Unit 2: Treatment of Goodwill in Partnership Accounts Chapter Notes | Accounting for CA Foundation PDF Download

Unit Overview

Goodwill

Goodwill refers to the value associated with a firm's reputation and its ability to generate profits in the future, exceeding the normal rate of profit.In simple terms, goodwill is the likelihood that old customers will keep returning to the same business.

It represents a business's capacity to earn superior profits in the future. Goodwill is an intangible asset; it cannot be seen, felt, or physically moved. However, it is very real and has monetary or saleable value from an accounting perspective.

- Goodwill is the extra profit a firm makes due to factors like being in a good location, offering better service, having a unique patent, or the personal reputation of the owner.

- Goodwill is measured by comparing a firm's profit to the normal profit of similar firms in the area.

- Goodwill is an intangible asset, which means it can't be seen or touched, but it still has real value.

- From an accounting perspective, it is important for goodwill to have some monetary or saleable value.

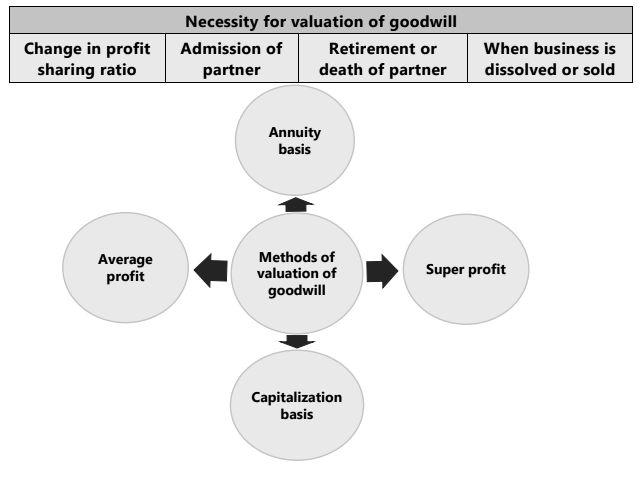

- Goodwill becomes relevant when there are changes in profit-sharing ratios among partners, when a new partner joins, when a partner leaves or passes away, or when the business is sold or dissolved.

For example, if a small book business has a net worth of ₹140,000 and a buyer is willing to pay ₹150,000 for it, the extra ₹10,000 is considered goodwill. The buyer might be willing to pay this extra amount due to the business's potential to earn higher profits in the future, perhaps because of its favorable location.

Factors Affecting Goodwill Valuation

- Quality of Goods Sold: The superior quality of products can enhance goodwill.

- Personal Reputation of Owners: Owners with a strong personal reputation can attract more customers.

- Location of Business Premises:. prime location, especially in a crowded market, can boost goodwill.

- Near Monopoly Rights: Exclusive rights, such as being the main agent for a specific product, can increase goodwill.

- Trademarks and Patents: Owning trademarks and patents adds to goodwill.

- Managerial Skill: Strong managerial skills contribute to the business's success and, thus, its goodwill.

- Research and Development Costs: Investments in R&D that lead to cost-effective and high-quality production enhance goodwill.

- Special Contracts: Having special contracts for material availability can positively impact goodwill.

Accounting Standards for Intangible Assets

Accounting Standards stipulate that an intangible asset should be recognized only if certain conditions are met:

- Asset Characteristics: The intangible asset must have value and be clearly identifiable, allowing it to be sold independently without other assets.

- Future Economic Benefits: The asset should be expected to bring future economic benefits, such as increased sales revenue, to the business. Management must be able to reasonably estimate these future benefits.

- Reliable Cost Measurement: The cost of the intangible asset must be objectively verifiable. If the cost cannot be measured reliably, the asset cannot be recognized.

Internally Generated Goodwill

- Internally generated goodwill, also known as inherent goodwill, does not meet the criteria for recognition as an asset.

- This is because it is not an identifiable resource like a patent or trademark, and its future benefits are difficult to assess.

- Additionally, the cost of internally generated goodwill cannot be reliably measured as there is no monetary consideration involved.

Recognizing Purchased Goodwill

- Goodwill should only be recorded in the books when there is a monetary consideration for it.

- For example, during the admission or retirement of a partner, or a change in profit-sharing ratio, goodwill should not be raised in the books of account as no consideration has been paid.

- Purchased goodwill, whether paid in cash or kind, can be recorded in the books of account.

- For instance, if partners ‘A’ and ‘B’ purchase the net assets of ‘C’ for ₹3,00,000, and the net assets are valued at ₹2,50,000, the additional ₹50,000 is considered purchased goodwill and can be recorded in the books.

Internally Generated Goodwill

- When no payment is made for goodwill and the goodwill account is raised in the books, it is considered internally generated goodwill, which is not permitted as per Accounting Standards.

