International Monetary System | Crash Course for UGC NET Commerce PDF Download

What Do You Mean by International Monetary System?

The international monetary system establishes the framework for global trade and financial transactions between countries. Its primary goal is to facilitate the smooth exchange of goods, services, and investments across international borders.

At its essence, this system revolves around currencies and exchange rates that facilitate international trade. Each country's currency serves as a medium of exchange in the global market. The exchange rates between currencies determine the value of one currency in relation to another.

Central banks play a crucial role by formulating monetary policies and managing exchange rates within their respective economies. They strive to ensure price stability and a sound financial system. Global institutions such as the IMF and the World Bank support the international monetary system and provide financial assistance to countries when needed.

Evolution of the International Monetary System

- The Classical Gold Standard (1870 - 1914): During this era, the global monetary framework revolved around the gold standard, linking currencies to gold at fixed rates. While offering stability, it lacked adaptability and collapsed during World War I.

- Interwar Years (1920 - 1944): Post-World War I, several nations abandoned the gold standard to focus on internal economic requirements. This shift led to competitive devaluations, trade barriers, and a dearth of international monetary collaboration.

- Bretton Woods System (1945 - 1973): The establishment of the IMF and World Bank at Bretton Woods aimed to promote global monetary stability and reconstruction. This system, featuring the US dollar as a reserve currency, was akin to a pseudo-gold standard. However, it faltered due to payment imbalances and US dollar devaluations.

- Floating Exchange Rates (1973 - Onwards): Most major currencies transitioned to a floating exchange rate mechanism, where currency values were determined by market forces of demand and supply. This setup offers greater flexibility but also heightened exchange rate volatility, introducing exchange rate risks.

- Post-Bretton Woods System: In the aftermath of Bretton Woods, the IMF and World Bank reassumed pivotal roles. The evolution of globalization, trade liberalization, and financial innovations has significantly shaped the contemporary international monetary landscape. Nonetheless, calls persist for reforms to navigate financial flux and global economic imbalances.

History of the International Monetary System

Gold Standard (19th Century - 1930s)

- Pre-World War I: The classical gold standard emerged in the 19th century, with many countries tying their currencies to a specific quantity of gold. This system facilitated international trade by providing a stable exchange rate environment.

- Interwar Period: The gold standard faced challenges during and after World War I. Countries suspended the convertibility of their currencies into gold to finance war efforts, leading to disruptions in the international monetary system.

Bretton Woods (1944)

- Formation of Bretton Woods Institutions:

In 1944, representatives from 44 Allied nations gathered at the Bretton Woods Conference in New Hampshire, USA. The conference led to the creation of two major institutions: the International Monetary Fund (IMF) and the World Bank. - Fixed Exchange Rates:

The Bretton Woods system established a fixed exchange rate regime where currencies were pegged to the U.S. dollar, and the U.S. dollar was convertible to gold. This system aimed to provide stability and prevent competitive devaluations. - Role of the U.S. Dollar:

The U.S. dollar became the primary reserve currency, with other currencies pegged to it. This system, known as the gold exchange standard, maintained stability for almost three decades.

Collapse of Bretton Woods (Early 1970s)

- Nixon Shocks (1971): Facing economic challenges, U.S. President Richard Nixon halted the convertibility of the U.S. dollar into gold in 1971, known as the "Nixon Shock." This action effectively brought about the end of the Bretton Woods system.

- Transition to Floating Exchange Rates: Following the collapse of the Bretton Woods system, major currencies shifted to floating exchange rates, allowing their values to be determined by market forces. This shift marked a significant change in the international monetary system.

Floating Exchange Rates (1970s - Present)

- Flexibility and Volatility: The period of floating exchange rates introduced more adaptability but also heightened fluctuations in currency markets. Exchange rates were determined by the interplay of supply and demand in the foreign exchange markets.

- Regional Monetary Arrangements: Certain regions established regional monetary arrangements, like the European Monetary System (EMS), which preceded the establishment of the euro.

Recent Developments (1990s - Present)

- Introduction of Managed Floating Exchange Rates: Some countries moved towards managed floating exchange rates, where central banks intervene to stabilize their currency values. This approach aims to minimize abrupt fluctuations while still allowing market forces to play a role in determining exchange rates.

- Rise of Currency Blocs: The formation of currency blocs has become more prevalent in recent times. These are groups of countries that coordinate their monetary policies and sometimes even use a common currency. An example of this is the Economic and Monetary Union (EMU) in Europe.

- Impact of Globalization: The increasing interconnectedness of economies due to globalization has had a profound impact on exchange rates. Factors such as international trade, capital flows, and geopolitical events now play a significant role in influencing currency values.

