Introduction to Company Law | Company Law - CLAT PG PDF Download

Introduction

Company Law is a critical subject for the CLAT PG examination, forming a significant portion of the corporate law syllabus. It deals with the legal framework governing the formation, management, and dissolution of companies in India, primarily under the Companies Act, 2013. For CLAT PG aspirants, mastering this subject is essential as it tests both conceptual understanding and practical application through objective (MCQs) and subjective (essay) questions. These notes aim to provide a comprehensive yet simple explanation of key concepts, doctrines, case laws, and statutory provisions to help you prepare effectively. By focusing on the foundational principles, landmark judgments, and recent developments, this guide ensures you are well-equipped to tackle company law questions in the exam.

Understanding a Company

A company is a legal entity created under the Companies Act, 2013, recognized as a separate "person" in the eyes of the law. It can own assets, enter contracts, sue, and be sued independently of its owners (shareholders).

Characteristics of a Company

- Separate Legal Entity: A company exists independently of its shareholders. For example, it can own property in its own name.

- Limited Liability: Shareholders are only liable for the company’s debts up to the amount they invested (e.g., unpaid share value).

- Perpetual Succession: A company continues to exist even if its shareholders or directors die or leave.

- Common Seal: Historically used as the company’s signature, though now optional under the 2013 Act.

- Capacity to Sue: A company can initiate or face legal proceedings in its own name.

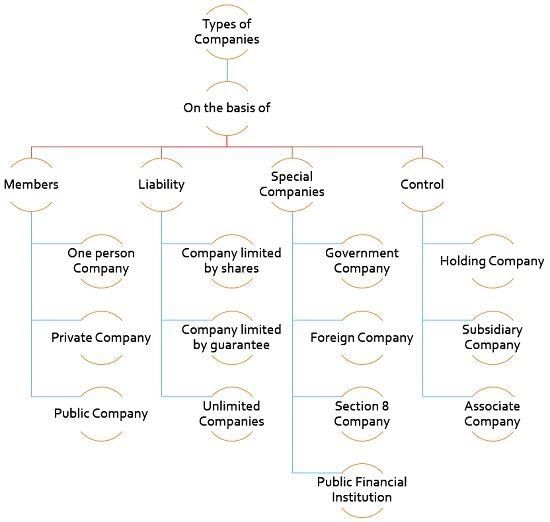

Types of Companies

- Private Company: Maximum 200 shareholders, restricted share transfer, minimum 2 directors, no public share trading.

- Public Company: Can issue shares to the public, minimum 7 shareholders, minimum 3 directors.

- One Person Company (OPC): A single shareholder, ideal for small businesses, with relaxed compliance rules.

- Small Company: Defined by low turnover or paid-up capital, eligible for simplified regulations.

- Section 8 Company: Non-profit companies for charitable purposes, with profits reinvested.

Landmark Case: Salomon v. Salomon & Co. Ltd. (1897) - Established the principle of separate legal entity. Even though Salomon controlled the company, it was treated as distinct from him, protecting him from personal liability.

Incorporation of a Company

Incorporation is the process of legally forming a company, governed by Sections 3-12 of the Companies Act, 2013. It involves registering the company with the Ministry of Corporate Affairs (MCA).

Steps for Incorporation

- Name Approval: Submit a unique name via the MCA’s RUN (Reserve Unique Name) service. The name must not resemble existing companies or violate trademark laws.

- Digital Signature Certificate (DSC): Directors need DSCs for signing electronic forms securely.

- Director Identification Number (DIN): Each director must obtain a unique DIN from MCA.

- Filing SPICe+ Form: Submit the SPICe+ (Simplified Proforma for Incorporating Company Electronically) form, which includes MOA, AOA, and other details.

- Memorandum and Articles of Association: Draft MOA (company’s objectives) and AOA (internal rules).

- Certificate of Incorporation: Issued by MCA, it acts as the company’s birth certificate, assigning a Corporate Identification Number (CIN).

