Depreciation and Amortisation Chapter Notes | Accounting for CA Foundation PDF Download

Chapter Overview

Concept of Depreciation

- Tangible Assets are physical assets that can be seen and touched. They are held for use in producing or supplying goods or services, renting to others, or for administrative purposes. The useful life of a tangible asset is based on its expected usage.

- Property, plant, and equipment are tangible items that are:

(a) Held for use in producing or supplying goods or services, renting to others, or for administrative purposes.

(b) Expected to be used for more than twelve months. - These are commonly known as fixed assets. When a fixed asset is purchased, it is recorded in the accounts at its original cost. However, fixed assets are used to generate revenue or save costs over several accounting periods at the same acquisition cost until they are sold or discarded.

- For example, a machine bought for production expected to last 10 years will generate revenue over that period. Similarly, an ATM machine installed by a bank will save costs over its expected life by eliminating the need for personnel to dispense cash.

- Since the life of such assets exceeds one year, a portion of their acquisition cost needs to be allocated as an expense in each accounting period they are used. This allocated amount is called depreciation. The value of fixed assets decreases over time due to:

1. Wear and tear from use in business.

2. Passage of time (even when not in use).

3. Obsolescence due to technological or other changes.

4. Decrease in market value.

5. Depletion, especially in cases like mines and natural reserves. - It is crucial to account for the portion of property, plant, and equipment used to generate revenue in a year to accurately determine income. Depreciation reflects the cost of the asset used in generating income or cost savings.

- According to Schedule II of the Companies Act, 2013, depreciation is the systematic allocation of an asset's depreciable amount over its useful life. The depreciable amount is the asset's cost or revalued amount minus its residual value. The useful life is the period an asset is expected to be used or the number of units expected to be produced from it.

Three key factors for computing depreciation are:

- Estimated useful life of the asset2. Cost of the asset3. Residual value at the end of its useful life1. Estimated Useful Life of the Asset: This refers to the duration for which the asset is expected to be useful for the business. It could be based on industry standards, manufacturer’s guidelines, or historical data of similar assets. 2. Cost of the Asset: The total expenditure incurred to acquire the asset and make it ready for use. This includes the purchase price, taxes, installation charges, and any other costs directly attributable to bringing the asset to working condition. 3. Residual Value: This is the estimated salvage value of the asset at the end of its useful life. It is the amount the business expects to recover from the asset after it has been fully depreciated.

- Depreciation Start Date: Depreciation begins when the asset is ready for use, meaning it is in the right location and condition to operate as intended. An asset can depreciate even if it is not actively used, as its value decreases due to wear and tear or obsolescence.

- Matching Principle: Depreciation should be allocated in a way that a fair portion of the depreciable amount is charged in each accounting period during the asset’s useful life. This aligns with the matching principle, where expenses are matched with the revenues they help generate.

- Expired and Unexpired Costs: The total cost of the asset is reflected as a) Expired cost (depreciation) and b) Unexpired Cost, which is the written down value of the asset shown in the balance sheet.

- Impact on Profits: Charging depreciation annually reduces distributable profits, ensuring funds are available for future asset replacements.

- Business Expenditure: Depreciation is a type of loss in asset value and is an essential part of business expenditure. It is necessary to calculate this loss and make a provision to determine the profit or loss of the business accurately.

- Economic Life: The cost of an asset used for business purposes should be written off over its economic life, which is estimated based on how long the asset will be useful. At the end of its economic life, the asset usually has some scrap value or residual value.

- Scrap Value: The amount to be written off each year should be calculated to reduce the book value of the asset to its estimated scrap value by the end of its economic life.

Depreciation on Components of Assets

- Accounting Standards and the Companies Act, 2013 mandate that depreciation be charged on a component basis. This means that each significant part of an item of Property, Plant and Equipment (PPE) should be depreciated separately.

- An enterprise must allocate the initial cost of an item of PPE to its significant parts or components and depreciate each part based on its useful life and residual value.

- For example, consider an aircraft, which consists of the airframe, engines, and interiors, each with different useful lives. While the airframe may have the longest life and be considered the overall life of the aircraft, the engines and interiors should be depreciated over their respective useful lives.

- Small and low-value components that need frequent replacement may be depreciated over the airframe's useful life, with the cost of their frequent replacements expensed as incurred.

