Permanent Settlement: Land Revenue Systems in British India | History Optional for UPSC PDF Download

Pre-British Agrarian Structure

- In the pre-capitalist stage of the Indian economy, the concept of absolute ownership of land did not exist. All classes connected with land possessed certain rights.

- The cultivator had the right to cultivate the land and enjoyed security of tenure by paying a fixed share of the annual produce to the overlord.

- The Patil or village headman acted as the collector(and also as magistrate and head farmer) and passed on the state demand for land revenue, which varied from 1/6th to 1/3rd of the rental value, to the ruler.

- The internal village arrangements related to cultivation, such as land allotment, provision of irrigation facilities, and collection of land revenue from individual cultivators, were settled by the Patil in consultation with the village Panchayats according to local customs and practices.

British Land Revenue System and Administration

- The British aimed to maximize economic benefits from their rule in India.

- British industrial and mercantile interests prevented the East India Company from raising substantial revenue through high custom tariffs, leading the Company to rely primarily on land revenue as its main source of income.

- Early British administrators viewed India as a vast estate, believing the Company was entitled to the entire economic rent, leaving cultivators with only their cultivation expenses and labor wages.

- Village communities were ignored, and the early administrators often resorted to farming land revenues.

- Excessive land revenue demands had negative consequences, causing agriculture to decline, large areas to fall out of cultivation, and famines to threaten the population.

- This situation prompted serious reconsideration of land revenue policies in both India and England, leading to new policy decisions.

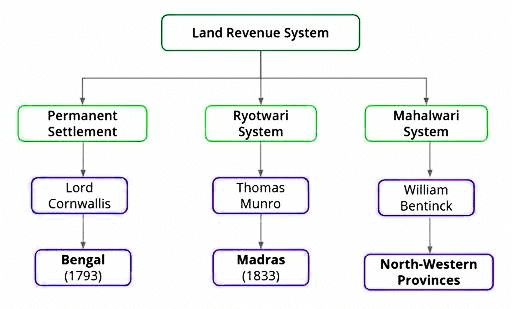

New Land Tenures

- The British introduced three main types of land tenures in India: Zamindari, Mahalwari, and Ryotwari.

- Permanently Zamindari settlements were established in Bengal, Bihar, Orissa, Benares Division of Uttar Pradesh, Northern Camatic, covering about 19% of British India.

- Mahalwari settlements were introduced in major parts of Uttar Pradesh, Central Provinces, Panjab, covering nearly 30% of the area.

- Ryotwari settlements were made in significant portions of Bombay,Madras Presidencies,Assam, and other parts of British India, covering roughly 51% of the area.

Land Revenue System during the Dual Government in Bengal

- In 1765, after the Battle of Buxar and through the Treaty of Allahabad, the East India Company received the right of Diwani from the Mughal Emperor Shah Alam II. This gave the Company the authority to collect revenue for Bengal, Bihar, and Orissa.

- The primary focus of the East India Company’s administration after gaining Diwani was to collect as much revenue as possible, as agriculture was the backbone of the economy.

- Despite retaining the Nawabi administration with Muhammad Reza Khan as Naib Diwan, the Company introduced various land revenue experiments to maximize revenue extraction.

- The nawabs collected revenue from zamindars, who were either large landlords with their own armed retainers or smaller zamindars. Peasants paid the zamindars at customary rates, which could vary by subdivision, and sometimes additional charges called abwabs were collected.

- Under Clive and his successors, the traditional system of revenue collection was maintained but with increased targets, raising the collection from Rs. 8,180,000 in 1764 to Rs. 23,400,000 in 1771. Revenue officials deducted a commission (about 10%) before depositing the balance in the Company’s treasury.

- Although native officials were in charge of revenue collection, European officers supervised them. This led to disorganization in the agrarian economy due to corruption and a lack of understanding of local conditions.

- The East India Company consistently raised its demands from collectors, who in turn increased demands on the peasants, causing significant hardship. The famine of 1769-70, which devastated about one-third of Bengal’s population, was a tragic result of this chaos.

- Unable to meet expected dividends, the Company directors sought reasons for declining revenues and blamed Reza Khan, who was falsely accused of corruption. The real motive was Warren Hastings’ desire to replace Indian revenue officials with British ones.

- The Ijardari System, introduced by Warren Hastings in 1772, involved auctioning the right to collect revenue to the highest bidders. It aimed to streamline revenue collection but ultimately failed due to the excessive burden it placed on peasants and the instability it introduced.

