Banking Sector Reforms in India | Crash Course for UGC NET Commerce PDF Download

What are Banking Sector Reforms?

- Banking sector reforms involve changes and updates to banking operations and regulations designed to improve the system. These reforms facilitate the adoption of new technologies, enhance banking practices, and improve accessibility for users.

- In India, banking sector reforms have been implemented over the years to help banks adapt to evolving standards and technologies. These reforms are an ongoing process, with new policies regularly introduced to simplify banking services and enhance their accessibility.

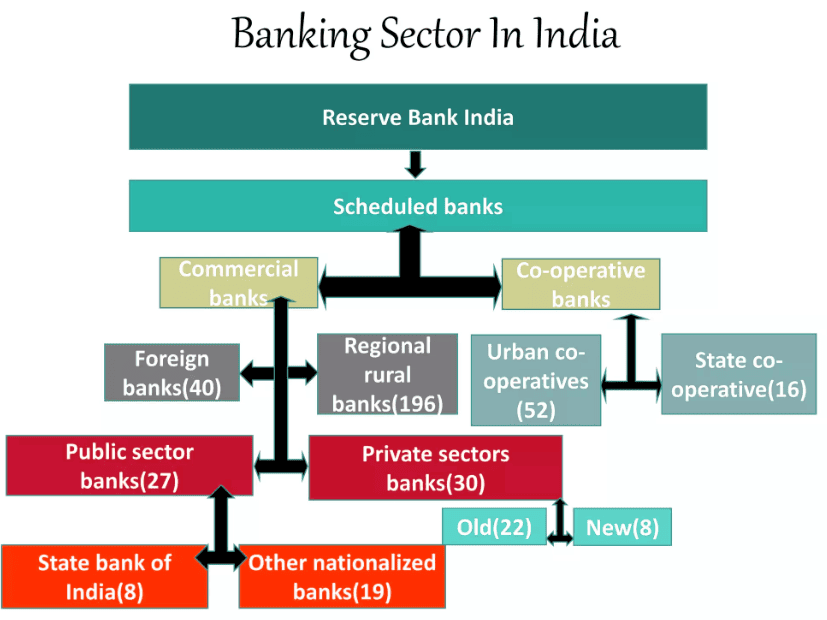

- A major objective of these reforms is to ensure that banking services are available to all sectors and populations, including those in rural and remote areas. The government, in conjunction with the Reserve Bank of India (RBI), plays a crucial role in shaping these reforms. The RBI, as the primary regulatory body, oversees the implementation of these policies.

- By keeping pace with international standards and global market trends, banking sector reforms in India aim to continually meet the changing needs of the sector and improve overall efficiency.

History of Banking Sector Reforms in India

The Indian banking sector has undergone numerous changes and reforms since its early days. Here’s an overview of its historical development:

Before Independence:The roots of banking reform in India can be traced back to the pre-independence era:

- General Bank of India: Established in 1786, it was the first formal Indian bank and laid the foundation for the banking sector.

- Presidency Banks: In 1806, the East India Company established the Presidency Bank in Kolkata.

- Bank of Bombay: Founded in 1840, followed by the Bank of Madras in 1843.

- Reserve Bank of India (RBI): The RBI was established on April 1, 1935, under the Reserve Bank of India Act. Its initial focus was on maintaining monetary stability, regulating banknote issuance, and managing reserves.

Following India’s independence, many banks continued to serve only urban areas, leaving rural and remote regions largely underserved and reliant on moneylenders for credit.

To address this issue, the Indian government implemented nationalization measures:

- First Nationalization: In 1969, the government nationalized major banks to enhance their reach and promote broader economic objectives.

- Second Nationalization: In 1985, further nationalization aimed to support rural development and expand banking services to underserved areas.

Over the years, several reforms have been introduced to strengthen and modernize the Indian banking sector.

Objectives of Banking Sector Reforms in India

The evolution of the banking sector in India has been marked by continuous reforms aimed at enhancing its efficiency and stability. Below are the key objectives of these reforms:

- Banking Transformation: The reforms focused on revamping Indian banking, leading to a more efficient and stable system.

- International Integration: These measures aimed to align Indian banks with global standards, facilitating integration with international markets.

- Competitiveness: Reforms were implemented to enhance the competitiveness of Indian banks, enabling them to effectively compete with global counterparts.

- Social Objectives: The reforms had a social dimension, ensuring that banking services were accessible to all segments of society.

- Credit Allocation: By eliminating credit rigidities, the reforms made it easier for individuals to access loans, thereby fostering economic growth.

- Strengthen Banks: Measures were taken to fortify banks against economic shocks, ensuring their stability and resilience in the face of fluctuations.

Reasons For Banking Sector Reforms in India

All the past and recent efforts to reform the banking sector in India have shared a common goal: to fortify and stabilize the banking industry. These reforms were prompted by various challenges faced by Indian banks. Explore below the underlying reasons for these banking sector reforms.

- The banking sector grappled with high inflation, fiscal imbalances, and a payment crisis, necessitating reforms to enable banks to contribute effectively to economic progress.

- Political instability in India had adverse effects on the economy.

- In the midst of 1991, India was confronted with external payment imbalances and soaring inflation, leading to an economic crisis.

- An agricultural slowdown, combined with sluggish industrial growth, hampered GDP expansion.

