Past Year Questions: Accounting Process | Accounting for CA Foundation PDF Download

(i) Trade discount is recorded in the discount column in the triple-column cash book. (15 May 2025)

Answer: False. Discount column of cash book records the cash discount. Further, Trade discount is not shown in the Cash book/books of accounts.

(ii) A ledger is also known as the principal books of accounts. (12 Jan 2025)

Answer: True. Since it classifies all the amounts related to a particular account and then it is used as the base for preparing the trial balance, a ledger is also known as the principal books of accounts.

(iii) Customers of business should not be considered as users of accounts prepared by business. They are not interested in knowing the performance of the business. (12 Jan 2025)

Answer: False. Customers are concerned with the stability and profitability of the enterprise because their functioning is dependent on the supply of goods. Hence customers of business are users of accounts prepared by business.

(iv) Nominal Accounts are balanced at the end of the Accounting Year. (13 Sep 2024)

Answer: False. Nominal Accounts are not balanced. The balances at the end are transferred to Trading/ Profit & Loss A/c.

(v) Overhaul Expenses of a second-hand machinery purchased are Revenue Expenditure. (13 Sep 2024)

Answer: False. Overhaul expenses are incurred to put second-hand machinery in working condition to derive endurable long-term advantage. So, it should be capitalised.

(vi) If the amount is posted in the wrong account or it is written on the wrong side of the account, it is called an error of principle. (20 Jun 2024)

Answer: False. If the amount is posted in the wrong account or it is written on the wrong side of the account, it is called error of commission and not error of Principle.

(vii) All errors are rectified using journal entries. (20 Jun 2024)

Answer: False. Errors not affecting the trial balance can be rectified by passing a rectification journal entry. While other errors that affect one account of trial balance cannot be rectified by passing journal entries. Totaling errors cannot be rectified by passing journal entries

(viii) If Closing Stock appears in the Trial Balance then it does not enter in Trading Account. It is shown only in the Balance Sheet. (20 Jun 2024)

Answer: True. If closing stock appears in the trial balance then it is not entered in the trading account but it is shown only in the balance sheet because it has already been adjusted to purchase account.

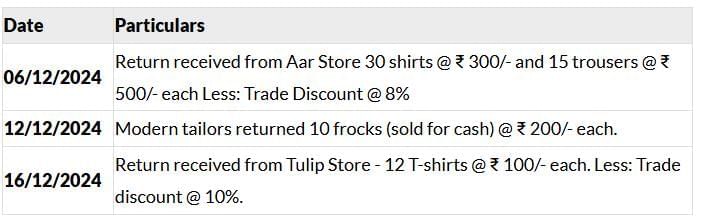

Q 2. From the following transactions, prepare the Sales Return Book of Kay & Co., a readymade garments dealer: (4 Marks, 12 Jan 2025)

Answer:

In the books of Kay & Co.

Returns Inward Book

Note: Returns of goods sold from modern tailors will not be included in return inward book as the sales were made in cash.

Note: Returns of goods sold from modern tailors will not be included in return inward book as the sales were made in cash.

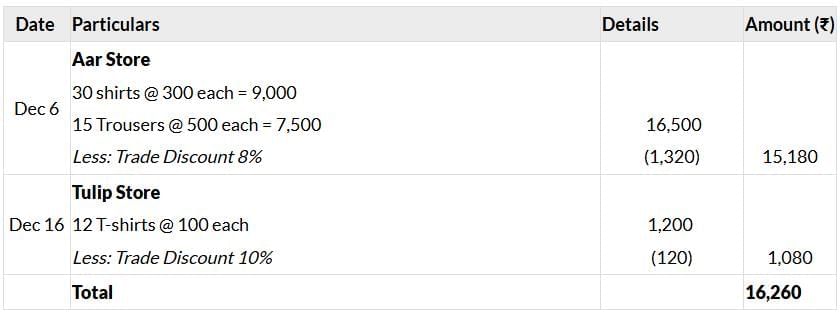

Q 3. Pass journal entries for the following transactions in the books of Mr. Kapil: (4 Marks, 20 Jun 2024)

(i) Purchased goods from Sonu for ₹ 1,50,000 at a trade discount of 10% plus CGST and SGST @ 6% each.

(ii) Sold goods to Mohit for ₹ 50,000 and charged CGST and SGST @ 5% each. Out of the amount due, 40% is received by cheque immediately.

(iii) Goods costing ₹ 25,000 withdrawn for personal use. Such Goods were purchased by paying CGST and SGST @ 6% each.

