Unit 7: Contract of Indemnity and Guarantee Chapter Notes | Business Laws for CA Foundation PDF Download

Contract of Indemnity

- The term “Indemnity” literally means “Security against loss” or “to make good the loss” or “to compensate the party who has suffered some loss”.

- The term “Contract of Indemnity” is defined under Section 124 of the Indian Contract Act, 1872. It is “a contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person.”

Example

- Example 1: Mr. X contracts with the Government to return to India after completing his studies (which were funded by the Government) at University of Cambridge and to serve the Government for a period of 5 years.

- If Mr. X fails to return to India, he will have to reimburse the Government.

- It is a contract of indemnity.

Parties

- The party who promises to indemnify/ save the other party from loss - indemnifier,

- The party who is promised to be saved against the loss - indemnified or indemnity holder.

Example 2: A may contract to indemnify B against the consequences of any proceedings which C may take against B in respect of a sum of 5000/- advanced by C to B. In consequence, when B who is called upon to pay the sum of money to C fails to do so, C would be able to recover the amount from A as provided in Section 124.

Example 3: X may agree to indemnify Y for any loss or damage that may occur if a tree on Y’s neighboring property blows over. If the tree then blows over and damages Y’s fence, X will be liable for the cost of fixing the fence.

However, the above definition of indemnity restricts the scope of contracts of indemnity in as much as it covers only the loss caused by:

- (i) the conduct of the promisor himself, or

- (ii) the conduct of any other person.

Thus, loss occasioned by an accident not caused by any person, or an act of God/ natural event, is not covered.

In case of Gajanan Moreshwar v/s Moreshwar Madan (1942), decision is taken on the basis of English Law. As per English Law, Indemnity means promise to save another harmless from the loss. Here it covers every loss whether due to negligence of promisee or by natural calamity or by accident.

Mode of contract of indemnity: A contract of indemnity like any other contract may be express or implied.

- A contract of indemnity is said to be express when a person expressly promises to compensate the other from loss.

- A contract of indemnity is said to be implied when it is to be inferred from the conduct of the parties or from the circumstances of the case.

A contract of indemnity is like any other contract and must fulfil all the essentials of a valid contract.

Example 4: A asks B to beat C promising to indemnify him against the consequences. The promise of A cannot be enforced. Suppose, B beats C and is fined 1000, B cannot claim this amount from A because the object of the agreement is unlawful.

A contract of Fire Insurance or Marine Insurance is always a contract of indemnity. But there is no contract of indemnity in case of contract of Life Insurance.

Rights of Indemnity-holder when sued (Section 125): The promisee in a contract of indemnity, acting within the scope of his authority, is entitled to recover from the promisor/indemnifier—

- all damages which he may be compelled to pay in any suit

- all costs which he may have been compelled to pay in bringing/ defending the suit and

- all sums which he may have paid under the terms of any compromise of suit.

When does the liability of an indemnifier commence?

- Although the Indian Contract Act, 1872, is silent on the time of commencement of liability of indemnifier, however, on the basis of judicial pronouncements it can be stated that the liability of an indemnifier commences as soon as the liability of the indemnity-holder becomes absolute and certain.

- This principle has been followed by the courts in several cases.

- Example 5: A promises to compensate X for any loss that he may suffer by filling a suit against Y. The court orders X to pay Y damages of ` 10000. As the loss has become certain, X may claim the amount of loss from A and pass it to Y.

Contract of Guarantee

A contract of guarantee is a contract to perform the promise made or discharge the liability of a third person in case of his default.

Parties Involved

- Surety - person who gives the guarantee

- Principal debtor - person in respect of whose default the guarantee is given

- Creditor - person to whom the guarantee is given

Examples

- Example 6: When A requests B to lend ` 10,000 to C and guarantees that C will repay the amount within the agreed time and that on C failing to do so, he (A) will himself pay to B, there is a contract of guarantee. Here, B is the creditor, C the principal debtor, and A the surety.

- Example 7: X and Y go into a car showroom where X says to the dealer to supply the latest model of Wagon R to Y and agrees that if Y fails to pay, he will. In case of Y’s failure to pay, the car showroom will recover its money from X. This is a contract of guarantee because X promises to discharge the liability of Y in case of his defaults.

