Revision Notes: Commercial Banking | Economics Class 10 ICSE PDF Download

| Table of contents |

|

| Introduction to Commercial Banks |

|

| Significance of Banks |

|

| Credit Creation |

|

| Nationalisation of Banks |

|

| Privatisation of Banks |

|

| Classification of Commercial Banks in India |

|

Introduction to Commercial Banks

A commercial bank is a type of financial institution that offers various services such as accepting deposits, providing business loans, mortgage lending, and basic investment products like savings accounts and certificates of deposit. These banks are also known as joint stock banks because they are organized similarly to joint stock companies.

Key Features of Commercial Banks

- Commercial banks primarily deal with money by accepting deposits and providing short-term loans to traders.

- Their main objective is to earn profits and create demand deposits, which act as a medium of exchange.

Functions of Commercial Banks

Primary Functions

Accepting Deposits

- Accepting deposits from the public is the core function of a commercial bank. To attract savings, banks offer three types of deposits:

- Demand Deposits: These have a very low interest rate and can be withdrawn at any time. They are also chequable, meaning customers can withdraw funds using cheques.

- Fixed Deposits: These carry a higher interest rate but can only be withdrawn after a specific period. They are not chequable.

- Savings Deposits: These offer a moderate interest rate and are used to encourage savings.

Advancing Loans

- Commercial banks provide loans to individuals and businesses against approved securities. The types of loans offered include:

- Cash Credit: Banks offer cash credit based on the borrower’s needs and credit limit. Interest is charged only on the amount withdrawn.

- Overdraft Facilities: Account holders can withdraw more money than they have deposited, and interest is charged on the excess amount withdrawn.

- Short-Term Loans: These are provided for various short-term needs.

- Discounting of Bills of Exchange: Banks provide funds by discounting bills of exchange.

- Money at Call: This involves lending money that can be called back on short notice.

Functions of Commercial Banks

1. Collection and Payment Services: Commercial banks offer services to collect and make payments on behalf of their customers. This includes payments for insurance premiums and dividends.

2. Fund Transfer: Banks facilitate the transfer of funds from one location to another through instruments like cheques and drafts.

3. Safety Lockers: To help customers safeguard their valuable items, commercial banks provide safety locker services.

4. Foreign Exchange and Trade Financing: Commercial banks engage in foreign exchange business and finance foreign trade by accepting foreign bills of exchange.

Significance of Banks

Role of Commercial Banks in a Country's Industrial and Commercial Life

- Financial Assistance: Commercial banks support traders and industrialists by providing essential financial assistance. Their cheques and drafts facilitate large-scale trading activities.

- Encouraging Savings and Production: Banks accept deposits from individuals with surplus funds and offer loans to investors in need of capital for productive activities. This process encourages savings and promotes production activities by channeling funds into productive ventures.

- Capital Redistribution: Banks play a vital role in redistributing surplus capital from regions where it is abundant to areas where it is scarce. This helps in balancing regional economic disparities.

- Concessional Loans to Priority Sectors: Commercial banks provide concessional loans to priority sectors such as agriculture, small-scale industries, retail trade, and export. This targeted financial support helps stimulate growth in these crucial sectors.

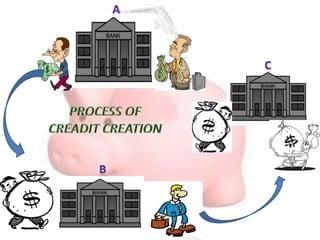

Credit Creation

Credit creation is an essential function of banks, and it begins with bank deposits. When banks receive deposits from the public, they open a deposit account known as a primary deposit. However, banks do not keep the entire deposit amount in the account, nor do they withdraw it all at once. Instead, they retain only a small portion of the total deposits and use the rest to advance loans to individuals and businesses.

The Central Bank regulates the amount of cash that banks must hold in reserve, known as the cash reserve ratio (CRR). When banks provide loans, they do so against collateral securities, and instead of giving cash directly, they create a derivative deposit in the borrower's name. This derivative deposit, also called a secondary deposit, represents the creation of credit.

Limitations of Credit Creation by Commercial Banks Credit creation by commercial banks is subject to several limitations:

- Primary Deposits: Credit creation relies on primary deposits, and there needs to be a substantial amount of cash available.

- Central Bank Control: The Central Bank has full control over the cash deposited by individuals. It determines the amount of cash that banks must hold as reserves and the amount available for advancing loans.

