Unit 4: Subsidiary Books Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Unit Overview |

|

| Introduction |

|

| Purchases Book |

|

| Posting the Purchases Book |

|

| Sales Book |

|

| Posting the Sales Book |

|

| Sales Returns Book or Returns Inward Book |

|

| Importance of Journal |

|

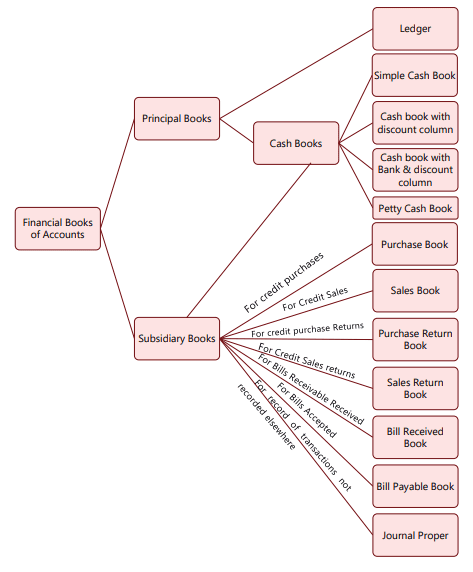

Unit Overview

Introduction

In a business, most transactions typically involve the receipt and payment of cash, as well as the sale and purchase of goods. To streamline record-keeping, it is practical to maintain separate registers for each type of transaction: one for cash receipts and payments, one for the purchase of goods, and one for the sale of goods. These registers are known as books of original entry or prime entry. Transactions recorded in these books do not require journal entries.The system where transactions of a particular class are first recorded in the designated book, specifically meant for it, and based on which ledger accounts are prepared, is called the Practical System of Bookkeeping or the English System. It is important to note that this system adheres to the principles of the double-entry system.

Books of original or prime entry are also referred to as subsidiary books because ledger accounts are prepared based on them without further processing of ledger posting. Typically, the following subsidiary books are used in a business:

- Cash Book: Records receipts and payments of cash, including cash transactions involving the bank.

- Purchases Book: Records credit purchases of goods, materials, and stores required in the factory.

- Purchase Returns Book: Records returns of goods and materials previously purchased.

- Sales Book: Records sales of goods dealt with by the firm.

- Sale Returns Book: Records returns of goods made by customers that were sold to them earlier.

- Bills Receivable Book: Records receipts of promissory notes or hundies from various parties.

- Bills Payable Book: Records the issuance of promissory notes or hundies to other parties.

- Journal (Proper): Records transactions that cannot be recorded in any of the seven books mentioned above.

It is worth noting that in all these cases, the term “Journal” may be used interchangeably with “book.”

Advantages of Subsidiary Books:

- Division of work: Instead of relying on a single journal, using multiple subsidiary books allows the accounting tasks to be shared among several clerks.

- Specialization and efficiency: When a specific person is responsible for the same type of work over time, they gain a deeper understanding of it, becoming more skilled and effective in completing those tasks.

- Saving of time: With various accounting books in use, different processes can be carried out at the same time, speeding up the overall work completion.

- Availability of information: Each type of transaction is recorded in its own book, making it easy to find all related information in one spot.

- Facility in checking: If the trial balance doesn't match, having separate books makes it easier to find and correct errors. This system also helps detect mistakes and fraud.

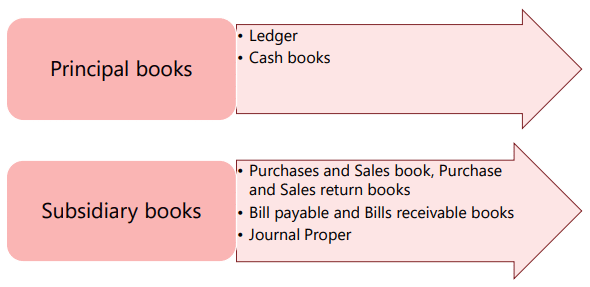

Difference Between Subsidiary Books and Principal Books

The books where transactions are initially recorded for further processing are known as subsidiary books. In contrast, the ledger and cash book are referred to as principal books because they provide essential information for preparing the trial balance and financial statements. The chart below will clarify the distinctions between subsidiary books and principal books.

Purchases Book

To keep track of credit purchases for goods or materials used in a business, companies usually maintain a special register known as the Purchases Book or Purchases Journal. The typical layout includes the following sections:

- Date

- Particulars

- Details

- Amount

Here are some important points to remember:

- Cash purchases are not recorded in this book because they are documented in the cash book.