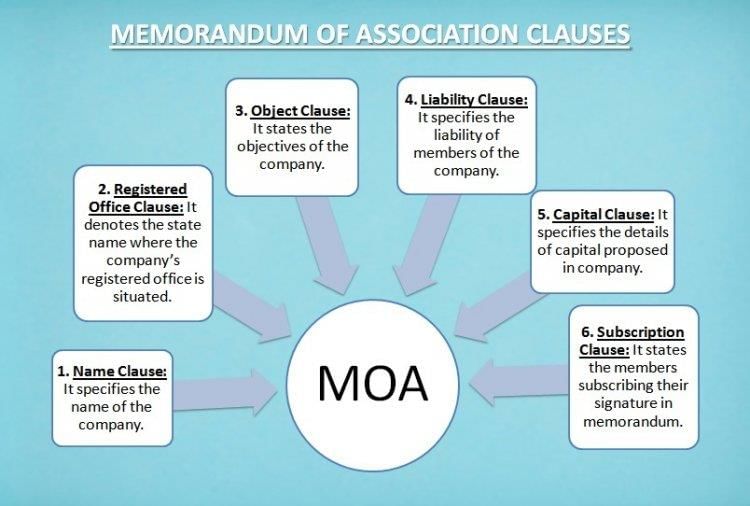

Memorandum of Association (MOA)

The MOA is the company’s charter, outlining its scope and objectives. It includes:

- Name clause, registered office clause, object clause, liability clause, and capital clause.

- Any act beyond the MOA’s objectives is ultra vires (invalid).

- Alteration requires shareholder approval and MCA consent.

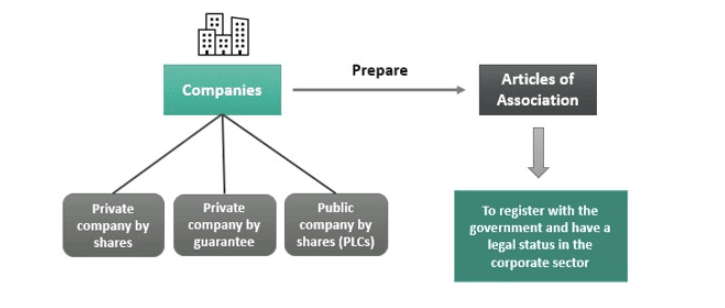

Articles of Association (AOA)

The AOA contains internal rules, such as procedures for meetings, share issuance, and director appointments. It is subordinate to the MOA.

Key Doctrine: Doctrine of Ultra Vires - Actions outside the MOA’s objectives are void. Example: Ashbury Railway Carriage v. Riche (1875) - A company’s contract to finance railways was invalid as it was beyond its MOA.

Key Doctrine: Doctrine of Ultra Vires - Actions outside the MOA’s objectives are void. Example: Ashbury Railway Carriage v. Riche (1875) - A company’s contract to finance railways was invalid as it was beyond its MOA.

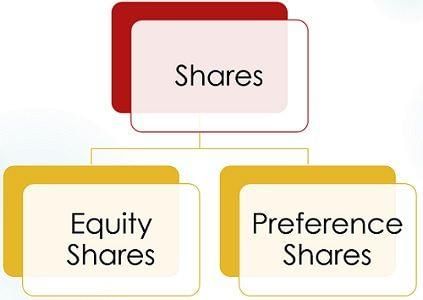

Share Capital and Shares

Share capital is the funds raised by issuing shares to shareholders, who become part-owners of the company.

Types of Shares

- Equity Shares: Carry voting rights and dividends based on profits. Riskier but offer higher returns.

- Preference Shares: Fixed dividends, no voting rights, priority in dividend payment and repayment during winding up.

Key Concepts

- Authorized Capital: Maximum capital a company can raise, as per MOA.

- Issued Capital: Portion of authorized capital offered to shareholders.

- Subscribed Capital: Portion of issued capital shareholders agree to buy.

- Paid-up Capital: Amount actually paid by shareholders.

- Share Transfer: Selling shares to another person, subject to AOA rules.

- Buy-back of Shares: Company repurchasing its shares to reduce capital (Section 68).

- Reduction of Capital: Decreasing share capital with NCLT approval (Section 66).

Note: For CLAT PG, focus on the distinction between equity and preference shares and the process of share buy-back, as these are common MCQ topics.

Management and Administration

A company is managed by its Board of Directors and shareholders through meetings and resolutions, as per Sections 96-122 and 149-172.

Directors

- Appointment: By shareholders or board; minimum 2 (private) or 3 (public) directors.

