Past Year Questions: Preparation of Final Accounts of Sole Proprietors | Accounting for CA Foundation PDF Download

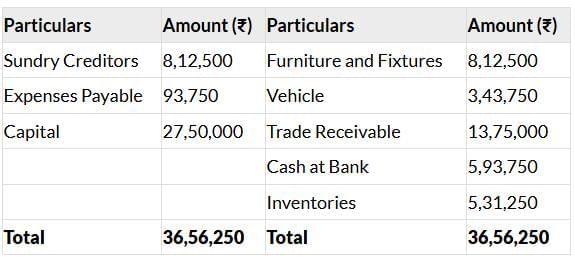

Q 1. The balance sheet of ABC as on 1st April, 2024 was as follows: (10 Marks, May 2025)

During 2024-25, his Profit and Loss Account revealed a net profit of ₹ 8,37,500. This was after allowing for the following:

(i) Commission paid to selling agent ₹ 81,250

(ii) Discount received from creditors ₹ 93,750

(iii) Purchased a vehicle of ₹ 62,500 on 31st March, 2025

(iv) Depreciation on Furniture and Fixtures @ 10% and on Vehicle @ 20%.

(v) A provision for doubtful debts @ 3% of the trade receivables as at 31st March, 2025, but while preparing the Profit and Loss Account he had forgotten to provide for:

(1) Prepaid expenses ₹ 18,750 and

(2) Outstanding commission ₹ 43,750.

His current assets and liabilities on 31st March, 2025 were: Inventories ₹ 8,12,500, Trade Receivables ₹ 16,25,000 (before provision for doubtful debts), Cash at Bank ₹ 6,87,500 and Trade Payables ₹ 1,82,500. During the year he introduced further capital of ₹ 3,75,000 into the business.

You are required to prepare the balance sheet as at March 31, 2025.

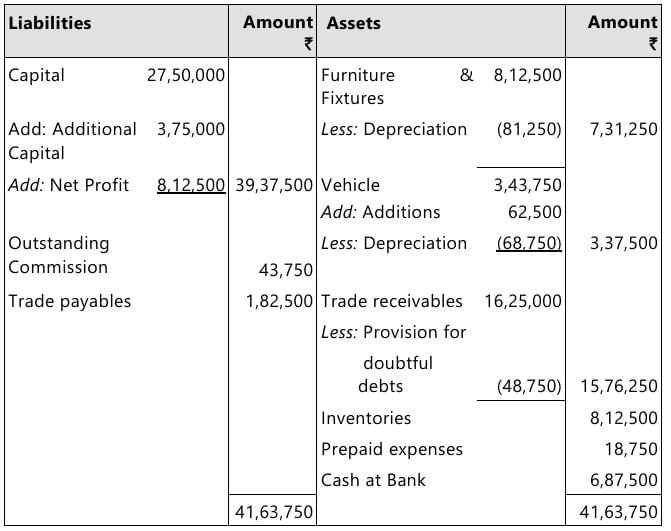

Answer: Balance Sheet of ABC as at 31st March, 2025

Working Note:

Profit and Loss Account of ABC (Revised)

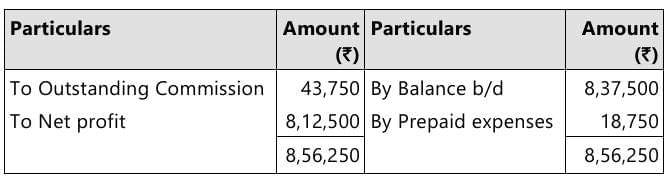

Q 2. From the following schedule of balances extracted from the books of Mr. Piyush, prepare Trading and Profit and Loss Account for the year ended 31st March, 2024 and the Balance Sheet as on that date after making the necessary adjustments: (15 Marks, Jan 2025)

Adjustments:

(i) The value of stock as on 31st March, 2024 is ₹ 7,65,000. This includes goods returned by customers on 31st March, 2024 to the value of ₹ 25,000 for which no entry has been passed in the books.

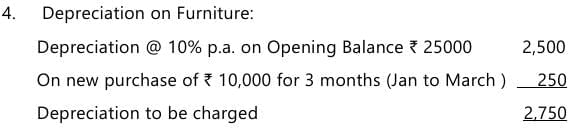

(ii) Purchases include one furniture item purchased on 1st January, 2024 for ₹ 10,000. Depreciation @ 10% p.a. is to be provided on furniture.

