Negotiable Instruments Act, 1881 | Crash Course for UGC NET Commerce PDF Download

Introduction

- This Act, enacted in 1881, defines and amends laws regarding promissory notes, bills of exchange, and cheques.

- It applies to all of India, including Jammu and Kashmir.

- The act came into effect on 1st March 1882.

Meaning of Negotiable Instrument

A negotiable instrument is a transferable piece of paper or document that specifies payment to a specific person or bearer at a pre-determined date.

Kinds of Negotiable Instruments - Section 13

- Promissory note - Section 4

- Bills of exchange - Section 5

- Cheque - Section 6

Features of Negotiable Instruments

- It should be in writing

- Freely transferable

- Right to Receive and Corresponding Liability

- A negotiable instrument establishes the right of a person to receive money and imposes a corresponding liability on another person to pay that money.

Holder's Title Free from Defects

- A holder in due course gains a good title regardless of any defects in the previous holder's title.

- A holder in due course is someone who receives the instrument for consideration, in good faith, without notice of any defects in the transferor's title, and before maturity.

- Transferability: A negotiable instrument can be transferred multiple times until it is paid.

Presumptions under Section 118

- Consideration: It is assumed that every negotiable instrument was created for consideration and that each action involving the instrument—such as acceptance, endorsement, negotiation, or transfer—was done for consideration.

- Date: It is presumed that a negotiable instrument bearing a date was indeed made or drawn on that date.

- Time of Acceptance: It is presumed that every accepted bill of exchange was accepted within a reasonable time after its date and before its maturity.

- Transfer: It is presumed that every transfer of a negotiable instrument occurred before its maturity.

- Order of Indorsement: It is presumed that indorsements were made in the order they appear on the instrument.

- Stamp: It is presumed that an instrument is properly signed and stamped.

Promissory Note - Section 4

- Meaning of Promissory Note: A Promissory Note is a legal document in which one party commits to paying a specified debt to another party.

- Definition of Promissory Note: A Promissory Note is a written instrument containing an unconditional promise signed by the maker to pay a specified sum of money to a certain person, their order, or the bearer of the instrument.

Parties Involved

- Maker: The individual creating the promissory note and making the promise to pay.

- Payee: The person to whom the payment is to be made.

Essentials of a Promissory Note

- Must be in writing.

- Should contain an unconditional promise to pay.

- Must be signed by the maker.

- The amount payable must be definite.

- Must promise the payment of money and only money.

Additional Key Points

- The maker and payee must be clearly identified.

- Stamping is essential as per The Indian Stamp Act, 1899.

- An unstamped promissory note is not admissible as evidence.

- It should include a date.

- The limitation period for filing a suit regarding a promissory note is 3 years from the execution or acknowledgment date.

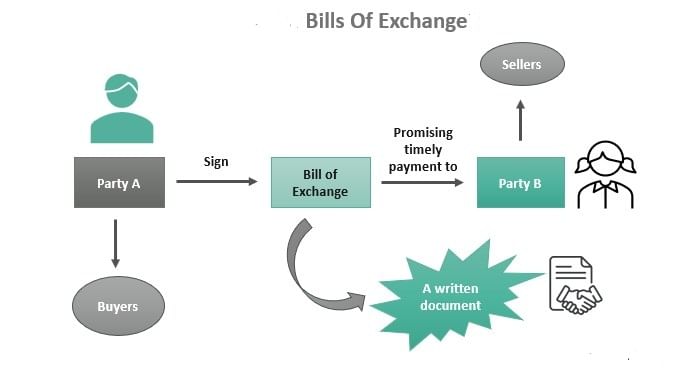

Bills of Exchange - Section 5

Meaning:

- A Bill of Exchange is a written negotiable instrument that contains an unconditional order to pay a specified sum of money to a person or the holder of the instrument as directed by the maker.

- The bill of exchange is not payable on demand but either after a specified term.

Definition:

- A bill of exchange is a written instrument that includes an unconditional order, signed by the maker, directing a certain person to pay a specific sum of money to a certain person or to the bearer of the instrument.

Parties to Bills of Exchange:

- The Drawer: The individual who gives the order to pay or creates the bill is known as the drawer.

- The Drawee: The person instructed to pay is called the drawee. Upon acceptance of the bill, the drawee becomes the acceptor.

