Unit 1: Final Accounts of Non-Manufacturing Entities Chapter Notes | Accounting for CA Foundation PDF Download

Unit Overview

Introduction

Non-manufacturing entities are businesses that buy and sell goods for profit without altering their form or use. These entities operate by selling products in their original condition and incur various liabilities, create assets, and incur expenses such as salaries, stationery, advertising, and rent to manage their operations. At the end of the accounting year, they prepare financial statements to determine the business's income and financial position.

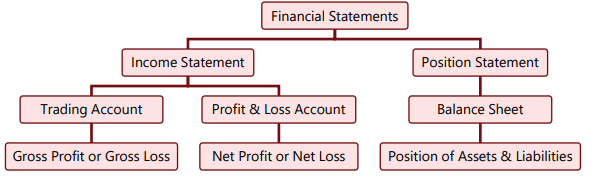

Financial Statements

- Income Statement

- Trading Account

- Gross Profit or Gross Loss

- Profit & Loss Account

- Net Profit or Net Loss

- Position Statement

- Balance Sheet

- Assets & Liabilities

What are Financial Statements?

Financial Statements are organized summaries of all the accounts in the ledger. They are created to provide clear information about the financial situation and performance of a business. These statements are divided into two main categories to help measure profit or loss at different levels:

- Gross Profit or Gross Loss: This measures the profit after deducting direct costs associated with selling goods or services.

- Net Profit or Net Loss: This indicates the overall profit after all expenses, including indirect costs, have been subtracted from the total revenue.

The profit or loss of the enterprise is obtained through the preparation of Income Statement i.e. Trading and Profit & Loss A/c

Trading and Profit & Loss A/c:

The financial position of a business is evaluated by assessing its assets, liabilities, and capital, which is then communicated to financial statement users. This financial status can be effectively understood through the preparation of a Position Statement, commonly known as the Balance Sheet, along with the Trading and Profit & Loss Account.

Comparison Between Income Statement and Position Statement

Income Statement:

- The Income Statement is prepared at the end of the financial year to show the profit or loss for that period.

- It is divided into two parts: the Trading Account and the Profit and Loss Account for non-manufacturing businesses.

- The Income Statement reveals the net profit or loss by subtracting all expenses from the income earned during the year.

Position Statement:

- The Position Statement, on the other hand, presents the assets and liabilities of the business as of the end of the financial year.

- It provides a snapshot of the company's financial position at a specific point in time, showing what the business owns and owes.

- In addition to the Balance Sheet, businesses may prepare additional statements like the Cash Flow Statement and Statement of Changes in Equity to provide a clearer picture of their financial position, although this is not mandatory for non-corporate entities.

Preparation of Final Accounts

The main purpose of final accounts, which include the Trading Account, Profit and Loss Account, and Balance Sheet, is to accurately and fairly present the performance and financial position of a business. To prepare these accounts correctly, it is crucial to maintain a proper record of all transactions conducted by the business during a specific accounting period.

Here are the basic principles for accumulating data for the accounting period:

- Capital and Revenue Distinction: It is important to differentiate between capital and revenue receipts and payments.

- Period Separation: Income and expenses pertaining to different accounting periods should be separated.

- Significant Heads: Different items of income and expenditure should be accumulated under significant heads to disclose the sources of capital and nature of outstanding liabilities.

Considering these principles, attention should be paid to various aspects of transactions and the heads under which different items of income and expenditure should be accumulated. Here are some key points to consider:

(a) Distinction between Personal and Business Income: It is crucial to separate personal income and expenditure from business income and expenditure, as the final accounts aim to reflect the profitability of the business, not its owners.

(b) Distinction between Capital and Revenue Expenditure:. clear distinction should be made between capital and revenue receipts and expenditure. Different types of income and expenditure should be classified under separate heads. Assets should be included in the Balance Sheet following accounting principles and standards, and provisions for accrued but unpaid expenses should be made based on estimates, similar to previous years.

(c) Disclosure of Material Information: All material information relevant to evaluating the business's performance or financial position should be disclosed. For instance, if labor charges have significantly increased due to bonuses paid to workers, the bonus amount should be disclosed. Similarly, substantial write-offs in inventory should be shown separately.

(d) Recording Only Current Period Transactions: While transactions should be recorded continuously, at the end of each accounting period, transactions from the closing period should be separated from those of the succeeding period.

(e) Effect of Completed Transactions: Only the effects of transactions completed before the close of the accounting period should be reflected in the accounts. For example, if a sale of goods is contingent upon inspection by the purchaser and the inspection has not occurred before the period's end, it would be incorrect to record the sale in that accounting period.

Inter-relationship of the two statements

One of the points to be remembered is that of total expenditure incurred some type of expenditure appears in the Profit and Loss Account and some in the Balance Sheet. Consider few examples,

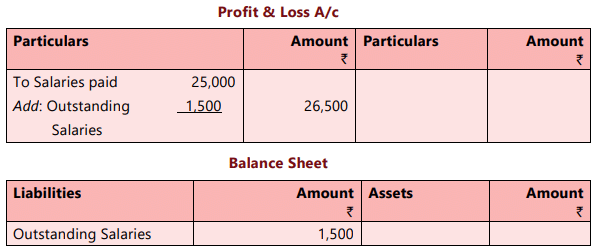

1. Salaries paid for current year is shown on the Dr. side of Profit and Loss Account but outstanding salaries is shown on liabilities side of Balance Sheet and is added to Salaries paid and shown under Profit and Loss Account.

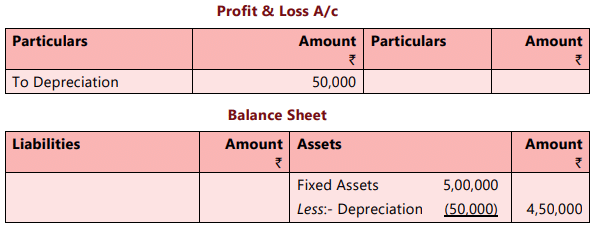

2. When a machine is purchased, that part of it which is attributable to the year considered as depreciation is debited to the Profit and Loss Account and the balance amount after reducing the amount of depreciation is shown in the Balance Sheet as an asset.

These illustrations show that the two statements, the Profit and Loss Account and the Balance Sheet, are thoroughly inter-related. The assets shown in the Balance Sheet are mostly only the remainder of the expenditure incurred after a suitable amount has been charged to the Profit and Loss Account or the Trading Account. For preparing the two statements properly, it is of the greatest importance that the amounts to be charged to the Profit and Loss Account should be properly determined otherwise both statements will show an incorrect position. The principle that governs this concept is called the Matching Principle.

Matching Principle

The Matching Principle requires that expenses incurred to generate revenue should be properly matched. This means:

- When revenue and income are recorded in the Trading/Profit and Loss Account, all related expenses, whether paid or not, should be debited to the account. This is why outstanding expenses are accounted for at the year-end and why opening inventory is debited to the Trading Account.

- If an expense is incurred but the corresponding sale or income will occur next year, the expense should be carried forward as an asset and shown in the Balance Sheet. It will be debited to the Profit and Loss Account only when the relevant income is credited. This also applies to depreciation of assets.

- If income or revenue is received in the current year but the work has to be done and costs incurred next year, such income is considered to be for the next year. It should be shown in the Balance Sheet as "income received in advance" and credited to the Profit and Loss Account of the next year.

An exception

There is an exception to the principle that only costs generating or expected to generate revenue should be recorded in the Profit and Loss Account. For instance, if a fire damages company property, the resulting loss must be recorded in the Profit and Loss Account, minus any insurance coverage. Similarly, losses from selling prices dropping below costs or from bad debts should also be recorded in the Profit and Loss Account to avoid overstating profits.

(NOTE: - The relevant entries and adjustments regarding the above three items are discussed in detail later in this unit.)

Trading Account

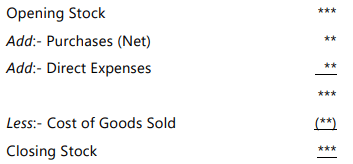

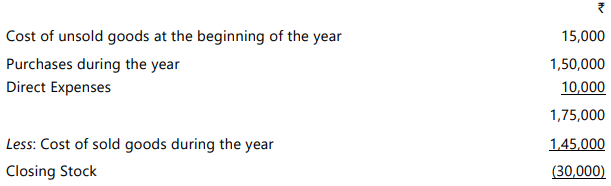

At year-end, determining net profit or loss requires knowing gross profit or loss first. Gross profit is calculated as the difference between selling price and cost of goods sold. For a trading firm, the cost of goods sold is determined by adjusting the cost of goods remaining at year-end against total purchases.It is done as follow:-

Suppose, in the first year, the net purchases (that is after deducting returns) total ₹1,00,000 and that ₹15,000 worth of goods (at cost) were not sold at the end of the year. The cost of the goods sold will then be ₹ 85,000. If in the next year purchases are ₹1,50,000, direct expenses are ₹10,000 and the cost of goods sold is ₹ 1,45,000 the closing stock will be ₹ 30,000 calculated as follows:

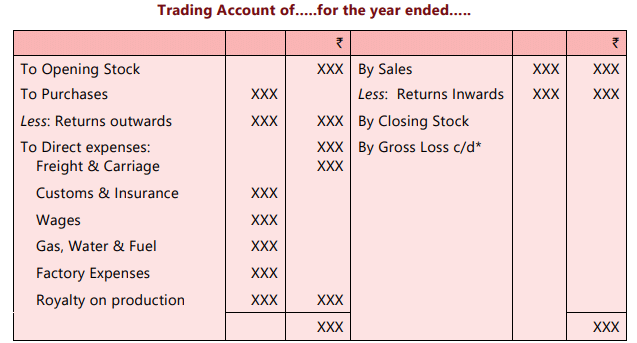

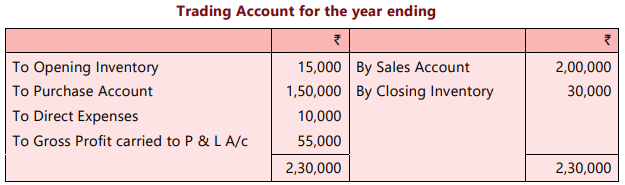

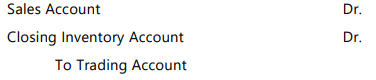

Gross profit is usually ascertained by preparing a Trading account. The format of Trading Account can be shown as below:-

To Gross Profit c/d*

*Only one will appear

If in the above example net sales, i.e., after adjustment for sales returns, is ₹ 2,00,000 then the gross profit will be ₹ 55,000, i.e., ₹2,00,000 – ₹ 1,45,000. This profit is called gross profit since from it indirect expenses have still to be deducted for knowing the net profit. Now, for the same example Trading account will appear as follows:-

Point to Remember:-

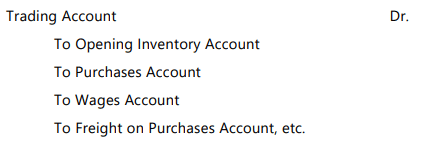

Opening Inventory and PurchasesSales and Closing Inventory

- These are recorded on the debit side of the Trading Account.

Direct Expenses

- Sales and closing inventory are entered on the credit side of the Trading Account.

Gross Profit

- Any direct expenses should be written on the debit side of the Trading Account.

Gross Loss

- If the credit side balance is higher, the difference is recorded on the debit side as gross profit.

- This gross profit amount is also carried forward to the Profit and Loss Account on the credit side.

- In case of a gross loss, where the debit side exceeds the credit side, the amount is written on the credit side of the Trading Account.

- This amount is then transferred to the debit side of the Profit and Loss Account.