Criteria for Identifying Separate Components

To identify a part of Property, Plant & Equipment as a separate component, it must meet two criteria:

- Significant Cost: The cost of the component should be significant compared to the overall cost of the item.

- Different Useful Life or Depreciation Method: The component should have an estimated useful life or depreciation method that differs from the rest of the parts of the property, plant, and equipment.

Grouping of Components

- A significant part of an item of property, plant, and equipment may have the same useful life and depreciation method as another significant part of the same item.

- In such cases, these parts can be grouped together when determining the depreciation charge.

Objectives for Providing Depreciation

Depreciation is an essential accounting practice that serves several important objectives for businesses. Here are the prime objectives for providing depreciation:1. Correct Income Measurement:

- Depreciation is crucial for accurately estimating the periodic profit or loss of an enterprise.

- If an enterprise fails to account for depreciation on its Property, Plant, and Equipment (PPE), it overlooks the loss in value of these assets due to their use in production or operations.

- This omission can lead to a misleading representation of the true profit or loss for the period.

2. True Position Statement:

- The value of Property, Plant, and Equipment should be adjusted for the depreciation charged to reflect the actual financial position of the business.

- If depreciation is not accounted for appropriately, PPE may be reported in financial statements at a value higher than their true worth.

- It is essential to present these assets at their unexpired cost, which is the value after deducting the expired cost through depreciation.

3. Funds for Replacement:

- Depreciation helps generate adequate funds for the replacement of assets at the end of their useful life.

- It indicates the amount an enterprise should set aside to replace a fixed asset once its economic useful life is over.

- However, the replacement cost may also be influenced by factors such as inflation and technological changes

4. Ascertainment of True Cost of Production:

- Depreciation is necessary for determining the true cost of production, as it is considered an item of production cost.

- Unlike other expenses such as wages or rent, depreciation is a non-cash expense and does not result in an immediate cash outflow.

- It serves to highlight the need to retain a portion of gross revenue receipts for the replacement of assets used in operations.

- By charging depreciation, businesses reduce distributable profits and ensure funds are set aside for asset replacement.

Factors in the Measurement of Depreciation

- Cost of Asset: This includes the total expenses incurred to acquire the asset, such as installation, commissioning, and trial runs.

- Estimated Useful Life: This refers to the period over which the asset is expected to be used, or the number of units it is expected to produce. This estimation is based on various factors, including past experiences with similar assets.

- Estimated Scrap Value: This is the expected residual value of the asset at the end of its useful life. If this value is considered negligible, it is often set to zero.

1. Cost of Asset:

- The cost of a depreciable asset includes all expenses related to its acquisition, installation, and commissioning, as well as any improvements made to enhance its efficiency.

- The cost also covers expenses for trial runs and any necessary adjustments before the asset is put into regular use.

2. Estimated Useful Life:

The useful life of an asset can be defined in two ways:

- (i) the period during which the asset is expected to be used by the enterprise, or

- (ii) the number of production or similar units anticipated from the asset's use.

- Determining the useful life is an estimation process that takes into account factors such as past experiences with similar assets, expected working hours, production capacity, and the need for repairs and maintenance.

3. Estimated Scrap Value:

- The residual or scrap value is the estimated value of the asset at the end of its useful life.

- If the residual value is expected to be minimal, it is often considered to be zero.

- Conversely, if the residual value is expected to be significant, it should be estimated at the time of asset acquisition or installation, or during subsequent revaluations of the asset.

4. Depreciable Amount:

- The depreciable amount of an asset is calculated by subtracting the estimated residual value from its historical cost or revalued amount.

- For example, if machinery is purchased for ₹1,10,000 with a residual value of ₹10,000 and an expected useful life of 5 years, the depreciable amount would be ₹1,00,000 (₹1,10,000 - ₹10,000).

Depreciation = Depreciable amount / Estimated useful life i.e. ₹ 1,00,000/ 5 = ₹ 20,000 per year

Cost of Property, Plant, and Equipment

The cost of Property, Plant, and Equipment (PPE) includes various components that are essential to bring the asset to a condition and location suitable for its intended use.

(a) Purchase Price. This includes the purchase price after deducting trade discounts and rebates, along with non-refundable import duties and purchase taxes.

(b) Directly Attributable Costs. These are costs that can be directly linked to bringing the asset to the desired location and condition. Examples include:

- Cost of employee benefits directly related to the acquisition or construction of the asset.

- Cost of site preparation.

- Initial delivery and handling costs.

- Installation and assembly costs.

