Higher Order Thinking Skills - Government Budget and the Economy | Economics Class 12 - Commerce PDF Download

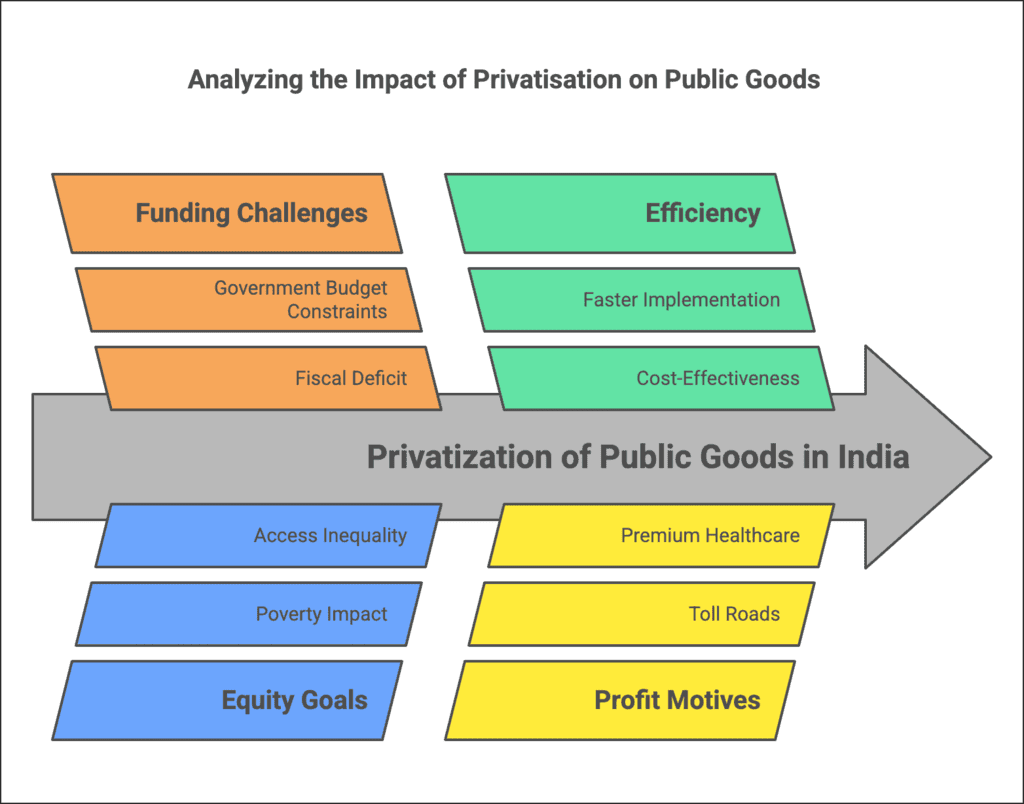

Q1: Public goods, being non-rivalrous and non-excludable, require government provision. Critically assess whether privatization of public goods like roads or healthcare could address funding challenges in India’s mixed economy. Propose a hybrid model and evaluate its potential impact on equity and efficiency.

Ans:

- Public goods, like roads and healthcare, are non-rivalrous (one’s use doesn’t reduce availability) and non-excludable (hard to deny access), necessitating government provision, as the document notes.

- Privatizing them in India’s mixed economy could tackle funding challenges.

- Private firms, driven by profit, might invest in toll roads or premium hospitals, easing the fiscal burden (e.g., India’s 6.4% GDP fiscal deficit in 2022-23).

- However, privatization risks exclusion—tolls deter poor users, and private healthcare prioritizes paying clients, clashing with equity goals in a nation where 21% live below the poverty line.

- Efficiency might rise (e.g., faster road construction), but profit motives could skew access, undermining the public goods’ universal benefit, as “free-riders” are excluded.

Proposed Hybrid Model

- A Public-Private Partnership (PPP) hybrid could balance funding and access:

- Roads: Private firms build and maintain highways, charging tolls, while the government subsidizes rural roads, ensuring free access where tolls are unfeasible.

- Healthcare: Private hospitals operate urban facilities for profit, but the government contracts them to provide subsidized care in rural areas, funded via taxes.

Impact on Equity and Efficiency

- Equity: Subsidised rural access preserves inclusivity, countering privatization’s bias toward affluent users. Urban tolls or fees might still strain low-income groups, but targeted subsidies (e.g., free passes) could mitigate this. India’s GST revenue (7.5% of GDP) could fund such equity measures.

- Efficiency: Private expertise boosts project speed and quality—India’s PPP highways (e.g., NH-44) show this. Yet, profit-driven cuts might compromise rural service quality unless regulated strictly.