(iii) One months' rent is outstanding and ₹ 12,000 is payable towards salary.

(iv) Interest paid includes ₹ 9,000 paid against Bank loan and Interest received pertains to Investments and Deposits.

(v) Provide for interest payable on Bank Loan and interest receivable on investments and deposits.

(vi) Make provision for doubtful debts at 5% on the balance under sundry debtors.

(vii) Insurance premium includes ₹ 18,000 paid towards proprietor's life insurance policy.

Answer: In the books of Mr. Piyush

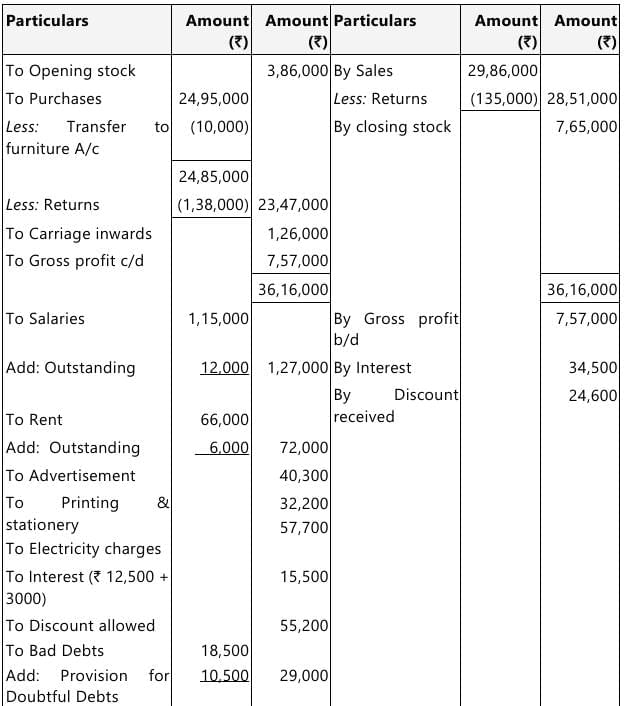

Trading and Profit & Loss Account for the year ended 31st March,2024

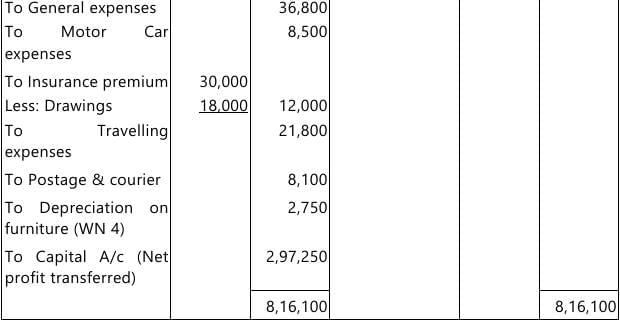

Balance Sheet as at 31st March,2024

