Accounting Equation | Accountancy Class 11 - Commerce PDF Download

Q1: What will be effect of the following on the Accounting Equation?

(i) Started business with cash ₹ 45,000

(ii) Opened a Bank Account with a deposit of ₹ 4,500

(iii) Bought goods from M\s. Sun & Co. for ₹ 11,200

Ans: This question is as follows:

Therefore, Liabilities = 11,200

Capital = 45,000

Assets = Liabilities + Capital

= 45,000 + 11,200 = 56,200

Q2: Show the Accounting Equation for the following transactions:

Ans: This question is as follows:

Here, Liabilities = 10,000

Capital = 19,700

Assets = 10,000 + 19,700 = 29,700

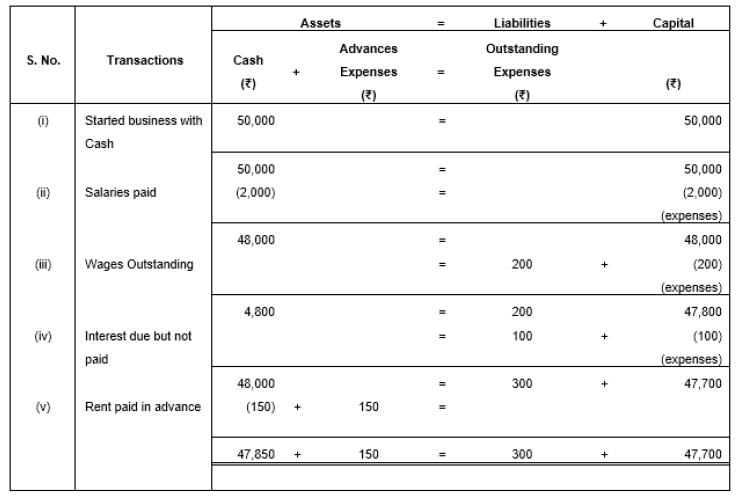

Q3: Show the effect of the following transactions on the Accounting Equation:

(i) Started business with cash ₹ 50,000.

(ii) Salaries paid ₹ 2,000.

(iii) Wages Outstanding ₹ 200.

(iv) Interest due but not paid ₹ 100.

(v) Rent paid in advance ₹ 150.

Ans: This question is as follows:

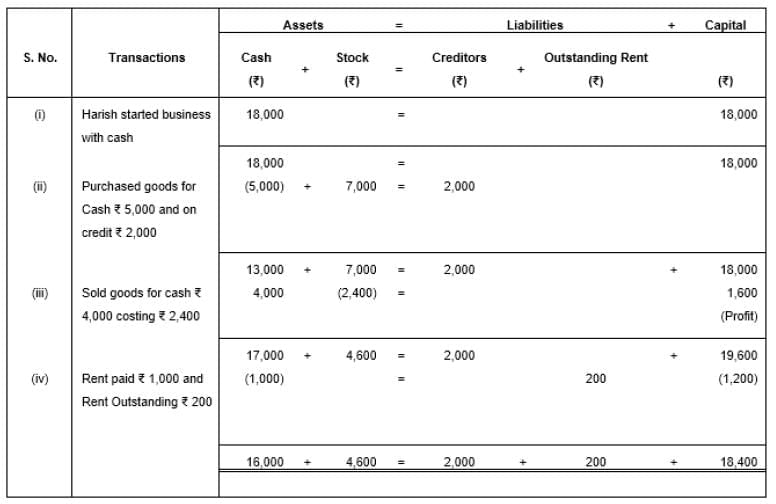

Q4: What will be the effect of the following on the Accounting Equation?

(i) Harish started business with cash ₹ 18,000

(ii) Purchased goods for Cash ₹ 5,000 and on credit ₹ 2,000

(iii) Sold goods for cash ₹ 4,000 (costing ₹ 2,400)

(iv) Rent paid ₹ 1,000 and rent outstanding ₹ 200

Ans: This question is as follows:

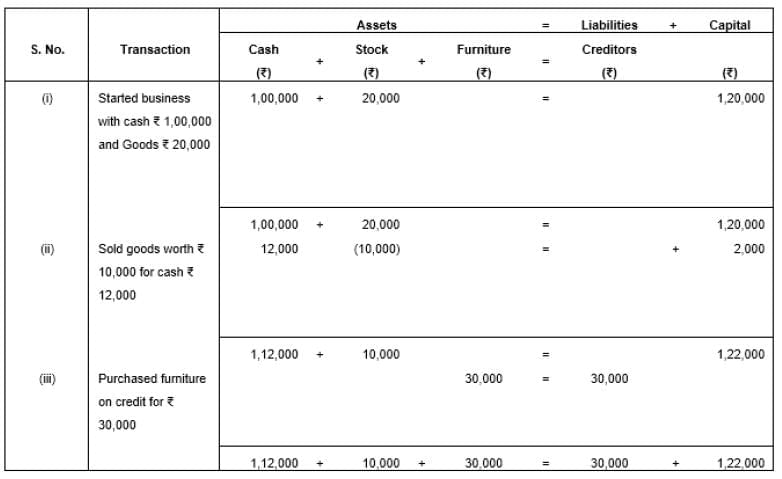

Q5: Prepare Accounting Equation from the following:

(i) Started business with cash ₹ 1,00,000 and Goods ₹ 20,000.

(ii) Sold goods worth ₹ 10,000 for cash ₹ 12,000.

