Rights and Discharge of a Surety | Law of Contracts - CLAT PG PDF Download

Continuing Guarantee

Definition of Continuing Guarantee

- A continuing guarantee, as per Section 129, is a type of guarantee that covers a series of transactions. In this arrangement, the surety's liability persists until the guarantee is revoked.

Examples of Continuing Guarantee

- Example 1: On A's recommendation, C employed B to collect rent from his tenants. A promised to cover any defaults made by B. This arrangement constitutes a continuing guarantee.

- Example 2: A guarantees payment to B, a tea dealer, up to Rs 100 for any tea supplied to C over time. B supplies C with tea worth Rs 100, and C pays B. Later, B supplies C with tea worth Rs 200, but C fails to pay. A's guarantee was a continuing one, making him liable to B for up to Rs 100.

Note on Continuing Guarantee

- A continuing guarantee can be issued for a portion of the total debt or for the entire debt, subject to a limit.

Revocation of Continuing Guarantee

1. By Notice of Revocation [Section 130]

- A continuing guarantee can be revoked by the surety for future transactions by notifying the creditor. However, the surety remains responsible for past transactions that have already occurred.

- Example 1: X guarantees up to Rs 60,000 for loans given by Y to Z. Y lends Rs 20,000 to Z. Afterward, X revokes the guarantee. X is no longer liable to Y for loans granted after the revocation but is still liable for the Rs 20,000 loan if Z defaults.

- Example 2: A guarantees to B, up to 100,000 rupees, that C will pay all bills drawn by B on C. B draws a bill on C, which C accepts. A revokes the guarantee. If C dishonors the bill at maturity, A is still liable under his guarantee.

- Lloyd’s v. Harper: It was determined that the employment of a servant constitutes a single transaction. Therefore, a guarantee for a servant is not a continuing guarantee and cannot be revoked as long as the same servant is employed.

- Wingfield v. De St Cron: In this case, a person who guaranteed the rent payment for his servant but revoked it after the servant left his employment was not held liable for the rents after the revocation.

2. By Death of Surety [Section 131]

- Unless otherwise stipulated in a contract, the death of the surety serves as a revocation of a continuing guarantee concerning future transactions occurring after the surety's death.

- However, the estate of the surety remains liable for past transactions that took place before the surety's death.

Discharge of Surety in a Continuing Guarantee

In the case of Durga Priya v/s Durga Pada, the court emphasized the importance of examining the specific contract of guarantee between the parties to determine whether it has been revoked due to the death of the surety. If the contract includes a clause stating that death does not cause revocation, then the guarantee continues even after the surety's death.

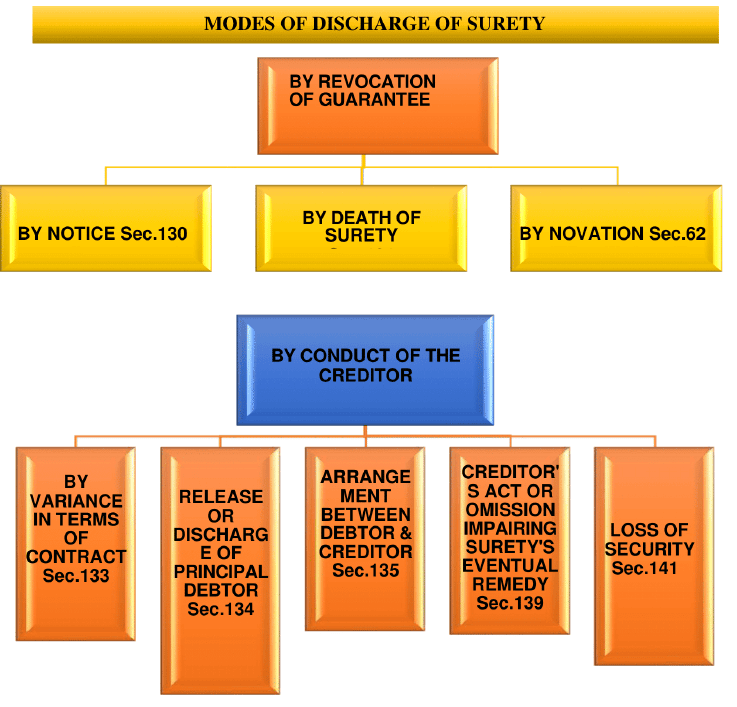

A continuing guarantee can be revoked in the same ways the surety is discharged, including:

- Novation [Section 62]

- Variance in terms of contract [Section 133]

- Release or discharge of principal debtor [Section 134]

- When creditors enter into an arrangement with the principal debtor [Section 135]

- Creditor's act or omission impairing surety's eventual remedy [Section 139]

- Loss of security [Section 141]

Rights of a Surety

The rights of a surety can be categorized as follows:

Rights Against the Principal Debtor

(a) Right to Subrogation [Section 140]

- When the surety pays the guaranteed debt or fulfills the guaranteed duty, they gain all the rights that the creditor had against the principal debtor.