- Collateral Requirements: Banks can only create credit if borrowers have acceptable collateral securities to submit against a loan. If approved securities are not available, the bank cannot create credit through loans.

Nationalisation of Banks

Arguments in Favour of Nationalisation of Banks

- Branch expansion: Nationalised banks aimed to expand their branches to balance the banking system. The number of bank branches increased significantly from about 8,260 in 1969 to around 80,514 in 2009.

- Deposit mobilisation: Banks played a crucial role in developing banking habits among the people, which is essential for the expansion of bank deposits and, consequently, the development of the economy.

- Priority sector lending: Nationalised banks focused on providing more credit to priority sectors such as agriculture and small-scale industries.

- Involvement in development efforts: After nationalisation, public sector commercial banks shifted their focus from profitability to contributing to development efforts.

Arguments against Nationalisation of Banks

- Political pressure: Nationalisation could lead to political interference in routine banking activities. Political and administrative intervention in credit decision-making often resulted in a decline in the quality of loan portfolios and poor recovery rates.

- Possibility of losses: Banks may extend credit to priority sectors at concessional interest rates, which could negatively impact their profitability.

- Lack of competition: Despite the presence of many banks, competition was limited due to regulated interest rates. This lack of competition also led to a decline in customer services, as banks had no incentive to improve.

- Trade unions of bank employees: Trade unions representing bank employees strongly supported the nationalisation of banks. However, their influence also meant that bank strikes could lead to economic crises.

|

Download the notes

Revision Notes: Commercial Banking

|

Download as PDF |

Privatisation of Banks

Arguments in Favour of Privatisation of Commercial Banks

- Freedom in Decision-Making: Privatised commercial banks would have the autonomy to make decisions regarding loan approvals, allowing them to target sectors with higher returns and better recoverability.

- Innovative Deposit Schemes: These banks could develop a variety of innovative deposit schemes to attract more depositors, enhancing their competitive edge.

- Increased Competition: Privatisation would foster a competitive environment in the banking sector, as domestic banks would face competition from foreign private banks. This competition would drive each bank to improve efficiency and adopt new methods to survive and thrive.

Arguments against Privatisation of Commercial Banks

- Employment Concerns: Privately run banks may reduce employment opportunities as their operations would be driven by profit motives, potentially leading to job cuts.

- Monopoly and Inequality: There is a risk of monopoly power concentrating in the hands of private sector banks, which could exacerbate income and wealth inequality in the economy.

- Savings and Investment Concerns: If privatised banks merge with foreign banks and restrictions on the movement of financial capital are lifted, there is no guarantee that savings mobilised from the Indian economy would be reinvested within India. These funds could be relocated abroad, undermining domestic financial stability.

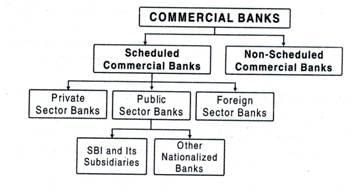

Classification of Commercial Banks in India

Commercial banks in India can be classified based on two main criteria: statute and ownership.

1. Classification Based on Statute:

a. Scheduled Banks: These banks are included in the Second Schedule of the Reserve Bank of India Act, 1934. Scheduled banks meet certain criteria set by the Reserve Bank of India (RBI) and are considered to be more financially stable.

b. Non-Scheduled Banks: Non-scheduled banks are not included in the Second Schedule of the RBI Act, 1934. These banks do not meet the criteria set by the RBI, and their financial position may not be as strong as that of scheduled banks.

2. Classification Based on Ownership:

a. Public Sector Banks: Public sector banks are owned and operated by the Government of India. These banks play a crucial role in the Indian economy and are involved in various government initiatives.

b. Private Sector Banks: Private sector banks are owned by private shareholders. This category includes:

i. Indian Private Sector Banks: Banks that are privately owned by Indian citizens and institutions.

ii. Foreign Banks: Banks that are headquartered in other countries but operate in India. These banks are owned by foreign shareholders.

FAQs on Revision Notes: Commercial Banking - Economics Class 10 ICSE

| 1. What are the primary functions of commercial banks? |  |

| 2. What are agency functions of commercial banks? |  |

| 3. What utility functions do commercial banks perform? |  |

| 4. What limitations do commercial banks face in creating credit? |  |

| 5. How do commercial banks contribute to the economy? |  |