- Credit purchases of items that are not goods or materials, like office furniture or typewriters, are entered in the journal and not in the Purchases Book.

The Particulars column is used to note the name of the supplier and the items bought along with their quantities. The Details column includes the amount for each item. After calculating the total for each purchase, any additional costs like packing charges are added, and any trade discounts are subtracted. The final total is recorded in the Amount column. The sum in this column reflects the total purchases made during a specific time period.

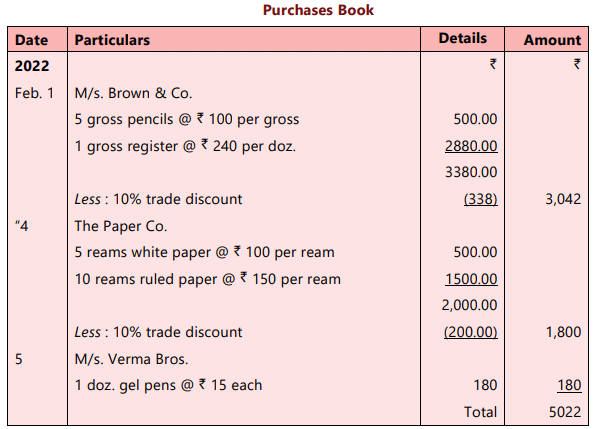

ILLUSTRATION 1

The Rough Book of M/s. Narain & Co. contains the following :

2022 Feb.

- Purchased from Brown & Co. on credit :

5 gross pencils @ ₹100 per gross,

1 gross register @ ₹ 240 per doz.

Less : Trade Discount @ 10% - Purchased for cash from the Stationery Mart; 10 gross exercise books @ ₹300 per doz.

- Purchased computer for office use from M/s. office Goods Co. on credit for ₹ 30,000.

- Purchased on credit from The Paper Co.

5 reams of white paper @ ₹100 per ream.

10 reams of ruled paper @ ₹150 per ream.

Less : Trade Discount @ 10% - Purchased one dozen gel pens @₹15 each from

M/s. Verma Bros. on credit.

Make out the Purchase Book of M/s. Narain & Co.

SOLUTION

Note : Purchases of cash and purchase of computer are not recorded in the Purchase Book.

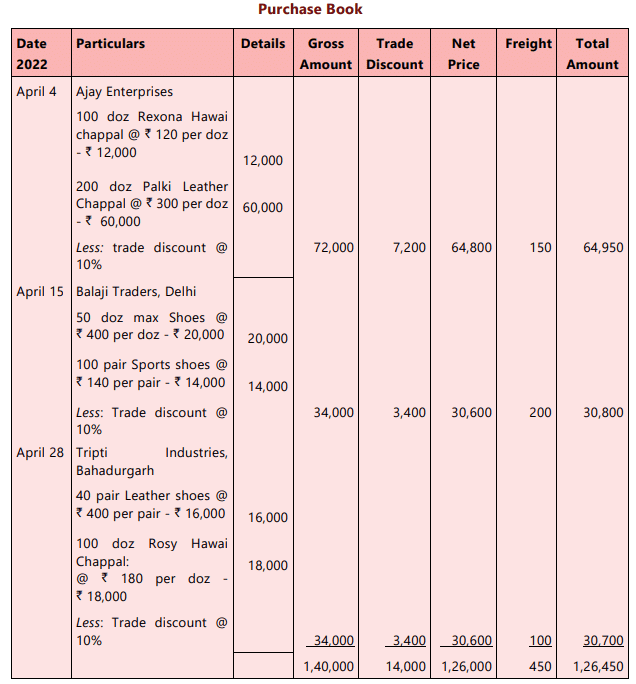

ILLUSTRATION 2

Enter the following transactions in Purchase Book and post them into ledger.

2022

April

- 4 Purchased from Ajay Enterprises, Delhi

- 100 Doz. Rexona Hawai Chappal @ ₹120 per doz.

- 200 Doz. Palki Leather Chappal @ ₹ 300 per Doz.

April 15

- Less : Trade discount @ 10%

- Freight charged ₹ 150.

- Purchased from Balaji Traders, Delhi

- 50 doz. Max Shoes @ ₹ 400 per doz.

- 100 pair Sports Shoes @ ₹ 140 per pair.

- Less : Trade discount @ 10%.

- Freight charged ₹ 200.

