Mergers, Acquisitions, and Amalgamations | Company Law - CLAT PG PDF Download

Introduction to Mergers, Acquisitions, and Amalgamations

Mergers, acquisitions, and amalgamations are strategic corporate restructuring processes that involve the consolidation of companies or their assets to achieve business objectives such as growth, market expansion, or operational efficiency. These processes are governed by the Companies Act, 2013, SEBI regulations, and other statutory frameworks in India.

Definitions

- Merger: The combination of two or more companies into one, where one company survives (absorbing company) and the other(s) cease to exist (absorbed company). It can be a merger by absorption or by formation of a new entity.

- Acquisition: The purchase or takeover of one company by another, where the acquiring company gains control over the target company’s assets, operations, or shares without merging their legal identities.

- Amalgamation: A legal process where two or more companies combine to form a new entity, with the original companies dissolving. It is a specific type of merger under Indian law.

Objectives

- Achieve economies of scale and operational synergies.

- Expand market share or geographic presence.

- Diversify product portfolios or business operations.

- Enhance financial strength or tax benefits.

- Eliminate competition or acquire strategic assets.

CLAT PG Focus: Understand the distinctions between mergers, acquisitions, and amalgamations, as questions often test their definitions and legal implications.

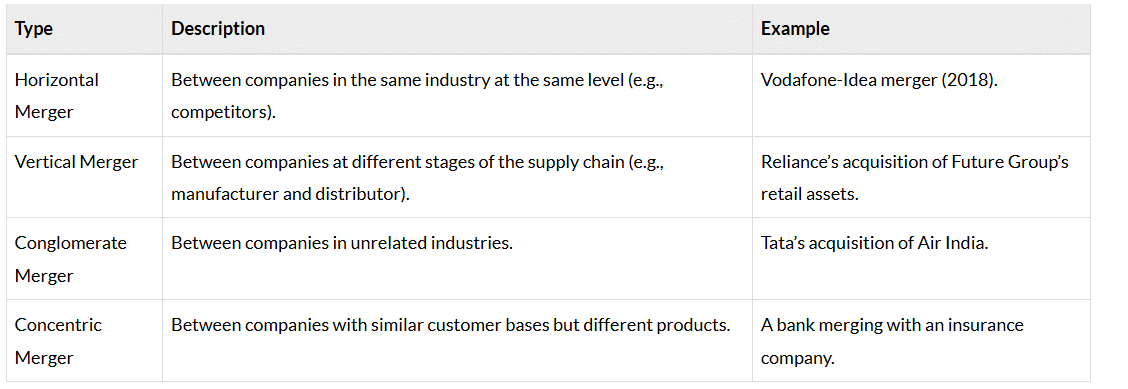

Types of Mergers and Acquisitions

Mergers and acquisitions can be classified based on their structure, purpose, or economic impact.

Types of Mergers

Types of Acquisitions

- Friendly Acquisition: The target company agrees to be acquired.

- Hostile Acquisition: The acquiring company takes over without the target’s consent, often through a tender offer or proxy fight.

- Leveraged Buyout (LBO): Acquisition financed through significant debt.

- Management Buyout (MBO): Company’s management acquires its own company.

Exam Tip: Questions may ask you to identify the type of merger or acquisition based on a case study or scenario.

Legal Framework in India

Mergers, acquisitions, and amalgamations in India are governed by a combination of statutory provisions, regulatory guidelines, and judicial precedents.

Companies Act, 2013

- Section 230-232:Governs the procedure for compromises, arrangements, and amalgamations, including mergers and demergers.

- Section 230: Deals with compromises and arrangements between a company and its creditors or members.

- Section 231: Empowers the National Company Law Tribunal (NCLT) to enforce schemes.

- Section 232: Specific provisions for mergers and amalgamations, including the scheme of arrangement.

- Section 234: Facilitates cross-border mergers, allowing Indian companies to merge with foreign companies (subject to RBI approval).

- Section 391-394 (Companies Act, 1956): Earlier provisions, now replaced by Sections 230-232, but relevant for historical case laws.

SEBI Regulations

- SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Code):

- Regulates acquisitions of shares or control in listed companies.

- Mandates open offer requirements when an acquirer crosses a 25% voting rights threshold.

- SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015:

- Requires disclosures for mergers and acquisitions involving listed companies.

- Ensures shareholder approval for material transactions.