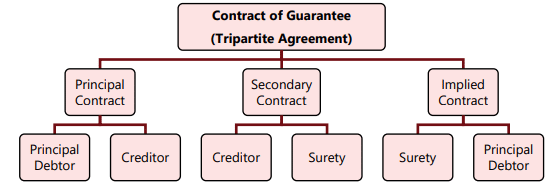

Nature of the Contract

A contract of guarantee is a tripartite agreement between principal debtor, creditor, and surety. There are, in effect, three contracts:

- A principal contract between the principal debtor and the creditor.

- A secondary contract between the creditor and the surety.

- An implied contract between the surety and the principal debtor whereby the principal debtor is under an obligation to indemnify the surety if the surety is made to pay or perform.

Rights of the Surety

The right of surety is not affected by the fact that the creditor has refused to sue the principal debtoror that he has not demanded the sum due from him.

Diagram of Contract of Guarantee

Essential Features of a Guarantee

- Purpose: The purpose of a guarantee being to secure the payment of a debt, the existence of recoverable debt is necessary. If there is no principal debt, there can be no valid guarantee.

- Consideration: Like every other contract, a contract of guarantee should also be supported by some consideration. A guarantee without consideration is void, but there is no need for a direct consideration between the surety and the creditor.

As per Section 127, consideration received by the principal debtor is sufficient consideration to the surety for giving the guarantee, but past consideration is no consideration for the contract of guarantee. Even if the principal debtor is incompetent to contract, the guarantee is valid. But, if the surety is incompetent to contract, the guarantee is void.

Example 8: B requests A to sell and deliver to him goods on credit. A agrees to do so provided C will guarantee the payment of the price of the goods. C promises to guarantee the payment in consideration of A’s promise to deliver the goods. As per Section 127, there is a sufficient consideration for C’s promise. Therefore, the guarantee is valid.

Example 9: A sells and delivers goods to B. C afterwards, without consideration, agrees to pay for them in default of B. The agreement is void. - Existence of a liability: There must be an existing liability or a promise whose performance is guaranteed. Such liability or promise must be enforceable by law. The liability must be legally enforceable and not time barred.

- No misrepresentation or concealment (section 142 and 143): Any guarantee which has been obtained by the means of misrepresentation made by the creditor, or with his knowledge and assent, concerning a material part of the transaction, is invalid (section 142).

Any guarantee which the creditor has obtained by means of keeping silence as to material circumstances, is invalid (section 143).

Example 10: A engages B as clerk to collect money for him. B fails to account for some of his receipts, and A in consequence calls upon him to furnish security for his duly accounting. C gives his guarantee for B’s duly accounting. A does not acquaint C with his previous conduct. B afterwards makes default. The guarantee is invalid.

Example 11: A guarantees to C payment for iron to be supplied by him to B to the amount of 2,000 tons. B and C have privately agreed that B should pay rupee five per ton beyond the market price, such excess to be applied in liquidation of an old debt. This agreement is concealed from A. A is not liable as a surety. - Writing not necessary:Section 126 expressly declares that a guarantee may be either oral or written.

- Joining of the other co-sureties (Section 144): Where a person gives a guarantee upon a contract that the creditor shall not act upon it until another person has joined in it as co-surety, the guarantee is not valid if that other person does not join. That implies, the guarantee by a surety is not valid if a condition is imposed by a surety that some other person must also join as a co-surety, but such other person does not join as a co-surety.

Types of Guarantees

Guarantee may be classified under two categories:- A. Specific Guarantee - A guarantee which extends to a single debt/ specific transaction is called a specific guarantee. The surety’s liability comes to an end when the guaranteed debt is duly discharged or the promise is duly performed.

- Example 12: A guarantees payment to B of the price of the five bags of rice to be delivered by B to C and to be paid for in a month. B delivers five bags to C. C pays for them. This is a contract for specific guarantee because A intended to guarantee only for the payment of price of the first five bags of rice to be delivered one time [Kay v Groves].

- B. Continuing Guarantee [Section 129] - A guarantee which extends to a series of transactions is called a continuing guarantee. A surety’s liability continues until the revocation of the guarantee.

- The essence of continuing guarantee is that it applies not to a specific number of transactions but to any number of transactions and makes the surety liable for the unpaid balance at the end of the guarantee.