- The Payee: The recipient of the payment specified in the bill is referred to as the payee.

Requisites of a Bill of Exchange:

- Parties should be certain: All parties involved in the bill must be clearly identified.

- Stamping: Every bill of exchange must be stamped in accordance with the provisions of The Indian Stamp Act, 1899.

- Date and Place: The bill must specify the date and place of payment or drawing.

- Order to Pay: The bill must include a clear direction to pay.

- Time of Payment: The bill should indicate the time of payment with certainty.

- Amount Payable: The sum to be paid must be clearly stated.

- Consideration: The consideration for a bill of exchange should only be in the form of money.

Other Important Points:

- Unconditional Nature: A bill of exchange must be drawn unconditionally, even though the liability of the acceptor or indorser may be conditional.

- Identification of Parties: The bill must clearly identify the parties involved, with the signature of the drawee being essential.

- Indication of Drawee: The bill must indicate a drawee who is called upon to accept or pay it with reasonable certainty.

Types of Bills

Inland Bills: Two essential conditions for an inland instrument:

- The instrument must be drawn or made in India.

- The instrument must be payable in India or the drawee must be in India.

Foreign Bills:

- All bills that are not inland are considered foreign bills.

- Foreign bills are typically drawn in sets of three copies.

Trade Bills:

- A trade bill is drawn and accepted for a genuine trade transaction.

- Used when a trader sells goods on credit.

Accommodation Bill:

- An accommodation bill involves a person lending his name to oblige a friend or acquaintance.

- It is drawn, accepted, or endorsed without consideration.

- The accommodating party is not liable to the party accommodated as there was no consideration between them.

- The accommodation party is liable to a holder for value if the bill is taken for value.

Bills in Sets:

- Foreign bills are often drawn in sets to prevent loss.

- Drawn in sets of three, each known as "Via"; when one is paid, the others become inactive.

Bills in Sets:

(a) Foreign bills are often issued in sets to minimize the risk of loss.

(b) These bills are created in sets of three, each known as a "Via." Once one part is paid, the others are no longer valid.

(c) All parts together constitute a single bill, and the drawer must sign and hand over all parts to the payee.

(d) A stamp is placed on only one part, and only one part needs to be accepted.

(e) However, if the drawer mistakenly accepts all parts of the bill, they will be held responsible for each part as though it were an individual bill.

Bank Draft:

A bank draft is a type of bill of exchange drawn by one bank on another bank, or by a bank on its own branch, and is considered a negotiable instrument.

A bank draft is a type of bill of exchange drawn by one bank on another bank, or by a bank on its own branch, and is considered a negotiable instrument.

Section 6

Meaning: A cheque is a negotiable instrument that issues an unconditional order to a bank to pay a specified amount from the account of the person who wrote it (the drawer) to the individual or entity named in the cheque (the payee), or to the bearer of the cheque. This definition also covers cheques that are electronically processed or truncated.

Definition: A cheque is defined as a bill of exchange directed to a specific banker and payable upon demand. This definition also includes the electronic image of a truncated cheque and cheques in electronic form.

Note: While a cheque is a type of bill of exchange, it has two key distinctions:

- It is always addressed to a specified banker.

- It is always payable on demand.

Essentials of a Cheque:

- A cheque must be a written order.

- It must contain an unconditional directive.

- The cheque must be signed by the person who is issuing it.

- The amount to be paid should be clearly specified in both figures and words.

- A cheque can be made payable to a specific individual (order) or to the bearer. The two common types of cheques are: a) bearer or order cheque b) self cheque

- The cheque must be dated.

- The payee must be clearly identifiable.

Section 7

Meaning:

- Acceptance for honor involves a third party agreeing to pay a dishonored bill of exchange, either partially or fully, on behalf of the drawer or an endorser.

- Also known as acceptance supra protest.

Acceptance Process:

- The accepting party must declare in writing their acceptance under protest for the honor of the drawer or a specific endorser they name.

Rights and Liabilities:

- The acceptor for honor commits to paying the bill amount if the drawee defaults.

- Liability is conditional and arises only upon the drawee's failure to pay.

- The acceptor can seek reimbursement for losses and damages from the drawee.

Holder - Section 8

Definition of "Holder": A "holder" of a promissory note, bill of exchange, or cheque is someone entitled in their name:

- to possess the instrument

- to receive or claim the amount due from the involved parties

- Rights and title depend on the transferor. The holder can demand and receive but lacks the right to sue.