(iii) Purchased furniture on credit for ₹ 30,000.

Ans: This question is as follows:

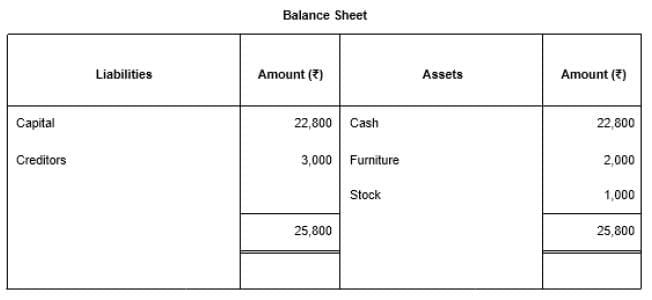

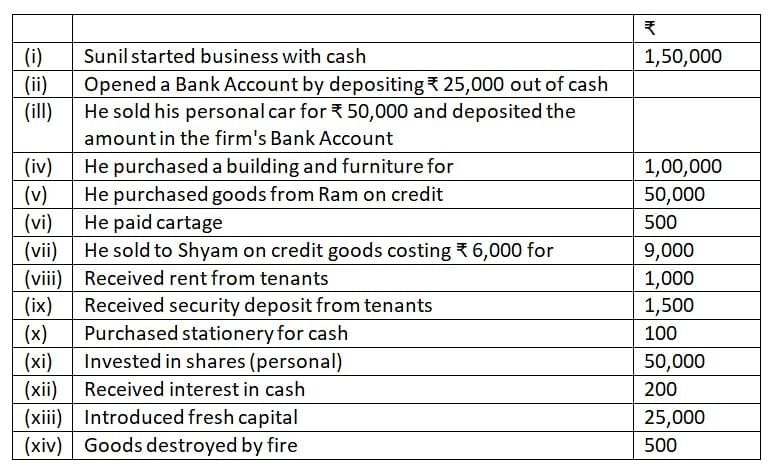

Q6: Prepare an Accounting Equation and Balance Sheet on the following basis:

(i) Ajeet started business with cash ₹ 20,000.

(ii) He purchased furniture for ₹ 2,000.

(iii) He paid rent of ₹ 200.

(iv) He purchases goods on credit ₹ 3,000.

(v) He sold goods (cost price ₹ 2,000) for ₹ 5,000 on cash.

Ans: This question is as follows:

The balance sheet is prepared as follows

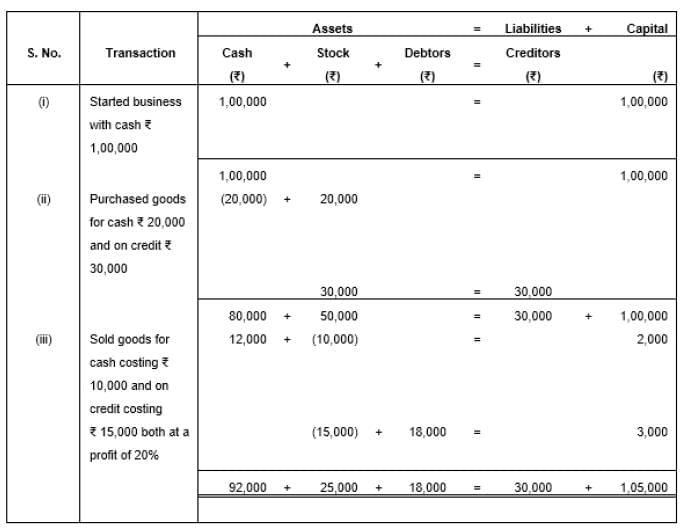

Q7: Prepare an Accounting Equation from the following:

(i) Started business with cash ₹ 1,00,000.

(ii) Purchased goods for cash ₹ 20,000 and on credit ₹ 30,000.

(iii) Sold goods for cash costing ₹ 10,000 and on credit costing ₹ 15,000 both at a profit of 20%.

Ans: This question is as follows:

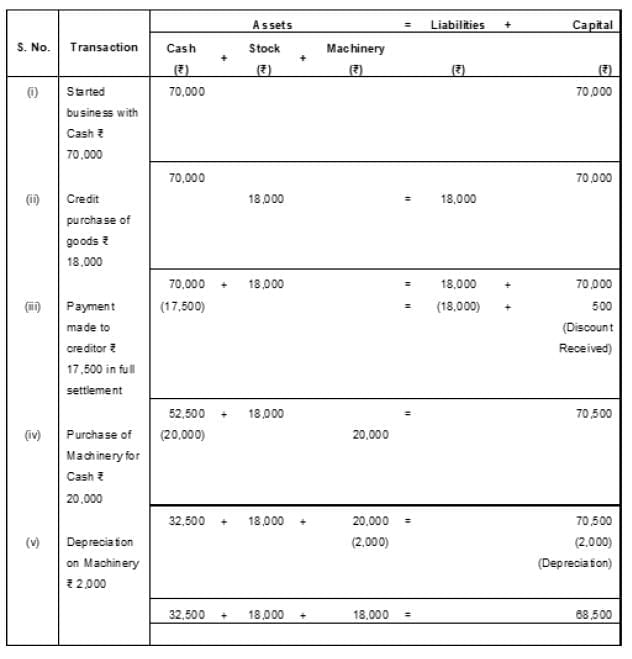

Q8: Prepare an Accounting Equation on the basis of the following transactions:

(i) Started business with cash ₹ 70,000.