- Testing costs to ensure the asset is functioning properly, after deducting net proceeds from selling items produced during testing.

- Professional fees, such as engineers hired for installation assistance.

(c) Initial Estimate of Dismantling Costs. This includes the estimated costs of dismantling, removing the item, and restoring the site where the asset is located.

Costs Not Included in Asset Cost. Certain expenses should not be included in the cost of the asset, such as:

- Costs of opening a new facility or business (e.g., inauguration costs).

- Costs of introducing a new product or service (e.g., advertising or promotional costs).

- Costs of conducting business in a new location or with a new customer class (e.g., staff training costs).

- Administration and general overhead costs.

Capitalization Criteria. Costs should only be recognized as part of the asset's cost if they significantly increase the asset's useful life or production capacity. Costs incurred while the asset is capable of operating as intended but is not yet in use or is used at less than full capacity should not be capitalized. Similarly, costs related to the relocation of an asset should not be capitalized.

Depreciation of Additions. Additions made to an item of PPE after it has been put to use are depreciated over the remaining useful life of the asset. If an addition or extension has a separate identity and can be used after the existing asset is disposed of, it should be accounted for separately.

Importance of Asset Register. Maintaining an asset register is crucial to capture details such as cost, depreciation rate, and date of capitalization for each asset. This information is also necessary for any additions to existing assets. Without adequate information, it becomes challenging to compute depreciation expenses year after year and determine gains or losses on asset disposals or discards.

Methods for Providing Depreciation

Depreciation methods are typically based on formulas that reflect the historical behavior of assets over time, aiming to accurately compute the depreciation incurred by various asset types. However, each method should be applied with careful consideration of the asset's nature and usage conditions.

Commonly Used Methods of Depreciation

- Straight-Line Method: This method results in a constant annual charge over the asset's useful life, assuming the residual value remains unchanged.

- Diminishing Balance Method: This method leads to a decreasing charge over the asset's useful life.

The Income Tax Rules typically prescribe the Diminishing Balance Method, except for assets used in power generation and distribution.

Straight Line Method

- The Straight-Line Method involves writing off an equal amount each year over the asset's working life, reducing its cost to zero or its residual value by the end of its useful life.

- This method is advantageous because it is simple to apply and yields accurate results, particularly for leases and assets like plant and machinery. It is also known as the Fixed Instalment Method.

Formulae:

- Straight Line Depreciation: Cost of Asset - Scrap Value / Useful Life

- Straight Line Depreciation Rate: Straight Line Depreciation x 100 / Cost of Asset

- The underlying assumption of this method is that the tangible asset provides equal utility throughout its lifetime. However, this is not always the case.

- In the earlier years, repair and maintenance costs are generally lower, while they increase as the asset ages. Additionally, the asset's capacity may vary over the years, suggesting the need for unequal depreciation provisions.

- Nevertheless, for many assets with minimal repair and maintenance expenses, the Straight-Line Method is applicable.

- When using this method, it is important to consider the period of use for an asset in a given year.

- For example, if an asset is purchased partway through a year, depreciation should be prorated to reflect the actual period of use.

- For instance, if an asset is bought on March 1, 2022, and the financial statements are prepared for the year ending March 31, 2022, depreciation would be calculated for only one month.

- A similar situation occurs in the year when an asset is retired from use or sold.

Reducing or Diminishing Balance Method

Introduction

- The Reducing or Diminishing Balance Method, also known as the Written Down Value (WDV) Method, involves writing off a fixed percentage of the diminishing value of an asset each year.

- This method aims to reduce the asset's value to its residual value by the end of its useful life.

- It is commonly used for plant, fixtures, and similar assets.

Key Features

- Annual Charge: The annual charge for depreciation decreases over time.

- Asset Value: Unlike the Straight Line Method, the asset's value is never completely extinguished.

- Repair Costs: This method assumes that repair costs will increase as the asset ages.

- Depreciation Timing: Higher depreciation is allocated in the earlier years when repair costs are expected to be low, and lower depreciation is allocated in the later years when repair costs are expected to be high.

Rationale

- The Reducing Balance Method aims to distribute the burden of depreciation evenly across the asset's life.

- It balances the decreasing depreciation with the increasing repair costs over time.

Comparison with Straight Line Method

- Straight Line Method: Charges a constant amount for depreciation each year.

- Reducing Balance Method: Charges a decreasing amount for depreciation each year.

