UPSC Exam > UPSC Notes > PIB (Press Information Bureau) Summary > PIB Summary- 16th December, 2024

PIB Summary- 16th December, 2024 | PIB (Press Information Bureau) Summary - UPSC PDF Download

Public Sector Banks: A Resurgent Force

Context

In FY 2023-24, Public Sector Banks (PSBs) in India achieved record profits, reflecting significant improvements in asset quality, with a sharp decline in non-performing assets (GNPA).

PSBs have also contributed to financial inclusion through key government schemes.

The government has supported these banks through reforms like the EASE framework.

Introduction: Public Sector Banks’ Achievements

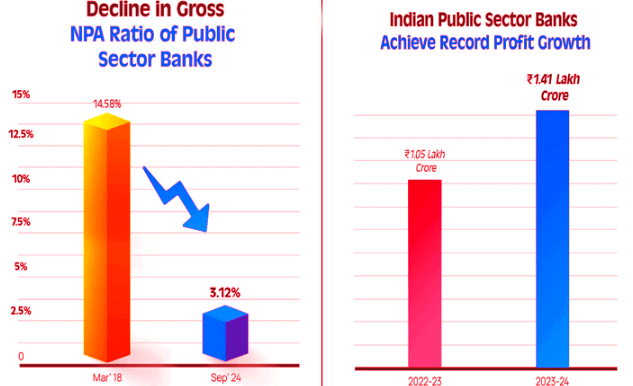

- Public Sector Banks (PSBs) in India achieved a record net profit of ₹1.41 lakh crore in FY 2023-24, marking their highest-ever aggregate profit.

- The sector saw a significant improvement in asset quality, with the Gross Non-Performing Assets (GNPA) ratio declining to 3.12% in September 2024.

- PSBs also recorded a net profit of ₹85,520.6 crore in the first half of 2024-25 and paid a total dividend of ₹61,964 crore over the past three years.

- These achievements reflect improved operational efficiency, stronger capital base, and better asset quality.

Decline in GNPA: Strengthening Resilience

- The GNPA ratio of PSBs dropped from a peak of 14.58% in March 2018 to 3.12% in September 2024.

- The Reserve Bank of India (RBI) initiated the Asset Quality Review (AQR) in 2015, which helped in transparent recognition of NPAs and increased provisioning.

- To address banking stress, the Government introduced a comprehensive 4R’s strategy (Recognition, Resolution, Recapitalisation, and Reforms).

- The Capital to Risk (Weighted) Assets Ratio (CRAR) of PSBs rose by 3983 basis points to 15.43% in September 2024, indicating enhanced stability.

Expanding Financial Inclusion

- PSBs continue to drive financial inclusion, with 54 crore Jan Dhan accounts and 52 crore collateral-free loans under various schemes.

- The number of bank branches increased from 1,17,990 in March 2014 to 1,60,501 in September 2024, with most branches in rural and semi-urban areas.

- As of September 2024, the Kisan Credit Card (KCC) scheme supported 7.71 crore accounts, with an outstanding loan of ₹9.88 lakh crore.

- MSME advances grew at a CAGR of 15% over the past 3 years, totaling ₹28.04 lakh crore in March 2024.

Strengthening PSBs through the EASE Framework

- The Enhanced Access & Service Excellence (EASE) framework promotes incremental reforms focusing on governance, risk management, technology, and data-driven banking.

- Key reforms have led to improved financial health and better banking services.

Conclusion: A Stronger Banking Sector

- PSBs have made significant progress in financial health and contributed to India’s economic growth.

- The decline in GNPA and improved CRAR reflect sound risk management.

- The EASE framework has facilitated reforms, and the focus on financial inclusion has expanded banking access. PSBs are now well-positioned to drive inclusive economic growth.

Question for PIB Summary- 16th December, 2024Try yourself: What is the main focus of the EASE framework implemented for Public Sector Banks?View Solution

The document PIB Summary- 16th December, 2024 | PIB (Press Information Bureau) Summary - UPSC is a part of the UPSC Course PIB (Press Information Bureau) Summary.

All you need of UPSC at this link: UPSC

FAQs on PIB Summary- 16th December, 2024 - PIB (Press Information Bureau) Summary - UPSC

| 1. What are the key factors contributing to the resurgence of Public Sector Banks (PSBs) in India? |  |

Ans.The resurgence of Public Sector Banks in India can be attributed to several key factors including improved asset quality, increased capital infusion from the government, enhanced operational efficiency, and the implementation of digital banking technologies. Additionally, measures taken to address non-performing assets (NPAs) and the focus on financial inclusion have played a significant role in revitalizing PSBs.

| 2. How has the government supported the revival of Public Sector Banks? |  |

Ans.The government has supported the revival of Public Sector Banks through various initiatives such as recapitalization plans to strengthen their balance sheets, policy reforms to enhance governance, and measures aimed at reducing NPAs. Furthermore, the introduction of the Insolvency and Bankruptcy Code has provided a framework for quicker resolution of stressed assets, thereby improving the financial health of these banks.

| 3. What role do Public Sector Banks play in promoting financial inclusion in India? |  |

Ans.Public Sector Banks play a crucial role in promoting financial inclusion in India by providing banking services to underserved and unbanked populations. They have implemented various schemes to offer affordable loans, savings accounts, and insurance products to low-income individuals. Additionally, PSBs actively participate in government initiatives aimed at financial literacy and access to credit for rural and marginalized communities.

| 4. How has digital transformation impacted the operations of Public Sector Banks? |  |

Ans.Digital transformation has significantly impacted the operations of Public Sector Banks by streamlining processes, enhancing customer service, and reducing operational costs. The adoption of technologies such as mobile banking, online loan applications, and digital payment systems has improved accessibility and convenience for customers. This shift towards digital banking has also enabled PSBs to compete more effectively with private sector banks.

| 5. What challenges do Public Sector Banks still face despite their resurgence? |  |

Ans.Despite their resurgence, Public Sector Banks still face several challenges including high levels of non-performing assets, the need for ongoing capital support, and the pressure to innovate in a rapidly changing financial landscape. Additionally, issues related to bureaucratic processes, workforce management, and adapting to customer expectations in a digital age continue to pose challenges for these banks.

Related Searches