NCERT Solution - Introduction to Accounting | Accountancy Class 11 - Commerce PDF Download

Short Question Answers

Q1: Define accounting.

Ans: Accounting is a process of identifying the events of a financial nature, recording them in Journal, classifying in their respective ledgers, summarising them in the Profit and Loss Account and Balance Sheet and communicating the results to the users of such information, viz. owner/s, government, creditors, investors etc.

According to the American Institute of Certified Accountants, 1941, “Accounting is an art of recording, classifying and summarising in a significant manner and in terms of money transactions and events that are, in part at least, of a financial character and interpreting the results thereof.”

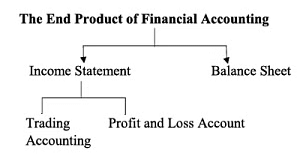

Q2: State what is end product of financial accounting?

Ans:

- Income statements (Trading and/or Profit and Loss Account) - An income statement that includes Trading and Profit and Loss Account, ascertains the financial results of a business in terms of gross (or net) profit or loss.

- Balance Sheet - It depicts the true financial positions of a business that provides required information like assets and liabilities of a business firm, to the users of accounting information like owners, creditors, investors, government, etc.

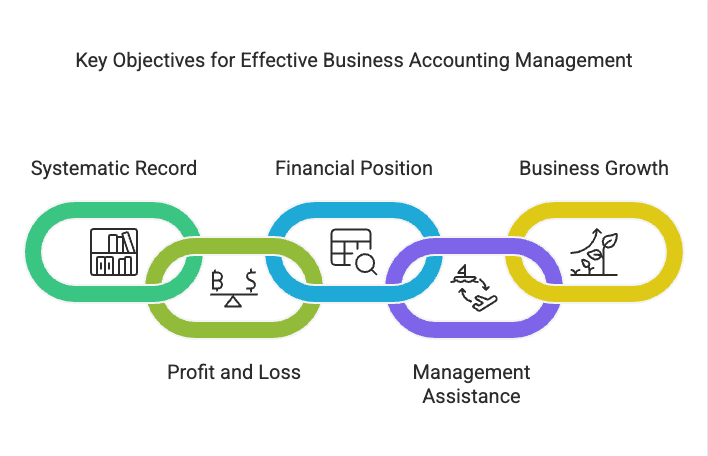

Q3: Enumerate main objectives of accounting.

Ans: The main objectives of accounting are given below.

- To keep a systematic record of all business transactions

- To determine the profit earned or loss incurred during an accounting period by preparing a profit and loss account

- To ascertain the financial position of the business at the end of each accounting period by preparing a balance sheet

- To assist management with decision-making, effective control, forecasting, etc.

- To assess the progress and growth of business from year to year

- To detect and prevent fraud and errors

- To communicate information to various users

Q4: Who are the users of accounting information?

Ans: Users of accounting information are bifurcated into two categories as- Internal Users and External Users.

Internal Users- These are the users who are internal to an organisation. Such users have direct access to the financial statements of a business. Some of the internal users are given below.

- Owners

- Management

- Employees and Workers

External Users- External users are those who are outsiders to an organisation and are interested in the financial affairs of the business. These users do not have direct access to the financial statements of the business. The following parties come under the head of external users.

- Banks and Financial Institutions

- Investors and Potential Investors

- Creditors

- Tax Authorities

- Government

- Consumers

- Researchers

- Public

Q5: State the nature of accounting information required by long-term lenders.

Ans: Accounting information required by long-term lenders includes the repaying capacity of the business, profitability, liquidity, operational efficiency, and potential growth of the business.

Q6: Who are the external users of information?

Ans: External users of information are individuals or organisations that have a direct or indirect interest in the business firm but are not part of management. They do not have direct access to the internal data of the firm and use published data or reports like profit and loss accounts, balance sheets, annual reports, press releases, etc. Examples of external users include the government, tax authorities, labour unions, etc.

Q7: Enumerate the informational needs of management.

Ans: The informational needs of management are concerned with the activities given below.

- Assists in decision-making and business planning

- Preparing reports related to funds, costs and profits to ascertain the soundness of the business

- Comparing current financial statements with its historical financial statements and those of other similar firms to assess the operational efficiency of the business.

Q8: Give three examples of revenues.

Ans: Three examples of revenue are given below.