April 28

- Purchased from Tripti Industries, Bahadurgarh

- 40 pair leather shoes @ ₹ 400 per pair

- 100 doz. Rosy Hawai Chappal @ ₹ 180 per doz.

- Less : Trade discount @ 10%.

- Freight charged ₹ 100.

SOLUTION

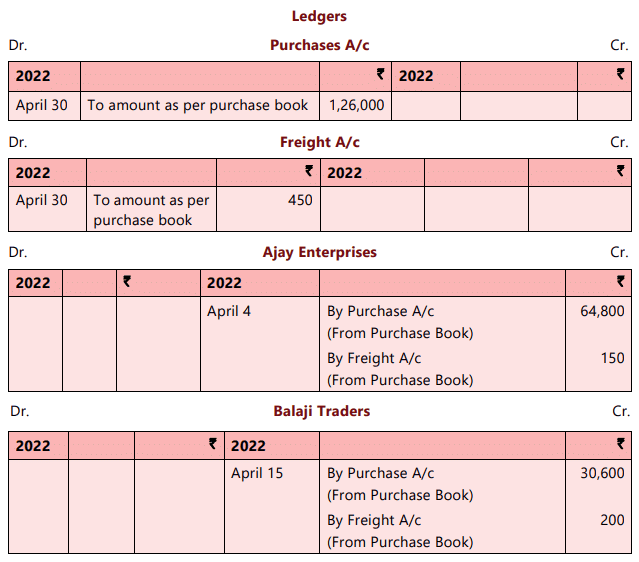

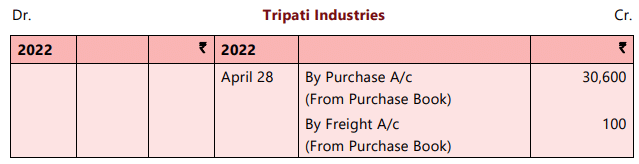

Posting the Purchases Book

The Purchases Book records the names of parties from whom goods have been acquired on credit, making them trade payables. Their accounts are credited with the respective amounts listed in the purchase book. The total of the amounts column reflects the credit purchases made during a specific period. The Purchase Account is debited to signify the receipt of goods. In Illustration 1, the Purchases Account is debited by ₸5,022, while M/s. Brown & Co. is credited by ₹3,042, The Paper Company by ₹1,800, and M/s. Verma Bros. by ₹180. The total amounts credited equal the debit, thereby completing the double entry.Sales Book

A Sales Book is a special register used to record credit sales of goods that a firm deals in. Cash sales are recorded in the Cash Book and not in the Sales Book. If a firm makes credit sales of items that it does not deal in, those sales are journalized instead of being entered in the Sales Book.Similarity with Purchases Book

- The rules for entering sales in the Sales Book are the same as those for the Purchases Book.

- Entries in the Sales Book are made in the same way as in the Purchases Book.

Details in the Sales Book

- Particulars Column: This column records the names of the customers, along with details and quantities of the goods sold.

- Amount Entry: The amount for each item is entered in the details column. After totaling the amounts for one sale, additional charges like packing are added, and any trade discount is deducted. The net amount is then put in the outer column.

- Total Credit Sales: The total of the outer column shows the total credit sales for a specific period.

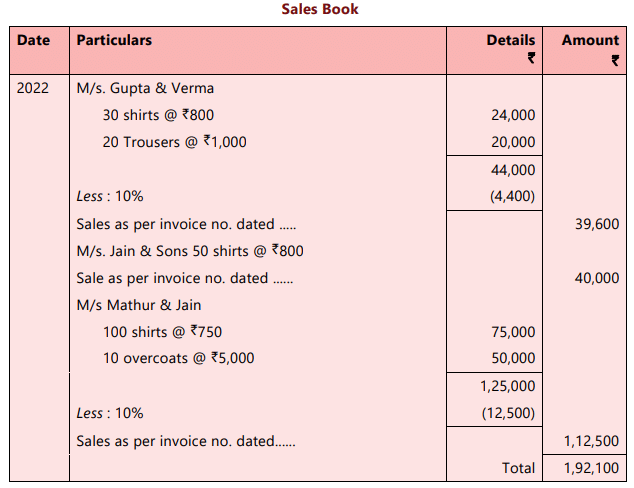

ILLUSTRATION 3

The following are some of the transaction of M/s Kishore & Sons of the year 2022 as per their Waste Book. Make out their Sales Book.

