CBSE Textbook Solutions: Property, Succession and Inheritance | Legal Studies for Class 11 - Humanities/Arts PDF Download

Based on your understanding, answer the following questions:

Q1. X, a hindu male, dies leaving behind a farm house that he purchased out of his own earnings and a flat that he acquired from his father. The heirs left behind after him included his mother, wife, brother and two sons. He bequeathed the house and farm house by way of a will in favour of his younger son and nothing for his elder son.

Answer the following:

(a) Identify the two types of properties and the mode of disposing off both the types.

(b) Is the above Will valid? If not, distribute the property of X amongst his heirs giving all the applicable rules.

Ans: (a) Types of Properties and Mode of Disposing

The two types of properties left by X are:

- Farm House: Purchased out of his own earnings (self-acquired property).

- Flat: Acquired from his father (ancestral property).

The mode of disposing of both types of properties is through a Will, where X bequeathed the farm house and flat to his younger son.

(b) Validity of the Will

The Will is not valid under Hindu law because it discriminates against the elder son, who has a birthright to a share in the ancestral property (the flat). According to the Hindu Succession Act, 1956, all legal heirs are entitled to an equal share of the property.

Distribution of Property

Since the Will is invalid, the property will be distributed according to the rules of intestate succession under the Hindu Succession Act, 1956. The heirs include:

- Mother

- Wife

- Brother

- Two Sons

The distribution will be as follows:

- The total property will be divided into five equal shares (one for each heir).

- Each heir will receive 1/5th of the total property.

This ensures that both sons receive an equal share of the property, adhering to the principles of intestate succession.

Q2. What do you mean by inheritance? Differentiate between inheritable and uninheritable rights with relevant examples.

Ans: Inheritance is the right of an heir to succeed to property upon the death of an ancestor. It is a means of acquiring property, governed by different laws of succession based on religion.

Inheritable Rights

A right is considered inheritable if it survives the owner and can be transferred to legal representatives after death. Examples include:

- Proprietary Rights: Rights attached to property, such as debts owed to the deceased.

Uninheritable Rights

A right is classified as uninheritable if it ceases to exist upon the owner's death. Examples include:

- Personal Rights: Rights associated with an individual, such as the right to personal services, which extinguish upon death.

Summary

In summary, inheritable rights continue beyond the owner's death and can be passed on, while uninheritable rights do not survive the individual and end with their passing.

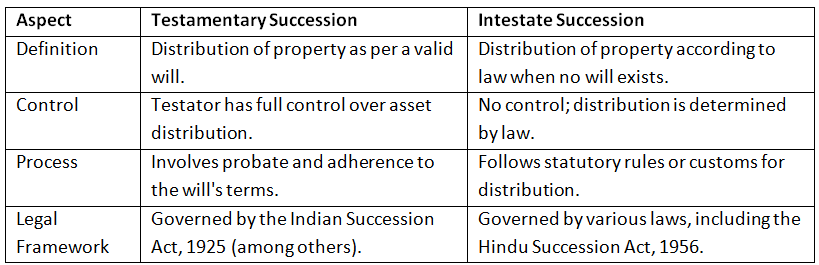

Q3. Differentiate between Testamentary and Intestate Succession.

Ans:

- Testamentary Succession: Testamentary succession occurs when a person, known as the testator, creates a will during their lifetime to dictate how their property should be distributed after their death. The law respects and enforces the wishes expressed in the will, ensuring that the testator's intentions are honored. This process allows for a clear and organized transfer of assets according to the testator's preferences.

- Intestate Succession: Intestate succession applies when a person dies without a valid will, making them intestate. In such cases, the distribution of their property is governed by statutory laws or customs applicable to the deceased. For example, under the Hindu Succession Act, 1956, if a Hindu dies intestate, both separate and joint family properties are distributed among the legal heirs according to prescribed rules.

Key Differences

Q4. A dies without an heir. She has left behind substantial property that is self acquired through her own learning. By what rule will her property be disposed of and who will acquire the property?

Ans: A dies without an heir, leaving behind substantial self-acquired property. The rules governing the disposal of her property depend on the applicable succession laws.

Applicable Rules

Since A has died intestate (without a will), the property will be disposed of according to the rules of intestate succession relevant to her religion:

1. Hindu Law

If A was a Hindu, her property would be governed by the Hindu Succession Act, 1956. Under this act:

- In the absence of heirs (lineal descendants), the property would pass to her spouse or kindred.

- If no spouse or kindred exists, the property would escheat to the government.

2. Muslim Law

If A was a Muslim, her property would be governed by Islamic principles, which do not distinguish between ancestral and self-acquired property. The property would pass to her legal heirs as defined by Islamic law. If no heirs exist, the property would also escheat to the government.

3. Other Religions

For Christians and Parsis, the Indian Succession Act, 1925 applies. Similar rules of intestate succession would apply, leading to government escheat in the absence of heirs.

Conclusion

In summary, A's property will be disposed of according to the intestate succession laws of her religion, and in the absence of any heirs, it will ultimately escheat to the government.

Q5. You are a practicing lawyer who is an expert in creating wills. Draft a Will for your client who is a Senior Vice President in a Company. She is married with two daughters. She owns a house in a posh locality in South Delhi, has share holdings, jewellery and fixed deposits and money in the savings account. She has two cars. She also has an old help who has been working for her for the past 25 years. She wants to divide her property equally between her husband and children. She also wants to ensure that she provides for some amount to her old help in her will.

Ans:

Last Will and Testament

I, [Client's Full Name], aged [Client's Age], residing at [Client's Address], hereby declare this to be my last will and testament. I revoke all previous wills and codicils made by me.

I am of sound mind and body, and I make this will voluntarily and without any undue influence.

Family Details

I am married to [Husband's Name], and we have two daughters:

- [Daughter 1's Name], aged [Daughter 1's Age]

- [Daughter 2's Name], aged [Daughter 2's Age]

Assets

As of today, I own the following assets:

- One house located at [House Address], South Delhi

- Cash amounting to [Amount in Fixed Deposits] in fixed deposits at [Bank Name]

- Gold jewellery weighing approximately [Weight in Grams] in [Bank/Locker Name]

- Shareholdings in [Company Names and Amounts]

- Money in savings account at [Bank Name]

- Two cars: [Car 1 Details] and [Car 2 Details]

Distribution of Assets

It is my wish that my assets be distributed as follows:

- To my husband, [Husband's Name]: 50% of all my assets.

- To my daughters, [Daughter 1's Name] and [Daughter 2's Name]: 25% each of all my assets.

- To my old help, [Help's Name], who has served me faithfully for 25 years: a sum of [Amount] to be paid from my estate.

Debts and Liabilities

All my debts and liabilities, including taxes and other charges, shall be settled from my estate before distribution to my beneficiaries.

Witnesses

This will is signed in the presence of the following witnesses:

- [Witness 1 Name] - Signature: ___________________

- [Witness 2 Name] - Signature: ___________________

|

69 videos|80 docs|25 tests

|

FAQs on CBSE Textbook Solutions: Property, Succession and Inheritance - Legal Studies for Class 11 - Humanities/Arts

| 1. What is the difference between property ownership and inheritance in the context of CBSE syllabus? |  |

| 2. How does the Hindu Succession Act impact inheritance rights in India? |  |

| 3. What are the key factors that affect succession planning in families? |  |

| 4. What role do wills play in property succession? |  |

| 5. Can a property owner change their will, and what implications does this have for heirs? |  |