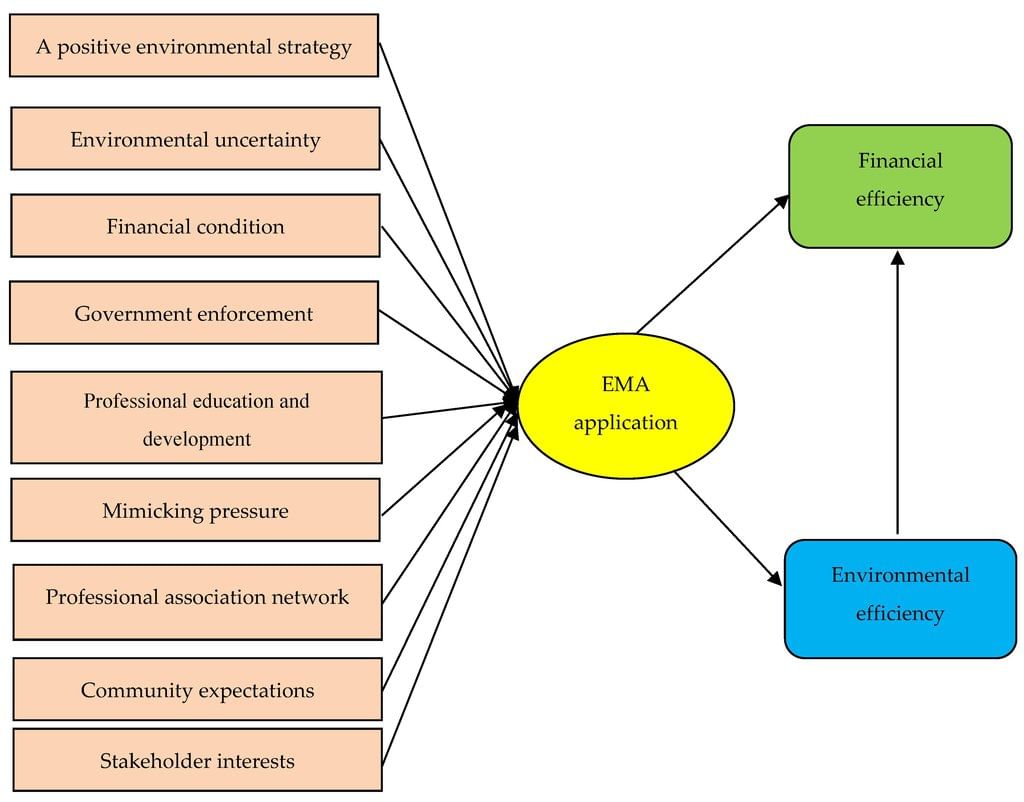

Environmental Accounting Strategies

Environmental accounting strategies refer to the methods and approaches employed by organizations to integrate environmental factors into their financial reporting, decision-making processes, and overall business operations. These strategies assist organizations in evaluating, quantifying, and overseeing the environmental impacts and costs associated with their activities. Here are some essential environmental accounting strategies:

Environmental accounting strategies refer to the methods and approaches employed by organizations to integrate environmental factors into their financial reporting, decision-making processes, and overall business operations. These strategies assist organizations in evaluating, quantifying, and overseeing the environmental impacts and costs associated with their activities. Here are some essential environmental accounting strategies:

- Life Cycle Assessment (LCA): LCA is a method to evaluate the environmental impact of a product, process, or service from creation to disposal. It assesses effects like greenhouse gas emissions and energy consumption throughout the life cycle, aiding decisions in design, sourcing, and waste management.

- Environmental Cost Accounting: This involves tracking and quantifying environmental costs tied to business activities, including direct costs (like pollution control equipment), indirect costs (such as fines), and hidden costs (like resource depletion). It helps in understanding financial implications and identifying cost reduction opportunities.

- Carbon Accounting: Focuses on managing an organization's greenhouse gas emissions by calculating the carbon footprint and devising strategies to decrease emissions, leading to initiatives like carbon neutrality and pricing strategies.

- Environmental Performance Indicators (KPIs): Organizations establish and monitor KPIs related to environmental impacts like energy use, water consumption, waste generation, and emissions to track progress and pinpoint areas for enhancement.

- Sustainability Reporting: Documents revealing an organization's ESG performance, providing transparent data on sustainability efforts using frameworks like GRI and SASB.

- Triple Bottom Line (TBL) Accounting: Expands financial reporting to include social and environmental aspects alongside economic performance, assessing success based on profit, people, and planet, to encourage responsible decision-making.

- Environmental Management Systems (EMS): Frameworks such as ISO 14001 offer structured approaches to environmental management, aiding in setting objectives, implementing processes, and monitoring performance for environmental accounting purposes.

- Resource Efficiency Programs: Organizations implement programs to minimize waste, reduce energy and water consumption, and optimize material usage, leading to cost savings and reduced environmental impacts.

- Environmental Risk Assessment: Assessing and quantifying environmental risks allows for the development of mitigation strategies and resource allocation to address issues like compliance risks and disruptions.

- Green Procurement: Involves selecting environmentally friendly suppliers and products by considering factors like raw material sustainability, energy efficiency, and recyclability.

- Investment in Renewable Energy: Transitioning to renewable energy sources reduces reliance on fossil fuels, lowering the carbon footprint, with environmental accounting aiding in assessing both financial and environmental benefits.

- Circular Economy Initiatives: Adoption of circular economy principles such as recycling and remanufacturing promotes resource efficiency and reduces waste, with environmental accounting tracking economic and environmental benefits.

- Environmental Benchmarking: Comparing an organization's environmental performance against industry benchmarks helps identify areas for improvement and guides strategic decisions.

|

Download the notes

Types of Environmental Accounting

|

Download as PDF |

Conclusion

In summary, environmental accounting involves monitoring a company's environmental impact, akin to maintaining an eco-conscious shopping list that guides companies towards better decisions. Despite its initial complexity, environmental accounting stands as a potent instrument benefiting companies, shareholders, and the environment concurrently. This synergy enables businesses to fulfill their environmental responsibilities while reaping various advantages. Companies globally employ diverse environmental accounting methods tailored to their locations or preferences.

The merits of environmental accounting parallel the benefits of maintaining a hiking diary. This practice aids companies in making informed choices, enhancing their reputation, cutting costs, ensuring regulatory compliance, and boosting their environmental performance. Just as a diligently kept diary can enhance one's hiking skills, environmental accounting facilitates companies in becoming more sustainable and accountable.

|

235 docs|166 tests

|

FAQs on Types of Environmental Accounting - UGC NET Commerce Preparation Course

| 1. What are the components of Environmental Accounting? |  |

| 2. Why is Environmental Accounting significant? |  |

| 3. What are some Environmental Accounting strategies? |  |

| 4. What types of Environmental Accounting are there? |  |

| 5. How can businesses benefit from implementing Environmental Accounting? |  |