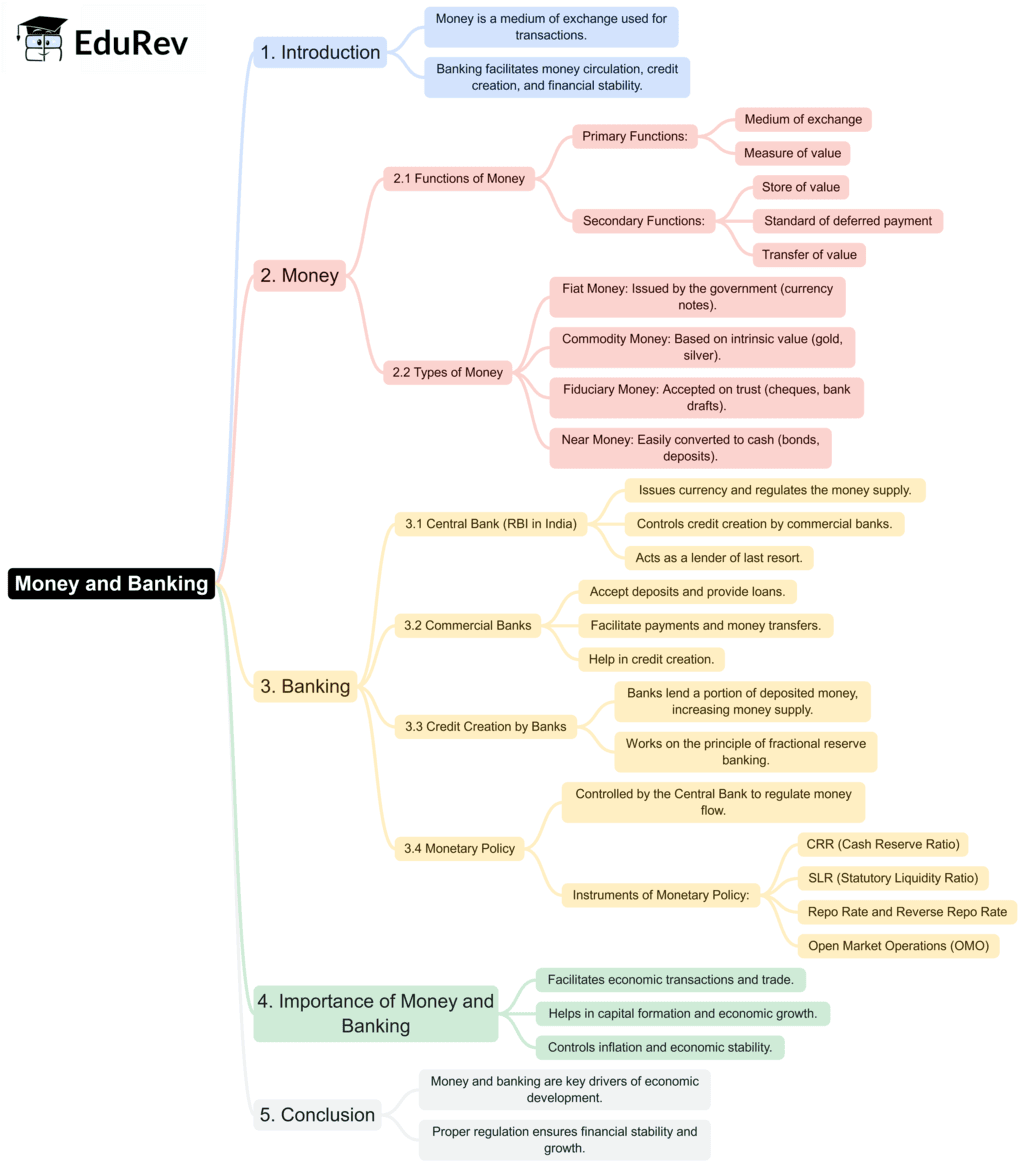

Commerce Exam > Commerce Notes > Economics Class 12 > Mind Map: Money and Banking

Mind Map: Money and Banking | Economics Class 12 - Commerce PDF Download

The document Mind Map: Money and Banking | Economics Class 12 - Commerce is a part of the Commerce Course Economics Class 12.

All you need of Commerce at this link: Commerce

|

64 videos|308 docs|51 tests

|

FAQs on Mind Map: Money and Banking - Economics Class 12 - Commerce

| 1. What is the role of central banks in the economy? |  |

Ans.Central banks are responsible for managing a nation's monetary policy, regulating the banking system, and maintaining financial stability. They control interest rates, manage the money supply, and act as a lender of last resort to banks during financial crises, ensuring the overall health of the economy.

| 2. How do interest rates affect borrowing and spending? |  |

Ans.Interest rates have a direct impact on borrowing costs. When interest rates are low, borrowing becomes cheaper, encouraging consumers and businesses to take loans for spending and investment. Conversely, high-interest rates can deter borrowing and slow down economic activity as loans become more expensive.

| 3. What is the difference between commercial banks and investment banks? |  |

Ans.Commercial banks primarily focus on accepting deposits, providing savings accounts, and offering loans to individuals and businesses. In contrast, investment banks specialize in underwriting securities, facilitating mergers and acquisitions, and providing advisory services for corporate finance, making them crucial for capital markets.

| 4. What are the functions of money in an economy? |  |

Ans.Money serves three primary functions in an economy: it acts as a medium of exchange, allowing transactions to occur without the need for bartering; it serves as a unit of account, providing a standard measure of value for goods and services; and it functions as a store of value, enabling individuals to save and defer consumption until a later date.

| 5. How do banks create money through lending? |  |

Ans.Banks create money through a process called fractional reserve banking. When a bank receives deposits, it is required to keep only a fraction of those deposits as reserves and can lend out the remainder. This lending process effectively increases the money supply, as borrowers can spend the loaned money, which then gets deposited back into the banking system.

Related Searches