- This means the surety effectively steps into the creditor's position.

(b) Right to Indemnity [Section 145]

- In every guarantee contract, there is an implicit promise from the principal debtor to indemnify the surety.

- The surety has the right to recover from the principal debtor any amount they have rightfully paid under the guarantee, excluding any amounts paid wrongly.

Example I:

- If B owes money to C, and A is the surety for this debt, when C demands payment from A and subsequently sues him for the amount, A can defend the suit if he has valid reasons.

- If A is forced to pay the debt along with legal costs, he can recover from B not just the principal amount but also the costs incurred.

Example II:

- If C lends money to B and A, at B's request, accepts a bill of exchange from B to secure the amount, and C, the holder of the bill, demands payment from A.

- If A defends the suit without valid reasons and ends up paying the bill and costs, he can recover from B the amount of the bill but not the costs, as there was no valid reason for the defense.

Example III:

- If A guarantees to C the payment of up to Rs 2,000 for rice supplied by C to B, and C supplies rice worth less than Rs 2,000 but collects Rs 2,000 from A.

- A cannot claim more from B than the price of the rice actually supplied.

Rights Against Creditor

(a) Right to Securities [Section 141]

- A surety is entitled to the benefit of any security that the creditor has against the principal debtor at the time the contract of suretyship is made.

- This right exists regardless of whether the surety is aware of the security's existence.

- If the creditor loses or disposes of the security without the surety's consent, the surety is released from liability to the extent of the security's value.

Example I:

- If C lends Rs 2,000 to his tenant B with A as guarantor and C also has a mortgage on B's furniture as security.

- If C cancels the mortgage and B becomes insolvent, C can sue A on the guarantee.

- A will be released from liability up to the value of the furniture.

Example II:

- If C, a creditor, has a decree securing his advances to B and also receives a guarantee from A for the advance.

- If C executes B's goods under the decree and later withdraws the execution without A's knowledge.

- A will be discharged from the guarantee.

Example III:

- If A, as surety for B, jointly bonds with B to C to secure a loan from C to B.

- If C later obtains additional security from B for the same debt and then gives up this additional security.

- A will not be discharged from the guarantee.

(b) Right to Claim Set Off

- The surety has the right to claim set off or counterclaim against the creditor if the principal debtor had any claims against the creditor.

- This right applies when the creditor sues the surety for the principal debtor's liability.

Rights Against Co-Sureties

Co-Sureties

Meaning of Co-sureties: When two or more persons guarantee the same debt or duty, they are known as "co-sureties."

(a) Co-sureties Liable to Contribute Equally (Section 146):

Co-sureties are generally liable to pay equal shares of the debt or duty they are guaranteeing, as per Section 146 of the Indian Contract Act.

- Example 1: If A, B, and C are co-sureties for a loan of 3,00,000 rupees to E, and E defaults, A, B, and C are each liable to pay 1,00,000 rupees.

- Example 2: If A, B, and C have an agreement where A pays one-quarter, B pays one-quarter, and C pays one-half of a total debt, their liabilities will be divided accordingly.

(b) Liability of Co-sureties Bound in Different Sums (Section 147):

When co-sureties are bound by different sums, they are still required to contribute equally, but only up to the limits of their respective obligations.

- Example 1: If A, B, and C are sureties with penalties of 1,00,000 rupees, 2,00,000 rupees, and 4,00,000 rupees respectively, and the default is for 3,00,000 rupees, each is liable to pay 1,00,000 rupees.

- Example 2: If the default is for 4,00,000 rupees, A pays 1,00,000 rupees, and B and C each pay 1,50,000 rupees.

- Example 3: If the default is for 7,00,000 rupees, A, B, and C must each pay the full penalty of their bond.

Right to Claim Contribution:

If a co-surety pays more than their share, they can claim contribution from the other co-sureties.

Right to Share the Security:

If a co-surety receives any security from the principal debtor, the other co-sureties have the right to share that security.

