Economic Development - 3 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

| Table of contents |

|

| What is Bond Yield? |

|

| RBI to Review NBFCs |

|

| RBI Integrated Ombudsman Scheme |

|

| PayU Gets Approval as Payment Aggregator |

|

| RBI Guidelines for Asset Reconstruction Companies |

|

What is Bond Yield?

Why in news?

As inflation continues to moderate, bond yields will also soften and borrowing costs will come down, the Reserve Bank of India Governor said recently.

Overview:

- A bond is a fixed-income instrument representing a loan from an investor to a borrower, usually a corporation or government, for a predetermined duration, in exchange for regular interest payments.

- The duration from issuance to repayment is termed the 'term to maturity'.

- Funds raised through bonds are utilized for various purposes, including expansion projects, refinancing debt, or welfare initiatives.

- Bond yield represents the annual return an investor anticipates over the bond’s term to maturity.

- Bond yields are influenced by coupon payments, which are the periodic interest earnings received for holding the bond.

- At the bond’s maturity, bondholders receive the face value of the bond, but they can buy bonds at par value, discount, or premium in the secondary market.

- The market price of bonds directly impacts the bond yield.

- Bond Yield can be calculated using the formula:

Bond Yield = Coupon Amount / Price

Bond Yield vs. Price:

- Price and yield exhibit an inverse relationship.

- When a bond's price increases, its yield decreases, and conversely, when the yield rises, the bond's price declines.

- For instance, if interest rates drop, newly issued bonds will offer lower interest rates, making existing bonds with higher interest more attractive, thus increasing their price.

- If the price of a bond escalates, it becomes costlier for new investors, leading to a decline in yield since the expected return decreases.

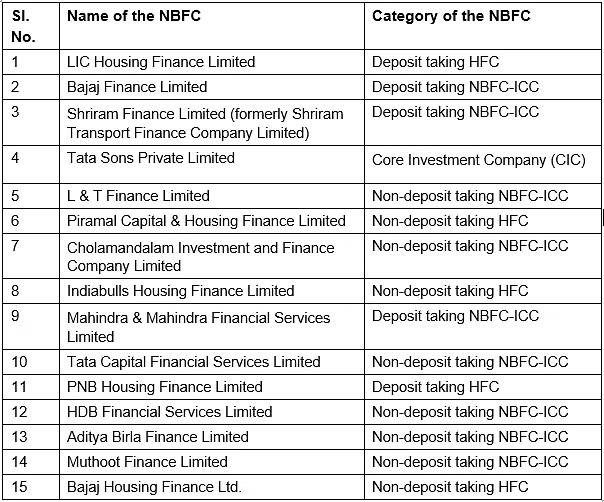

RBI to Review NBFCs

Why in News?

The Reserve Bank of India (RBI) is preparing to undertake a thorough assessment of the classification of Non-Banking Finance Companies (NBFCs) in 2024. This review is anticipated to be a preliminary step that may lead to the granting of banking licenses to certain NBFCs in the future. By elevating specific NBFCs, the RBI aims to evaluate their suitability for potential licensing as banks.

What are NBFCs?

About: An NBFC, or Non-Banking Financial Company, is registered under the Companies Act, 1956 or the Companies Act, 2013. These companies engage in a variety of financial activities, including lending, investing in securities, leasing, and insurance. Although they provide many banking services, they do not hold a banking license.

Key Features:

- NBFCs offer a wide range of financial services, such as personal loans, home loans, vehicle loans, gold loans, microfinance, insurance, and investment management.

- They are permitted to accept public deposits for a period ranging from a minimum of 12 months to a maximum of 60 months.

- However, they are not allowed to accept demand deposits.

- NBFCs do not participate in the payment and settlement system and cannot issue cheques drawn on themselves.

Classification

On the Basis of Deposits:

- Deposit-taking non-banking finance companies

- Non-Deposit taking Non-Banking Financial Institutions

On the Nature of their Major Activity:

- Investment and Credit Company

- Consumer Durable Loan Finance

- Core Investment Company (CIC)

- Infrastructure Finance Company (IFC)/Infrastructure Debt Fund (IDF)

- Asset Reconstruction Companies (ARC)

- Factoring Companies

- Gold Loan Companies

- Fintech companies: P2P Lenders

Licensing:

- To be registered as an NBFC, a company must be incorporated as either a public or private entity.

- The company is required to maintain a minimum net owned fund of at least Rs. 10 crores for eligibility.

- A minimum of one-third of the company's directors should have relevant experience in the finance sector.

- The company must have a strong credit history with CIBIL (Credit Information Bureau India Limited).

- It must adhere to all regulations and guidelines outlined under Capital Compliances and the Foreign Exchange Management Act (FEMA).

Regulation:

- The RBI is empowered under the RBI Act of 1934 to register, set policy, issue directives, inspect, regulate, supervise, and monitor NBFCs that meet the 50-50 criteria of principal business.