- Repair Costs: In the Straight Line Method, repair costs tend to increase with the asset's life, while in the Reducing Balance Method, depreciation is higher in the early years when repair costs are lower.

Disadvantages

- Low Depreciation Rate: If a too-low percentage is adopted for depreciation, it may result in insufficient depreciation over the asset's life.

- Asset Grouping: Grouping assets in a way that individual assets are difficult to identify can lead to residues remaining in the asset account even after the asset has been scrapped.

Overcoming Difficulties

- Maintaining a Plant Register can help overcome the difficulty of asset grouping and identification.

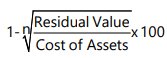

The rate of depreciation under this method may be determined by the following formula:  where, n = useful life

where, n = useful life

Similar to straight line method, in this method also period of use in a particular year e.g. year of purchase or sale an item of property plant and equipment needs to be considered while computing the depreciation amount.

Accounting Entries under Straight Line and Reducing Balance Methods

There are two methods for recording accounting entries for depreciation:

First Alternative

This method involves opening a provision for depreciation or an accumulated depreciation account to accumulate the balance of depreciation while carrying the assets at their historical cost. Most organizations prefer this method as it presents both the gross investment and the current value of the assets.

Accounting Entry:

- Depreciation Account Dr.

- To Provision for Depreciation Account or Accumulated Depreciation

- Profit and Loss Account Dr. To Depreciation Account

Second Alternative

In this method, the amount of depreciation is credited to the asset account every year, and the asset account is carried at historical cost less depreciation.

Accounting Entries:

- Depreciation Account Dr. To Asset Account

- Profit and Loss Account Dr. To Depreciation Account

ILLUSTRATION 1

Jain Bros. acquired a machine on 1st July, 2021 at a cost of ₹ 14,00,000 and spent ₹ 1,00,000 on its installation. The firm writes off depreciation at 10% p.a. of the original cost every year. The books are closed on 31st December every year.

Required

Show the Machinery Account and Depreciation Account for the year 2021 and 2022.

SOLUTION

ILLUSTRATION 2

Jain Bros. acquired a machine on 1st July, 2021 at a cost of ₹ 14,00,000 and spent ₹ 1,00,000 on its installation. The firm writes off depreciation at 10% p.a. every year. The books are closed on 31st December every year.

Required

Show the Machinery Account on diminishing balance method for the year 2021 and 2022.

SOLUTION

As per Reducing Balance Method

Sum of Years of Digits Method

- This method is a variation of the "Reducing Balance Method."

- In the Sum of Years of Digits Method, annual depreciation is calculated by multiplying the original cost of the asset (minus its estimated scrap value) by a fraction.

- The fraction is determined by:

- For example, if an asset's estimated life is 10 years, the total of all digits from 1 to 10 is 55. This total can be calculated by summing the digits or using the formula n(n+1) / 2, where n is the number of years.

- In the first year, the depreciation would be 10/55 of the cost of the asset minus the estimated scrap value. In the second year, it would be 9/55, and so on.

- Although this method is not widely used yet, its advantages are similar to those of the Reducing Balance Method.

ILLUSTRATION 3

M/s Akash & Co. purchased a machine for ₹ 10,00,000. Estimated useful life and scrap value were 10 years and ₹ 1,20,000 respectively. The machine was put to use on 1.1.2017.

Required

Show Machinery Account and Depreciation Account in their books for 2022 by using sum of years digits method.

SOLUTION

Working Notes:

(1) Total of sum of digit of depreciation for 2017-21

(2) Written down value as on 1-1-2022

₹ 10,00,000 – ₹ 6,40,000 = ₹ 3,60,000(3) Depreciation for 2022

(₹ 10,00,000 – ₹ 1,20,000) × 5/ 55 = ₹80,000.

Machine Hour Method

- The Machine Hour Method of depreciation is used when it is feasible to track the actual running hours of each machine. Under this method, depreciation is calculated based on the number of hours a machine has worked. The machine hour rate for depreciation is determined by estimating the total number of hours the machine is expected to operate during its entire lifespan.

- However, this rate may need to be adjusted over time due to changes in economic and technological conditions to ensure that the depreciation amount remains appropriate. This method is essentially a variation of the Straight Line Method, where depreciation is calculated per year. In the Machine Hour Method, depreciation is calculated for each hour the machine operates.