- For example, during the reconstitution of a firm due to admission, retirement, or death of a partner, the goodwill of the firm is evaluated.

- In such cases, the goodwill should not be brought into the books of account as it is inherent or self-generated goodwill.

- The value of goodwill calculated through different valuation methods should be adjusted through the capital accounts of the partners.

- Goodwill accounts should not be raised in the books of account during the reconstitution of the firm or change in profit-sharing ratio.

Writing Off Goodwill

- The amount of goodwill should be written off over a specific period.

- If a goodwill account exists at the time of reconstitution of the firm, it should be written off immediately, regardless of whether it is internally generated or purchased for consideration.

Methods for Goodwill Valuation

There are three primary methods for the valuation of goodwill:- Average Profit Basis - includes Simple and Weighted averages.

- Super Profit Basis - includes Number of Years Purchase, Annuity Basis, and Capitalization of Super Profit.

- Capitalization Basis - based on Average Profits.

1. Average Profit Basis

This method adjusts the average profits of past years for any expected changes in the future. The number of years used is based on judgment and negotiation.

- Simple Average: Used when there is no clear trend in profits.

- Weighted Average: Used when there is a clear trend; more weight is given to recent years' profits.

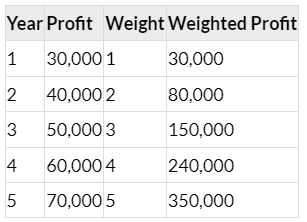

Example: Given profits of ₹30,000, ₹40,000, ₹50,000, ₹60,000, and ₹70,000, the weighted average profit is calculated as follows:

Total Weighted Profit = ₹850,000; Weighted Average Profit = ₹56,667 (approx). If goodwill is valued at three years’ purchase, its value is ₹170,000.

2. Super Profit Basis

This method values goodwill based on super profits earned by the firm, defined as:

Super Profit = Actual Profit - Normal Profit

- Actual Profit: Average maintainable profit.

- Normal Profit: Normal Rate of Return (NRR) × Capital Employed.

Example: With a total capital employed of ₹100,000 and an average profit of ₹25,000, with a normal rate of return of 22%, the calculations are:

- Normal Profit = ₹22,000

- Super Profit = ₹3,000

Number of Years Purchase Method: Value of goodwill = Super Profit × Number of Years.

Example: If super profit is ₹3,000 and expected for 5 years, goodwill = ₹15,000.

Example Calculation of Super Profit

Total capital investment of ₹4,50,000 with profits over four years as follows:

- Year 1: ₹70,000

- Year 2: ₹80,000

- Year 3: ₹1,20,000

- Year 4: ₹1,00,000

Average Profit = ₹92,500; Normal Profit = ₹67,500; Super Profit = ₹25,000. Thus, goodwill based on 3 years’ purchase = ₹75,000.

Annuity Method

This method accounts for the time value of money in calculating goodwill. The present value of super profits is calculated using discount factors.

Example: For annual maintainable profit ₹65,000, capital employed ₹4,00,000, and NRR of 12%, with present value of annuity at 5 years as 3.604776:

- Super Profit = ₹17,000

- Present Value of Annuity = ₹61,281 (approx).

3. Capitalization Basis

This method calculates the total business value using the normal rate of return. If this value exceeds the capital employed, the difference is considered goodwill.

Calculation Steps:

- Determine the normal rate of return.

- Find the average profit.

- Determine capital employed.

- Calculate normal value of the business.

- Subtract actual capital from normal value to find goodwill.

Example: If average profit is `₹60,000, normal rate of return is 12%, and net tangible assets are ₹4,10,000:

- Normal Value = ₹5,00,000

- Goodwill = ₹90,000.

Above methods are explained below with the help of following illustrations:

ILLUSTRATION 1

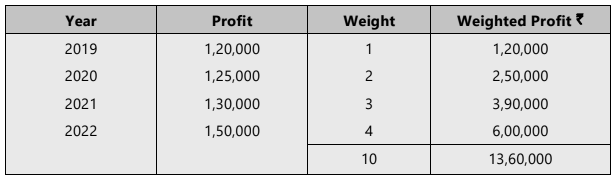

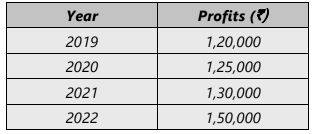

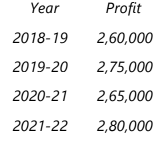

Lee and Lawson are in equal partnership. They agreed to take Hicks as one-fourth partner. For this it was decided to find out the value of goodwill. M/s. Lee and Lawson earned profits during 2019-2022 as follows:

On 31.12.2022 capital employed by M/s. Lee and Lawson was₹5,00,000. Rate of normal profit is 20%.