Holder of a Negotiable Instrument:

- Not every possessor of an instrument is considered a holder.

- To qualify as a holder, one must be named as the payee, endorsee, or bearer of the instrument.

- A person who acquires an instrument through theft or forged endorsement is not a holder and cannot claim rights to it.

- An agent holding an instrument for a principal is not a holder, even if they receive payment on its behalf.

- The term "holder" typically refers to a de jure holder in law, not a de facto holder in fact.

Holder in Due Course - Section 9

A holder in due course:

- Receives the instrument for consideration, in good faith, and before maturity.

- Is unaware of any defects in the transferor's title.

- Has rights and title independent of the transferor.

- Has the right to demand, receive, and sue on the instrument.

Payment in Due Course – Section 10

Payment in due course involves:

- Conforming to the apparent terms of the instrument.

- Making the payment in good faith and without negligence.

- Paying the rightful holder entitled to receive the payment.

- Ensuring the payment is made in currency only.

Classification of Negotiable Instruments

Bearer Instruments:

- Negotiable instruments can be payable to bearers under the following conditions:

- Explicitly stated as payable to bearers by the parties involved.

- Endorsed in blank if required.

- The bearer of such an instrument can claim payment.

Order Instruments:

- These instruments are payable:

- When expressly stated to be so.

- To a specific person or order.

- Should not have any transfer restrictions.

Inland Instruments:

- An inland instrument:

- Drawn and payable in India or drawn in India on residents of India, even if payable abroad.

Definition of Foreign Instruments:

- Any instrument not inland is considered a foreign instrument.

- These instruments are drawn in a foreign country but can be payable within or outside India.

- They must be drawn in India, made payable outside India, and drawn on a person residing outside India.

Types of Instruments

Demand Instruments:- Negotiable instruments with no specified time for payment are known as demand instruments.

Time Instruments:

- Time instruments have a fixed future date for payment.

- They are payable at a specific date in the future.

Ambiguous Instruments:

- An ambiguous instrument is one that can be interpreted as either a bill or a note by its holder.

- Under such circumstances, the holder can treat them as bills of exchange or promissory notes.

- For example, the drawee may be a fictitious person or legally incompetent to contract.

Incomplete Instruments:

- Incomplete instruments lack essential requirements of typical negotiable instruments.

- The holder has the authority to complete them up to the mentioned amount, creating a legally binding negotiable instrument.

- Any holder, including subsequent ones, can complete such instruments.

Amount Discrepancy in Negotiable Instruments - Section 18

- If the amount in figures and words differs, the amount in words is considered the agreed sum to be paid.

Maturity of Instruments - Sections 22, 23, and 24

Meaning of Maturity:

- Maturity refers to the date on which a promissory note or bill of exchange becomes due.

Days of Grace:

- Instruments not payable on demand, at sight, or on presentment mature on the third day after the specified payment date and are entitled to a 3-day grace period.

- No grace period is allowed for instruments like cheques or those payable at sight, on presentment, or on demand.

- Installments of instruments are each entitled to a 3-day grace period.

Calculation of Maturity

- If a negotiable instrument is payable on a specified date, it becomes payable on that date with an additional 3-day grace period.

Negotiable Instruments and Grace Period

- When a negotiable instrument is due a certain number of days after a specified date, sight, or event, it becomes payable on:

- The same date of the instrument's creation plus three days of grace.

- The date of presentation for sight plus three days of grace.

- The date of the specified event plus three days of grace.

- If a negotiable instrument is due a certain number of months after a specified date, sight, or event, it becomes payable on:

- The corresponding day of the relevant month (based on the date of creation of the instrument) plus three days of grace.

- The corresponding day of the relevant month (based on the date of presentation for sight) plus three days of grace.

- The corresponding day of the relevant month (based on the date of the specified event) plus three days of grace.

Examples:

- An instrument dated 31st January, 2020, payable one month after date matures on 3rd March, 2020.

- An instrument dated 30th August, 2020, payable three months after date matures on 3rd December, 2020.

- An instrument dated 31st August, 2020, payable three months after date matures on 3rd December, 2020.

If the last grace day falls on a public holiday, the instrument is due on the preceding business day.

If the maturity day falls on an emergency or unforeseen holiday, the maturity is moved to the following business day.