- Schedule II of the Companies Act 2013 recognizes this method to some extent by prescribing the estimated useful life of different assets for companies. It suggests charging depreciation based on the estimated useful life provided in the schedule. However, for certain categories of plant and machinery, it allows for higher depreciation charges if these assets are used for two or three shifts. In this way, Schedule II combines elements of the Straight Line Method and the Machine Hour Method.

ILLUSTRATION 4

A machine was purchased for ₹ 30,00,000 having an estimated total working of 24,000 hours. The scrap value is expected to be ₹ 2,00,000 and anticipated pattern of distribution of effective hours is as follows :

Year

1– 3 3,000 hours per year

4- 6 2,600 hours per year

7- 10 1,800 hours per year

Required

Determine Annual Depreciation under Machine Hour Rate Method.

SOLUTION

Statement of Annual Depreciation under Machine Hours Rate Method

|

Test: Depreciation Accounting - 2

|

Start Test |

Production Units Method

The Production Units Method calculates depreciation based on the actual production of an asset compared to its estimated total production capacity. This method is suitable for machines that produce items with uniform specifications.Formula:

- Depreciation Expense = (Production during the period / Estimated total production) × Depreciable Amount

ILLUSTRATION 5

A machine is purchased for ₹ 20,00,000. Its estimated useful life is 10 years with a residual value of ₹ 2,00,000. The machine is expected to produce 1.5 lakh units during its life time. Expected distribution pattern of production is as follows:

Year Production

1-3 20,000 units per year

4-7 15,000 units per year

8-10 10,000 units per year

Required

Determine the value of depreciation for each year using production units method.

SOLUTION

Statement showing Depreciation under Production Units Method

Depletion Method

- Depletion refers to the way we spread out the cost of using up natural resources like oil, gas, timber, and minerals across the production process.

- This method is commonly applied in places like mines and quarries, where there is a limited amount of a resource available.

- The depreciation rate is determined by taking the total cost of the resource and dividing it by the estimated amount that can be extracted.

- To calculate the annual depreciation, you multiply the amount of the resource extracted in a year by the rate per unit.

ILLUSTRATION 6

M/s Surya & Co. took lease of a quarry on 1-1-2019 for ₹ 1,00,00,000. As per technical estimate the total quantity of mineral deposit is 2,00,000 tonnes. Depreciation was charged on the basis of depletion method. Extraction pattern is given in the following table:

Required

Show the Quarry Lease Account and Depreciation Account for each year from 2019 to 2021.

SOLUTION

Profit or Loss on Sale/Disposal of Property, Plant, and Equipment

- When a depreciable asset is sold during the year, depreciation is applied to it for the period it has been used in the year of sale. The written down value after accounting for this depreciation is used to calculate the profit or loss on the sale of that asset.

- The resulting profit or loss from the sale is eventually transferred to the profit and loss account. All entries related to the sale and the profit or loss on the sale of the asset are posted in the respective asset account.

Alternatively, a new account called the "Asset Disposal Account" can be created in the ledger to calculate the profit or loss on the sale of an asset. In this case, the book value of the asset is transferred from the asset account to the asset disposal account. All entries related to the sale, such as sale proceeds and the calculation of profit or loss on the sale, are posted in the Asset Disposal Account.

For example: The book value of the asset as on 1st January, 2022 is ₹ 50,00,000. Depreciation is charged on the asset @10%. On 1st July 2022, the asset is sold for ₹ 32,00,000. In such a situation, profit or loss on the sale will be calculated as follows:

ILLUSTRATION 7

A firm purchased on 1st January, 2020 certain machinery for ₹ 5,82,000 and spent ₹ 18,000 on its erection. On July 1, 2020 another machinery for ₹ 2,00,000 was acquired. On 1st July, 2021 the machinery purchased on 1st January, 2020 having become obsolete was auctioned for ₹ 3,86,000 and on the same date fresh machinery was purchased at a cost of ₹ 4,00,000.

Depreciation was provided for annually on 31st December at the rate of 10 per cent p.a. on written down value.

Required

Prepare machinery account.

SOLUTION

Working Note

ILLUSTRATION 8

On April 1, 2019 Shubra Ltd. purchased a machinery for ₹ 12,00,000. On Oct 1, 2021, a part of the machinery purchased on April 1, 2019 for ₹ 80,000 was sold for ₹ 45,000 and a new machinery at a cost of ₹ 1,58,000 was purchased and installed on the same date. The company has adopted the method of providing 10% p.a. depreciation on the written down value of the machinery.