- Technological Advancements: Advances in technology, particularly in the realm of financial technology (FinTech), have revolutionized the way currency markets operate. Automated trading algorithms, high-frequency trading, and online platforms have all contributed to the efficiency and speed of foreign exchange transactions.

Features of International Monetary System

- Multiple Currencies: The system comprises over 180 national currencies used for global trade. Each country has its own currency.

- Floating Exchange Rates: Major currencies have rates determined by market forces, offering flexibility but also leading to volatility.

- Reserve Currencies: Dominant currencies like the US dollar, euro, Japanese yen, and British pound are used for global trade, investments, and reserves.

- Free Capital Flows: Capital moves among nations with few restrictions, facilitating global investment and trade.

- Role of Central Banks: Central banks manage monetary policies and exchange rates, striving for stability, financial health, and balanced payments.

- Functions of IMF: The IMF fosters global monetary cooperation, sets standards, provides financing to member countries, and conducts economic research.

- Functions of World Bank: The World Bank offers financing, policy advice, and technical support for economic projects in developing countries.

- Financial Globalization: Integration of global financial markets has shaped the modern monetary system, though it poses risks like financial contagion.

- Need for Reforms: Calls for reform aim to address economic imbalances, financial volatility, and the representation of emerging economies.

Functions of International Monetary System

- Facilitating Global Trade: The international monetary system supports global trade by providing a set of currencies and exchange rates that serve as a common unit of account, enabling countries to price and settle trade transactions effectively.

- Financing Global Trade: The system facilitates the flow of finance necessary to sustain global trade. It enables importers and exporters to access foreign exchange markets, allowing them to exchange currencies as needed.

- Absorbing Shocks: The system helps to absorb economic and financial shocks that might originate in one country and spread to others. Institutions like the IMF provide financial assistance and policy guidance to mitigate the risk of contagion.

- Enhancing Financial Stability: The IMF and other entities within the system work to maintain financial stability by monitoring financial risks, managing debt issuance, and promoting transparency and collaboration among nations.

- Allocating Global Savings: The system directs global savings to areas where they can be most productively invested. It channels surplus savings from some countries to those with deficits in need of funds.

- Facilitating Risk Diversification: By enabling global investments and trade across different markets and economies, the system allows countries to diversify their macroeconomic risks.

- Transmitting Monetary Policies: Changes in monetary policies and interest rates in one country can be transmitted to others through exchange rate mechanisms within the system.

- Setting Standards and Guidelines: The system, through institutions like the IMF and the Bank for International Settlements, establishes standards and policies that member countries are expected to follow.

Importance of the International Monetary System

- Facilitates Global Trade and Investment: The system plays a crucial role in enabling trade and investment between countries by providing currencies and exchange rates that function as a common unit of account, thereby driving global economic activity.

- Promotes Financial Stability: Through institutions like the IMF, the system contributes to overall economic stability by monitoring risks, providing crisis financing, and issuing policies that support sustained growth.

- Enables Risk Diversification: The system allows countries to spread their macroeconomic risks by supporting global trade and investments in various markets, which enhances the resilience of economies.

- Transmits Monetary Policies: The system facilitates the transmission of monetary policies and interest rate changes from one country to others through exchange rate adjustments, promoting policy coordination.

- Fosters Economic Growth: An effective international monetary system that facilitates trade, investment, and risk diversification can accelerate economic growth for member countries.

- Reduces Poverty: Economic growth supported by the system can contribute to poverty reduction over time by creating more job opportunities and income sources.

- Promotes Technological Diffusion: The system encourages the spread of new technologies, management practices, and ideas across borders, thereby enhancing productivity and growth.

- Sustains Global Economic and Political Stability: A stable and well-functioning international monetary system underpins broader geopolitical stability by integrating national economies.

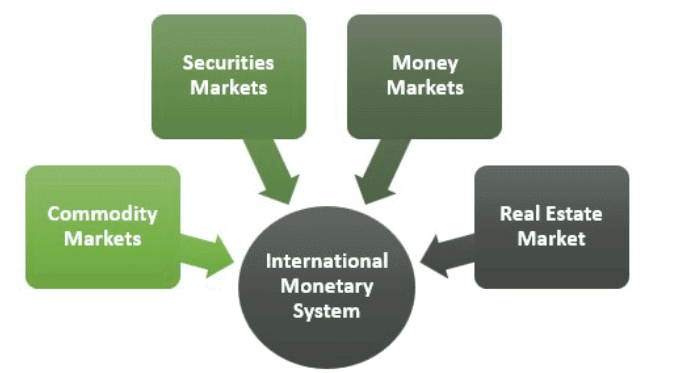

Types of International Monetary System

The international monetary system defines how countries' currencies are exchanged, providing a framework for monetary transactions across borders. Here are the different types:

Fixed Exchange Rate System:

- Currencies are pegged to a specific currency, such as the US dollar, at a fixed rate. This system prioritizes stability but lacks flexibility. It is not commonly used today.