- Sales revenue

- Interest received

- Dividends

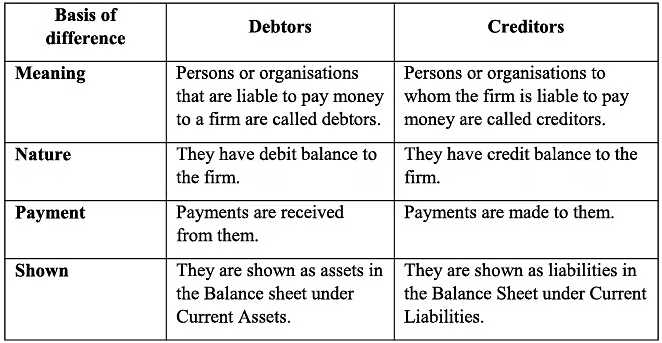

Q9: Distinguish between debtors and creditors; Profit and Gain.

Ans:

Difference between Debtors and Creditors is given below.

The difference between Profit and Gain is given below.

- Gain - Gain is incidental to the business. They arise from irregular activities or non-recurring transactions; for example, profit on the sale of fixed assets, appreciation in the value of an asset, profit on the sale of investment, etc.

- Profit - This refers to the excess of revenue over the expense. It is normally categorised into gross profit or net profit. Net profit is added to the capital of the owner, which increases the owner’s capital. For example, goods sold above their cost.

Q10: ‘Accounting information should be comparable’. Do you agree with this statement? Give two reasons.

Ans: Accounting information should be comparable for the following reasons.

- Comparable accounting information helps in inter-firm comparisons. This helps in assessing the viability and advantages of various policies adopted by different firms.

- It also helps in intra-firm comparisons that help in determining the changes and also to ascertain the results of various policies and plans adopted in different time periods. This also helps to figure out the errors, ascertain growth and assist in management planning.

Q11: If the accounting information is not clearly presented, which of the qualitative characteristics of the accounting information is violated?

Ans: If the accounting data isn't clearly presented, then the qualitative characteristics like comparison, reliability, and understanding capability are violated. This is because if the accounting information is not clearly provided, a meaningful assessment may not be possible, as the information may not be trustworthy, which could lead to faulty conclusions.

Q12: "The role of accounting has changed over the period of time" - Do you agree? Explain.

Ans: The role of accounting is ever-changing. In earlier times, accounting was merely concerned with recording financial events, i.e., record-keeping activity; however, nowadays, accounting is carried out with the purpose of not only keeping records but also providing an information system that offers essential and relevant information to various accounting users. The need for this change is brought about due to the ever-changing and dynamic business environment, which is more competitive now than it was before. Additionally, relevant activities such as decision-making, forecasting, analysis, and evaluation make these changes in the role of accounting inevitable.

Q13: Giving examples, explain each of the following accounting terms:

- Fixed assets

- Revenue

- Expenses

- Short-term liability

- Capital

Ans:

- Fixed assets: These are held for the long term and increase the profit-earning capacity of the business over several accounting periods. These assets are not intended for sale; for example, land, building, machinery, etc.

- Revenue: It refers to the amount received from daily activities of the business, such as sales of goods and services to customers; rent received, commission received, dividend, royalty, interest received, etc., are items of revenue that are added to capital.

- Capital: It refers to the amount invested by the owner of a firm. It may be in the form of cash or assets. It is a liability of the business towards the owner of the firm, as the business is treated separately from the owner.

- Expenses: These are costs incurred to maintain the profitability of a business, like rent, wages, depreciation, interest, salaries, etc. These help in production, business operations, and generating revenue.

- Short-term liabilities: These are liabilities that are incurred and are to be paid or are payable within a year; for example, bank overdrafts, creditors, bills payable, outstanding wages, short-term loans, etc.

Q14: Define revenues and expenses.

Ans:

Revenues: Revenue refers to the amount obtained from the daily activities of the business, such as proceeds from sales of goods and rendering services to customers. Rent received, the commission received, royalties and interest received are considered revenue, as they are regular in nature and involve day-to-day activities. It is shown on the credit side of the income and loss account or trading account.

Expenses: Expenses refer to those costs that are incurred to earn revenue for the business. They are incurred for maintaining the profitability of the business. It represents the amount spent to meet the short-term needs of the business. It is shown on the debit side of the income and loss account or trading account; for example, wages, rent paid, salaries paid, outstanding wages, etc.

