Sure Shot Questions: Accounting for Partnerships: Basic Concepts | Accountancy Class 12 - Commerce PDF Download

Based on a careful analysis of the previous years' questions and trends, we've put together a list of questions that are most likely to appear in the Class 12 Accountancy Board exams. These predictions aren’t just guesses—they’re based on how often these questions show up and how CBSE usually frames its papers.

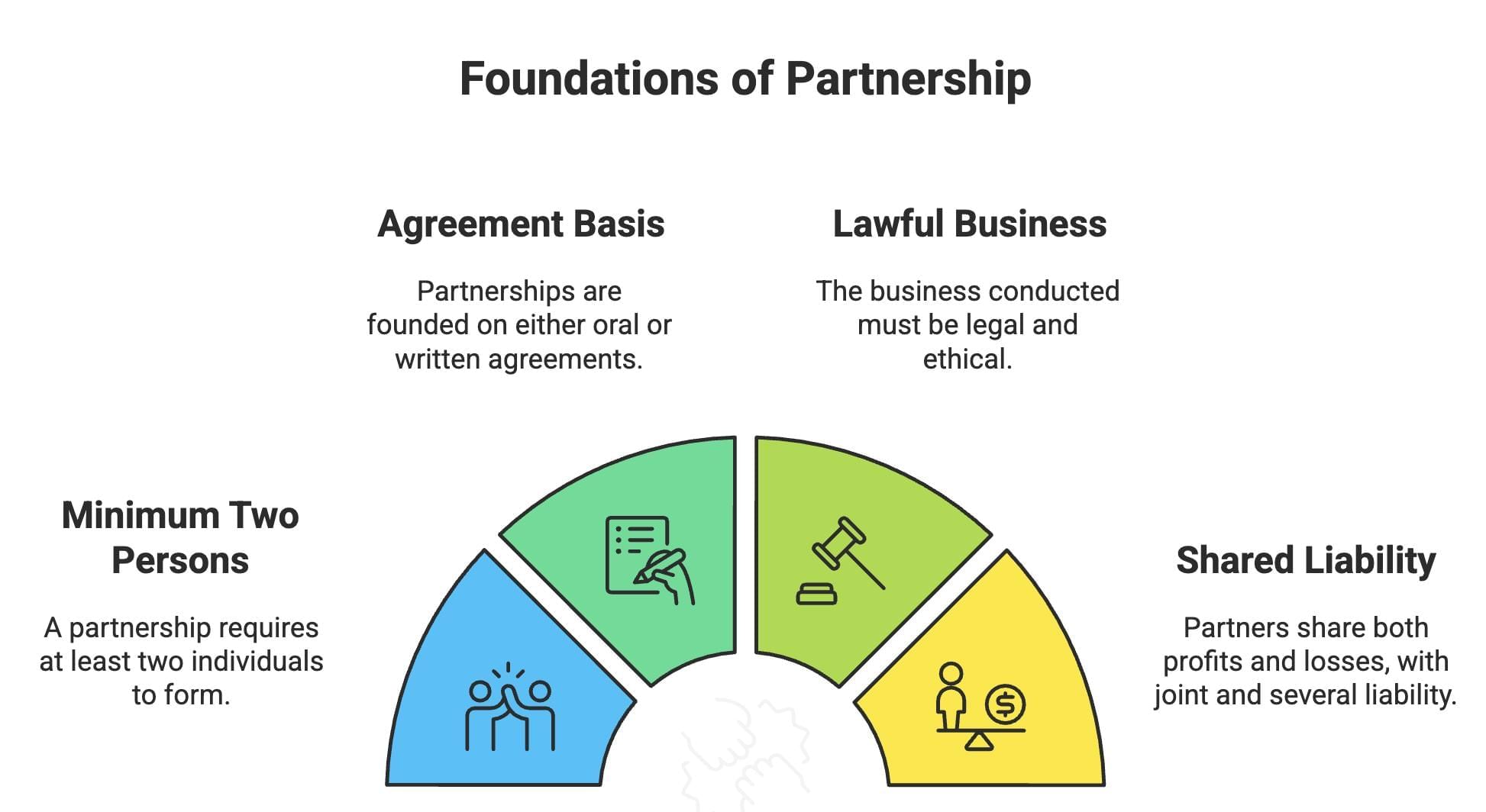

Q1: Define partnership and list its four main features.