Trading Account Items

In a trading firm like a wholesaler, the primary business activity involves buying and selling the same goods. When preparing the trading account, it is important to include not only the opening inventory but also all expenses related to bringing the goods to the firm's godown (storage facility) and making them ready for sale. Expenses such as freight charges, cartage, and octroi paid on purchases should be debited to the Trading Account. The key principle is to debit this account with all costs incurred in getting the goods to their current location and condition.We shall now consider individual items:

(1) Opening Inventory: Since this was closing inventory of the last year, it must have been entered in the opening inventory account, through the opening entry. Therefore, it will be found in the trial balance. This item is usually put as the first item on the debit side of the Trading Account. Of course, in the first year of a business there will be no opening inventory.

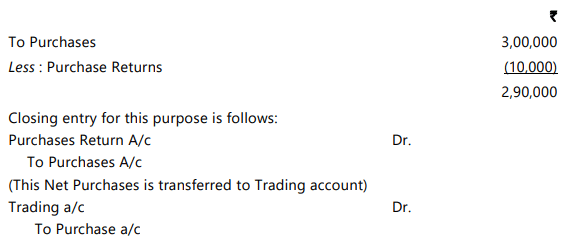

(2) Purchases and Purchase Returns: The purchases account will have debit balance, showing the gross amount of purchases made of the materials. The purchase returns account will have credit balance showing the return of materials to the supplier. On the debit side of the trading account the net amount is shown as indicated (with assumed figures) : `

It happens sometimes that goods are received but the relevant invoice is not received from the supplier. On the date of the closing of the account, an entry must be passed to debit the purchases account and credit the supplier with the cost of goods.

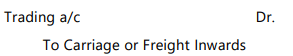

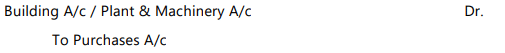

(3) Carriage or Freight Inwards/Freight: This item should also be debited to the Trading Account, as it is incurred to bring the materials to the firm’s godown and make them available for use. However, if any freight or cartage is paid on any asset, like machinery, it should be added to the cost of the asset and not debited to the Trading Account.

(4) Wages: Wages paid to workers in the godown/stores, should be debited to the Trading Account. If any amount is outstanding, it must be brought into books so that full wages for the period concerned are charged to the Trading Account. However, if wages are paid for installation of a fixed asset, it should be added to the cost of the asset.

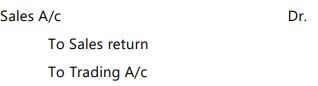

(5) Sales and Sales Returns: The sales account will have a credit balance indicating the total sales made during the year. The sales return account will have a debit balance, showing the total amount of goods returned by customer The net of the two amounts is entered on the credit side of the Trading Account.

Sometimes, goods are sold on approval basis that is when the customer has the right to return the goods with in stipulated period in that case the sale entry should be reversed. It is discussed later in detail.

(6) Closing Inventory and its valuation: Usually there is no account to show the value of goods lying in the godown at the end of the year. However, to correctly ascertain the gross profit, the closing Inventories must be properly taken and valued.

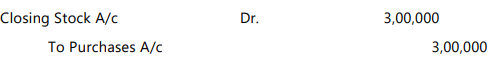

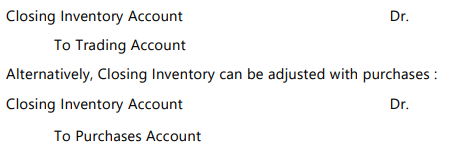

The entry is

The effect of this entry is to reduce the debit in the Purchases Account. The closing inventory is also shown in balance sheet on Assets side.

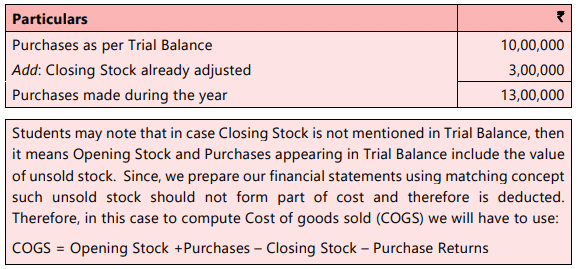

If Closing Stock appears in the Trial balance:-

The closing inventory is not included in the trading account; instead, it is reflected solely in the balance sheet, as it has already been accounted for when calculating the Cost of Goods Sold.

To determine the value of closing inventory, a comprehensive inventory list of all items in the godown must be compiled, including quantities. Damaged or obsolete items should be listed separately. Additionally, the inventory should include finished goods, goods with agents on consignment, and items sent on approval to customers.

The valuation principle is cost or net realisable value whichever is lower.

Taking inventory is quite a lengthy process. Strictly, immediately at the end of the year the taking of inventory should be completed. Sometimes, however this is done either a few weeks before or a few weeks after the closing. In such a case the value of the inventory thus taken must be adjusted to relate it to the closing date. The adjustment will be necessary because, in the meantime, purchases and sales must have been made. The main point to remember is that in respect of sales their cost has been established. Cost will be sales less gross profit.

Below is the summary for all transfer / closing entries to Trading a/c:

(1)

(2)

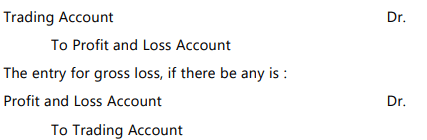

At this stage Trading Account will reveal the gross profit, if the credit side is more, or gross loss if the credit side is less. The gross profit will be transferred to the Profit and Loss Account by the entry: Dr.

ILLUSTRATION 1

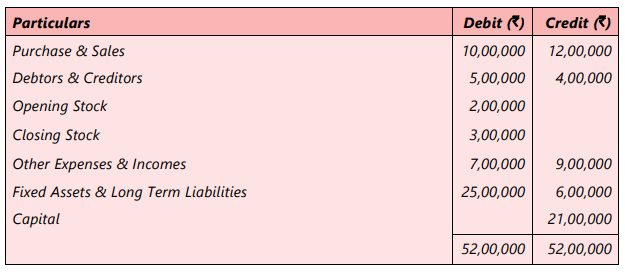

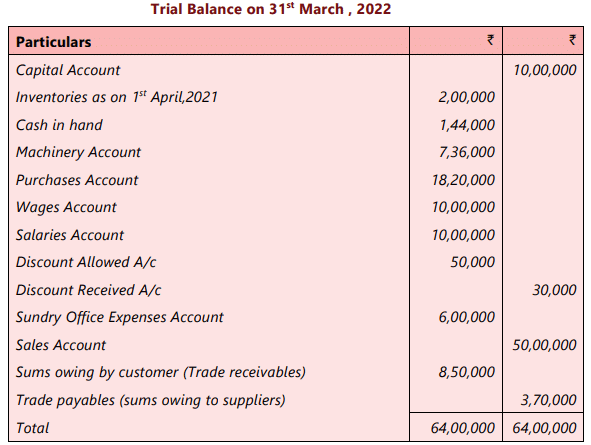

Trial Balance for the financial year (FY) ended 31st March 2022 of M/s Deepakshi shows following details:

Additional Information: Creditors balance as on 1st April, 2021 is ₹ 3,00,000.

You are required to calculate cost of goods sold and amount paid to creditors during the year.

SOLUTION

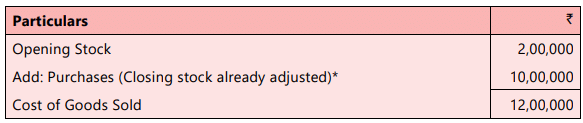

(i) Calculation of Cost of Goods sold:

*Since, closing stock appears in Trial Balance, it means following entry has already been passed in books:

So, we can see purchases have already been reduced by the amount of unsold stock, therefore no more adjustment needs to be made on account of closing stock for computing Cost of goods sold (COGS).

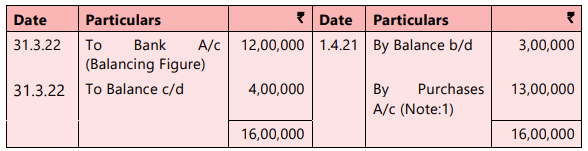

(ii) Calculation of amount paid to creditors:

Note: (1) Purchases made during the year can be computed as:

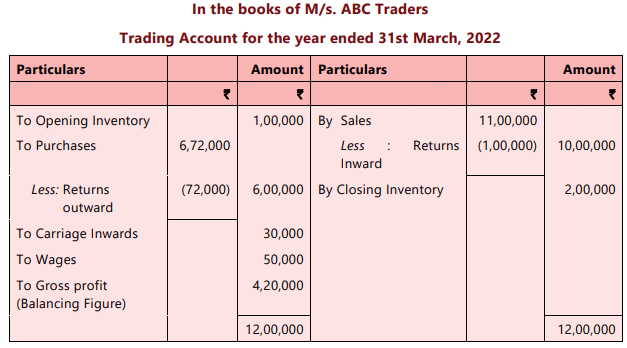

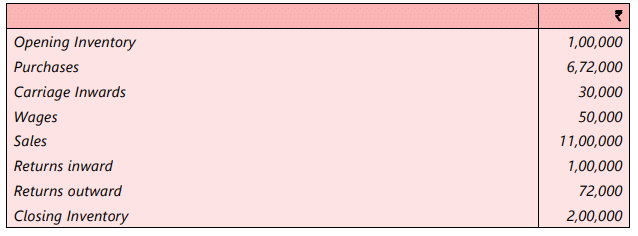

ILLUSTRATION 2

Required:

From the above information, prepare a Trading Account of M/s. ABC Traders for the year ended 31st March, 2022 and Pass necessary closing entries in the journal proper of M/s. ABC Traders

