Clubbing of Income | UGC NET Commerce Preparation Course PDF Download

Clubbing Of Income Under Section 64 of Income under Income Tax Act

You must have heard people saying, “Take payments in the wife's name to save tax.” In India, we have a progressive system of taxation, which means as your income increases, you have to pay more taxes as per the applicable income tax slab. In order to avoid paying high taxes, many people transfer their assets or arrange sources of income in the name of their wives, children, parents, and relatives to bring down their income.

In order to curb such tax avoidance practices, the income tax introduced a “clubbing of income” provision under section 60 to section 64 of the income tax act.

What is Clubbing of Income in Income Tax Act?

When the income of another person is included in your income and taxed in your hands, then such a situation is called Clubbing of Income. The income clubbed in your income is called deemed income. The provisions of clubbing of income are applicable only to individuals and no other type of assessee like firm/HUF/Company, etc.

When the income of another person is included in your income and taxed in your hands, then such a situation is called Clubbing of Income. The income clubbed in your income is called deemed income. The provisions of clubbing of income are applicable only to individuals and no other type of assessee like firm/HUF/Company, etc.

Let's consider an example: If you have a total income of Rs 3,00,000, consisting of a salary income of Rs 2,00,000 and rental income of Rs 1,00,000, and you transfer the rental income to your wife without transferring the ownership of the house, your taxable income will still be considered as Rs 3,00,000 due to the Clubbing of Income provisions.

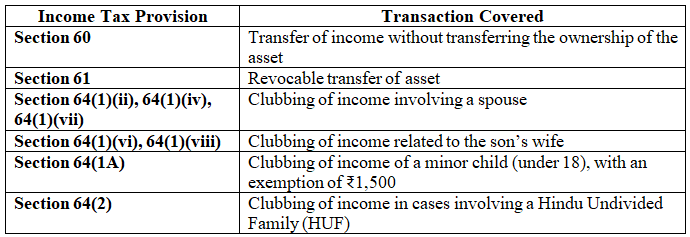

Income Tax Sections on Clubbing of Income

When will Provisions of Clubbing of Income be Applicable?

Transfer of Income without Transfer of Asset [Section 60]

When a person transfers income without transferring ownership of the asset that generates that income, the income will still be taxable to the original owner (transferor). A common example is when property owners instruct their tenants to pay rent to a parent, spouse, or child. Even though the rent is deposited in someone else's account, the income remains taxable to the owner.

To illustrate, Ashish owns a house in Jaipur and receives Rs 20,000 per month as rental income. To reduce his tax liability, he asks his tenant to deposit the rent into his wife's account. Although the rent goes to his wife's bank, the income is still taxable to Ashish because the ownership of the house remains with him. Many people overlook this when planning their taxes, so it’s important to transfer the asset's ownership, not just the income. Our Tax Advisory Service can guide you in avoiding such mistakes for better tax planning.

Revocable Transfer of Asset [Section 61]

A revocable transfer occurs when someone transfers an asset but retains the right to reclaim ownership at any time in the future. According to the provisions of income clubbing, if a "revocable transfer" happens, the income generated from the asset will be taxable to the transferor, not the transferee.

For example, Karan transfers his house to Arjun, but there is a clause that allows Karan to take back ownership after two years. In this case, any income Arjun earns from the house in those two years will be added to Karan’s income for tax purposes.

We’ve covered the basic rules for Clubbing of Income. Next, we’ll explore how these rules apply in cases involving a spouse, son’s wife, minor child, and Hindu Undivided Family (HUF).

Clubbing of Income of Spouse

Transferring income to one's spouse is a common tax-saving practice, but there are specific regulations governing such transfers. Here are the key aspects:

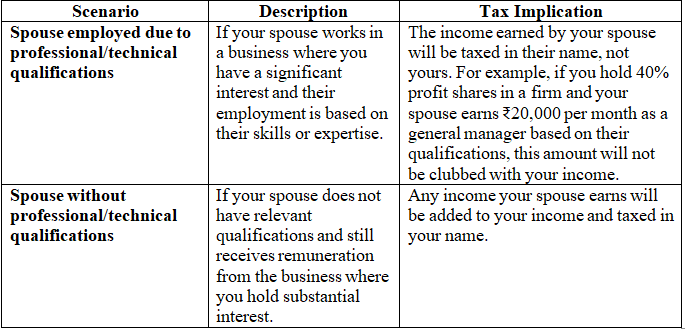

- Your spouse working in a concern/entity where you hold a substantial interest:

- When you and your spouse receive compensation from an entity in which both hold a significant interest, the income of both will be combined and taxed in the hands of the spouse whose income, excluding that compensation, is higher. However, if the compensation is earned by each spouse based on their professional skills, these clubbing provisions will not apply.