(iv) Machinery purchased from M/s Bright Industries for ₹ 2,00,000 plus CGST and SGST @ 9% each. Paid ₹ 1,00,000 immediately by cheque and balance to be paid after two months.

Answer:

Journal entries in the books of Mr. Kapil

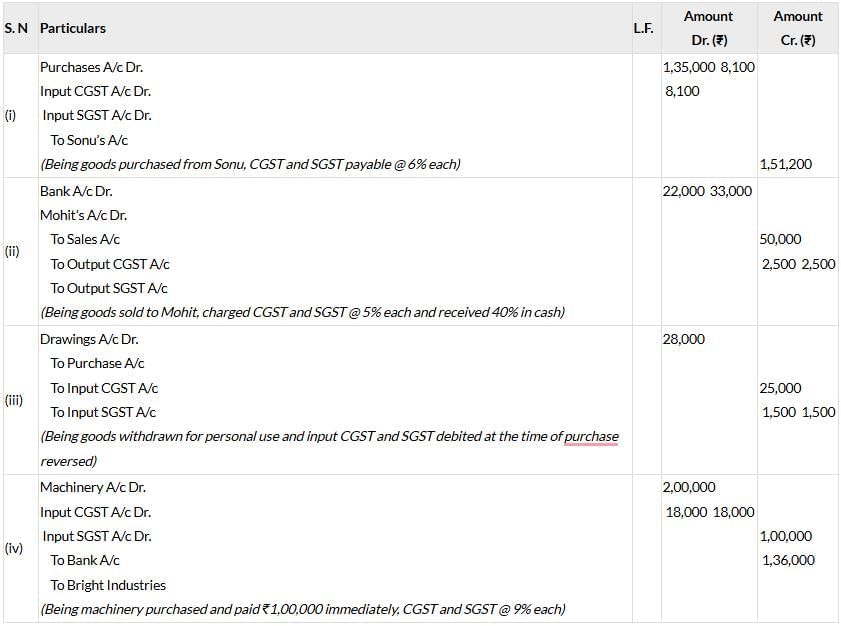

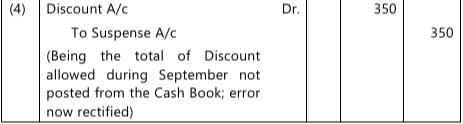

Q 4. Pass the necessary Journal entries to rectify the following errors, using a Suspense Account: (4 Marks, Sep 2024)

(i) Goods of the value of ₹ 500 returned by Mr. A were entered in the Sales Day Book and posted there from to the credit of his account.

(ii) ₹ 250 entered in the Sales Returns Book, has been posted to the debit of Mr. R, who returned the goods.

(iii) A sale of ₹ 700 made to Mr. Q was correctly entered in the Sales Day Book but wrongly posted to the debit of Mr. S as ₹ 70.

(iv) The total of "Discount allowed" Column in the Cash Book for September amounting to ₹ 350 was not posted.

Answer:

Journal

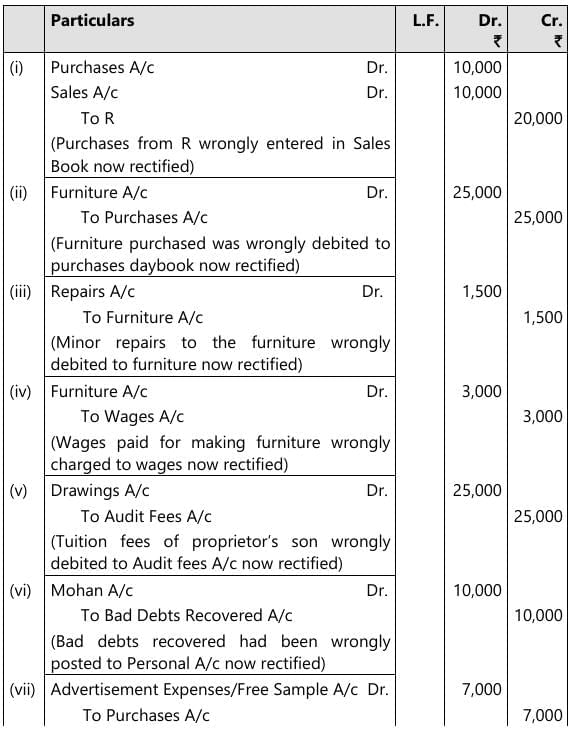

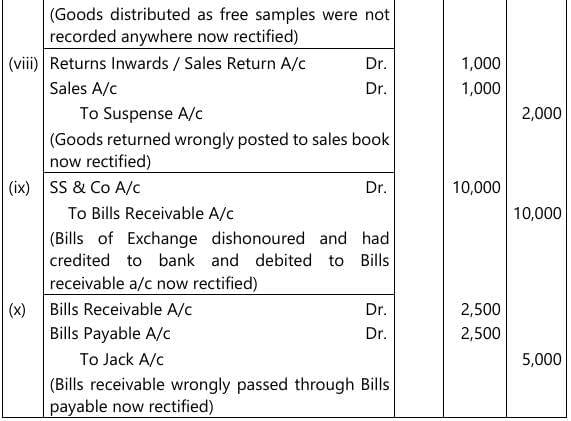

Q 5. The following errors were found in the books of XYZ. Give necessary entries to correct them: (10 Marks, 15 May 2025)

(i) A purchase of goods from R amounting to ₹ 10,000 has been wrongly entered through the sales book.

(ii) Furniture purchased for office use, amounting to ₹ 25,00,0 has been entered in the purchase day book.

(iii) Minor repairs to the Furniture Account amounting to ₹ 1,500 were debited to the Furniture Account.

(iv) Wages amounting to ₹ 3,000 paid to workmen for making Office Furniture have been charged as wages account.

(v) Tuition Fees of proprietor's son ₹ 25,000 has been debited to Audit fees A/c.

(vi) An amount of ₹ 10,000 due from Mohan which had been written off as bad debt in the previous year was unexpectedly recovered and has been posted to the personal account of Mohan.

(vii) Goods (Cost being ₹ 7,000 and sales price being ₹ 10,000) distributed as free samples among prospective customers were not recorded anywhere.

(viii) Goods amount to ₹ 1,000 returned by a customer, G & Co. were entered in the Sales Day Book and posted there from to the credit of his account.

(ix) A bill of Exchange (received from SS & Co.) for ₹ 10,000 had been returned by the bank as dishonoured and had been credited to the bank and debited to bills receivable account.

(x) A Bills Receivable for ₹ 2,500 was passed through Bills Payable Book. The Bill was given by Jack.

Answer:

In the books of XYZ

Journal

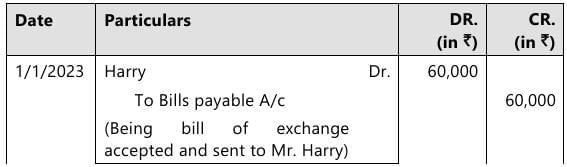

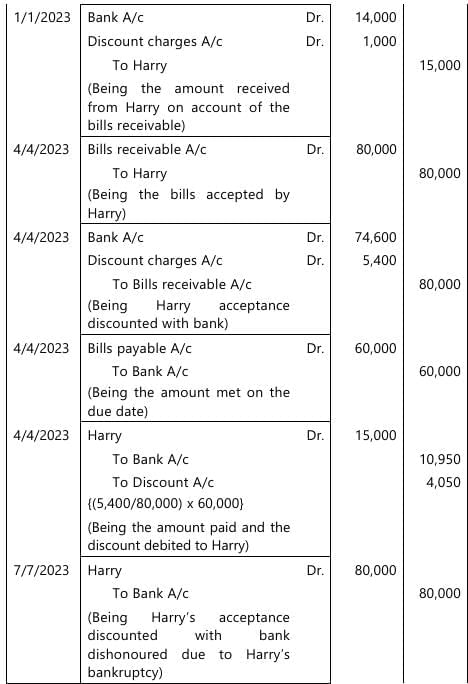

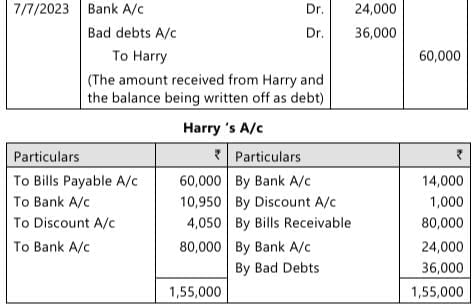

Q 6. Harry draws a bill on Sejal for ₹ 60,000 on 01.01.2023 for 3 months. Sejal accepts the bill and sends it back to Harry to get it discounted for ₹ 56,000. Harry remits 1/4th amount to Sejal. On the due date, Harry was unable to remit his share to Sejal, rather accepts a bill of ₹ 80,000 for 3 months. This bill was discounted by Sejal for ₹ 74,600. Sejal after making the payment of first bill sent 3/4th of the amount remaining to Harry. On maturity of the bill, Harry became bankrupt and his estate paying 40 paise in the rupee.