Other Laws

- Competition Act, 2002: The Competition Commission of India (CCI) approves combinations (mergers/acquisitions) that may affect market competition (Section 5 and 6).

- Income Tax Act, 1961: Provides tax benefits for amalgamations (e.g., carry-forward of losses under Section 72A).

- Foreign Exchange Management Act (FEMA), 1999: Governs cross-border mergers and acquisitions, requiring RBI approval.

- Insolvency and Bankruptcy Code (IBC), 2016: Facilitates acquisitions of distressed companies through resolution plans.

CLAT PG Tip: Focus on Sections 230-232 and 234 of the Companies Act, 2013, and the SEBI Takeover Code, as they are frequently tested.

Procedure for Mergers and Amalgamations

The process for mergers and amalgamations under the Companies Act, 2013, involves multiple steps, primarily overseen by the NCLT.

Key Steps

- Board Approval: The boards of the merging companies approve the scheme of merger/amalgamation.

- Application to NCLT: File an application with the NCLT under Section 230, along with the draft scheme.

- Shareholder and Creditor Approval:

- Obtain approval from 75% of shareholders and creditors (in value) in meetings convened by NCLT.

- For listed companies, SEBI and stock exchanges must also approve.

- CCI Approval: If the merger qualifies as a “combination” under the Competition Act, 2002, obtain CCI clearance.

- NCLT Hearing and Sanction:

- NCLT reviews the scheme, ensuring it is fair and in the public interest.

- Issues a final order sanctioning the scheme (Section 232).

- Filing with ROC: File the NCLT order with the Registrar of Companies (ROC) to complete the merger.

- Post-Merger Compliance: Transfer assets, liabilities, and shares as per the scheme, and update records.

Cross-Border Mergers (Section 234)

- Allows mergers between Indian and foreign companies in notified jurisdictions.

- Requires prior approval from the Reserve Bank of India (RBI).

- NCLT oversees the process, similar to domestic mergers.

Exam Tip: Questions may test the procedural steps or the role of regulatory bodies like NCLT, CCI, or SEBI.

Procedure for Acquisitions

Acquisitions involve the purchase of shares, assets, or control of a target company, with distinct procedures based on whether the target is listed or unlisted.

Acquisition of Shares in Listed Companies

- SEBI Takeover Code:

- An acquirer gaining 25% or more voting rights must make an open offer to public shareholders for at least 26% additional shares.

- Disclosures are required at 5%, 10%, 14%, 25%, and 75% shareholding thresholds.

- Process:

- Negotiate with the target company or major shareholders.

- Announce the open offer through a public announcement.

- File the offer document with SEBI and complete the acquisition.

Acquisition of Unlisted Companies

- Involves share purchase agreements or asset purchase agreements.

- Requires shareholder approval under Section 180 of the Companies Act, 2013, for significant disposals.

- No mandatory open offer, but due diligence is critical.

CLAT PG Focus: Be prepared for questions on the SEBI Takeover Code, especially open offer thresholds and disclosure requirements.

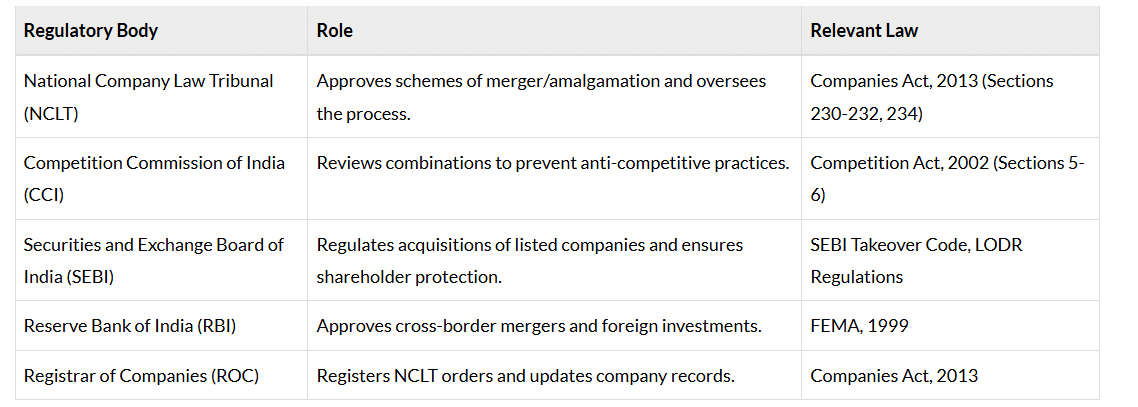

Role of Regulatory Bodies

Several regulatory bodies oversee mergers, acquisitions, and amalgamations to ensure compliance and protect stakeholders.