Substantial interest refers to owning 20% or more of the firm's profits or having at least 20% voting power in a company at any time during the year. - If you transfer an asset to your wife without adequate compensation, the income generated from that asset will be taxable in your hands. This rule aims to prevent tax avoidance by transferring income-generating assets to a spouse. However, this rule does not apply if:

- The asset was transferred for adequate consideration,

- The transfer was part of a divorce agreement, or

- The transfer occurred before the marriage.

If the spouse who receives the asset changes its nature, such as investing it to generate income, the clubbing provisions of Section 64(1)(iv) will apply. For instance, if Mr. Sharma gifts his wife ₹5,00,000, and she invests it in a fixed deposit (FD) that generates interest, the interest will be taxed in Mr. Sharma's name under section 64(1)(iv), since the nature of the asset (cash) was changed.

Additionally, if an asset is transferred to a third party or an association of persons (AOP) without adequate consideration, with the intention of benefiting your spouse either now or later, such transfers will also fall under the clubbing provisions.

|

Test: Clubbing of Income

|

Start Test |

Clubbing of Income in the Case of Son’s Wife [Section 64(1)(vi), 64(1)(viii)]

Income tax regulations address scenarios where income is shifted to your daughter-in-law. Here’s a summary:

If you transfer an asset to your daughter-in-law without receiving any payment in return, the income produced by that asset will still be taxed in your name.

For instance, if you own 10,000 debentures with a 10% interest rate and a face value of Rs 100 each, and you transfer them to your daughter-in-law without compensation, the interest income of Rs 1,00,000 will remain taxable to you.

Moreover, if you transfer assets to another individual or entity with the goal of benefiting your daughter-in-law, and these transactions are perceived as attempts to avoid taxes without proper consideration, they will be examined by the Income Tax Department. In such cases, the income will be added to your taxable income under the clubbing provisions.

Clubbing of Income of Minor Child [Section 64(1A)]

Then a minor child earns income, it is combined with the income of the parent who has the higher earnings (excluding the child’s income). For example, if a minor child earns interest from a fixed deposit, that interest will be taxed in the hands of the higher-earning parent.

Certain exceptions apply:

- If the child has a disability as specified in Section 80U.

- If the child earns income from manual labor.

- If the child earns income from their skills, talents, or knowledge (such as winning prize money from competitions like Indian Idol Junior).

Additionally, parents can claim an exemption of Rs 1500 per child under Section 10(32) for the income of the minor child that is included with theirs. It's important to claim this exemption when eligible.

Income Clubbing for Major Children

Many people inquire about the income earned by their major child. Generally, there's no need for a specific rule for this situation. A major child is subject to the same tax rules as any individual under 60. Therefore, if your major child earns more than Rs 2,50,000 (before deductions), they must file their income tax return, and income clubbing provisions do not apply.

If a child was a minor but became major within the same financial year, their income will be clubbed only for the period when they were a minor, not for the rest of the year.

Clubbing of Income and Hindu Undivided Family (HUF) [Section 64(2)]

The Hindu Undivided Family (HUF) concept has long existed, and income tax laws recognize HUFs as taxpayers. Thus, HUFs are subject to income clubbing rules.

If you transfer personal assets to an HUF without proper consideration, the income from those assets will be taxed as your income. If an HUF splits in the future, any property distributed to your spouse will be clubbed with your income. For instance, if you transfer a house that generates Rs 5,00,000 in annual rental income to the HUF without adequate consideration, this income will be taxed in your name.

Conversion of Self-Acquired Property to Joint Ownership

When a person's self-acquired property is converted into joint family property without appropriate consideration, the income from this property becomes part of the joint family’s total income.