(ii) Credit purchase of goods ₹ 18,000.

(iii) Payment made to creditors in full settlement ₹ 17,500.

(iv) Purchase of machinery for cash ₹ 20,000.

(v) Depreciation on machinery ₹ 2,000.

Ans: This question is as follows:

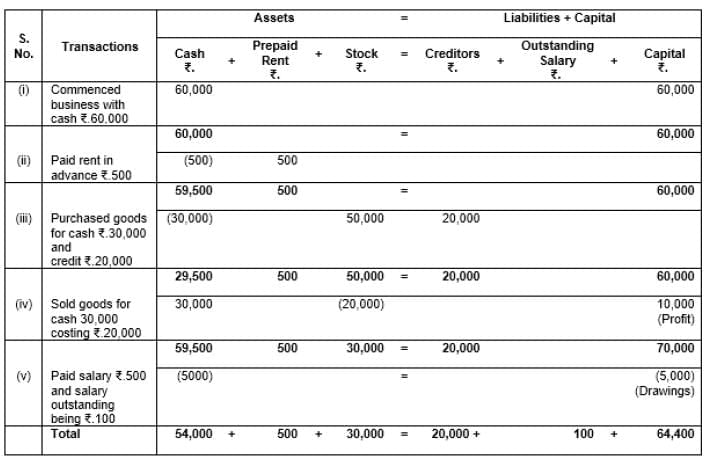

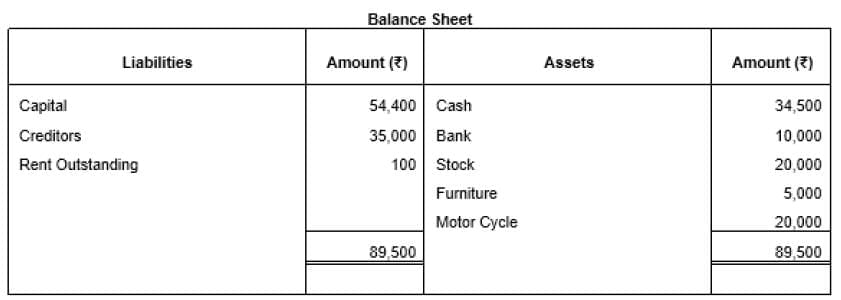

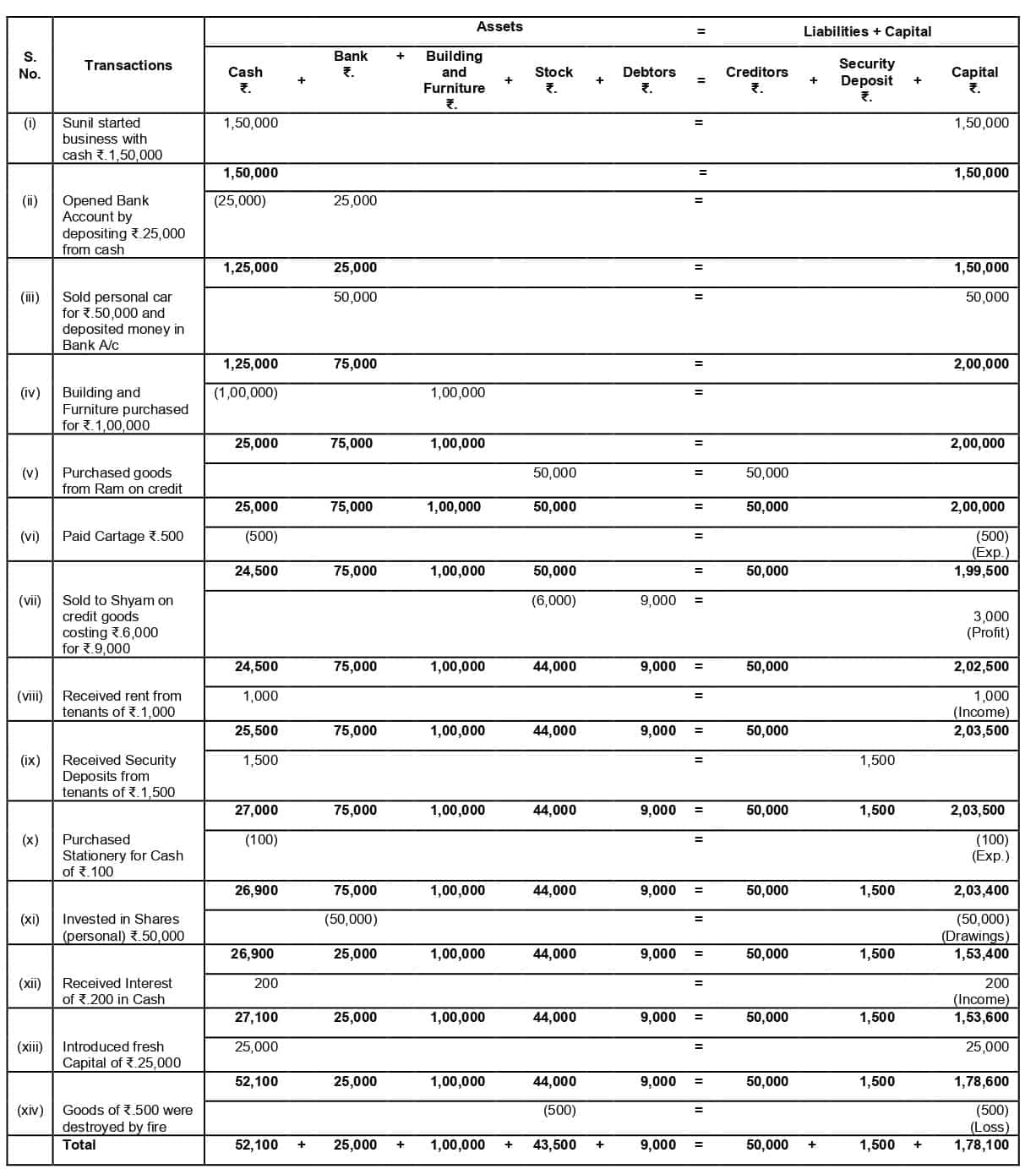

Q9: Prove that the Accounting Equation is satisfied in all the following transactions of Suresh. Also prepare a Balance Sheet.

(i) Commenced business with cash ₹ 60,000.

(ii) Paid rent in advance ₹ 500.

(iii) Purchased goods for cash ₹ 30,000 and credit ₹ 20,000.

(iv) Sold goods for cash ₹ 30,000 costing ₹ 20,000.

(v) Paid salary ₹ 500 and salary outstanding being ₹ 100.

(vi) Bought motorcycle for personal use ₹ 5,000.

Ans: This question is as follows:

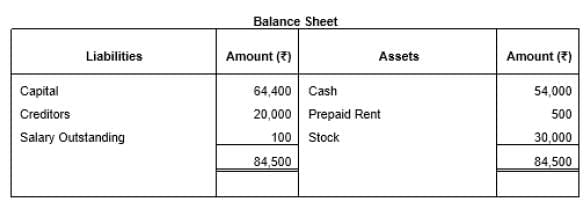

Here, Liabilities = 20,000 + 100 = 20,100

Capital = 64,400

Assets = 64,400 + 20,100 = 84,500Balance sheet is prepared as follows

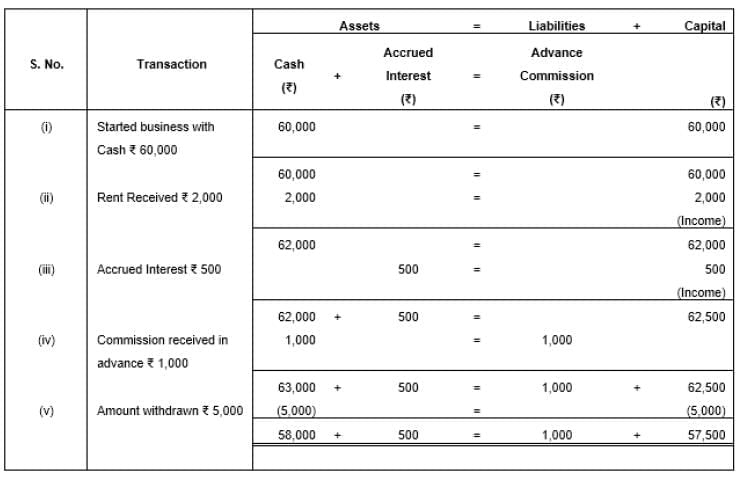

Q10: Show the effect of the following transactions and also prepare a Balance Sheet:

(i) Started business with cash ₹ 60,000.

