Short Answer Questions - Accounting for partnership firms: Fundamentals | Accountancy Class 12 - Commerce PDF Download

Q1. Define partnership.

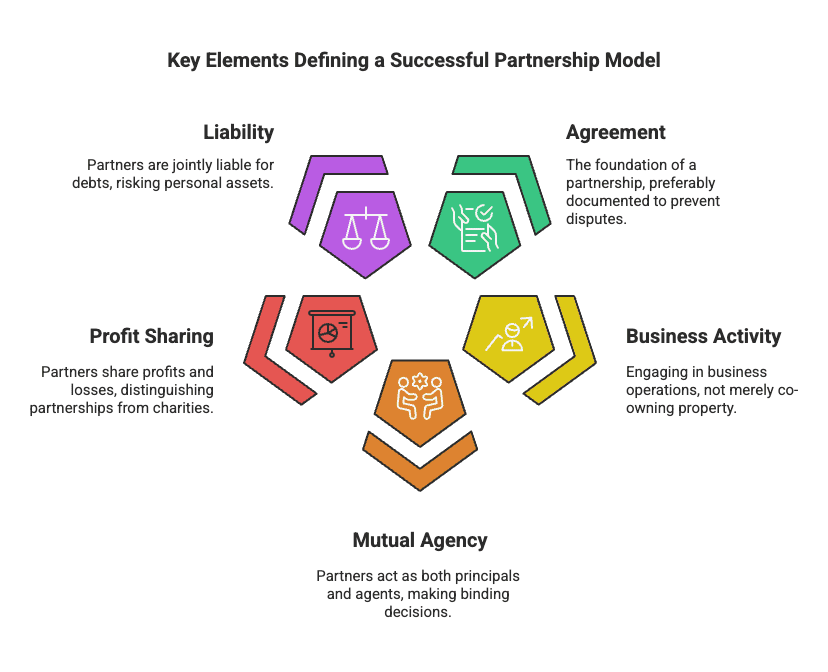

Ans: Partnership is defined as the relationship between two or more individuals who agree to conduct a business and share its profits and losses. Key features include:

- Agreement: A partnership arises from an agreement, which can be oral or written. However, a written agreement is preferred to avoid disputes.

- Business: The agreement must involve carrying out a business. Simply co-owning property does not constitute a partnership.

- Mutual Agency: Each partner acts as both a principal and an agent, meaning they can make decisions for the business and bind other partners.

- Profit Sharing: Partners must agree to share both profits and losses. If they engage in charitable activities, it does not qualify as a partnership.

- Liability: Partners are jointly and severally liable for the firm's debts, which means their personal assets can be used to settle business obligations.

Q2. What do you understand by "partners", "firm", and "firm's name"?

Ans: Individuals who enter into a partnership are known as partners. Collectively, they form a firm. The name under which the business operates is referred to as the firm's name.

Q3. Write any four main features of partnership.

Ans:

- Two or More Persons: A partnership requires at least two individuals to come together for a common purpose.

- Agreement: It is formed through an agreement, which can be either oral or written, outlining the terms of the partnership.

- Lawful Business: The partnership must be established for a legal business activity; mere co-ownership of property does not qualify.

- Profit Sharing: Partners share the profits and losses according to a pre-agreed ratio; if no ratio is specified, profits and losses are shared equally.

Q4. What is the minimum and maximum number of partners in all partnerships?

Ans: To form a partnership, there must be:

- At least two persons involved.

- A maximum of ten partners for firms engaged in banking.

- A maximum of twenty partners for other types of businesses.

Q5. What is the status of partnership from an accounting viewpoint?

Ans: From an accounting perspective, a partnership is viewed as a distinct business entity. However, legally, it is not separate from the owners, similar to a sole proprietorship.

- A partnership involves two or more individuals who agree to share profits and losses.

- It is established through an agreement, which can be oral or written.

- Partners are jointly responsible for the business's liabilities.

- Specific accounting practices apply to partnerships, including the maintenance of capital accounts and profit distribution.

Q6. What is meant by a partnership deed?

Ans: A Partnership Deed is a written document that outlines the terms and conditions agreed upon by the partners in a business. This deed is crucial as it governs the relationship between partners and can be modified with their mutual consent.

Q7. State any four contents of a partnership deed.

Ans:

- Date of formation and duration of the partnership.

- Names and addresses of all partners.

- Name of the firm.

- Profit and loss sharing ratio among partners.

Q8. In the absence of a partnership deed, how are mutual relations of partners governed?

Ans: In the absence of a Partnership Deed, the mutual relations of partners are governed by the Partnership Act, 1932. Key points include:

- Profits and losses are shared equally among partners.

- No partner is entitled to a salary unless agreed otherwise.

- No interest is paid on partners' capital unless specified.

