Simple Interest Chapter Notes | Mathematics for JSS 3 PDF Download

Introduction

Imagine borrowing money from a friend or a bank to buy something special, like a new bicycle or a gadget. When you return the money, you might need to pay a little extra as a thank-you for using their money. This extra amount is called simple interest, and it’s a fascinating concept in mathematics! In this chapter, we’ll explore how simple interest works, learn about the key terms like principal, rate, and time, and discover how to calculate it step by step. Get ready to dive into the world of money and math, where you’ll see how these calculations help in real-life situations like loans and savings!

Simple Interest

- Simple interest is the extra money paid when you borrow money for a certain period.

- The original money borrowed is called the principal (P).

- The time for which the money is borrowed is called the time period (T).

- The percentage at which the interest is calculated is called the rate of interest (R).

- The total money returned, which includes the principal and the interest, is called the amount (A).

- Formula for Amount: A = P + S.I.

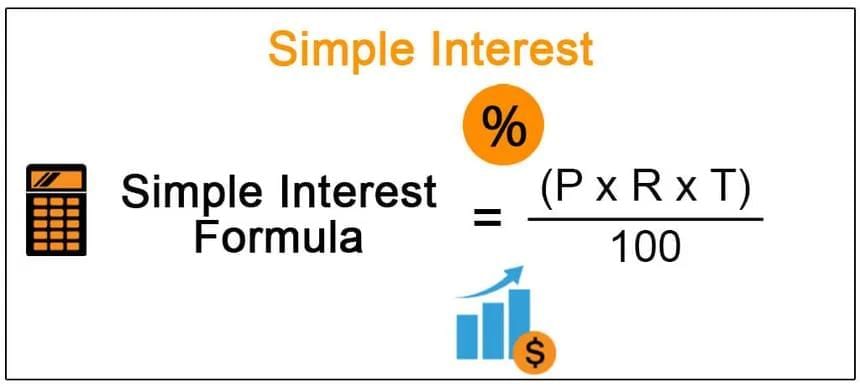

- Formula for Simple Interest: S.I. = (P × R × T) / 100

- Steps to calculate Simple Interest:

- Identify the principal (P), rate of interest (R), and time period (T).

- Multiply P, R, and T, then divide by 100 to find S.I.

- Steps to calculate Principal: P = (S.I. × 100) / (R × T)

- Identify the simple interest (S.I.), rate of interest (R), and time period (T).

- Multiply R and T, then divide S.I. by the result and multiply by 100.

- Steps to calculate Time: T = (S.I. × 100) / (P × R)

- Identify the simple interest (S.I.), principal (P), and rate of interest (R).

- Multiply P and R, then divide S.I. by the result and multiply by 100.

- Steps to calculate Rate of Interest: R = (S.I. × 100) / (P × T)

- Identify the simple interest (S.I.), principal (P), and time period (T).

- Multiply P and T, then divide S.I. by the result and multiply by 100.

Important Note: The time period should match the rate of interest. If the rate is per year, time should be in years; if the rate is per month, time should be in months.

Example 1: Find the simple interest on a loan of ₹ 25,000 at the rate of 7% per year for 3 years.

- Given: P = ₹ 25,000, R = 7%, T = 3 years

- Use the formula: S.I. = (P × R × T) / 100

- Substitute the values: S.I. = (25,000 × 7 × 3) / 100

- Calculate: S.I. = (5,25,000) / 100 = ₹ 5,250

Answer: The simple interest is ₹ 5,250.

Calculating Amount

- The amount is the total money paid back, which is the sum of the principal and the simple interest.

- Formula: A = P + S.I.

Steps to calculate Amount:

- Calculate the simple interest using S.I. = (P × R × T) / 100.

- Add the simple interest to the principal to get the amount.

Example 2: Find the amount to be paid on a loan of ₹ 6,600 at the rate of 8% per annum at the end of 5 years.

- Given: P = ₹ 6,600, R = 8%, T = 5 years

- Calculate S.I.: S.I. = (P × R × T) / 100 = (6,600 × 8 × 5) / 100

- Calculate: S.I. = (2,64,000) / 100 = ₹ 2,640

- Calculate Amount: A = P + S.I. = ₹ 6,600 + ₹ 2,640 = ₹ 9,240

Answer: The amount to be paid is ₹ 9,240.