(ii) Rent received ₹ 2,000.

(iii) Accrued interest ₹ 500.

(iv) Commission received in advance ₹ 1,000.

(v) Amount withdrawn ₹ 5,000.

Ans: This question is as follows:

Balance sheet is prepared as follows

Q11: Prove that the Accounting Equation is satisfied in all the following transactions of Sameer Goel:

(i) Started business with cash ₹ 10,000.

(ii) Paid rent in advance ₹ 300.

(iii) Purchased goods for cash ₹ 5,000 and credit ₹ 2,000.

(iv) Sold goods for cash ₹ 8,000 costing ₹ 4,000.

(v) Paid salary ₹ 450 and salary outstanding being ₹ 100.

(vi) Bought motorcycle for personal use ₹ 3,000.

Ans: This question is as follows:

Here, Liabilities = 2000 + 100 = 2100

Capital = 10,450

Assets = 10,450 + 2100 = 12,550

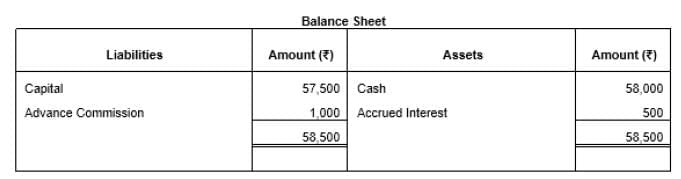

Q12: Show the Accounting Equation on the basis of the following transactions and present a Balance Sheet on the last new equation balance:

Ans: This question is as follows:

Balance sheet is prepared as follows

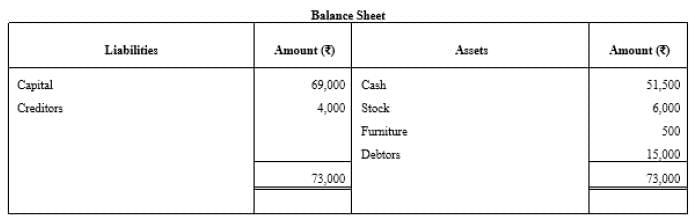

Q13: Raghunath had the following transactions in an accounting year:

(i) Commenced business with cash ₹ 50,000.