- In October 2021, the RBI introduced a Scale Based Regulation (SBR) framework, categorizing NBFCs into four layers: Base Layer (NBFC-BL), Middle Layer (NBFC-ML), Upper Layer (NBFC-UL), and Top Layer (NBFC-TL). This framework provides a methodology for identifying NBFCs in the Upper Layer based on their asset size and scoring criteria.

What is the 50-50 Criteria of Principal Business?

- The RBI defines a company's principal business as financial if over 50% of its total assets and gross income are derived from financial activities. This definition ensures that only those companies whose primary operations are financial in nature qualify as NBFCs and fall under RBI's regulatory oversight.

- Companies that mainly engage in non-financial activities, even if they conduct some financial business, are not regulated by the RBI.

- This assessment is commonly referred to as the "50-50 criteria" for determining a company's engagement in financial business.

RBI Integrated Ombudsman Scheme

Why in News?

Recently, the Reserve Bank of India (RBI) reported a remarkable 68.2% increase in complaints under its Integrated Ombudsman Scheme (RB-IOS) for the fiscal year 2023, totaling approximately 703,000 complaints. This surge is significant compared to past years, where FY22 recorded a 9.4% rise and FY21 saw a 15.7% increase in complaints.

What are the Factors Behind this Surge in Complaints?

- The RBI's proactive public awareness campaigns have played a crucial role in motivating individuals to express their grievances.

- As awareness of consumer rights grows, more people are inclined to report issues with banks and non-bank payment systems.

- The introduction of a simplified process for filing complaints has made it easier for the public to address problems with financial institutions.

- With the rise of digital transactions, especially in mobile and electronic banking, there is an increased likelihood of facing issues such as unauthorized or fraudulent transactions.

- Digital banking's convenience means that even minor system issues can impact a large number of users, resulting in a higher volume of complaints.

What is an Ombudsman?

- An ombudsman is a government official tasked with handling complaints from the public against government organizations.

- This concept originated in Sweden, where it refers to an officer appointed by the legislature to manage complaints regarding services provided by administrative bodies.

- In India, ombudsmen are appointed to address grievances in various sectors, including:

(a) Insurance Ombudsman

(b) Income Tax Ombudsman

(c) Banking Ombudsman

What is RBI Integrated Ombudsman Scheme (RB-IOS)?

- RB-IOS consolidates three previous ombudsman schemes: the Banking Ombudsman Scheme of 2006, the Ombudsman Scheme for Non-Banking Financial Companies (NBFCs) of 2018, and the Ombudsman Scheme for Digital Transactions of 2019.

- The unified scheme aims to address customer complaints regarding deficiencies in services provided by RBI-regulated entities such as banks, NBFCs, and prepaid instrument providers.

- Complaints are addressed if they are unresolved to the customer's satisfaction or not responded to within 30 days by the respective entity.

- The scheme also includes non-scheduled primary co-operative banks with deposits of Rs 50 crore and above.

- Its approach, termed “One Nation One Ombudsman,” emphasizes jurisdiction neutrality.

Need:

- The initial ombudsman scheme was introduced in the 1990s but faced criticism from consumers.

- Consumers often found it challenging to contest decisions made by regulated entities, leading many to prefer consumer courts despite longer resolution times.

- The integration of banking, NBFC, and digital payment schemes aims to address these concerns and is expected to enhance consumer satisfaction.

Features:

- The Scheme specifies ‘deficiency in service’ as a valid reason for filing complaints, with a clear list of exclusions.

- Complaints will not be dismissed merely because they fall outside previously defined grounds.

- The scheme is jurisdiction-neutral, and a centralized complaint handling center has been established in Chandigarh to process complaints in any language.

- Provisions for using Artificial Intelligence tools have been created to improve coordination between banks and investigative agencies for quicker resolutions.

- Customers can file complaints, submit documentation, track their status, and provide feedback through a single email address.

- A multilingual toll-free number will offer relevant information regarding grievance resolution.

- Regulated entities will have no right to appeal against ombudsman decisions that require them to provide satisfactory and timely information.

Appellate Authority:

- The RBI’s Executive Director overseeing the Consumer Education and Protection Department will serve as the Appellate Authority under the integrated scheme.

Significance:

- This initiative aims to enhance the grievance resolution mechanism for customer complaints against RBI-regulated entities.

- It seeks to establish uniform and user-friendly mechanisms, adding value to the scheme and promoting customer satisfaction and financial inclusion.

PayU Gets Approval as Payment Aggregator

Why in News?

Fintech company PayU has recently announced that it has obtained in-principle approval from the Reserve Bank of India (RBI) to function as a payment aggregator (PA) under the Payment and Settlement Systems (PSS) Act, 2007. This preliminary approval allows PayU to onboard new merchants; however, the final approval process usually takes between six months to a year.

What is a Payment Aggregator?

- A payment aggregator serves as an intermediary between businesses and financial institutions, managing payment processing for merchants.

- By simplifying the acceptance of electronic payments, payment aggregators help businesses avoid the complications of establishing direct relationships with financial entities.