Finding Principal from Interest

- When the simple interest, rate, and time are known, we can find the principal.

- Formula: P = (S.I. × 100) / (R × T)

Steps:

- Multiply the rate of interest (R) and time period (T).

- Divide the simple interest (S.I.) by the result and multiply by 100.

Example 3: Mr. Mishra took a loan for 2 years at the rate of 7½% per annum. He paid ₹ 2,025 as interest. Find the loan amount.

- Given: T = 2 years, R = 7½% = 15/2%, S.I. = ₹ 2,025

- Use the formula: P = (S.I. × 100) / (R × T)

- Substitute: P = (2,025 × 100) / ((15/2) × 2)

- Calculate: P = (2,025 × 100) / 15 = ₹ 13,500

Answer: The loan amount is ₹ 13,500.

Finding Rate of Interest

- When the principal, time, and amount or simple interest are known, we can find the rate of interest.

- Formula: R = (S.I. × 100) / (P × T)

Steps:

- If the amount is given, calculate S.I. = A - P.

- Multiply the principal (P) and time (T).

- Divide the simple interest by the result and multiply by 100.

Example 4: Find the rate of interest at which a sum of money will triple itself in 4 years.

- Assume: P = ₹ 100, A = ₹ 300 (since the amount triples), T = 4 years

- Calculate S.I.: S.I. = A - P = ₹ 300 - ₹ 100 = ₹ 200

- Use the formula: R = (S.I. × 100) / (P × T)

- Substitute: R = (200 × 100) / (100 × 4) = 200 / 4 = 50%

Answer: The rate of interest is 50% per annum.

Finding Time Period

- When the principal, rate, and simple interest or amount are known, we can find the time period.

- Formula: T = (S.I. × 100) / (P × R)

Steps:

- If the amount is given, calculate S.I. = A - P.

- Multiply the principal (P) and rate (R).

- Divide the simple interest by the result and multiply by 100.

Example 5: In how much time will the interest be 3/5 of the principal at the rate of 4% per annum?

- Assume: P = ₹ x, S.I. = (3/5) × x = ₹ (3x/5), R = 4%

- Use the formula: T = (S.I. × 100) / (P × R)

- Substitute: (3x/5) = (x × 4 × T) / 100

- Solve: T = (3x × 100) / (5 × x × 4) = 300 / 20 = 15 years

Answer: The time period is 15 years.

Finding Time for Fixed Deposit

- In a fixed deposit, the principal earns interest for a specific time, and the total amount is received at maturity.

- Use the time formula: T = (S.I. × 100) / (P × R).

Steps:

- Calculate S.I. = A - P (where A is the amount received).

- Multiply P and R, then divide S.I. by the result and multiply by 100.

Example 6: Rohit deposited ₹ 1,000 in a fixed deposit scheme at 10% per annum. At maturity, he received ₹ 2,500. Find the term of the deposit.

- Given: P = ₹ 1,000, A = ₹ 2,500, R = 10%

- Calculate S.I.: S.I. = A - P = ₹ 2,500 - ₹ 1,000 = ₹ 1,500

- Use the formula: T = (S.I. × 100) / (P × R)

- Substitute: T = (1,500 × 100) / (1,000 × 10) = 1,50,000 / 10,000 = 15 years

Answer: The term is 15 years.

Finding Principal from Amount

When the amount, rate, and time are known, we can find the principal.

Steps (Method 1):

- Calculate S.I. for an assumed principal (e.g., ₹ 100) using S.I. = (P × R × T) / 100.

- Find the amount: A = P + S.I.

- Use the ratio: If the amount is A for principal P, then for a given amount, the principal = (P × given amount) / A.

Steps (Method 2):

- Let principal = ₹ x.

- Calculate S.I. = (x × R × T) / 100.

- Solve A = x + (x × R × T) / 100 for x.

Example 7: Find the principal that will amount to ₹ 4,826 in 6 years at the rate of 4½% per annum.