Sold to M/s. Gupta & Verma on credit:

30 shirts @ ₹ 800 per shirt.

20 trousers @ ₹1,000 per trouser.

Less : Trade Discount @ 10%

Sold furniture to M/s. Sehgal & Co. on credit ₹8,000.

Sold 50 shirts to M/s. Jain & Sons @ ₹800 per shirt.

Sold 13 shirts to Cheap Stores @ ₹750 each for cash.

Sold on credit to M/s. Mathur & Jain.

100 shirts @ ₹750 per shirt

10 overcoats @ ₹5,000 per overcoat.

Less: Trade Discount @ 10%

SOLUTION

Note : Cash sale and sale of furniture are not entered in Sales Book.

Posting the Sales Book

The Sales Book lists the names of parties that have received goods, requiring their accounts to be debited with the corresponding amounts. The total sales recorded in the Sales Book represent credit sales for the specified period, with this total credited to the Sales Account. For example, in Illustration 3, ₹1,92,100 is credited to the Sales Account; ₹39,600 is debited to M/s. Gupta and Verma, ₹40,000 to M/s Jain and Sons, and ₹1,12,500 to M/s Mathur & Jain. The amounts on the credit side equal the total on the debit side, demonstrating adherence to the double entry principle.

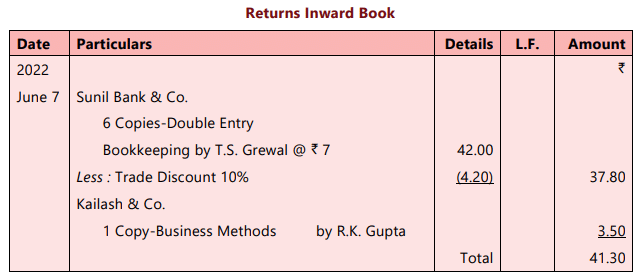

Sales Returns Book or Returns Inward Book

- If customers often send back the items they bought, it is helpful to keep track of these returns in a special book.

- This book is called the Sales Returns Book or the Returns Inward Book.

- The rules for using this book are similar to those for the Sales Book.

- Entries in the Sales Returns Book are recorded in the same way as in the Sales Book.

To illustrate this, let's use some example numbers:

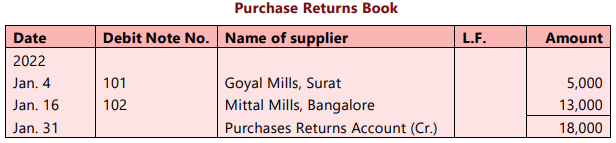

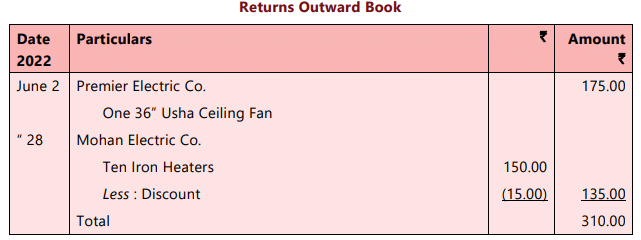

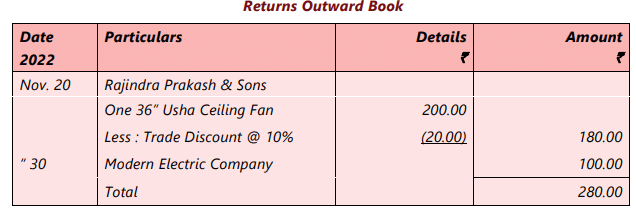

Purchase Returns or Returns Outward Book

- A Purchase Returns Book is used to keep track of the goods or materials that are returned to suppliers.

- If returns are not made often, it might be enough to just write these transactions in the journal.

- The rules for the Purchase Returns Book are similar to those for the Purchase Book.

- The way entries are recorded follows the same process, as shown in the example below.

