UGC NET Paper 2: Commerce 7th Dec 2023 Shift 1 | UGC NET Past Year Papers PDF Download

Q1: In a certain population, 22% of people are smokers, 57% of people are males and 12% of the population are both males and smokers. If a person is chosen at random from the population, what is that probability that selected person is either a male or a smoker?

(a) 0.79

(b) 0.22

(c) 0.45

(d) 0.67

Ans: D

Sol: The correct answer is 0.67

- The probability that a selected person is either a male or a smoker can be found using the formula P(A or B) = P(A) + P(B) - P(A and B), where A and B are two events. Here, A represents the event of being a male, and B the event of being a smoker.

- The probability of a person in the population being a male, P(A), is given as 57% or 0.57, and the probability of a person being a smoker, P(B), is given as 22% or 0.22. The probability of a person being both a male and a smoker, P(A and B), is given as 12% or 0.12.

- Substituting these probabilities into the formula gives P(A or B) = 0.57 + 0.22 - 0.12 = 0.67.

- Therefore, the probability that a randomly selected person is either a male or a smoker is 0.67 or 67%.

Other Related Points

- Probability is a fundamental concept in mathematics and statistics that quantifies the likelihood or chance of an event occurring. It is a measure of uncertainty associated with a particular outcome in a given situation.

- Probability provides a numerical measure of uncertainty or randomness associated with different outcomes of a particular event or experiment. It helps us understand how likely or unlikely an event is to occur.

Q2: Laxmi industries issued shares of Rs 1000 at a premium of Rs 10 per share, payable Rs 20 on application, Rs. 35 on allotment (including premium) and the balance on the first and final call. Mr. X who held 200 shares has paid only the application money and these shares were subsequently forfeited by the company. In this regard, by which amount share forfeiture account will be credited?

(a) Rs. 4000

(b) Rs. 2000

(c) Rs. 3000

(d) Rs. 200

Ans: A

Sol: The correct answer is Rs. 4000

- When shares are forfeited, the shareholder loses the right to the shares and any amount already paid on those shares. The company then forfeits the shares and may later reissue them.

- Let's calculate the amount credited to the share forfeiture account when Mr. X's 200 shares are forfeited:

- Amount paid on application per share = Rs. 20

- Total amount paid on application for 200 shares = Rs. 20 *200 = Rs. 4000.

- Since Mr. X paid only the application money and no further amounts, when his shares are forfeited, the company will credit the share forfeiture account with the amount received on application.

Other Related Points

- Forfeited shares refer to shares that were originally issued to a shareholder but are subsequently taken back or forfeited by the company due to non-payment of required amounts or failure to fulfill certain obligations by the shareholder.

- This typically occurs when a shareholder fails to pay calls (installments) on the shares as required by the terms of the share issuance.

Q3: Which of the following will be clubbed into the income of Mr. Q whose Income from Profession is Rs. 85,000?

A. Income from Mrs. Q's profession, Rs. 45,000

B. Mrs. Q's salary as a clerk, Rs. 66,000

C. Minor son's earned interest on deposits of money gifted to him by his uncle, Rs. 15,000

D. Minor daughter's earnings from sports, Rs 85,000

E. Minor son's winnings from lottery, Rs 1,05,000

Choose the correct answer from the options given below:

(a) A, C, D and E Only

(b) C, D and E Only

(c) C and D Only

(d) C and E Only

Ans: D

Sol: The correct answer is C and E Only

- As a general rule as per Income Tax Act in India, only income earned by or on behalf of the minor child is to be clubbed in the income of the parent whose income (excluding the minor's income) is greater.

- According to income tax laws in many jurisdictions, income earned by minor children from assets gifted to them by relatives (like the uncle in this case) is clubbed with the income of the parent whose total income is greater. Therefore, this income (Minor son's earned interest on deposits of money gifted to him by his uncle, Rs. 15,000) is likely to be clubbed with Mr. Q's income.

- Similar to option C, income earned by minor children, including winnings from lotteries, is generally clubbed with the income of the parent whose total income is greater. Therefore, this income is likely to be clubbed with Mr. Q's income.

Other Related Points

- The exceptions to this rule are when the minor child earns income through manual work or any activity involving his/her skill, talent, or specialized knowledge and experience. This exception applies to option D (minor daughter's earnings from sports) so it will not be clubbed with Mr. Q's income.

- Income from a spouse (A and B) is not clubbed with the income of the other spouse unless it falls under specific conditions like spouse's income generated from assets transferred without adequate consideration which is not the case in Options A and B.

Q4: In which ratio, will the remaining partners compensate the retiring partner for a share of goodwill?

(a) Profit-sharing ratio

(b) Sacrificing ratio

(c) Gaining ratio

(d) Capital ratio

Ans: C

Sol: The correct answer is Gaining ratio

Key Points

- When a partner retires from a partnership, the remaining partners usually compensate the retiring partner for their share of goodwill.

- Goodwill represents the value of the reputation, customer base, brand recognition, and other intangible assets of the partnership.

- The ratio in which the remaining partners compensate the retiring partner for their share of goodwill is the gaining ratio.

- This ratio essentially represents the extent to which each remaining partner gains from the retirement of the outgoing partner, in terms of acquiring a share of future profits that had previously been attributable to the retiring partner.

Other Related Points

- The profit-sharing ratio determines how profits and losses are distributed among the partners. It does not necessarily reflect the value of goodwill or the compensation paid to a retiring partner.

- The sacrificing ratio is used to determine how the existing partners' profit-sharing ratios change when a new partner is admitted to the partnership. It does not directly relate to compensating a retiring partner for goodwill.

- The capital ratio represents the proportion of capital contributed by each partner to the partnership. While the capital ratio may influence the distribution of profits and losses, it is not directly used to compensate a retiring partner for their share of goodwill.

Q5: Which one of the following consists of physical working conditions, work schedule, incentives and the number of people with whom the employee would normally interact?

(a) Job profile

(b) Job content

(c) Job context

(d) Job specification

Ans: C

Sol: The correct answer is Job context

Key Points

- Job context refers to the broader environment and conditions in which a job is performed. It encompasses various factors that influence the work experience and conditions for an employee.

- This includes aspects such as the physical environment where the work takes place (e.g., office, factory floor, outdoor site), the safety measures in place, the equipment and tools used, and any specific requirements related to ergonomics or health and safety.

- The work schedule outlines when the employee is expected to work, including details about regular hours, shifts (if applicable), any flexibility in scheduling (such as telecommuting or flexible hours), and any requirements for overtime or weekend work.

- Incentives refer to the various motivators or rewards offered to employees to encourage performance, productivity, and retention. This may include bonuses, commissions, profit-sharing, performance-based rewards, recognition programs, benefits such as health insurance or retirement plans, and opportunities for career advancement or skill development.

- Number of people with whom the employee would normally interact relates to the social and interpersonal aspects of the job. It includes information about the size and composition of teams or workgroups, the hierarchy and structure of the organization, the frequency and nature of interactions with colleagues, supervisors, clients, customers, or other stakeholders, and any collaborative or teamwork requirements.

Other Related Points

- A job profile typically outlines the duties, responsibilities, skills, qualifications, and experience required for a particular job role.

- Job content refers to the specific tasks, duties, and responsibilities involved in performing a job.

- Job specification typically outlines the qualifications, skills, experience, and other specific requirements necessary to perform a job effectively.

Q6: Which of the following can become the member of an LLP?

A. Resident Indians

B. Limited Liability Partnership

C. Corporation Sole

D. Co-operative society

E. Companies (including foreign companies)

Choose the most appropriate answer from the option given below:

(a) A, B and C Only

(b) A, C and D Only

(c) A, B and D Only

(d) A, E and B Only

Ans: D

Sol: Correct answer is A, E and B only

LLP = LLP is Limited Liability Partnership is a partnership where each partner's liability is limited to the extent of the amount they put in the business. Limited liability means if the partnership fails the creditors cannot go after the partner's personal assets.

Features of LLP

- LLP is a body corporate = LLP is a body corporate formed and incorporated under the Limited Liability Partnership Act 2008. It is a legal entity separate from its owners.

- Perpetual succession = Unlike in partnership firm the LLP can continue its business operations even after the death, retirement, insanity or insolvency of one or more partners. It can enter into contracts and hold property in its name.

- Separate legal entity = LLP is a separate legal entity means the owners and the business are separate from each other. The liability of the partner has certain limitations in their contribution to the LLP.

- Mutual agency = All the partners in the LLP are agents of the LLP and not of the partners. It means that the partners are not bound by any acts done by the other partner. Every partner is independent and unauthorized by the actions done by the other partner.

- LLP agreement = Agreement between all the partners governs the rights and duties of all the partners. If there is no agreement then the act governs the mutual rights and duties of the partners.

- Limited liability = This is the most important feature of the LLP that it has limited liability. Limited liability means the liability to the extent of the amount that they put in the business. The partners are not liable to pay for the liabilities to the creditors from there personal assets.

