Commerce Exam > Commerce Notes > Accountancy Class 12 > Mind Map: Cash Flow Statements

Mind Map: Cash Flow Statements | Accountancy Class 12 - Commerce PDF Download

The document Mind Map: Cash Flow Statements | Accountancy Class 12 - Commerce is a part of the Commerce Course Accountancy Class 12.

All you need of Commerce at this link: Commerce

|

42 videos|199 docs|43 tests

|

FAQs on Mind Map: Cash Flow Statements - Accountancy Class 12 - Commerce

| 1. What is a cash flow statement and why is it important in commerce? |  |

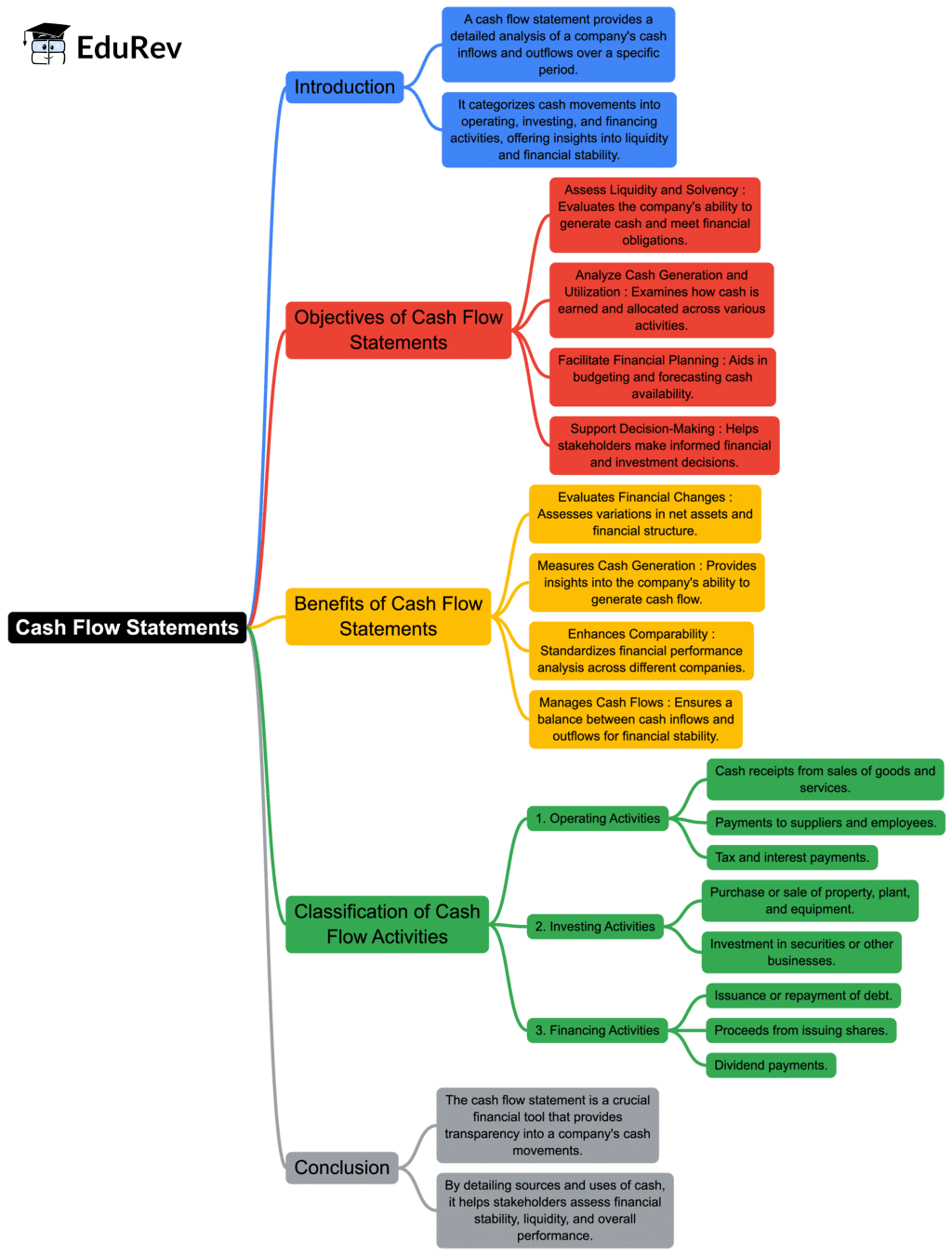

Ans. A cash flow statement is a financial document that provides a summary of an organization’s cash inflows and outflows over a specific period. It is crucial in commerce because it helps businesses understand their liquidity position, manage cash effectively, and make informed financial decisions. It shows how cash is generated and used in operating, investing, and financing activities.

| 2. How do you read and interpret a cash flow statement? |  |

Ans. To read a cash flow statement, start by identifying the three main sections: operating activities, investing activities, and financing activities. Look for net cash provided or used in each section. Positive cash flow indicates that the company is generating more cash than it spends, while negative cash flow may signal potential financial issues. Comparing cash flow with net income can also provide insights into a company's financial health.

| 3. What are the main components of a cash flow statement? |  |

Ans. The main components of a cash flow statement include cash flows from operating activities (cash generated from core business operations), cash flows from investing activities (cash used for investments in assets, acquisitions, etc.), and cash flows from financing activities (cash transactions related to debt and equity financing). Each section provides insights into different aspects of the company's financial performance.

| 4. How can cash flow statements aid in business decision-making? |  |

Ans. Cash flow statements aid in business decision-making by providing a clear picture of cash availability. They help management assess whether there is enough cash to meet obligations, plan for future expenses, and evaluate investment opportunities. By analyzing cash flow trends, businesses can make strategic decisions regarding budgeting, expansion, and risk management.

| 5. What are common mistakes to avoid when preparing a cash flow statement? |  |

Ans. Common mistakes to avoid when preparing a cash flow statement include failing to distinguish between cash and accrual accounting, neglecting to include all cash inflows and outflows, and not reconciling net income with cash flow from operating activities. It's also important to ensure that all non-cash transactions are properly disclosed, as they can impact the overall understanding of the company's financial situation.

Related Searches