UGC NET Paper 2: Economics 2nd Mar 2023 Shift 1 | UGC NET Past Year Papers PDF Download

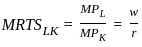

Q1: Which one of the following is not true in case of producer's equilibrium?

(a)

(b)

(c)

(d)

Ans: d

Sol: Option 4 is the right answer.

- The Producer’s equilibrium is the point where all of the variables used in production are at their respective minimum amounts.

- At this point, all costs would be zero, meaning that there would be no prices involved, and everyone would receive a profit. However, it is not entirely true that the Producer’s equilibrium is reached at this point.

- To achieve his goal of producing maximum output with minimal costs, the Producer must also have cash on hand to pay for such items as raw materials, labour services, and rent on fixed capital equipment.

- Determination of Producer's Equilibrium and Expansion Path

- Producer's equilibrium occurs at the tangency of isocost and isoquant, where MRTS equals factor price ratios.

- MRTS=w/r.

Q2: Which of the following is not true in case of Indifference curves?

(a) The Indifference curves are usually convex or bowed inward.

(b) Indifference curve for two goods that are perfect complements is shaped as right angles.

(c) Indifference curve for two goods that are perfect substitutes is a downward sloping straight line.

(d) Indifference curve for two normal goods is a downward sloping straight line.

Ans: d

Sol: The correct answer is Indifference curve for two normal goods is a downward sloping straight line.

The Indifference curves are usually convex or bowed inward.

- The reason indifference curves are usually convex, or bowed inward, towards the origin is due to a principle known as diminishing marginal rate of substitution (MRS).

- The marginal rate of substitution is the amount of a good a person is willing to give up to get an additional unit of another good, and still remain equally satisfied (on the same indifference curve). As a person consumes more and more of one good, the willingness to give up units of the second good to get more of the first good declines. This is the idea of diminishing marginal rate of substitution.

Indifference curve for two goods that are perfect complements is shaped as right angles.

- An indifference curve is a graph that shows a combination of two goods that a consumer considers equally preferable, meaning they have the same level of satisfaction (or utility) with any of the combinations.

- When the two goods are perfect complements, it means they are used together in a fixed ratio. Think of a car and gasoline, or a pen and ink. You need both together to achieve the desired use. Increasing one without the other doesn't add any value or satisfaction to the consumer.

Indifference curve for two goods that are perfect substitutes is a downward sloping straight line.

- Two goods are considered perfect substitutes if the consumer is perfectly okay with consuming one good instead of the other. That means the two goods are completely interchangeable from the consumer's viewpoint. For example, imagine if you had two brands of plain bottled water – most people would be indifferent as to which brand of water they drink.

Q3: A game in which the gains or losses of one player or firm do not come at the expenses of or provide equal benefit to the other player or firm, is known as ____________.

(a) Zero - Sum game

(b) Non - Zero Sum game

(c) Mixed game

(d) Balanced game

Ans: b

Sol: Non-zero sum game.

- A Non-Zero-Sum Game is a situation where one's win does not necessarily mean another's loss, and one's loss does not necessarily mean that the other party wins.

- In a Non-Zero-Sum Game, all parties could gain, or all parties could lose. This is in direct contrast to a Zero-Sum Game where one party's win necessitates another party's loss, such as in competitive games like basketball, where if one team wins, the other automatically loses.

- A classic example of a Non-Zero-Sum Game situation is called the Prisoner's Dilemma, where two prisoners are interrogated separately, and are offered a bargain where if one confesses, he is set free, while the other prisoner is convicted for 10 years.

- If both confess, they both face 2 years in prison. If both keep their mouth shut, they would both serve 6 months for a minor crime.

- Obviously, the optimal choice for both of them would be to keep silent and serve the 6 months. But since they don't know what the other person intends to do, they will both fear that the other one might confess, leaving them to suffer the 10 years.

Q4: The condition of preferring a risky income to a certain income with the same expected value is referred as :

(a) Risk averse

(b) Risk loving

(c) Risk neutral

(d) Risk premium

Ans: b

Sol: The condition of preferring a risky income to a certain income with the same expected value is refered as risk loving.

- Risk lovers gravitate towards investments with extremely high potential payouts even if the potential for loss is comparatively larger.

- The types of investment a risk lover is willing to consider are the same ones that common valuation methods filter out.

- Risk lovers play an important market function by helping de-risk the market for more conservative investors.

Q5: ____________ arises when the firm can produce any combination of the two outputs more cheaply than could two independent firms that each produced a single output.

(a) Learner's curve

(b) Economies of scale

(c) Dis - economies of scale

(d) Economies of scope

Ans: d

Sol: Economies of Scope is the right answer.

- An economy of scope means that the production of one good reduces the cost of producing another related good.

- Economies of scope occur when producing a wider variety of goods or services in tandem is more cost effective for a firm than producing less of a variety, or producing each good independently.

In such a case, the long-run average and marginal cost of a company, organization, or economy decreases due to the production of complementary goods and services.

- While economies of scope are characterized by efficiencies formed by variety, economies of scale are instead characterized by volume. The latter refers to a reduction in marginal cost by producing additional units.

- Economies of scale, for instance, helped drive corporate growth in the 20th century through assembly line production.

Q6: In which oligopoly model, firms produce homogenous goods and each firm treats the price of its competitors as fixed and all firms decide simultaneously, what price to change?

(a) Bertrand model

(b) Cournot model

(c) Stackelberg model

(d) Sweezy model

Ans: a

Sol: Bertrand model is the correct answer.

- Bertrand competition is a model of competition used in economics, named after Joseph Louis François Bertrand (1822–1900).

- It describes interactions among firms (sellers) that set prices and their customers (buyers) that choose quantities at the prices set. The model was formulated in 1883 by Bertrand in a review of Antoine Augustin Cournot's book Recherches sur les Principes Mathématiques de la Théorie des Richesses (1838) in which Cournot had put forward the Cournot model.

- Cournot's model argued that each firm should maximise its profit by selecting a quantity level and then adjusting price level to sell that quantity.

- The outcome of the model equilibrium involved firms pricing above marginal cost; hence, the competitive price.

- In his review, Bertrand argued that each firm should instead maximise its profits by selecting a price level that undercuts its competitors' prices, when their prices exceed marginal cost.

- The model was not formalized by Bertrand; however, the idea was developed into a mathematical model by Francis Ysidro Edgeworth in 1889.

Q7: Who wrote that "every man thus lives by exchanging or becomes in some measure a merchant, and the society itself grows to be what is properly a commercial society."

(a) Milton Friedman

(b) Keynes

(c) Benjamin Olken

(d) Adam Smith

Ans: d

Sol: The correct answer is Adam Smith.

- When the division of labour has been thoroughly established, it is but a very small part of a man’s wants that the produce of his labour can supply. He supplies the far greater part of them by exchanging that surplus part of the produce of his labour, which is over and above his consumption, for such parts of the produce of other men’s labour as he has occasion for. Every man thus lives by exchanging or becomes in some measure a merchant, and the society itself grows to be what is properly a commercial society.

- "The Wealth of Nations," written by the influential economist Adam Smith. Published in 1776, the book provides one of the world's best-known rationales for free trade, competition, and the efficiency of market economics.

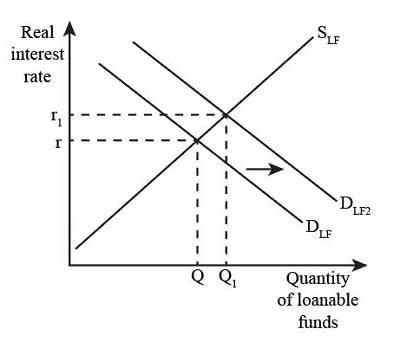

Q8: If the demand for labour increases, then

(a) Real wage rises

(b) The amount of labour employed increases

(c) Both 1 and 2 happen

(d) None of the above

Ans: c

Sol: The correct answer is Real wage rises.

If the demand for labor increases, typically two main outcomes can be expected in the labor market.

Wage increases: Higher demand for labor generally results in an increase in wages, as firms are willing to pay more to attract the workers they need. This is based on the basic economic principle of supply and demand -- as demand rises while supply remains the same, the price, in this case, wages, should rise.

Employment increases: If the demand for labor increases, it means more jobs are being created in the economy, which leads to an increase in employment. Companies hiring more workers can lead to a reduction in unemployment rates, assuming there's a sufficient supply of workers.

These outcomes, however, rely on a number of assumptions, like the flexibility of wage rates, the preparedness and ability of the labor force to fill the new jobs, and how effectively the labor market matches workers to jobs. For example, there could be a situation where the demand for labor increases in a certain high-skill industry, but there may not be a sufficient supply of workers who possess these specific skills. Furthermore, changes might not be immediate as labor market adjustments often take time.

