Past Year Questions: Bank Reconciliation Statement | Accounting for CA Foundation PDF Download

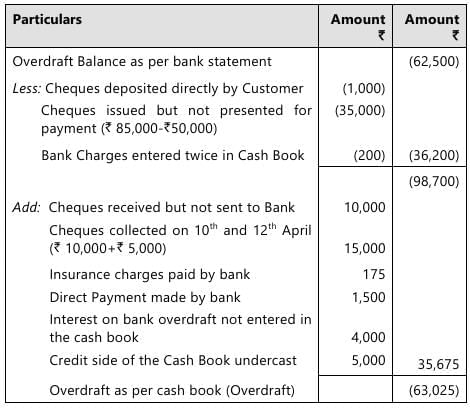

(i) The Bank Pass Book had a debit balance of ₹ 62,500 on 31st March, 2025.

(ii) A cheque worth ₹ 1,000 directly deposited into Bank by customer but no entry was made in the Cash Book.

(iii) Out of cheques issued worth ₹ 85,000, cheques amounting to ₹ 50,000 only were presented for payment till 31st March, 2025.(iv) A cheque for ₹ 10,000 received and entered in the Cash Book but it was not sent to the Bank.

(v) Cheques worth ₹ 50,000 had been sent to Bank for collection but the collection was reported by the Bank as under:

(1) Cheques collected before 31st March, 2025, ₹ 35,000.

(2) Cheques collected on 10th April, 2025, ₹ 10,000.

(3) Cheques collected on 12th April, 2025, ₹ 5,000.

(vi) The Bank made a direct payment of ₹ 1,500 which was not recorded in the Cash Book.

(vii) Interest on Overdraft charged by the bank ₹ 4,000 was not recorded in the Cash Book.

(viii) Bank charges worth ₹ 200 have been entered twice in the cash book whereas Insurance charges for ₹ 175 directly paid by Bank was not at all entered in the Cash Book.

(ix) The credit side of bank column of the Cash Book was under cast by ₹ 5,000.

Answer:

Bank Reconciliation Statement as on 31st March, 2025

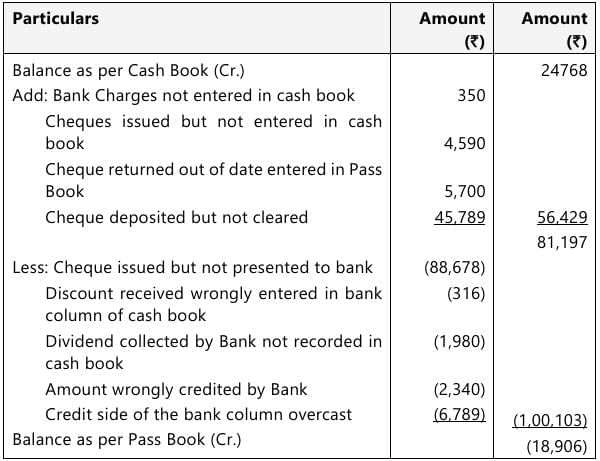

Q 2. From the following information, prepare a Bank Reconciliation Statement as on June 30, 2024 for M/s XYZ Limited: (10 Marks, Jan 2025)

(i) The Bank column of Cash Book was overdrawn to the extent of ₹ 24,768.

(ii) Bank charges amounting to ₹ 350 had not been entered in the Cash Book.

(iii) Cheque amounting to ₹ 88,678 issued before June 30, 2024 but not yet presented to Bank.

(iv) One payment of ₹ 4,590 was recorded in the Cash Book as if there is no bank column.

(v) The company paid ₹ 15,500 to a creditor and received a cash discount @ 2%. The cashier erroneously entered the gross amount in the bank column of the Cash Book.

(vi) A debit of ₹ 5,700 appeared in the Bank Statement for an unpaid cheque, which had been returned marked 'out of date'. The cheque had been re-dated by the customer and paid into the Bank again on July 8, 2024.

(vii) Cheques deposited in bank but not yet cleared amount to ₹ 45,789.

(viii) Dividends of ₹ 1,980 collected by the Bank was not recorded in the Cash Book.

(ix) Amount of ₹ 2,340 wrongly credited by bank to company account for which no details are available.

(x) On June 25, 2024 the credit side of bank column of the Cash Book was overcast by ₹ 6,789.