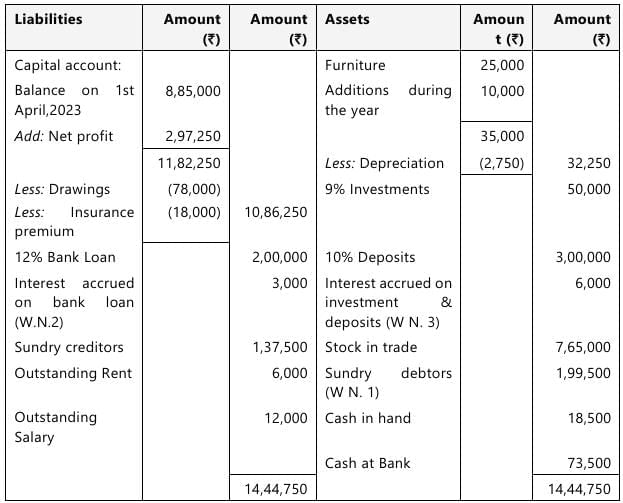

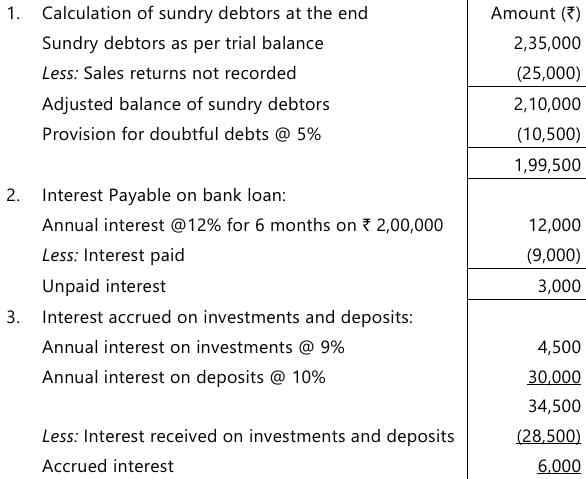

Working Notes:

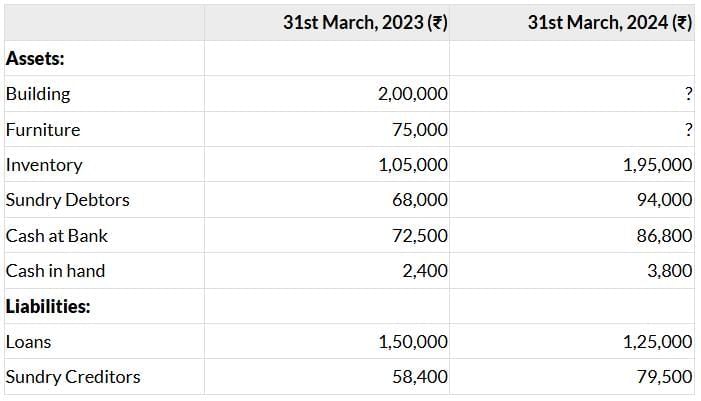

Q 3. Following are the details of Assets and Liabilities of Mr. Sarthak for the year ended 31st March, 2023 and 31st March, 2024: (5 Marks, Jan 2025)

It was decided to depreciate Building by 5% p.a. and Furniture by 10% p.a. On 1st June, 2023 an additional capital of ₹ 40,000 was brought in the business. Proprietor has withdrawn @ ₹ 2,500 p.m. for meeting the family expenses.

Prepare Statement of Affairs as on 31st March, 2023 and 31st March, 2024. Find the profit or loss earned by Mr. Sarthak for the year ended 31st March, 2024.

Answer:

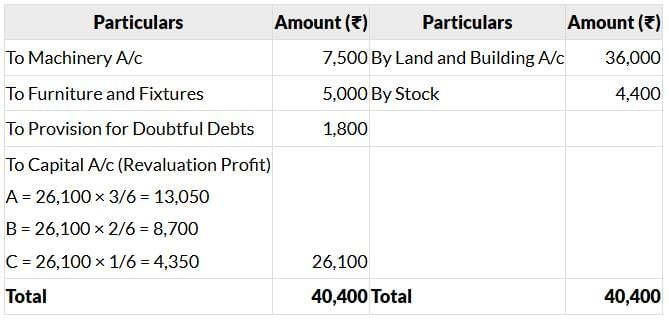

Revaluation Account

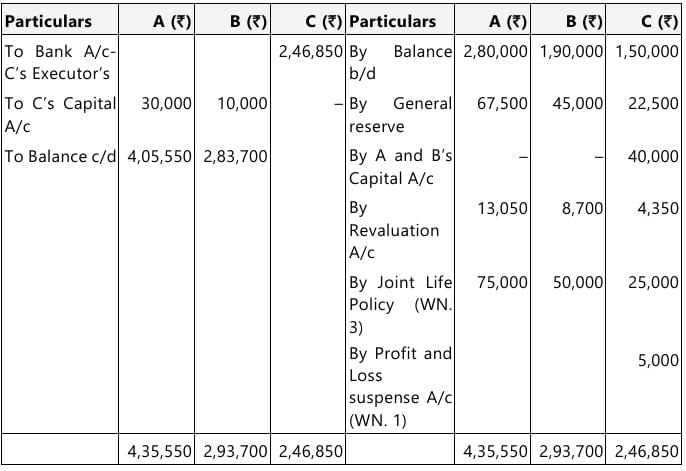

Partners’ Capital Accounts

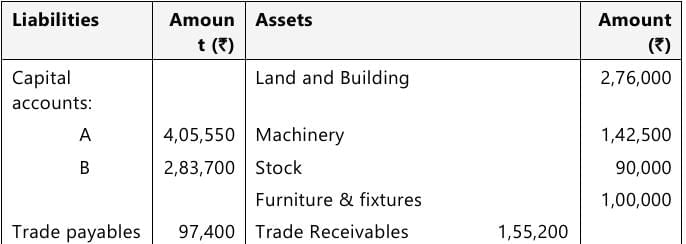

Partners’ Capital Accounts  Balance Sheet of M/s ABC as at 30th June,2024

Balance Sheet of M/s ABC as at 30th June,2024

Working Note:

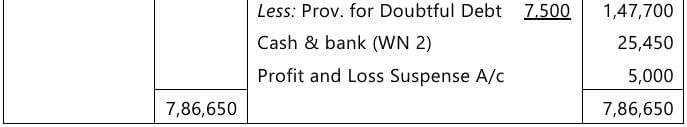

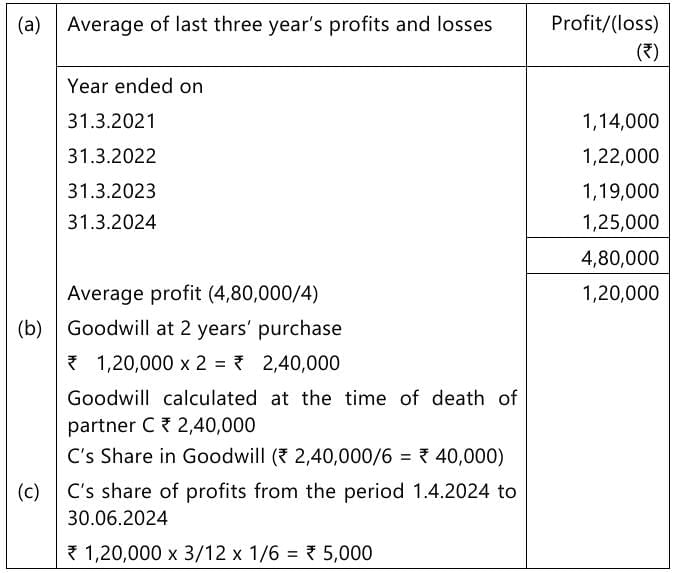

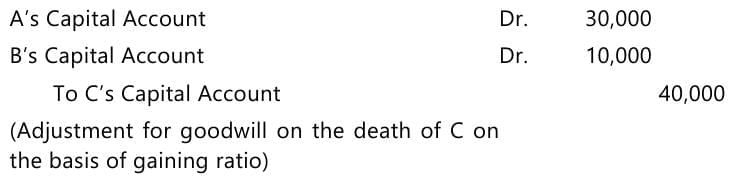

1. Calculation of goodwill and C’s share of profit Calculation of Gaining Ratio

Calculation of Gaining Ratio  Adjusting entry:

Adjusting entry:

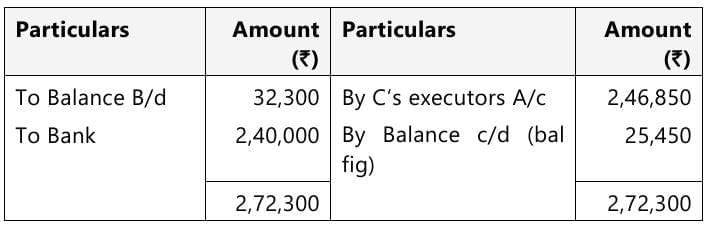

2. Bank A/c Alternatively, the balance of Bank A/c can also be ascertained in statement form.

Alternatively, the balance of Bank A/c can also be ascertained in statement form.

3. The Joint life policy is calculated on the basis of surrender value method- where in the amount shown in the balance sheet shall be deducted from the JLP proceeds received from the insurance co, on the death of a partner.

Hence the calculations will be ₹ 2,40,000- 90,000 (Balance Sheet value) = ₹ 1,50,000 (divided in profit sharing ratio between the partners.)