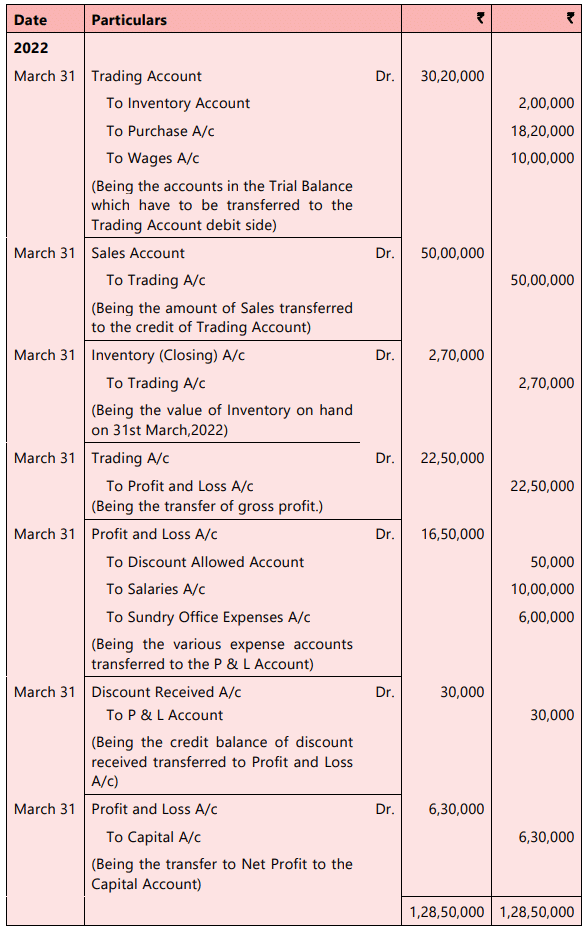

SOLUTION

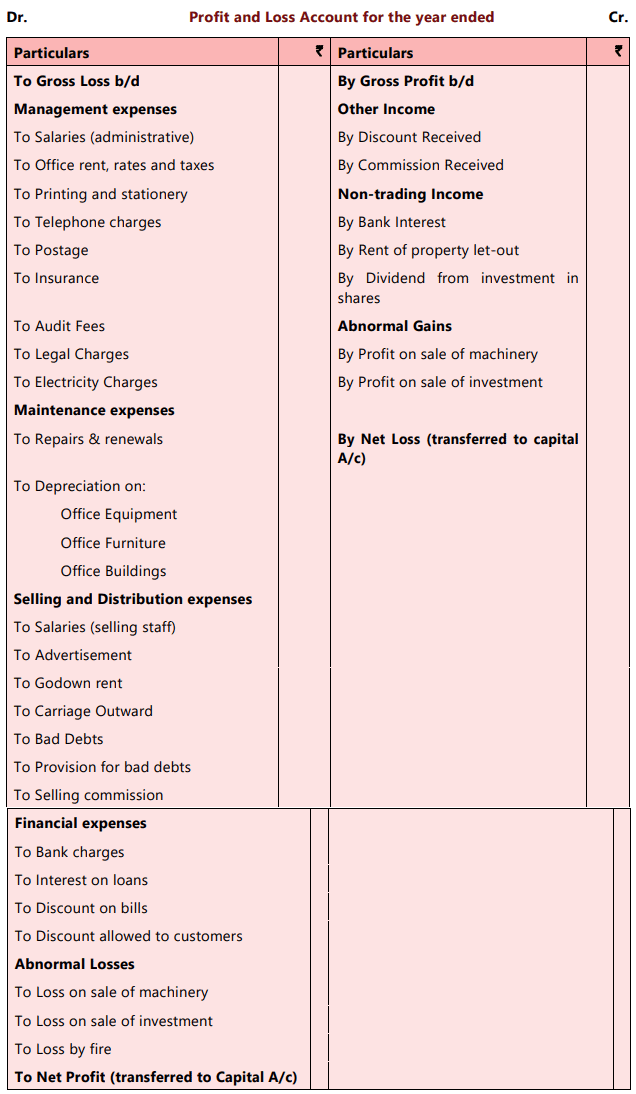

Profit and Loss Account

The Profit and Loss Account begins with gross profit on the credit side. In case of a gross loss, it will be recorded on the debit side. Following this, all expenses and losses not included in the Trading Account will be listed on the debit side of the Profit and Loss Account. Incomes and gains, apart from sales, will be recorded on the credit side.- Understanding the term 'expenses' is crucial for differentiating between items to be debited to the Profit and Loss Account and those to be shown as Assets in the balance sheet. Additionally, personal expenses are not charged to the Profit and Loss Account. Only revenue expenses and losses related to the current year are debited to the Profit and Loss Account.

- Modern practice suggests preparing the Profit and Loss Account in a way that gives a clear picture of the profit or loss incurred by the firm during the period, along with significant factors. Overly detailed information can obscure the reasons behind the profit earned. Therefore, items should be categorized according to various functions, such as administration, selling, and financing.

The profit/loss A/c appears as follows:-

Note:

- Gross loss is recorded at the top on the debit side of the Profit and Loss Account, while Gross Profit is shown on the credit side.

- Net loss is displayed on the credit side of the Profit and Loss Account, whereas Net profit appears on the debit side as a balancing figure.

- It is advisable to either present certain expenses in a separate schedule or to highlight their total prominently in the Profit and Loss Account, especially when there are a large number of items.

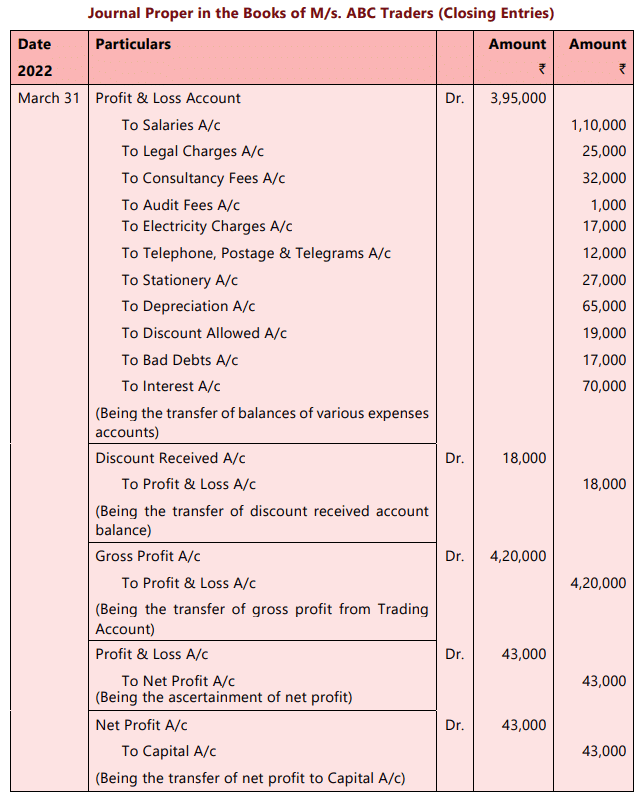

Closing Entries

Closing entries are the journal entries made to transfer various accounts to the Trading and Profit and Loss Accounts. These entries are necessary to complete the Profit and Loss Account after transferring the gross profit.

(a) Expenses Debited to Profit and Loss Account:

- When items need to be debited to the Profit and Loss Account, this account is debited, and the concerned accounts are credited.

For example:

- Profit and Loss Account Dr.

- To Salaries Account

- To Rent Account

- To Interest Account

- To Other Expenses Account

(b) Income or Gain Items:

- Items of income or gain, such as interest received or miscellaneous income, are credited to the Profit and Loss Account.

For example:

- Discount Received Account Dr.

- Bad Debts Recovered Account Dr.

- To Profit and Loss Account

(c) Transfer of Net Profit or Loss to Capital Account:

- After making the necessary entries, the Profit and Loss Account will show either a net profit or a net loss.

In case of net profit:

- Profit and Loss Account Dr.

- To Capital Account

In case of net loss:

- Capital Account Dr.

- To Profit and Loss Account

Entries in Detail

- Other Income: Includes items like interest received, discount received, rent from subletting, and miscellaneous incomes such as from selling junk material.

- Segregation of Items: Interest on fixed deposits, income from investments, and specific items debited/credited to the proprietor should be shown separately.

- Drawings: Drawings are a reduction of capital and should be debited to the Capital account of the proprietor, not the Profit and Loss Account.

- Income Tax: In sole proprietorships, income tax is a personal expense and debited to the Capital Account. In partnerships, the firm's tax liability is debited to the Profit and Loss Account, while partners' tax liabilities are treated as drawings.

- Discount Received and Allowed: Trade discount is not debited to the Profit and Loss account as it is already adjusted in sales. Cash discount, however, is debited to the Profit and Loss account.

- Rebate: An allowance given to customers based on their total purchases over a period. The Rebate Account is debited at the end of the year and later written in the Profit and Loss Account on the debit side.

(i) Drawings:

- Drawings represent a reduction of capital for the firm and should be reflected in the proprietor’s Capital Account, not the Profit and Loss Account.

- The entry in the Capital Account would be:

- If the proprietor benefits personally from the firm’s resources, such as using the firm’s car, the equivalent value should be treated as a drawing, reducing the Profit and Loss Account accordingly.

(ii) Income Tax:

- In sole proprietorships, income tax is considered a personal expense and is debited to the Capital Account, not the Profit and Loss Account.

- The entry would be:

- This is because the tax liability depends on the total income of the proprietor or partners, not just the firm’s profit.

- In partnerships, the firm’s tax liability is debited to the Profit and Loss Account, while partners’ tax liabilities are considered personal expenses. If the firm pays income tax on behalf of partners, it should be treated as drawings.

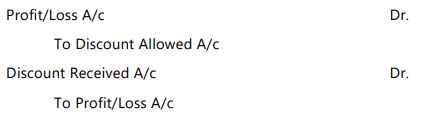

(iii) Discount Received and Allowed:

- Trade Discount: This is allowed when the order for goods exceeds a certain figure and is deducted from the invoice. It is not further treated in the accounts as it is already adjusted in sales.

- Cash Discount: This is allowed to customers for prompt payment and is recorded in the books. It is debited to the Profit and Loss Account.

- Discount Received: This is a gain and is credited to the Profit and Loss Account.

- Discount Allowed: This is a loss and is debited to the Profit and Loss Account.

- The entries would be:

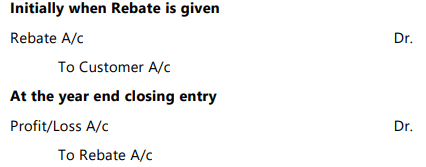

(iv) Rebate:

- A rebate is an allowance given to customers based on their total purchases over a specified period, such as a year.

- For example, if a firm offers a 4% rebate to customers whose annual purchases exceed ₹ 5,000, the entries would be made at the end of the year.

- The Rebate Account is debited and later reflected in the Profit and Loss Account on the debit side.

When a rebate is initially given, the following entry is made:

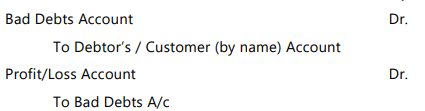

(v) Bad Debts:

- Bad debts occur when a customer fails to pay the amount owed, and all possibilities of recovery are exhausted. This situation represents a loss for the firm.

- To reflect this loss, the bad debts account is debited, and the amount is subsequently transferred to the Profit and Loss Account on the debit side.

- Since the amount due is no longer considered an asset, the account of the customer in question is closed by crediting it.

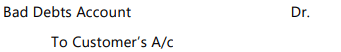

The journal entry for bad debts is as follows:

In cases where a Provision for Bad Debts has already been established, bad debts should be written off from this provision first. The entry for this action is:

The journal entry for bad debts recovered is as follows:

For detailed understanding of Provision of Bad Debts please refer Point (6) topic Adjustments of Provision of Bad and Doubtful Debts .

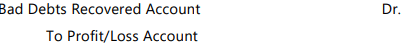

ILLUSTRATION 3

Revenue, Expenses and Gross Profit Balances of M/s ABC Traders for the year ended on 31st March 2022 were as follows:

Gross Profit ₹ 4,20,000, Salaries ₹ 1,10,000, Discount (Cr.), ₹ 18,000, Discount (Dr.) ₹ 19,000, Bad Debts ₹17,000, Depreciation ₹65,000, Legal Charges ₹25,000, Consultancy Fees ₹ 32,000, Audit Fees ₹ 1,000, Electricity Charges ₹17,000, Telephone, Postage and Telegrams ` 12,000, Stationery ₹ 27,000, Interest paid on Loans ₹ 70,000.

Required:

Prepare Profit and Loss Account of M/s ABC Traders for the year ended on 31st March, 2022. Show necessary closing entries in the Journal Proper of M/s. ABC Traders also.

SOLUTION

Adjustments

The core principle of accounting dictates that income and expenditure should align with the accounting period. Therefore, prior to preparing final accounts, it's essential to adjust for accrued expenses and outstanding income, while also excluding expenses that benefit future periods and advance income.The entries that must be passed for adjusting various accounts of income and expenditure are shown below:

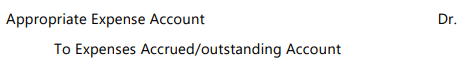

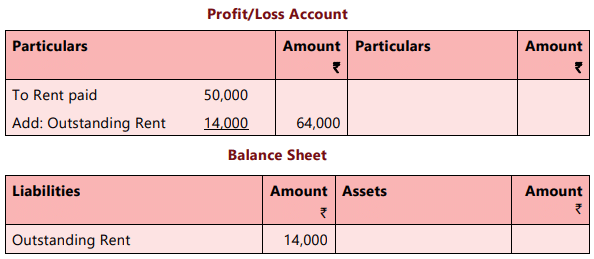

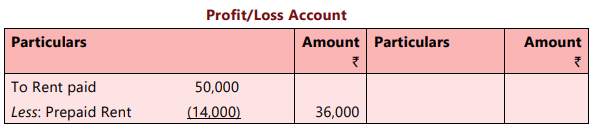

(1) Expenses accrued and accruing, e.g., Rent, Interest, Local Taxes, Wages etc.

