Revision Notes: Public Debt | Economics Class 10 ICSE PDF Download

Understanding Public Debt

Public debt occurs when a government's planned spending surpasses its total revenue, necessitating borrowing from individuals and organizations.

Sources of Public Borrowing

- Government Bonds: Individuals can purchase government bonds and securities.

- Bank Purchases: Banks buy government bonds, as they are required to hold a certain proportion of government securities relative to their deposits.

- External Loans: The government can borrow from international agencies like the International Monetary Fund (IMF) and the World Bank.

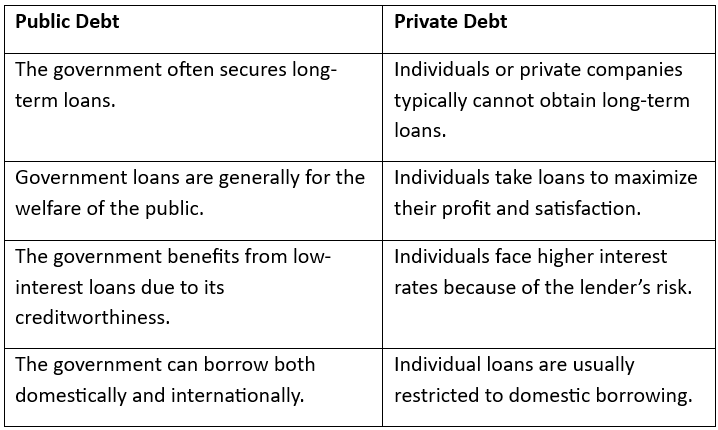

Differences between Public and Private Debts

Similarities between Public and Private Debts

- Both the government and individuals incur debts to bridge the gap between income and expenditure for their daily activities.

- Loans are taken for specific periods at a fixed interest rate.

Structure of Public Debt

Internal and External Debts

- Internal debt refers to the government's borrowings within the country. The government borrows from various internal sources such as individuals, banks, and business firms. The instruments of internal debt include market loans, bonds, treasury bills, and ways and means advances. External debt involves the government's borrowings from abroad, which can include multilateral and bilateral borrowings, as well as loans from institutions like the World Bank and the Asian Development Bank. External debt is often used to support various developmental programs.

Productive and Unproductive Debts

- Productive debt refers to loans taken for projects that generate revenue for the government, such as irrigation and power projects. These debts are self-liquidating, meaning the principal and interest are paid from the revenue generated by the projects.

- Unproductive debt is incurred for purposes like war or emergency relief, where the government cannot generate revenue from the expenditure. These debts become a burden on the community, requiring additional taxation for servicing and repayment.

Redeemable and Irredeemable Debts

- Redeemable debt is repaid by the government after a fixed period. When the government borrows from the public, it sells securities, paying interest at regular intervals. Upon maturity, the public surrenders the security and receives the principal and interest.

- Irredeemable debts do not have a specified repayment date. The government may pay interest regularly, but there is no commitment for exact repayment. Such borrowings are rare.

Voluntary and Compulsory Debts

- Voluntary debt occurs when the government raises public debt without compelling buyers to purchase government bonds. Most public debts fall under this category.

- Compulsory debt involves lenders purchasing government bonds under obligation, similar to a tax.

Funded and Unfunded Debts

- Funded debt involves the government setting up a separate fund to meet debt obligations, also known as long-term debt.

- Unfunded debt does not have a separate fund for meeting debt obligations.

Unfunded Debt or Floating Debt: When the government takes a loan without setting up a separate fund for repaying the principal amount along with interest, it is called unfunded debt or floating debt. These are short-term debts that are typically cleared within a year.

Gross and Net Debts: Gross debt refers to the total sum of all debts, while net debt is the amount of debt remaining after excluding the sinking fund and other assets meant for loan repayment.

Role of Public Debt in the Indian Economy

- To Meet Budgetary Deficits: Public debt is utilized to bridge the gap between public expenditure and tax revenues. When government revenue from taxes and other sources falls short of meeting public expenditure, the government resorts to borrowing.