Ans: Partnership is a relationship between two or more individuals who agree to conduct a business and share its profits and losses. Four main features are:

- Requires at least two persons.

- Based on an agreement (oral or written).

- Involves a lawful business.

- Partners share profits and losses and have joint and several liability.

Q2: What is a partnership deed, and why is it important to have it in writing?

Ans: A partnership deed is a written document outlining the terms and conditions of a partnership, including profit-sharing ratios, capital contributions, and duties. It is important in writing to: (a) Provide clear guidance in resolving disputes. (b) Serve as legal evidence in court, preventing misunderstandings.

Q3: Assertion (A): Partners share profit and losses equally.

Reason (R): Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.

Ans: (d) Assertion (A) is false, but Reason (R) is true. Partners share profits and losses as per the partnership deed, not necessarily equally. If no deed exists, the Indian Partnership Act, 1932, mandates equal sharing. The reason correctly defines a partnership but does not explain equal sharing.

Q4: Assertion (A): The Secret Partner does not participate in the affairs of the management.

Reason (R): The secret partner is not liable to pay debts of the firm.

Ans: (c) Assertion (A) is true, but Reason (R) is false. A secret partner does not participate in management but is liable for the firm’s debts, as all partners share joint and several liability under the Indian Partnership Act, 1932.

Q5: Assertion (A): A minor may become a partner with the consent of all the partners.

Reason (R): A minor partner can share profits and losses as per the agreement but is not liable to pay the debts of the partnership firm.

Ans: (b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A). A minor can be admitted with all partners’ consent and can share profits, but their liability is limited to their investment, not extending to personal assets. The reason does not fully explain the assertion.

Q6: What is meant by fixed and fluctuating capital of partners?

Ans: Fixed Capital: Capital remains unchanged unless additional capital is introduced or permanently withdrawn, recorded in a separate Capital Account, with other transactions in the Current Account. Fluctuating Capital: Capital changes with each transaction (e.g., drawings, profits), recorded in a single Capital Account that reflects all adjustments.

Q7: How is interest on drawings calculated for equal amounts withdrawn at the end of each month?

Ans: Interest on drawings for equal amounts withdrawn at the end of each month is calculated using an average period of 5.5 months. Formula: Interest = Total Drawings × Rate × 5.5 / (100 × 12). Example: For ₹1,20,000 withdrawn at 8% p.a., Interest = ₹1,20,000 × 8 × 5.5 / (100 × 12) = ₹4,400.

Q8: Assertion (A): When the partners put in additional capital, it is recorded in the credit side of the Current Account.

Reason (R): The Current Account records all the transactions relating to the interest on capital, drawings, commissions to partners, etc. when the capital is to remain fixed.

Ans: (d) Assertion (A) is false, but Reason (R) is true. Additional capital is credited to the Capital Account, not the Current Account, even in the fixed capital method. The reason correctly states that the Current Account records transactions like interest and drawings.

Q9: Chhavi and Neha were partners sharing profits equally. Chhavi withdrew a fixed amount at the beginning of each quarter, with interest on drawings charged at 6% p.a. Interest on Chhavi’s drawings amounted to ₹900. Pass the necessary journal entry.

Ans: Journal Entry:

Interest on Drawings A/c Dr. ₹900

To Chhavi’s Capital/Current A/c ₹900

(Being interest on Chhavi’s drawings charged at 6% p.a.)

Q10: Assertion (A): The interest on drawings is recorded in the debit side of the Current Account when the fixed capital method is followed.

Reason (R): The capital of the partners is fixed, and all the transactions are recorded in the Current Account.

Ans: (a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A). Under the fixed capital method, interest on drawings is debited to the Current Account, as all transactions like drawings, interest, and profits are recorded there, keeping the capital account unchanged.

Q11: Dev withdrew ₹10,000 on the 15th day of every month. Interest on drawings is charged at 12% p.a. Calculate interest on Dev’s drawings.

Ans: Total Drawings = ₹10,000 × 12 = ₹1,20,000. Average period (mid-month) = 6 months. Interest = ₹1,20,000 × 12 × 6 / (100 × 12) = ₹7,200.