(ii) Paid into bank ₹ 10,000.

(iii) Purchased goods for cash ₹ 20,000 and credit ₹ 30,000.

(iv) Sold goods for cash ₹ 40,000 costing ₹ 30,000.

(v) Rent paid ₹ 500. (vi) Rent outstanding ₹ 100.

(vii) Bought furniture ₹ 5,000 on credit.

(viii) Bought refrigerator for personal use ₹ 5,000.

(ix) Purchased motorcycle for cash ₹ 20,000.

Create an Accounting Equation to show the effect of the above and also show his Balance Sheet.

Ans: This question is as follows:

Balance sheet is prepared as follows

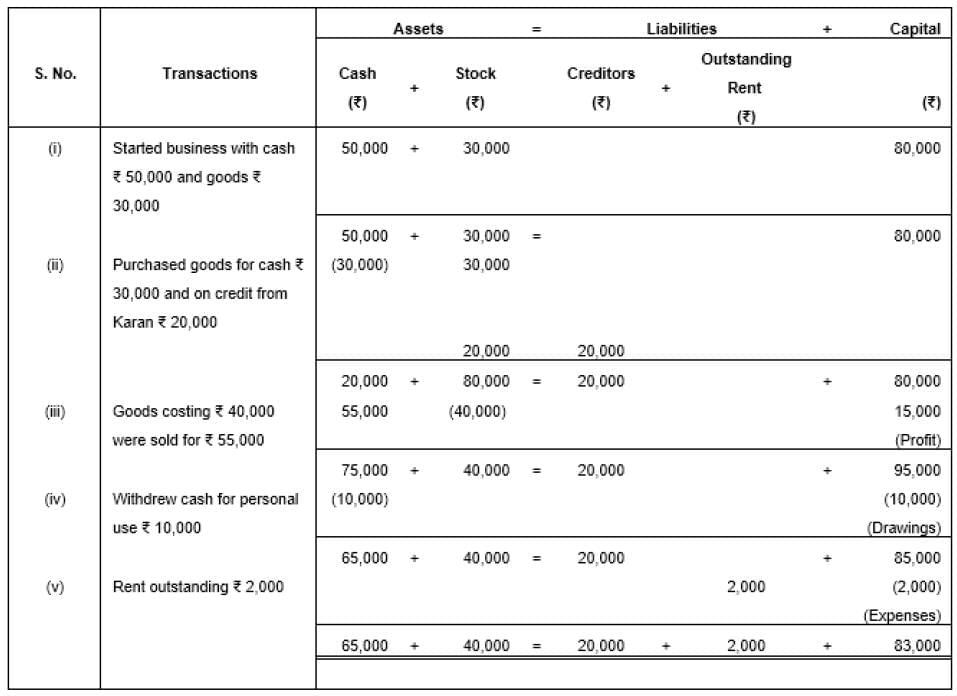

Q14: Prepare an Accounting Equation from the following:

(i) Started business with cash ₹ 50,000 and goods ₹ 30,000.

(ii) Purchased goods for cash ₹ 30,000 and on credit from Karan ₹ 20,000.

(iii) Goods costing ₹ 40,000 were sold for ₹ 55,000.

(iv) Withdrew cash for personal use ₹ 10,000.

(v) Rent outstanding ₹ 2,000.

Ans: This question is as follows:

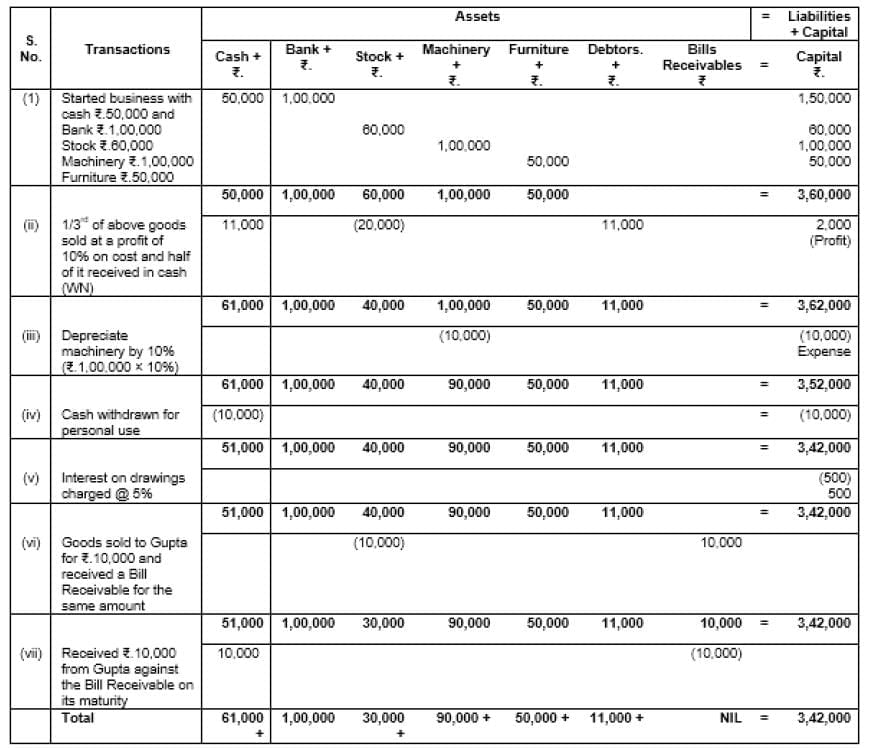

Q15: Show an Accounting Equation for the following transactions:

(i) D. Mahapatra commenced business with cash ₹ 50,000 and ₹ 1,00,000 by cheque; goods ₹ 60,000; machinery ₹ 1,00,000 and furniture ₹ 50,000.