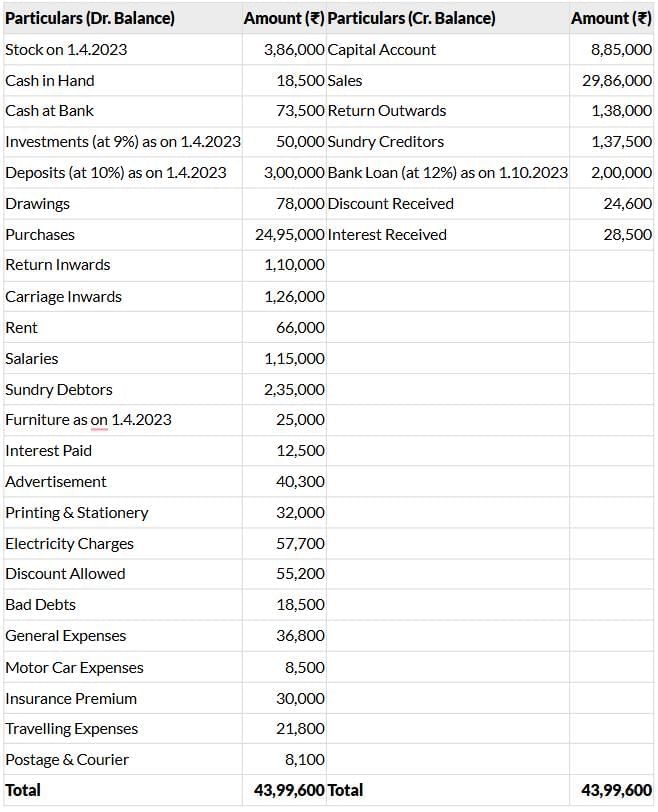

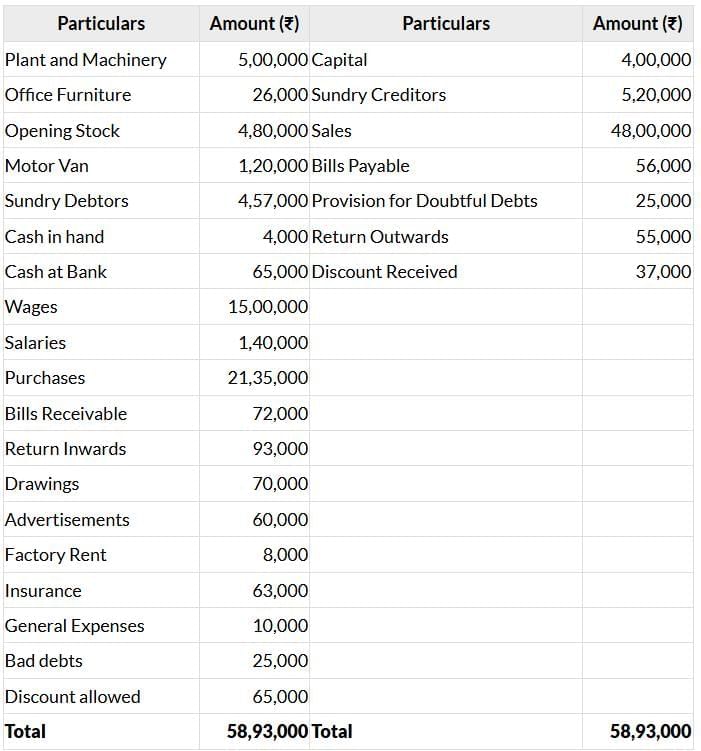

Q 4. The following Trial Balance is the Trial Balance of a Proprietor as on March 31st 2024. Prepare Trading and Profit & Loss Account for the year ending March 31st 2024 and a Balance Sheet as at that date. (10 Marks, Sep 2024)

Additional Information to be considered:

(i) Closing Stock on March 31st 2024 is ₹ 5,20,000.

(ii) During the year, Plant and Machinery was purchased for ₹ 3,00,000 but it was debited to Purchase Account.

(iii) 3 months factory rent is due but not paid ₹ 3,000.

(iv) Provide depreciation at 5% per annum on furniture and 10% on plant and machinery and motor van.

(v) Further bad debts ₹ 7,000.

(vi) Provision for doubtful debts to be increased to ₹ 30,000 at year-end.

(vii) Provision for discount on Debtors to be made at 2%.