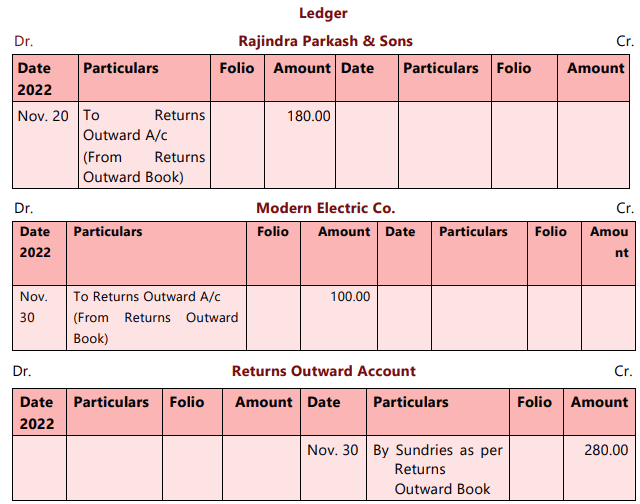

Posting of the Return Books

Sales Return Book:- Records total returns made by customers.

- Reduces overall sales figures.

- Amount can be debited to Sales Account, but usually to a separate Returns Inward Account.

- Customers returning goods are credited with respective amounts.

Credit Notes:

- Issued to customers when goods are received back.

- Indicates amount to be credited to the customer’s account.

Returns to Suppliers:

- When goods are returned to suppliers, they issue a credit note.

- The firm returning the goods also issues a debit note to the supplier.

- Debit note indicates the amount for which the supplier account is being adjusted.

The total of Returns Outwards Book shows the total purchase returns made. The amount can be credited to the Purchase Account, but in practice, it is credited to a separate account called Purchase Returns or Returns Outward Account. The suppliers whose names appear in the Book have received the goods, so their accounts are debited. This is shown in the illustration given below:

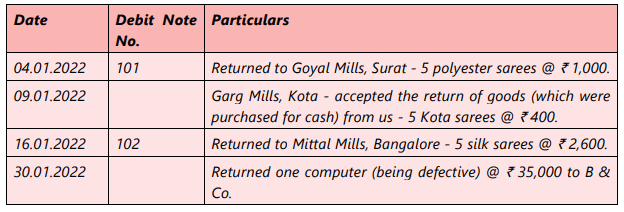

ILLUSTRATION 4

Post the following into the ledger

SOLUTION

Bills Receivable and Bills Payable Books

When a firm regularly receives a number of promissory notes or hundies, it is practical to record these transactions in a separate book known as the Bills Receivable Book. Conversely, when promissory notes or hundies are frequently issued, maintaining a Bills Payable Book becomes convenient.

Importance of Journal

The journal plays a crucial role in maintaining the accuracy and integrity of financial records in a business. Here are some of the key points highlighting the importance of the journal:

- Record of Transactions: The journal serves as the primary book of accounts where all financial transactions are recorded as soon as they occur. This ensures that no transaction is missed or recorded incorrectly.

- Debit and Credit Aspects: The journal clearly shows the debit and credit aspects of each transaction, helping to maintain the balance in the accounts.

- Basis for Ledger: The transactions recorded in the journal are later transferred to the respective accounts in the ledger. This forms the basis for preparing the financial statements of the business.

- Monitoring Financial Performance: By keeping a record of all transactions, the journal provides a clear picture of the financial position of the business at any given point of time. This helps in monitoring the financial performance of the business.

- Error Rectification: If any error is committed in recording a transaction, it can be rectified through a journal entry. This helps in maintaining the accuracy of financial records.

- Transfer of Amounts: The journal is used to transfer amounts from one account to another, ensuring proper allocation of funds.

- Adjusting Entries: At the end of the year, adjusting entries such as outstanding expenses, prepaid expenses, interest on capital, and depreciation are made through the journal. This ensures that the financial statements reflect the true financial position of the business.

- Miscellaneous Entries: The journal is also used to record miscellaneous entries such as credit purchases of items other than goods, allowance to customers, receipt or issue of promissory notes, irrecoverable amounts, effects of accidents, and transfer of net profit to capital account.

In summary, the journal is an essential tool for maintaining the accuracy and integrity of financial records in a business. It helps in keeping track of all financial transactions and provides a basis for preparing financial statements.

ILLUSTRATION 5

From the following transactions, prepare the Purchases Returns Book of Alpha & Co., a saree dealer :

SOLUTION

|

68 videos|375 docs|83 tests

|

FAQs on Unit 4: Subsidiary Books Chapter Notes - Accounting for CA Foundation

| 1. What is a Purchases Book and what is its purpose in accounting? |  |

| 2. How do you post transactions from the Purchases Book to the General Ledger? |  |

| 3. What is the significance of the Sales Book in accounting? |  |

| 4. How are sales returns recorded in the Sales Returns Book? |  |

| 5. Why are subsidiary books important in accounting? |  |