Q9: The Sticky - Price Model is

(a) The upward sloping short run aggregate supply curve

(b) The upward sloping long run aggregate supply curve

(c) The downward sloping short run Aggregate Demand curve

(d) The downward sloping long run Aggregate Demand curve

Ans: a

Sol: The correct answer is The upward-sloping short-run aggregate supply curve.

- The Sticky-Price Model is an economic concept used in macroeconomics to explain how prices of goods and services adjust in the short run. According to this model, prices don't adjust instantly to changes in supply and demand but instead change slowly over time.

- The term "sticky" implies that prices tend to remain fixed or adjust only gradually.

Other Related Points

- Price stickiness, or sticky prices, is the failure of market price(s) to change quickly, despite shifts in the broad economy suggesting a different price is optimal.

- When prices cannot adjust immediately to changes in economic conditions or in the aggregate price level, there is an inefficiency or disequilibrium in the market.

- Often the price stickiness operates in just one direction—for instance, prices will rise far more easily than they will fall.

- The concept of price stickiness can also apply to wages. When sales fall, the company doesn’t resort to cutting wages

Q10: Macroeconomics distinguishes between real economy and ___________

(a) Virtual economy

(b) Monetary economy

(c) Normative economy

(d) Underground economy

Ans: b

Sol: The correct answer is Monetary economy.

- To sum up, macroeconomics distinguishes between the real economy and the monetary economy. The real economy deals with the production and consumption of goods and services, while the monetary economy deals with the creation, distribution, and use of money.

- The monetary economy refers to the part of the economy that deals with the creation, distribution, and use of money. It includes institutions such as banks, central banks, and financial markets. In the monetary economy, money is used as a medium of exchange, a store of value, and a unit of account. The monetary economy is measured by indicators such as money supply, interest rates, and exchange rates.

Q11: In accelerator theory, capital output ratio is assumed to be

(a) Increasing

(b) Independent from level of National income

(c) Decreasing

(d) Constant

Ans: d

Sol: The correct answer is Constant.

- In accelerator theory, the capital-output ratio (also known as the capital coefficient) is typically assumed to be constant. The theory is based on the notion that investment levels are determined by rates of change in income or consumption. It is seen as a response to changes in the rate of economic growth.

- This constant capital-output ratio assumption suggests a fixed relation between the capital stock necessary to produce a given level of output. If the demand for output increases, causing output to rise, firms will correspondingly need to increase their capital stock to meet this new demand level—thus, maintaining the constant capital-output ratio.

- However, one should note that this is an assumption to simplify the model, and in the real world, the capital-output ratio can change due to multiple factors, including advances in technology, changes in labor efficiency, and shifts in production processes

Q12: Government spending is

(a) a second element of autonomous expenditure.

(b) to be controlled by policy makers.

(c) does not depend directly on the level of income.

(d) All of the above

Ans: d

Sol: The correct answer is All of the above

Government spending refers to money expended by the public sector, funded by national revenues, to administer and manage the state and its objectives. The sources of such funds can be taxes, government borrowing, or revenue from government-controlled entities.

Government spending can be categorized into three main types:

- Current Spending (or revenue spending): These are recurring and usually cover wages, rents, and daily expenditures.

- Capital Spending: These are expenditures that result in the acquisition of assets or the enhancement of existing assets. These could include infrastructure projects, such as highways, airports, schools, hospitals, etc.

- Transfer Payments: This is money the government gives without receiving goods or services in return, like social security benefits, unemployment benefits, welfare payments, and pensions.

The allocation and volume of government spending can have a significant impact on a country's economy, affecting everything from economic stability, and income distribution, to the level of infrastructure development.

Q13: Find the variance of random variables which constitute the number of heads in a toss of two coins simultaneously.

(a) 1/2

(b) 1

(c) 2

(d) 4

Ans: a

Sol:

When tossing two coins simultaneously, the possible outcomes for the number of heads are 0, 1, and 2. Let's denote the random variable X as the number of heads. The probability distribution for X is as follows:

- P(X=0)=1/4

- P(X=1)=1/2

- P(X=2)=1/4

Other Related Points

- μ= 0.(1/4)+1(1/2)+2.(1/4)

- μ=1

- let's find the variance (σ) using the formula:

- Variance= (0-1)2 . 1/4 +(1-1)2 .1/2 + (2-1)2. 1/4

- Variance= (1/4)+(1/4)

- Variance=1/2

Q14: If the demand and supply functions are given Pd = 20 - 5x and Ps = 4x + 8; obtain Producer's surplus

(a) 31 / 9

(b) 32 / 9

(c) 129 / 9

(d) 29 / 9

Ans: b

Sol: Producer surplus is 32/9.

For market equilibrium, Pd = Ps

- 20 - 5x = 4x + 8

- 9x = 12

- x = 4/3

- Putting x into price equation, Pd = 20 - 5x

- we get P0= 40/3

- Consumer Surplus is calculated by :

- (4/3)(40/3)

- (4/3)(40/3)- CS = [20(4/3) - (5(4/3)2)/2] - 160/9

- CS = 80/3 - 80/18 - 160/9

- CS = 40/9

- Producer surplus = x0p0 -

- PS = (4/3).(40/3) -

- PS = (160/9 ) - (32/9) - (32/3)

- PS = 32/9 units

Other Related Points

- Producer surplus is the difference between how much a person would be willing to accept for a given quantity of a good versus how much they can receive by selling the good at the market price. The difference or surplus amount is the benefit the producer receives for selling the good in the market.

- A producer surplus is generated by market prices in excess of the lowest price producers would otherwise be willing to accept for their goods. This may relate to Walras' law.

Q15: The demand function for Good A is given by QA = 100 - 2 PA + 0.2 Y + 0.3 PB.

Find the cross - price elasticities of demand at PA = 6, Y = 500, PB = 10.

(a) 0.06

(b) 0.016

(c) 0.52

(d) -0.06

Ans: b

Sol: the cross - price elasticities of demand at PA = 6, Y = 500, PB = 10 is 0.016 approximately.

- Cross-price elasticity measures how sensitive the demand of a product is over a shift of a corresponding product price.

- Often, in the market, some goods can relate to one another. This may mean a product’s price increase or decrease can positively or negatively affect the other product’s demand.

- Cross E of x and y equals % change in Qx with respect to % change in Px Where:Qx = Average quantity between the previous quantity and the changed quantity, calculated as (new quantityX + previous quantityX) / 2

- Py = Average price between the previous price and changed price, calculated as (new pricey + previous pricey) / 2

Δ = The change of price or quantity of product X or Y - Substitute PA=6,Y=500,PB=10 into the demand function to calculate QA : QA = 100−2(6) + 0.2(500) + 0.3(10) = 100 − 12 + 100 + 3 = 191.

- Substitute the values into the elasticity formula: EC = 0.3 {10}/{191} = {3}/{191} = 0.016.

- The cross-price elasticity of demand is therefore 0.016

Q16: Find the Elasticity of Substitution (σ) of Constant elasticity of substitution (CES) Production function. When the substitution parameter(p) lies between 0 < p < ∞

(a) σ > 1

(b) σ < 1

(c) σ = ∞

(d) σ = 1

Ans: a

Sol: The correct answer for the given question is option 1.

The Elasticity of Substitution of Constant elasticity of substitution (CES) Production function is greater than 1 when the substitution parameter lies between 0

Q17: A box of nine golf gloves contains two left handed and seven right - handed gloves. If two gloves are randomly selected from the box without replacement, what is the probability that one is left - handed and the other is a right - handed glove?

(a) 7 / 12

(b) 2 / 9

(c) 7 / 18

(d) 1 / 9

Ans: c

Sol: The correct answer is '7 / 18.'

Probability Basics:

- Probability is the measure of the likelihood that an event will occur, calculated by dividing the number of favorable outcomes by the total number of possible outcomes.

- When selecting items without replacement, the probability changes as items are removed from the pool.

Calculating the Desired Probability:

- We need to find the probability that one glove is left-handed and the other is right-handed when two gloves are selected without replacement from a box of nine gloves (2 left-handed and 7 right-handed).

- The total number of ways to choose 2 gloves out of 9 (29) = 2!(9−2)!9! = 36.

- The number of favorable outcomes where one glove is left-handed and the other is right-handed can be calculated by multiplying the number of ways to choose 1 left-handed glove from 2 and 1 right-handed glove from 7 is 14.

- Therefore, the probability of selecting one left-handed glove and one right-handed glove is 14/36 = 7/18

- Therefore, the correct answer is '7 / 18.'

Q18: Which Five year plan proposed to make India, "Self - reliant and Self generating economy"?