(ii) 1/3rd of above goods sold at a profit of 10% on cost and half of the payment is received in cash.

(iii) Depreciation on machinery provided @ 10%.

(iv) Cash withdrawn for personal use ₹ 10,000.

(v) Interest on drawings charged @ 5%.

(vi) Goods Sold to Gupta for ₹ 10,000 and received a Bill Receivable for the same amount for 3 months.

(vii) Received ₹ 10,000 from Gupta against the Bills Receivable on its maturity.

Ans: This question is as follows:

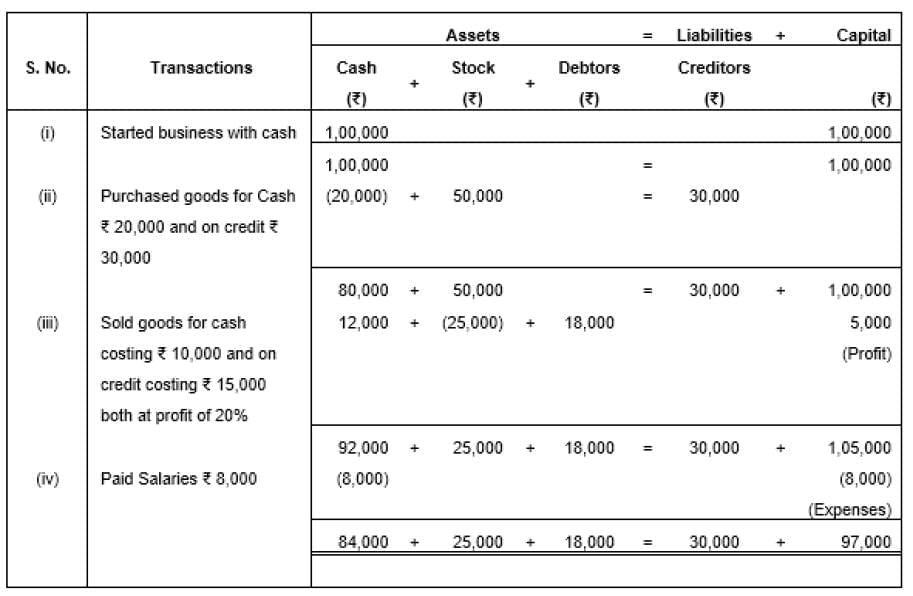

Q16: Prepare Accounting Equation from the following:

(a) Started business with cash ₹ 1,00,000.

(b) Purchased goods for cash ₹ 20,000 and on credit ₹ 30,000.

(c) Sold goods for cash costing ₹ 10,000 and on credit costing ₹ 15,000 both at a profit of 20%.

(d) Paid salaries ₹ 8,000.

Ans: This question is as follows:

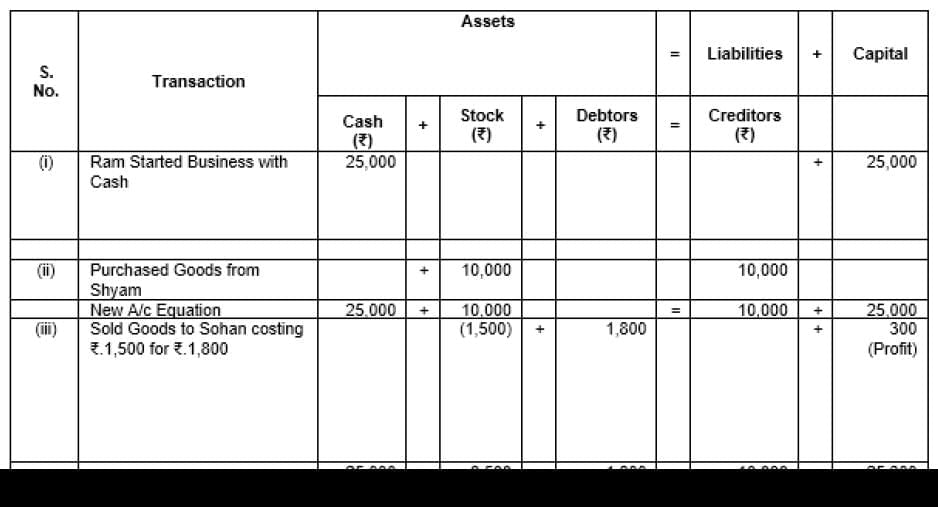

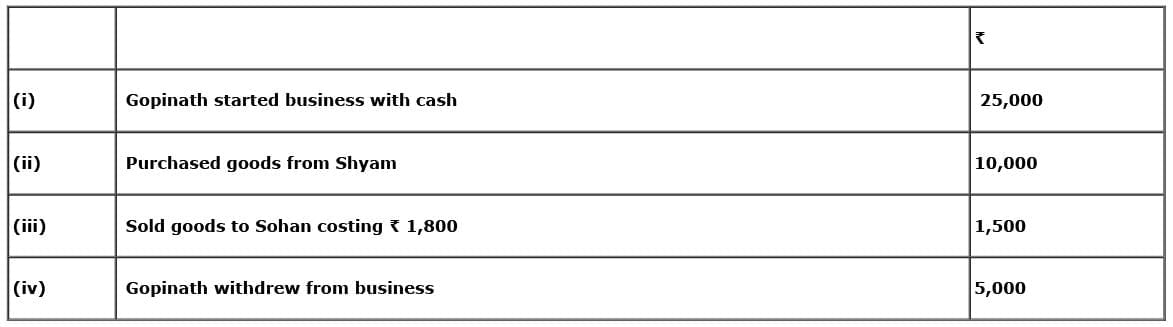

Q17: Show the accounting equation on the basis of following transactions:

(a) Ram started business with ₹ 25,000.