Answer:

Bank Reconciliation Statement of M/s XYZ Limited as on June 30, 2024

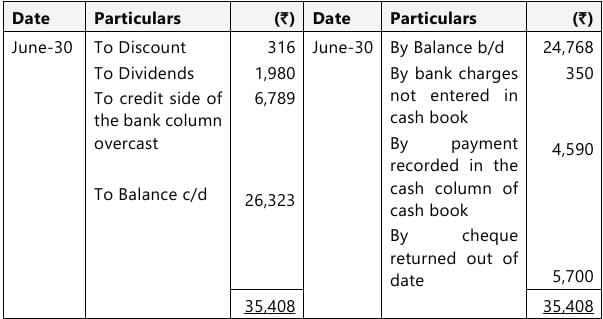

Cash Book (Bank Column only)

Cash Book (Bank Column only)

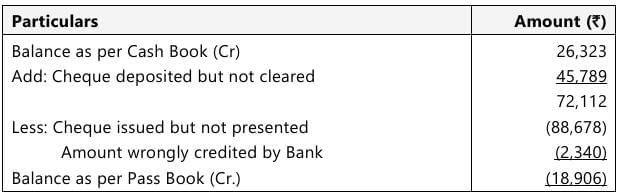

Bank Reconciliation Statement as on June 30, 2024

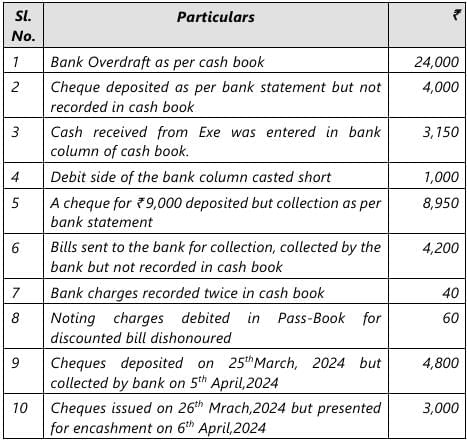

Q 3. From the following particulars, prepare the Bank Reconciliation Statement of a businessman as on 31st March, 2024: (10 Marks, Jun 2024)

You are required to prepare the Bank Reconciliation Statement as on 31st March, 2024.

Answer:

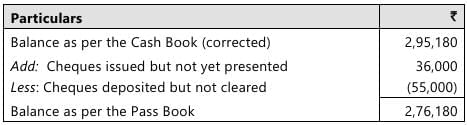

Bank Reconciliation Statement as on 31st March,2024

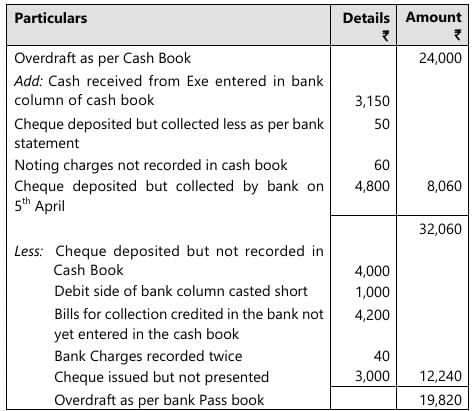

(i) A dividend of ₹ 18,000 was deposited in the bank of which Hari had no information.

(ii) A cheque was issued to Suresh of ₹ 14,780 on 18.12.2023 which was recorded in cash book as ₹ 14,870.

(iii) Cheques totalling of ₹ 55,000 were deposited into bank on 30.12.2023 which were not cleared until 31.12.2023.

(iv) Mediclaim premium of ₹ 14,160 was paid as per the standing instruction of Hari which was not recorded in cash book.

(v) Goods amounting ₹ 1,60,000 were sold to Ajay in November 2023. He deposited cheque on 15.12.2023 after deducted 4% cash discount. This entry was missed while preparing cash book.

(vi) Bank charges for issue of cheque book ₹ 150 was skipped while preparing cash book.

(vii) Hari received a UPI of ₹ 1,000 on 29.12.2023 for sale of scrap which was not entered in cash book.

(viii) Cheques amounting to ₹ 1,80,000 were issued during the month but cheques of ₹ 1,44,000 were only presented during the month for payment.

Prepare Bank Reconciliation Statement on 31.12.2023 and ascertain balance as per pass book.

Answer:

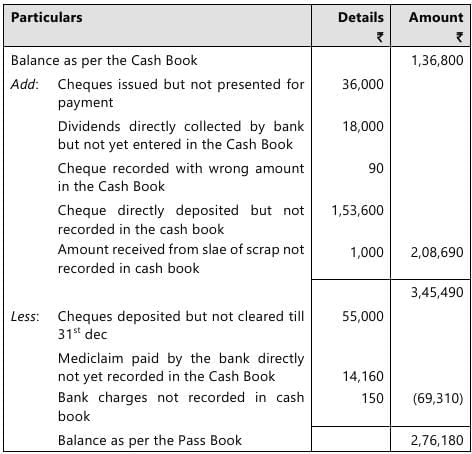

Bank Reconciliation Statement of Mr. Hari as on 31st Dec., 2023  Cash Book (Bank Column)

Cash Book (Bank Column)

Bank Reconciliation Statement of Mr. Hari as on 31st Dec., 2023

|

68 videos|265 docs|83 tests

|

FAQs on Past Year Questions: Bank Reconciliation Statement - Accounting for CA Foundation

| 1. What is a Bank Reconciliation Statement and why is it important? |  |

| 2. What are the common items that cause discrepancies in bank reconciliation? |  |

| 3. How do you prepare a Bank Reconciliation Statement? |  |

| 4. What is the significance of reconciling bank statements regularly? |  |

| 5. What are the typical time frames for reconciling bank statements? |  |