Q12: Raj and Seema started a partnership on 1st July 2018, with Seema entitled to a 10% commission on net profit after Raj’s salary of ₹2,500 per quarter. Net profit before adjustments for the year ended 31st March 2019 was ₹2,27,500. Calculate Seema’s commission.

Ans: Raj’s salary = ₹2,500 × 3 = ₹7,500. Net profit after salary = ₹2,27,500 - ₹7,500 = ₹2,20,000. Seema’s commission = 10% of ₹2,20,000 = ₹22,000.

Q13: A and B are partners sharing profits in the ratio of 7:3 with fixed capitals of A ₹9,00,000 and B ₹4,00,000. The partnership deed provides for 10% p.a. interest on capital and A’s salary of ₹50,000 per year, B’s salary of ₹3,000 per month. Profit for the year ended 31st March 2019 was ₹2,78,000, distributed without adjustments. Pass the adjustment entry.

Ans: Interest on A’s capital = ₹9,00,000 × 10% = ₹90,000; B’s capital = ₹4,00,000 × 10% = ₹40,000. A’s salary = ₹50,000; B’s salary = ₹3,000 × 12 = ₹36,000. Total = ₹90,000 + ₹40,000 + ₹50,000 + ₹36,000 = ₹2,16,000. Remaining profit = ₹2,78,000 - ₹2,16,000 = ₹62,000 (A: ₹43,400, B: ₹18,600). Distributed profit (7:3) = A: ₹1,94,600, B: ₹83,400. Adjustment Entry:

A’s Capital A/c Dr. ₹61,600

To B’s Capital A/c ₹61,600

(Being adjustment for interest on capital and salaries omitted)

Q14: Maanika, Bhavi, and Komal are partners sharing profits in the ratio of 6:4:1. Komal is guaranteed a minimum profit of ₹2,00,000. The firm incurred a loss of ₹22,00,000 for the year ended 31st March 2018. Pass the necessary journal entry and prepare the Profit and Loss Appropriation Account.

Ans: Komal’s share of loss = ₹22,00,000 × 1/11 = ₹2,00,000. Guaranteed profit = ₹2,00,000. Deficiency = ₹2,00,000 + ₹2,00,000 = ₹4,00,000 (borne by Maanika and Bhavi in 6:4). Journal Entry:

Maanika’s Capital A/c Dr. ₹2,40,000

Bhavi’s Capital A/c Dr. ₹1,60,000

To Komal’s Capital A/c ₹4,00,000

Profit and Loss Appropriation Account:

Dr. To Loss A/c ₹22,00,000

Cr. By Maanika ₹12,00,000, Bhavi ₹8,00,000, Komal ₹2,00,000

(Adjusted for guarantee: Maanika ₹14,40,000, Bhavi ₹9,60,000, Komal ₹-2,00,000)

Q15: Harshad and Dhiman are partners with no partnership agreement, contributing capitals of ₹4,00,000 and ₹1,00,000, respectively. Harshad advanced a ₹1,00,000 loan on 1st October 2013. Profits for the year ended 31st March 2014 were ₹1,80,000. Settle their dispute and prepare the Profit and Loss Appropriation Account.

Ans: Per the Indian Partnership Act, 1932: (a) Profits are shared equally, not proportional to capital. (b) No interest on capital or remuneration is allowed. (c) Interest on Harshad’s loan = ₹1,00,000 × 6% × 6/12 = ₹3,000. Profit and Loss Appropriation Account:

Dr. To Interest on Harshad’s Loan ₹3,000, Harshad’s Capital ₹88,500, Dhiman’s Capital ₹88,500

Cr. By Profit ₹1,80,000

|

42 videos|198 docs|43 tests

|

FAQs on Sure Shot Questions: Accounting for Partnerships: Basic Concepts - Accountancy Class 12 - Commerce

| 1. What are the key features of a partnership in accounting? |  |

| 2. How is profit sharing determined in a partnership? |  |

| 3. What is the significance of a partnership agreement? |  |

| 4. What are the different types of partnerships in accounting? |  |

| 5. How do partnerships differ from sole proprietorships in accounting? |  |