Required : Show the necessary ledger accounts for the years ended 31st March, 2020 to 2022 assuming that

(a) ‘Provision for Depreciation Account’ is not maintained

(b) Provision for Depreciation Account is maintained.

SOLUTION

(a) When ‘Provision for Depreciation Account’ is not maintained.

(b) When ‘Provision for Depreciation Account’ is maintained

Working Notes:

(1) Calculation of Profit/Loss on Sale of Machinery

(2) Calculation of Depreciation for Current Year on Machines (other than sold)

ILLUSTRATION 9

A firm purchased second hand machinery on 1st January, 2019 for ₹ 3,00,000, subsequent to which ₹ 60,000 and ₹ 40,000 were spent on its repairs and installation, respectively. On 1st July, 2020 another machinery was purchased for ₹ 2,60,000. On 1st July, 2021, the first machinery having become outdated was auctioned for ₹ 3,20,000 and on the same date, another machinery was purchased for ₹ 2,50,000.

On 1st July, 2022, the second machinery was also sold off and it fetched ₹ 2,30,000.

Depreciation was provided on machinery @ 10% on the original cost annually on 31st December, under the straight line method.

Required

Prepare the following accounts in the books of the company:

(i) Machinery Account for the years ending Dec. 31, 2019 to 2022 and

(ii) Machinery Disposal Account.

SOLUTION

Change in Depreciation Method

- The method of depreciation applied to an asset should be reviewed at least at the end of each financial year.

- If there is a significant change in the expected pattern of how the future economic benefits of the asset will be consumed, the depreciation method should be adjusted to reflect this new pattern.

- When a change in the depreciation method is made, it is considered a change in accounting estimate according to accounting standards.

- The impact of this change needs to be quantified and disclosed separately in the financial statements.

- A change in accounting estimate can affect either the current period only or both the current and future periods.

Example:

Cost of Machine ₹ 10,50,000

Residual Value ₹ 50,000

Useful life 10 years.

The company charges depreciation on straight line method for the first two years and thereafter decides to adopt written down value method by charging depreciation @ 25%. (calculated based on useful life). You are required to calculate depreciation for the 3rd year.

Depreciation already charged for the first 2 years as per straight line method is ₹ 2,00,000. Therefore, WDV for 2nd year is ₹ 8,50,000

Therefore, in the profit and loss account of the 3rd year, the depreciation of ₹ 2,12,500 (25% of ₹ 850,000) should be debited. In case the entity would have continued with Straight Line Method, depreciation for 3rd year would have been ₹ 1,00,000.

ILLUSTRATION 10

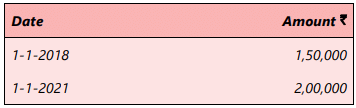

M/s Anshul & Co. commenced business on 1st January 2017, when they purchased plant and equipment for ₹ 7,00,000. They adopted a policy of charging depreciation at 15% per annum on diminishing balance basis and over the years, their purchases of plant have been: On 1-1-2021 it was decided to change the method and rate of depreciation to straight line basis. On this date remaining useful life was assessed as 6 years for all the assets purchased before 1.1.2021 with no scrap value and 10 years for the asset purchased on 1.1.2021.

On 1-1-2021 it was decided to change the method and rate of depreciation to straight line basis. On this date remaining useful life was assessed as 6 years for all the assets purchased before 1.1.2021 with no scrap value and 10 years for the asset purchased on 1.1.2021.

Required

Calculate the difference in depreciation to be adjusted in the Plant and Equipment Account for the year ending 31st December, 2021.

SOLUTION

Revision of the Estimated Useful Life of Property, Plant and Equipment

- At the end of each financial year, it is necessary to review the residual value and useful life of an asset. If these factors are expected to change based on new information, the adjustments should be made as a change in accounting estimate, following the relevant Accounting Standards.

- When the estimated useful life of an asset is revised, the written down value or the remaining depreciable amount should be spread over the newly estimated remaining useful life of the asset.

ILLUSTRATION 11

A Machine costing ₹ 6,00,000 is depreciated on straight line basis, assuming 10 years working life and Nil residual value, for three years. The estimate of remaining useful life after third year was reassessed at 5 years.

Required

Calculate depreciation for the fourth year.