- Payment aggregators allow businesses to accept multiple payment methods—such as credit cards, debit cards, e-wallets, and bank transfers—through a single platform.

- Examples of well-known payment aggregators include Google Pay, Amazon Pay, PhonePe, and PayPal.

Capital Requirements:

- New payment aggregators must possess a minimum net worth of Rs 15 crore at the time of application.

- By the end of the third financial year post-authorization, they are required to reach a net worth of Rs 25 crore.

Authorization Process:

- While banks can offer PA services as part of their standard banking operations without needing separate authorization, non-bank PAs must secure authorization from the RBI as per the Payment and Settlement Systems Act, 2007.

Settlement and Escrow Account Management:

- Non-bank payment aggregators are required to keep the funds they collect in an escrow account with a scheduled commercial bank.

- They must follow specific timelines for settling funds with merchants based on the transaction lifecycle and the terms agreed upon.

RBI Guidelines for Asset Reconstruction Companies

Why in news?

The Reserve Bank of India (RBI) has announced new directives regarding Asset Reconstruction Companies (ARCs), which will be effective from April 24, 2024.

Increased Minimum Capital Requirement:

- ARCs must now maintain a minimum capital of Rs 300 crore, up from the previous Rs 100 crore.

- Existing ARCs have until March 31, 2026, to meet the new Net Owned Fund (NOF) threshold of Rs 300 crore.

- As part of the transition, ARCs are required to have a minimum capital of Rs 200 crore by March 31, 2024.

- Failure to comply with these requirements may result in supervisory actions, including restrictions on new business until compliance is achieved.

Eligibility as Resolution Applicants:

- Only ARCs with a minimum NOF of Rs 1000 crore can participate as resolution applicants in the asset resolution process under the Insolvency and Bankruptcy Code, 2016 (IBC).

Investment Opportunities:

- ARCs are permitted to invest in government securities and deposits with scheduled commercial banks, SIDBI, NABARD, or other entities specified by the RBI.

- They can also invest in short-term instruments such as money market mutual funds, certificates of deposit, and corporate bonds or commercial papers rated AA- or higher.

- However, there is a limitation of 10% of the NOF on these short-term investments.

What are Asset Reconstruction Companies?

- ARCs are specialized financial institutions that purchase Non-Performing Assets (NPAs) from banks and financial institutions, helping them to clean their balance sheets.

- These companies are incorporated under the Companies Act, 2013, and registered with the RBI under the SARFAESI Act, 2002.

Examples:

- The National Asset Reconstruction Company Limited (NARCL) was established by banks to consolidate stressed assets for resolution, with a majority stake held by Public Sector Banks (PSBs).

- India Debt Resolution Company Ltd. (IDRCL) is set up to market the stressed assets, with PSBs and Public Financial Institutions holding a maximum of 49% stake and the remaining 51% owned by private lenders.

Function:

- ARCs operate under the SARFAESI Act, 2002, focusing on the recovery and turnaround of distressed assets.

- They buy bad debt either in cash or through a combination of cash and security receipts.

Business Model:

- Acquisition of Stressed Loans: Lenders sell stressed loans to ARCs at discounted rates, allowing them to redirect resources towards new loans.

- Security Receipts: ARCs issue security receipts to lenders, which are redeemable upon the recovery of specific loans. They charge an annual management fee of 1.5% to 2% of the asset value and share recovery gains with the selling financial institutions.

Challenges:

- ARCs often deal with aged NPAs, making valuation and recovery difficult due to prolonged delinquency.

- Aggregating debt from multiple lenders for the same borrower can be complex, requiring coordination among various stakeholders.

- Raising funds on their balance sheets can be challenging for ARCs, limiting their ability to acquire distressed assets or support borrower revival.

- Determining the fair value of distressed assets for acquisition and recovery presents additional challenges, especially with illiquid or complex assets.

Recent Changes in ARC Regulations by RBI:

- Strengthening Corporate Governance: The RBI has mandated that the chairperson and at least half of the board members at ARCs be independent directors to enhance governance.

- Increased Transparency: ARCs must now disclose their historical performance on returns for security receipt investors and engage with rating agencies for schemes launched in the last eight years.

- Investment Requirements: ARCs are required to invest in security receipts at a minimum of either 15% of the transferor's investment in those receipts or 2.5% of the total receipts issued, whichever is higher, changing from the previous requirement of 15% of total security receipts.

SRs are financial instruments issued by ARCs to Qualified Buyers in exchange for their purchase of distressed assets from banks and Non-Banking Financial Companies (NBFCs).

|

38 videos|5293 docs|1118 tests

|

FAQs on Economic Development - 3 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What is Bond Yield? |  |

| 2. What is the RBI Integrated Ombudsman Scheme? |  |

| 3. What are the RBI Guidelines for Asset Reconstruction Companies? |  |

| 4. What is PayU's Approval as a Payment Aggregator? |  |

| 5. Why is the RBI reviewing NBFCs? |  |