UGC NET Exam > UGC NET Notes > Crash Course for UGC NET Commerce > Procedure of Formation of LLP in India

Procedure of Formation of LLP in India | Crash Course for UGC NET Commerce PDF Download

Structure and Formation of Limited Liability Partnership (LLP)

Overview of LLP

- A Limited Liability Partnership (LLP) combines the flexibility of a partnership with the limited liability advantages of a corporation.

- It shields individual partners from the liabilities of the LLP.

- An LLP must have a minimum of two partners, with no restriction on the maximum number of partners.

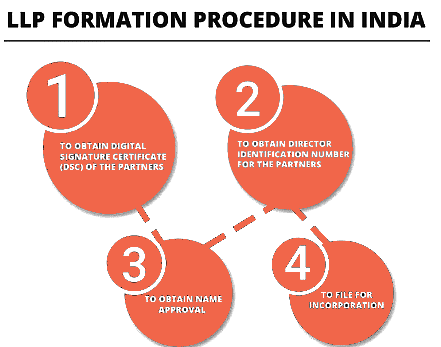

Formation Process

- Obtaining Digital Signature Certificates and drafting the LLP Agreement are the initial steps in forming an LLP in India.

- Choosing a unique name, paying the registration fee, and filing incorporation papers with the Registrar of Companies are essential steps in the process.

Formation of LLP in India

A Limited Liability Partnership or LLP combines the flexibility of a partnership and the limited liability benefits of a firm into one entity. It allows personal partners to be shielded from the liability of the LLP. An LLP needs at least two partners, and there is no limit on the maximum number of partners. The partners have flexibility in calming the management structure as per mutual agreement through a Partnership Agreement. This agreement specifies each partner's rights, duties, and profit/loss share. To form an LLP in India, first, the partners need to obtain Digital Signature Certificates and draft the LLP Agreement. Then, they have to choose a unique name, pay the registration fee, and file the incorporation documents with the Registrar of Companies.

Question for Procedure of Formation of LLP in IndiaTry yourself: Which documents are required in the initial steps of forming a Limited Liability Partnership (LLP) in India?View Solution

LLP Structure in India

A Limited Liability Partnership (LLP) in India combines the advantages of a partnership structure with limited liability protections similar to a corporation. To form an LLP, a minimum of two partners is required, with no maximum limit on the number of partners.

An LLP functions based on an agreement among the partners that outlines their respective rights, responsibilities, and profit/loss sharing arrangements. The partners have the flexibility to structure the management as agreed upon in the LLP agreement.

For legal compliance under the LLP Act, an LLP must have at least two designated partners, with at least one being a resident Indian. The other partners can be either individuals or corporate bodies.

Partners in an LLP are liable only up to the extent of their agreed contribution to the LLP. This shields their personal assets from the business debts and risks of the LLP.

Essential requirements for an LLP include maintaining a registered office address, opening a bank account in the LLP's name, proper bookkeeping, and submitting the LLP agreement.

Documents Required for LLP Formation in India

- LLP Agreement: A legal document required under the LLP Act 2008 that outlines details about the partners, their rights and responsibilities, profit-sharing arrangements, and how the LLP will be run.

- Incorporation Document (Form 1): This document includes key details about the LLP, such as its name, registered address, partner information, and the nature of its business activities. It is submitted to the Registrar of Companies.

- Name Approval Letter: Before incorporation, the LLP’s name must be approved by the Registrar of Companies. After this approval, an official letter is issued.

- Registered Office Address Proof: Documents like a rent agreement, lease deed, or utility bill that confirm the registered office address of the LLP.

- Partner Identity and Address Proof: Documents such as PAN card, Aadhaar card, voter ID, or passport, along with proof of address, are required for each partner.

- Consent Letters from Partners: Letters in which the partners formally agree to be part of the LLP.

- Service Tax Registration: Required for LLPs that provide taxable services.

- Digital Signature of a Partner: A digital signature is needed for filing various electronic forms with the Ministry of Corporate Affairs.

- PAN and TAN for the LLP: These are necessary for tax-related purposes, including income tax and TDS (Tax Deducted at Source).

- Authorization Letters: Letters that authorize individuals to sign documents and represent the LLP officially.

Procedure for Registration of LLP in India

Steps to Register a Limited Liability Partnership (LLP):

- Decide LLP name and check availability: Before setting up an LLP, it is essential to ensure that the chosen name is unique and not already in use. This involves searching the MCA database to confirm name availability.

- Draft LLP agreement: The LLP agreement must be prepared in accordance with the LLP Act, 2008. This document should encompass crucial details such as the names of partners, their contributions, profit-sharing arrangements, and other relevant specifics.

- Obtain the digital signature of the designated partner: Designated partners are required to acquire a Class 2 digital signature to electronically submit registration forms.

- File Designated Partner Identification Number (DPIN) application: The designated partner must apply for a DPIN from the ROC.

- File Document of Incorporation (Form 1): Submission of Form 1, along with the LLP agreement and name availability confirmation, to the ROC is necessary. Filing fees should also be paid at this stage.

- Obtain a Certificate of Incorporation: Upon successful submission of Form 1, the ROC will issue a Certificate of Incorporation within 14 days.

- Open a bank account: Establish a bank account in the LLP's name to facilitate business transactions.

- Apply for PAN and TAN card of the LLP: Obtain a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

- Register for GST and other applicable registrations: Fulfill the necessary registrations, such as GST registration, based on the business activities of the LLP.

- File form 8 and 11 for post-incorporation changes: Inform the ROC about any alterations in partners or the LLP agreement by submitting Form 8 and 11.

Question for Procedure of Formation of LLP in IndiaTry yourself: Which document is required for an LLP to outline details about the partners, profit-sharing arrangements, and management structure?View Solution

Procedure for LLP Formation in India

Steps to Register a Limited Liability Partnership (LLP)- Decide the Name of the LLP and Check Availability with ROC

- Draft the LLP Agreement

- Obtain Digital Signature of Designated Partner

- Apply for Designated Partner Identification Number (DPIN)

- File Form 1 (Document of Incorporation) with ROC

- ROC Issuance of Certificate of Incorporation

- Open Bank Account for the LLP

- Apply for PAN and TAN Numbers

- Register for Applicable Registrations like GST, FSSAI, etc.

- File Form 8 and Form 11 with ROC for Changes

- Maintain Books of Accounts and Ensure Compliance

- File Annual Returns and Financial Statements with ROC

Conclusion

Forming a Limited Liability Partnership (LLP) in India is a straightforward process but requires adherence to specific legal formalities. The procedure for forming an LLP in India is guided by the LLP Act of 2008. By following the correct procedure, your LLP can be legally registered, allowing for a smooth commencement of business operations. While the initial steps of the LLP formation process may appear complex due to various requirements, adhering to the correct procedure from the outset lays a solid groundwork for the business activities of your LLP. Seeking guidance from legal experts can facilitate a seamless navigation of the registration process.

The document Procedure of Formation of LLP in India | Crash Course for UGC NET Commerce is a part of the UGC NET Course Crash Course for UGC NET Commerce.

All you need of UGC NET at this link: UGC NET

|

157 videos|236 docs|166 tests

|

FAQs on Procedure of Formation of LLP in India - Crash Course for UGC NET Commerce

The remote server returned an error: (500) Internal Server Error.

Related Searches