- The Amini Commission, appointed in 1776 to assess land values, could not rectify the situation. The Ijardari System created uncertainty about future assessments and collectors, leading to further confusion.

- By the time Lord Cornwallis arrived in 1784, the revenue administration was in disarray. Cornwallis was tasked with streamlining the system to stabilize the agricultural population and revenue collection.

Zamindari Settlement/ Permanent Settlement

Background:

- The Land Revenue System under Dual Government in Bengal from 1765 to 1772 and the Zamindari Settlement introduced by Warren Hastings in 1772 were both unsuccessful. This led the Company to realize the need for a more effective land revenue system.

- Even before Lord Cornwallis arrived in India, several Company officials and European observers, including Alexander Dow,Henri Patullo,Philip Francis, and Thomas Law, were advocating for a permanent fix to the land tax.

- Despite their differing views, these individuals shared a belief in the Physiocratic school, which emphasized the importance of agriculture in the economy. Dow introduced the concept of permanent settlement in his book History of Hindustan, while Patullo expanded on this idea. Francis proposed recognizing zamindars as permanent land proprietors.

- The Pitt’s India Act of 1784, influenced by Philip Francis, set the stage for Permanent Rules regarding land revenue.

- When Lord Cornwallis became Governor-General in 1786, he found the land revenue system established by Warren Hastings to be problematic, with various English officials expressing doubts about its viability.

- As a member of the British landed aristocracy and a proponent of landlordism, Cornwallis favored the zamindars. He recognized that the existing system was damaging the economy, harming agriculture, and failing to generate the expected surplus for the Company.

- The decline in agriculture also impacted the Company’s trade, particularly in silk and cotton, which were major export items. To address this, Cornwallis believed that permanently fixing revenue would be the solution.

- There were two main perspectives regarding the land revenue settlement:

- According to James Grant, zamindars did not have permanent rights as either soil proprietors or officials responsible for collecting and paying revenue. This perspective held that the State was not bound by any strict limits in its demands from zamindars.

According to Sir John Shore:

- Zamindars owned the land and the state was entitled only to customary revenue from them.

- John Shore's Minute in 1789 laid the groundwork for the Zamindari settlement.

- Instructions from the Court of Directors made it easier for Cornwallis to implement the settlement without much exploration.

- After extensive discussions, the Permanent Settlement was introduced in Bengal and Bihar in 1793 by Lord Cornwallis.

- The Zamindari settlement, initially a ten-year settlement in 1790 based on Shore's Minute, was made permanent in 1793.

- The policy of assessment for ever was established in Bengal, fixing land revenue at a high level in perpetuity.

- The revenue demand in 1793 was about 20% higher than before 1757, with some calculations indicating it nearly doubled between 1765 and 1793.

- The settlement was introduced in Bengal, Bihar, Orissa, and later in Varanasi and parts of Madras, replacing traditional systems like Khuntkatti in tribal areas.

Main features of the Permanent Settlement

- Zamindar Ownership: Zamindars were recognized as the owners of the land, with the right to mortgage, bequeath, transfer, and sell the land. The British East India Company made the settlement with them.

- Revenue Collection: Zamindars acted as agents of the Government in collecting land revenue from the ryots (peasants) and became the owners of the entire land in their zamindaris. Their right of ownership was made hereditary and transferable.

- Zamindar Rights: Zamindars could sell their lands and had the right to purchase land. The State held zamindars responsible for the payment of land revenue, and in case of default, the land could be confiscated and sold.

- Tenant Status: Cultivators were reduced to the status of mere tenants, losing long-standing rights to the soil and other customary rights. Their rights to use pasture and forest land, irrigation lands, fisheries, homestead plots, and protection against rent enhancement were sacrificed.

- Zamindar Responsibilities: Zamindars were expected to improve the condition of the tenants and agriculture. They were required to pay a fixed amount of land revenue, which could not be increased later.

- Revenue Distribution: Zamindars were to give 10/11 of the rental they derived from the peasantry to the state, keeping only 1/11th for themselves. If the rental of a zamindar’s estate increased, he would keep the entire amount of the increase.

- Sale Law: An enactment known as the sunset law in 1794 allowed the Government to auction Zamindari rights in case of revenue payment failure.

- State Intervention: The state had no direct contact with the peasants and did not interfere in the internal dealings of the zamindars with their tenants, as long as the fixed land revenue was paid to the Government.

- Initial Revenue Fixation: The initial fixation of revenue was made arbitrarily and without consultation with the zamindars, aiming to secure the maximum amount. This led to high sales of revenue.