Required: Find out the value of goodwill following various methods.

SOLUTION

Average Profit:

Weighted Average Profit = ₹ 13,60,000 divided by 10 =₹ 1,36,000

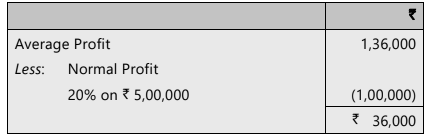

Method (1): Average Profit Basis

Assumption: Goodwill is valued at 3 year’s purchase

Valuation of Goodwill: ₹1,36,000 ×3 = ₹ 4,08,000Method (2): Super Profit Basis

Assumption: Goodwill is valued at 3 years’ purchase.

Value of Goodwill = ₹36,000 × 3 = ₹1,08,000Method (3): Annuity Basis

Assumptions:

(a) Interest rate is equivalent to normal profit rate i.e. 20%p.a.

(b) Goodwill is valued at 3 years’ purchases

Valuation of Goodwill: ₹ 36,000 × 2.1065 = ₹ 75,834

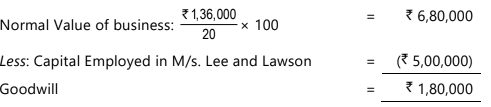

Method (4): Capitalisation Basis

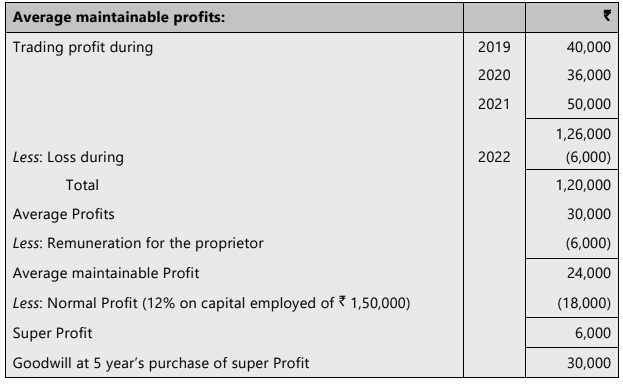

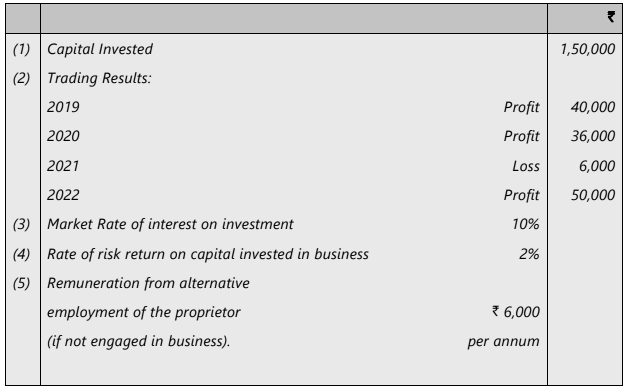

ILLUSTRATION 2

The following particulars are available in respect of the business carried on by Rathore

You are required to compute the value of goodwill on the basis of 5years’ purchase of super profit of the business calculated on the average profits of the last four years.

SOLUTION

Hidden or Inferred or implied Goodwill

- Sometimes, the value of goodwill is not clearly stated and must be estimated based on the capital arrangement or the profit-sharing ratio.

- For instance, A has a capital of ₹ 20,000 and B has a capital of ₹ 15,000. They share profits equally.

- C joins as a partner with a capital of ₹ 18,000 for a 1/4 share in the profits.

- The total capital of the firm should be ₹ 72,000. This is because if C invests ₹ 18,000 for a 1/4 share, then for a full share, he should contribute ₹ 72,000 (calculated as ₹ 18,000 x 4).

- However, the total capital contributed by A, B, and C adds up to only ₹ 53,000.

- Therefore, the hidden value of the goodwill should be considered as ₹ 19,000 to ensure that the total capital reaches ₹ 72,000.

Need for Valuation of Goodwill

- When there is a change in the partnership relationship, some partners may have to give up future profits while others gain.

- Those who sacrifice future profits need to be compensated by those who are gaining.

- This adjustment of partnership rights can occur due to various reasons such as the admission of a new partner, change in profit sharing ratio, retirement or death of a partner, or dissolution of the partnership.

- Partners who gain in terms of profit sharing ratio must pay for their gain in proportion to the value of goodwill.

- Conversely, partners who lose in terms of profit sharing ratio receive payments for their sacrifice in proportion to the value of goodwill.

Valuation of Goodwill in Case of Admission of a Partner1. Introduction

- When a new partner joins an existing partnership, certain adjustments in the accounts are necessary. This is because the new partner will be entitled to a share of the profits, which means the old partners will have to give up part of their share.

