CLAT PG Exam > CLAT PG Notes > Tax Law > Concepts, Defects (Old System) and Benefits of GST

Concepts, Defects (Old System) and Benefits of GST | Tax Law - CLAT PG PDF Download

| Table of contents |

|

| Old Indirect Tax Structure |

|

| Defects in Old System |

|

| Basic Concept of GST |

|

| Benefits of GST |

|

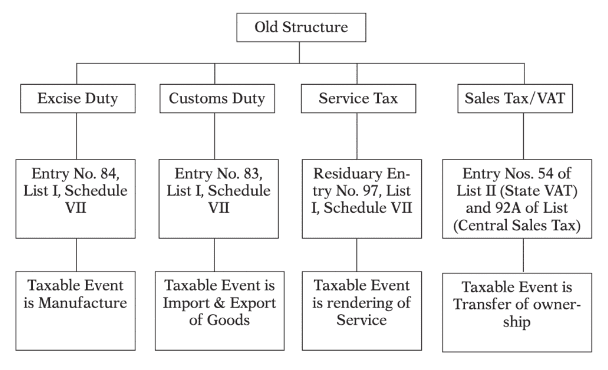

Old Indirect Tax Structure

Defects in Old System

- Cascading Effect: Both the central and state governments levied tax on the same goods. The central government taxed the manufacture of goods, while the state government levied VAT on the sale of those same goods. The state did not allow credit for the excise duty paid by the manufacturer, causing VAT to be applied on the excise duty component as well, leading to a cascading effect. Similarly, service tax was charged on the provision of services, with no credit for service tax paid on input services used in selling goods. This resulted in tax being levied on tax, contributing to inflation.

- Multiplicity of Tax/Cess: Prior to GST, multiple taxes such as Excise duty, VAT, Entry tax, luxury tax, Entertainment tax, Service tax, and various cesses imposed by the State and Central Government made the tax structure cumbersome.

- Overlapping of Jurisdiction: The distinction between goods and services became unclear over time, leading to overlapping state VAT and Central Service tax on transactions such as works contract, food-related services, computer software, SIM cards, and renting of movable property. This made it difficult to determine whether a transaction was the sale of goods or the provision of services, resulting in both central and state taxes being imposed.

- Rivalry amongst states: Before GST, indirect tax was origin-based rather than destination-based. Taxes were collected and utilized by the state where goods or services were transacted, manufactured, or supplied. This system encouraged states to offer sales tax or VAT relief to attract industries and discourage the supply of goods from other states by imposing entry taxes, octroi, luxury tax, etc. on goods coming from outside the state.

- Hindrance to Integrated market system: Despite being one nation, India could not develop into a national market due to barriers such as Central State tax, VAT, and entry tax. These barriers were evident in the form of check posts at state boundaries.

- Loss of Man and Truck hours: Check posts set up by states at entry points resulted in the loss of millions of man-hours and truck hours. Additionally, corruption at these check posts made logistics management expensive.

- Difficulty in Compliance for Taxpayers: The pre-GST regime had a multiplicity of taxes and tax laws. Each tax had a different taxable event, such as manufacture for Excise and sales for VAT. There were also multiple tax authorities, making compliance effortful for taxpayers and promoting Inspector Raj.

- Difficulty in Cross Verification of Credit availed by Assessee: It was challenging for tax departments to verify reports from suppliers regarding input tax credit claims due to the lack of online data. Verification was done offline, often leading to delays or missing reports. This situation was exploited by unscrupulous dealers to claim fraudulent credits.

- Tax Evasion: The burden of compliance and multiplicity of tax laws increased tax evasion. Methods such as record falsification, transaction concealment, and bribing tax officials were used to avoid the tax net.

- Huge Amount of litigation: The multiple tax laws with different taxable events led to disputes regarding credit availment, goods classification, valuation, and other issues. The dispute settlement mechanism was overwhelmed with these disputes, resulting in a backlog of tax demands.

Question for Concepts, Defects (Old System) and Benefits of GSTTry yourself: Which of the following was a major issue in the old indirect tax structure prior to the implementation of GST?View Solution

Basic Concept of GST

- Value Added Tax: GST is a value-added tax imposed on the manufacture, sale, and consumption of goods and services.

- Chain of Tax Credits: GST provides a comprehensive and continuous chain of tax credits from the producer or service provider to the retailer or consumer, taxing only the value added at each stage of the supply chain.

- Borne by Final Consumer: At each stage, the supplier can claim credit for GST paid on purchases and set off this credit against GST payable on their supplies. This means only the final consumer bears the GST charged by the last supplier in the supply chain, with set-off benefits at all previous stages.

- No Cascading Effect: Under GST, only the value added at each stage is taxed, eliminating tax on tax or cascading of taxes. GST treats goods and services the same, taxing them at a single rate.