For Example, if Rent Paid is ₹ 50,000 for a year and Outstanding Rent is ₹ 14,000. It will be treated as follows:-

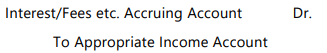

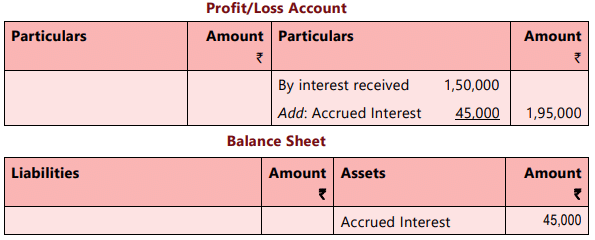

(2) Income accrued and accruing, e.g., Interest on Government Loans, Discounts on Bill, Professional fees, Rents and Premiums on leases, etc. Suppose interest received is ₹ 1,50,000 and accrued interest for the same period is ₹ 45,000. It will be treated as follows:-

Suppose interest received is ₹ 1,50,000 and accrued interest for the same period is ₹ 45,000. It will be treated as follows:-

Notes:

- The term “accrued” means that an amount has been recognized as either an expense or income, but the payment is due in the following accounting period. If the payment is due in the current accounting period, the correct terms to use are “outstanding” or “accrued and due”.

- The phrase “accrued and accruing” refers to items that, while not yet due for payment, are related to the current accounting period, and a provision has been set aside for them. This is different for income items, where the situation is the opposite.

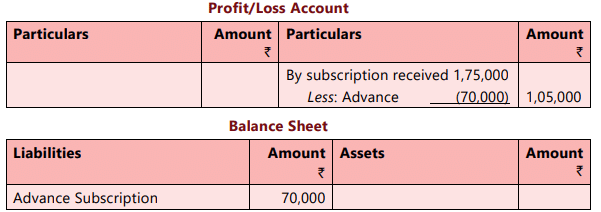

(3) Carrying forward income received in advance e.g., Subscription in the case of a club or fees in case of professional person.

For Example Subscription Received in advance is ₹ 70,000 and total subscription received is ₹ 1,75,000.

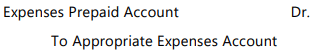

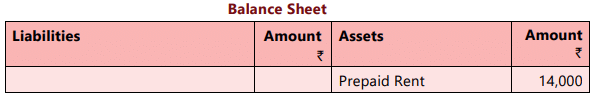

(4) Carrying forward of payments made in advance e.g., Telephone, Rent, Insurance etc., Expenses Prepaid Account Dr.

Suppose out of the total Rent of ₹ 50,000 paid, ₹ 14,000 pertains to the next year.

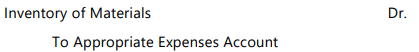

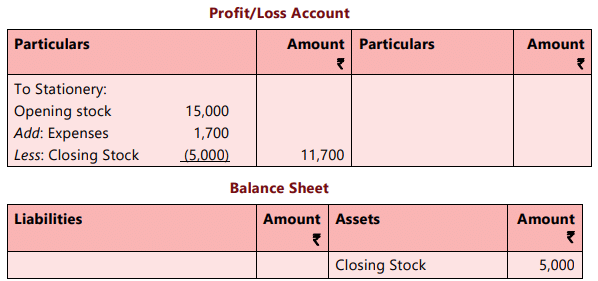

(5) Adjustment of Inventory of materials in hand, e.g., Stationery, Advertisement, Material, Manufacturing Stores, etc., the cost whereof already has been debited to expense account.

For Example, if opening stock of stationery is ₹ 15,000 and direct expenses on it is ₹ 1,700. It is also given outside the Trial Balance. Closing stock of stationery is ` 5,000. The treatment is as follow:-

Note: Next year in the beginning entries No. (1) to (5) should be reversed.

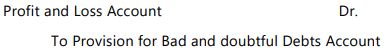

(6) Provision for Bad and doubtful Debts: When it is feared that some of the amount due from customers will not be collected it is prudent to recognise the expected loss by reducing the current year’s profit and placing the amount to the credit of a special account called “Provision for Bad and Doubtful Debts Account”. The entry is;

Note: The accounts of the customers concerned are not affected until the amount is actually written off for which the entry is,

When bad debts are written off, they are charged to the existing provision for bad debts, if available, or directly to the Profit and Loss Account, with a corresponding credit to the trade receivables account. If a provision needs to be created, the amount is also charged to the Profit and Loss Account. In cases where certain bad debts must be written off and a provision for doubtful debts established, the bad debts should first be debited against the current provision balance, and then the remaining balance should be adjusted to reach the required level.

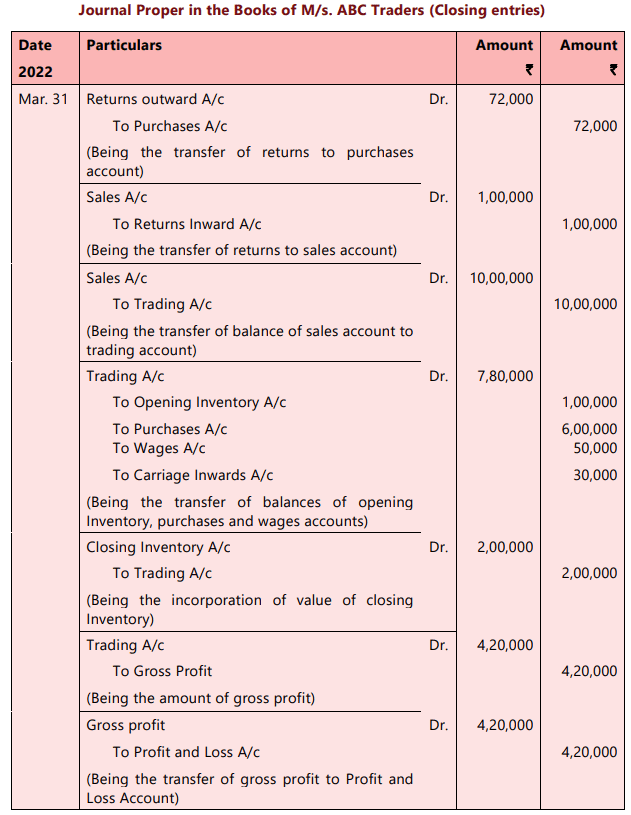

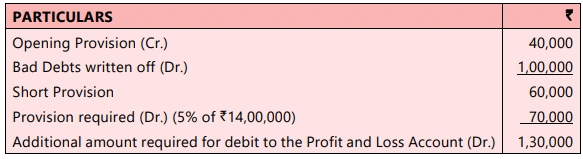

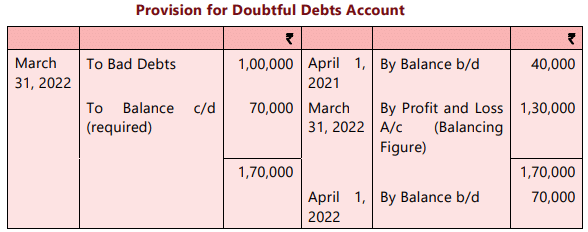

ILLUSTRATION 4

On 1st April 2021 provision for Doubtful Debts existed at ₹ 40,000. Trade receivables on 31.03.2022 were ₹ 15,00,000; bad debts totaled ₹1,00,000. It is required to write off the bad debts and create a provision equal to 5% of the Trade receivables’ balances.

Show how you would compute the amount debited to the Profit and Loss Account.

SOLUTION

The account will appear as follows:

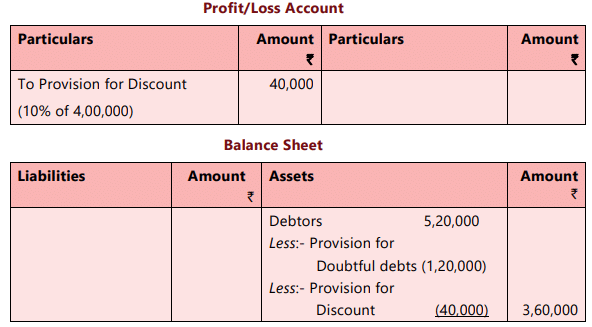

(7) Provision for Discount: This provision is created in the same manner, discussed above but the amount of provision is required to be calculated after deducting the Provision for Bad Debts from the total trade receivables. This is because Provision for discount is created only on good debtors.

For Example, if Trade Receivables is ₹ 5,20,000 and provision for doubtful debt is ₹ 1,20,000. You are required to create a 10% provision for discount on debtors.

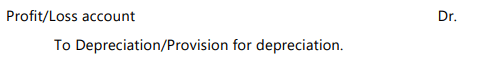

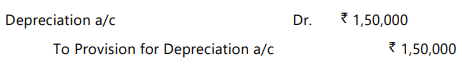

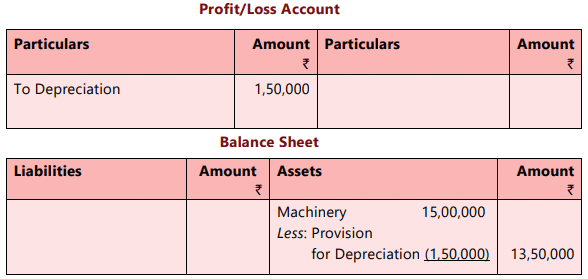

(8) Provision for Depreciation: It is made either by debiting Depreciation Account and crediting the Provision for depreciation account concerned and afterwards closing of the Depreciation Account by transfer to the Profit and Loss Account or by directly debiting the profit and loss Account and crediting provision for depreciation account and explaining the nature of adjustment by recording a detailed narration in the Journal.

The amount of depreciation is deducted from the concerned asset and is then shown in the Balance sheet.

For Example if machinery Cost ` 15,00,000 and 10% depreciation is to be provided. The treatment is as follow:-

Depreciation is now charged to P&L a/c as:

(9) Other Provisions:

Provisions in Accounts

- Definition:. provision is an amount set aside in accounts to cover a potential loss that is expected but not certain.

- Example: If a business anticipates it will have to pay compensation for late delivery of goods, it should create a provision for this potential loss.

- Accounting Entry: To record a provision, debit the Profit and Loss Account and credit a suitably named account.

- Balance Sheet Presentation: Provisions appear on the liability side of the Balance Sheet.

- Bad and Doubtful Debts Provision: This provision is deducted from the total book debts, not shown as a separate liability.

- Provision for Discount on Trade Receivables: Similar to the provision for bad debts, this is also deducted from the total book debts.

- Provision for Depreciation: This provision is deducted from the cost of the assets concerned, reflecting the reduced value of the assets due to wear and tear over time.

(10) Adjustments in Trial Balance

Transfers and Adjustments:

- Transfers: Corrections of errors are made by debiting or crediting the affected accounts. The corresponding effect is recorded in a Suspense Account or another account.

- Special Charges: Transfers related to special charges, such as partner's salaries and interest, are recorded by debiting the Profit and Loss Account and crediting the concerned parties.

- Double Entry System: Every entry has two aspects: debit and credit. For instance, in case of prepaid insurance charges, the Insurance Charges Account is credited, and the Prepaid Expenses Account is debited with the same amount. The balance of the Prepaid Expenses Account would be included on the debit side of the Trial Balance.

Recording Adjustments:

- Students should record adjustments for various items stated in a question on rough working sheets before reflecting them in the Trial Balance.

- This practice helps in ensuring accuracy and completeness before proceeding to prepare the Final Accounts.

Certain Adjustments and Their Treatments

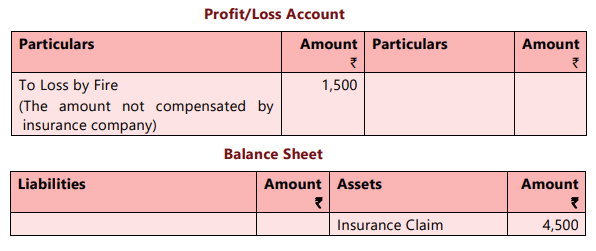

1. Abnormal loss of Inventory by accident or fire: Sometimes loss of goods occurs due to fire, theft, etc. If due to accident or fire, a portion of Inventory is damaged, the value of loss is first to be ascertained. Thereafter, Abnormal Loss Account is to be debited and Purchase Account or Trading Account is to be credited.