Effect of Release of One Co-surety [Section 138]

- In cases of co-sureties, if the creditor releases one co-surety, it does not discharge the others from their obligations.

- The released co-surety is still responsible to the other co-sureties.

- Under English law, releasing one co-surety releases all co-sureties because their liability is considered joint, not joint and several.

Extent of Surety’s Liability (Sec. 128)

- In the absence of a contract stating otherwise, the liability of the surety is co-extensive with that of the principal debtor.

- This means that the surety's liability is equal to that of the principal debtor unless agreed otherwise.

Key Points Regarding Surety's Liability

- The surety is liable for the same amounts as the principal debtor.

- The surety's liability begins only when the principal debtor defaults.

- If the principal debtor is not liable due to a defect in the document, the surety's liability also ends.

- The surety can be pursued for payment even if the principal debtor has not been sued.

- The surety may set conditions in the guarantee contract, and is not liable until those conditions are met.

Important Cases on Surety's Liability

- In Bank of Bihar Ltd. v. Damodar Prasad , the Supreme Court ruled that a surety's liability is immediate and does not require exhausting remedies against the principal debtor first.

- In Maharashtra Electricity Board Bombay v. Official Liquidator and Another , the bank was held liable to pay up to Rs.50000/- to the Electricity Board under a letter of guarantee.

- In Kellappan Nambiar v. Kanhi Raman , if a minor is the principal debtor and the agreement is void, the surety is also not liable because their liability is co-extensive with that of the principal debtor.

- In State Bank of India v. V.N. Anantha Krishnam , the Presiding officer's direction to the bank to proceed against property was incorrect as per section 128, where the surety's liability is co-extensive with that of the principal debtor.

- In Industrial Financial Corporation of India v. Kannur Spinning & Weaving Mills Ltd. , a surety's liability does not end just because the principal debtor is discharged from liability.

- In Harigobind Aggarwal v. State Bank of India , if the principal debtor's liability is reduced, such as after the creditor recovers part of the due sum from his property, the surety's liability is also reduced accordingly.

Discharge of Surety

Revocation of Contract of Guarantee

By Notice [Section 130]

- A specific guarantee can be revoked by a surety through notice to the creditor if the surety's liability has not yet accrued.

- A continuing guarantee can be revoked by the surety for future transactions at any time by notifying the creditor.

- The surety remains responsible for past transactions that have already occurred.

By the Death of Surety [Section 131]

- Unless stated otherwise in a contract, the death of a surety revokes a continuing guarantee for future transactions occurring after the surety's death.

- The estate of the deceased surety is liable for past transactions that took place before their death.

- The estate is not liable for transactions occurring after the surety's death, even if the creditor is unaware of the surety's passing.

Discharge of Contract of Guarantee

By Novation [Section 62]

- A contract of guarantee is considered discharged by novation when a new contract is formed, either between the same parties or different parties, with the mutual discharge of the old contract as the consideration.

- The original contract of guarantee is terminated, and the surety under the original contract is released from their obligations.

By Conduct of Creditor

By Variance In Terms of Contract [Section 133]

- Any change made without the surety's consent in the terms of the contract between the principal debtor and the creditor discharges the surety for transactions occurring after the change.

- For example, if C agrees to lend A Rs 5,000 on March 1st, and A guarantees repayment, if C pays Rs 5,000 to A on January 1st, A is released from liability because the contract terms have changed, allowing C to sue A for the money before March 1st.

- However, if the variation is not substantial, material, or beneficial to the surety, it will not discharge them from liability. In the case of M.S. Anirudhan v. Thomeo's Bank, the surety was held liable because the alteration was beneficial and not substantial.

By Release or Discharge of Principal Debtor [Section 134]

- The surety is released from their obligations when there is a contract between the creditor and the principal debtor that releases the principal debtor, or through any actions or omissions by the creditor that legally discharge the principal debtor.

Examples:

- Example I: A contracts with B to build a house for A within a set timeframe, with B providing the necessary timber. C guarantees A's fulfillment of the contract. If B fails to supply the timber, C is relieved from his guarantee.

- Example II: A agrees with B to grow a crop of wheat on A's land and deliver it to B at a fixed rate, with C guaranteeing A's compliance. If B diverts a crucial water source needed for irrigation, preventing A from growing the wheat, C is no longer responsible for the guarantee.

By Arrangement [Section 135]

- When a creditor makes a deal with the principal debtor, such as agreeing to a settlement, offering more time, or deciding not to sue, the surety is released from their obligations unless they agree to the terms of the contract.