Q15: What is the primary reason for business students and others to familiarize themselves with the accounting discipline?

Ans: Every economic transaction has to be recorded in such a manner that various accounting users can understand and interpret these results in the same way without any ambiguity. The reasons why business students and others need to familiarize themselves with the accounting field are given below:

- It helps in studying various aspects of accounting.

- It enables learning how to maintain books of accounts.

- It facilitates learning how to summarize accounting data.

- It aids in understanding how to interpret the accounting data with relative accuracy.

Long Question Answers

Q1: Define accounting.

Ans: Accounting is a process of identifying the events of a financial nature, recording them in the journal, classifying them in their respective accounts, summarizing them in the Profit and Loss Account and Balance Sheet, and communicating the results to users of such information, viz. owner, government, creditors, investors, etc.

According to the American Institute of Certified Accountants, 1941, “Accounting is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events that are, in part at least, of financial character and interpreting the results thereof.”

In 1970, the American Institute of Certified Public Accountants changed the definition and stated, “The function of accounting is to provide quantitative information, primarily financial in nature, about economic entities, that is intended to be useful in making economic decisions.”

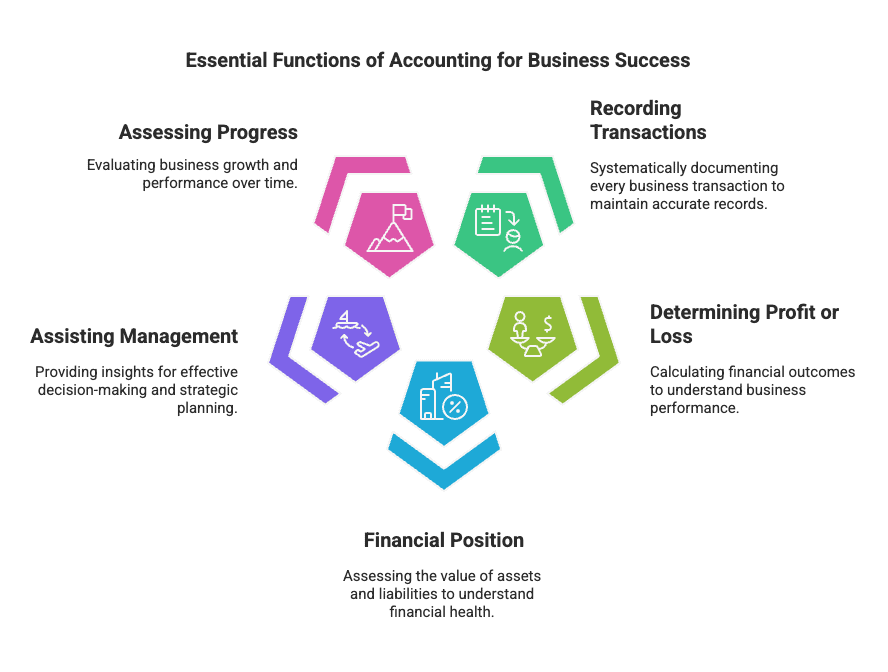

Objectives of Accounting:

- Recording business transactions systematically - It is necessary to maintain systematic records of every business transaction, as it is beyond human capacity to remember such a large number of transactions. Skipping the record of any one of the transactions may lead to erroneous and faulty results.

- Determining profit earned or loss incurred - In order to determine the net result at the end of an accounting period, we need to calculate profit or loss. For this purpose, trading and profit and loss accounts are prepared. It gives information regarding how much goods have been purchased and sold, expenses incurred, and the amount earned during a year.

- Ascertaining financial position of the firm - Ascertaining profit earned or loss incurred is not enough; the proprietor is also interested in knowing the financial position of his/her firm, i.e., the value of the assets, amount of liabilities owed, net increase or decrease in his/her capital. This purpose is served by preparing the balance sheet that facilitates ascertaining the true financial position of the business.

- Assisting management - Systematic accounting helps the management in effective decision-making, efficient control on cash management policies, preparing budgets and forecasting, etc.

- Assessing the progress of the business - Accounting helps in assessing the progress of business from year to year, as accounting facilitates the comparison both inter-firm as well as intra-firm.