Method 1:

- Assume P = ₹ 100, R = 4½% = 9/2%, T = 6 years

- Calculate S.I.: S.I. = (100 × 9 × 6) / (100 × 2) = ₹ 27

- Calculate A: A = 100 + 27 = ₹ 127

- Proportion: If A = ₹ 127, P = ₹ 100; then for A = ₹ 4,826, P = (100 × 4,826) / 127 = ₹ 3,800

- Let P = ₹ x, R = 9/2%, T = 6 years

- S.I. = (x × 9 × 6) / (100 × 2) = 27x / 100

- A = x + 27x / 100 = 127x / 100

- Given A = 4,826: 127x / 100 = 4,826

- Solve: x = (4,826 × 100) / 127 = ₹ 3,800

Answer: The principal is ₹ 3,800.

Finding the Amount for Different Rates and Times

To find the amount for a new rate and time, first find the principal from the given amount, then calculate the new amount.

Steps:

- Calculate S.I. for an assumed principal (e.g., ₹ 100) for the first case.

- Find the amount: A = P + S.I.

- Find the actual principal using the proportion method.

- Use the new principal, rate, and time to calculate the new S.I. and amount.

Example 8: A sum of money invested at 6% p.a. amounts to ₹ 826 in 3 years. How much would it amount to in 6 years at 10½% p.a.?

Step 1: Assume P = ₹ 100, R = 6%, T = 3 years

- Calculate S.I.: S.I. = (100 × 6 × 3) / 100 = ₹ 18

- Calculate A: A = 100 + 18 = ₹ 118

- Proportion: If A = ₹ 118, P = ₹ 100; then for A = ₹ 826, P = (100 × 826) / 118 = ₹ 700

Step 2: New P = ₹ 700, R = 10½% = 21/2%, T = 6 years

- Calculate S.I.: S.I. = (700 × 21 × 6) / (100 × 2) = ₹ 441

- Calculate A: A = 700 + 441 = ₹ 1,141

Answer: The amount is ₹ 1,141.

Finding Rate with Different Principals

When two people invest different principal at the same rate and time, and the difference in interest is known, we can find the rate.

Steps:

- Calculate S.I. for each principal: S.I. = (P × R × T) / 100.

- Find the difference in S.I. and set it equal to the given difference.

- Solve for R.

Alternative:

- Find the difference in principals.

- Use the difference in interest to calculate R for the difference in principal.

Example 9: Ria and Tia invest ₹ 5,000 and ₹ 8,000 respectively at the same rate for 4 years. Tia gets ₹ 500 more interest than Ria. Find the rate of interest.

Method 1:

- For Ria: S.I. = (5,000 × R × 4) / 100 = 200R

- For Tia: S.I. = (8,000 × R × 4) / 100 = 320R

- Given: 320R - 200R = 500

- Solve: 120R = 500, R = 500 / 120 = 4⅙%

Method 2:

- Difference in principal: ₹ 8,000 - ₹ 5,000 = ₹ 3,000

- Interest on ₹ 3,000 for 4 years = ₹ 500

- (3,000 × R × 4) / 100 = 500

- Solve: R = 500 / 120 = 4⅙%

Answer: The rate of interest is 4⅙% per annum.

Interest for a Specific Time Period

When the time period is given in days or months, convert it to years (if the rate is per annum).

Steps:

- Calculate the total number of days between the given dates.

- Convert days to years: T = days / 365.

- Use the S.I. formula: S.I. = (P × R × T) / 100.

Example 10: Find the interest on ₹ 9,600 from July 26 to October 7 at 7% per annum.

- Given: P = ₹ 9,600, R = 7%

- Calculate days: July (5 days) + August (31 days) + September (30 days) + October (7 days) = 73 days

- Convert to years: T = 73 / 365 = 1/5 year

- Calculate S.I.: S.I. = (9,600 × 7 × 1/5) / 100 = ₹ 134.40

Answer: The interest is ₹ 134.40.

|

26 videos|209 docs|58 tests

|

FAQs on Simple Interest Chapter Notes - Mathematics for JSS 3

| 1. What is simple interest and how is it calculated? |  |

| 2. What are the components involved in the simple interest formula? |  |

| 3. How does simple interest differ from compound interest? |  |

| 4. Can simple interest be used for different types of loans or investments? |  |

| 5. What is the significance of understanding simple interest in everyday financial decisions? |  |