- Example 13: On A’s recommendation B, a wealthy landlord employs C as his estate manager. It was the duty of C to collect rent on 1st of every month from the tenant of B and remit the same to B before 5th of every month. A guarantees this arrangement and promises to make good any default made by C. This is a contract of continuing guarantee.

- Example 14: A guarantees payment to B, a tea-dealer, to the amount of ₹ 10,000, for any tea he may from time-to-time supply to C. B supplies C with tea to above the value of ₹ 10,000, and C pays B for it. Afterwards B supplies C with tea to the value of ₹ 20,000. C fails to pay. The guarantee given by A was a continuing guarantee, and he is accordingly liable to B to the extent of ₹ 10,000.

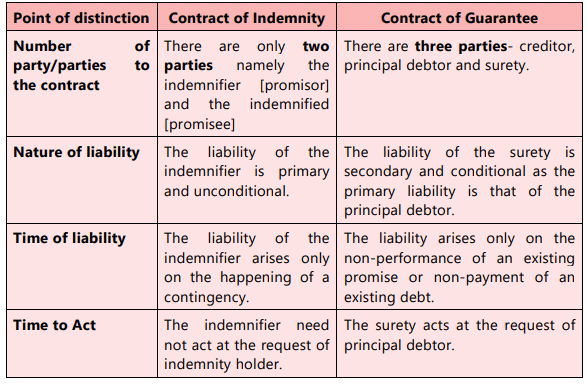

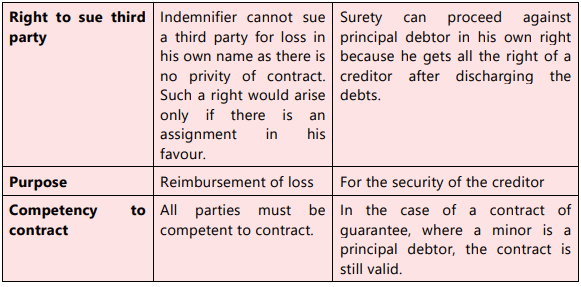

Distinction Between a Contract of Indemnity and a Contract of Guarantee

Nature and Extent of Surety’s Liability [section 128]

- The liability of the surety is co-extensive with that of the principal debtor unless it is otherwise provided by the contract. [Section 128]

- Liability of surety is of secondary nature as he is liable only on default of principal debtor.

- Where a debtor cannot be held liable on account of any defect in the document, the liability of the surety also ceases.

- A creditor may choose to proceed against a surety first, unless there is an agreement to the contrary.

- Example 15: A guarantees to B the payment of a bill of exchange by C, the acceptor. The bill is dishonoured by C. A is liable not only for the amount of the bill but also for any interest and charges which may have become due on it.

Liability of Two Persons, Primarily Liable, Not Affected by Arrangement Between Them That One Shall Be Surety on Other’s Default

- Where two persons contract with a third person to undertake a certain liability, and also contract with each other that one of them shall be liable only on the default of the other, the third person not being a party to such contract, the liability of each of such two persons to the third person under the first contract is not affected by the existence of the second contract, although such third person may have been aware of its existence. (Section 132)

- Example 16: A and B make a joint and several promissory note to C. A makes it, in fact, as surety for B, and C knows this at the time when the note is made. The fact that A, to the knowledge of C, made the note as surety for B, is no answer to a suit by C against A upon the note.

Discharge of a Surety

A surety is said to be discharged when his liability as surety comes to an end. The various modes of discharge of surety are discussed below:- By revocation of the contract of guarantee.

- By the conduct of the creditor, or

- By the invalidation of the contract of guarantee.

Modes of discharge

By revocationof the Contract of GuaranteeRevocation of continuing guarantee by Notice(Section 130): The continuing guarantee may at any time be revoked by the surety as to future transactions by notice to the creditors. Once the guarantee is revoked, the surety is not liable for any future transaction; however, he is liable for all the transactions that happened before the notice was given.

A specific guarantee can be revoked only if liability to principal debtor has not accrued.

- Example 17: Arun promises to pay Rama for all groceries bought by Carol for a period of 12 months if Carol fails to pay. In the next three months, Carol buys ₹ 2000/- worth of groceries. After 3 months, Arun revokes the guarantee by giving a notice to Rama. Carol further purchases ₹ 1000 of groceries. Carol fails to pay. Arun is not liable for ₹ 1000/- of the purchase that was made after the notice but he is liable for ₹ 2000/- of the purchase made before the notice.

