Commerce Exam > Commerce Notes > Accountancy Class 12 > Mind Map: Issue and Redemption of Debentures

Mind Map: Issue and Redemption of Debentures | Accountancy Class 12 - Commerce PDF Download

The document Mind Map: Issue and Redemption of Debentures | Accountancy Class 12 - Commerce is a part of the Commerce Course Accountancy Class 12.

All you need of Commerce at this link: Commerce

|

51 videos|270 docs|51 tests

|

FAQs on Mind Map: Issue and Redemption of Debentures - Accountancy Class 12 - Commerce

| 1. What are debentures and how do they function in a corporate finance context? |  |

Ans. Debentures are long-term debt instruments issued by companies to raise capital. They are essentially loans made by investors to the company, which promises to pay back the principal amount along with interest at specified intervals. Debentures can be secured, backed by the company's assets, or unsecured, relying solely on the company's creditworthiness. They are a popular means for companies to finance expansion, acquisitions, or other capital expenditures.

| 2. What is the process of issuing debentures, and what key factors should companies consider? |  |

Ans. The process of issuing debentures involves several steps:

1. <b>Approval</b>: The company must obtain approval from its board of directors and shareholders.

2. <b>Terms Setting</b>: Define the terms of the debenture, including the interest rate, maturity date, and any covenants.

3. <b>Regulatory Compliance</b>: Ensure compliance with securities regulations and file necessary documents with regulatory authorities.

4. <b>Marketing</b>: The debentures are marketed to potential investors, which may involve an underwriter.

5. <b>Issuance</b>: Once sold, the funds are collected, and the debentures are issued to investors.

Key factors to consider include market conditions, interest rates, and the company’s credit rating, as these will influence the attractiveness of the debenture to investors.

| 3. What are the key differences between convertible debentures and non-convertible debentures? |  |

Ans. Convertible debentures are a type of debt security that can be converted into a predetermined number of the company’s equity shares after a specified period. This gives investors the potential for capital appreciation if the company performs well. Non-convertible debentures, on the other hand, cannot be converted and remain as debt throughout their life. As a result, they typically offer higher interest rates than convertible debentures to compensate for the lack of conversion option.

| 4. What are the implications of redeeming debentures before their maturity date? |  |

Ans. Redeeming debentures before maturity can have several implications for a company. Early redemption may require the company to pay a premium, depending on the terms of the debenture. This can lead to a cash outflow that affects liquidity. Additionally, redeeming debentures early may alter the company’s capital structure and reduce interest expenses, but it could also impact investor confidence if perceived as a sign of financial distress. It’s crucial for companies to assess the financial implications and market conditions before deciding on early redemption.

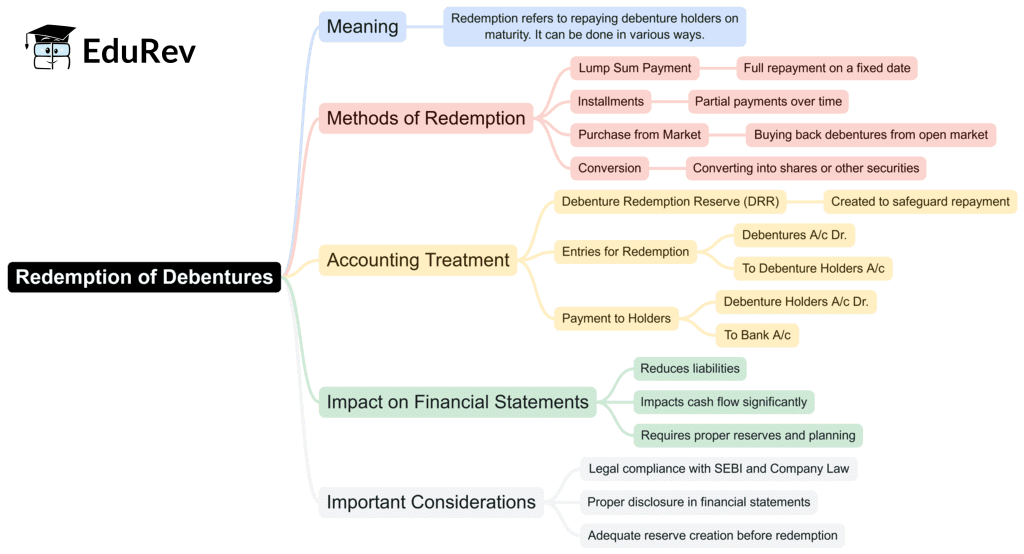

| 5. How does the redemption of debentures impact the financial statements of a company? |  |

Ans. The redemption of debentures impacts a company's financial statements in several ways. Upon redemption, the liability on the balance sheet is reduced by the amount of debentures redeemed. This decreases total liabilities and may improve the debt-to-equity ratio. The cash flow statement will also reflect an outflow of cash for the redemption. Additionally, if a premium is paid during redemption, it will be recorded as an expense in the income statement, impacting net income for that period.

Related Searches