- For example, if partners A and B are sharing profits in the ratio of 3:2 and their total profit is ₹20,000, A would receive ₹12,000 and B would get ₹8,000. If partner C is admitted and given a one-fourth share of the profits, he would receive ₹5,000, leaving ₹15,000 to be divided between A and B.

- In this case, A would get ₹9,000 and B would get ₹6,000. This means A loses ₹3,000 and B loses ₹2,000 per year due to C’s admission. C needs to compensate A and B for this loss.

2. The Problem of Compensation

- The issue of compensation is central to the admission of a new partner and is addressed through the concept of goodwill.

- Goodwill serves as compensation to the old partners for their sacrifice when a new partner is admitted. It is credited to the partners according to their profit-sharing ratio.

- The share that the new partner is receiving can be sacrificed by the old partners either in proportion to their old profit-sharing ratio or in a different proportion.

3. Goodwill as Compensation

- Goodwill is essentially a way to value the future potential of the partnership and compensate the old partners for their share of this potential when a new partner is brought in.

- The old partners are entitled to this compensation because they are giving up a portion of their current and future profits to accommodate the new partner.

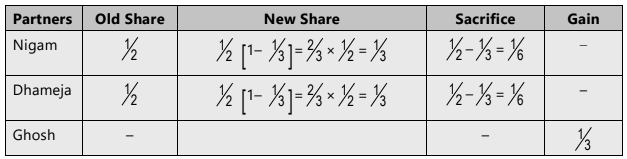

For example, Nigam and Dhameja are in partnership sharing profits and losses equally. They agreed to take Ghosh as one-third partner. Now one-third share of Ghosh may come out of sacrifice made by Nigam and Dhameja equally (i.e. at their old profit sharing ratio). See the following profit sharing pattern:

Profit Sharing Pattern

In other words, one-third share of Ghosh was borne by Nigam and Dhameja at their old profit sharing ratio. By this process Nigam sacrificed 1/2–1/3 = 1/6 in share and Dhameja sacrificed

1/2–1/3 = /1/6 in share. So the profit sacrificing ratio becomes:

Nigam = Dhameja

1/6 = 1/6

1 : 1

Which is the same as old profit sharing ratio.

But if the new profit sharing ratio of Nigam, Dhameja and Ghosh becomes 4:2:3, then profit sacrificed by Nigam and Dhameja on Ghosh’s admission is not at the old profit sharing ratio. In this case profit sacrificing ratio is as follows:

Nigam = 1/2 – 4/9 = 1/18

Dhameja = 1/2 – 2/9 = 5/18

i.e. 1 : 5

If Ghosh pays goodwill of ₹ 24,000, then in the first case, Nigam and Dhameja should share it equally; but in second case Nigam should get ₹ 4,000 and Dhameja should get ₹ 20,000.

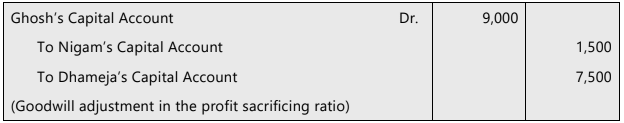

Take another example: Nigam and Dhameja are equal partners. They agreed to take Ghosh as one-third partner. The new profit sharing ratio is 4:2:3. Nigam and Dhameja agreed ₹ 27,000 as value of goodwill.

Journal Entry

Nigam - ₹ 27,000 × 1/18

Dhameja - ₹ 27,000 × 5/18

As per the Accounting Standards, it is not recommended to raise goodwill account but to show the adjustment of goodwill through partners’ capital accounts.

Accounting Treatment of Goodwill in Case of Admission of a New Partner

- Goodwill Recognition: Goodwill should only be recorded in the books when there is a payment involved, either in cash or in kind. This means that only purchased goodwill should be acknowledged in the firm’s accounts.

- Admission of a New Partner: When a new partner is admitted, goodwill cannot be raised in the firm’s books because no payment is made for it. If the incoming partner offers a premium for goodwill above his capital contribution, this premium should be distributed among the existing partners.

- Profit Sharing Adjustment: Old partners typically lower their profit-sharing ratios to accommodate the new partner. The premium for goodwill brought in by the new partner is allocated to the existing partners based on their profit sacrificing ratio, which is calculated by subtracting the new profit-sharing ratio from the old profit-sharing ratio.

- Eligibility for Goodwill Share: Only those existing partners who sacrifice a portion of their profits in favor of the new partner are entitled to a share of the goodwill.

- Inherent Goodwill: In situations where the incoming partner cannot bring in cash for goodwill, the value of goodwill should not be raised in the books since it is inherent goodwill. Instead, it is preferable to adjust this value through the partners’ capital accounts.