SOLUTION

Depreciation per year = ₹ 6,00,000 / 10 = ₹ 60,000

Depreciation on SLM charged for three years = ₹ 60,000 x 3 years = ₹ 1,80,000

Book value of the computer at the end of third year = ₹ 6,00,000 – ₹ 1,80,000 = ₹ 4,20,000.

Remaining useful life as per previous estimate = 7 years

Remaining useful life as per revised estimate = 5 years

Depreciation from the fourth year onwards = ₹4,20,000 / 5 = ₹ 84,000 per annum

Revaluation of Property, Plant, and Equipment

- Initial Recognition: When an asset is initially recognized, it can be carried at its revalued amount if its fair value can be reliably measured. This revalued amount is the fair value at the revaluation date, less any accumulated depreciation and accumulated impairment losses (if any).

- Revaluation Option: If an entity chooses to revalue its assets:

- Adequate Intervals: Revaluations must be conducted at regular intervals (e.g., yearly) to ensure that the carrying amount does not significantly differ from the fair value at the end of the reporting period.

- Whole Class Revaluation: If an item of Property, Plant, and Equipment (PPE) is revalued, the entire class of PPE to which the asset belongs should also be revalued.

- Increase in Carrying Amount: If the carrying amount of an asset increases due to revaluation, the increase should be credited to the revaluation surplus and accumulated in equity. However, it should be recognized in the Profit and Loss statement only to the extent of reversing a previous decrease of that asset recognized in the Profit and Loss statement.

- Decrease in Carrying Amount: If the carrying amount of an asset decreases due to revaluation, the decrease should be recognized in the Profit and Loss account. However, it should be debited to the revaluation surplus to the extent of reversing a previous increase recognized in the revaluation surplus for that asset.

- Transfer of Revaluation Surplus: The revaluation surplus may be transferred directly to retained earnings when the asset is derecognized. This transfer cannot be made through the Profit or Loss statement.

- Upward Revaluation and Depreciation: In cases of upward revaluation, the excess depreciation resulting from the revaluation may be transferred from the revaluation surplus to retained earnings. This transfer cannot be made through the Profit or Loss statement.

Accounting Policy Choice: It is important to note that revaluation of Property, Plant, and Equipment is an accounting policy choice and not mandatory under accounting standards or the Companies Act, 2013.

Treatment of Revaluation Increases and Decreases:

- Increase: Credited directly to owners' interests under the heading of Revaluation surplus.

- Decrease: Charged to the Statement of Profit and Loss.

Exceptions:

- Subsequent Increase (Initially Decrease): Recognized in the Statement of Profit and Loss to the extent that it reverses a revaluation decrease of the same asset previously recognized in the Statement of Profit and Loss.

- Subsequent Decrease (Initially Increase): Decrease should be debited directly to owners' interests under the heading of Revaluation surplus to the extent of any credit balance existing in the Revaluation surplus in respect of that asset.

ILLUSTRATION 12

A machine of cost ₹12,00,000 is depreciated straight-line assuming 10 year working life and zero residual value for three years. At the end of third year, the machine was revalued upwards by ₹ 60,000 the remaining useful life was reassessed at 9 years.

Required

Calculate depreciation for the fourth year.

SOLUTION

Depreciation per year charged for three years = ₹ 12,00,000 / 10 = ₹ 1,20,000

WDV of the machine at the end of third year = ₹ 12,00,000 – ₹1,20,000 × 3 = ₹ 8,40,000.

Depreciable amount after revaluation = ₹ 8,40,000 + ₹ 60,000 = ₹ 9,00,000

Remaining useful life as per previous estimate = 7 years

Remaining useful life as per revised estimate = 9 years

Depreciation for the fourth year onwards = ₹ 9,00,000 / 9 = ₹ 1,00,000.

|

Download the notes

Chapter Notes: Depreciation and Amortisation

|

Download as PDF |

Intangible Assets

- Definition: An intangible asset is a non-physical, identifiable asset that is held for use in producing or supplying goods or services, renting to others, or for administrative purposes.

- Examples:

- Streaming rights for movies and shows on platforms like Netflix and Amazon Prime.

- Broadcasting rights for sports events such as the Cricket World Cup and the Indian Premier League.

- Landing rights at airports allowing specific time slots for aircraft.

- Legal protections such as patents, trademarks, and copyrights.

- Distribution rights for films in theaters.

- Long-term customer contracts and collected customer data.

- Purchased goodwill and computer software.