- Tenant Rights: Regulations of 1799 and 1812 allowed zamindars to seize tenant property in case of non-payment of rent without court permission.

- Rack Renting: A snag in the Permanent Settlement was that while the state’s land revenue demand was fixed, the rent to be realized by the landlord from the cultivator was left unspecified, leading to rack renting and frequent ejections of tenants.

- Absentee Landlordism: Many zamindars became absentee landlords as they found it difficult to pay the fixed revenue. They sublet parts of their estate to unofficial middlemen, leading to a process of subinfeudation.

- Urban Landlords: Old rural-based zamindars were replaced by new urban landlords who obtained Zamindari for profit and social distinction. These urban zamindars left their agents to collect revenue from peasants, further exploiting them.

Merits of the Settlement

Views on Cornwallis' Permanent Settlement

- Opinions among scholars and historians about Cornwallis' Permanent Settlement vary widely.

Positive Perspectives:

- Marshman described the settlement as “a bold step and a wise measure.”

- The settlement created indefeasible interests in land ownership, leading to extended cultivation and visible improvements in the habits and comforts of the people.

Financial Benefits:

- The Permanent Settlement provided a fixed and stable income for the state, ensuring revenue regardless of monsoon fluctuations.

- It eliminated the need for periodic assessments and settlements, reducing administrative costs.

- The abolition of the entire revenue collection machinery,including Tehsildars and other officers, brought financial advantages.

Political Gains:

- Under Mughal rule, zamindars had significant power, but the settlement reduced their political authority.

- Cornwallis aimed to create a class of loyal zamindars who would support British interests.

- The settlement secured political support for the British government, similar to the Bank of England’s support for King William III.

- During the Mutiny of 1857, zamindars remained loyal to the British, validating Cornwallis' vision.

Facilitated Revenue Collection:

- The settlement simplified land revenue collection for the East India Company, reducing the need for a large administrative setup.

Improvement in Judicial Services:

- The settlement allowed East India Company servants to focus on judicial services rather than revenue work.

Increased Land Value:

- Zamindars focused on land improvement, leading to increased land value.

- Waste land and jungles were converted into cultivable land, enhancing land productivity.

Merits Visualized and Expected

Economic Benefits:

- Landlords would invest in land improvements, as the fixed state demand meant they would reap the entire benefit from increased production and income.

- The Permanent Settlement was expected to boost agricultural enterprise and prosperity, leading to the reclamation of waste land and improvement of cultivated soil.

- Zamindars would introduce advanced farming methods, such as better seeds, manure, fertilizers, crop rotation, and irrigation, enhancing soil productivity and fostering a content and resourceful peasantry.

Social Impact:

- Zamindars were anticipated to act as natural leaders, promoting education and charitable activities within the peasantry.

Trade, Industry, and Commerce:

- The Permanent Settlement would make Zamindars wealthy, enabling them to invest surplus capital in trade, industry, and commerce.

Government Income:

- Although the government could not increase land revenue, it could benefit indirectly through regular tax collection and potential increases in income from taxing trade and commerce.

- Richer individuals would lead to higher tax revenues for the government.

Reduction of Temporary Settlement Issues:

- The Permanent Settlement aimed to eliminate problems associated with temporary settlements, such as harassment of cultivators and their tendency to abandon land.

- It was believed to reduce corruption by limiting officials' ability to alter assessments and simplify revenue collection by dealing with fewer zamindars instead of numerous peasants.

Demerit of the Settlement

Impact of the Permanent Settlement on Different Parties

- Scholarly Views: Many scholars argue that the Permanent Settlement was detrimental to the interests of the British East India Company, the Zamindars, and especially the peasants.

- Holmes' Critique: Holmes described the Permanent Settlement as a significant mistake, claiming that it brought no benefits to the inferior tenants.

- Peasant Disadvantages: The system overlooked the interests of the peasants, causing them significant losses.

- Zamindar Empowerment: The Permanent Settlement granted land ownership rights to the Zamindars, who previously only had the right to collect revenue. This left peasants at the mercy of the Zamindars, stripping them of their customary occupancy rights and reducing them to the status of tenants.

- Loss of Traditional Rights: Peasants lost all traditional rights related to land, including rights to pastures, forests, and canals. They could not appeal against tax increases.

- Patta Provision Ignored: The provision of patta, a written agreement between the peasant and the Zamindar outlining rent terms, was rarely followed, leaving peasants to work at the Zamindar's discretion.

- Zamindar Exploitation: Many Zamindars exploited peasants by demanding excessive rents for lavish spending.

