Humanities/Arts Exam > Humanities/Arts Notes > Legal Studies for Class 11 > Mind Map: Property, Succession and Inheritance

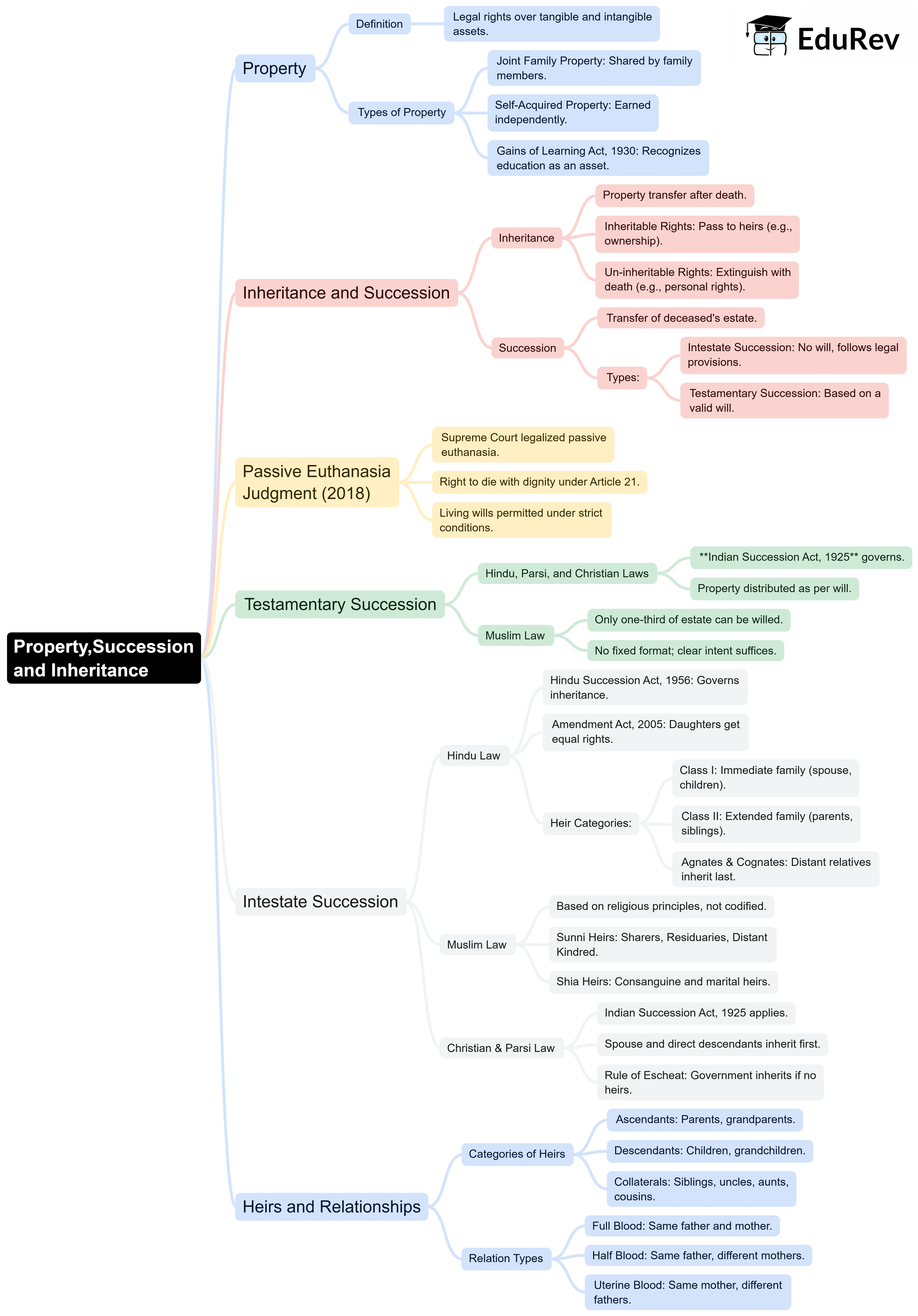

Mind Map: Property, Succession and Inheritance | Legal Studies for Class 11 - Humanities/Arts PDF Download

The document Mind Map: Property, Succession and Inheritance | Legal Studies for Class 11 - Humanities/Arts is a part of the Humanities/Arts Course Legal Studies for Class 11.

All you need of Humanities/Arts at this link: Humanities/Arts

|

69 videos|80 docs|25 tests

|

FAQs on Mind Map: Property, Succession and Inheritance - Legal Studies for Class 11 - Humanities/Arts

| 1. What is the difference between property ownership and inheritance? |  |

Ans.Property ownership refers to the legal right to possess, use, and dispose of property, while inheritance is the process through which property is passed down from one individual to another, typically after the owner's death, according to their will or the laws of intestacy.

| 2. How does a will affect the process of inheritance? |  |

Ans.A will is a legal document that outlines how a person's assets and property should be distributed after their death. It provides clear instructions for inheritance, which can help prevent disputes among heirs and ensures that the deceased's wishes are honored.

| 3. What are the key components of succession planning? |  |

Ans.Key components of succession planning include identifying and training potential successors, developing a clear plan for the transfer of assets, understanding tax implications, and ensuring that legal documents such as wills and trusts are in place to facilitate a smooth transition.

| 4. What happens if someone dies without a will? |  |

Ans.If someone dies without a will, they are considered to have died intestate. In this case, the distribution of their property will be determined by the laws of intestacy in their jurisdiction, which typically prioritizes spouses, children, and other close relatives.

| 5. What are the tax implications of inheritance? |  |

Ans.Inheritance can have various tax implications, including estate taxes, inheritance taxes, and capital gains taxes on appreciated assets. The specific taxes owed depend on the jurisdiction and the value of the inherited assets, so it's important for heirs to consult with a tax professional to understand their obligations.

Related Searches