(b) Purchased goods from Shyam ₹ 10,000.

(c) Sold goods to Sohan costing ₹ 1,500 for ₹ 1,800.

Ans: This question is as follows:

Q18: If the capital of a business is ₹ 3,00,000 and liabilities are ₹ 50,000, loss ₹ 70,000, calculate the total assets of the business.

Ans: We know that total assets of a business can be calculated by

Total Assets = Capital - Loss + Liabilities

= 3,00,000 - 70,000 + 50,000

= ₹ 2,80,000

Q19: If total assets of a business are ₹ 1,30,000 and net worth is ₹ 80,000, calculate the creditors.

Ans: The value of creditors can be calculated as follows

Creditors = Total Assets - Net worth

= 1,30,000 - 80,000

= 50,000

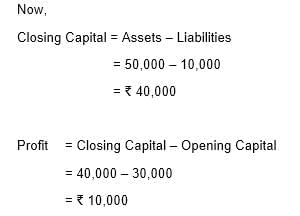

Q20: A commenced his cloth business on 1st April, 2018 with a capital of ₹ 30,000. On 31st March 2019, his assets were worth ₹ 50,000 and liabilities of ₹ 10,000. Find out his closing capital and profits earned during the year.

Ans: Here Capital = 30,000

Assets = 50,000

Liabilities = 10,000

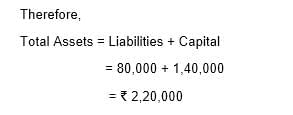

Q21: If capital of a business is ₹ 1,40,000 and liabilities are of ₹ 80,000, calculate the total assets of the business.

Ans: Here Capital = 1,40,000

Liabilities = 80,000

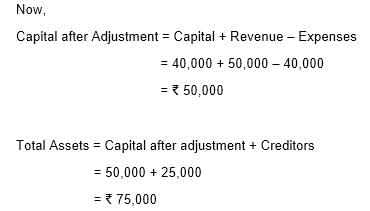

Q22: Calculate the total assets if:

(i) Capital is ₹ 40,000.

(ii) Creditors are ₹ 25,000.

(iii) Revenue during the period is ₹ 50,000.

(iv) Expenses during the period are ₹ 40,000.

Ans: Here Capital = 40,000

Creditors = 25,000

Revenue = 50,000

Expenses = 40,000

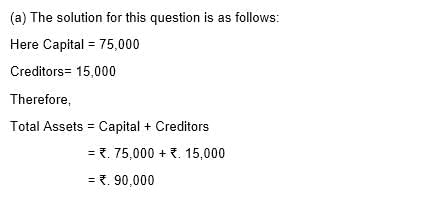

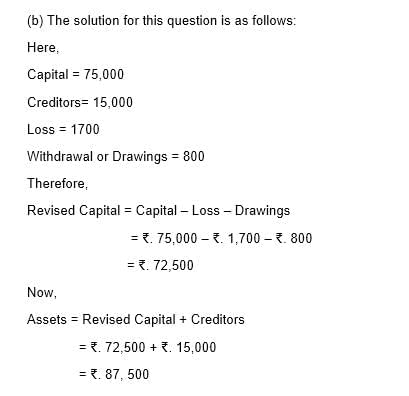

Q23: (a) A had a capital of ₹ 75,000 on 1st April, 2018. He had also goods amounting to ₹ 15,000 which he had purchased on credit and the payment had not been made. Find out the value of the total assets of the business.

(b) After a period of one month, he came to know that he had suffered a loss of ₹ 1,700. He withdrew ₹ 800 for his personal use. Find out his capital and assets of the business.

Ans:

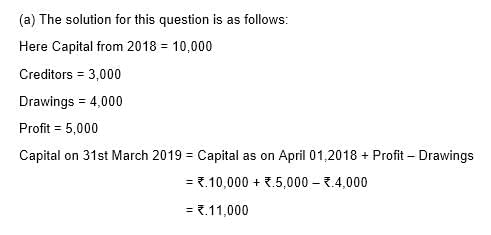

Q24: (a) Mohan started a business on 1st April, 2018 with a capital of ₹ 10,000 and borrowed ₹ 3,000 from a friend. He earned a profit of ₹ 5,000 during the year ended 31st March, 2019 and withdrew cash ₹ 4,000 for personal use. What is his capital on 31st March, 2019?

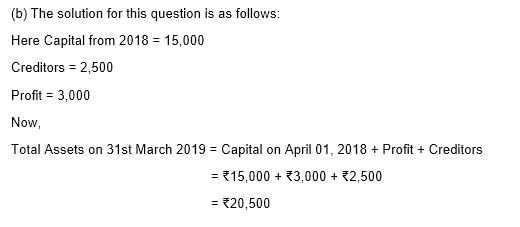

(b) Mahesh started a business with a capital of ₹ 15,000 on 1st April, 2018. During the year, he made a profit of ₹ 3,000. He owes ₹ 2,500 to suppliers of goods. What is the total of assets in his business on 31st March, 2019?