Floating Exchange Rate System:

- Exchange rates are determined by supply and demand in the foreign exchange market. This system offers more flexibility but can also lead to volatility. It is the most widely utilized system at present.

Hybrid Exchange Rate System:

This system combines features of both fixed and floating exchange rates. It includes the following components:

- Crawling pegs: Exchange rates adjust gradually over time in small increments.

- Crawl-like formats: Trade rates fluctuate within agreed-upon bands.

- Currency boards: Domestic currency is linked to a foreign currency at a fixed rate.

Currency Unions:

- In a currency union, member nations adopt a shared currency and follow a unified monetary policy. Examples include the Eurozone and the East Caribbean Currency Union.

Commodity-based Systems:

- In this system, a commodity like gold serves as the primary medium of exchange. An example is the gold standard, which was prevalent in the past.

Bancor System:

- The Bancor system, proposed by Keynes as part of the Bretton Woods system, envisioned a global currency (Bancor) supported by a basket of key commodities. However, this system was never implemented.

Criteria for Good International Monetary System

Criteria for a Good International Monetary System

- Facilitates Global Trade and Investment: The primary criterion is that the system should support and enhance global trade and financial flows by providing reliable currencies, exchange rates, and financial institutions.

- Enhances Global Economic Stability: The system should be capable of absorbing economic shocks and disturbances in one country without significantly affecting overall global stability.

- Allows for Adjustment of Imbalances: The system must enable adjustments in exchange rates, trade flows, and capital flows to correct cost imbalances between countries.

- Maintains Currency Stability: The system should aim to keep the currencies of member countries relatively stable over time to facilitate trade and investment decisions.

- Accommodates Flexibility: The system should be adaptable, allowing for flexibility in responding to changing economic needs while maintaining stability. Both stability and flexibility are crucial.

- Encourages Multilateral Coordination: The system functions best when member countries cooperate and coordinate their economic policies on a multilateral basis through institutions like the IMF and regional agreements.

- Ensures Effective Surveillance: The system must have robust monitoring tools to oversee members' economic policies and provide timely warnings of emerging risks.

- Promotes Representation and Participation: The governance of the system should strive for broad representation and participation from all member countries, especially emerging economies.

- Leverages Innovation and Technology: The system should continually seek to incorporate innovations in technology, finance, and policymaking to enhance its effectiveness over time.

Evaluation of International Monetary System

- Easing trade and investment - The system facilitates global trade and investment by managing crucial elements like currencies, exchange rates, and financial institutions. Challenges arise from imbalances and volatility, impacting smooth operations.

- Helping stability - While the system offers some protection against economic shocks, it has been criticized for its failure to avert major crises such as the 1997 Asian financial crisis and the 2007-08 global financial crisis. Reforms are necessary to enhance resilience.

- Helpful flexibility - Transitioning to a more adaptable exchange rate system has improved the ability of economies to respond to changing conditions. However, excessive currency market volatility can disrupt stability, necessitating a delicate balance between stability and flexibility.

- Adjusting imbalances - Efforts are made within the system to address significant trade and payment imbalances among nations that have accumulated over time. Addressing these imbalances requires improvements in surveillance, policy coordination, and incentive mechanisms.

- Representativeness and governance - Criticisms have been raised regarding the dominance of a few developed economies and reserve currencies in the system. Enhancing governance structures to involve emerging economies more extensively can enhance legitimacy and effectiveness.

- Innovation and reform - The system has undergone evolution through successive changes in institutions, regulations, and currencies. However, the pace of reforms has often lagged behind the rapid integration of the global economy and finance. More proactive and forward-looking reforms are essential.

Conclusion

The international monetary system plays a crucial role in facilitating global economic activities such as trade, investment, and financial cooperation. While it has contributed significantly to economic growth since World War II, it faces challenges in promoting financial stability, correcting imbalances, accommodating all economies, and implementing necessary reforms. There is room for improvement to make the system more balanced, flexible, and inclusive.

|

157 videos|236 docs|166 tests

|

FAQs on International Monetary System - Crash Course for UGC NET Commerce

| 1. What is the International Monetary System? |  |

| 2. How has the International Monetary System evolved over time? |  |

| 3. What are the key features of the International Monetary System? |  |

| 4. What are the functions of the International Monetary System? |  |

| 5. Why is the International Monetary System important? |  |