Negotiation of Negotiable Instruments

- Meaning of Negotiation: When an instrument is transferred from one person to another to make the recipient the holder, it is considered negotiated.

- Modes of Negotiation:

- For Promissory Notes (PN), Bills of Exchange (BOE), Cheques payable to bearer: by Delivery.

- For PN, BOE, Cheques payable to order: through endorsement and delivery.

- Negotiation Back:The process of transferring the instrument back to a previous holder.

- When an endorser reacquires the instrument they endorsed, it is considered negotiated back to that endorser.

- In such a scenario, intermediary endorsees are not liable to the endorser.

- Example: If Raju endorses a bill to Shyam, which passes through others and comes back to Raju, he can only recover from Shyam, Babu Bhai, and Anuradha. He cannot sue them as he has been restored to his original position.

- Exclusion of Liability by Endorser

- If an endorser excludes their liability and later becomes the holder of the instrument, all intermediate endorsers are liable to them.

- Example: If Raju endorses an instrument 'sans recourse' to Shyam, and it comes back to Raju, he can claim against Shyam, Babu Bhai, and Anuradha.

Delivery - Section 46

The completion of making, accepting, or endorsing a promissory note, bill of exchange, or cheque is achieved through delivery, which can be actual or constructive.

What is Endorsement?

Meaning of Endorsement:

- Endorsement involves signing at the back of an instrument for negotiation purposes.

- For instance, signing a cheque to transfer it to someone else constitutes endorsement.

- If there's no space on the instrument, endorsement can be done on a separate slip attached to it.

Definition of Endorsement:

- An endorser signs a negotiable instrument for negotiation, either on the back or face of it, or on an attached slip or a stamped paper intended for completion as a negotiable instrument.

- This act is termed endorsement, and the signatory is known as the endorser.

Kinds of Endorsement:

- Endorsement in Blank / General: The endorser signs the instrument without specifying a payee.

- Endorsement in Full / Special: The endorser not only signs but also names the payee for whom the payment is intended.

- Endorsement Overview: Endorsement is the act of signing the back of a negotiable instrument, transferring the rights to another party.

Types of Endorsement

- Partial Endorsement: A partial endorsement transfers only a part of the amount mentioned in the instrument and is legally invalid.

- Conditional Endorsement: This type of endorsement limits or negates the liability of the endorser, such as through sans recourse or event-based conditions.

- Restrictive Endorsement: Restrictive endorsement restricts the further negotiability of the instrument to prevent fraud or unauthorized access.

- Endorsement Sans Recourse: With this type of endorsement, the endorser disclaims liability and excludes themselves from any responsibility to subsequent parties.

Who May Negotiate an Instrument - Section 51

- Section 51 specifies that makers, drawers, payees, or endorsees of a negotiable instrument can negotiate the instrument.

Obtaining Instruments Unlawfully - Section 58

- Section 58 addresses situations where negotiable instruments are lost, obtained through fraud, or for unlawful considerations.

Summary

Liabilities of Parties

Liability of a Minor:

- Minors, due to their inability to contract, cannot be held liable on negotiable instruments as per Section 26. They bind all parties except themselves.

Liability of an Agent:

- Individuals capable of entering into contracts may handle promissory notes, bills of exchange, or cheques personally or through an authorized agent.

- General authority to conduct business does not grant the power to an agent to endorse bills of exchange, unless explicitly signed as an agent to avoid personal liability.

- An agent remains personally liable unless clearly stating that the signature is on behalf of the principal.

Liability of Legal Representative:

- A legal representative of a deceased person, by signing their own name on an instrument, assumes personal liability for the entire amount. However, they can limit liability to the assets they've received.

Liability of Drawer:

- The drawer's liability on a bill or cheque is secondary and contingent on dishonor by the drawee or acceptor.

- The acceptor and maker have primary and unconditional liability.

- After dishonor notification, the drawer must compensate the holder regardless of the account status with the drawee or acceptor.

Liability of Drawee Bank of Cheque:

- Incorrectly dishonoring a customer's cheque leads to exemplary damages against the bank, with the amount inversely related to the dishonored cheque value.

Liability of Drawee of Bill of Exchange/Maker of Promissory Note:

- The maker of a promissory note must pay the amount at maturity.