- Types: Executive (managing day-to-day operations), Non-Executive, Independent (no company ties), Women Directors (mandatory for certain companies).

- Duties (Section 166): Act in good faith, avoid conflicts, ensure company’s benefit, and exercise due care.

- Liabilities: Liable for fraud, negligence, or breach of fiduciary duty.

Meetings

- Annual General Meeting (AGM): Held yearly to approve financials, declare dividends, and appoint directors (Section 96).

- Extraordinary General Meeting (EGM): For urgent matters, like altering MOA or AOA.

- Board Meetings: Directors meet at least 4 times a year to make strategic decisions.

Resolutions

- Ordinary Resolution: Simple majority (e.g., approving accounts).

- Special Resolution: 75% majority (e.g., changing MOA or reducing capital).

- Resolution Requiring Special Notice: For specific matters like removing a director.

Landmark Case: Foss v. Harbottle (1843) - Established the “proper plaintiff rule,” meaning only the company (not individual shareholders) can sue for wrongs done to it, except in cases of fraud or ultra vires acts.

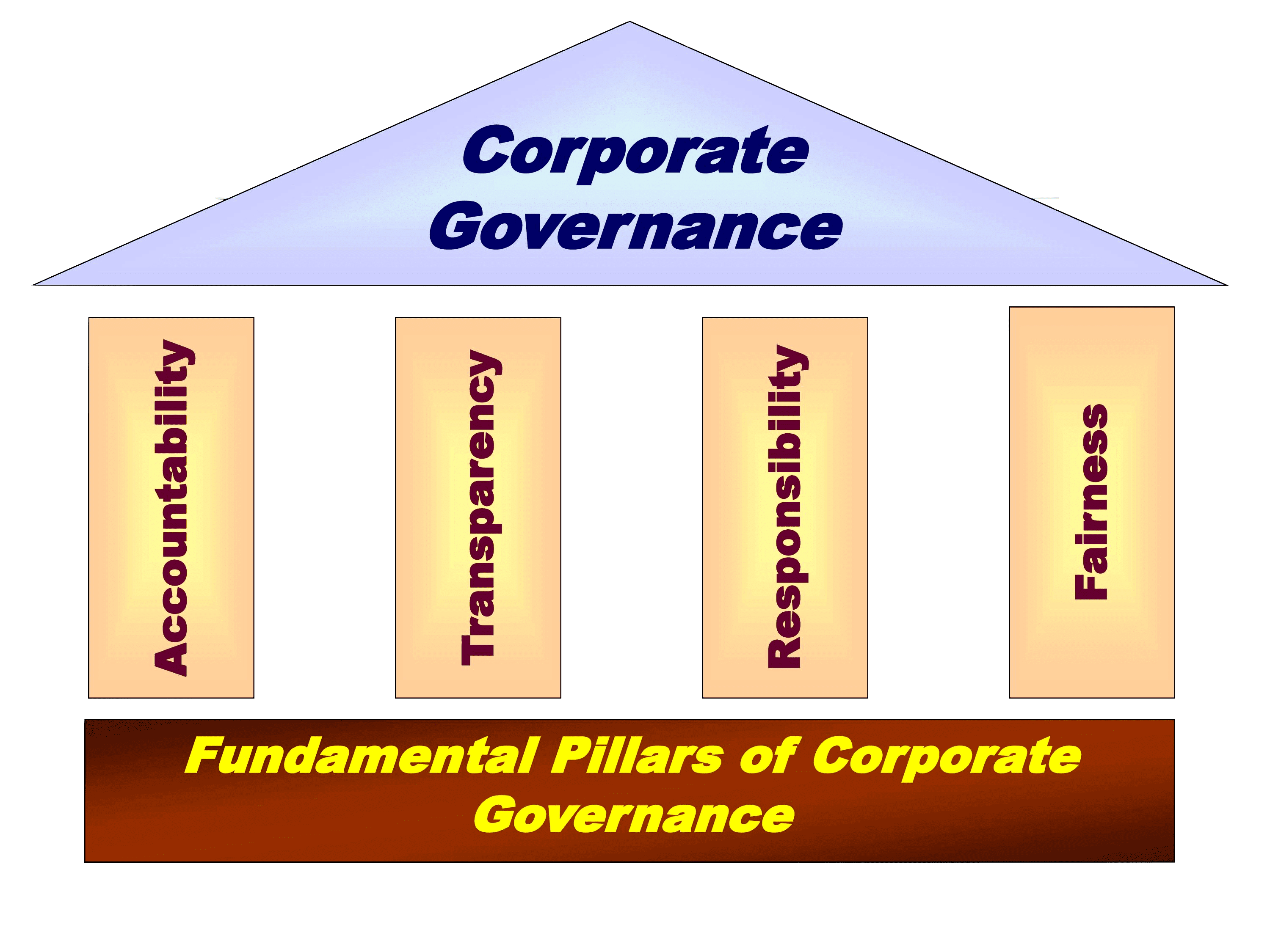

Corporate Governance

Corporate governance ensures transparency, accountability, and fairness in a company’s operations.

- Principles: Fair treatment of shareholders, ethical conduct, and accurate disclosures.

- SEBI’s Role: Regulates listed companies through the Listing Obligations and Disclosure Requirements (LODR) Regulations, ensuring transparency.

- Corporate Social Responsibility (CSR): Under Section 135, companies meeting profit/turnover criteria must spend 2% of average net profits on social causes (e.g., education, health).

Note: CSR is a popular essay topic in CLAT PG. Understand its applicability and penalties for non-compliance.

Winding Up and Insolvency

Winding up is the process of closing a company, governed by Sections 270-365. Insolvency is handled under the Insolvency and Bankruptcy Code (IBC), 2016.

Types of Winding Up

- Voluntary Winding Up: Initiated by shareholders when the company is solvent or insolvent.

- Compulsory Winding Up: Ordered by NCLT (e.g., inability to pay debts, mismanagement).

Insolvency under IBC, 2016

- Corporate Insolvency Resolution Process (CIRP): A time-bound process to revive the company or liquidate it.

- Liquidation: If CIRP fails, assets are sold to pay creditors.

- Role of NCLT/NCLAT: NCLT approves winding up or insolvency processes; NCLAT hears appeals.