(a) IInd Five year plan

(b) IIIrd Five year plan

(c) IVth Five year plan

(d) Vth Five year plan

Ans: b

Sol: Third Five Year Plan.

- The focus was on agriculture and improvement in the production of wheat.

- States were entrusted with additional development responsibilities. Ex- States were made responsible for secondary and higher education.

- Panchayat elections were introduced to bring democracy to the grassroots level.

- The target growth rate was 5.6% and the actual growth rate only achieved 2.4%

- This indicated a miserable failure of the Third Plan, and the government had to declare "Plan Holidays" (1966-67, 1967-68, and 1968-69). The Sino-Indian War and the Indo-Pak War, which caused the Third Five Year Plan to fail, were the primary causes of the plan holidays.

Q19: The money supply in the IS - LM model is assumed to be

(a) Real narrow money

(b) Nominal money supply

(c) Nominal Broad money

(d) Real money supply

Ans: d

Sol: The correct answer is Real money supply.

- The nominal money supply is the total amount of money in circulation in an economy. It includes all the currency and other liquid instruments in a country's economy as of a particular time. The nominal money supply does not adjust for inflation and is not related to the purchasing power of the money. It's simply the face value of the money in circulation.

- Real narrow money refers to the money supply in an economy, adjusted for inflation, and considering only the most liquid forms of money. Narrow money usually refers to the most liquid instruments, such as currency in circulation (coins and banknotes) and other money equivalents that can be quickly converted into physical cash, like checking accounts.

- Nominal broad money is the measure of broad money that has not been adjusted for inflation. The term "nominal" means that the measurement has not factored in inflation, so increases in nominal broad money could be due to real growth (more money being held), inflation (the value of money decreasing), or a combination of both.

- Real money supply' means the total amount of money available in the economy, but with the effect of inflation taken into account. This provides a measure of the purchasing power of the money supply—how much goods and services this money can actually It helps to provide a more accurate sense of the economic reality and the available liquidity in the economy.

Q20: Total Budget Allocation in year 2022 - 23. For "Har Ghar, Nal Se Jal" in rupees is:

(a) 50,000/ - crore

(b) 80,000/ - crore

(c) 60,000/ - crore

(d) 70,000/ - crore

Ans: c

Sol: The correct answer is 60,000/ - crore.

- The "Har Ghar Nal se Jal" scheme or the Jal Jeevan Mission is a program initiated by the Government of India with the aim to provide piped water supply (Har Ghar Nal se Jal) to all rural and urban households by 2024. The program was launched in August 2019 by Prime Minister Narendra Modi.

- An allocation of Rs. 60,000 crore has been made to cover 3.8 crore households in 2022-23 under Har Ghar, Nal Se Jal Scheme.

- Finance Minister said that the currect coverage of Har Ghar, Nal Se Jal is 8.7 corres.

- Outof which 5.5 crore households were provided tap water in the last two years itself.

Other Related Points

- Over 8.60 Crore Tap Water Connections provided in last 4 Years Up from 3.23 Crore in 2019 to 11.84 Crore till date One tap connection every second during January – March 2023

- At the time of the announcement of the Jal Jeevan Mission, only 3.23 crore (16.65%) rural households had tap water connections. Under the Mission, in a short span of less than four years, more than 8.60 Crore rural households have been provided with tap water connections. Thus, as on April 27, 2023, over 11.84 Crore (60.92%) rural households have a functional tap water supply in their homes. Further, Union Budget 2023-24 has allocated a massive Rs. 70,000 Crore for the implementation of the Jal Jeevan Mission.

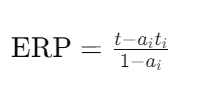

Q21: Which of the following formulae is used to measure the tax mutiplier:

(a)

(b)

(c)

(d)

Ans: a

Sol: The tax multiplier is measured using the formula -1(MPC/1-MPC).

Q22: The regression model Yt = α1 + α2 Dt + β1Xt +β2(YtDt) + Ut is used to

(a) Deseasonalize a time series data

(b) Analyze the seasonal trend in data

(c) Analyse structural break in data

(d) Analyse piecewise linear relationship in data

Ans: c

Sol: The correct answer is - Analyse structural break in data

Analyse structural break in data

- The regression model provided includes interaction terms (e.g., Dt, a dummy variable) and the product of the dummy variable with Yt.

- This setup is used to detect structural breaks, i.e., significant changes in the relationship between variables over time or across subsets of data.

- Structural breaks can occur due to policy changes, economic crises, or other events that alter the underlying data-generating process.

- The interaction terms allow the model to estimate different coefficients for subsets of the data, helping identify and analyze the break points.

Other Related Points

Deseasonalize a time series data

- Deseasonalization removes the seasonal component from data to analyze trends and cycles more effectively.

- This process typically involves using methods like moving averages, seasonal indices, or decomposition techniques rather than regression models with structural terms.

Analyze the seasonal trend in data

- Seasonal trends refer to periodic fluctuations within a specific time frame (e.g., monthly sales patterns).

- While regression can capture trends, specialized time series models such as SARIMA or decomposition techniques are more commonly employed for this purpose.

Analyse piecewise linear relationship in data

- Piecewise linear relationships are analyzed using segmented regression or spline models.

- The provided regression model focuses on detecting structural changes, not explicitly modeling piecewise linear relationships.

Q23: Which institution has published the Human Development Report annually since 1990?

(a) International Monetary Fund

(b) World Bank

(c) Asian Development Bank

(d) United National Development Programme

Ans: d

Sol: The correct answer is United National Development Programme.

The Human Development Reportis published annually by the United Nations Development Programme (UNDP). This report provides comprehensive data about global poverty, literacy, education, lifespan, and other factors as a way to measure and compare overall human development across different countries.

- The United Nations Development Programme (UNDP) was established on November 22, 1965.

The International Monetary Fund (IMF) is an international organization headquartered in Washington, D.C., United States. It was established in 1944 at the Bretton Woods Conference and formally created in 1945. The IMF's primary goal is to ensure the stability of the international monetary system—the system of exchange rates and international payments that enables countries (and their citizens) to transact with one another.

World Bankis an international organization dedicated to providing financing, advice, and research to developing nations to aid economic advancement.

- Headquaters: Washington D.C.

- Established: July 7, 1944 Bretton Woods, Conference.

The Asian Development Bank It is a regional development bank that was established on December 19, 1966.The aim of the ADB is to enhance social and economic development in Asia and the Pacific region.

- Headquaters: Manila, Philippines

Q24: The Free-rider problem arises :

(a) when goods are congestible.

(b) when goods are of a rival nature.

(c) when number of beneficiaries is large and exclusion of any one of them is impossible.

(d) when goods are available freely but on a first cum first serve basis till stocks last.

Ans: c

Sol: The correct answer is when number of beneficiaries is large and exclusion of any one of them is impossible.

- The free rider problem is an economic concept of a market failure that occurs when people are benefiting from resources, goods, or services that they do not pay for. If there are too many free riders, the resources, goods, or services may be overprovided.

- Public Goods and the Free Rider Problem

- Public goods commonly face a free rider problem due to the two characteristics of a public good:

- Non-rival: Consumption of the good or service by one individual does not reduce the availability of the good to others.

- Non-excludable: It is impossible to prevent other consumers from consuming the good or service

- The Free-rider problem occurs in situations where individuals can benefit from a resource, good, or service without paying for it, leading to under-provision or depletion of that resource.

When the number of beneficiaries is large and exclusion of any one of them is impossible: Non-excludability: It is difficult or impossible to exclude individuals from using the good. This means that once the good is provided, it is available to all, and no one can be effectively excluded from its use. For example, national defense or clean air.Non-rivalry: One person’s use of the good does not reduce its availability to others. For instance, when one person enjoys a fireworks display, it does not prevent others from enjoying it as well.Because of these characteristics, individuals may choose not to contribute to the cost of providing the good, knowing they can still benefit from it without paying. This behavior leads to the Free-rider problem, where everyone relies on others to pay for the provision of the good, resulting in it being underfunded or not provided at all.

Q25: In logit model as Pi goes from 0 to 1, logit L varies from

(a) 0 to + ∞

(b) - ∞ to + ∞

(c) 0 to 1

(d) - ∞ to 0

Ans: b

Sol: The correct answer is - ∞ to + ∞.

In a logit model, the logit (L) of a probability (Pi) is calculated as the natural logarithm of the odds ratio, which is given by Pi / (1 - Pi).

- As Pi goes from 0 to 1 (exclusive), the logit L varies from negative infinity to positive infinity. Specifically:

- When Pi approaches 0, the logit L approaches negative infinity.

- When Pi approaches 1, the logit L approaches positive infinity.

