Higher Order Thinking Skills - National Income Accounting | Economics Class 12 - Commerce PDF Download

Q1: Unpaid caregiving and environmental costs (e.g., pollution) are excluded from GDP. Discuss the ethical implications of this exclusion. Propose adjustments to GDP to reflect these factors and analyze potential policy impacts.

Ans: GDP measures final goods and services produced but excludes unpaid caregiving (e.g., housework) and environmental costs (e.g., pollution), as noted in the document. Ethically, this is problematic. Unpaid caregiving, often by women, sustains households yet is invisible in GDP, undervaluing a vital social contribution and reinforcing gender inequity. Ignoring environmental costs, like pollution from production, hides harm to public health and ecosystems, prioritizing profit over well-being. This skews welfare perceptions, as GDP rises while caregivers and nature suffer uncounted losses.

Proposed Adjustments to GDP

- Include Unpaid Caregiving: Estimate the monetary value of unpaid work (e.g., housework, eldercare) using market wage equivalents. If a caregiver’s work mirrors a paid nurse’s, assign it a similar value, adding it to GDP.

- Account for Environmental Costs: Subtract negative externalities (e.g., pollution cleanup costs, health impacts) from GDP. For an oil refinery polluting a river, deduct estimated damages to fisheries or water quality from its value added.

Potential Policy Impacts

- Caregiving Inclusion: Recognizing unpaid work could boost GDP, prompting policies like caregiver subsidies or tax credits. In India, this might support rural women, reducing poverty but straining budgets if funded publicly.

- Environmental Deduction: Lowering GDP for pollution could push firms to adopt cleaner tech, aligning with sustainability goals. In India’s mixed economy, this might mean stricter regulations on mining, raising costs but improving long-term ecological health.

- Trade-offs: Higher GDP from caregiving might justify welfare spending, but environmental penalties could shrink reported growth, deterring investment unless offset by green incentives.

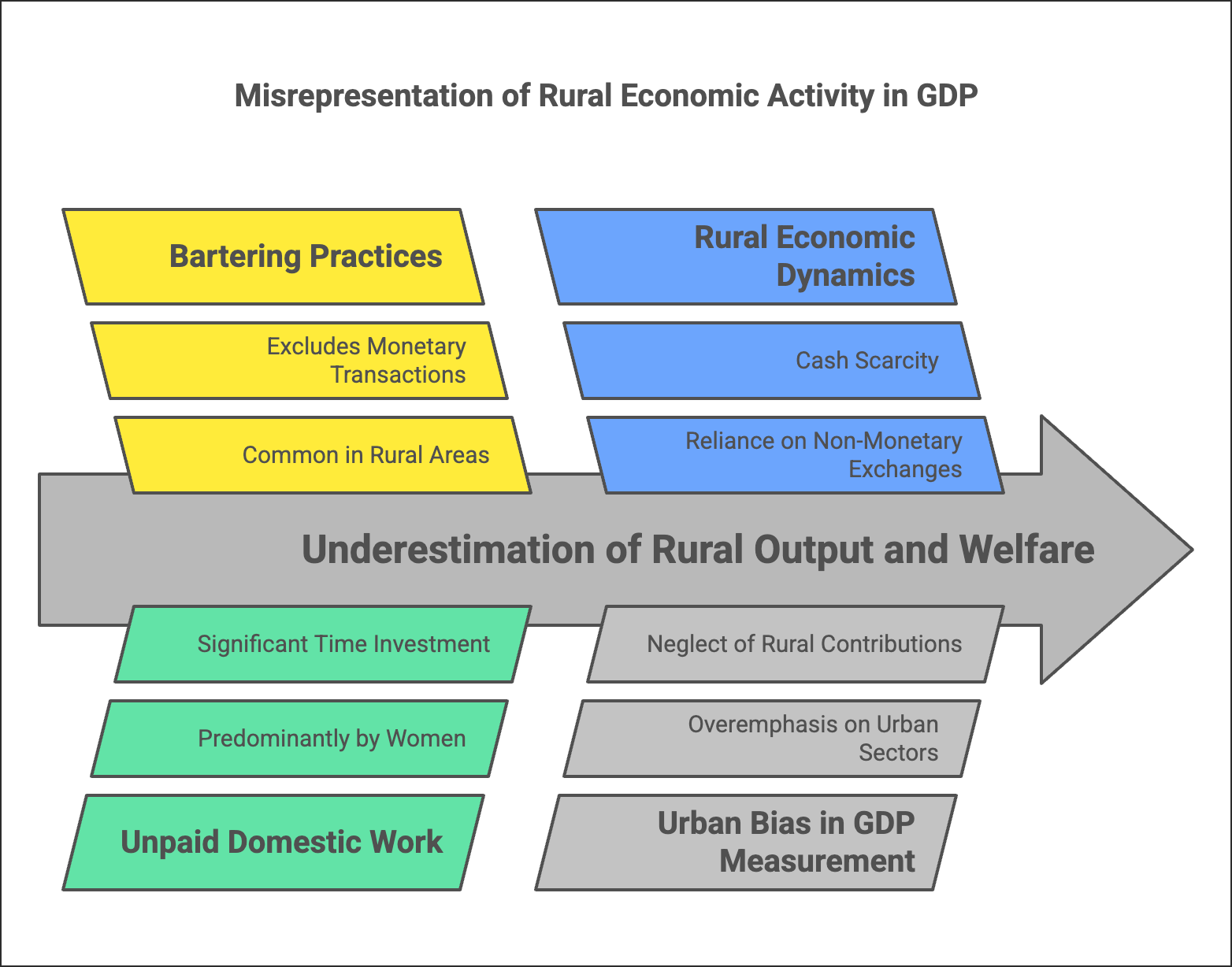

Q2: GDP excludes non-monetary exchanges like barter and unpaid domestic work. Critically analyze how this exclusion might misrepresent the economic activity in rural India, where such practices are common. Propose a method to integrate these into national income accounts and evaluate its feasibility.