- Private Premium Payments: If the incoming partner privately pays a premium for goodwill to the existing partners, no entry is required in the firm’s books. The amount to be paid to each partner should be calculated according to the profit sacrificing ratio.

- Profit Sacrificing Ratio: This ratio is crucial in determining how much each existing partner will receive from the goodwill premium. It reflects the amount of profit each partner is sacrificing for the new partner.

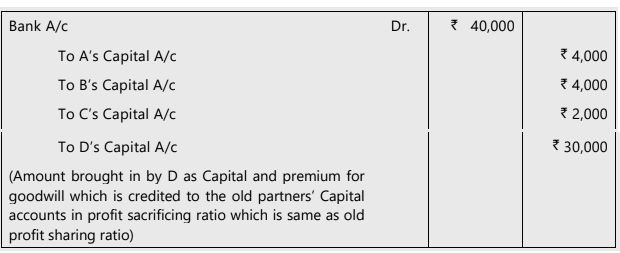

Example 1: A, B & C are in partnership sharing profits and losses in the ratio 2:2:1. They want to admit D into partnership with one-fifth share. D brings in ₹ 30,000 as capital and ₹ 10,000 as premium for goodwill.

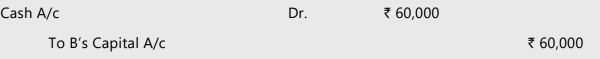

The necessary journal entry will be:

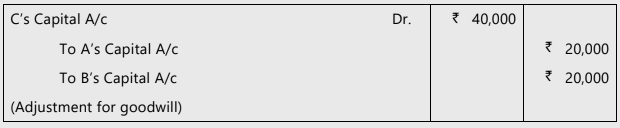

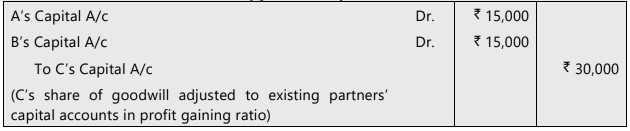

Example 2: A & B are equal partners. They wanted to take C as a third partner for one third share and for this purpose goodwill was valued at ₹ 1,20,000. The journal entry for adjustment of value of goodwill through partners’ capital accounts will be:

The net effect in partners’ capital accounts is shown on the basis of profit sacrificing ratio:

A = 1/6 × ₹ 1,20,000 = ₹ 20,000 (Cr.)

B = 1/6 × ₹ 1,20,000 = ₹ 20,000 (Cr.)

C = 1/3 × ₹1,20,000 = ₹ 40,000 (Dr.)

Example 3: A & B are equal partners. They wanted to admit C as 1/6th partner who brought ₹ 60,000 as goodwill. The new profit sharing ratio is 3:2:1. Profit sacrificing ratio is to be computed as follows:

Old Share – New Share = Share Sacrificed

A = 1/2 – 3/6 = 0

B = 1/2 – 2/6 = 1/6

So the entire goodwill should be credited to B’s Capital A/c.

(Goodwill brought in by C credited to B’s Capital A/c)

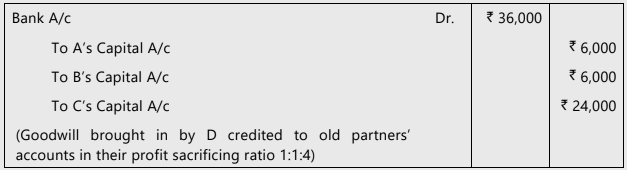

Example 4: A, B & C are equal partners. They decided to take D who brought in ₹ 36,000 as goodwill. The new profit sharing ratio is 3:3:2:2.

Old Share – New Share = Share Sacrificed

A = 1/3 – 3/10 = 1/30

B = 1/3 – 3/10 = 1/30

C = 1/3 – 2/10 = 4/30

So goodwill should be shared in the ratio 1:1:4

ILLUSTRATION 3

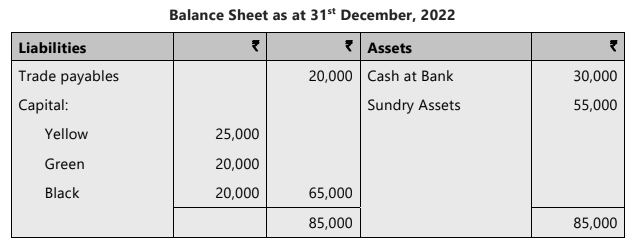

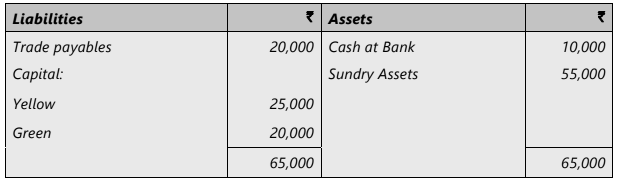

The following is the Balance Sheet of Yellow and Green as at 31st December, 2022:

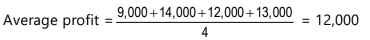

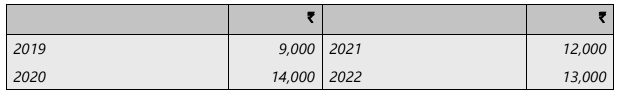

The partners shared profits and losses in the ratio 3:2. On the above date, Black was admitted as partner on the condition that he would pay ₹ 20,000 as Capital. Goodwill was to be valued at 3 years’ purchase of the average of four years’ profits which were:

The new profit sharing ratio is 6:5:5.

Give journal entries and Balance Sheet if goodwill is adjusted through partners’ capital accounts.

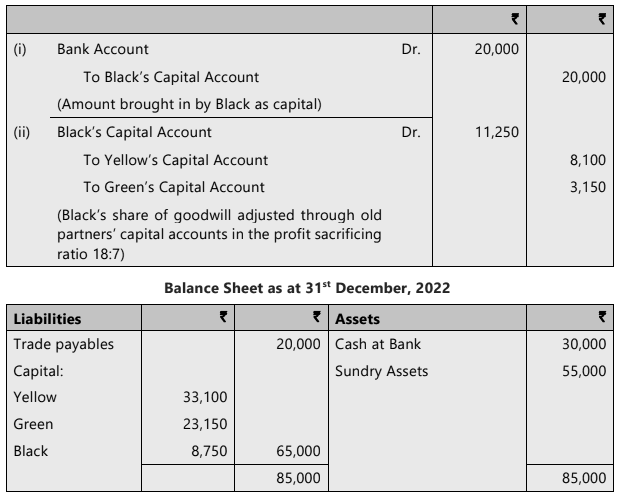

SOLUTION

Note: Calculation of Profit Sacrificing Ratio

Old Share – New Share = Share Sacrificed

Yellow 3 / 5 – 6 /16 = 18 / 80

Green 2 / 5 – 5 / 16 = 7 / 80

Calculation of GoodwillGoodwill of the firm = 3 × 12,000 = 36,000

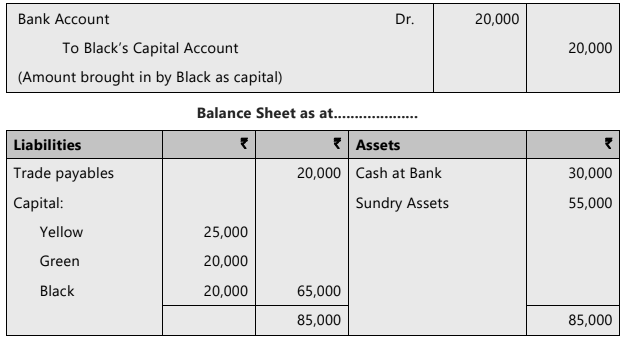

ILLUSTRATION 4

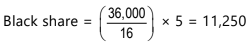

With the information given in illustration 3, let us give journal entries and prepare balance sheet assuming that goodwill is brought in cash.

SOLUTION

ILLUSTRATION 5

Continuing with the same illustration 3, let us give journal entries and prepare balance sheet assuming that goodwill is brought in cash, but withdrawn.

SOLUTION

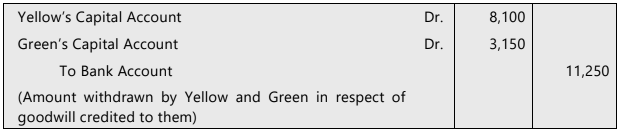

Goodwill brought in cash, but withdrawn

In addition to the treatment under Illustration 3 the following additional entry will be made:

ILLUSTRATION 6

On the basis of information given in illustration 3, let us give journal entries and prepare balance sheet assuming that goodwill is paid privately.

SOLUTION

There will be no entry for goodwill but Black will pay ₹ 8,100 to Yellow and ₹ 3,150 to Green. For capital brought in by Black, the entry is:

|

Download the notes

Chapter Notes- Unit 2: Treatment of Goodwill in Partnership Accounts

|

Download as PDF |

Accounting Treatment of Goodwill in Case of Change in Profit Sharing Ratio

In case of change in profit sharing ratio, the value of goodwill should be determined and preferably adjusted through capital accounts of the partners on the basis of profit sacrificing ratio.ILLUSTRATION 7

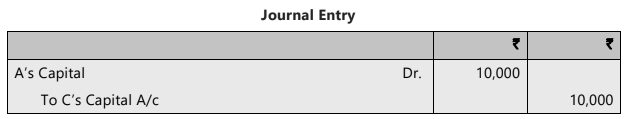

A, B & C are equal partners. They wanted to change the profit sharing ratio into 4:3:2. Make the necessary journal entries. Goodwill of the firm is valued at ₹ 90,000.