Therefore, the logit function maps probabilities from the (0, 1) interval to the entire real line (-∞ to +∞)

Q26: Test statistics used to test stationary of a time series in the presence of correlated error term is

(a) Dickey - Fuller test

(b) Engle - Granger test

(c) Error - Correction mechanism

(d) Augmented Dickey - Fuller test

Ans: d

Sol: Augmented Dickey - Fuller test is used to test stationary of a time series in the presence of correlated error term.

- In statistics, an augmented Dickey–Fuller test (ADF) tests the null hypothesis that a unit root is present in a time series sample.

- The alternative hypothesis is different depending on which version of the test is used, but is usually stationarity or trend-stationarity.

- It is an augmented version of the Dickey–Fuller test for a larger and more complicated set of time series models.

Q27: A toll is a tax on those citizens who use toll roads. This policy can be viewed as an application of

(a) The benefit principle

(b) Horizontal equity

(c) Vertical equity

(d) Tax progressivity

Ans: a

Sol: The correct answer is The benefit principle.

- The Benefit Principle of taxation asserts that those who receive more benefits from government programs should pay more taxes to support these programs. Accordingly, in the case of tolls, drivers who use toll roads, and thus benefit from them, and the ones who pay for that usage via toll fees.

- Horizontal Equity: If everyone who uses the toll road pays the same fee, it can reflect horizontal equity in that people in the same economic situation are treated equally.

Vertical Equity (which argues that those with a greater ability to pay, i.e., wealthier individuals, should pay more) or.

- Tax Progressivity (where the tax rate increases as the taxable amount increases),

- unless the toll fee is variable based on the type of vehicle or time of day, potentially correlating with the ability to pay. In the general case, tolls are flat fees regardless of the driver's income or wealth, which might be seen as regressive rather than progressive.

Q28: The birth of World Trade Organisation emerged from which round?

(a) Geneva

(b) HongKong

(c) Uruguay

(d) Tokyo

Ans: c

Sol: The correct answer is Uruguay

- The World Trade Organization (WTO) is an international body that regulates and facilitates international trade between nations. Its main function is to ensure that trade flows as smoothly, predictably, and freely as possible.

- World Trade Organization was founded on 1 January 1995, but its trading system is half a century older. Since 1948, the General Agreement on Tariffs and Trade (GATT) has provided the rules for the system.

- The Director General of the World Trade Organization is Ngozi Okonjo lweala Since 1 March 2021.

Q29: Which of the following two economists are associated with the problem of time inconsistency?

(a) J. M. Keynes and Joan Robinson

(b) Kydland and Prescott

(c) Baumol and Tobin

(d) Friedman and Scwartz

Ans: b

Sol: Kydland and Prescott.

Time inconsistency refers to the following idea:

- the government has a policy rule;

- the people make commitments, based on an expectation of continuation of the policy rule;

- later, the government can benefit society by changing its policy rule, taking advantage of the commitments made by the people.

Q30: The Value - Trade ratio captures trading relative to the size of the

(a) economy

(b) market

(c) market and economy

(d) none of these

Ans: a

Sol: The correct answer is 'economy'

Value - Trade Ratio:

- The Value - Trade ratio is a metric used to measure the volume of trade relative to the size of a country's economy.

- This ratio is important as it indicates how much of a country's economic activity is generated through trade.

- A higher Value - Trade ratio implies that a significant portion of the economy is engaged in international trade, which can be a sign of economic openness and integration into the global market.

- This ratio helps in assessing the impact of trade policies and economic strategies on a country's overall economic performance.

Other Related Points

Market:

- The term "market" refers to the arena in which buyers and sellers interact to exchange goods and services. It does not specifically relate to the size of the economy when considering trade volume.

- While market size can influence trade, it is the broader economy that provides the context for understanding the Value - Trade ratio.

Market and Economy:

- The combination of both market and economy is not specifically captured by the Value - Trade ratio. This ratio is more directly related to the size of the economy rather than the market alone.

- Focusing on the economy provides a clearer picture of how trade affects the overall economic activities of a country.

Q31: "Under-developed countries are the slums of the world economy", is a statement given by

(a) Keynes

(b) G. Myrdal

(c) Adam Smith

(d) Cairncross

Ans: d

Sol: "Under-developed countries are the slums of the world economy", is a statement given by Cairncross.

This statement was given by Cairncross a famous economist whose findings are basis for macroeconomic study in the current economic world.

Q32: Which of the following forms the credit side of the Balance of Payments?

A. Unilateral transfer recieved

B. Capital transfer recieved

C. Income Payments (Import of factor services)

D. Exports of factor services

E. Merchandise imports

Choose the correct answer from the options given below:

(a) A, B and E only

(b) B, C and D only

(c) A, C and D only

(d) A, B and D only

Ans: d

Sol:

- The balance of payments account follows a double-entry system.

- All receipts are entered on the credit side, whereas all payments are entered on the debit side.

- Theoretically, a balance of payments accounts is always zero, with the total on the debit side equaling the total on the credit side.

- All these items fall on credit side.

Q33: Consider a competitive polluting industry with identical firms and free entry. If the regulator sets an emission cap for each firm equal to the socially optimal long run level per firm, which of the following will characterize the long run impact of such an environmental policy on this competitive industry?

A. The industry size will be larger than the social optimum.

B. The output produced by each firm will be less than socially optimal.

C. The industry size will be smaller than the social optimum.

D. The output produced by each firm will be larger than socially optimal.

E. Total output and total pollution are greater than the social optimum.

Choose the correct answer from the options given below:

(a) A, D and E only

(b) B, C and E only

(c) C, D and E only

(d) A, B and E only

Ans: d

Sol: A, B and E only.

- The industry size will be larger than the social optimum

- The output produced by each firm will be less than socially optimal.

- Total output and total pollution are greater than the social optimum.

Q34: Which of the following are the members of SAARC countries?

A. India

B. Pakistan

C. Sri Lanka

D. Afghanistan

E. China

Choose the correct answer from the options given below:

(a) A, C and E only

(b) B, C and E only

(c) A, D and E only

(d) A, B, C and D only

Ans: d

Sol: The correct answer is A, B, C and D only.

The South Asian Association for Regional Cooperation (SAARC) was established with the signing of the SAARC Charter in Dhaka on 8 December 1985.

The SAARC Secretariat was established in Kathmandu on 16 January 1987.

The member countries of SAARC are:

- Afghanistan

- Bangladesh

- Bhutan

- India

- Nepal

- Maldives

- Pakistan

- Sri Lanka

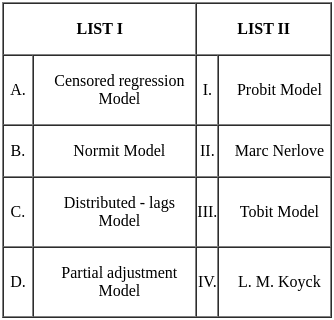

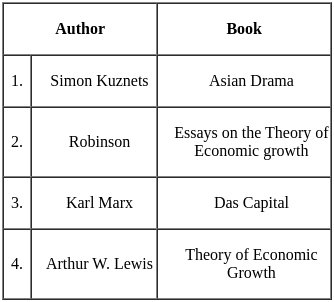

Q35: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - IV, C - III, D - II

(b) A - III, B - IV, C - I, D - II

(c) A - III, B - IV, C - II, D - I

(d) A - I, B - II, C - III, D - IV

Ans: b

Sol: The correct answer is - A → III, B → IV, C → I, D → II

Key Points

A → III. Price of Risk

- The extra risk that an investor must incur to enjoy a higher expected return is referred to as the Price of Risk.

- Investors expect to be compensated for taking on additional risk, which is the fundamental concept behind the price of risk.

B → IV. Endowment Effect

- The Endowment Effect is a cognitive bias where individuals tend to value an item more when they own it than when they do not.

- This effect often leads to people overvaluing their possessions, even if they would not have paid that much for the item initially.

C → I. Risky Asset

- A Risky Asset provides an uncertain flow of money or services to its owner because the returns are not guaranteed.

- Examples of risky assets include stocks and bonds, which carry different levels of risk depending on market conditions.

D → II. Moral Hazard

- Moral Hazard occurs when one party's actions, which are unobserved by others, affect the likelihood of a specific event or payment, often in situations like insurance policies.

- It refers to situations where the behavior of the insured party is influenced by the knowledge that they are protected from the full consequences of their actions.

Additional Information

Price of Risk

- Price of risk refers to the compensation an investor demands for taking on additional risk. It is the difference between the return of a risky asset and a risk-free asset.

- Higher risk generally requires higher returns as compensation to the investor.