Ans:

- GDP measures monetary transactions for final goods and services, excluding non-monetary exchanges like barter and unpaid domestic work, as noted in the document.

- In rural India, where cash is scarce, bartering goods (e.g., grains for tools) and unpaid tasks (e.g., women’s housework or farming) dominate.

- This exclusion misrepresents economic activity by underestimating rural output and welfare.

- A farmer trading wheat for cloth contributes to livelihoods, yet GDP ignores it.

- Similarly, unpaid caregiving sustains households but isn’t counted, skewing India’s economic picture—especially since rural areas host over 60% of the population.

- This paints an incomplete view of productivity and living standards, overemphasising urban, monetised sectors.

Proposed Method

To integrate these, estimate their monetary value:

- Barter Exchanges: Survey rural households to quantify traded goods (e.g., kg of rice for hours of labour), valuing them at local market prices. Add this to GDP as imputed output.

- Unpaid Domestic Work: Assign market-equivalent wages (e.g., housekeeper rates) to hours spent on tasks like cooking or childcare, including this in national

Q3: Depreciation is subtracted from Gross Domestic Product to derive Net Domestic Product, reflecting capital wear and tear. Evaluate the ethical and economic implications of not accounting for the depreciation of natural resources (e.g., forests, water) in GDP. Suggest a policy framework to include this and discuss its potential impact on India’s industrial sector.

Ans: Depreciation is deducted from GDP to get NDP, capturing capital wear and tear, as the document explains. However, not accounting for natural resource depreciation (e.g., forests, water) has ethical and economic flaws. Ethically, it hides the depletion of resources future generations rely on—logging forests or overusing water boosts GDP but ignores long-term harm, violating intergenerational fairness. Economically, it overstates growth by treating finite resources as free inputs. In India, mining or deforestation may inflate GDP, but uncounted losses (e.g., soil erosion, water scarcity) burden rural livelihoods and public health, misrepresenting true economic health.

Proposed Policy Framework

- Measure Resource Depreciation: Estimate annual natural capital loss (e.g., forest cover in hectares, water table decline) using satellite data and ecological studies. Assign monetary values based on replacement costs (e.g., reforestation) or market rates (e.g., water treatment).

- Adjust GDP: Subtract this “natural depreciation” from GDP, alongside physical capital depreciation, to derive a “Green NDP” reflecting sustainable output.

- Incentivize Conservation: Tax firms depleting resources (e.g., coal miners) based on environmental cost, redirecting funds to restoration projects.

Impact on India’s Industrial Sector

- Challenges: Industries like mining or textiles, reliant on cheap resources, would face higher costs, shrinking profits and GDP figures. Steel plants in Chhattisgarh, for instance, might resist as coal extraction taxes rise, potentially slowing industrial growth.

- Benefits: It could spur innovation—firms might adopt water recycling or renewable energy to cut penalties, aligning with India’s climate goals. Long-term, it sustains resource availability, vital for agro-based industries.

- Mitigation: Phased implementation and subsidies for green tech could ease the transition, balancing industrial needs with sustainability.

Q4: Nominal GDP reflects current prices, while Real GDP uses constant prices to show production volume. Compare their relevance in assessing economic growth during a period of high inflation in India (e.g., post-COVID recovery). Argue which measure better informs policy decisions for sustainable development, and suggest complementary indicators to address their limitations.

Ans: Nominal GDP reflects output at current prices, while Real GDP uses constant prices to show production volume, as explained in the document. During high inflation in India’s post-COVID recovery (e.g., 2021-22, with inflation near 6-7%), Nominal GDP might surge—say, from Rs 200 lakh crore to Rs 230 lakh crore—due to rising prices, suggesting robust growth. However, if production barely increases (e.g., 2% volume growth), Real GDP (e.g., Rs 204 lakh crore at 2011-12 prices) reveals the truth: inflation, not output, drives the rise. Nominal GDP overstates progress, while Real GDP isolates real economic expansion.

Relevance in High Inflation

In high inflation, Nominal GDP misleads by inflating growth perceptions, masking stagnant production. Post-COVID, India’s fuel and food price spikes padded Nominal GDP, but Real GDP showed a slower recovery, reflecting supply chain woes and weak demand. Real GDP is more relevant—it highlights actual output changes, crucial for sustainable development, which needs genuine growth, not price illusions.

Better Measure for Policy Decisions

Real GDP better informs sustainable development policies. It guides the RBI to tackle inflation (e.g., rate hikes) or boost production (e.g., infrastructure spending) without chasing inflated figures. Nominal GDP might push short-term populist measures (e.g., subsidies), ignoring structural fixes. For sustainability, policymakers need output reality, not price distortions.

Complementary Indicators

- GDP Deflator: Measures price changes (Nominal/Real GDP ratio), revealing inflation’s role, and aiding targeted price controls.

- Employment Rate: Tracks jobs created, linking growth to livelihoods—Real GDP might rise without jobs.

- Environmental Index: Adjusts for ecological costs (e.g., pollution), ensuring growth isn’t resource-depleting, a limit both measures ignore.

|

69 videos|380 docs|57 tests

|

FAQs on Higher Order Thinking Skills - National Income Accounting - Economics Class 12 - Commerce

| 1. What is national income accounting and why is it important? |  |

| 2. What are the main components of national income? |  |

| 3. How is Gross Domestic Product (GDP) calculated? |  |

| 4. What is the difference between nominal and real GDP? |  |

| 5. Why is it necessary to adjust national income figures for inflation? |  |