- Trade-offs: Higher efficiency may raise fiscal costs initially (subsidies), but long-term savings from reduced public maintenance could offset this, aligning with FRBMA deficit targets.

Q2: It is debatable whether public debt burdens future generations or is offset by Ricardian equivalence. Assess the validity of Ricardian equivalence in India, where savings rates are high but financial literacy varies. Propose a debt management framework balancing intergenerational equity and current welfare and analyse its feasibility given FRBMA constraints.

Ans:

Ricardian equivalence suggests that consumers anticipate future tax increases to offset current deficits, saving more to pay these taxes, thus neutralizing the impact of government borrowing. In India, where household savings rates are high but financial literacy varies, the validity of this theory is mixed. High savings align with Ricardian behaviour, but uneven financial literacy means many households might not fully grasp or act on future tax implications, undermining the equivalence.

A pragmatic debt management framework for India should balance intergenerational equity and current welfare. It could include:

- Debt Stabilisation Fund: Save excess revenues during booms to cushion recessions, reducing reliance on borrowing.

- Productive Investments: Prioritize spending on infrastructure, health, and education to boost long-term growth and ease debt servicing.

- Progressive Taxation: Broaden the tax base and implement more progressive taxes to ensure equitable burden sharing.

- Financial Literacy Programs: Enhance understanding of public debt implications, encouraging prudent financial behaviour.

Given the Fiscal Responsibility and Budget Management Act (FRBMA) constraints—mandating fiscal deficit reductions to 3% of GDP and eliminating revenue deficit—the feasibility hinges on disciplined fiscal management. Efficient expenditure through better planning can free resources for necessary investments without violating FRBMA targets. Enhanced transparency and accountability will build public trust for necessary fiscal measures.

In conclusion, while Ricardian equivalence has limited applicability in India due to varied financial literacy, a balanced approach focusing on productive investments and progressive taxation, aligned with FRBMA constraints, can effectively manage public debt.

Q3: Revenue deficit reflects dissaving, often financed by cutting capital expenditure, as per the document. Analyze the long-term economic consequences of prioritizing revenue expenditure (e.g., subsidies) over capital expenditure (e.g., infrastructure) in India. Suggest a fiscal strategy to reverse this trend and predict its effects on GDP growth.

Ans:

- Prioritising revenue expenditure (e.g., subsidies) over capital expenditure (e.g., infrastructure) has significant long-term consequences for India’s economy.

- Revenue expenditure, such as subsidies, salaries, and interest payments, does not create assets or enhance productivity.

- Instead, it focuses on short-term welfare and administrative needs.

- On the other hand, capital expenditure builds infrastructure, boosts productivity, and supports sustainable growth.

- When revenue expenditure dominates, it often comes at the cost of cutting capital expenditure, which reduces future growth potential.

- The long-term effects include reduced economic productivity due to poor infrastructure, lower private investment because of inadequate public support, and a decline in global competitiveness.

- For instance, underinvestment in roads, energy, and education limits industrial growth and increases costs for businesses.

- This leads to slower GDP growth, higher unemployment, and reduced living standards.

- Additionally, excessive reliance on subsidies can distort resource allocation, increase fiscal deficits, and create inflationary pressures.

To reverse this trend, a fiscal strategy could involve:

- Rationalizing Subsidies: Target subsidies to benefit only vulnerable groups using Direct Benefit Transfers (DBT).

- Boosting Tax Revenues: Increase tax compliance, broaden the tax base, and reduce tax evasion.

- Prioritising Capital Expenditure: Allocate more budgetary resources to infrastructure, health, and education, which have high multiplier effects.

- Public-Private Partnerships (PPPs): Encourage private sector participation in infrastructure projects to share costs and risks.

Implementing these measures would likely boost GDP growth by enhancing productivity, attracting private investments, and ensuring efficient resource use. For example, better infrastructure lowers logistics costs, encouraging industries to expand. Investments in education and health improve human capital, fostering innovation and entrepreneurship. However, the feasibility of this strategy depends on adhering to FRBMA constraints, which mandate reducing fiscal deficits. By balancing welfare and growth-focused spending, India can achieve sustainable development and intergenerational equity.

|

64 videos|308 docs|51 tests

|

FAQs on Higher Order Thinking Skills - Government Budget and the Economy - Economics Class 12 - Commerce

| 1. What is the purpose of a government budget? |  |

| 2. How does a government budget impact the economy? |  |

| 3. What are the main components of a government budget? |  |

| 4. What is a budget deficit, and how does it affect the economy? |  |

| 5. How can citizens influence government budgeting processes? |  |