Class 10 Exam > Class 10 Notes > Mathematics Class 10 ICSE > Revision Notes: Banking

Revision Notes: Banking | Mathematics Class 10 ICSE PDF Download

Important Concepts

- The business of receiving, safeguarding and lending of money is called banking.

- Bank is a financial institution which carries on the business of taking deposits, lending money and providing other useful services to the society.

- Maturity value is the amount returned to the depositor at the end of the period. It includes all deposits made every month plus the interest earned on it.

Recurring Deposit Account (R. D. Account)

- In this account, a depositor chooses a specified amount and deposits that amount every month for a specified period.

- This period may range from 3 months to 10 years.

- At the end of the period (maturity period), the bank returns the lumpsum amount (maturity value).

Maturity Value of R.D. Account

This includes the amount deposited by the account holder together with interest compounded quarterly at a fixed rate.

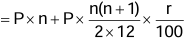

By Formula, we have

Maturity Value (M.V.) of the R.D. Account

= Total Sum Deposited + Interest on it

where,

P = Amount deposited every month

n = Number of months

r = Rate of interest

The document Revision Notes: Banking | Mathematics Class 10 ICSE is a part of the Class 10 Course Mathematics Class 10 ICSE.

All you need of Class 10 at this link: Class 10

|

74 videos|328 docs|30 tests

|

FAQs on Revision Notes: Banking - Mathematics Class 10 ICSE

| 1. What are the main functions of a bank? |  |

Ans. The main functions of a bank include accepting deposits, providing loans, facilitating money transfers, offering savings and investment products, and providing financial advisory services. Banks play a crucial role in the economy by mobilizing savings and directing funds to productive uses.

| 2. What types of accounts can individuals open in a bank? |  |

Ans. Individuals can open various types of accounts in a bank, including savings accounts, current accounts, fixed deposit accounts, and recurring deposit accounts. Each account type serves different purposes, such as saving for the future, managing daily transactions, or earning interest on fixed deposits.

| 3. How do banks ensure the safety of deposits? |  |

Ans. Banks ensure the safety of deposits through various measures, including regulatory guidelines, insurance coverage (like FDIC insurance in the U.S.), and maintaining adequate capital reserves. Additionally, banks implement security measures such as encryption and fraud detection systems to protect customer information and funds.

| 4. What is the role of the Reserve Bank of India (RBI) in the banking system? |  |

Ans. The Reserve Bank of India (RBI) serves as the central bank of India, regulating the banking sector, managing monetary policy, and ensuring financial stability. RBI oversees the operation of commercial banks, controls inflation, and acts as a lender of last resort during financial crises.

| 5. What are the benefits of digital banking for customers? |  |

Ans. Digital banking offers numerous benefits for customers, including convenience, 24/7 access to banking services, reduced transaction costs, and the ability to manage accounts and make transactions from anywhere with an internet connection. It also enhances security through advanced technologies and provides quicker service responses.

Related Searches