Answer:

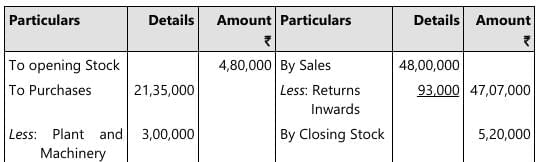

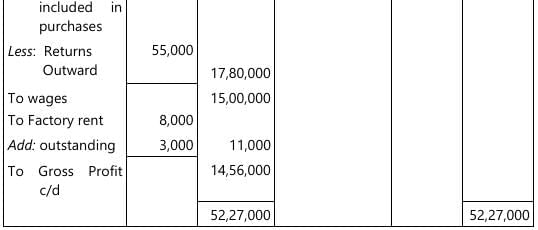

Trading Account for the year ended 31st March, 2024

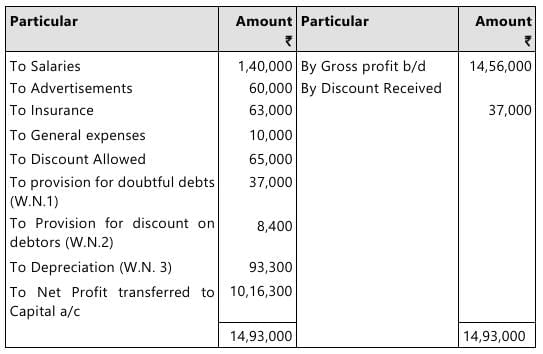

Profit and Loss Account for the year ended 31st March, 2024

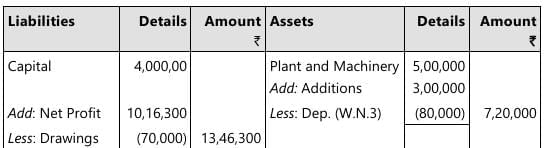

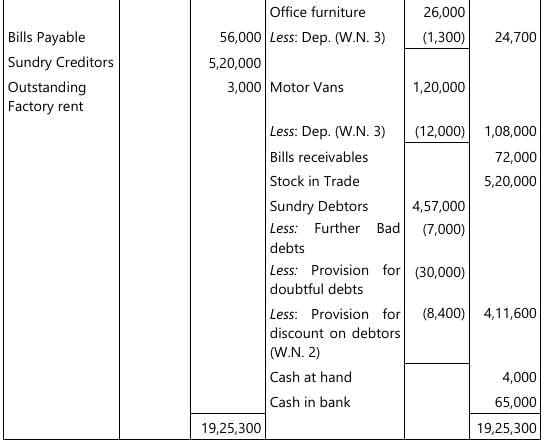

Balance Sheet as at 31st March, 2024

Working Notes :

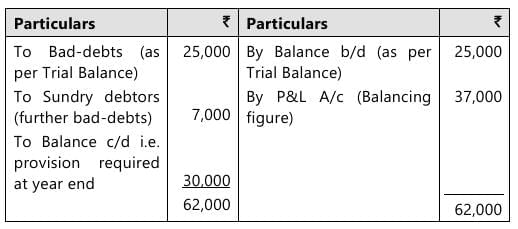

(1) Provision for Bad and Doubtful Debts Account

(2) Provision for discount on debtors

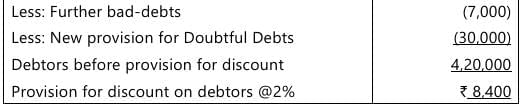

(3) Depreciation  *Purchase of plant and machinery during the year for ₹ 3,00,000 which was wrongly debited to purchase now added to Plant and Machinery.

*Purchase of plant and machinery during the year for ₹ 3,00,000 which was wrongly debited to purchase now added to Plant and Machinery.