Abnormal Loss Account is to be transferred to Profit & Loss Account. If amount of loss is recoverable from insurance company, then insurance company is to be debited instead of Profit & Loss Account. Till the money is not received from the insurance company, Insurance Company’s Account will be shown in the Assets side of the Balance Sheet. If any part of the loss is recoverable from the insurance company, then the portion not compensated by the insurance company should be debited to Profit & Loss Account. For example, if goods worth ` 6,000 are destroyed by fire and the insurance company admits the claim for ` 4,500, the Journal entries will be:-

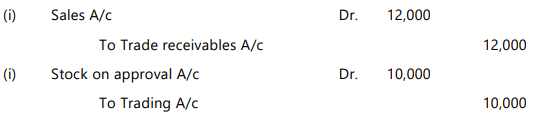

2. Goods sent on Approval basis: Sometimes goods are sold to customers on sale or return basis or on approval basis. It should not be treated as actual sale till the time it is not approved by the customer. When goods were sold we have passed the entry for actual sales. Therefore, at the year end, if the goods are still lying with the customers for approval, following entries are to be passed:

For example - Goods costing ₹10,000 sent to a customer on sale or return basis for ₹12,000. The entry for such unapproved sale shall be-

These goods should now be included in the amount of Closing Stock at their cost price.

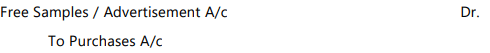

3. Goods used other than for sale: Sometimes goods are used for some other purposes, such as distributed as free samples, used in construction of any assets or used by proprietor for personal use. In such cases the amount used for other purposes is subtracted from Purchases A/c and depending upon the specific use done, the suitable account head is debited.

For example:- When goods are given away as donation-

When goods are used by the proprietor for his personal use-

When goods are distributed as free samples :-

When goods are used in business for construction of Building or the Machinery :-

When goods are used for maintenance of business premises/ Machinery: -

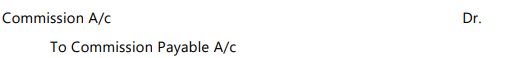

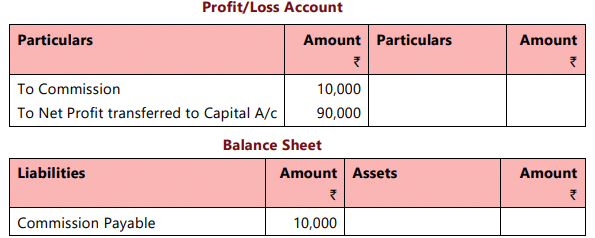

4. Commission based on profit: Sometimes commission is payable to manager based on net profit; in such a case calculation is done as follows:

(i) Commission on net profit before charging such commission = Profit before commission x Rate of commission / 100

(ii) Commission on net profit after charging such commission = Profit before commission x Rate of commission / 100 + Rate of commission

Commission is recorded by following journal entry

(Being commission payable to Mr ….. @ …..% on net profit after charging such commission, net profit before charging commission being ₹……..)

Commission will be debited in the Profit & Loss Account and Commission Payable Account will be shown in the Balance Sheet on liability side.

For example if Net profit before Commission is ₹ 1,00,000 and Manager is entitled to a Commission of 10% of Net Profit before charging such commission. The amount of Commission is = ₹ 10,000 (10% of ₹ 1,00,000). It will be shown as follow:-

Now, let us assume that 10% commission is payable on Net Profit after charging such commission. The amount of commission now is = 9,090.90 or 9091 (approx) (₹ 1,00,000 x 10/110)

ILLUSTRATION 5

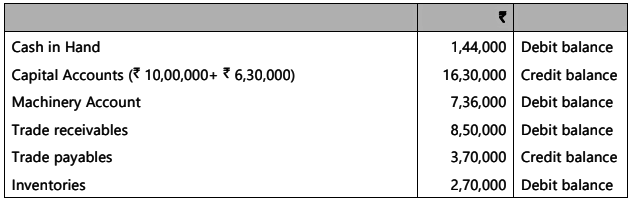

The following is the Trial Balance of C. Wanchoo on 31st March, 2022.

Value of Closing Inventory on 31st March, 2022 was ₹2,70,000

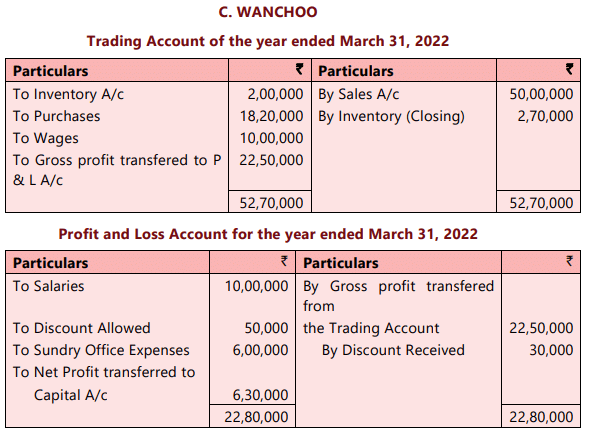

Prepare closing entries for the above items and Prepare Trading and Profit and Loss Account.

SOLUTION

|

Download the notes

Chapter Notes- Unit 1: Final Accounts of Non-Manufacturing Entities

|

Download as PDF |

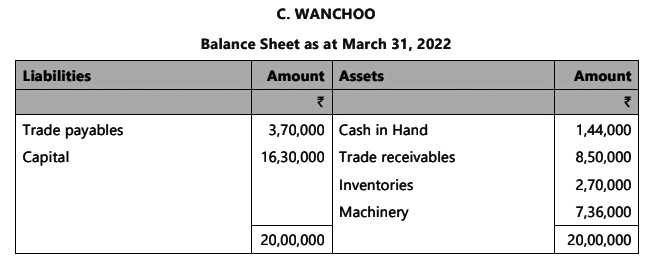

Balance Sheet

A balance sheet is a financial statement that presents the assets, liabilities, and capital of a firm or institution at a specific point in time. It reflects the financial position of the entity "as at" a particular date, highlighting the snapshot of its resources and obligations.

1. Definition:

- A balance sheet is defined as a statement detailing the assets and liabilities of a firm or institution as of a specific date.

- The phrase "as at" indicates that the balance sheet is accurate only for that particular moment in time.

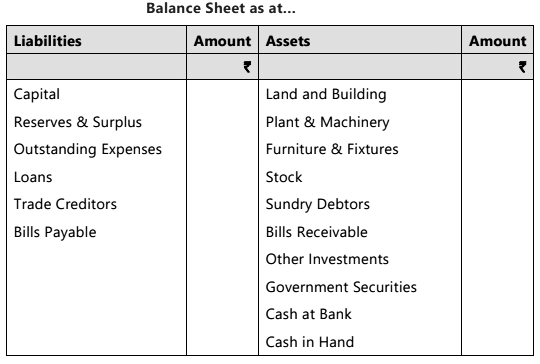

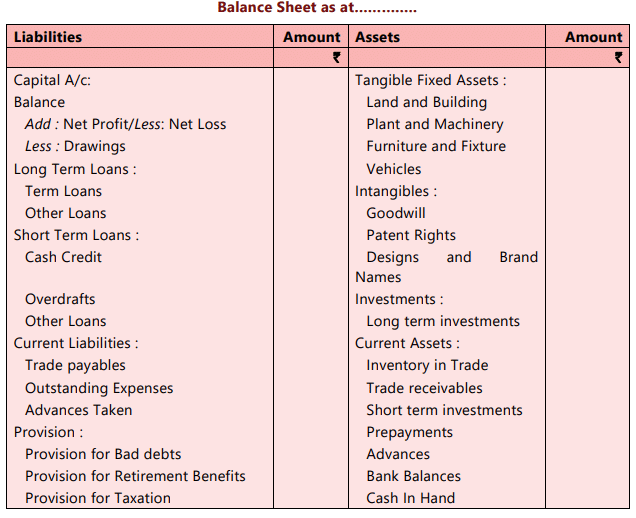

2. Presentation:

- In a balance sheet, assets are listed on the right-hand side, while liabilities and capital are shown on the left-hand side.

Characteristics of Balance Sheet:

- Preparation Date: The balance sheet is prepared at a specific date, reflecting the financial position at the close of that day. It is not valid for any other time.

- Sequence of Preparation: The balance sheet is prepared after the Profit and Loss Account. Together, they are referred to as Final Accounts. The balance sheet alone cannot provide a clear picture of the financial position without the profit figures from the Profit and Loss Account.

- Equality of Totals: The totals of both sides of the balance sheet must be the same. Since capital is the difference between assets and liabilities, this equality is crucial. If the totals do not match, it indicates an error in the preparation.

In the illustration no. 5 worked out above it will be seen that the under mentioned accounts have not been closed even after preparation of the Profit and Loss Account and the transfer of the net profit to the capital account.

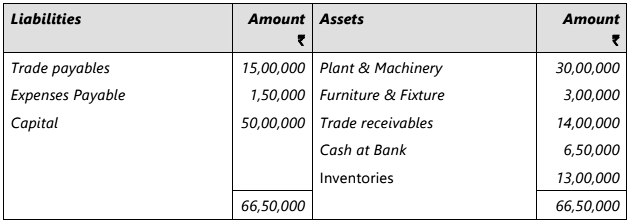

The accounts reveal that the firm holds various assets such as cash on hand, cash at bank, machinery, and furniture, along with liabilities owed to trade payables and the proprietor’s capital. The capital represents the difference between total assets and total liabilities. This information is typically summarized in a statement known as the Balance Sheet, as illustrated below for the mentioned accounts.

Arrangements of Assets and Liabilities

(1) Assets: Assets may be grouped in one of the following two ways:

(i) Liquidity: Under this approach, the asset, which can be converted into cash first, is presented first. Those assets, which are most difficult in this respect, are presented at the bottom. As per Liquidity the balance sheet can be prepared as follow:-

(ii) Permanence: Assets, which are to be used, for long term in the business and are not meant to be sold are presented first. Assets, which are most liquid, such as cash in hand, are presented at the bottom.

Note:- Some of the assets may be capable of being sold easily like investment in government securities or shares of some companies. They should be treated as liquid or permanent according to the intention of the firm.

(2) Liabilities: Liabilities may also be shown according to the urgency with which payment has to be made. One way is to first show the capital, then long-term liabilities and last of all short term liabilities like amounts due to suppliers of goods or bills payable. The other way is to start with short-term liabilities and then show long term liabilities and last of all capital.

Classification of Assets and Liabilities

Assets are classified into three categories:

(i) Current Assets. These assets are expected to be converted into cash quickly, typically within one year. Examples include:

- Cash in hand

- Cash at bank

- Trade receivables

- Inventories

(ii) Long-Term Assets. Also known as fixed assets, these are intended for long-term use by the firm and are not sold in the ordinary course of business. Examples include:

- Machinery

- Buildings

- Long-term investments

(iii) Intangible Assets. These assets do not have a physical presence and cannot be seen or touched. Examples include:

- Patents

- Copyrights

Liabilities to Outsiders are classified into:

(i) Current Liabilities. These liabilities must be settled within one year and are also known as short-term liabilities. Examples include:

- Creditors

- Bills payable

(ii) Long-Term Liabilities. These liabilities extend beyond one year. Examples include long-term loans from banks and undistributed profits.

In the balance sheet, it is advisable to present current and long-term assets separately and prominently to provide clear and meaningful information.

Sole proprietors generally present Balance Sheet in a horizontal form with “Capital and Liabilities” on the left hand side and ‘Assets’ on the right-hand side. In the Balance Sheet the various items should be grouped suitably as indicated below:

In course, there is no hard and fast rule regarding presentation of assets, liabilities and equities in the Balance sheet. However, the model presentation shown above has been designed considering the nature of Balance Sheet elements and categorizing them appropriately.