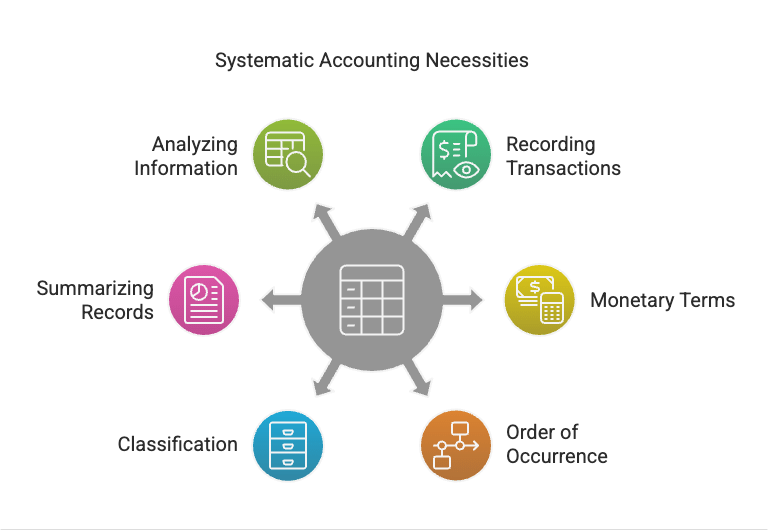

Q2: Explain the factors that necessitated systematic accounting.

Ans: The elements that necessitate systematic accounting are given below.

- Recording only financial transactions - Only those activities that are monetary are recorded in the books of accounts. For example, the salary of an employee is recorded in the books, but his/her educational qualification is not recorded.

- Transactions recorded in monetary terms - Only those transactions that can be expressed in monetary terms are recorded in the books. For example, if a business has two buildings and four machines, then their economic values are recorded in the books, i.e., buildings costing Rs 2,00,000, four machines costing Rs 8,00,000. Therefore, the total value of assets is Rs 10,00,000.

- The art of recording - Transactions are recorded in the order of their occurrence.

- Classification of transactions - Business transactions of a similar nature are classified and posted under their respective accounts. For example, all the transactions relating to machinery may be posted in the Machinery Account.

- Summarizing of records - All business transactions are summarized in the form of Trial Balance, Trading Account, Profit and Loss Account, and Balance Sheet, which provide essential information to various users.

- Analyzing and interpreting information - Systematic accounting information enables users to analyze and interpret the accounting data in a proper and suitable way. This information is presented in the form of graphs, statements, and charts, facilitating easy communication and understanding by various users. Moreover, this aids in decision-making and future predictions.

Q3: Describe the informational needs of external users.

Ans: There are various external users of accounting who need accounting data for decision-making, investment planning, and assessing the economic position of the business. The various external users are listed below:

- Banks and other financial institutions - Banks provide finance in the form of loans and advances to various businesses. Thus, they need information concerning liquidity, creditworthiness, solvency, and profitability to advance loans.

- Lenders - These are individuals and companies to whom a business owes money due to credit purchases of goods and receiving services. Therefore, creditors require information about the creditworthiness of the business.

- Investors and potential investors - They invest or plan to invest in the business. Hence, to verify the viability and prospects of their investment, creditors need information about the profitability and solvency of the enterprise.

- Tax authorities - They need information about sales, revenue, profit, and taxable income to determine the levy of various types of taxes on the business.

- Government - It needs information to determine national income, GDP, industrial growth, etc. Accounting data helps the government in the formulation of various policies and measures to address economic issues like employment, poverty, etc.

- Researchers - Various research institutes like NGOs and other independent research institutions like CRISIL, stock exchanges, etc., undertake research projects. Accounting data facilitates their research work.

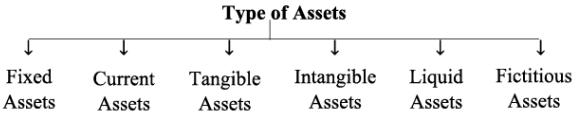

Q4: What do you mean by an asset, and what are the different types of assets?

Ans: Any valuable element that has economic value, which is owned by a business, is its asset. In other words, assets are the economic value of the properties or the legal rights owned by business organizations.

Types of Assets:

- Fixed Assets - These are assets held for the long term and increase the income-earning ability and productive capacity of the business. These assets are not meant for sale, e.g., land, buildings, machinery, etc.

- Current Assets - Assets that can be easily converted into cash or cash equivalents are termed as current assets. These are required to run daily business activities, e.g., cash, debtors, stock, etc.