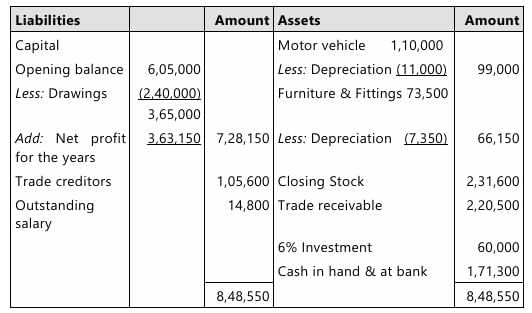

Q 5. Harshit Traders are carrying on the retail business of electrical goods. They keep their books of account under a single-entry system. The Balance Sheet as on 31st March, 2023 was as follows: (8 Marks, Jun 2024)

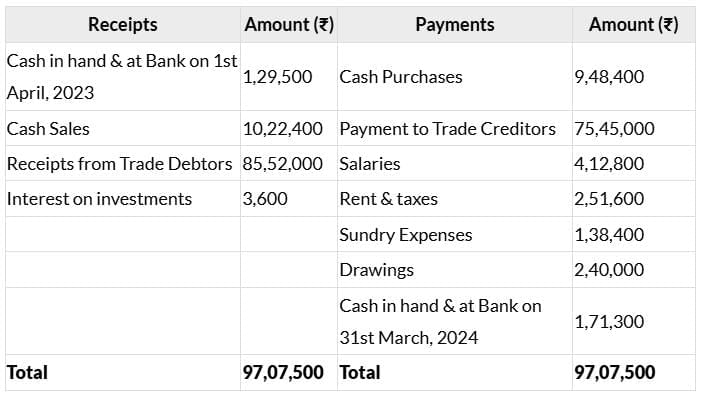

The summary of Cash and Bank Book for the year ended 31st March, 2024 was given as below:

Additional Information:

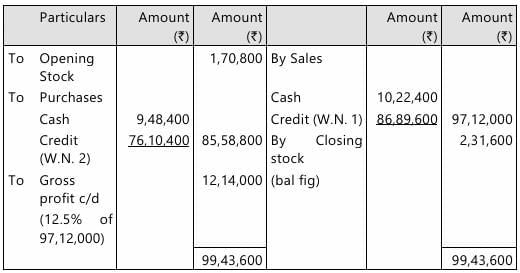

(i) Gross Profit ratio of 12.5% on Sales is maintained throughout the year.

(ii) During the year, discount allowed to Trade debtors was for ₹ 62,500 and discount received from Trade Creditors amounted to ₹ 35,000.

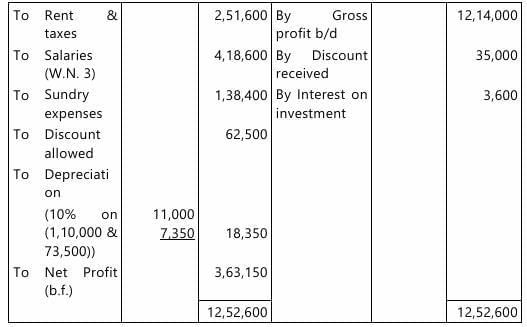

(iii) As on 31st March, 2024, the closing balances of Trade Debtors and Trade Creditors were ₹ 2,20,500 and ₹ 1,05,600 respectively.

(iv) On 31st March, 2024 an amount of ₹ 14,800 was outstanding towards Salary.

(v) Depreciation @ 10% p.a. to be charged on Motor Vehicle and Furniture.

You are required to prepare Trading and Profit & Loss account for the year ended 31st March 2024, and Balance Sheet as on that date.

Answer: In the books of Harshit Traders

Trading and Profit and Loss Account for the year ended 31st March, 2024

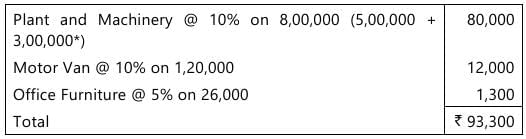

Balance Sheet as at 31st March, 2024

Balance Sheet as at 31st March, 2024

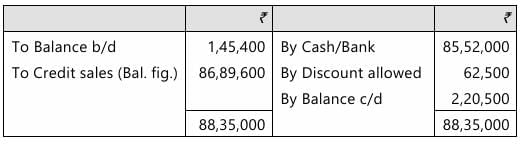

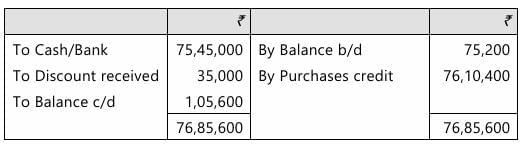

Working Notes:

1. Trade Debtors Account  2. Trade Creditors Account

2. Trade Creditors Account

3. Computation of salary to be charged to Profit & Loss A/c

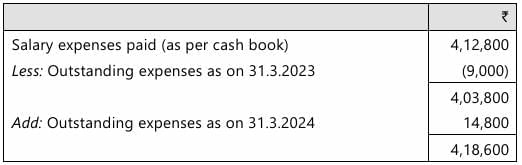

Q 6. The following information relates to Mr. Prem, who maintains his books under a single-entry system. He is not able to ascertain the amount of bad debts incurred by him and seeks your help.