- Revocation of continuing guarantee by surety’s death(Section 131): In the absence of any contract to the contrary, the death of surety operates as a revocation of a continuing guarantee as to the future transactions taking place after the death of surety. However, the surety’s estate remains liable for the past transactions which have already taken place before the death of the surety.

- Example 18: ‘S’ guarantees ‘C’ for the transaction to be done between ‘C’ & ‘P’ for next month. After 5 days ‘S’ died. Now guarantee is revoked for future transactions but ‘S’s estate is still liable for transactions done during previous five days.

- By novation[Section 62]: The surety under the original contract is discharged if a fresh contract is entered into either between the same parties or between other parties, the consideration being the mutual discharge of the old contract.

- Example 19: ‘S’ guarantees ‘C’ for the payment of the supply of wheat to be done by ‘C’ & ‘P’ for next month. After 5 days, the contract is changed. Now ‘S’ guarantees ‘C’ for the payment of the supply of rice to be done by ‘C’ & ‘P’ for the rest of next month. Here, guarantee is revoked for the supply of wheat. But ‘S’ is still liable for the supply of wheat done during the previous five days.

- By conduct of the creditor by variance in terms of contract(Section 133):Where there is any variance in the terms of contract between the principal debtor and creditor without surety’s consent, it would discharge the surety in respect of all transactions taking place subsequent to such variance.

- Example 20: A becomes surety to C for B’s conduct as a manager in C’s bank. Afterwards, B and C contract, without A’s consent, that B’s salary shall be raised, and that he shall become liable for one-fourth of the losses on overdrafts. B allows a customer to overdraw, and the bank loses a sum of money. A is discharged from his suretyship by the variance made without his consent and is not liable to make good this loss.

- By release or discharge of principal debtor(Section 134):The surety is discharged if the creditor:

- enters into a fresh/new contract with the principal debtor; by which the principal debtor is released, or

- does any act or omission, the legal consequence of which is the discharge of the principal debtor.

- Example 21: A contracts with B for a fixed price to build a house for B within a stipulated time, B supplying the necessary timber. C guarantees A’s performance of the contract. B omits to supply the timber. C is discharged from his suretyship.

- Example 22: A gives a guarantee to C for goods to be delivered to B. Later on, B contracts with C to assign his property to C in lieu of the debt. B is discharged of his liability and A is discharged of his liability.

- Discharge of surety when creditor compounds with, gives time to, or agrees not to sue, principal debtor[Section 135]: A contract between the creditor and the principal debtor, by which the creditor makes a composition with, or promises to give time to, or promises not to sue, the principal debtor, discharges the surety, unless the surety assents to such contract.

- Composition: If the creditor makes a composition with the principal debtor, without consulting the surety, the latter is discharged. Composition inevitably involves variation of the original contract, and, therefore, the surety is discharged.

- Promise to give time: When the time for the payment of the guaranteed debt comes, the surety has the right to require the principal debtor to pay off the debt. Accordingly, it is one of the duties of the creditor towards the surety not to allow the principal debtor more time for payment.

- Promise not to sue: If the creditor under an agreement with the principal debtor promises not to sue him, the surety is discharged. The main reason is that the surety is entitled at any time to require the creditor to call upon the principal debtor to pay off the debt when it is due and this right is positively violated when the creditor promises not to sue the principal debtor.

Cases where surety not discharged: Surety not discharged when agreement made with third person to give time to principal debtor [Section 136]: Where a contract to give time to the principal debtor is made by the creditor with a third person, and not with the principal debtor, the surety is not discharged.

- Example 23: C, the holder of an overdue bill of exchange drawn by A as surety for B, and accepted by B, contracts with M to give time to B. A is not discharged.

Creditor’s forbearance to sue does not discharge surety [Section 137]: Mere forbearance on the part of the creditor to sue the principal debtor or to enforce any other remedy against him does not, in the absence of any provision in the guarantee to the contrary, discharge the surety.

- Example 24: B owes to C a debt guaranteed by A. The debt becomes payable. C does not sue B for a year after the debt has become payable. A is not discharged from his suretyship.