Endowment Effect

- The Endowment Effect is a bias that affects the perceived value of an owned object compared to an identical one that is not owned. It influences decision-making and consumer behavior.

Risky Asset

- Risky assets are investments that have uncertain returns. Common examples include stocks, commodities, and currencies.

- The uncertainty in returns is what makes them risky, and investors require compensation for bearing that risk.

Moral Hazard

- Moral hazard is a situation where one party to a transaction can affect the risk taken by another party without bearing the full consequences of that risk.

- This is a common issue in insurance and financial markets, where the insured party may take on riskier behavior because they do not bear the full cost of their actions.

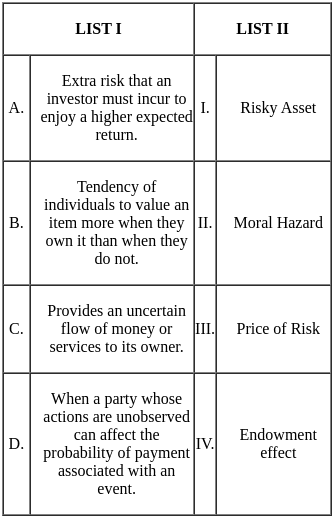

Q36: Match List I with List II

Choose the correct answer from the options given below:

(a) A - II, B - I, C - III, D - IV

(b) A - I, B - IV, C - III, D - II

(c) A - I, B - II, C - III, D - IV

(d) A - III, B - IV, C - I, D - II

Ans: b

Sol: A - I, B - IV, C - III, D - II is the right answer.

- The Phillips curve is an economic theory that inflation and unemployment have a stable and inverse relationship. Developed by William Phillips, it claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment

- Taxable Capacity means the maximum capacity of the people of a country to bear the burden of taxation without much hardship. It is nothing but the maximum limit that a government can tax the people- Findlay Shirras

- The life-cycle hypothesis (LCH) is an economic theory that describes the spending and saving habits of people over the course of a lifetime. The theory states that individuals seek to smooth consumption throughout their lifetime by borrowing when their income is low and saving when their income is high.

- The concept was developed by economists Franco Modigliani and his student Richard Brumberg in the early 1950s.

- The concept of Money Illusion was given by Pigou.

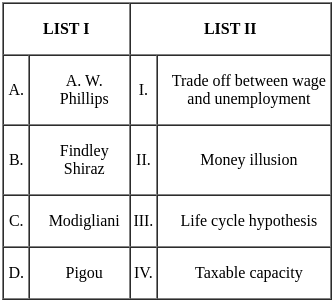

Q37: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - III, C - II, D - IV

(b) A - III, B - I, C - IV, D - II

(c) A - III, B - IV, C - I, D - II

(d) A - IV, B - III, C - I, D - II

Ans: b

Sol: A - III, B - I, C - IV, D - II is the right answer.

- Tobit Model - When your regression model involves an interaction term, it is advisable to use a centered score regression model. It is because this transformation can yield a proper interpretation of the data, and also make the scales of the dependent and independent variables comparable.

- A probit model- a type of regression where the dependent variable can take only two values, for example married or not married. The word is a portmanteau, coming from probability + unit.

- A distributed lag model - a model for time series data in which a regression equation is used to predict current values of a dependent variable based on both the current values of an explanatory variable and the lagged (past period) values of this explanatory variable.

- The partial adjustment model- has been used in many areas of applied economics as a description of optimal behavior in the face of adjustment costs. The model requires a specification of how expectations are formed; for example static or adaptive expectations are frequently specified.

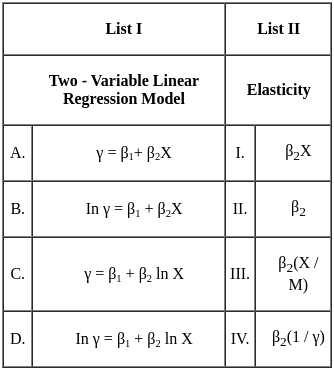

Q38: Match List I with List II

Choose the correct answer from the options given below:

(a) A - III, B - IV, C - I, D - II

(b) A - III, B - I, C - IV, D - II

(c) A - II, B - I, C - III, D - IV

(d) A - II, B - III, C - IV, D - I

Ans: b

Sol: The correct option is 'A - III, B - I, C - IV, D - II'.

Two-Variable Linear Regression Model:

- A two-variable linear regression model explains the relationship between a dependent variable (γ) and an independent variable (X) through a linear equation.

γ = β1 + β2X:

- This equation represents a simple linear regression where β1 is the intercept and β2 is the slope coefficient.

- In this context, elasticity is represented by β2(X / M), which indicates the responsiveness of γ to changes in X proportionate to the mean value M.

In γ = β1 + β2X:

- This equation is a semi-logarithmic model where the dependent variable (γ) is logarithmically transformed.

- Here, elasticity is represented by β2X, showing how percentage changes in γ are related to changes in X.

γ = β1 + β2 ln X:

- This equation is another form of a semi-logarithmic model where the independent variable (X) is logarithmically transformed.

- Elasticity in this model is represented by β2(1 / γ), indicating how changes in γ respond to changes in X inversely proportional to γ.

In γ = β1 + β2 ln X:

- This equation represents a double-logarithmic model where both the dependent and independent variables are logarithmically transformed.

- In this context, elasticity is given by β2, showing a constant proportional change in γ with respect to proportional changes in X.

Additional Information

Elasticity:

- Elasticity measures how one variable responds to changes in another variable, typically expressed as a percentage.

- In regression models, elasticity helps understand the sensitivity of the dependent variable (γ) to changes in the independent variable (X).

- Different functional forms of regression models capture different types of elasticity, providing insights into the relationship between variables.

Therefore the correct pairing is:

A - III: γ = β1 + β2X - β2(X / M)

B - I: In γ = β1 + β2X - β2X

C - IV: γ = β1 + β2 ln X - β2(1 / γ)

D - II: In γ = β1 + β2 ln X - β2

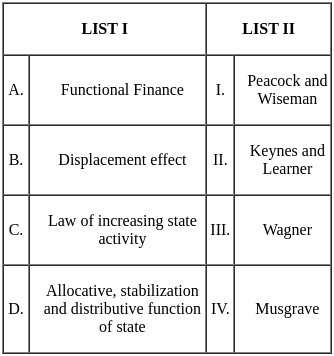

Q39: Match List I with List II

Choose the correct answer from the options given below:

(a) A - II, B - I, C - III, D - IV

(b) A - IV, B - I, C - III, D - II

(c) A - II, B - III, C - I, D - IV

(d) A - I, B - II, C - IV, D - III

Ans: a

Sol: A - II, B - I, C - III, D - IV is the right answer.

- Functional finance is an economic theory proposed by Abba P. Lerner, based on effective demand principles and chartalism.

- It states that government should finance itself to meet explicit goals, such as taming the business cycle, achieving full employment, ensuring growth, and low inflation.

- peacock and Wiseman (1961) presented the displacement effect, according to which during times of war tax rates are increased to generate more revenues, sustaining the increase in defense spending.

- Wagner gave Law of Increasing activity.

- Wagner's law, also known as the law of increasing state activity, is the observation that public expenditure increases as national income rises. It is named after the German economist Adolph Wagner (1835–1917), who first observed the effect in his own country and then for other countries.

- Allocative, stabilization and distributive function of state was given by Musgrave.

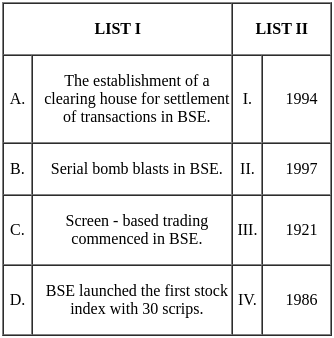

Q40: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - III, C - II, D - IV

(b) A - III, B - II, C - IV, D - I

(c) A - III, B - I, C - II, D - IV

(d) A - II, B - I, C - III, D - IV

Ans: c

Sol: A - III, B - I, C - II, D - IV is the right answer.

- The establishment of a clearing house for settlement of transactions in BSE. - 1921

- Serial bomb blasts in BSE- 1994

- Screen - based trading commenced in BSE- 1997

- BSE launched the first stock index with 30 scrips- 1986

Other Related Points

- Various events of Bombay Stock Exchange(BSE) are discussed in right sequence.

- BSE Limited, also known as the Bombay Stock Exchange, is an Indian stock exchange which is located on Dalal Street in Mumbai.

- Established in 1875 by cotton merchant Premchand Roychand,[8] it is the oldest stock exchange in Asia,[9] and also the tenth oldest in the world.[10] The BSE is one of the world's largest stock exchanges by market capitalization with a market cap of US$ 3.8 trillion as of June 2023.