- Drawee's liability arises upon accepting bills, with primary and unconditional responsibility.

- Drawee is liable for the principal amount, interest, and any noting or protesting charges.

Liability of Maker, Drawer, and Acceptor

Maker's Liability:

- The maker of a promissory note is liable as the principal debtor.

Drawer and Acceptor's Liability:

- In a bill of exchange, the acceptor acts as a principal debtor.

- The drawer acts as a surety; liable to pay only if the acceptor defaults.

Effect of Forged Indorsement on Acceptor's Liability

Acceptance of Indorsed Bill:

- An acceptor of a bill of exchange already indorsed is not relieved from liability if the indorsement is forged.

Liability on Various Types of Instruments

Fictitious Name:

- The acceptor is not relieved from liability by proving that the drawer is fictitious.

Consideration:

- An instrument made, drawn, accepted, indorsed, or transferred without consideration creates no obligation of payment between the parties.

Presentment - Section 61 to section 67

Presentment Classifications

- Presentment for acceptance.

- Presentment for payment for Bills of Exchange, Promissory Notes, and Cheques.

Presentment for Acceptance

- Only Bills of Exchange require presentment for acceptance.

- Bills should be presented within a reasonable time, on a business day, and during business hours to the drawee for acceptance.

- Specific bills must be presented for acceptance, such as bills payable after sight or with express conditions.

- If not presented for acceptance, the bill is dishonored due to non-acceptance, and no party is liable.

Recipients for Acceptance

- Bills of exchange should be presented to the drawee or their agent for acceptance.

Legal Aspects of Bills of Exchange

Parties Involved in Bill Presentation:

- Bill must be presented to all drawees.

- Legal representatives of a deceased drawee.

- Official receiver or assignee of an insolvent drawee.

- Drawee in case of need, if applicable.

- Acceptor for honour.

Drawee's Time for Deliberation:

- Allow 48 hours for the drawee to accept the bill of exchange.

Presentment for Payment:

- Promissory notes, bills of exchange, and cheques must be presented to the respective maker, acceptor, or drawee for payment by or on behalf of the holder.

- If not presented, other parties are not liable to the holder.

Hours for Presentment:

- Present for payment during usual business hours or within banking hours if at a banker's.

When Presentment is Unnecessary:

- Not required in certain cases like intentional prevention by the maker, drawee, or acceptor, closure of business place during business hours, inability to find the maker, or agreed payment without presentment.

- Part-payment by the maker without presentment.

Presentment for Acceptance Exceptions:

- Not needed if the drawee cannot be found after search, is fictitious, refuses acceptance on other grounds, is incompetent to contract, or if one or more drawees (not partners) refuse acceptance.

Payment and Interest:

- To discharge the maker or acceptor, payment should be made to the holder of the instrument.

Negotiable Instruments: Discharge from Liability

Interest Rate Specification in Negotiable Instrument:- When interest rate is specified: The rate mentioned in the instrument is applied.

- When interest rate is not specified: A rate of 18% per annum is considered.

Discharge from Liability

Discharge from liability occurs when the obligations of parties involved cease to exist.

Modes of Discharge:

By Cancellation, Release or Payment:- Cancellation: Removing the acceptor's name or any party's name discharges them.

- Release: Releasing the acceptor or any party discharges them from the liability.

- Payment: Settling the amount due by the primary liable party leads to discharge of the instrument.

By Allowing Drawee More Than 48 Hours:

- If the drawee is given more than 48 hours to consider acceptance, previous parties may be discharged if they do not consent to the extension.

By Delay in Presenting Cheques:

- If a cheque isn't presented promptly, and the drawer suffers losses due to the delay caused by the bank, the liability to the holder is reduced by the extent of the damages.

Forgery of Endorser's Signature in Cheque:

- The bank is absolved of liability if the endorser's signature is forged.

By Qualified Acceptance

- If the holder accepts a qualified acceptance, previous parties not consenting are discharged unless they assent after notice.

By Material Alteration

- Material alterations void the instrument against parties not consenting unless it aligns with the original intention of the parties.

Discharge of Bank:

- Bank is discharged by payment in due course under Section 89, especially when alterations are not evident from records.

- Under Section 90, the acceptor of a bill of exchange or maker of a promissory note is discharged when becoming the holder on or after maturity.