Discharge of surety by creditor’s act or omission impairing surety’s eventual remedy [Section 139]: If the creditor does any act which is inconsistent with the rights of the surety or omits to do any act which his duty to the surety requires him to do, and the eventual remedy of the surety himself against the principal debtor is thereby impaired, the surety is discharged.

In a case before the Supreme Court of India, “A bank granted a loan on the security of the stock in the godown. The loan was also guaranteed by the surety. The goods were lost from the godown on account of the negligence of the bank officials. The surety was discharged to the extent of the value of the stock so lost.” [State bank of Saurashtra V Chitranjan Rangnath Raja (1980) 4 SCC 516]

- Example 25: A puts M as apprentice to B and gives a guarantee to B for M’s fidelity. B promises on his part that he will, at least once a month, see that M make up the cash. B omits to see this done as promised, and M embezzles. A is not liable to B on his guarantee.

- By the invalidation of the contract of guarantee Guarantee obtained by misrepresentation[Section 142]: Any guarantee which has been obtained by means of misrepresentation made by the creditor, or with his knowledge and assent, concerning a material part of the transaction, is invalid.

- Example 26: ‘C’ sells AC to ‘P’ on misrepresenting that it is made of copper while it is made of aluminum. ‘S’ guarantees for the same as surety without the knowledge of the fact that it is made of aluminum. Here, ‘S’ will not be liable.

- Guarantee obtained by concealment[Section 143]:Any guarantee which the creditor has obtained by means of keeping silence as to material circumstances is invalid.

- Example 27: A engages B as a clerk to collect money for him, B fails to account for some of his receipts, and A in consequence calls upon him to furnish security for his duly accounting. C gives his guarantee for B’s duly accounting. A does not acquaint C with B’s previous conduct. B afterwards makes default. The guarantee is invalid.

- Example 28: A guarantees to C payment for iron to be supplied by him to B for the amount of ₹ 2,00,000 tons. B and C have privately agreed that B should pay five rupees per ton beyond the market price, such excess to be applied in liquidation of an old debt. This agreement is concealed from A. A is not liable as a surety.

- Guarantee on contract that creditor shall not act on it until co-surety joins(Section 144):Where a person gives a guarantee upon a contract that the creditor shall not act upon it until another person has joined in it as co-surety, the guarantee is not valid if that other person does not join.

- Example 29: ‘S1’ guarantees ‘C’ for payment to be done by ‘P’ to ‘C’ on the condition that ‘S1’ will be liable only if ‘S2’ joins him for such guarantee. ‘S2’ does not give his consent. Here, ‘S1’ will not be liable.

Rights of a Surety

The surety enjoys the following rights against the creditor:- Rights against the creditor

- Rights against the principal debtor

- Rights against co-sureties

Right against the Principal Debtor

Rights of subrogation [Section 140]: Where, a guaranteed debt has become due, or default of the principal debtor to perform a guaranteed duty has taken place, the surety, upon payment or performance of all that he is liable for, is invested with all the rights which the creditor had against the principal debtor.

- This right is known as right of subrogation. It means that on payment of the guaranteed debt, or performance of the guaranteed duty, the surety steps into the shoes of the creditor.

- Example 30: ‘Raju’ has taken a housing loan from Canara Bank. ‘Pappu’ has given guarantee for repayment of such loan. Besides, there was a condition that if ‘Raju’ does not repay the loan within time, the bank can auction his property by giving 15 days notice to ‘Raju’. On due date ‘Raju’ does not repay, hence Pappu being a surety has to repay the loan. Now ‘Pappu’ can take the house from bank and has a right to auction the house by giving 15 days notice to ‘Raju’.

Implied promise to indemnify surety [Section 145]: In every contract of guarantee there is an implied promise by the principal debtor to indemnify the surety. The surety is entitled to recover from the principal debtor whatever sum he has rightfully paid under the guarantee, but not sums which he paid wrongfully.

- Example 31: B is indebted to C and A is surety for the debt. Upon default, C sues A. A defends the suit on reasonable grounds but is compelled to pay the amount. A is entitled to recover from B the cost as well as the principal debt.

- In the same case above, if A did not have reasonable grounds for defence, A would still be entitled to recover principal debt from B but not any other costs.

Right against the Creditor

Surety’s right to benefit of creditor’s securities [Section 141]: A surety is entitled to the benefit of every security which the creditor has against the principal debtor at the time when the contract of suretyship is entered into, whether the surety knows of the existence of such security or not; and, if the creditor loses, or, without the consent of the surety, parts with such security, the surety is discharged to the extent of the value of the security.