- Minimum and maximum number of partners = The minimum number of partners that an LLP should have is at least 2 partners and at least two designated partners out of which one should be resident of India. There is no maximum limit on the number of partners in the entity.

- Who can be members of an LLP

- Resident Indians = Any resident of India who is competent to enter into the contract can become a member of an LLP. To form an LLP at least two designated partners are to be appointment one of whom shall be resident of India.

- Limited Liability Partnership = An LLP can also become a member of an LLP in India.

- Companies including foreign companies = Foreign companies can also become a member of an LLP in India. However they must comply with the specific rules such as obtaining digital signatures and a director identification number. In addition to this it needs to take necessary approvals from RBI.

Q7: Which of the following are deemed to be dividend for the purpose of computing income chargeable under the head, Income from other sources, as per the Income Tax Act, 1961?

A. Payment on buy-back of shares

B. Payment to shareholders on reduction of capital

C. Distribution of debentures to shareholders

D. Loan granted to shareholders in the ordinary course of business

E. Loan granted to shareholders by a closely held company

Choose the correct answer from the options given below:

(a) B and C Only

(b) B, C and E Only

(c) A, B and C Only

(d) A and C Only

Ans: B

Sol: The correct answers are B, C, and E.

Deemed Dividends under the Income Tax Act, 1961:

- Payment to shareholders on reduction of capital (B): Can be considered as deemed dividend to the extent of accumulated profits which are not utilized for the benefit of the business, akin to distribution of surplus.

- Distribution of debentures to shareholders (C): May be treated as a deemed dividend as per the Income Tax Act, 1961, when distribution to shareholders represents distribution out of accumulated profits.

- Loan granted to shareholders by a closely held company (E): Is considered as deemed dividend under Section 2(22)(e) of the Income Tax Act, 1961, specifically for loans or advances given by a closely held company to its shareholders.

Other Related Points

- Payment on buy-back of shares (A): Not classified as deemed dividend for the purpose of "Income from other sources" under the Income Tax Act, 1961, as Specific provisions like Section 115QA handle buy-back of share scenarios.

- Loan granted to shareholders in the ordinary course of business (D): Generally not deemed as a dividend under the Income Tax Act, 1961, as it falls outside the purview of dividends and is considered as a regular business transaction.

Hence, the options B. Payment to shareholders on reduction of capital, C. Distribution of debentures to shareholders, and E. Loan granted to shareholders by a closely held company, are deemed to be dividends for the purpose of computing income chargeable under the head, "Income from other sources", as per the Income Tax Act, 1961.

Q8: _______ takes into account a host of inputs, such as buyer’s image of the product performance, the channel deliverables, the warranty quality, customer support and softer attributes such as the supplier’s reputation, trustworthiness and esteem.

(a) Target rate-of-return pricing

(b) Auction-type pricing

(c) Economic-value-to-customer pricing

(d) Competitive pricing

Ans: C

Sol: Correct answer is Economic-value-to-customer pricing.

- Economic-value-to-customer pricing focuses on assessing and setting the product's price based on the total value it delivers to the customer. This method integrates various inputs, including the buyer's perception of the product’s performance, the effectiveness and efficiency of the distribution channels, the quality of the product's warranty, the level of customer support, and softer attributes like the supplier's reputation, trustworthiness, and esteem. These factors together contribute to the overall perceived value the product offers to the customer, which this pricing strategy aims to quantify and capitalize on.

Other Related Points

Target rate-of-return pricing is a pricing strategy that sets the product’s price based on a predetermined return on investment (ROI) or specific profit targets. While it takes production costs into account, it is more internally focused on achieving financial objectives rather than directly on the customer's perceived value of the product.

Auction-type pricing is a method where the final price of the product is determined through a bidding process. The selling price varies depending on how much buyers are willing to pay at that moment. It does not explicitly consider the composite aspects of value (like product image, channel deliverables, or supplier reputation) in setting the price. Instead, it relies on the competitive dynamics of the auction setting.

Competitive pricing involves setting the price of a product or service based on what competitors are charging for similar products or services. While understanding the market landscape is crucial, this strategy primarily focuses on positioning against competitors' pricing rather than on the comprehensive value offered to the customer, as considered in economic-value-to-customer pricing.

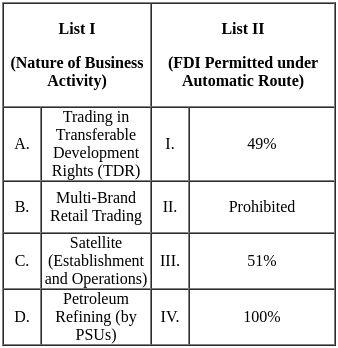

Q9: For Foreign Direct Investment, it is argued that a location in question attracts FDI because it combines the unique advantage of which of the following conditions?

A. Internalisation Advantage

B. First Mover Advantage

C. Knowledge Advantage

D. Ownership Advantage

E. Location Advantage

Choose the correct answer from the options given below:

(a) E, A and C Only

(b) E, A and D Only

(c) C, B and D Only

(d) C, E and D Only

Ans: B

Sol: Correct answer is E, A and D Only

FDI = FDI stands for foreign direct investment. It refers to the investment made by the individual, organization or the government from one country into business that are located in another country. FDI involves acquiring interest in an enterprise abroad through the purchase of stocks, ownership stakes or the establishment of new ventures. FDI contribute to the economic growth, technology transfer and job creation. Different countries have different rules and regulations governing the FDI.

- The decision to invest by FDI is determined by the OLI paradigm which was formulated by an economist John Dunning. He states that OLI stands for Ownership, Location and Internalization.

- Ownership advantage = The first consideration is the ownership advantage including proprietary information and ownership rights of the company. This may include branding, copyrights, trademark and the patents. It provides specific advantages to the parent company. Ownership advantages are considered to be intangible as it gives a relative competitive advantage such as reputation.

- Location advantage = Location advantage is the second necessary decision while investing in the FDI. Companies must assess whether there is advantage or not for performing specific functions within a particular nation. This depends on the availability and cost of resources. Locational advantage refers to natural or created advantage which are generally immobile such as coal mines, gold mines, petroleum etc.

- Internalization advantage = Internalization refers to the idea that a firm whether choose to internalize its activities rather than relying on external markets or a third party. Sometimes it is more beneficial or cost effective for an organization to operate from a different market or a third party while the business keep doing the work in house. So the business must think of outsourcing its production as it will benefit the business more in terms of cost.

- The OLI paradigm that is ownership advantage, location advantage and internalization advantage provides a comprehensive framework for understanding the factors that can influence the firm's decision to engage in Foreign Direct Investment or not.

Q10: Companies use ________ when they lack financial resources to carry out direct marketing and when they can earn more by doing so.

(a) Intermediaries

(b) Internationalisation

(c) Influencers

(d) Innovation

Ans: A

Sol: Correct answer is Intermediaries

Intermediaries = Intermediaries also known as marketing channels are set of interdependent organizations involved in the process of marketing a product or a service available for use or consumption. Marketing channels helps to convert the potential buyers into profitable orders. The intermediaries can be of various types like wholesalers and retailers which buy the goods, take title and resell them others are agents which which search for the customer and negotiate on the producer's behalf for price and quality but do not take title of the goods and the last are facilitators they facilitate the sale and purchase but do not take title nor negotiate they include warehouses, banks, advertising agencies, transportation services.

Roles of marketing channels

- Many producers lack the financial resources to carry out the direct marketing so they opt for the marketing channels and the intermediaries for the purchase and sell of the product as it will be less costly and the product can reach the target market easily.

- Producers can earn a greater return by increasing the investment in their own business and giving out the marketing task to the intermediaries. This makes the goods widely available and accessible to the target market. The intermediaries often provides the producers more than it can achieve on its own as now they can focus only on their business.

- In some cases the direct marketing is not at all feasible because the then the producer will not be able to reach all the segments of the market because they do not have the contacts, experience, specializations which intermediaries have. This involves smooth flow of goods services in the market and reaching all the target segments.

Other Related Points

- Channel levels = Channel level shows the number of intermediaries that are working in a particular channel. There are mainly four types of channel levels 0 Level = Manufacturer ⇒ consumer ( direct marketing) 1Level = Manufacturer ⇒ wholesaler ⇒ consumer 2Level = Manufacturer ⇒ wholesaler ⇒ retailer ⇒ consumer 3 Level= Manufacturer ⇒ wholesaler ⇒ jobber ⇒ retailer ⇒ consumer

Number of intermediaries = Producer has to decide the number of intermediaries to use at each channel level. Three strategies are available for the producers that are

- Exclusive distribution = It means when the producer limits the number of intermediaries and wants to have control over the service and the output like in case of auto mobiles and major appliances.

- Selective distribution = It involves the use of more than few but less than of all the intermediaries who are willing to carry the product.

- Intensive distribution = It involves placing the goods and service by the producer in as many outlets as possible. This strategy is used by the products like soap, snack foods, tobacco.