- Industries experienced a downturn due to insufficient government investments and reduced imports.

- The Gulf Crisis and the collapse of the Soviet Union further dampened demand, impacting industrial activities.

These issues were pivotal in driving the reforms in India. The government recognized the imperative to bolster the stability of banks, a move essential for global competitiveness.

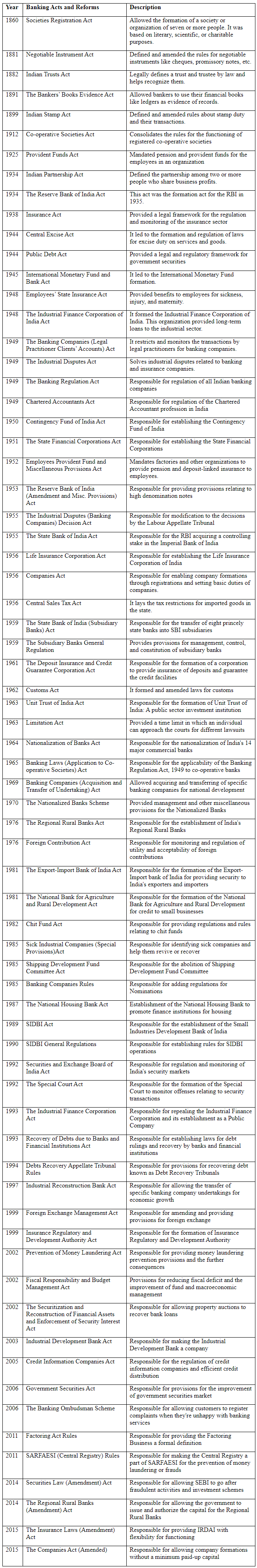

Acts and Reforms in the Banking Sector

To unlock India's economic potential, the banking sector faced numerous challenges that necessitated reforms. These reforms were structured into two distinct phases to address the sector’s difficulties and enhance its efficiency.

First Phase of Reforms

The initial phase of reforms was spearheaded by the Narasimham Committee I, which consisted of nine members under the leadership of Mr. M. Narasimham. This committee, officially known as the 'Committee on the Financial System,' was tasked with evaluating the health of the banking sector and recommending necessary changes. The committee's recommendations, released in November 1991, aimed to enhance the financial health and profitability of commercial banks.

The key objectives of the committee were:

- Modernization: Upgrading policies, procedures, and organizational systems to improve efficiency.

- Competitiveness: Enhancing competitiveness to ensure better credit availability and address growing monetary demands.

- Evaluation: Assessing the cost, adequacy, and capital structure of financial institutions.

- Balanced Development: Reviewing various financial institutions to ensure balanced development across the sector.

The committee's recommendations led to several significant reforms:

- Financial Health Improvement: The introduction of prudential norms helped banks withstand economic shocks and improve their financial stability.

- Transparency: Enhanced financial statement disclosure in accordance with International Accounting Standards was implemented, with the RBI adopting these changes in 1992.

- Institutional Strengthening: Reforms included licensing new private banks, increasing capital bases for public banks, and establishing Debt Recovery Tribunals for recovering outstanding debts.

- Asset Reconstruction Fund: This fund was created to manage and invest in bad bank assets more effectively.

Second Phase of Reforms

The second phase of reforms, initiated by the Narasimham Committee II in 1998, was focused on reviewing the progress of the first phase and further strengthening the banking sector. The key areas of impact included:

- Branch Licensing Deregulation: The RBI eased branch licensing requirements in 1992, granting banks greater autonomy to open or close branches without needing RBI approval. This also included the establishment of special branches and extension counters.

- Prudential Norms and Disclosure Requirements: The committee introduced a 90-day norm, which required that income accruals cease if the principal or interest remained unpaid for 90 days, with full implementation expected by 2022.

- Capital Adequacy: Emphasis was placed on addressing market risks related to the banks' balance sheet positions.

Impact of Banking Sector Reforms

The banking sector reforms had several notable impacts:

- Increased Flexibility: Banks gained greater autonomy, allowing them to operate more flexibly.

- Enhanced Accessibility: The reforms facilitated broader access to banking services, improving the overall banking experience.

- Foreign Competition: The increased autonomy helped domestic banks compete more effectively with global brands.

- Stronger Banking Structure: The reforms contributed to a more resilient banking sector capable of handling economic challenges.

- Financial Stability: The improved banking system contributed to better budget management, reduced public debt, and a more manageable fiscal deficit.

Conclusion

The reforms in the Indian banking sector have significantly transformed the industry, making it more robust, competitive, and inclusive. These changes have not only benefited banks but also improved access to financial services across the country. Despite ongoing challenges, the commitment of the government and regulatory authorities to address these issues continues to drive the growth and stability of the banking sector in India, helping it to compete effectively in the global market.

|

157 videos|236 docs|166 tests

|

FAQs on Banking Sector Reforms in India - Crash Course for UGC NET Commerce

| 1. What are the key objectives of banking sector reforms in India? |  |

| 2. How have banking sector reforms in India impacted the economy? |  |

| 3. What are some of the recent reforms introduced in the Indian banking sector? |  |

| 4. How have banking sector reforms in India contributed to financial inclusion? |  |

| 5. What challenges are faced by the banking sector in India post-reforms? |  |