Cases Where Surety is Discharged

(i) Contractual Agreement and Surety Discharge

- When a creditor makes a contract to give time to the principal debtor with a third party, rather than with the principal debtor, the surety is not released from their obligations.

- For example, if C, the holder of an overdue bill of exchange drawn by A as a surety for B and accepted by A, contracts with M to give more time to A, A is not discharged from the obligation.

(ii) Forbearance and Surety Discharge

- Simply refraining from suing the principal debtor or enforcing any other remedy against them by the creditor does not discharge the surety, unless there is a specific provision in the guarantee stating otherwise.

- For instance, if B owes a debt to C guaranteed by A, and C does not sue B for a year after the debt becomes due, A is still bound by the surety agreement.

(iii) Co-Sureties and Release

- In a situation with multiple co-sureties, if the creditor releases one of them from their obligations, it does not release the other co-sureties.

- The surety who is released is still responsible to the other co-sureties.

For example, if there are three co-sureties for a debt and the creditor releases one, the other two are still bound by their guarantees.

By Creditor's Act or Omission Impairing Surety's Eventual Remedy [Section 139]

- Discharge of Surety: If a creditor takes actions that undermine the surety's rights or fails to fulfill duties that protect the surety's interests, the surety may be released from their obligations.

- Example I: When B is contracted to build a ship for C, with A as surety for B. If C, without A's knowledge, pays B the last two installments upfront, A is relieved of responsibility due to this action.

- Example II: In a loan agreement between C and B, secured by a promissory note and a bill of sale of B's furniture with A as surety for B. If C sells the furniture but due to his mismanagement only a small amount is gained, A is freed from liability on the note.

Loss of Security [Section 141]

- If a creditor loses or disposes of security without the surety's consent, the surety is released from liability to the extent of the security's value.

- For example, if A lends money to B with C as a guarantor and B's furniture as security, and A later cancels the mortgage on the furniture, C is released from liability to the value of the furniture if B becomes insolvent.

By Invalidation of Contract

Guarantee Obtained by Misrepresentation [Section 142]

- A guarantee obtained through misrepresentation by a creditor, or with the creditor's knowledge and consent, regarding a crucial aspect of the transaction, is considered invalid.

Guarantee Obtained by Concealment [Section 143]

- A guarantee obtained by a creditor through the concealment of material facts is deemed invalid.

- Example: Suppose X hires Y as a clerk to collect money on his behalf. If Y fails to account for some of his receipts, X may request Z to provide security for Y's proper accounting. Z agrees to guarantee Y's accounting. If X fails to inform Z about Y's previous conduct, and Y later defaults, Z is not liable because the guarantee was obtained by concealing important facts.

Failure of Co-surety to Join a Surety [Section 144]

- When a person provides a guarantee in a contract, the creditor is not allowed to act on it until another individual has joined as a co-surety.

Difference Between Indemnity and Guarantee

Indemnity

- In an indemnity agreement, there are two parties: the indemnity holder and the indemnifier.

- It involves a single contract where the indemnifier promises to compensate for specific losses.

- The purpose of an indemnity contract is to safeguard the promisee against potential losses.

- The indemnifier's liability in an indemnity contract is primary and not contingent on the promisee's actions.

- Liability arises only upon the occurrence of a specified event.

- The indemnifier is not obligated to act at the request of the indemnity holder.

- The indemnifier cannot sue a third party in their own name due to lack of privity of contract, unless there is an assignment in their favor.

Guarantee

- A guarantee involves three parties: the principal debtor, the surety, and the creditor.

- There are three separate contracts between the surety, principal debtor, and creditor.

- The primary objective of a guarantee contract is to secure the creditor's interests.

- The surety's liability in a guarantee is secondary, arising only when the principal debtor defaults.

- Liability in a guarantee arises from the non-performance of an existing promise or non-payment of an existing debt.

- The surety acts at the request of the principal debtor.

- When the surety discharges the debt of the principal debtor, they have the right to sue the principal debtor in their own name.

|

53 docs|22 tests

|

FAQs on Rights and Discharge of a Surety - Law of Contracts - CLAT PG

| 1. What is a continuing guarantee and how does it differ from a regular guarantee? |  |

| 2. How can a surety revoke a continuing guarantee? |  |

| 3. In what circumstances can a surety be discharged from a continuing guarantee? |  |

| 4. What rights does a surety have against the principal debtor? |  |

| 5. What is the difference between a contract of indemnity and a contract of guarantee? |  |