Give journal entries in the books of Sejal. Also prepare ledger account of Harry. All workings should form part of the answer. (10 Marks, 13 Sep 2024)

Answer:

In the books of Sejal Journal Entries

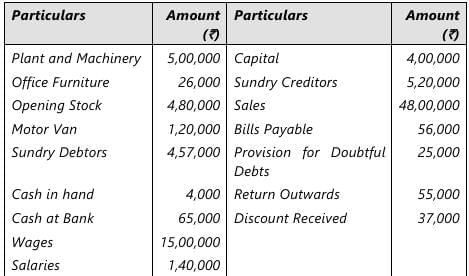

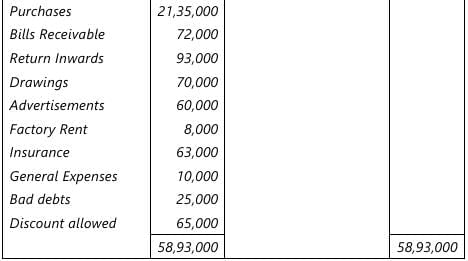

Q 7. The following Trial Balance is the Trial Balance of a Proprietor as on March 31st 2024. Prepare Trading and Profit & Loss Account for the year ending March 31st 2024 and a Balance Sheet as at that date. 10 Marks

Additional Information to be considered:

(i) Closing Stock on March 31st 2024 is ₹ 5,20,000.

(ii) During the year, Plant and Machinery was purchased for ₹ 3,00,000 but it was debited to Purchase Account.

(iii) 3 months factory rent is due but not paid ₹ 3,000.

(iv) Provide depreciation at 5% per annum on furniture and 10% on plant and machinery and motor van.

(v) Further bad debts ₹ 7,000.

(vi) Provision for doubtful debts to be increased to ₹ 30,000 at year-end.

(vii) Provision for discount on Debtors to be made at 2%.

Answer:

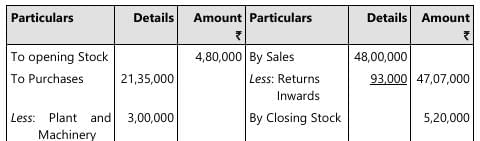

Trading Account for the year ended 31st March, 2024

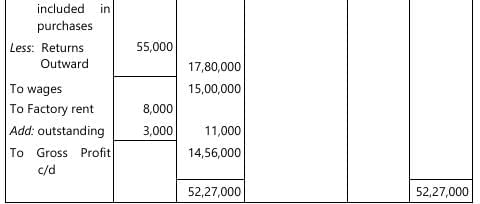

Profit and Loss Account for the year ended 31st March, 2024  Balance Sheet as at 31st March, 2024

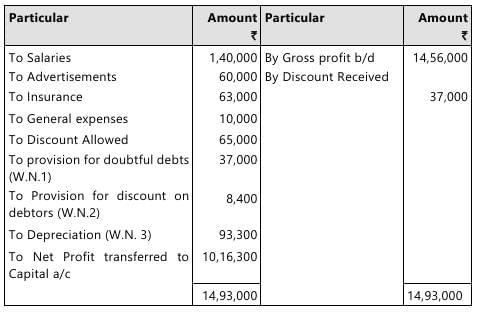

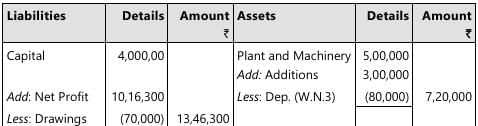

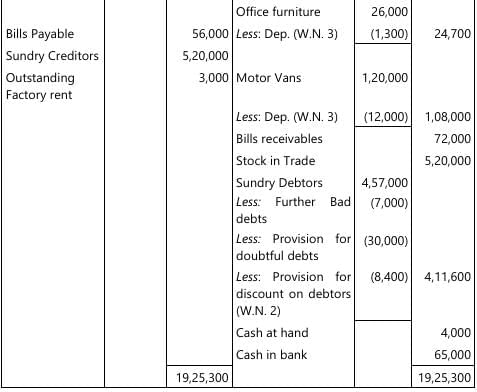

Balance Sheet as at 31st March, 2024

Q 8. The Trial Balance of Mr. Sarvesh Kumar as on 31 March, 2024 did not tally and the difference was posted to Suspense Account. On a scrutiny of the books, the following errors were detected: (12 Marks, 20 Jun 2024)

(i) The total of Sales Returns Book for January 2024 has been cast short by ₹ 1,000.