Dishonour of Bill of Exchange/Promissory Note

Dishonour can be categorized as follows:

Dishonour by Non-Acceptance (for Bill of Exchange):

A bill is dishonoured by non-acceptance in various scenarios:

- When the drawee fails to accept within 48 hours.

- When presentment for acceptance is excused and the bill remains unaccepted.

- When the drawee is legally incompetent to enter into a contract.

- When the drawee is a fictitious person or cannot be located after a reasonable search.

- When the acceptance is a qualified one.

Dishonour by Non-Payment

- A promissory note, bill of exchange, or cheque is considered dishonoured by non-payment if the maker of the note, acceptor of the bill, or drawee of the cheque defaults on payment.

Section 92

Section 92 defines dishonour of a bill of exchange or promissory note by non-payment as when the party primarily liable fails to make the payment.Notice of Dishonour (Section 93 & 94)

Key points related to notice of dishonour:

- Notice of dishonour must be given by the holder or a party liable on the instrument when it is dishonoured by non-acceptance or non-payment.

- Notice should be provided to parties the holder intends to charge with liability, such as the drawer and endorsers.

- Notice can be given to the party, their agent, legal representative, or official assignee in case of insolvency.

- No notice is required to be given to the maker of a note or the drawee/acceptor of a bill or cheque.

- If notice of dishonour is not sent to a prior party entitled to such notice within a reasonable time, that party is discharged from liability.

Cheque Crossings and Dishonor

Notice of Dishonor Exceptions

- When there is no intention to make the prior party liable.

- When the prior party is discharged.

- When the drawer and drawee are the same.

- When the drawer is fictitious.

- When the prior party has signed the indorsement 'without recourse'.

- When the party entitled to notice cannot be found after reasonable search.

- When the party liable to give notice is unable, due to circumstances like death, illness, or accident.

- When the prior party is incompetent.

Noting (Section 99)

- After dishonor of a promissory note or bill of exchange, the holder can have the dishonor noted by a notary public.

- The note must be made promptly and specify the date and reason for dishonor.

Protest (Section 100)

- After dishonor, the holder can have the dishonor noted and certified by a notary public.

- This certified note is known as a protest.

Protest for Better Security

- If the acceptor of a bill is in financial trouble before maturity, the holder can demand better security through a notary public.

- If this is refused, the facts can be noted and certified, known as a protest for better security.

Protest of Foreign Bills (Section 104)

- Foreign bills of exchange must be protested for dishonor as per the law of the place where they are drawn.

Crossing a Cheque

- Crossing a cheque involves drawing two parallel transverse lines on its corner.

- This instruction tells the banker to not pay it over the counter but only credit it to the named person's account.

- It enhances security, ensuring payment to the payee or their order.

Overview of Crossing of Cheque

The Development of Crossing of Cheque for Protection

- Payment protection in cheque transactions evolved gradually to prevent misuse.

Who Can Cross a Cheque?

- The Authorized Parties for Crossing

- The drawer of the cheque and the holder of the cheque can perform crossing.

Types and Objectives of Crossing

Objectives of Crossing:

- Protection and safeguarding of the cheque owner.

- Prevention of fraud and misuse of cheques.

- Detection of fraudulent activities.

Kinds of Crossing

General Crossing (Section 123)

- Characteristics and Effects of General Crossing:

- Cheque face marked with two parallel transverse lines.

- Payment only through a bank, not at the counter.

- Inclusion of banker's name not mandatory.

- Conversion to Special Crossing possible.

- Banker must pay to another banker.

- Payment made through an account only.

- Ensures protection and prevents fraudulent withdrawals.

- Banker accountable for proper payment verification.

- Liability on the paying banker in case of unauthorized payments.

Special Crossing (Section 124)

- Definition and Features of Special Crossing:

- Also known as Restricted Crossing.

- Not mandatory to draw two transverse lines.

- Banker's name added across the face of the cheque.

- Special or Restrictive Crossing

- Definition: This type of crossing specifies the name of the banker in the crossing. It may include '& Co.', 'Account payee', or 'Not Negotiable'.

- Payment: The payment can only be made through the bank mentioned in the crossing.

- Conversion: Specially crossed cheques cannot be converted to general crossing.

- Effect: Special crossing prevents fraudulent transactions by directing the paying banker to pay the amount only to the account holder of that bank.