- Balance Sheet Significance: Intangible assets can constitute a significant portion of a company's balance sheet and may even surpass the value of tangible assets. For example, a long-term customer contract or prime landing slots can be more valuable than physical assets.

- Recognition Criteria: Intangible assets can be recognized in financial statements if they are identifiable, controllable, expected to bring future economic benefits, and their cost can be measured reliably.

- Measurement: Intangible assets acquired separately are usually measured at cost, which includes purchase price, import duties, taxes, and directly attributable expenses. The cost determination is similar to that of tangible assets.

- Derecognition: An intangible asset should be removed from the balance sheet when it is disposed of or when it is no longer expected to provide future economic benefits.

- Recognition of Gains or Losses: Gains or losses from the retirement or disposal of an intangible asset are recognized as the difference between net disposal proceeds and carrying amount, and are recorded as income or expense in the profit and loss statement.

Difference between Tangible and Intangible Assets

Amortisation

- Amortisation is the process of gradually allocating the cost of an intangible asset over its useful life.

- Amortisation is the same as depreciation but applies to intangible assets.

- Depreciable Amount is the cost of an asset minus its residual value.

- Useful Life can be defined as the period over which an asset is expected to be used or the number of units expected to be produced from the asset.

- Residual Value is the expected amount an enterprise will receive for an asset at the end of its useful life, after deducting disposal costs.

- Amortisation should be done systematically over the estimated useful life of the asset.

- Amortisation begins when the asset is ready for use.

- Generally, the useful life of an intangible asset is not more than ten years from the date it is available for use, unless there is evidence suggesting otherwise.

- Intangible assets with contractual rights exceeding ten years should be amortised over the extended period.

- The method of amortisation should reflect how the economic benefits of the asset are consumed.

- If this pattern is not clear, the straight-line method should be used.

- The amortisation expense for each period should be recognized as an expense, unless it is allowed or required to be included in the carrying amount of another asset.

- The residual value of an intangible asset is usually considered to be zero, unless:

- There is a third-party commitment to buy the asset at the end of its useful life.

- There is an active market for the asset where the residual value can be determined and it is likely that such a market will exist at the end of the asset's useful life.

- The amortisation period and method should be reviewed at least annually.

- If the expected useful life or the pattern of economic benefits changes significantly, the amortisation period or method should be adjusted accordingly.

ILLUSTRATION 13

Kumar R&D Co. registered a patent (the patent meets the criteria of an intangible asset) on 1st July, 2021 developed at a cost of ₹ 28,00,000 and spent ₹ 2,00,000 towards legal fees and registration. The patent is granted for a period of 10 years. The books are closed on 31st December every year.

Required

Show the Patent Account and Amortisation Account for the year 2021 and 2022.

SOLUTION

Useful Life: 10 years from 1 July, 2021

Residual Value: NIL

Value of patent = ₹ 30,00,000 (₹ 28,00,000 cost + ₹ 2,00,000 legal expenses and registration fees)

Therefore, annual depreciation: ₹ 30,00,000 ÷ 10 years = ₹ 3,00,000

ILLUSTRATION 14

Prime Streaming Co. acquired the streaming rights of a movie for ₹18,00,000 with the contracted duration of the streaming period being 10 years. At the beginning of the fourth year, based on the decline in viewership, Prime Streaming Co. decided to stream the movie only for the next 5 years.

Required

Calculate amortisation for the fourth year.

SOLUTION

Amortisation per year = ₹ 18,00,000 / 10 = ₹ 1,80,000

Amortisation on SLM charged for three years = ₹ 1,80,000 x 3 years = ₹ 5,40,000

Carrying Amount of the Streaming Rights at the end of third year = ₹ 18,00,000 – ₹ 5,40,000 = ₹ 12,60,000.

Remaining useful life as per previous estimate = 7 years

Remaining useful life as per revised estimate = 5 years

Amortisation from the fourth year onwards = ₹ 12,60,000 / 5 = ₹ 2,52,000 per annum.

|

68 videos|160 docs|83 tests

|

FAQs on Depreciation and Amortisation Chapter Notes - Accounting for CA Foundation

| 1. What is the concept of depreciation in accounting? |  |

| 2. What are the main objectives for providing depreciation? |  |

| 3. What are the different methods used for providing depreciation? |  |

| 4. How is profit or loss calculated on the sale or disposal of property, plant, and equipment? |  |

| 5. What is the significance of revaluating property, plant, and equipment? |  |