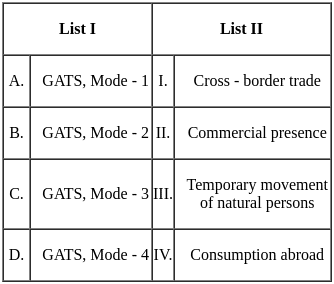

Q41: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - IV, C - III, D - II

(b) A - I, B - IV, C - II, D - III

(c) A - I, B - II, C - IV, D - III

(d) A - I, B - II, C - III, D - IV

Ans: b

Sol: A - I, B - IV, C - II, D - III is the right answer.

GATS covers services supplied

- from the territory of one Member into the territory of any other Member

- (Mode 1 — Cross border trade);

- in the territory of one Member to the service consumer of any other Member

- (Mode 2 — Consumption abroad);

- by a service supplier of one Member, through commercial presence, in the territory of any other Member

- (Mode 3 — Commercial presence); and

- by a service supplier of one Member, through the presence of natural persons of a Member in the territory of any other Member

- (Mode 4 — Presence of natural persons).

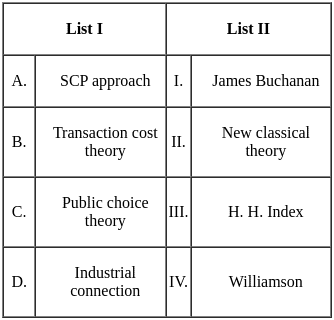

Q42: Match List I with List II

Choose the correct answer from the options given below:

(a) A - III, B - IV, C - I, D - II

(b) A - III, B - IV, C - II, D - I

(c) A - I, B - III, C - IV, D - II

(d) A - IV, B - II, C - I, D - III

Ans: a

Sol: The correct answer is A - III, B - IV, C - I, D - II.

- SCP approach (Structure-Conduct-Performance model) - H. H. Index Herfindahl-Hirschman Index is used to measure market concentration, which is a key element in SCP model.

- Transaction cost theory - Williamson (Oliver Williamson, a prominent economist, significantly contributed to transaction cost theory)

- Public choice theory - James Buchanan (James Buchanan is one of the main contributors to public choice theory)

- Industrial connection - New classical theory (This one does not seem to align well since 'industrial connection' is not a mainstream theory and the 'new classical theory' relates primarily to macroeconomics)

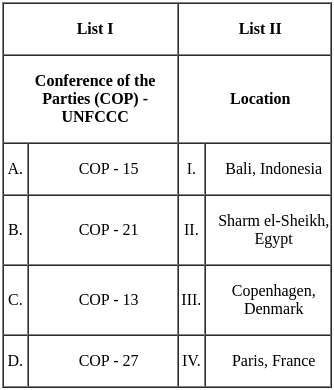

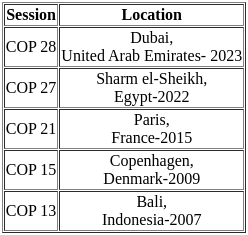

Q43: Match List I with List II

Choose the correct answer from the options given below:

(a) A - IV, B - I, C - II, D - III

(b) A - III, B - IV, C - I, D - II

(c) A - III, B - I, C - II, D - IV

(d) A - IV, B - III, C - I, D - II

Ans: b

Sol: The correct answer is A - III, B - IV, C - I, D - II.

- COP is the highest decision-making body of the United Nations Framework Convention on Climate Change (UNFCCC). It's an annual meeting where all member countries ("parties") come together to negotiate and assess the progress in dealing with climate change and develop and implement measures to stop global warming and cope with its impacts.

- Each COP event is numbered, starting from the first one held in 1995, so for example, COP25 was the 25th annual Conference of the Parties. These conferences have led to several significant agreements on addressing climate change, such as the Kyoto Protocol and the Paris Agreement.

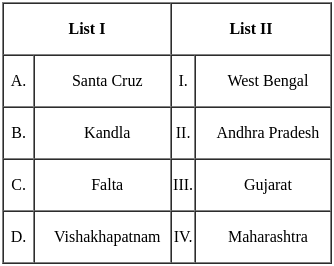

Q44: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - II, C - IV, D - III

(b) A - IV, B - III, C - I, D - II

(c) A - II, B - IV, C - III, D - I

(d) A - III, B - I, C - II, D - IV

Ans: b

Sol: The correct answer is A - IV, B - III, C - I, D - II.

- Santacruz is located in the district of Mumbai, Maharashtra.

- Kandla also known as the Deendayal Port is a seaport in the Kutch District of Gujarat state in western India.

- Falta in West Bengal.

- Vishakhapatnam District is one of the Northern Coastal of Andhra Pradesh.

Q45: Indicate the chronological sequence of the following in terms of their implementation in India.

A. Service Tax

B. Expenditure Tax

C. State VAT

D. Income Tax

E. Goods and Services Tax (GST)

Choose the correct answer from the options given below:

(a) B, D, C, A, E

(b) D, B, C, A, E

(c) D, B, A, C, E

(d) B, A, D, C, E

Ans: c

Sol: The correct answer is: Option 2) D, B, C, A, E

- To determine the chronological sequence of the implementation of various taxes in India, we need to examine the years each tax was introduced. This process is somewhat similar to organizing historical events, much like you would do while preparing notes on economic systems or educational reforms.

- Income Tax: The Income Tax Act was enacted in 1961 and came into effect on 1st April 1962. Income tax has been a significant part of India's tax system since its implementation.

- Expenditure Tax: The Expenditure Tax Act was introduced in 1987. This tax aimed to levy charges on expenditure incurred on certain specified items.

- Service Tax: Service Tax was introduced in 1994. Initially, it applied to a limited number of services but was gradually expanded to cover most services.

- State VAT (Value Added Tax): State VAT was implemented starting in 2005. This tax replaced the earlier sales tax and aimed to create a more efficient and transparent system for state-level indirect taxes.

- Goods and Services Tax (GST): GST was implemented on 1st July 2017. This tax subsumed most of the indirect taxes, including VAT, service tax, and excise duty, aiming to unify the tax system across India.

So, the correct chronological sequence is D, B, A, C, E

Q46: Arrange the followings chronologically in order of their introduction.

A. Ad hoc Treasury bills (T - bills)

B. 28 Days T - bills

C. 14 Days T - bills

D. 364 Days T - bills

E. 182 Days T - bills

Choose the correct answer from the options given below:

(a) A, D, E, B, C

(b) A, E, D, C, B

(c) D, E, A, B, C

(d) E, A, C, D, B

Ans: b

Sol: The correct answer is - A, E, D, C, B

Key Points

Ad hoc Treasury bills (T-bills)

- These were the first Treasury bills introduced by the government.

- Initially issued to meet short-term funding needs.

182 Days T-bills

- These were introduced after the ad hoc T-bills as medium-term instruments.

364 Days T-bills

- Introduced as longer-term T-bills for a period of one year (almost a full year).

28 Days T-bills

- Introduced after the 182-day T-bills, offering a shorter duration of 28 days.

14 Days T-bills

- Introduced last as the shortest duration T-bills (14 days).

Additional Information

Types of Treasury Bills

- T-bills are classified based on their maturity periods, ranging from very short-term to longer-term.

- Short-term T-bills are issued to meet urgent government funding needs.

- Longer-term T-bills offer a higher yield to investors due to the extended holding period.

Purpose of Treasury Bills

- Issued by the government to raise short-term capital.

- Provide a low-risk investment option for banks and other financial institutions.

- They are considered a safe instrument since they are backed by the government.

Government's Role in Treasury Bills

- The government is the sole issuer of T-bills in India, and they are used primarily for financing the budgetary deficit.

- T-bills are sold at a discount to face value and redeemed at par value at maturity.

Q47: Given below are two statements:

Statement I: Every point on the Contract curve is Pareto efficient because one person could not be made better off without making someone else worse off.

Statement II: Every point on the Contract curve neccessarily indicates equal level of economic welfare for the society.

In light of the above statements, choose the most appropriate answer from the options given below:

(a) Both Statement I and Statement II are correct.

(b) Both Statement I and Statement II are incorrect.

(c) Statement I is correct but Statement II is incorrect.

(d) Statement I is incorrect but Statement II is correct.

Ans: c

Sol: The correct answer is Statement I is correct but Statement II is incorrect.

- The contract curve in economics represents the set of efficient combinations of goods, where it's impossible to find a different allocation that both parties would prefer. This concept comes from the Edgeworth Box, a popular graphical representation in general equilibrium theory.

The contract curve reflects different allocations that are Pareto efficient, meaning you can't make one individual better off without making at least one other individual worse off. But this doesn't necessarily mean that the resources are equally distributed among individuals or that all individuals have the same level of welfare.