- To Finance Development Plans: The government plays a crucial role in financing developmental projects in India. When the government needs to ensure adequate funds for these development plans, it borrows from the public.

- To Build Infrastructure: In a developing country like India, basic infrastructure facilities are vital for development. Since these investment plans may not be attractive to private companies due to minimal returns, the government needs to borrow money to invest in such projects.

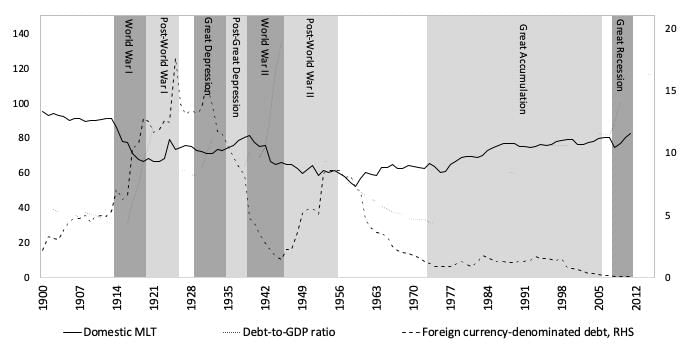

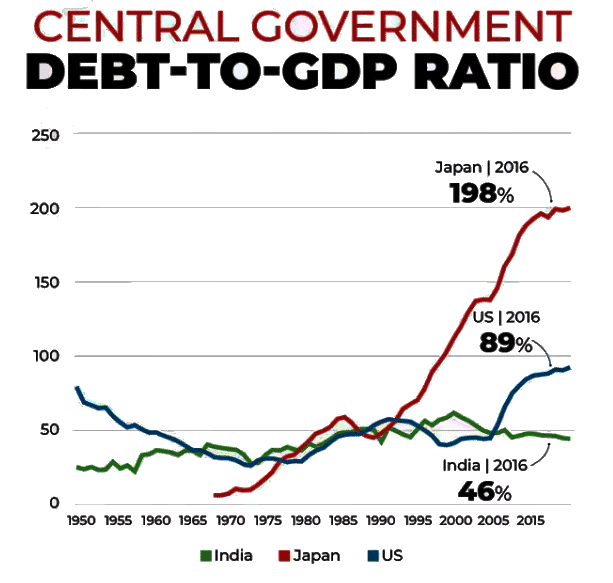

Growth of Public Debt in India

The internal debt of the central government has significantly increased from Rs 1,54,004 crore in 1990–91 to Rs 23,37,682 crore in 2009–10. Similarly, the external debt of the central government has risen from Rs 31,525 crore in 1990–91 to Rs 1,39,581 crore in 2009–10.

Effects of Public Debt

Burden of Public Debt

- Public debt is incurred by the government when its tax revenue falls short of covering public expenditure.

- If the government borrows more than necessary, it risks falling into a debt trap, where it borrows to pay interest on existing debts, increasing the burden on society.

- External debt results in an outflow of economic resources from the country.

- When loans are obtained from foreign agencies, interest payments are made from the domestic nation to the foreign nation.

- Additionally, if loans come with conditions requiring that certain inputs for projects be purchased from abroad, rather than domestically, the burden of external debt increases.

Inflationary

- A significant portion of funded debt loans is held by the Reserve Bank of India (RBI), allowing the RBI to issue more money to the public to meet the growing demand for economic development.

- The government also takes short-term loans by issuing treasury bills, which are held by the RBI and indicate deficit financing by the government.

- Therefore, public debt has an inflationary impact on the economy.

|

18 videos|50 docs|13 tests

|

FAQs on Revision Notes: Public Debt - Economics Class 10 ICSE

| 1. What is public debt and why is it important for a country like India? |  |

| 2. What are the main components of the structure of public debt in India? |  |

| 3. How has the public debt in India grown over the years? |  |

| 4. What are the potential effects of rising public debt on the Indian economy? |  |

| 5. What measures can be taken to manage and control public debt in India? |  |