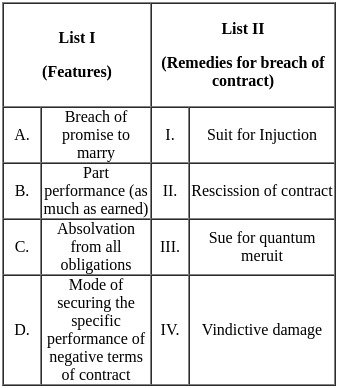

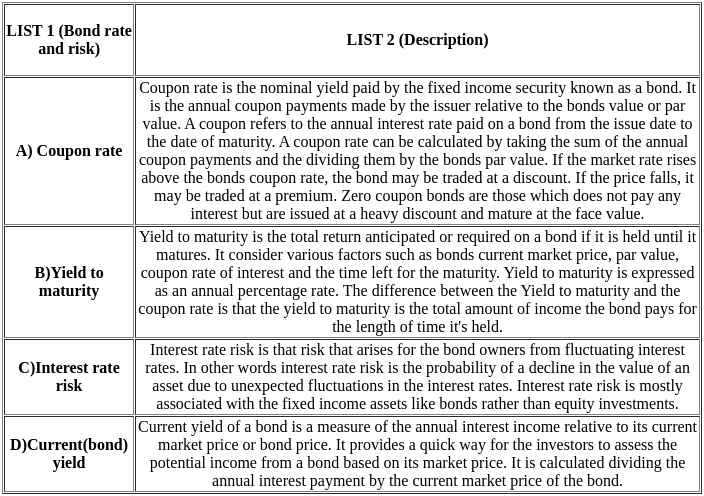

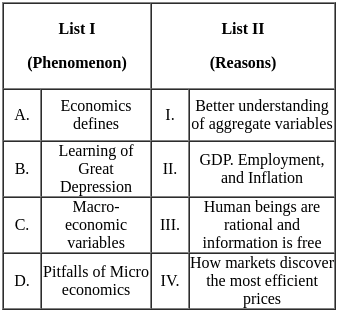

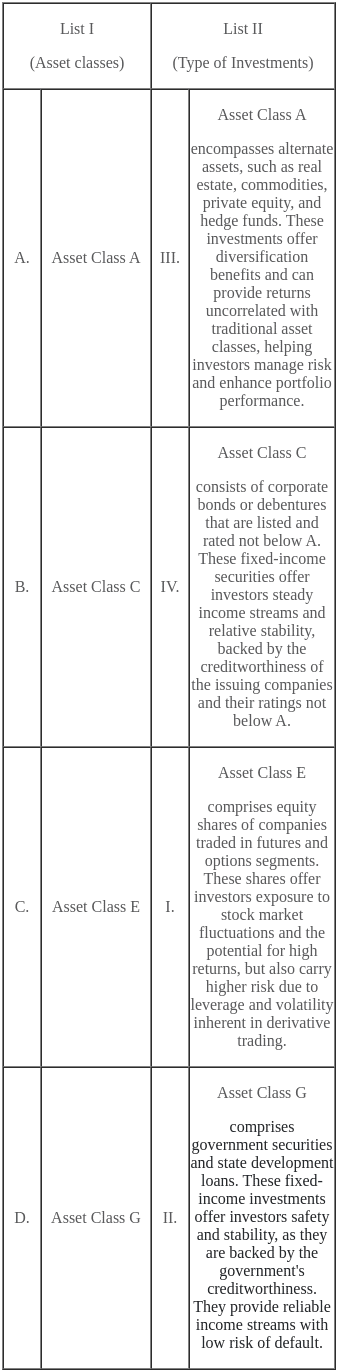

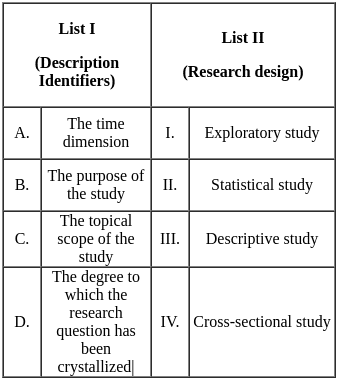

Q11: Match List - I with List - II.

Choose the correct answer from the options given below :

(a) A - IV, B - III, C - II, D - I

(b) A - I, B - II, C - III, D - IV

(c) A - III, B - IV, C - I, D - II

(d) A - II, B - I, C - IV, D - III

Ans: A

Sol: Correct answer is A - IV, B - III, C - II, D - I

Breach of promise to marry = Breach of promise to marry means the to the legal concept in which one party fails to fulfill an agreement to marry the other, despite of making the promises to marry. In many jurisdictions this allows the aggrieved party seek the damages in terms of financial losses, emotional distress or harm suffered as a result of broken promise.

- Remedy for breach of promise to marry is vindictive damage = Vindictive damage are awarded when one party in a contract breaches the contract and the other party is affected mentally such as emotional distress. It is to compensate the mental distress or injury cased to an aggrieved party.

Part performance(as much as earned) = Part performance refers to the legal doctrine in contract law where one party has fulfilled some obligations but not all of the contractual obligations. This recognition often arises to prevent unjust and unfairness to the performing party. For example if some party has partly performed the contractual obligations under the contract, a court may enforce the to grant the equitable remedies.

- Remedy for past performance is suit for quantum merit = A claim for the quantum merit is a quasi contract means there is no legal written contract between the two parties. It is made when one of the party has not performed all the contractual obligations under the contract then the aggrieved party may file a suit upon the quantum merit for the unfairness of the performing party.

Absolvation from all obligations = It means a complete release or discharge from the duties, responsibilities, commitments and contractual obligations. This contract ensures that all the parties involved should agree to the clauses of the contract willingly for them to be legally binding.

- Remedy for absolvation from all obligation is recession of contract = Recession of contract means the to rescind the contract or to cancel the contract at the option of the aggrieved or the affected party.

Mode of securing the specific performance of negative terms of the contract = It includes any specific performance which will have a negative effect on the contract. It can be related to any mischief that is being played by a third party. If the defendant does something that he or she should not perform then the affected party can go to the court for the remedy.

- Suit for Injunction = An order from the court to restrain a person from doing anything is known as injunction. It is a legal action in which a party seeks a court order to prohibit another party from engaging in any act or certain actions.

Q12: Channel power is the ability to alter channel members' behaviour so that they take actions they would not have taken otherwise. From the following channel powers, list the ones which are subjective in nature:

A. Legal Power

B. Coercive Power

C. Expert Power

D. Referent Power

E. Reward Power

Choose the correct answer from the options given below:

(a) D, A and C Only

(b) C and D Only

(c) A, B and E Only

(d) A, C and E Only

Ans: A

Sol: Correct answer is C and D Only

Subjective powers are Expert (C) and Referent (D), based on trust and relationships. Legal (A), Coercive (B), and Reward (E) are objective, relying on contracts or tangible incentives/punishments.

Definitions of Each Power:

A. Legal Power – Objective

Based on contractual or legal authority. Formal and enforceable.B. Coercive Power – Objective

Based on the threat of punishment. Tangible and externally imposed.C. Expert Power – Subjective

Based on the perception that someone has superior knowledge or skills.D. Referent Power – Subjective

Based on admiration, identification, or respect.E. Reward Power – Objective

Based on the ability to provide tangible benefits or incentives.

Subjective Powers:

C. Expert Power

D. Referent Power

These depend on perception and emotional connection rather than enforceable control.

Correct Answer: (b) C and D Only

These are the only subjective powers among the options.

Q13: Arrange the following in a sequence with regard to price leadership sustainability:

A. Small firms in the industry are allowed to sell all they want at that price

B. Dominant firm acts as the residual supplier of the commodity

C. The dominant firm sets the price for the commodity that maximizes its profits

D. Small firms in the industry behave as price takers

E. Dominant firm then comes into fill the market

Chose the correct answer from the option given below:

(a) A, B, C, D, E

(b) E, D, C, B, A

(c) A, C, B, D, E

(d) C, A, E, B, D

Ans: D

Sol: Correct answer is C, A, E, B, D

Price leadership = Price leadership occur when a dominant form sets the price for its product and services and other competitors follow by matching their prices accordingly. Price leadership is often followed in oligopolistic market where small number of large firm dominate the industry . Price leadership can help to stabilize prices in an industry and reduce uncertainty. It is a signal to customers and competitor that the dominant firm has a strong market position however it can lead to anticompetitive behavior and collusion

There are two main types of price leadership

- Dominant price leadership = In this the market leader or the dominant firm takes the initiative to set the price of industry and other firms followed its lead .

- Barometric price leadership = In this price leadership no single firm is recognized as dominant or market leader. Instead of this a group of firm observed and react to each other's pricing decision .In this the prices keeps on changing as firms adjust the prices according to changes in the market environment or cost.

Following is the sequences with regards to price leadership sustainability

- The first step to sustainability is that the dominant firm set the price for the commodity in the industry and the other firms in the industry follow that price. This allows the dominant firm to maximize its profit and achieve the objective of its firm.