- Tangible Assets - Assets that have physical existence, i.e., which can be seen and touched, are tangible assets, e.g., vehicles, furniture, buildings, etc.

- Intangible Assets - Assets that cannot be seen or touched, i.e., those assets that do not have physical existence, are intangible assets, e.g., goodwill, patents, trademarks, etc.

- Liquid Assets - Assets that can be kept either in cash or cash equivalents are regarded as liquid assets. These can be converted into cash in a very short period of time, e.g., cash, bank, bills receivable, etc.

- Fictitious Assets - These are the heavy revenue expenses, the benefit of which can be derived over multiple years. They represent losses or expenses that are written off over a period of time, e.g., if the promotional expenditure is Rs 1,00,000 for five years, then every year Rs. 20,000 will be written off.

Q5: Explain the meaning of gain and profit. Distinguish between these two terms.

Ans:

Profit: Excess of revenue over expense is known as profit. It is usually categorized into gross profit or net profit. It increases the owner's capital as it is added to the capital at the end of every accounting period. For example, goods costing Rs. 1,00,000 are sold at Rs. 1,20,000. Then, the sale proceeds of Rs. 1,20,000 is the revenue and Rs. 1,00,000 is the cost to generate this sale. Thus, an accounting profit of Rs. 20,000 (i.e., Rs. 1,20,000 - Rs. 1,00,000) is the difference between the revenue and cost, earned by the business.

Gain: It arises from irregular activities or non-habitual transactions. In other words, gain is a result of transactions that are incidental to the business, other than operating transactions. For example, old machinery with a book value of Rs. 20,000 is sold at Rs. 25,000. Hence, the gain is Rs. 5,000 (i.e., Rs. 25,000 - Rs. 20,000). Here, the sale of the old machinery is an abnormal activity; so, the difference is termed as gain. Therefore, the basic difference between profit and gain is that profit is the excess of revenue over expense, while gain arises from transactions outside of regular operations.

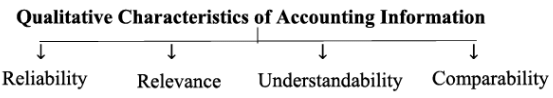

Q6: Explain the qualitative characteristics of accounting information.

Ans:  The following are the qualitative characteristics of accounting information:

The following are the qualitative characteristics of accounting information:

- Reliability: It means that the user can rely on the accounting records. All accounting records are verifiable and can be confirmed from the source document (voucher), e.g., cash memos, bills, etc. Hence, the available records should be free from errors and unbiased.

- Relevance: It means that essential and appropriate information should be easily and timely available, and any irrelevant information should be avoided. The users of accounting information need relevant information for decision-making, planning, and predicting future conditions.

- Understandability: Accounting information should be presented in such a way that anyone can interpret the information without difficulty, in a meaningful and suitable manner.

- Comparability: This is the most important quality of accounting information. Comparability means accounting information of a current year can be compared with that of previous years. Comparability allows for intra-company and inter-firm comparisons. This helps in assessing the effects of various policies and programs followed over different time horizons by the same or different companies. Additionally, it facilitates evaluating the growth and development of the business over time and compared to other businesses.

Q7: Describe the role of accounting in the modern world.

Ans: The role of accounting has been evolving over time. In the modern world, accounting is not only limited to recording financial transactions but also provides a fundamental framework for various decision-making processes, offering relevant information to various users and assisting in both short-term and long-term planning. The roles of accounting in the modern world are as follows:

- Supporting Management: Management uses accounting information for short-term and long-term planning of business activities, to forecast future conditions, prepare budgets, and implement control measures.

- Comparative Analysis: In the modern world, accounting information helps assess business performance by comparing current year profits with those of previous years and with other firms in the same industry.

- Memory Substitute: In today's world, businesses handle a large number of transactions, making it beyond human capacity to remember each transaction. Therefore, it is crucial to record transactions in the books of accounts.

- Information to End Users: Accounting plays an essential role in recording, summarizing, and presenting relevant and reliable information to its users in the form of financial data that aids in decision-making.

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solution - Introduction to Accounting - Accountancy Class 11 - Commerce

| 1. What is the importance of accounting in business? |  |

| 2. What are the basic principles of accounting? |  |

| 3. What is the difference between cash accounting and accrual accounting? |  |

| 4. How do financial statements reflect the performance of a business? |  |

| 5. What are the key components of an accounting system? |  |