If a member of an HUF:

- Converts their personal property into joint family property,

- Adds the property to the family’s common assets, or

- Transfers their individual property to the family,

and does so without receiving adequate consideration, the income from such property will be included in that individual’s total income. This ensures that any income resulting from the conversion or transfer of personal property to joint family property is included in the individual’s tax assessments.

In which Cases Clubbing of Income is not Applicable?

- Income transferred before marriage: Any asset or gift given to the future wife before marriage isn't considered under income clubbing rules. Clubbing applies when the relationship of husband and wife exists both when the assets are transferred and when income is generated.

- Income derived from clubbed income: Except for minors, any income earned from the income that has been clubbed isn't subject to further clubbing. For instance, if Mr. X transfers Rs. 5,00,000 to his wife and she invests it in a 10% FD, the interest earned (e.g., Rs. 50,000) is taxable for Mr. X. However, any income generated by Mrs. X from this interest won't be taxed for Mr. X.

- Saved money not considered as transferred asset: Any funds saved by the wife from money given for daily expenses are not covered by income clubbing rules.

|

Download the notes

Clubbing of Income

|

Download as PDF |

How to Avoid Clubbing of Income?

- Gift Money to Family Members: Consider gifting money to your wife or daughter-in-law before marriage to save on taxes. If they have no income, you can save up to Rs 2,50,000. Remember, this should be done before marriage to avoid clubbing provisions.

- Paying Rent Strategically: If you live with your parents and the house is in their name, consider paying them rent. This can help you claim an exemption on house rent allowance. Additionally, if your parents have no other income, they can benefit from falling within the basic exemption limit, reducing their tax liability.

- Family Health Insurance: Opt for health insurance for your family to claim a deduction under section 80D. You can claim up to Rs 25,000 for yourself, your spouse, and children. When insuring senior citizen parents, the maximum deduction increases to Rs 50,000. This deduction can also cover medical expenses for senior citizens within this limit.

- Prefer Loans Over Gifts: Providing a loan to your spouse at lower interest rates can be a tax-efficient strategy. Ensure the loan agreement is properly documented, and repayments are made through traceable modes like banking channels. This approach can shift the tax liability to your spouse, avoiding income clubbing. Analyze this option carefully considering all relevant factors.

- Investments through Joint Account: Ensure the primary holder has lower tax liability for joint accounts. Interest income taxability arises in the primary holder's hands, aiding in tax savings. Withdrawals are considered as gifts to relatives, thus tax-free.

- Investment in the name of a Non-working spouse: Income from investments or transfers to a spouse is clubbed, but not subsequent earnings on that income. For instance, income from a house owned by the spouse is taxable, but further income from investing this amount is not.

- Investing in Tax-efficient Products like PPF: Invest in tax-saving products like PPF in your spouse's or minor child's name for tax-free maturity proceeds. Similar benefits apply to equity products. Gift amounts to senior citizen parents, major children, or spouses with lower tax liability for further tax-free returns.

How to file Income Tax Return (ITR) in case of Clubbing of Income

When clubbed income is in the form of interest, lottery winnings, game show prizes, etc., it falls under the category of Income From Other Sources. If the clubbed income is from rent on residential property, it is taxed under Income From House Property. Essentially, the head of clubbed income aligns with its source of generation. Clubbing provisions impact income calculation and the required form for filing returns.

To illustrate:

Let's consider Mr. Happy, whose sole income is a salary of Rs 6,00,000. He has a minor son, Master Super Happy, who won Rs 2,00,000 in a lottery. Since Super Happy is a minor, his income merges with Mr. Happy's for taxation. Mr. Happy must file his return using Form ITR 2 due to the lottery income. Without this lottery income, he could have used Form ITR 1.

It's crucial to note that the ITR form to be used depends on the nature of the clubbed income. Hence, it's advisable to consider this when selecting your ITR form if you possess clubbed income.

|

235 docs|166 tests

|

FAQs on Clubbing of Income - UGC NET Commerce Preparation Course

| 1. What is the meaning of Clubbing of Income under Section 64 of the Income Tax Act? |  |

| 2. In which situations will the provisions of Clubbing of Income be applicable? |  |

| 3. Are there any cases where Clubbing of Income is not applicable? |  |

| 4. How can one avoid Clubbing of Income? |  |

| 5. How should one file Income Tax Return (ITR) in case of Clubbing of Income? |  |