Proper presentation of Balance Sheet items improves understandability of the information desired to be communicated to the users of account.

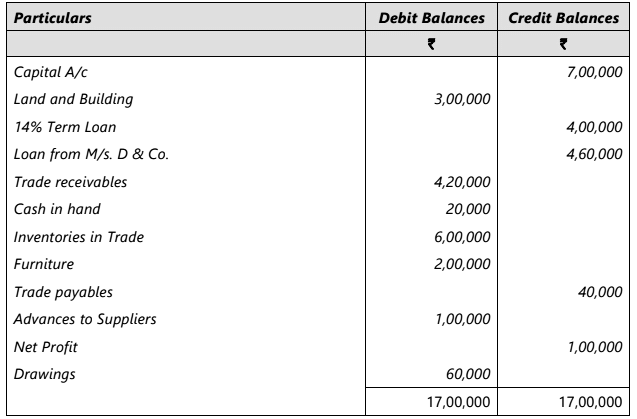

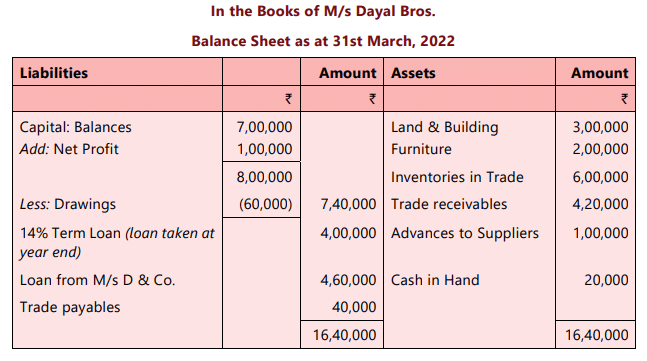

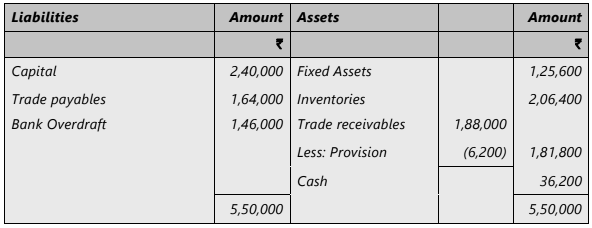

ILLUSTRATION 6

Given below Trial Balance of M/s Dayal Bros. as on 31st March, 2022 :

Required

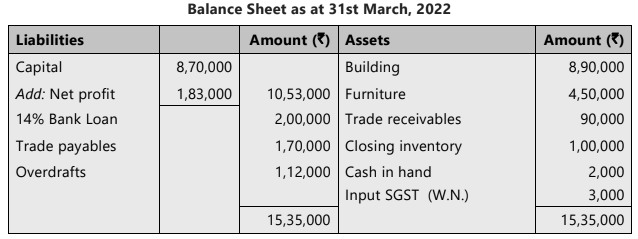

Prepare Balance Sheet as on 31st March, 2022.

SOLUTION

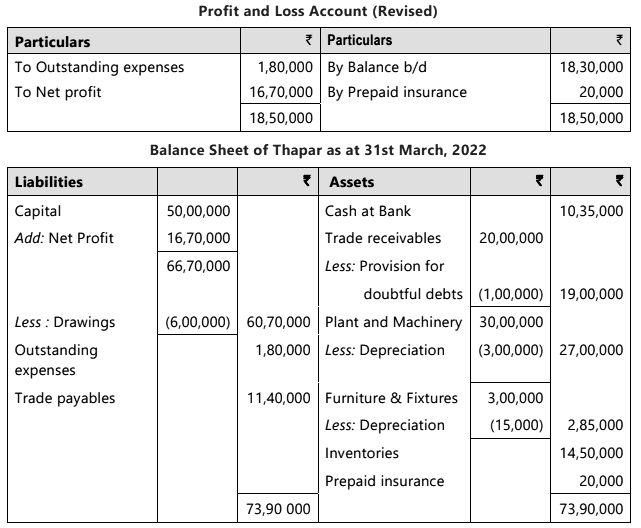

ILLUSTRATION 7

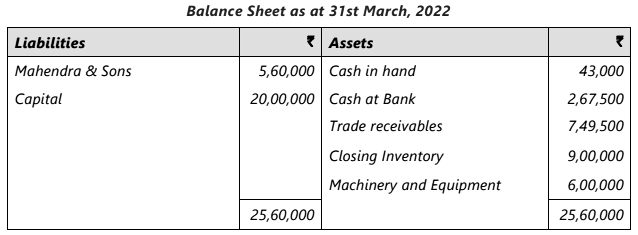

The balance sheet of Thapar on 1st April, 2021 was as follows:

During 2021-22, his Profit and Loss Account revealed a net profit of ` 18,30,000. This was after allowing for the following :

(a) Rent received from property let out ` 3,00,000.

(b) Depreciation on Plant and Machinery @ 10% and on Furniture and Fixtures @ 5%.

(c) A provision for Doubtful Debts @ 5% of the trade receivables as at 31st March, 2022.

But while preparing the Profit and Loss Account he had forgotten to provide for (1) outstanding expenses totaling ` 1,80,000 and (2) prepaid insurance to the extent of ` 20,000.

His current assets and liabilities on 31st March, 2022 were: Inventories ` 14,50,000; Trade receivables ` 20,00,000; Cash at Bank ` 10,35,000 and Trade payables ` 11,40,000.

During the year he withdrew ` 6,00,000 for domestic use.

Required

Draw up his Balance Sheet at the end of the year.

SOLUTION

Sequence of Accounting Procedure or the Accounting Cycle

The accounting process involves a series of steps that are followed in a specific order. These steps are:

- Recording Transactions: Transactions are recorded in the journal, a process known as journalizing.

- Preparing Ledger Accounts: Based on the journal entries, transactions are posted to the ledger, where individual accounts are maintained.

- Taking Out the Trial Balance:. trial balance is prepared to check the arithmetical accuracy of the accounts. This involves ensuring that the total debits equal the total credits.

- Preparing the Trading and Profit and Loss Account: The trading and profit and loss account, or income statement, is prepared for the relevant period. This statement shows the income and expenses of the business, leading to the determination of profit or loss.

- Preparing the Balance Sheet:. balance sheet is prepared to show the financial position of the business at the end of the period. This statement lists the assets, liabilities, and equity of the business, providing a snapshot of its financial health.

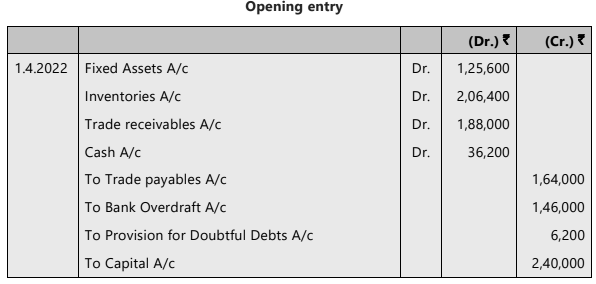

Opening Entry

When starting a new business, the cash account is debited and the capital account is credited with the amount introduced. A firm closes its books of accounts at the end of each year and starts new books at the beginning of each year. The first entry in the journal for the new year is to record the closing balances of various assets and liabilities from the previous year as the opening balances for the new year. This entry is based on the balance sheet prepared at the end of the year, which reflects these balances.

- Assets: The assets listed in the balance sheet are debited in the opening entry.

- Liabilities and Capital: The liabilities and capital account are credited in the opening entry.

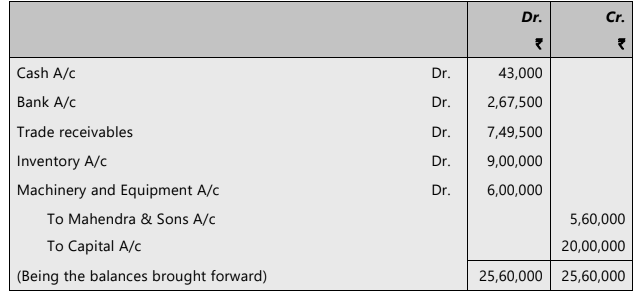

ILLUSTRATION 8

From the above given balance sheet prepare the relevant opening entry.

SOLUTION

The Opening Entry :01-04-2022

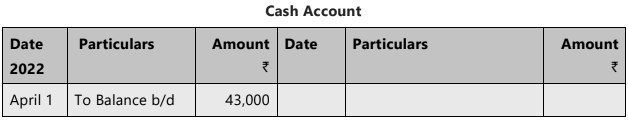

Posting the Opening Entry

All the assets show debit balance. Such accounts are opened and the relevant amounts written on the debit side as “To Balance b/d”. Following is the cash account arising from the entry given above.

Similarly account should be opened for all other assets and relevant amount should be posted on the Dr. side.

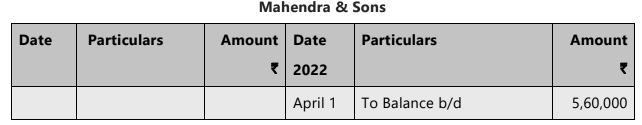

The accounts of liabilities show credit balances. An account for each liability is opened and the relevant account is written on the credit side as “By Balance b/d”. This is shown below by opening the accounts of Mahendra & Sons mentioned in the entry given above.

By posting the opening entry completely all the accounts of assets and liabilities in the beginning are opened. We illustrate below a complete cycle of journalising, posting and trial balance.

Students should work through the following illustration given by way of practice on the method of making adjustments in some of the accounts contained in a Trial Balance and afterwards preparing the final Account.

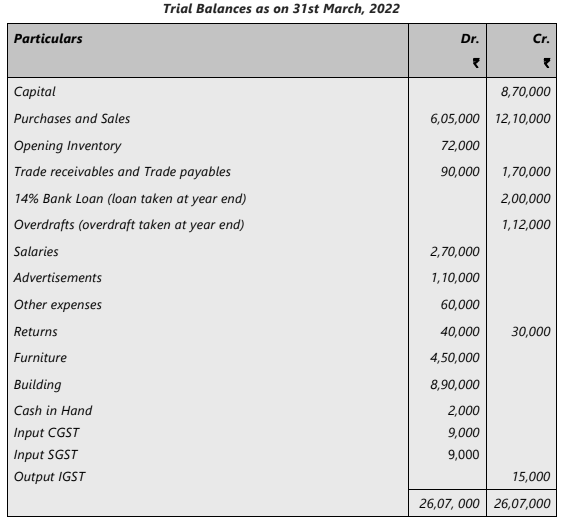

ILLUSTRATION 9

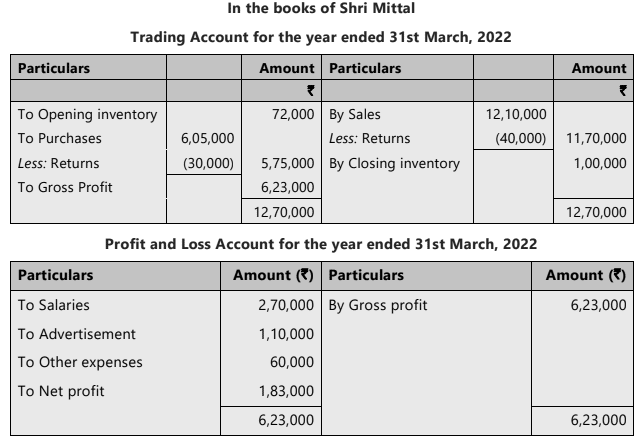

Shri Mittal gives you the following Trial Balance and some other information:

Closing Inventory on 31st March, 2022 was valued at ` 1,00,000.

Required

Prepare final accounts of Shri Mittal for the year ended 31st March, 2022.