Note: For CLAT PG, focus on the interplay between the Companies Act and IBC, especially NCLT’s role.

Key Doctrines

- Doctrine of Constructive Notice: Assumes everyone knows the company’s MOA and AOA, as they are public documents.

- Doctrine of Indoor Management: Protects outsiders assuming internal company rules are followed. Royal British Bank v. Turquand (1856) - A company was bound by a contract signed by directors, as outsiders weren’t expected to check internal compliance.

- Lifting the Corporate Veil: Courts ignore the separate entity to hold shareholders/directors liable in cases of fraud or public interest.

Regulatory Framework

- Ministry of Corporate Affairs (MCA): Administers the Companies Act and oversees company registration.

- Securities and Exchange Board of India (SEBI): Regulates listed companies and stock markets.

- National Company Law Tribunal (NCLT): Handles company disputes, winding up, and insolvency.

- National Company Law Appellate Tribunal (NCLAT): Appeals against NCLT orders.

Important Sections of Companies Act, 2013

- Sections 3-12: Incorporation and related procedures.

- Sections 23-42: Prospectus, share issuance, and public offers.

- Sections 96-122: Meetings and resolutions.

- Sections 149-172: Directors’ appointment, duties, and liabilities.

- Section 135: Corporate Social Responsibility.

- Sections 270-365: Winding up provisions.

Conclusion

Mastering Introduction to Company Law for CLAT PG requires a clear understanding of the Companies Act, 2013, key doctrines, and landmark case laws. By focusing on the formation, management, governance, and dissolution of companies, along with practical study tips, these notes provide a structured approach to excel in both objective and subjective questions. Regular practice, combined with staying updated on recent developments, will ensure you are well-prepared to tackle this subject confidently. Use these notes as a foundation, supplement with bare act reading and past papers, and aim for a thorough yet concise preparation strategy. All the best for your CLAT PG journey!

|

67 docs|12 tests

|

FAQs on Introduction to Company Law - Company Law - CLAT PG

| 1. What is the definition of a company in legal terms? |  |

| 2. How has corporate law evolved historically? |  |

| 3. What are the key features of the Companies Act, 2013? |  |

| 4. What are the basic characteristics of a company? |  |

| 5. Why is understanding corporate law important for legal professionals? |  |