- The smaller firm in the industry are allowed to sell at the price that they want as they do not take any risk by selling the product at a lower price than the prevailing market price as it can lead to the price war which smaller firms will not be able to sustain.

- Then the dominant firm comes to fill the market that smaller firm can not do. The smaller firms are not able to satisfy the customers in terms of the price as they are selling at a higher prices to overcome the price war so the dominant firm comes into the market to satisfy the customers need.

- Dominant firm acts as a residual supplier of the commodity to fill the market and balancing the demand and supply of the market so that their is no price war.

- At last the dominant firm sets the price of the commodity and he is considered as the price leader, the smaller firm in the industry behave as price takers because they have to accept the price set by the dominant firm as they do not have any power to influence the prices of the market . This brings the stability in the price leadership by the dominant firm.

Q14: Place the following service differentiators in a logical sequence:

A. Speed and timing of delivery

B. Maintenance and repair

C. Returns

D. Installation, training and consulting

E. Ease of ordering

Choose the correct answer from the option given below:

(a) E, D, B, C, A

(b) E, A, D, B, C

(c) E, D, A, C, B

(d) E, C, A, B, D

Ans: B

Sol: Correct answer is E, A, D, B, C

- Service differentiation = When the physical product cannot be easily differentiated the key to success in the competition lies in the valued services and improving them over time. The service differentiators process starts with ease of ordering, installation training and consultation, maintenance and repairs, returns and finally speed and timing of delivery.

- Ease of ordering = The first process in service differentiators is ease of ordering. It refers to how easy it is for a customer to place an order with the company. The more it will be easy for the customers the more will be the sales and profits for the company. For example the consumers are now able to order the groceries without going to the super market. One thing that should be care about is that the ordering process should be easy enough.

- Speed and timing of delivery = The next step in the process of service differentiators is the speed and delivery of the product. Delivery refers to how well the order of the product or service is delivered. Delivery should be fast and accurate and proper care should be taken in delivering the product. As fast as the delivery will be provided to the customers including the installation, training and consultations, maintenance and repairs the more satisfied the customers will be.

- Installation, training and consultation = The second step in service differentiators is installation, training and consultation. It should be done as soon as possible after the order. Installation refers to the work done to make the product operational. Ease of installation becomes the important selling point. Here the customer training refers to the training of the customer's training to use the equipment properly and efficiently. Consultation refers to the data and information that is provided by the sellers to the buyers for the use of the equipment. This stage deals with the education part of the customer.

- Maintenance and repairs = In this stage the service program for helping the customers to keep the product in the good working conditions. After the installation of the product there might be a problem in the product then the maintenance and the repairs services is used. The company which provides the best maintenance and repair services will have a good reputation in the market and that product will be purchased more.

- Returns = The next step in the service differentiators is returns. If the product does not meet the specification which is required by the customers there should a policy of returning the product. The request for the return to the company by the customer should not be delayed otherwise it will be the negative effect on the company and the products.

Q15: Which of following are pre-experimental designs?

A. One-group pre test-post test

B. Pre-test post-test control group

C. Quasi-experiments

D. Static group comparison

E. After-only study

Choose the correct answer from the options given below:

(a) D, B, C Only

(b) A, D, E Only

(c) A, C, E Only

(d) E, B, D Only

Ans: B

Sol: The correct answer is A, D, E Only

- Pre-experimental designs are the simplest form of research design and do not involve any kind of control or comparison group.

- Pre-experimental designs like the ones mentioned lack crucial elements such as random assignment, control groups, or pre-intervention measurements, which are essential for establishing causality and ruling out alternative s for observed effects.

Important Points

- One-group pre test-post test: This design involves measuring a single group of participants before and after they have been exposed to some intervention or treatment. The main limitation of this design is the lack of a control group. Without a comparison group, it's challenging to attribute any observed changes solely to the intervention, as there could be other factors influencing the results.

- Static group comparison: In this design, two separate groups are compared, but participants are not randomly assigned to groups. One group receives the treatment (experimental group), and the other does not (control group). The major limitation of this design is the lack of random assignment, which means that the groups may differ systematically before the treatment, making it difficult to determine whether any differences observed after the treatment are due to the treatment itself or pre-existing differences between the groups.

- After-only study: This design involves measuring the outcome of interest only after the treatment has been administered, without any pre-intervention measurements or control group. The key limitation of this design is the absence of baseline data or a control group, making it challenging to establish causality or determine whether any observed outcomes are truly attributable to the treatment.

Q16: The concept of product life cycle is based on which of the following key assumptions?

A. Profits remain stable at different stages of product life cycle

B. Products have an unlimited life

C. Product sales pass through distinct stages, each posing different challenges, opportunites and problems to the seller

D. Products require different marketing, financial, manufacturing, purchasing and human resource strategies in each of the life cycle stages

E. Products have a limited life

Choose the most appropriate answer from the option given below:

(a) B, C and D Only

(b) A, B and C Only

(c) A, C and D Only

(d) C, D and E Only

Ans: D

Sol: Correct answer is C, D and E Only

A company's positioning and differentiation strategies must be changed as the product, market and the competitors change over the product life cycle. The product life cycle has to purport four main things which are

- Product have a limited life cycle.

- Product sales pass through various stages which has different challenges, opportunities and problems to the seller.

- Profits may rise or fall at different stages of product life cycle.

- Products require different manufacturing, financial, marketing and purchasing and human resource strategies at each level of the product life cycle.

- Product life cycle has four stages which are introduction, growth, maturity and decline.

- Introduction stage = As the product is introduced in the market the sales growth will be slow and profits will be nonexistent because of the heavy expenses of product introduction. The strategies that are followed in the introduction stages are are intensive advertisement campaign should be run for the product to inform the potential customers and induce the product trial, the basis of selection of middlemen should be selective because the expenses are high, and the pricing of the product should be based on the normal profit policy.

- Growth stage = In this stage the customer starts accepting the product and the sales starts to increase. The promotion of the good becomes more focused, distribution points also increases rapidly. At this stage the company will maintain the higher price to earn the maximum amount of profits. As the production increases the cost per unit of product will decrease. The strategies that are followed in this stage are improvement in the product quality and adding new product features and improved styling, it adds new models of the product and increases the distribution channels.

- Market maturity stage = In this stage the sales become stagnant and starts to decrease slowly. Competition is very fast at this stage as many new competitors enter the market. Due to competition the company increases the promotion and this increase the pressure on the profits. The strategies adopted in this stage are to reduce the price of the product to attract the price sensitive customers and new uses of the products should be discovered and efforts should be made to bring novelty in the products by changing the color, shape and size etc.

- Market decline stage = This is the stage when the market starts to decline and it is the final stage of the product life cycle. Also known as market death stage. At this stage the product either becomes obsolete or in place of this product and improved product enters into the market. The strategies that are followed in death stage are to advertise the product to increase the demand of the product and to properly plan and implement the policies to survive against the competition and in case of losses sell the loss making products of the company.

Q17: When a target company makes a counter bid for the stock of the bidder, the defensive strategy in reference is called?

(a) Greenmail

(b) Poison pill

(c) Pacman defense

(d) Golden parachute

Ans: C

Sol: The correct answer is Pacman defense

Key Points

- When a target company makes a counter bid for the stock of the bidder, the defensive strategy in reference is called Pacman defense

- The Pacman defense is a strategic maneuver employed by a target company to lend off a hostile takeover bid by turning the tables on the would-be acquirer.

- The term is derived from the popular arcade game Pac-Man, where the titular character turns the tables on its pursuers by consuming them instead. Similarly, in the context of corporate takeovers, the target company attempts to "devour" or acquire the entity that initially sought to acquire it.

- Initially, a company (the bidder) launches a hostile takeover bid to acquire the target company.

- In response to the hostile takeover attempt, the target company adopts the Pacman defense strategy.

- By making a counter bid, the target company gains several strategic advantages

- Implementing a Pacman defense requires careful consideration of legal and regulatory implications.

- The Pacman defense can lead to negotiation and dialogue between the target company and the bidder.

- Both parties may seek to reach a mutually beneficial agreement, such as a merger or acquisition on favorable terms, to resolve the standoff.

Additional Information

- Greenmail is a defensive strategy where a target company repurchases its own stock from a potential acquirer at a premium, thus making the takeover attempt less financially attractive for the acquirer.

- A poison pill is a strategy used by a target company to defend itself against an unwanted takeover bid. It involves the issuance of new shares or rights to existing shareholders, which dilutes the ownership stake of the acquirer, making the acquisition more expensive and less attractive.

- Golden parachute refers to a compensation package offered to top executives of a company in the event of a change in ownership or control, typically following a merger or acquisition. This package provides lucrative benefits to key executives if they are terminated or if there is a change in control of the company.

Q18: As per the sub-section (8A) of Section 139 of the Income Tax Act, a person may furnish an updated return of his income for the previous year relevant to such assessment year, within _______ from the end of assessment year?