SOLUTION

Note: As loan and overdraft taken at year end so no interest shown.

Working Note:

Output IGST liability is paid by utilizing Input CGST of ₹ 9,000 and Input SGST of `₹6,000. Thereafter, closing balance of Input SGST of ₹ 3,000 is reported in Balance Sheet.

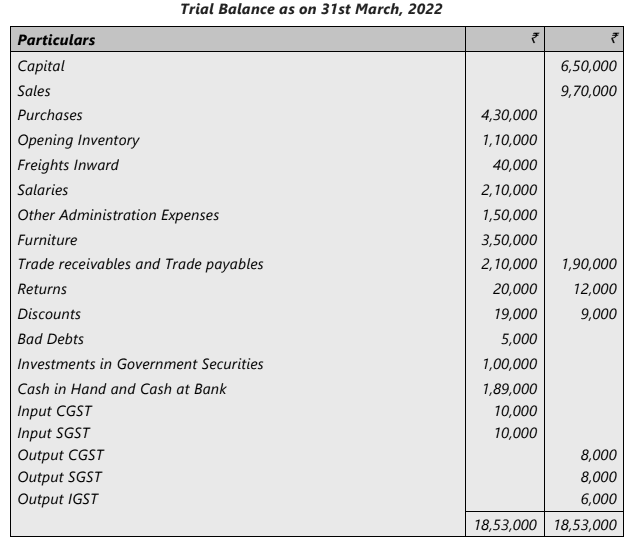

ILLUSTRATION 10

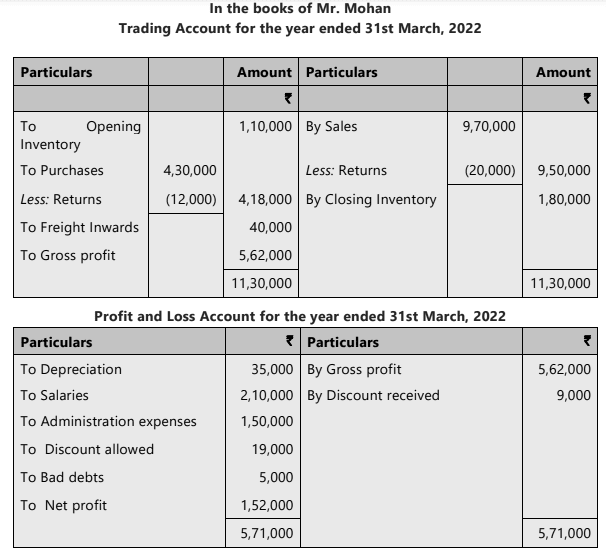

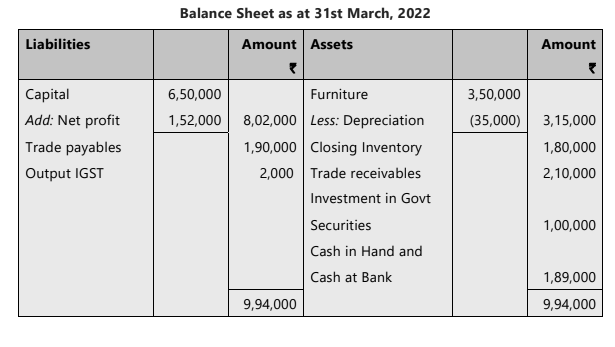

Mr. Mohan gives you the following trial balance and some other information:

Other Information:

(i) Closing Inventory was ₹ 1,80,000;

(ii) Depreciate Furniture @ 10% p.a.

Required

Prepare Trading and Profit and Loss Account for the year ended on 31.3.2022 and Balance Sheet of Mr. Mohan as on that date.

SOLUTION

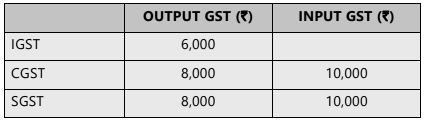

Working Note:

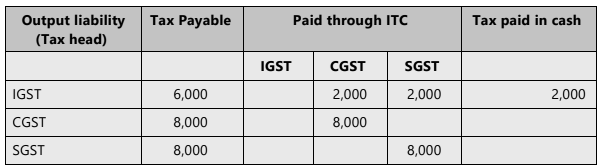

Summary of Output and Input GST liability (as per Trial Balance)

In the above solution, it is assumed that balance IGST liability of ₹ 2,000 (after utilising CGST and SGST) is not paid off in cash.

Alternatively, students may assume that the balance liability of ₹ 2,000 is paid off in cash. Accordingly, Output IGST liability of ₹2,000 shall not appear under liability side of the balance sheet and amount of cash at bank is reported as ₹ 1,87,000

ILLUSTRATION 11

The Balance Sheet of Mr. Popatlal, a merchant on 31st March, 2022 stood as below:

Required

Show opening journal entry on 1st April, 2022 in the books of Mr. Popatlal.

SOLUTION

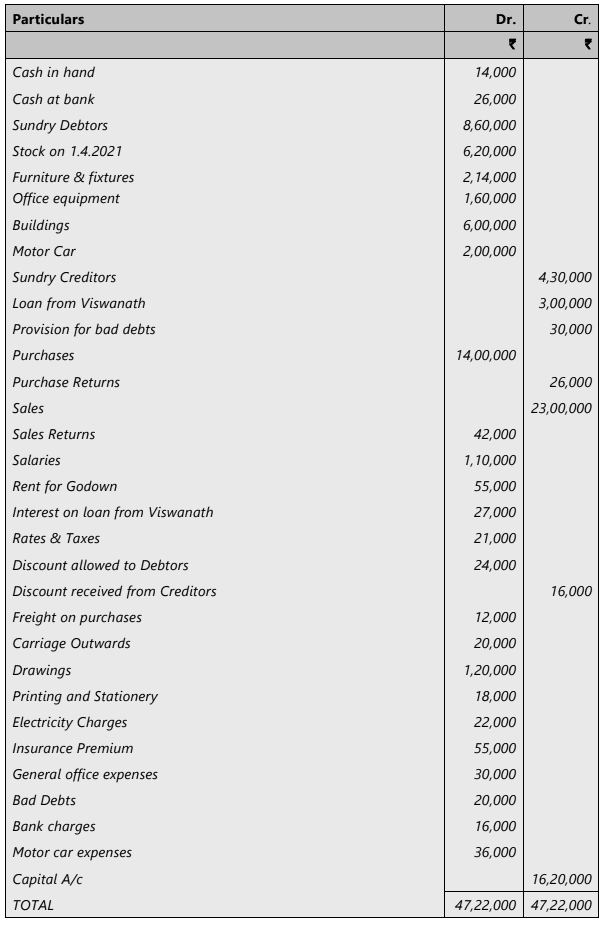

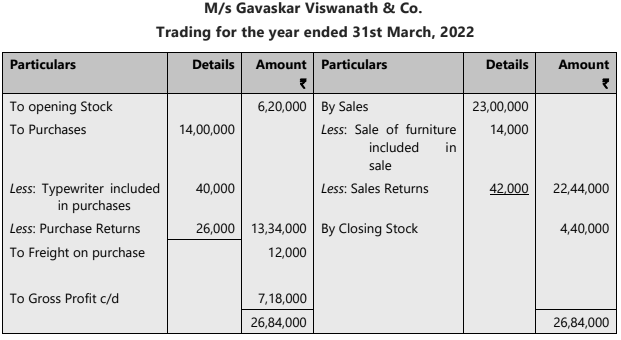

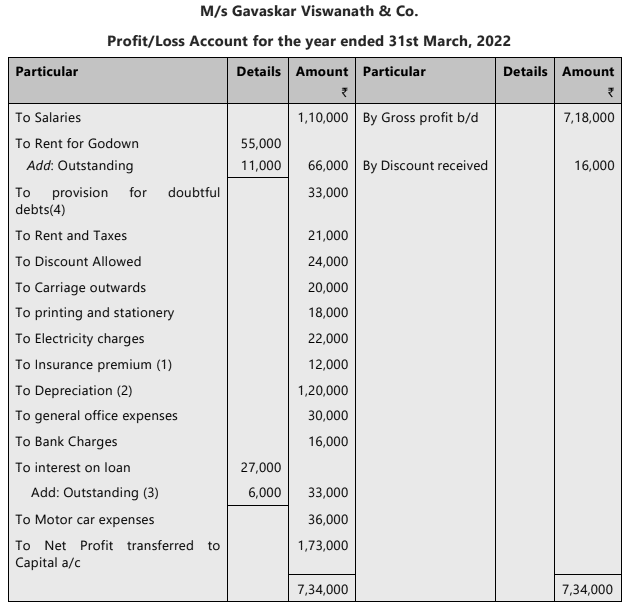

ILLUSTRATION 12

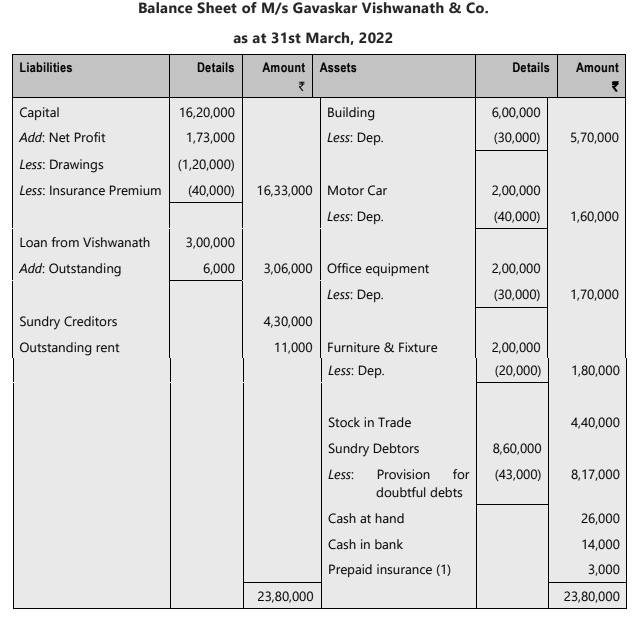

The following is the schedule of balances as on 31.3.22 extracted from the books of Shri Gavaskar, who carries on business under the same name and style of Messrs Gavaskar Viswanath & Co., at Mumbai:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2022 and the Balance Sheet as at that date after making provision for the following:

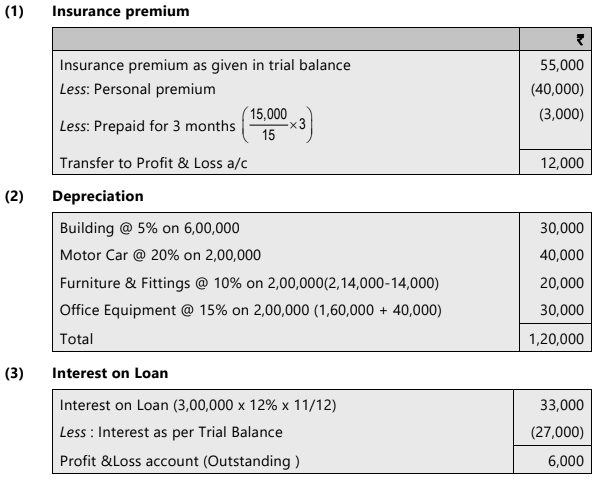

1. Depreciate: (a) Building used for business by 5 percent; (b) Furniture and fixtures by 10 percent; One steel table purchased during the year for ₹ 14,000 was sold for same price but the sale proceeds were wrongly credited to Sales Account; (c) Office equipment by 15 percent; Purchase of a typewriter during the year for ₹ 40,000 has been wrongly debited to purchase; and (d) Motor car by 20%.

2. Value of stock at the close of the year was ₹ 4,40,000.

3. Two month’s rent for godown is outstanding.

4. Interest on loan from Viswanath is payable at 12 percent per annum, this loan was taken on 1.5.2021.

5. Provision for bad debts is to be maintained at 5 percent of Sundry Debtors.

6. Insurance premium includes ₹ 40,000 paid towards proprietor’s life insurance policy and the balance of the insurance charges cover the period from 1.4.2021 to 30.6.2022.