- Eviction Rights: In 1799, Zamindars gained the right to evict peasants who failed to pay taxes, even taking their property. If peasants could not pay due to natural disasters or other reasons, their land could be seized by the Zamindars.

- Company Sacrifice of Peasant Interests: By recognizing the Zamindars' absolute ownership rights, the Company sacrificed peasant interests in property and occupancy.

- Tenancy Legislation: Some scholars believe that tenancy legislation was enacted primarily to maintain rural peace.

- Sir Edward Calebrook's View: According to Sir Edward Calebrook, sacrificing peasant interests was a grave mistake, as it deprived occupiers of their hereditary rights and left them vulnerable to landlord exploitation.

- Company's Revenue and New Taxes: The Company, benefiting from fixed land revenue, imposed new taxes that burdened peasants and ordinary people further.

- Settlement's Evolution: Initially serving some economic or political purposes, the Settlement soon became a tool of exploitation and oppression, creating a system of "feudalism at the top and serfdom at the bottom."

- Destruction of Cultivator Rights: Displacing cultivators from ownership rights was seen as a blunder. Matcalfe noted that Cornwallis, instead of creating property in India, destroyed it.

- Tenant Suffering: Cultivators reduced to tenant status suffered greatly at the hands of their landlords, as there were no protective laws until 1859.

- Tenancy Legislations: Tenancy legislations in 1859 and 1885 offered some protection to tenants by recognizing their occupancy rights.

- Company Raj Transformation: The period marked the transformation of the Company Raj into a confident territorial state, aiming to penetrate deeper into the economy and society.

- Zamindari Power and Legal Reforms: Despite new legal reforms, zamindari power remained largely unchecked, and the reforms often strengthened the position of powerful rich peasants, known as jotedars, rather than providing relief to poor cultivators.

- Economic Progress Retardation: The Permanent Settlement hindered Bengal's economic progress, as most landlords were more interested in maximizing rent than improving land.

- Lack of Incentives for Cultivators: Cultivators, fearing eviction, had no motivation to enhance land productivity.

- Zamindar Lifestyle: Zamindars often lived away from their estates, indulging in luxury, while the process of sub-infeudation could involve numerous intermediaries, each prioritizing their profits, leaving the ryot in a state of poverty.

Disadvantages to the Government

- The state faced long-term losses due to the fixed and stable income from land revenue. It sacrificed the potential share in the increase of land revenue.

- Even with new land under cultivation and increased rents, the state couldn't claim its rightful share in the revenue increase.

- The government suffered losses as income was fixed while expenses continued to rise. To cover Bengal's deficit, extra taxes were imposed on other provinces.

Political Disadvantages:

- The Permanent Settlement benefited the Company and the zamindars, creating a divide between zamindars and tenants, and embarrassing the government with law and order issues.

- The system weakened the bond between the government and the people, as long as the zamindars paid rents, the government had little involvement.

- Before 1793, zamindars in Bengal and Bihar did not have proprietary rights over most land. The British mistakenly thought zamindars were similar to English landlords.

- While the British landlord owned land in relation to the state and tenant, the zamindar was subordinate to the state, paying a large share of income as tax.

- The settlement, although pro-zamindar, led to frequent sales of zamindari estates, as zamindars often failed to pay their rent charges.

- Between 1794 and 1807, land yielding about 41% of revenue in Bengal and Bihar was sold at auction; in Orissa,51.1% of original zamindars were wiped out due to auction sales.

- Old zamindaris were parcelled out by zamindari officials, rich tenants, or neighboring zamindars.

- Some old houses, like the Burdwan raj, survived through subinfeudation, creating complex tenurial structures with multiple grades between zamindar and peasants.

- These subinfeudatory patni tenures increased demands on peasants, further complicating the agrarian structure.

No Improvement in Agriculture:

- Lord Cornwallis anticipated that once the zamindars were guaranteed ownership of the land, they would invest in its improvement.

- However, the zamindars did not meet these expectations. Instead of using the increased profits to enhance agricultural practices and uplift the villages, they squandered the money on personal luxuries and pleasures.

|

367 videos|995 docs

|

FAQs on Permanent Settlement: Land Revenue Systems in British India - History Optional for UPSC

| 1. What was the agrarian structure in Bengal before British rule? |  |

| 2. What was the Dual Government system implemented in Bengal? |  |

| 3. How did the Zamindari System evolve under British rule? |  |

| 4. What are the key features of the Permanent Settlement? |  |

| 5. What were the impacts of the Permanent Settlement on Indian agriculture? |  |