- Account Payee Crossing

- Meaning: This crossing is indicated by terms like 'Account payee' on the left side of the cheque between two transverse lines.

- Direction: It signifies that the amount should not be paid in cash but should be credited to the payee's account.

- Protection: Account payee crossing provides additional protection to the cheque by directing the receiving bank to credit the amount only to the payee's mentioned account.

- Effect: The impact of an "Account Payee" crossing serves as an instruction to the receiving bank, indicating that the drawer intends for the cheque to be deposited only into the payee's account at their bank. The collecting banker is obligated to ensure the cheque is credited solely to the specified payee's account. If the banker credits the cheque to a different account, they can be held accountable for negligence and liable for any resulting compensation.

Not Negotiable Crossing

- Meaning: A cheque crossed with 'Not Negotiable' warns that the person receiving it cannot have a better title than the one from whom they received it.

- Protection: This type of crossing offers more protection than general or special crossing, emphasizing caution for paying and collecting bankers in handling such cheques.

- Note: 'Not Negotiable' does not imply that the cheque is non-transferable.

General Crossing:

- The holder can add crossing to a cheque to provide more protection.

- Prevents easy cashing by a third party.

- It can be transferred like any other cheque.

Special Crossing:

- Allows the banker to re-cross it specially to another banker or agent for collection.

Effects of Crossing:

- Provides enhanced protection and safety to the cheque holder.

- Compels the finder to return the cheque to the true owner if stolen.

- Preserves the owner's rights against any subsequent holder.

Crossing after issue.

- If a cheque is not crossed, the holder has the option to cross it either generally or specially.

- If a cheque is already crossed generally, the holder can choose to cross it specially.

- Whether a cheque is crossed generally or specially, the holder can add the phrase "not negotiable."

- If a cheque is crossed specially, the banker it’s crossed to may cross it again specially to another banker or their agent for collection.

Conditions for Banker to Refuse Payment

Disallowed Scenarios:

- Post-dated cheques.

- Insufficient funds without communication for honoring the cheque.

- Cheques of illegality.

- Irregular, ambiguous, or materially altered cheques.

- Cheques presented after banking hours.

- Cheques presented at a branch where the customer has no account.

- Joint account cheques not signed jointly by all account holders.

- Stale cheques not presented within three months of the date mentioned.

Mandatory Refusal Factors:

- Customer countermands payment.

- Banker receives notice of customer's death, insolvency, or insanity.

- When a court order prohibits payment.

- When the customer has assigned the credit balance of their account.

- When the banker discovers a defective title held by the holder.

- When the customer has given notice to close their account.

Protection of Liability for the Paying Banker

- Endorsed Cheques: If a cheque payable to order appears to be endorsed by or on behalf of the payee, the drawee is released from liability by making payment in due course.

- Bearer Cheques: For a cheque originally payable to bearer, the drawee is discharged by making payment in due course to the bearer, even if there are endorsements on the cheque, whether in full or blank, and regardless of any endorsement that restricts or excludes further negotiation.

- General Crossed Cheques: A cheque crossed generally should be paid only to a banker.

- Specially Crossed Cheques: A cheque crossed specially must be paid only to the banker specified in the crossing or to their agent for collection.

- Payment in Due Course of Crossed Cheques: When a banker pays a crossed cheque in due course, both the banker making the payment and, if the cheque has been received by the payee, the drawer are entitled to the same rights and are placed in the same position as if the cheque amount had been paid directly to and received by the true owner.

- Payment of Crossed Cheques Out of Due Course: A banker who pays a generally crossed cheque to someone other than a banker, or a specially crossed cheque to someone other than the banker specified in the crossing or their agent, will be liable to the true owner for any loss resulting from the improper payment.

- Non-Liability for Banker Receiving Payment: According to Section 131, a banker who receives payment in good faith and without negligence for a customer of a cheque crossed generally or specially to themselves will not be held liable to the true owner of the cheque if the cheque's title is found to be defective.

To obtain such protection, the banker must demonstrate:

- Receipt of payment for the crossed cheque.

- Collection made on behalf of the customer.

- The collecting bank acted in good faith.

Dishonour of Cheque

Sections 138 to 142 - Dishonor of Cheques- Penalties for dishonor of cheques include imprisonment up to 2 years or a fine up to twice the amount of the cheque or both.

- Conditions for penalties:

- Cheque dishonored due to insufficient funds in the drawer's account.