- Interest on loans to the firm is set at 6% per annum.

- Rules for handling disputes and the admission or retirement of partners are defined by the Act.

This legal framework ensures that partners have a clear understanding of their rights and responsibilities in the absence of a written agreement.

Q9. Give any two reason in favour of having a partnership deed.

Ans: Reasons for Having a Partnership Deed

- Guidance in Disputes: The partnership deed serves as a key document in resolving any disputes or uncertainties among partners.

- Clarification of Roles: It clearly outlines the duties and powers of each partner, ensuring everyone understands their responsibilities.

Q10. State the provision of 'Indian Partnership Act 1932‘ relating to sharing of profits in the absence of any provision in the partnership deed.

Ans: In the absence of any provision in the Partnership Deed, the sharing of profits and losses among partners is done equally. This means:

- All partners receive an equal share of profits.

- Losses are also shared equally among partners.

- No partner is entitled to any additional remuneration unless specified.

This provision ensures fairness and simplicity in the distribution of profits and losses when no specific agreement exists.

Q11. Why is it important to have a partnership deed in writing?

Ans: The partnership deed is crucial because it clearly outlines the relationship between partners. Here are the key reasons for having it in writing:

- Defines the roles and responsibilities of each partner.

- Assists in resolving disputes if they arise.

- Serves as strong evidence in court if needed.

- Avoids potential misunderstandings and conflicts.

Q12. What do you understand by fixed capital of partners?

Ans: The Fixed capital of partners refers to the amount of capital that remains unchanged in a partnership, except in specific situations. Key points include:

- The capital is fixed unless additional funds are introduced.

- Withdrawals can only occur permanently.

- Partners' capital accounts reflect a stable balance year after year.

Q13. What do you understand by fluctuating capital of partners?

Ans: Fluctuating capital refers to a situation where a partner's capital changes with each transaction in their capital account. This includes:

- Withdrawals or drawings

- Interest credited to the account

- Other adjustments affecting the capital balance

In this method, the capital account reflects the current financial activities of the partner, leading to a fluctuating balance over time.

Q14. Give two circumstances in which the fixed capital of partners may change.

Ans: Two circumstances in which the fixed capital of partners may change are:

- When additional capital is introduced by the partners.

- When a part of the capital is permanently withdrawn by the partners.

Q15. List the items that may appear on the debit side and credit side of a partner's fluctuating capital account.

Ans: Debit Side:

- Drawings

- Interest on drawings

- Share of loss

- Closing credit balance of the capital

Credit Side:

- Opening credit balance of capital

- Additional capital introduced

- Share of profit

- Interest on capital

- Salary to a Partner

- Commission to a Partner

Q16. How will you show the following in case the capitals are? i) Fixed & ii) Fluctuating a) Additional capital introduced b) Drawings c) Withdrawal of capital d) Interest on capital and e) Interest on loan by partners?

Ans: Fixed Capital Method:

- Additional capital introduced: Credit side of capital account.

- Drawings: Debit side of current account.

- Withdrawal of capital: Debit side of capital account.

- Interest on capital: Credit side of current account.

- Interest on loan by partners: Credit side of loan from partner's account.

Fluctuating Capital Method:

- Additional capital introduced: Credit side of capital account.

- Drawings: Debit side of capital account.

- Withdrawal of capital: Debit side of capital account.

- Interest on capital: Credit side of capital account.

- Interest on loan by partners: Credit side of loan from partner's account.

Q17. If the partners' capital accounts are fixed, where will you record the following items:

i) Salary to partners

ii) Drawing by partners

iii) Interest on capital

iv) Share of profit earned by a partner

Ans:

- Salary to partners: Recorded on the credit side of the Partner's Current Account.

- Drawings by a partner: Recorded on the debit side of the Partner's Current Account.

- Interest on capital: Recorded on the credit side of the Partner's Current Account.

- Share of profit: Recorded on the credit side of the Partner's Current Account.

Q18. How would you calculate interest on drawings of equal amounts drawn on the Last day of every month?

Ans: To calculate interest on drawings made at the end of each month, follow these steps:

- When a partner withdraws a fixed amount at the end of each month, the interest is calculated based on the total amount withdrawn for an average period of 5.5 months.

- The formula to calculate interest on drawings is:

Interest on Drawings = Total Drawings × Rate of Interest × Average Period / 100

- For example, if the total drawings amount to Rs. 1,20,000 and the interest rate is 8% per annum, the calculation would be:

- Interest = Rs. 1,20,000 × 8 × 5.5 / 100 × 12 = Rs. 4,400.

In summary, the interest on drawings is determined by the amount withdrawn, the interest rate, and the average time the money is withdrawn.

Q19. How would you calculate interest on drawings of equal amounts drawn on the last day of every month?

Ans: To calculate interest on drawings made at the end of each month, follow these steps:

- Identify the total amount withdrawn.