Ans:

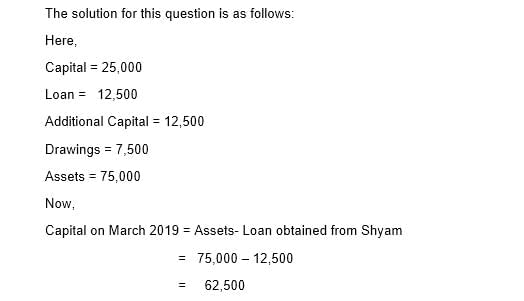

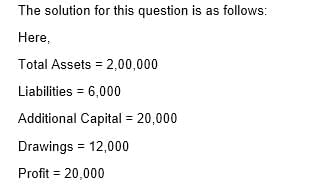

Q25: Mohan started a business on 1st April, 2018 with a capital of ₹ 25,000 and a loan of ₹ 12,500 borrowed from Shyam. During 2018-19 he had introduced additional capital of ₹ 12,500 and had withdrawn ₹ 7,500 for personal use. On 31st March, 2019 his assets were ₹ 75,000. Find out his capital as on 31st March, 2019 and profit made or loss incurred during the year 2018-19.

Ans:

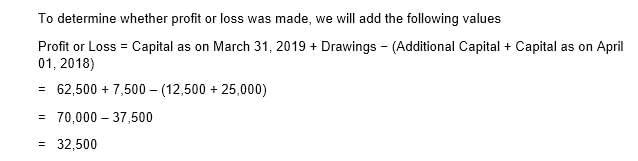

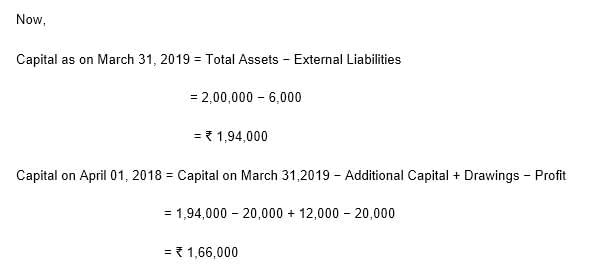

Q26: On 31st March, 2019, the total assets and external liabilities were ₹ 2,00,000 and ₹ 6,000 respectively. During the year, the proprietor had introduced capital of ₹ 20,000 and withdrawn ₹ 12,000 for personal use. He made a profit of ₹ 20,000 during the year. Calculate the capital as on 1st April, 2018.

Ans:

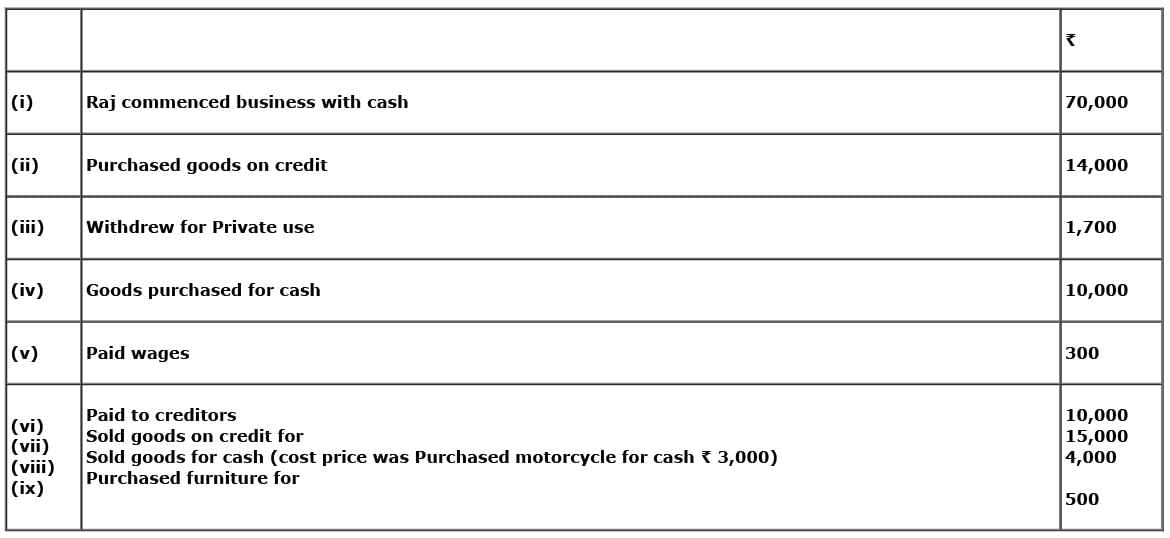

Q27: Show an Accounting Equation on the basis of the following transactions:

Ans: This question is as follows:

|

61 videos|154 docs|35 tests

|

FAQs on Accounting Equation - Accountancy Class 11 - Commerce

| 1. What is the accounting equation and how is it fundamental to financial accounting? |  |

| 2. How does the accounting equation apply to different types of businesses? |  |

| 3. What are the implications of the accounting equation for financial reporting? |  |

| 4. Can the accounting equation help in identifying financial problems within a company? |  |

| 5. How can understanding the accounting equation benefit individuals studying commerce? |  |