Debtors as on 01.04.2023 ₹ 6,50,000

Debtors as on 31.03.2024 ₹ 8,50,000

Sale for FY 2023-2024 is 16,00,000 out of which 80% is on credit.

Payment received during the year is ₹ 7,50,000 out of which cheques of ₹ 18,000 were dishonoured. Bills of exchange accepted by customers ₹ 2,90,000.

Discount allowed is 1% of the credit sale.

You are required to ascertain the amount of bad debts. (5 Marks, Sep 2024)

Answer: Debtors Account

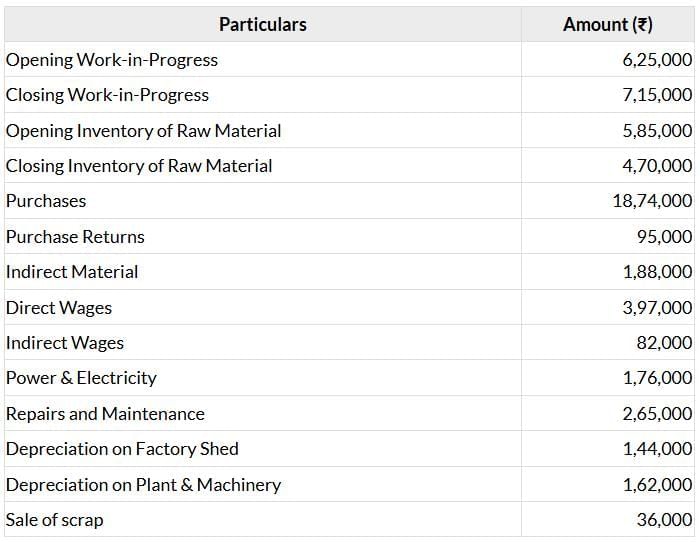

Q 7. Mr. Prakash runs a factory which produces Pressure Cookers. The following details were obtained about his manufacturing expenses for the year ended 31st March 2024:(5 Marks, Jun 2024)

You are required to prepare the Manufacturing Account for the year ended 31st March, 2024.

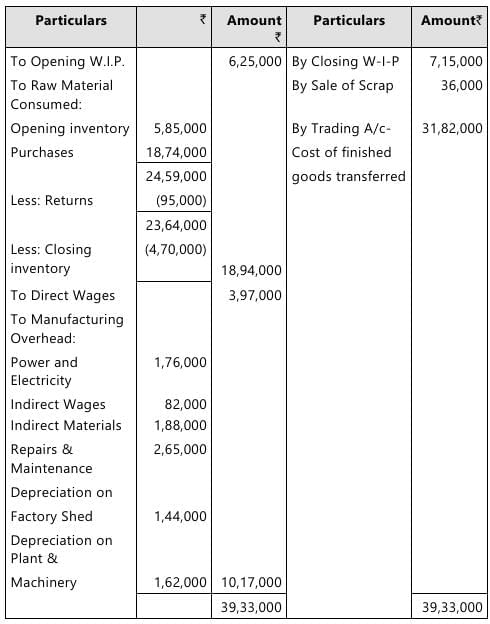

Answer: In the Books of Mr. Prakash

Manufacturing Account for the year ended on March 31,2024

|

68 videos|265 docs|83 tests

|

FAQs on Past Year Questions: Preparation of Final Accounts of Sole Proprietors - Accounting for CA Foundation

| 1. What are the key components of the final accounts of a sole proprietor? |  |

| 2. How do you prepare a Trading Account for a sole proprietor? |  |

| 3. What is the importance of the Profit and Loss Account in final accounts? |  |

| 4. How is the Balance Sheet structured for a sole proprietor? |  |

| 5. What adjustments might be necessary before finalizing the accounts of a sole proprietor? |  |