- Determine the interest rate agreed upon.

- Calculate the average period for which the amount is drawn. For monthly withdrawals at the end of each month, this period is typically 5.5 months.

- Use the formula: Interest on drawings = Total drawing x (Rate x Average period) / 100.

For example, if the total amount drawn is Rs. 1,20,000, the interest calculation would be: Interest on drawings = Rs. 1,20,000 x (Rate x 5.5) / 100.

Q20. How would you calculate interest on the drawing of an equal amount drawn in the middle of every month?

Ans: Interest on drawings is calculated based on the timing and amount withdrawn. For equal amounts drawn in the middle of every month, the calculation is as follows:

Average Period: The average period for the drawings is calculated as:

- Average Period = (No. of months of first drawing + No. of months of last drawing) / 2

- For middle-of-the-month withdrawals, this results in 6 months.

Interest Calculation: The formula for calculating interest on drawings is:

- Interest on Drawings = Total Drawings × Rate × Average Period / 100 × 12

- Example: If the total drawings are Rs. 1,20,000 at 8% interest:

- Interest = Rs. 1,20,000 × 8 × 6 / 100 × 12 = Rs. 4,800.

Q21. Ramesh, a partner in the firm has advanced a loan of a Rs. 1,00,000 to the firm and has demanded on interest @ 9% per annum. The partnership deed is silent on the matter. How will you deal with it?

Ans: Since the partnership deed does not mention interest on loans, the provisions of the Partnership Act, 1932 apply. Therefore:

- Ramesh is entitled to interest on his loan at a rate of 6% per annum.

Q22. The partnership deed provides that Anjali, the partner will get Rs. 10,000 per month as salary. But, the remaining partners object to it. How will this matter be resolved?

Ans: Entitlement to Salary: Anjali's claim for a monthly salary of Rs. 10,000 is not valid due to the following reasons:

- The partnership deed does not specify any salary for partners.

- According to the Partnership Act, 1932, if the deed is silent on salary, partners are not entitled to remuneration.

- The remaining partners' objections are justified as there is no provision for salary.

Therefore, Anjali is not entitled to the salary claimed.

Q23. Distinction between Profit and loss and profit and loss appropriation account:

Ans: Distinction between Profit and Loss and Profit and Loss Appropriation Account: The Profit and Loss Account and the Profit and Loss Appropriation Account serve different purposes in accounting:

- Profit and Loss Account:

- Records the overall net profit or net loss of the business.

- Reflects the income and expenses over a specific period.

- Used primarily for sole proprietorships, where profits or losses are transferred directly to the owner's capital account.

- Profit and Loss Appropriation Account:

- Extends the Profit and Loss Account by detailing how profits are distributed among partners.

- Includes adjustments such as interest on capital, partner salaries, and commissions.

- Begins with the net profit or loss from the Profit and Loss Account.

- Final figures are distributed among partners according to their profit-sharing ratio.

In summary, while the Profit and Loss Account summarises the financial performance of the business, the Profit and Loss Appropriation Account focuses on the distribution of profits among partners in a partnership.

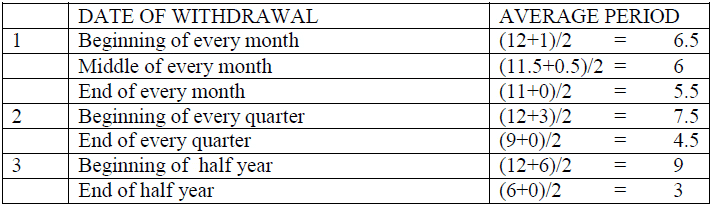

Q24. State the Average period to be taken for calculating interest on drawing in different cases if amount is withdrawn on regular interval.

Ans: Average Period for Calculating Interest on Drawings

- Fixed Amount Withdrawn Monthly:

- Withdrawn at the beginning of the month: Average period is 6.5 months.

- Withdrawn at the end of the month: Average period is 5.5 months.

- Withdrawn in the middle of the month: Average period is 6 months.

- Fixed Amount Withdrawn Quarterly:

- Withdrawn at the beginning of the quarter: Average period is 7.5 months.

- Withdrawn at the end of the quarter: Average period is 4.5 months.

- Varying Amounts Withdrawn:

- Interest is calculated using the product method, based on the amount and the time period for each withdrawal.

|

42 videos|199 docs|43 tests

|

FAQs on Short Answer Questions - Accounting for partnership firms: Fundamentals - Accountancy Class 12 - Commerce

| 1. What is accounting for partnership firms? |  |

| 2. What are the advantages of partnership firms? |  |

| 3. What are the different types of partnership firms? |  |

| 4. What are the legal requirements for partnership firms? |  |

| 5. How are profits and losses shared in a partnership firm? |  |