SOLUTION

In this case due to change in profit sharing ratio

A’s gain is = 4/9 less 1/3 = 1/9

B’s gain is = 1/3 less 1/3 = 0

C’s loss is = 1/3 less 2/9 = 1/9

So, A should compensate C to the extent of 1/9th of goodwill i.e. ₹ 90,000 × 1/9 = ₹ 10,000

ILLUSTRATION 8

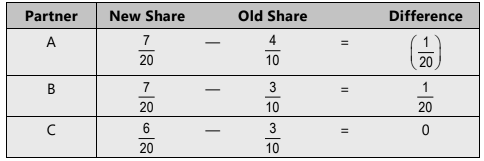

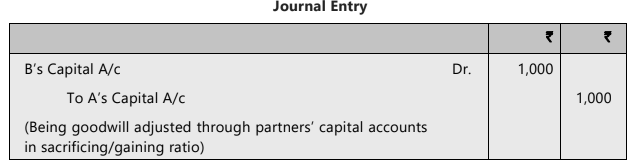

A, B and C are in partnership sharing profits and losses in the ratio of 4:3:3. They decided to change the profit sharing ratio to 7:7:6. Goodwill of the firm is valued at ₹ 20,000. Calculate the sacrifice / gain by the partners and make the necessary journal entry.

SOLUTION

Thus, B gained 1/20th share while A sacrificed 1/20th share For C there was no loss no gain.

ILLUSTRATION 9

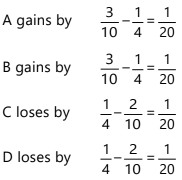

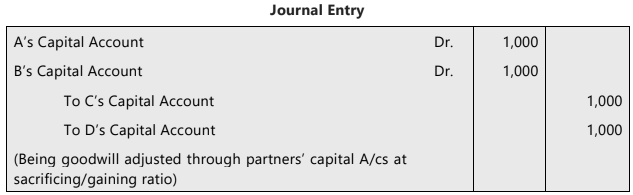

A, B, C and D are in partnership sharing profits and losses equally. They mutually agreed to change the profit sharing ratio to 3:3:2:2. Goodwill of the firm is valued at₹ 20,000. Give necessary journal entry.

SOLUTION

A and B should pay @` 1,000 each (i.e., ₹ 20,000×1/20) as compensation to C and D respectively for their sacrifice.

Accounting Treatment of Goodwill in Case of Retirement or Death of a Partner

Upon a partner's retirement, the remaining partners will benefit from an increased profit-sharing ratio and must compensate the retiring partner for their share of goodwill based on this gaining ratio. Similarly, in the event of a partner's death, the surviving partners are responsible for settling the deceased partner's goodwill share with their heirs. Goodwill is assessed as of the retirement or death date and adjustments are made through the partners' capital accounts.Example: A, B & C are equal partners. C wanted to retire for which value of goodwill is considered as ₹ 90,000. The necessary journal entry will be:

ILLUSTRATION 10

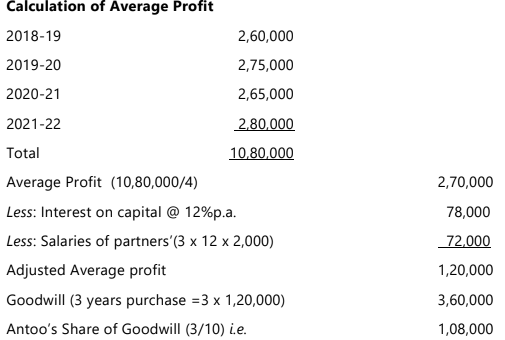

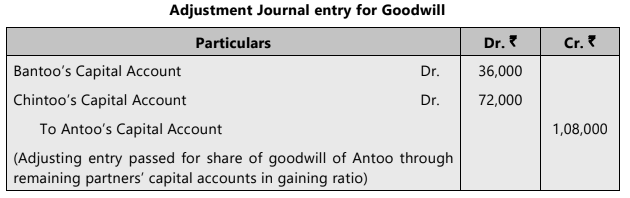

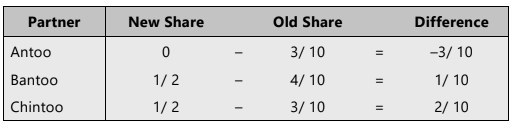

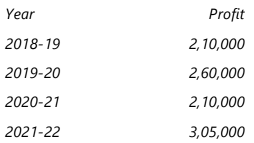

Antoo, Bantoo and Chintoo were in partnership sharing profits and losses 3:4:3 respectively. The accounts of the firm are made up to 31st March every year. The partnership provided, interalia, that: On the retirement of a partner the goodwill was to be valued at three years’ purchase of average profits of the past four years up to the date of the retirement after deducting interest @12%p.a. on capital employed and remuneration of ₹ 2,000 p.m.to each partner. On 1st April 2022, Antoo retired and it was agreed on his retirement to adjust goodwill in the capital accounts without showing any amount of goodwill in the Balance Sheet. It was agreed that the capital employed would be ₹ 6,50,000. Bantoo and Chintoo were to continue the partnership, sharing profits and losses equally after the retirement of Antoo. The following were the amounts of profits of earlier years before charging salary to partners and interest on capital employed.

You are required to compute the value of goodwill and show the adjustment there of in the books of the firm.

SOLUTION

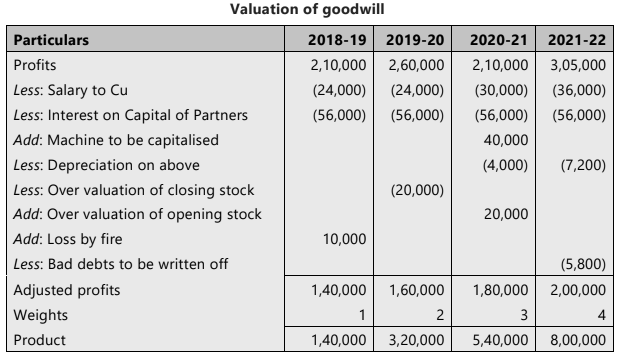

Valuation of Goodwill

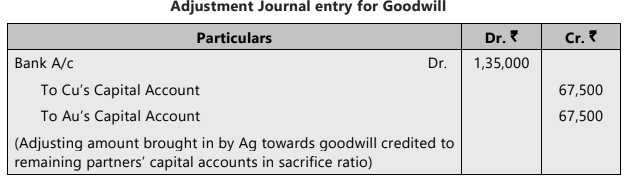

Adjustment Journal entry for Goodwill

Working Note:

ILLUSTRATION 11

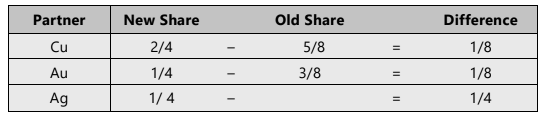

Cu and Au were in partnership sharing profits and losses in the ratio 5:3. On 1st April 2022, they decided to admit Ag the partnership on the following terms:

1. Ag will bring ₹ 2,00,000/- as capital for ¼ share.

2. New profit sharing ratio shall be 2:1:1 among Cu, Au and Ag.

3. Cu was entitled to salary of ₹ 2,000/- p.m., it was revised to ₹ 3,000 p.m. from 1st October 2020.

4. Interest on capital was paid at 8% p.a.

5. Capitals as on 31st March 2022 were Cu ₹4,00,000 Au ₹ 3,00,000, which had remained unchanged since last four years.

6. Goodwill was to be valued on the basis of 3 years purchase of average adjusted weighted average profits of past 4 years after deducting salaries to partners and interest on capital. The profits of previous four years, before charging interest on capital and salary to Cu were as follows:

These profits were subject to following rectification

(a) A machine costing ₹ 40,000 purchased on 1st October, 2020 was wrongly charged to revenue. The machinery was depreciated at 20% p.a. on written down value method

(b) Stock on 31st March 2020 was over valued by ₹ 20,000/-

(c) There was a loss by fire amounting to ₹ 10,000/- in the year 2018-19 which was not considered in trading account but correctly debited in the Profit & Loss a/c for that year.

(d) Debtors as on 31st March 2022 included bad debts of ₹ 5 ,800/-

7. Ag shall bring his share of goodwill in cash.

You are required to calculate amount of goodwill Ag is supposed to bring and journal entry for the same.

SOLUTION

Weighted Average profit = total product/ total weights

= 18,00,000/10 = 1,80,000

Goodwill (3 years purchase) = 3 x 1,80,000 = 5,40,000

Ag’s share ¼th = 5,40,000/4 = 1,35,000

Working Note:

|

68 videos|160 docs|83 tests

|

FAQs on Unit 2: Treatment of Goodwill in Partnership Accounts Chapter Notes - Accounting for CA Foundation

| 1. What is goodwill in the context of partnership accounts? |  |

| 2. What are the common methods for goodwill valuation? |  |

| 3. Why is the valuation of goodwill important in partnerships? |  |

| 4. How is goodwill treated in the case of a new partner's admission? |  |

| 5. What is the accounting treatment of goodwill when a partner retires or passes away? |  |