SOLUTION

Working Notes :

(5) Purchase of a typewriter during the year for ` 40,000 which was wrongly debited to purchase added to office equipment.

ILLUSTRATION 13

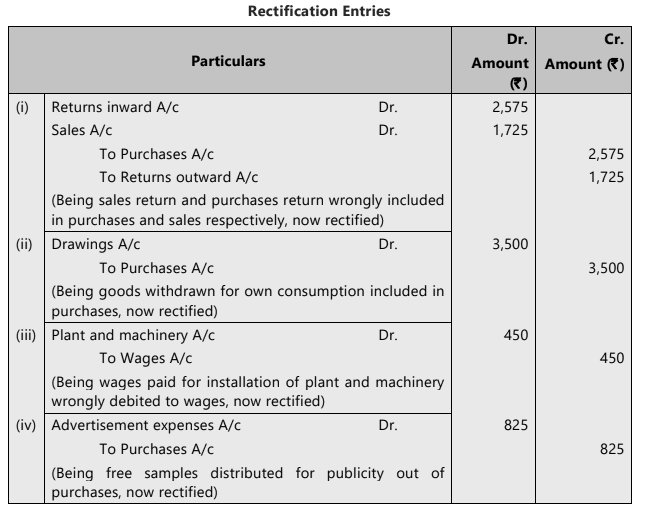

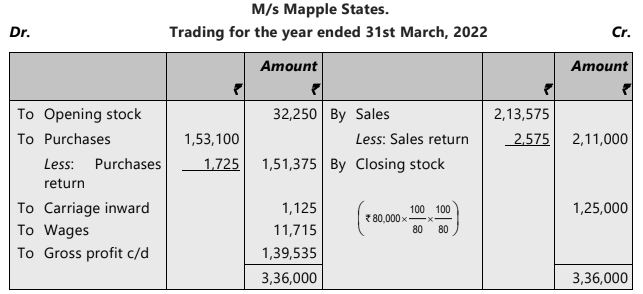

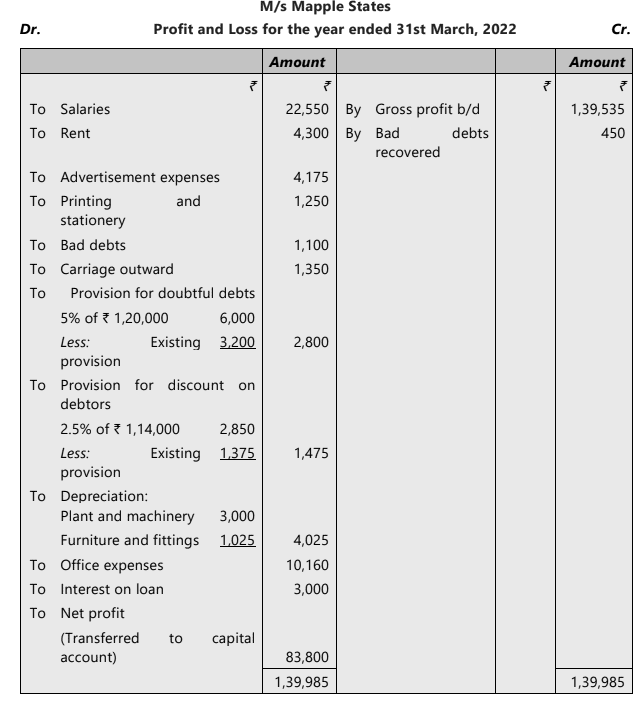

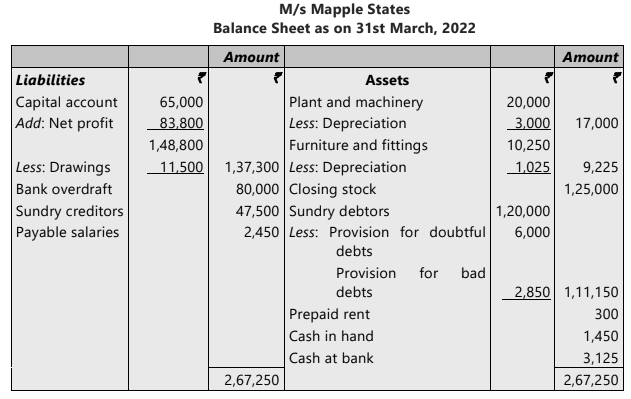

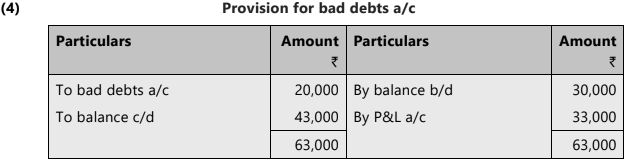

The following are the balances as at 31st March, 2022 extracted from the books of M/s Mapple States.

Additional Information:

1. Purchases include sales return of ` 2,575 and sales include purchases return of ` 1,725.

2. Goods withdrawn by Mr. XYZ for own consumption ` 3,500 included in purchases.

3. Wages paid in the month of April for installation of plant and machinery amounting to ` 450 were included in wages account.

4. Free samples distributed for publicity costing ` 825.

5. Create a provision for doubtful debts @ 5% and provision for discount on debtors @ 2.5%.

6. Depreciation is to be provided on plant and machinery @ 15% p.a. and on furniture and fittings @ 10% p.a.

7. Bank overdraft is secured against hypothecation of stock. Bank overdraft outstanding as on 31.3.2022 has been considered as 80% of real value of stock (deducting 20% as margin) and after adjusting the marginal value 80% of the same has been allowed to draw as an overdraft.

Prepare a Trading and Profit and Loss Account for the year ended 31st March, 2022, and a Balance Sheet as on that date. Also show the rectification entries.

SOLUTION

Provisions and Reserves

Provisions are amounts set aside from profits to cover estimated future expenses or losses, such as bad debts or legal claims. Reserves are portions of profits appropriated for specific purposes, like setting up a fund for asset replacement.- While provisions are a charge against profits, reserves are an appropriation of profits. Excess provisions can become reserves if they are no longer needed.

- A Reserve Fund is money set aside in a reserve that is invested in easily realizable securities, such as government bonds or shares.

ILLUSTRATION 14

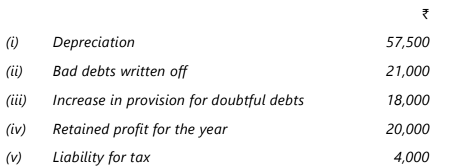

Crimpson traders profit and loss account for the year ended 31st March, 2022 includes the following information:

Required

State which one of the items (i) to (vi) above are – (a) transfer to provisions; (b) transfer to reserves; and (c) neither related to provisions nor reserves.

SOLUTION

(a) Transfer to provisions - (i), (iii) (v)

(b) Transfer to reserves - (iv)

(c) Neither related to provisions nor reserves - (ii).

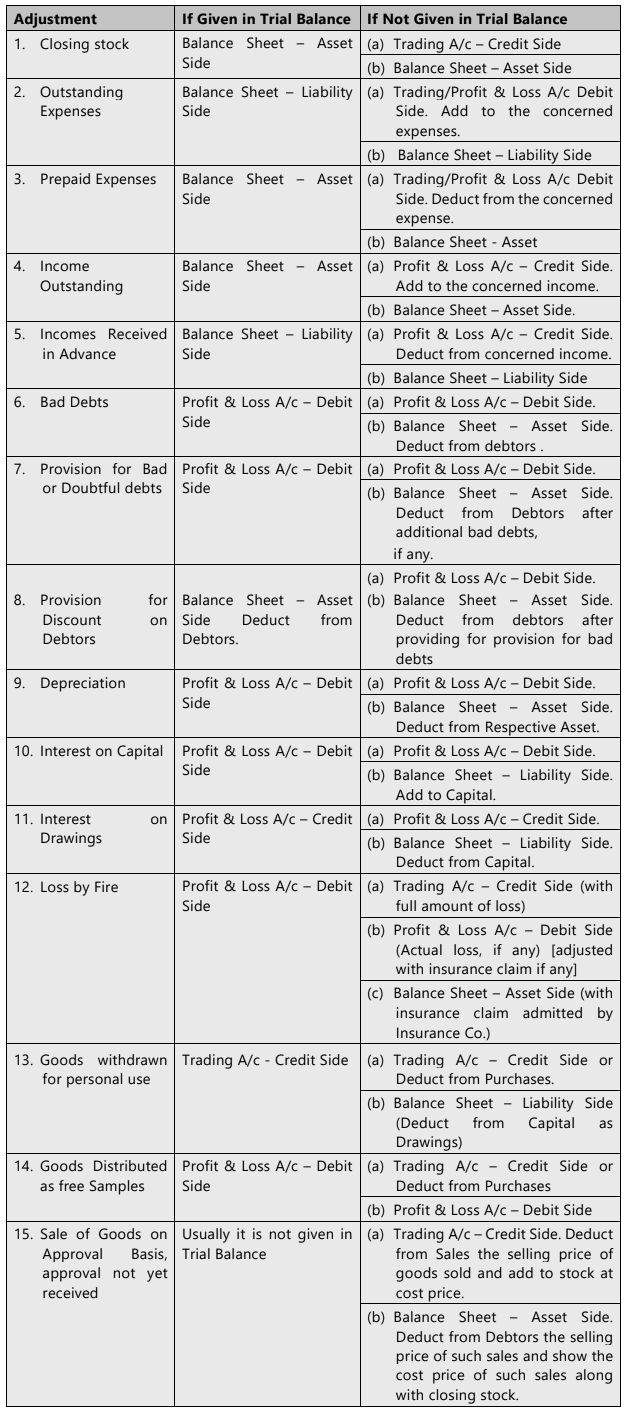

A summary of all adjustments are as follows:

Limitations of Financial Statements

- Financial statements have several limitations that need to be carefully considered to draw correct conclusions.

- These limitations are less problematic when assessing the performance of a single company over time.

- However, when comparing different companies or industries, it can be misleading unless they follow the same accounting systems and principles.

- The main limitations of financial statements include:

(a) Historical Cost. Financial statements are based on the historical cost of transactions, without considering changes in the value of money over time. This can lead to misleading representations, especially for fixed assets. For example, a house built in 1980 for ₹15,000 may have the same benefits as a house built in 2022 for ₹30,00,000. If the 1980 house is included in the financial statements at its original cost, it does not reflect the true value.

(b) Intangible Strengths and Weaknesses. Financial statements may not capture a company’s intangible strengths and weaknesses, such as the loyalty and skills of its staff. These factors should be considered when evaluating a company’s financial position.

(c) Perpetual Continuity and Periodical Accounts. Financial statements are prepared with the assumption that the business will continue indefinitely, which is known as the going concern assumption. This means that expenses are allocated over several years, even though the financial statements are prepared annually. As a result, the statements may not be completely accurate.

(d) Different Accounting Policies. Companies may adopt different accounting policies within certain limits, such as how they value assets or allocate expenses. For instance, one company may set up a fund for pension and gratuity payments, while another may only account for these expenses when they are paid.

(e) Management Policies. Management can have different accounting policies that affect the welfare of staff and the public.

|

68 videos|160 docs|83 tests

|

FAQs on Unit 1: Final Accounts of Non-Manufacturing Entities Chapter Notes - Accounting for CA Foundation

| 1. What is the purpose of preparing final accounts for non-manufacturing entities? |  |

| 2. What items are included in the Trading Account of a non-manufacturing entity? |  |

| 3. How do certain adjustments affect the Profit and Loss Account? |  |

| 4. What is the sequence of the accounting procedure or accounting cycle in final accounts preparation? |  |

| 5. How is the Balance Sheet structured in the final accounts of non-manufacturing entities? |  |