(a) 6 months

(b) 12 months

(c) 24 months

(d) 36 months

Ans: C

Sol: The correct answer is 24 months

Key Points

- Subsection (8A) of Section 139 of the Income Tax Act pertains to the provision for filing a revised return of income, commonly known as an updated return.

- This provision allows individuals to correct any errors or omissions in the original return filed for a particular assessment year.

- A revised return is a modified version of the original return filed by a taxpayer for a specific assessment year. It is filed when the taxpayer realizes that there are mistakes or important information that was not included in the original return.

- The purpose of allowing revised returns is to provide taxpayers with the opportunity to rectify any errors or omissions in their original return. This ensures that the taxpayer's income is accurately reported, which in turn helps in computing the correct tax liability.

Additional Information

- Taxpayers can file a revised return only if they have already filed the original return within the due date specified under Section 139(1) of the Income Tax Act.

- Additionally, the revised return can be filed multiple times before the end of the relevant assessment year or before completion of the assessment, whichever is earlier.

- To file a revised return, taxpayers need to use the same form that was used for filing the original return.

- They must mention that it is a revised return and provide details of the original acknowledgment number and date of filing.

- The revised return should include all corrections and amendments to the original return.

Q19: Which of the following theories of capital structure articulates that a firm borrows up to the point where the tax benefit from extra debt is exactly equal to the cost that comes from the increased probability of financial distress?

(a) The static theory

(b) Net income approach

(c) Modigliani-Miller theory

(d) Net operating income approach

Ans: A

Sol: The correct answer is The Static Theory

Key Points

- The theory of capital structure that articulates that a firm borrows up to the point where the tax benefit from extra debt is exactly equal to the cost that comes from the increased probability of financial distress is known as the "static theory."

- The static theory, also known as the trade-off theory, suggests that there is an optimal capital structure for a firm where the tax advantage of debt is balanced against the costs of financial distress.

- In other words, a firm will continue to add debt until the marginal tax benefit of debt equals the marginal cost of financial distress.

- Debt provides tax shields in the form of interest expense deductions, which reduce the taxable income of the firm, resulting in lower tax payments.

- As the firm increases its debt level, the tax benefit from interest payments also increases.

Other Related Points

- However, as the firm takes on more debt, it also faces increased financial distress costs, such as bankruptcy costs, agency costs, and the potential for loss of reputation and business opportunities.

- These costs rise with higher levels of debt due to increased risk of default.

- According to the static theory, the firm's optimal capital structure is achieved when the tax benefit of debt is precisely offset by the costs associated with financial distress.

- At this point, further increases in debt would not provide any net benefit to the firm.

Q20: Which are the states where every supplier of goods and/or services is required to obtain registration if his aggregate turnover exceeds the threshold limit of Rs. 20 lakh for supply of goods and/or services?

A. Arunachal Pradesh

B. Meghalaya

C. Manipur

D. Mizoram

E. Sikkim

Choose the most appropriate answer from the option given below:

(a) B, C and A Only

(b) C, D and E Only

(c) E, B and A Only

(d) All of the above

Ans: D

Sol: The correct answer is - (c)

- General (Normal) States: GST registration is mandatory if the aggregate turnover exceeds ₹20 lakh for services or mixed supplies, and ₹40 lakh for goods-only suppliers .

- Special Category States: These states have lower thresholds—generally ₹10 lakh for services and ₹20 lakh for goods/mixed supplies. However, some special category states may opt for higher thresholds as permissible by GST Council decisions

- Manipur and Mizoram fall under states where service/mixed supply threshold is ₹10 lakh, making the requirement stricter and thus not ₹20 lakh across all categories.

- Arunachal Pradesh, Meghalaya, and Sikkim maintain the ₹20 lakh threshold across both goods and services/mixed supplies

From the options provided:

- (a) B, C and A Only → Incorrect (includes Manipur → ₹10 lakh threshold for services)

- (b) C, D and E Only → Incorrect (includes Manipur & Mizoram → ₹10 lakh threshold for services)

- (c) E, B and A Only → Correct — Sikkim (E), Meghalaya (B), Arunachal Pradesh (A)

- (d) All of the above → Incorrect (not all states fit ₹20 lakh threshold for both supply types)

Final Answer: (c) E, B and A Only

That is, Sikkim, Meghalaya, and Arunachal Pradesh are the states where every supplier of goods and/or services must register if their aggregate turnover exceeds ₹20 lakh.

Q21: Which one of the following accounting concepts and conventions consider it reasonable to use the historical cost to record long-lived assets?

(a) The entity concept

(b) Going concern convention

(c) Materiality convention

(d) The periodicity convention

Ans: B

Sol: The correct answer is Going concern convention

- The going concern convention assumes that a company will continue its operations indefinitely.

- This allows the business to spread the cost of an asset over its expected lifespan.

- As a result, it is considered reasonable under the going concern convention to use the historical cost (the original cost at which the asset was acquired) to record long-lived assets.

- This is because under this convention, assets are not generally intended to be liquidated immediately, but are used over a period of time to generate revenues.

Other Related Points

- The entity concept, also known as the entity assumption or separate entity concept, is a fundamental accounting principal that separates the finances of the business from those of its owners or other entities. It treats the business as a distinct economic entity, independent of its owners.

- The materiality convention states that only items that significantly affect financial decisions or the economic condition of the business need to be reported. This convention guides accountants in determining which transactions or events should be recorded in the financial statements.

- The periodicity convention, also known as the time period assumption, assumes that the economic activities of a business can be divided into discrete time periods for financial reporting purposes.

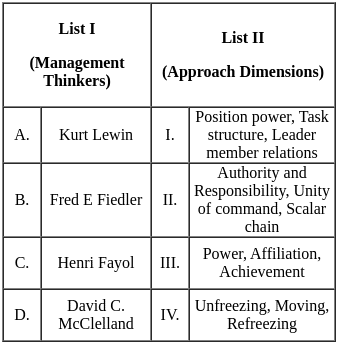

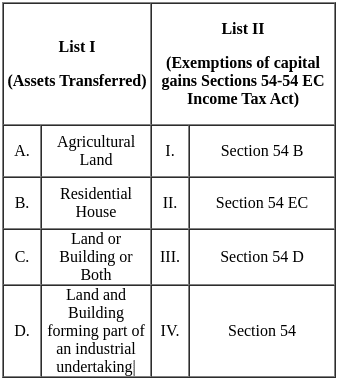

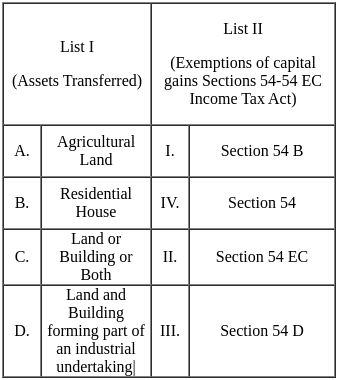

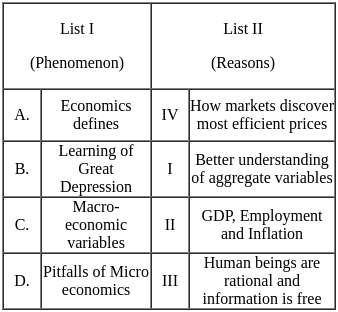

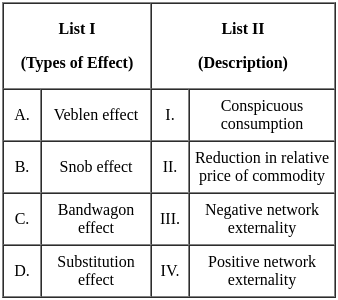

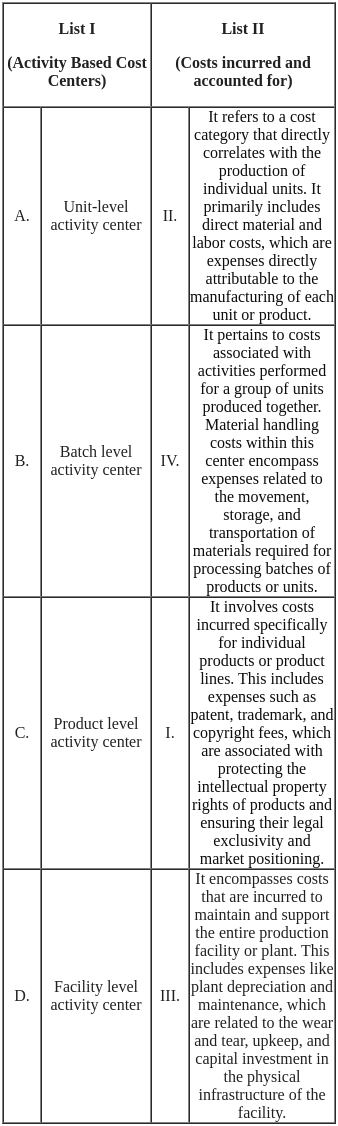

Q22: Match List - I with List - II.