- Example 32: C advances to B, his tenant, 2,00,000 rupees on the guarantee of A. C has also a further security for the 2,00,000 rupees by a mortgage of B’s furniture. C cancels the mortgage. B becomes insolvent, and C sues A on his guarantee. A is discharged from liability to the amount of the value of the furniture.

Right to set off: If the creditor sues the surety, for payment of principal debtor’s liability, the surety may have the benefit of the set off, if any, that the principal debtor had against the creditor.

- Example 33: ‘X’ took a loan of ₹ 50,000 from ‘Y’ which was guaranteed by ‘Z’. There was one another contract between ‘X’ and ‘Y’ in which ‘Y’ had to pay ₹ 10,000 to ‘X’. On default by ‘X’, ‘Y’ filed suit against ‘Z’. Now ‘Z’ is liable to pay ₹ 40,000 (₹ 50,000 – ₹10,000).

Right to share reduction: The surety has right to claim proportionate reduction in his liability if the principal debtor becomes insolvent.

- Example 34: ‘X’ took a loan of ₹ 50,000 from ‘Y’ which was guaranteed by ‘Z’. ‘X’ became insolvent and only 25% is realised from his property against liabilities. Now ‘Y’ will receive₹12,500 from ‘X’ and now ‘Z’ is liable to pay ₹ 37,500 (₹ 50,000 – ₹ 12,500).

Rights against Co-sureties

Co-sureties (meaning): When the same debt or duty is guaranteed by two or more persons, such persons are called co-sureties.

Co-sureties liable to contribute equally [Section 146]: Unless otherwise agreed, each surety is liable to contribute equally for discharge of whole debt or part of the debt remains unpaid by debtor.

- Example 35: A, B and C are sureties to D for the sum of 3,00,000 rupees lent to E. E makes default in payment. A, B and C are liable, as between themselves, to pay 1,00,000 rupees each.

- Example 36: A, B and C are sureties to D for the sum of 1,00,000 rupees lent to E, and there is a contract between A, B and C that A is to be responsible to the extent of one-quarter, B to the extent of one-quarter, and C to the extent of one-half. E makes default in payment. As between the sureties, A is liable to pay 25,000 rupees, B 25,000 rupees, and C 50,000 rupees.

Liability of co-sureties bound in different sums [Section 147]: The principal of equal contribution is, however, subject to the maximum limit fixed by a surety to his liability. Co-sureties who are bound in different sums are liable to pay equally as far as the limits of their respective obligations permit.

- Example 37: A, B and C, as sureties for D, enter into three several bonds, each in a different penalty, namely, A in the penalty of 1,00,000 rupees, B in that of 2,00,000 rupees, C in that of 4,00,000 rupees, conditioned for D’s duly accounting to E. D makes default to the extent of 3,00,000 rupees. A, B and C are each liable to pay 1,00,000 rupees.

- Example 38: A, B and C, as sureties for D, enter into three several bonds, each in a different penalty, namely, A in the penalty of 1,00,000 rupees, B in that of 2,00,000 rupees, C in that of 4,00,000 rupees, conditioned for D’s duly accounting to E. D makes default to the extent of 4,00,000 rupees; A is liable to pay 1,00,000 rupees, and B and C 1,50,000 rupees each.

- Example 39: A, B and C, as sureties for D, enter into three several bonds, each in a different penalty, namely, A in the penalty of 1,00,000 rupees, B in that of 2,00,000 rupees, C in that of 4,00,000 rupees, conditioned for D’s duly accounting to E. D makes default to the extent of 7,00,000 rupees. A, B and C have to pay each the full penalty of his bond.

|

51 videos|252 docs|57 tests

|

FAQs on Unit 7: Contract of Indemnity and Guarantee Chapter Notes - Business Laws for CA Foundation

| 1. What is a contract of indemnity under the Indian Contract Act, 1872? |  |

| 2. Who are the parties involved in a contract of indemnity? |  |

| 3. What are the rights of the indemnity-holder when sued as per Section 125 of the Indian Contract Act, 1872? |  |

| 4. How can a contract of indemnity be formed? |  |

| 5. What is the difference between a contract of indemnity and a contract of guarantee? |  |