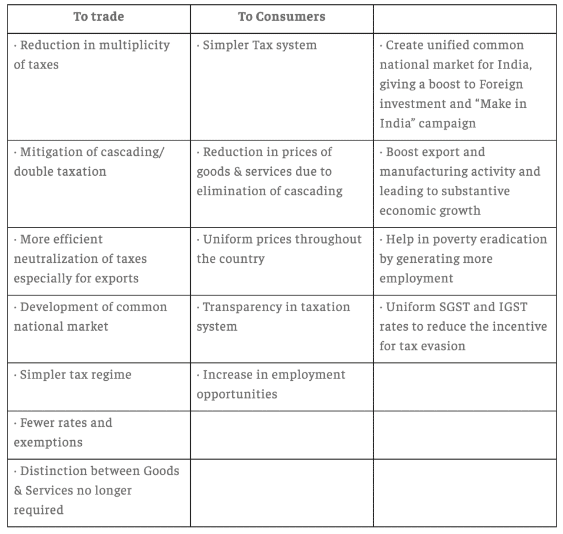

Benefits of GST

- GST is a consumption and "destination-based" tax system, unlike the earlier systems which were based on the origin of sale or manufacture. This feature reduces the regressive impact of indirect taxes. GST brings benefits to all stakeholders including industry, Government, and consumers.

- Integrated National Market: GST aims to create a common market in India with uniform tax rates and procedures, eliminating economic barriers and facilitating the smooth movement of goods and services across the country.

- Elimination of Cascading Effect: Cascading tax occurs when each successive transfer is taxed inclusive of previous taxes. GST addresses tax cascading through Input Tax Credit Mechanisms, ensuring the ultimate tax burden falls on the consumer of Goods and Services.

- Removal of Multiplicity of Taxes: GST replaces multiple taxes like Excise Duty, Value Added Tax, Entry Tax, Luxury Tax, Entertainment Tax, Octroi, and Services Tax with a single tax called GST. This simplification enhances transparency and ease of doing business in India.

- Increase in GDP: GST is expected to improve the ease of doing business in India, potentially lowering the Ease of Doing Business Index from around 140 to double digits. It is anticipated to attract significant foreign investment, boost manufacturing and services, and contribute to GDP growth.

- Efficient Administration by Government: GST is a fully automated tax system with online processes for filing returns, refunds, and assessments, minimizing physical interactions between taxpayers and revenue authorities. This online system aims to enhance transparency, reduce corruption, and improve government administration.

Question for Concepts, Defects (Old System) and Benefits of GSTTry yourself: Which of the following is NOT a benefit of GST?View Solution

|

25 docs|11 tests

|

FAQs on Concepts, Defects (Old System) and Benefits of GST - Tax Law - CLAT PG

| 1. What were the main defects of the old indirect tax structure in India? |  |

Ans. The old indirect tax structure in India was characterized by multiple taxes levied by both the central and state governments, leading to issues like tax cascading, complexity in compliance, and lack of uniformity. Businesses faced challenges due to the multiplicity of taxes such as excise duty, VAT, service tax, and others, which made tax calculations cumbersome and increased the cost of doing business.

| 2. How does the Goods and Services Tax (GST) address the defects of the old tax system? |  |

Ans. GST simplifies the tax structure by consolidating multiple indirect taxes into a single tax on goods and services. It eliminates tax cascading through the input tax credit mechanism, ensuring that taxes are only paid on the value added at each stage. This uniformity across states and sectors reduces compliance complexity and promotes ease of doing business.

| 3. What are the basic concepts of GST that differentiate it from the old system? |  |

Ans. The basic concepts of GST include a dual tax structure, where both the central and state governments levy GST on the same transaction, and the input tax credit mechanism, which allows businesses to claim credits for taxes paid on inputs. Additionally, GST is destination-based, meaning tax is collected at the point of consumption rather than origin, which encourages fair competition among businesses.

| 4. What are the benefits of implementing GST for businesses and consumers? |  |

Ans. The benefits of GST for businesses include reduced compliance costs, simpler tax administration, and improved cash flow due to the input tax credit system. For consumers, GST leads to lower prices as tax cascading is eliminated and efficiency in the supply chain is enhanced. Overall, GST aims to create a unified market, promoting economic growth and increasing tax revenue for the government.

| 5. How has GST impacted the overall economy since its implementation? |  |

Ans. Since its implementation, GST has significantly impacted the economy by broadening the tax base, improving tax compliance, and enhancing revenue collection for both central and state governments. It has facilitated smoother interstate trade, reduced the burden of indirect taxes on consumers, and contributed to the formalization of the economy, leading to more transparent business practices.

Related Searches