Exam Tip: Understand the distinct roles of NCLT and CCI, as questions often test their jurisdiction in merger approvals.

Financial and Tax Implications

Mergers and acquisitions have significant financial and tax implications, which are critical for CLAT PG preparation.

Financial Aspects

- Valuation: Determining the fair value of the target company using methods like discounted cash flow (DCF) or market multiples.

- Share Swap Ratio: In mergers, shares of the amalgamated company are issued to shareholders of the amalgamating company based on a swap ratio.

- Financing: Acquisitions may be financed through cash, debt, or equity issuance.

Tax Implications

- Section 2(1B) of Income Tax Act, 1961: Defines “amalgamation” for tax purposes, requiring all assets and liabilities to be transferred.

- Section 47: Exempts capital gains tax on amalgamations meeting specific conditions.

- Section 72A: Allows carry-forward of losses and unabsorbed depreciation in amalgamations of certain companies.

- Stamp Duty: Varies by state; some states exempt stamp duty on mergers approved by NCLT.

CLAT PG Focus: Questions may involve tax benefits or conditions for amalgamation under the Income Tax Act.

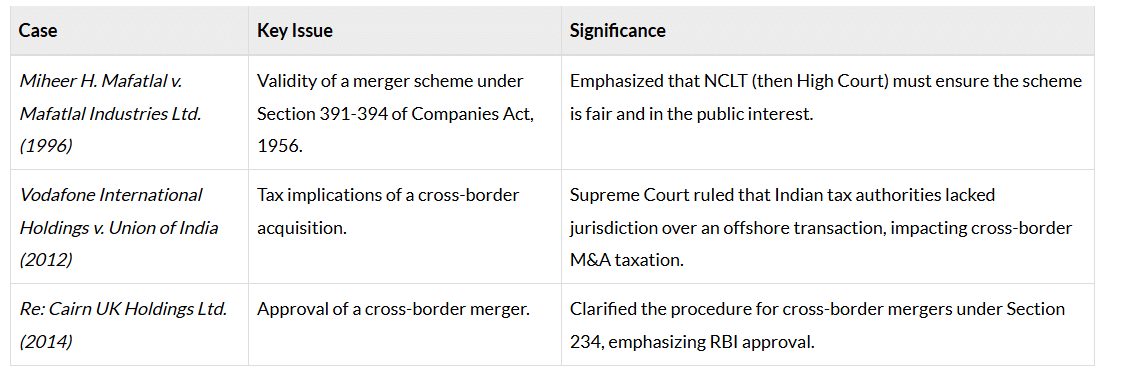

Landmark Case Laws

Case laws illustrate the application of legal principles in mergers and acquisitions, making them crucial for CLAT PG.

Exam Tip: Focus on the facts, issues, and judgments of these cases, as they may appear in passage-based questions.

Challenges and Emerging Trends

Mergers and acquisitions face several challenges, and recent trends are shaping their governance.

Challenges

- Regulatory Delays: Multiple approvals (NCLT, CCI, SEBI) can delay transactions.

- Valuation Disputes: Disagreements over share swap ratios or asset valuation.

- Integration Issues: Cultural and operational differences post-merger.

- Minority Shareholder Concerns: Ensuring fair treatment to avoid oppression claims.

Emerging Trends

- Cross-Border M&As: Increasing due to globalization and Section 234 provisions.

- Technology-Driven M&As: Acquisitions in tech, AI, and fintech sectors (e.g., Reliance’s acquisition of Netmeds).

- ESG Considerations: Companies prioritize environmental, social, and governance factors in M&A decisions.

- Distressed M&As: Acquisitions of insolvent companies under the IBC.

CLAT PG Tip: Stay updated on trends like ESG and IBC-related M&As, as they are increasingly relevant in exams.

|

65 docs|12 tests

|

FAQs on Mergers, Acquisitions, and Amalgamations - Company Law - CLAT PG

| 1. What are the main types of mergers and acquisitions? |  |

| 2. What is the legal framework governing mergers and amalgamations in India? |  |

| 3. What are the key steps involved in the procedure for mergers and amalgamations? |  |

| 4. What role do regulatory bodies play in the process of acquisitions? |  |

| 5. What are some financial and tax implications of mergers and acquisitions? |  |