Choose the correct answer from the options given below :

(a) A - I, B - II, C - III, D - IV

(b) A - IV, B - I, C - II, D - III

(c) A - IV, B - III, C - I, D - II

(d) A - II, B - IV, C - III, D - I

Ans: B

Sol: The correct answer is A - IV, B - I, C - II, D - III

Q23: Arrange the following rounds for multilateral trade negotiations under GATT/WTO in a chronological order.

A. Kennedy

B. Doha

C. Annecy

D. Torquay

E. Tokyo

Choose the correct answer from the option given below:

(a) C, D, A, E, B

(b) D, C, E, A, B

(c) B, A, E, C, D

(d) B, E, A, D, C

Ans: A

Sol: The correct answer is C, D, A, E, B

Key Points

- The chronological order of some key rounds of multilateral trade negotiations under the General Agreement on Tariffs and Trade (GATT), which later led to the establishment of the World Trade Organization (WTO).

- Annecy Round (1950): The second round of GATT negotiations took place in Annecy, France, in 1949, not in 1950. This round primarily focused on further tariff reductions on industrial goods.

- Torquay Round (1950-1951): The third round of GATT negotiations occurred in Torquay, England, from 1950 to 1951. This round aimed to further reduce tariffs and trade barriers, particularly focusing on agricultural products.

- Kennedy Round (1964-1967): The sixth round of GATT negotiations, known as the Kennedy Round, was held in Geneva, Switzerland, from 1964 to 1967. The Kennedy Round focused on further tariff reductions, particularly in sectors such as chemicals, textiles, and agricultural products.

- The Tokyo Round was the seventh round of GATT negotiations, spanning from 1973 to 1979. It involved 102 nations and aimed to address non-tariff barriers to trade, such as quotas, subsidies, and technical barriers.

- Doha: Under the banner of WTO, the Doha Development Round of World Trade Organization negotiations aimed to lower trade barriers around the world and launched in 2001.

Other Related Points

- Both GATT and the WTO have played significant roles in promoting international trade, fostering economic growth, and ensuring a rules-based trading system.

- While GATT focused primarily on tariff reduction, the WTO covers a broader range of trade issues and has a more robust institutional structure for trade governance.

Q24: Given below are two statements:

Statement I: The ordinary treasury bills that are marketable and have a secondary market are issued to the public and financial institutions.

Statement II: Ad hoc treasury bills are issued only in favour of the Reserve Bank of India which is authorized to issue currency notes against them.

In the light of the above statements, choose the most appropriate answer from the options given below:

(a) Both Statement I and Statement II are true

(b) Both Statement I and Statement II are false

(c) Statement I is true but Statement II is false

(d) Statement I is false but Statement II is true

Ans: A

Sol: The correct answer is Both Statement I and Statement II are true

- Both statements accurately describe the characteristics and issuance of ordinary treasury bills and ad hoc treasury bills

- Ordinary treasury bills (T-bills) are indeed marketable securities issued by the government to raise short-term funds.

- They are typically sold through auctions to a wide range of investors, including the public and financial institutions such as banks, mutual funds, and insurance companies.

- Moreover, T-bills are traded in the secondary market, allowing investors to buy and sell them before their maturity date.

- Ad hoc treasury bills are special short-term securities issued by the government, usually to the Reserve Bank of India (RBI), to meet temporary mismatches in its receipts and expenditures.

- These bills are not typically issued to the public or other financial institutions but are instead used as a mechanism for the government to borrow directly from the RBI.

- The RBI may issue currency notes against these ad hoc treasury bills, effectively monetizing the government's debt.

Other Related Points

- Treasury bills (T-bills) are short-term debt securities issued by the government to raise funds.

- They are typically sold at a discount from their face value and mature in a relatively short period, ranging from a few days to a year. T-bills are considered one of the safest investments because they are backed by the full faith and credit of the government.

Q25: Which of the following are objectives of Immediate Payment Service (IMPS)?

A. To enable bank clients to use mobile instruments as a channel for accessing their bank accounts and remit funds

B. To build the foundation for a full range of mobile based banking services.

C. To sub-serve the goal of Reserve Bank of India (RBI) in digital payments.

D. To make payments simpler with the mobile number of the beneficiary

E. To restrain a nation-wide payment system facilitating one-to-one funds transfer

Choose the most appropriate answer from the option given below:

(a) A, C, D and E Only

(b) A, B, C and D Only

(c) B, C, D and E Only

(d) B, A, E and D Only

Ans: B

Sol:

- The objective of IMPS is to enable bank clients to use mobile instruments as a channel for accessing their bank accounts and remit funds. It is a easy, quick and secure way to transfer funds via the mobile phones. Users can transfer money through internet banking, m- banking or through pre-paid payments instrument.

- It builds the foundation of full range of mobile based banking services. IMPS can be used to conduct multiple transactions at any time of the day, enabling the users to make use of IMPS without any time constraints. The versatility of IMPS allows individuals to use it for several purposes other than just sending and receiving money. It offers multiple services such as making payments to merchants, shopping online, insurance premium payment, utility bill payments and travel and ticketing.

- IMPS serves the goal of RBI to increase the usage of digital payments. Being a digital mode of transferring funds, IMPS strengthens the goal of rbi by providing a robust and real time fund transfer service across the nation. It has deepened the digital payments penetration across the country by facilitating easier transfer of funds.

- IMPS has made the process of making payments simpler and hassle free by just using the beneficiary's mobile number and MMID ( Mobile money Identifier). It streamlines the process of fund transfer by just using the mobile number where bank account details are not required.

- IMPS enables nation wide payment system by facilitating one-to one funds transfer. It allows the remitter to instantly transfer the funds to the beneficiary's bank account, irrespective of time and location. It enables the extension of banking services across the nation and enhances financial inclusion by providing access to banking services to even the most remote areas.

Other Related Points

- IMPS is managed by National Payments Corporation of India (NPCI), which is the umbrella organization for operating retail payments and settlement system in India.

- IMPS can be initiated using a mobile banking app, internet banking or a bank's ATM.

- Funds can be transferred in various modes using mobile number or MMID, using Account number and IFS Code or using Aadhaar number of the beneficiary.

- The maximum transfer limit of funds through IMPS is Rs. 5 lakh.

Q26: Which of the following frameworks is considered as the Open International Standard for Digital Business Reporting?

(a) CSR reporting

(b) TBL reporting

(c) XBRL reporting

(d) PPP reporting

Ans: C

Sol: The correct answer is XBRL reporting.

- XBRL( extensible Business Reporting Language) is an open international standard for digital business reporting.

- It enables the companies to report their financial statements in a structured and machine readable format which makes it easier to analyse complex business information, thus improving transparency, accuracy, efficiency of financial reports.

- XBRL has been widely adopted across the world as an open standard for financial reporting purposes.

- It offers multiple benefits to all the producers and Consumers of financial data in terms of cost saving, accuracy, reliability, flexibility and efficiency in handling business and financial information.

- CSR reporting (Corporate social responsibility reporting ) is used to report the firm's CSR policy, composition of CSR committee and the allocation of CSR expenditure to various social projects and programmes.

- TBL ( Triple bottom Line) reporting is used to measure the financial, social and environment performance of a company over a period of time.

- PPP ( Public private partnership reporting) refers to reporting the information about the public private partnership projects so that the stakeholders can assess the performance of the PPP projects.

Q27: Which of the following are relevant in technological innovations?

A. Most innovations are incremental

B. Most innovations involve the commercial utilization of ideas

C. Innovations cannot be explained with isoquants

D. Introduction of innovations is not stimulated by strong domestic rivalry and geographic concentrations

E. The risk in introducing innovations is usually high

Choose the correct answer from the options given below:

(a) B, D and E only

(b) A, C and E only

(c) A, B and E only

(d) A, B and C only

Ans: C

Sol: The correct answer is A, B and E only.

- Most innovational are incremental. This because most of the technological innovations make small scale, gradual and continuous improvements on the existing products and services. Products are modified and improved to make them more efficient and user friendly. For example, TV has seen considerable incremental innovation in terms of improvement in design, functions, resolution and picture quality.

- Most innovations involve commercial utilisation of ideas. Innovations create products that have a commercial value. Innovations develop products which are commercially successful. This is done by marketing and distributing the product to the market and exploiting it for profit maximisation. For example, smart phones have created a substantial commercial and economic value to the manufacturers.

- The risk in introducing innovations is high as new technologies require huge investment in terms of financial investment, time and expertise. The innovations encounter various challenges due to the uncertainties in the market which involve risks of market positioning, technical barriers, changing customer needs and preferences and economic and political fluctuations.

- Innovations are stimulated by domestic rivalry and geographic concentrations. Rivalry in a competitive market stimulates the firms to differentiate, improve and innovate their products in order to gain a larger market share. Geographic clusters facilitate exchange of knowledge and creative ideas which results in innovative methods of saving costs, transfer of technology and fosters technological advancements.