For instance, you might have a Pareto efficient point on the contract curve where one individual has a lot of both goods and the other has very little. That's Pareto efficient because you can't give more to the person with less without taking away from the person with more. But it's not equal – you could say one person is better off in that situation.

Q48: Given below are two statements, one is labelled as Assertion (A) and the other is labelled as Reason (R).

Assertion (A): The low income countries are far more likely to borrow money to finance their public sector expenditure.

Reason (R): Governments need not repay their loans, along with interest payment.

In light of the above statements, choose the correct answer from the options given below:

(a) Both (A) and (R) are true and (R) is the correct explanation of (A).

(b) Both (A) and (R) are true but (R) is NOT the correct explanation of (A).

(c) (A) is true but (R) is false.

(d) (A) is false but (R) is true.

Ans: c

Sol: The correct answer is '(A) is true but (R) is false'

Assertion (A): The low-income countries are far more likely to borrow money to finance their public sector expenditure.

- Low-income countries often have limited internal resources and revenues, making it necessary for them to seek external financial assistance to fund their public sector projects and services.

- Borrowing is a common practice among these countries to bridge the gap between their expenditures and revenues, especially for infrastructure development, healthcare, and education.

- International financial institutions like the World Bank and International Monetary Fund (IMF) often provide loans to these countries under various terms and conditions.

Other Related Points

Reason (R): Governments need not repay their loans, along with interest payment.

- This statement is false. Governments are typically required to repay the loans they receive, along with the agreed-upon interest, unless specific debt relief programs or restructuring agreements are in place.

- Failure to repay loans can lead to a debt crisis, affecting the country's credit rating and its ability to secure future funding.

- Debt relief initiatives, such as those from the IMF and World Bank, aim to provide struggling nations with more manageable repayment terms but do not imply that loans need not be repaid at all.

Q49: Given below are two statements:

Statement I: Supply side policies are long term measures to increase the productive capacity of the economy leading to an outward shift in the production possibility curve.

Statement II: Privatisation is the act of selling state owned assets in order to increase competition, productivity and efficiency.

In light of the above statements, choose the correct answer from the options given below:

(a) Both Statement I and Statement II are true.

(b) Both Statement I and Statement II are false.

(c) Statement I is true but Statement II is false.

(d) Statement I is false but Statement II is true.

Ans: a

Sol: The correct answer is Both Statement I and Statement II are true.

Supply-side policies are economic measures implemented by governments to enhance the productive capacity and efficiency of the economy. The primary goal is to stimulate long-term economic growth and improve the economy's overall performance. These policies often result in an outward shift of the production possibility curve.

- Supply-side economics holds that increasing the supply of goods translates to economic growth for a country.

- In supply-side fiscal policy, tax cuts, lower interest rates, and deregulation help foster increased production.

- Supply-side fiscal policy was formulated in the 1970s as an alternative to Keynesian, demand-side policy.

Privatization is indeed the process of transferring ownership or control of state-owned assets to private entities, such as individuals or corporations. The primary goals of privatization are often as you mentioned to increase competition, productivity, and efficiency in the economy.

Q50: Arrange the rates in descending order based on 'Reserve Bank of India' data, December 2022.

A. Cash Reserve Ratio

B. Repo rate

C. Bank rate

D. Reverse Repo rate

E. Standing Deposit Facility rate

Choose the correct answer from the options given below:

(a) A, B, C, D, E

(b) E, C, D, B, A

(c) C, B, E, A, D

(d) A, B, D, E, C

Ans: c

Sol: The correct answer is 'C, B, E, A, D'.

Bank Rate (C):

- The Bank Rate is the rate at which the Reserve Bank of India (RBI) lends money to commercial banks for long-term loans, typically higher than other rates. As of December 2022, the Bank Rate was 6.50%.

- This rate influences lending rates of banks and is used by RBI to control money supply and inflation.

Repo Rate (B):

- The Repo Rate is the rate at which the RBI lends short-term funds to commercial banks. As of December 2022, the Repo Rate was 6.25%.

- This rate is a critical tool for controlling inflation and managing the country's economic stability through liquidity adjustments.

Standing Deposit Facility rate (E):

- The Standing Deposit Facility (SDF) rate is relatively new and allows the RBI to absorb liquidity from the banking system without needing collateral. As of December 2022, the SDF rate was 6.00%.

- This facility is part of the RBI's liquidity management framework and aids in stabilizing short-term interest rates.

Cash Reserve Ratio (A):

- The Cash Reserve Ratio (CRR) is the percentage of a bank's total deposits that must be kept with the RBI as reserves. As of December 2022, the CRR was 4.50%.

- While CRR is not an interest rate, it plays a crucial role in ensuring liquidity and financial stability in the banking system.

Reverse Repo Rate (D):

- The Reverse Repo Rate is the rate at which the RBI borrows funds from commercial banks. As of December 2022, the Reverse Repo Rate was 5.75%.

- This rate is used primarily to manage liquidity in the economy and is typically lower than the Repo Rate.

Q51: Arrange the following in chronological order starting from the oldest relating to the theory of money.

A. Patinkin

B. Fisher

C. Friedman

D. Marshall

E. Keynes

Choose the correct answer from the options given below:

(a) E, B, C, A, D

(b) B, D, E, A, C

(c) A, B, C, D, E

(d) D, B, A, C, E

Ans: b

Sol: The correct answer is 'B, D, E, A, C'

Theory of Money:

- The theory of money involves various concepts and models developed by economists to understand the role of money in the economy, its impact on inflation, interest rates, and economic stability.

Fisher (B):

- Irving Fisher (1867-1947) was an American economist known for the Quantity Theory of Money.

- His work emphasized the relationship between money supply and price levels, encapsulated in the equation MV = PT.

Marshall (D):

- Alfred Marshall (1842-1924) was a British economist whose contributions laid the foundation for microeconomic theory and monetary economics.

- Marshall's work in money focused on the demand for money and its relationship to the broader economy.

Keynes (E):

- John Maynard Keynes (1883-1946) was a British economist whose General Theory of Employment, Interest, and Money revolutionized economic thought.

- Keynes' work emphasized the importance of aggregate demand and the role of money in influencing economic activity and employment.

Patinkin (A):

- Don Patinkin (1922-1995) was an Israeli economist who integrated monetary theory with general equilibrium theory.

- His seminal work, "Money, Interest, and Prices," advanced the understanding of the real effects of money on the economy.

- Friedman (C):

- Milton Friedman (1912-2006) was an American economist and a leading advocate of monetarism.

- Friedman emphasized the role of government in controlling the money supply to manage inflation and economic stability.

Other Related Points

Chronological Order Explanation:

- Irving Fisher and Alfred Marshall are among the earliest contributors, with Fisher's work on the Quantity Theory of Money and Marshall's foundational work in microeconomics.

- John Maynard Keynes' theories came next, bringing a new understanding of the role of money in the macroeconomy during the Great Depression era.

- Don Patinkin's integration of monetary and general equilibrium theories marked significant advancements in the mid-20th century.

- Milton Friedman’s contributions to monetarism came later, emphasizing the importance of controlling money supply for economic stability.

Q52: Given below are two statements:

Statement I: A rising ratio of interest payments to GNP imposes a burden because taxation is needed to finance the interest payment and imposes a dead weight loss.

Statement II: A rising rate of interest payment in the budget tends to crowd out other public programs.

Choose the correct answer from the options given below:

(a) Both Statement I and Statement II are true.

(b) Both Statement I and Statement II are false.

(c) Statement I is true but Statement |l is false.

(d) Statement I is false but Statement II is true.

Ans: a

Sol: The correct answer is Both Statement I and Statement II are true.

- High-interest rates can lead to a larger portion of the nation's Gross National Product (GNP) being committed to interest payments on government debt. This payment, in turn, is financed through taxation, which can impose a deadweight loss. Deadweight loss refers to the lost economic efficiency when the equilibrium for a good or service is not achieved, in this case, because taxation has diverted resources away from more productive uses.

- Crowding-out effect happens when government spending increases interest rates, which leads to a reduction in private investment that offsets the increase in government spending. A rising rate of interest payment in the budget means that more of the budget is being dedicated to paying off interest rather than being spent on other public programs. This reduction in government spending on public programs is the crowding-out effect.

Q53: Arrange the percentage share of nominal GVA(RE), 2019 - 20 for the following sectors in descending order

A. Agriculture and Allied

B. Manufacturing

C. Construction

D. Finance, Real estate and Professional services

E. Mining and Quarrying

Choose the correct answer from the options given below:

(a) D, A, B, C, E

(b) A, D, B, C, E

(c) D, B, A, C, E

(d) B, A, D, E, C

Ans: a

Sol: The correct answer is D, A, B, C, E.