(ii) Freight paid for installation of a Machine, ₹ 8,500, was posted to the Freight Account as ₹ 5,600.

(iii) Goods of the value of ₹ 2,500 returned by a customer were entered in the Sales Day Book and posted therefrom to the credit of his account.

(iv) ₹ 18,000 paid for the purchase of an old Motorcycle for the personal use of Mr. Sarvesh Kumar was debited to the conveyance account.

(v) A purchase of ₹ 6,700 had been posted to the creditor’s account as ₹ 6,000.

(vi) Receipt of cash ₹ 5,000 from Mr. Avinash was posted to the debit of his account.

(vii) A cheque for ₹ 2,500 received from Mr. Alok had been dishonoured and was posted to the debit of Mr. Ashok.

(viii) Sale of ₹ 8,500 to Mr. Deepak was recorded in the sales book correctly but while posting in ledger credited to his account.

(ix) The total of "Discount Allowed" column in the cash book for December 2023 amounting to ₹ 3,800 was not posted.

(x) Sale of old office table for ₹ 2,200 treated as sale of goods.

You are required to pass the necessary journal entries with narrations to rectify the above errors.

Answer:

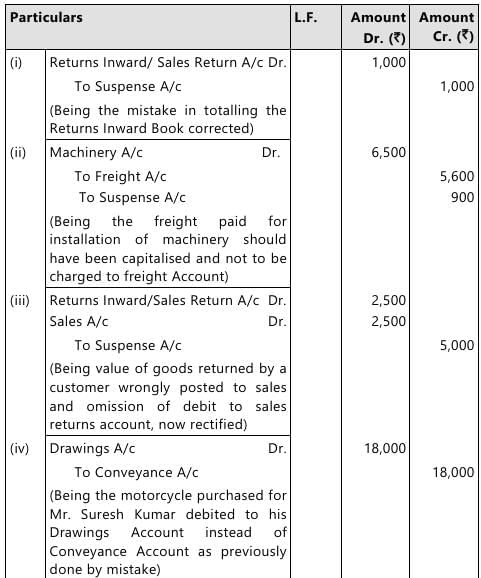

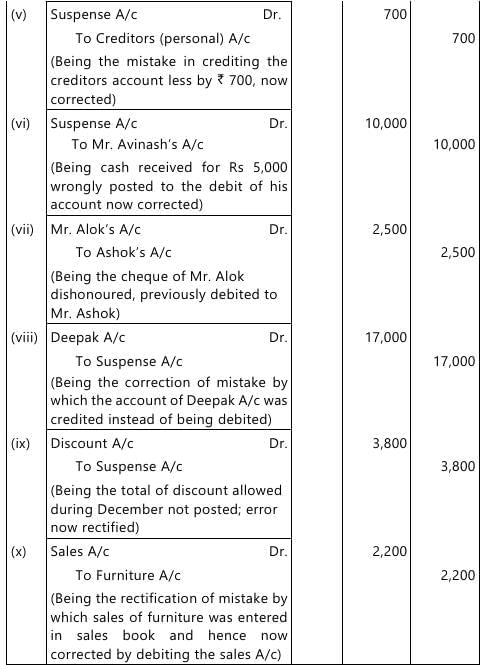

Journal Entries in the Books of Mr. Sarvesh Kumar

Q 9. What are the advantages of Subsidiary Books? (5 Marks, 20 Jun 2024)

(i) Division of work: Since in the place of one journal there will be so many subsidiary books, the accounting work may be divided amongst a number of clerks.

(ii) Specialization and efficiency: When the same work is allotted to a particular person over a period of time, he acquires full knowledge of it and becomes efficient in handling it. Thus, the accounting work will be done efficiently.

(iii) Saving of the time: Various accounting processes can be undertaken simultaneously because of the use of a number of books. This will lead to the work being completed quickly.

(iv) Availability of information: Since a separate register or book is kept for each class of transactions, the information relating to each class of transaction be available at one place.

(v) Facility in checking: When the trial balance does not agree, the location of the error or errors is facilitated by the existence of separate books. Even the commission of errors and frauds will be checked by the use of various subsidiary books.

|

68 videos|375 docs|83 tests

|

FAQs on Past Year Questions: Accounting Process - Accounting for CA Foundation

| 1. What is the accounting process in the context of financial reporting? |  |

| 2. How does double-entry bookkeeping work in the accounting process? |  |

| 3. What are the primary financial statements prepared at the end of the accounting process? |  |

| 4. What role do journals and ledgers play in the accounting process? |  |

| 5. Why is the trial balance important in the accounting process? |  |