- Isoquants are curves that show various combinations of inputs that result in a certain level of output. Isoquants can depict technological advancements by showing different combinations of inputs that result in same level of output using different technological conditions.

Q28: The trademarks can be broadly classified into which of the following categories?

A. Descriptive

B. Normative

C. Generic

D. Explanatory

E. Invented

Choose the most appropriate answer from the option given below:

(a) A, B and D Only

(b) D, E and C Only

(c) B, C and E Only

(d) C, A and E Only

Ans: D

Sol: The correct answer is C, A and E Only

- The trademarks can be broadly classified into Generic, Descriptive and Invented categories.

- The three categories of trademarks Generic, Descriptive, and Invented represent different levels of distinctiveness and eligibility for trademark protection.

- Understanding these categories is essential for businesses and individuals seeking to develop and protect their brand identity.

Additional Information

- Descriptive trademarks are those that directly describe the product or service being offered. These trademarks are often not distinctive and may not be eligible for trademark protection unless they acquire secondary meaning. For example, "The Shoe Store" for a shoe store would be considered descriptive.

- Generic terms are common names for products or services and cannot function as trademarks because they do not distinguish the goods or services of one provider from another. Using a generic term as a trademark would give one company exclusive rights to use that term, which would be unfair to competitors and against the purpose of trademark law. For example, "Computer" used as a trademark for computers would be considered generic.

- Invented trademarks are those that are coined or created solely for the purpose of functioning as a trademark. These trademarks are typically the strongest and most protectable because they are inherently distinctive and have no other meaning apart from identifying the source of the goods or services. For example, "Kodak" for cameras and film is an invented trademark.

Q29: SAFTA (South Asian Free Trade Agreement) categorises member nations as Non-Least Developed Contracting States (NLDCS) and Least Developed Contracting States (LDCS). Identify the NLDSC states from the following

A. Bangladesh

B. Pakistan

C. Bhutan

D. India

E. Sri Lanka

Choose the correct answer from the options given below:

(a) A, B and D Only

(b) A, C and E Only

(c) E, A and B Only

(d) E, D and B Only

Ans: D

Sol: The correct answer is E, D And B only.

- South Asian Free Trade Agreement categorises India, Pakistan and Sri Lanka as Non- least Developed Contracting States. These are relatively more economically developed within the region. These states have higher levels of income, infrastructure and industrialisation.

- Bangladesh and Bhutan are categorised as Least Developed Contracting states. These states are designated as Least Developed Country by the United Nations. These are low income countries who confront various economic challenges and are more vulnerable to external shocks.

- All contracting states provide special and more favourable treatment exclusively to the Least Developed contracting states with regards to enhancing exports from LDCs, providing technical assistance and assisting them in expansion of trade.

- The agreement contains rules where safeguard measures are not applied against products originating in Least Developed contracting states.

- SAFTA is a free trade agreement of the South Asian Association of Regional Cooperation (SSARC), which came into effect on 1 January, 2006.

- SAFT signatory countries are Afghanistan, Bangladesh, Bhutan, India, Pakistan, Sri Lanka , Maldives and Nepal.

- The primary objective of the SAFTA agreement is to promote mutual trade and economic cooperation among the member countries by eliminating barriers to trade and promoting conditions of fair competition in the free trade area.

Q30: Which one of the following is an exception to the doctrine of Constructive Notice.

(a) Doctrine of Subrogation

(b) Doctrine of Ultra Vires

(c) Corporate Veil

(d) Turquand Rule

Ans: D

Sol: The correct answer is 'Turquand Rule'

Turquand Rule:

- The Turquand Rule, also known as the "Indoor Management Rule," states that outsiders dealing with a company are entitled to assume that internal company rules are observed.

- This rule exempts outsiders from investigating whether the company's internal procedures have been properly followed, thus protecting them from the doctrine of constructive notice which implies that everyone is presumed to know the contents of a company's public documents.

- The Turquand Rule provides a safeguard against the complexities that outsiders might face if they were required to verify that every internal procedure of the company was correctly followed.

Other Related Points

Doctrine of Subrogation:

- This doctrine pertains to insurance and indemnity law, allowing one party (usually an insurance company) to "step into the shoes" of another by assuming their legal rights and claims.

- It is unrelated to corporate internal management or the doctrine of constructive notice.

Doctrine of Ultra Vires:

- This doctrine states that actions taken by a company outside the scope of its charter or articles of association are void and cannot be ratified, even if approved by all shareholders.

- While it concerns the limits of corporate power, it does not provide an exception to the doctrine of constructive notice.

Corporate Veil:

- The corporate veil separates the personality of a corporation from its shareholders, protecting them from being personally liable for the company’s debts and obligations.

- This concept deals with liability and does not address the exceptions to the doctrine of constructive notice.

Q31: When a country's currency is accepted as a reserve currency, the potential conflict may arise between which of following policy objectives?

A. Domestic monetary policy

B. Domestic fiscal policy

C. External currency policy

D. Foreign trade policy

E. Inland trade policy

Choose the correct answer from the options given below:

(a) A, B, and C Only

(b) A, C and D Only

(c) B, D and E Only

(d) C, D and E Only

Ans: B

Sol: The correct answer is A, C and D only.

- Domestic monetary policy: When a country's currency is accepted as a reserve currency, the country's ability to conduct independent domestic monetary policy comes into conflict because any changes in the domestic money supply or interest rates can have international consequences.

- External currency policy: The policies which are aimed at maintaining the exchange rate stability can come in conflict with the domestic objectives as such policies can hamper the policies like price stability or devaluation of currency.

- Foreign Trade policy: When a country's currency is used as a reserve currency it strengthens the currency's exchange rate. A strong currency cam affect a country's export an import market, making the exports costlier and imports cheaper, thus disrupting the balance of payments. Conflict may arise when the country wants to promote exports and protect its domestic industries.

- Reserve currency is a globally recognised foreign currency that is held by other countries as a part of their foreign exchange reserves.

- A reserve currency is easily convertible and has a stable value. The US dollar is the dominant reserve currency, with a share of 61% of global reserves.

- A reserve currency reduces the exchange rate risks there is no risk of exchanging the currency while making payments.

Q32: The sequential stages of moral development in business organization are characterised by:

(a) Conceptualised disposition, consistency and harmony, principald oriented

(b) Consistency and harmony, conceptualised disposition, principald oriented

(c) principald oriented, conventional and preconventional

(d) Preconventional, conventional, principald oriented

Ans: D

Sol: The correct answer is Preconventional, conventional, principald oriented.

- Preconventional: At this stage of moral development, an individual makes moral decisions to adhere to the rules of the organization in order to avoid punishment or seek any personal benefit. The behaviour of the individuals is determined by the consequences.

- Conventional : In the conventional stage, individuals make moral decisions in conformity to the social rules or norms. The individuals support rules that are set by the society to maintain harmony and uphold social order.

- Principal oriented : At the principal oriented level, they make decisions on the basis of moral principals and values. They prioritise ethical principals such as justice, fairness, human rights over personal or societal norms. Impartiality, dignity, equality and a just society are values that are considered universal.