Gross Value Added (GVA)

- Real GVA at Basic Prices is estimated to increase from ₹129.07 lakh crore in 2018-19 to ₹135.40 lakh crore in 2019-20. The estimated growth of real GVA in 2019-20 is 4.9 percent as against 6.6 percent in 2018-19.

- GVA at Basic Prices for 2019-20 from ‘Construction’ sector is expected to grow by 3.2 per cent as compared to growth of 8.7 per cent in 2018-19. Key indicators of Construction sector, namely, the Production of Cement and Consumption of Finished Steel registered growth rates of (-) 0.02 per cent and 3.5 per cent respectively during April-November, 2019-20.

- The contribution of manufacturing to GVA can be calculated by subtracting the cost of raw materials and other inputs from the total output value of the manufacturing sector. This gives the net value added by the process of manufacturing to the economy.

Q54: Arrange the following in descending order on the basis of the year of WTO Ministerial Conferences held.

A. Cancun, Mexico Conference.

B. Nairobi, Kenya Conference.

C. Bali, Indonesia Conference.

D. Buenos Aires, Argentina Conference.

E. Seattle, United States Conference.

Choose the correct answer from the options given below:

(a) A, C, D, B, E

(b) D, B, C, A, E

(c) B, C, A, E, D

(d) E, A, C, B, D

Ans: b

Sol: The correct answer is D, B, C, A, E.

WTO Ministerial Conferences in descending order (from the most recent to the oldest), here's the correct sequence:

- Buenos Aires, Argentina Conference (2017)

- Nairobi, Kenya Conference (2015)

- Bali, Indonesia Conference (2013)

- Cancun, Mexico Conference (2003)

- Seattle, United States Conference (1999

Q55: According to the CMIE data (September, 2022) arrange the states in ascending order based on their unemployment rate.

A. Madhya Pradesh

B. Gujarat

C. Chhattisgarh

D. Assam

E. Uttarakhand

Choose the correct answer from the options given below:

(a) D, B, A, C, E

(b) C, D, E, A, B

(c) B, A, C, E, D

(d) A, B, C, D, E

Ans: c

Sol: The correct option is 3) B, A, C, E, D

Gujarat

- According to CMIE data from September 2022, Gujarat had an unemployment rate of 1.6%.

- It is one of the states with the lowest unemployment rates in India.

- Industries such as textiles, chemicals, and petrochemicals play a significant role in providing employment.

Madhya Pradesh

- The unemployment rate in Madhya Pradesh was 1.8%.

- Known for its agriculture and mineral resources, it provides substantial employment opportunities in these sectors.

Chhattisgarh

- Chhattisgarh had an unemployment rate of 2.2%.

- The state is rich in minerals and has a strong presence of steel and power industries, contributing to job creation.

Uttarakhand

- The unemployment rate in Uttarakhand was 3.2%.

- The tourism and service sectors are major employers in the state.

Assam

- Assam had an unemployment rate of 6.9%.

- The state's economy is primarily driven by agriculture, tea plantations, and oil, but it faces challenges in providing sufficient employment opportunities.

Other Related Points

- The sequence of states arranged in ascending order based on their unemployment rates is: 1. Gujarat (1.6%) 2. Madhya Pradesh (1.8%) 3. Chhattisgarh (2.2%) 4. Uttarakhand (3.2%) 5. Assam (6.9%).

Q56: Arrange the trading groups as per their year of establishment starting from the oldest

A. European Free Trade Association

B. North American Free Trade Agreement

C. Asia Pacific Economic Cooperation

D. Andean Community

E. Association of South - East Asian Nations

Choose the correct answer from the options given below:

(a) A, E, D, B, C

(b) A, D, E, B, C

(c) A, E, D, C, B

(d) B, C, D, E, A

Ans: a

Sol: The correct answer is A, E, D, B, C.

- The European Free Trade Association (EFTA) is a regional trade organization and free trade area consisting of four European states: Iceland, Liechtenstein, Norway, and Switzerland. Operational since 1960, the organization operates in parallel with, and is linked to, the European Union (EU).

The Andean Community (CAN) is a customs union that comprises the South American countries of Bolivia, Colombia, Ecuador, and Peru. The organization promotes the expansion of member nations through integration and economic and social cooperation. The Andean Community was established in 1969 with the signing of the Cartagena Agreement. The organization provides a framework for the exchange of goods, services, and factors contributing to the economic process.

The Association of Southeast Asian Nations, or ASEAN, is an intergovernmental organization composed of ten Southeast Asian countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. Formally established on August 8, 1967, with the signing of the ASEAN Declaration, it promotes intergovernmental cooperation and facilitates economic, political, security, military, educational, and sociocultural integration among its members and other countries in Asia.

The Asia-Pacific Economic Cooperation, or APEC, is an intergovernmental forum for 21 economies that promotes free trade throughout the Asia-Pacific region. This organization was established in 1989 in response to the increasing interdependence of Asia-Pacific economies and the advent of regional trade blocs in other parts of the world.

The North American Free Trade Agreement (NAFTA) was an agreement signed by Canada, Mexico, and the United States, creating a trilateral trade bloc in North America. It took effect on January 1, 1994, and it aimed to eliminate barriers to trade and investment between the three countries.

Q57: Given below are two statements, one is labelled as Assertion (A) and the other is labelled as Reason (R).

Assertion (A): Partisan theory views macroeconomic policy outcomes as the result of ideologically motivated decisions by leaders of different political parties.

Reason (R): The parties represent constitutencies with different preferences concerning macroeconomic variables.

In light of the above statements, choose the correct answer from the options given below:

(a) Both (A) and (R) are true and (R) is the correct explanation of (A).

(b) Both (A) and (R) are true but (R) is NOT the correct explanation of (A).

(c) (A) is true but (R) is false.

(d) (A) is false but (R) is true.

Ans: a

Sol: The correct answer is Both (A) and (R) are true and (R) is the correct explanation of (A).

The partisan theory suggests that the outcomes of macroeconomic policies are influenced by ideological preferences and decisions made by political leaders belonging to different political parties.

Partisan Theory Include

Ideological motivations

- In partisan theory, political leaders have ideological motivations that shape their policy preferences and ideological preferences influence the economic policies they pursue.

Policy Outcomes

- The theory contends that macroeconomic policy outcomes, such as fiscal and monetary policies, are not solely driven by economic consideration but are influenced by the ideological stance of the political party in power.

Partisan Differences

- Partisan theory emphasizes the differences in economic policy preferences between political parties. These differences can manifest in areas such as taxation, government spending, and approaches to economic regulation.

Policy Inertia

- They recognize that there can be policy inertia, where changes in policy direction may be gradual and influenced by the persistence of party ideology over time.

Empirical Studies

- Empirical studies testing the partisan theory often analyze the impact of political party affiliation on economic policy choices and outcomes.

Q58: Arrange the books in ascending order based on their year of publication

A. An Inquiry Into the Nature and Causes of Wealth of Nations

B. The Theory of Moral Sentiments

C. Capitalism, Socialism and Democracy

D. The Great Transformation: The Political and Economic Origin of Our Time

E. The Affluent Society

Choose the correct answer from the options given below:

(a) B, C, D, E, A

(b) B, A, C, D, E

(c) D, E, A, B, C

(d) A, C, E, B, D

Ans: b

Sol: B, A, C, D, E is the correct sequence in ascending order.

- "The Theory of Moral Sentiments"- 1759

- "An Inquiry Into the Nature and Causes of the Wealth of Nations- 1776

- "The Great Transformation: The Political and Economic Origins of Our Time"-1944

- "Capitalism, Socialism and Democracy"-1942.

- "The Affluent Society" -1958

Q59: Arrange the following stages of the Budget in the correct sequence.

A. Appropriation Bill.

B. General Discussion.

C. Finance Bill.

D. Presentation to the Legislative Assembly.

E. Voting on the Demand for Grants.

Choose the correct answer from the options given below:

(a) B, C, E, A, D

(b) A, B, E, C, D

(c) D, A, C, B, E

(d) D, B, A, C, E

Ans: d

Sol: The correct answer is 'D, B, A, C, E'

Presentation to the Legislative Assembly:

- This is the first stage where the Budget is formally presented to the Legislative Assembly by the Finance Minister.

- It includes the financial statement of the government for the upcoming fiscal year.

General Discussion:

- After the presentation, a general discussion on the Budget takes place.

- Members of the Legislative Assembly debate the overall Budget proposals without going into details.

Appropriation Bill:

- Following the general discussion and voting on demands, the Appropriation Bill is introduced.