- Cheque issued to discharge a legally enforceable debt or liability.

- Cheque presented within 3 months of issuance.

Presumptions and Defenses

- Presumption in favor of holder (Section 139): Holder received the cheque for debt discharge.

- Defense not allowed (Section 140): Ignorance of possible dishonor isn't a defense.

Offences by Companies

- If a company commits an offence, individuals involved are jointly liable.

Procedure before Charging Penalty

Sequence of actions:

- Drawer issues a cheque.

- Payee presents the cheque.

- Collecting bank informs the payee of dishonor.

- Payee must notify the drawer within 30 days of dishonor.

- Notice can be sent by post or telegram.

- Drawer must make payment within 15 days of notice.

- Complaint must be filed within one month of the cause of action.

Cognizance of Offences - Section 142

Filing Case

- Court takes cognizance of offenses under section 138 only if in writing.

- Complaint must be filed within 1 month.

- Offenses under section 138 can only be tried by a Metropolitan Magistrate or a Judicial Magistrate of the first class.

Place of Jurisdiction for Trial

- Cheque dishonor cases under section 138 are tried where the cheque was delivered for collection or presented for payment.

- Dependent on the location of the bank branches involved.

Power of Court to Try Cases Summarily - Section 143

- Magistrate can sentence imprisonment up to one year and a fine exceeding five thousand rupees in summary trials under this section.

Power to Direct Interim Compensation - Section 143A

- Despite provisions in the Code of Criminal Procedure, 1973, a court handling a case under section 138 can order the cheque issuer to provide interim compensation to the complainant under the following conditions: a) In cases of summary trials or summons cases where the accused pleads not guilty to the charges; and b) In other types of cases, after charges have been framed.

- The amount of interim compensation cannot exceed 20% of the cheque's value.

- This interim compensation must be paid within 60 days of the order, or within an additional period of up to 30 days if the court grants an extension based on sufficient cause shown by the cheque issuer.

- If the cheque issuer is found not guilty, the court will require the complainant to refund the interim compensation, along with interest at the bank rate published by the Reserve Bank of India at the start of the relevant financial year, within 60 days of the order. The court may extend this period by up to 30 days if the complainant provides sufficient cause.

Offences to be Compoundable - Section 147

- Every offense under this Act is compoundable.

Power of Appellate Court to Order Payment Pending Appeal - Section 148

- In appeals against conviction under section 138, the Appellate Court may order the appellant to deposit a minimum amount of the fine or compensation awarded by the trial Court.

Legal Aspects of Remittance Instruments

Interim Compensation under Section 143A

- Under this provision, additional payment is required apart from any interim compensation already provided by the appellant.

Deposit Timeframe

- The amount specified must be deposited within 60 days from the order date, with a possible extension of up to 30 days granted by the Court for valid reasons.

Release of Deposited Amount

- The Appellate Court can order the release of the deposited amount to the complainant while the appeal is ongoing. However, if the appellant is acquitted, the complainant must repay the released amount with interest.

Hundis

- Meaning of Hundis: Hundis are negotiable instruments typically in an oriental language. They can function as bills of exchange or promissory notes and are not covered by the Negotiable Instruments Act, 1881. Local customs apply, but in case of ambiguity, the Act takes precedence.

Types of Hundis:

NEFT (National Electronic Funds Transfer)

- NEFT is a nation-wide payment system allowing the transfer of funds between bank accounts.

- Individuals, firms, and corporates can transfer funds electronically between banks participating in the scheme.

- Primarily used for transactions involving smaller amounts.

- Operates on a Deferred Net Settlement (DNS) basis, settling transactions in batches.

RTGS (Real Time Gross Settlement)

- RTGS systems are specialized funds transfer systems for real-time and gross transfers between banks.

- A safe and secure system primarily used for large-value interbank fund transfers.

|

157 videos|236 docs|166 tests

|

FAQs on Negotiable Instruments Act, 1881 - Crash Course for UGC NET Commerce

| 1. What are the different types of bills under the Negotiable Instruments Act, 1881? |  |

| 2. How are negotiable instruments classified? |  |

| 3. What is the process of negotiation of negotiable instruments? |  |

| 4. What are the liabilities of parties involved in negotiable instruments? |  |

| 5. What conditions allow a banker to refuse payment of a cheque? |  |