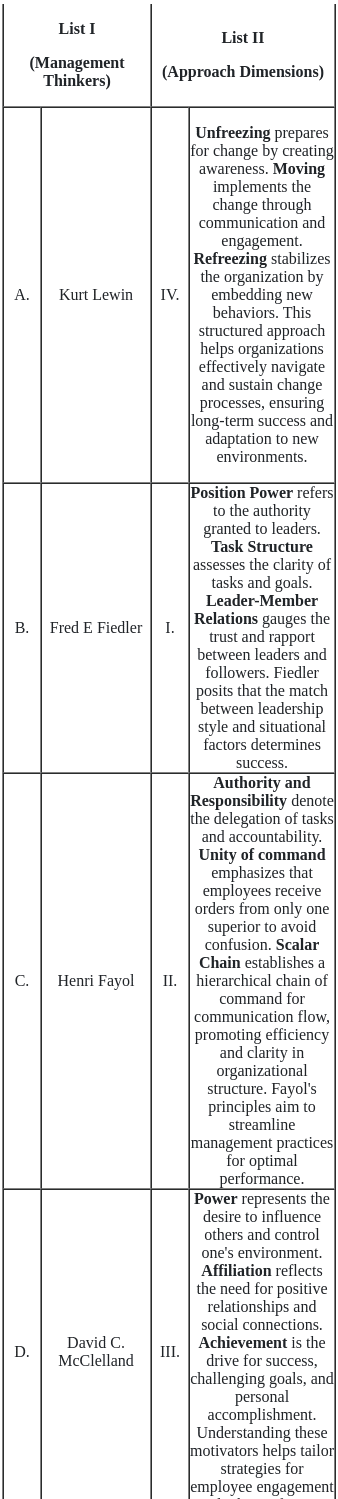

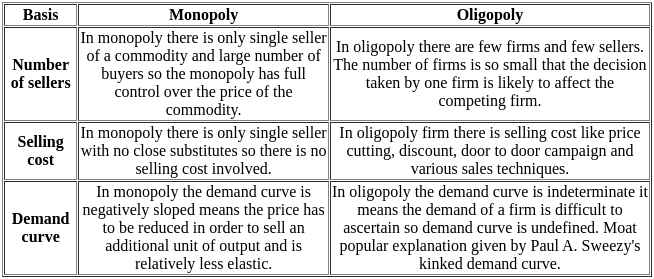

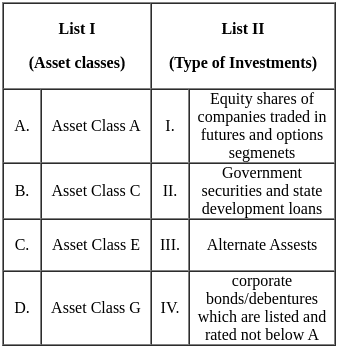

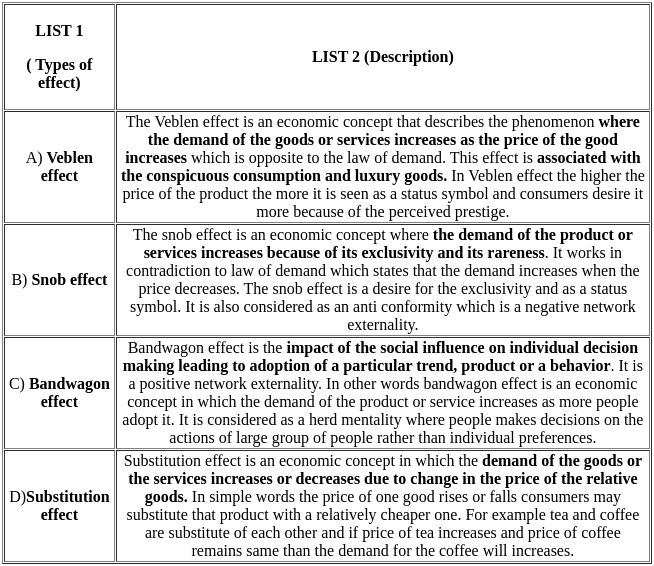

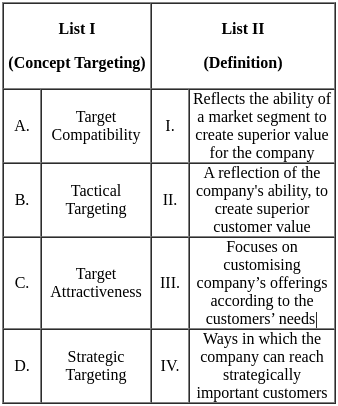

Q33: Match List - I with List - II.

Choose the correct answer from the options given below :

(a) A - IV, B - I, C - III, D - II

(b) A - II, B - III, C - I, D - IV

(c) A - III, B - II, C - IV, D - I

(d) A - I, B - III, C - II, D - IV

Ans: A

Sol: Correct answer is A - IV, B - I, C - III, D - II

Q34: Which of the following are the reasons for substitution between domestic and MNC goods?

A. Increased knowledge of foreign products due to international information revolution

B. No need to conduct advertising campaigns

C. Transportation costs having fallen to very low levels for most products

D. Restricted international travel

E. Tastes are consistent at the global level

Choose the correct answer from the options given below:

(a) A and C Only

(b) D and E Only

(c) C and D Only

(d) A and B Only

Ans: A

Sol: Correct answer is A and C Only

- MNC = MNC means Multinational Company. Multinational company means a company which has its business operations in many countries other than the home country and has a huge capital base and technological know how. In MNC the production process is scattered across more than one country and the investments are also made in several countries. So the goods sold by an MNC are known as MNC goods.

- Domestic goods = These are the goods which are manufactured by the domestic or the national company. Domestic company means those companies which do not have huge financial resources and are generally confined to a narrower place. In domestic company the production process are confined to domestic country and there is no investment other than the home country.

Reasons for substitution between domestic and MNC goods

- Increased knowledge = Due to increased knowledge of the customer they can understand and compare the benefits and the advantages of the MNC goods versus domestic goods and then make an informed decision to purchase the goods. If the MNC good will be superior than the domestic customer will drift away from buying the local goods and will move on to MNC goods.

- Low transportation cost = As the transportation cost reduces the overall cost of importing the goods also reduces into the domestic market. This decreased cost will make the cost of the product less. This reduction in price would lead a shift to MNC goods from the domestic goods.

- Technological advancements = As MNC have more technological advancements they can offer a good quality product at less price. This can lead to substitution of domestic goods with MNC goods.

- Access to resources = As MNC have access to resources related to specialized labor, advance technologies and specific natural resources there production cost decreases and as result per unit cost of the product also decreases. This decreased cost can make the MNC goods price competitive with domestic goods and leads to substitute of domestic goods.

Q35: Which one of the following statements is the most relevant to the substitution effect?

(a) In the real world, substitution effect is much larger than the income effect

(b) Most of the goods are not reasonable substitutes

(c) In reality, the income effect represents its predominance over the substitution effect

(d) Substitution and income effects cannot be separated easily

Ans: A

Sol: Correct answer is In the real world, substitution effect is much larger than the income effect.

Substitution Effect refers to the change in consumption patterns due to a change in the relative prices of goods, holding the consumer's utility (satisfaction) constant. When the price of a good decreases (or increases), consumers are more likely to substitute it for other goods that have become relatively more expensive (or cheaper).

The statement "In the real world, substitution effect is much larger than the income effect" highlights a commonly observed phenomenon in consumer behavior economics. This can be explained through a few key considerations:

Price Sensitivity: Consumers are often highly sensitive to changes in prices. A slight decrease in the price of a good makes it more attractive compared to other goods whose prices have not changed. This sensitivity induces consumers to substitute towards the cheaper good, often in significant amounts.

Availability of Alternatives: The modern marketplace offers a vast array of alternatives for most goods and services. This abundance makes it easier for consumers to find substitutes when the price dynamics change, amplifying the substitution effect.

Limited Income Changes: When the price of a product changes, the real income (purchasing power) of consumers changes as well. However, this income effect (the change in consumption patterns due to a change in consumer's real income) is often smaller in comparison to the substitution effect because consumer incomes do not usually change as quickly or significantly as prices do.

Real-World Observations: Empirical evidence in various markets often shows that consumers tend to adjust their buying habits more significantly in response to price changes (substitution effect) than to changes in their real income (income effect). This is partly because real income changes are generally more gradual, while price changes can be sudden and noticeable.

Other Related Points

Most of the goods are not reasonable substitutes: This statement, although it can be true in certain contexts, does not directly address the nature or impact of the substitution effect.

In reality, the income effect represents its predominance over the substitution effect: This statement contradicts the commonly observed economic behavior where the substitution effect usually plays a larger role than the income effect in consumer choices.

Substitution and income effects cannot be separated easily: While academically challenging, this statement does not specifically highlight the significance or magnitude of the substitution effect compared to the income effect.

Q36: Arrange the following steps of a well planned experiment in the sequential order.

A. Specify the treatment levels

B. Assign subject to groups and conduct pilot test

C. Choose an experimental design suited to the hypotheses

D. Control the environmental and extraneous factors

E. Select relevant variables for testing

Choose the correct answer from the option given below:

(a) C, D, E, A, B

(b) A, C, D, E, B

(c) E, A, D, C, B

(d) D, C, B, A, E

Ans: C

Sol: Correct answer is E, A, D, C, B

Process of a well planned experiment

Select relevant variables for testing= Anything which is capable of assuming the different values is known as variables. The first step in the process of an experiment is to identify the variables which are required for testing. There are mainly two types of variables dependent and independent variables.

- Dependent variables = It is also called the outcome or response variables. This variable changes as a result of changes in the independent variables.

- Independent variables = It is also known as manipulated, experimental or treatment variable. They become the cause of change in another variable.

- In addition to these there are intervening and extraneous variables also. Intervening variables are those variables through which one variable affects another. Extraneous variable are those variable which affect the dependent variable and it needs to be controlled while conducting an experiment.

- Specify the treatment levels = The next step is specifying the treatment levels means how the independent variable should be manipulated in the experiment and also controlling the extraneous variable so that the experimenter can determine weather the dependent variable changes in relation to a variation in an independent variable.

- Chose the environmental and extraneous factors = Environmental and extraneous factors are those factors which can affect the dependent variable. Therefore the environmental and extraneous factors or the variable must be controlled so that the experimenter can determine weather the dependent variable changes in relation to a variation in an independent variable.

- Choosing an experimental design = In this step an experimenter will choose an experimental design suited to the hypothesis. There are many experimental design which he can choose like cross sectional study( data is collected only once in the research process), longitudinal study(data is collected at various points of time in the research study), experimental study( in this the independent variable is manipulated to see the changes in the dependent variable), Action research( to solve the problem immediately).