NCERT Solution - Theory Base of Accounting | Accountancy Class 11 - Commerce PDF Download

Short Question Answer

Q1: Why is it necessary for accountants to assume that a business entity will remain a going concern?

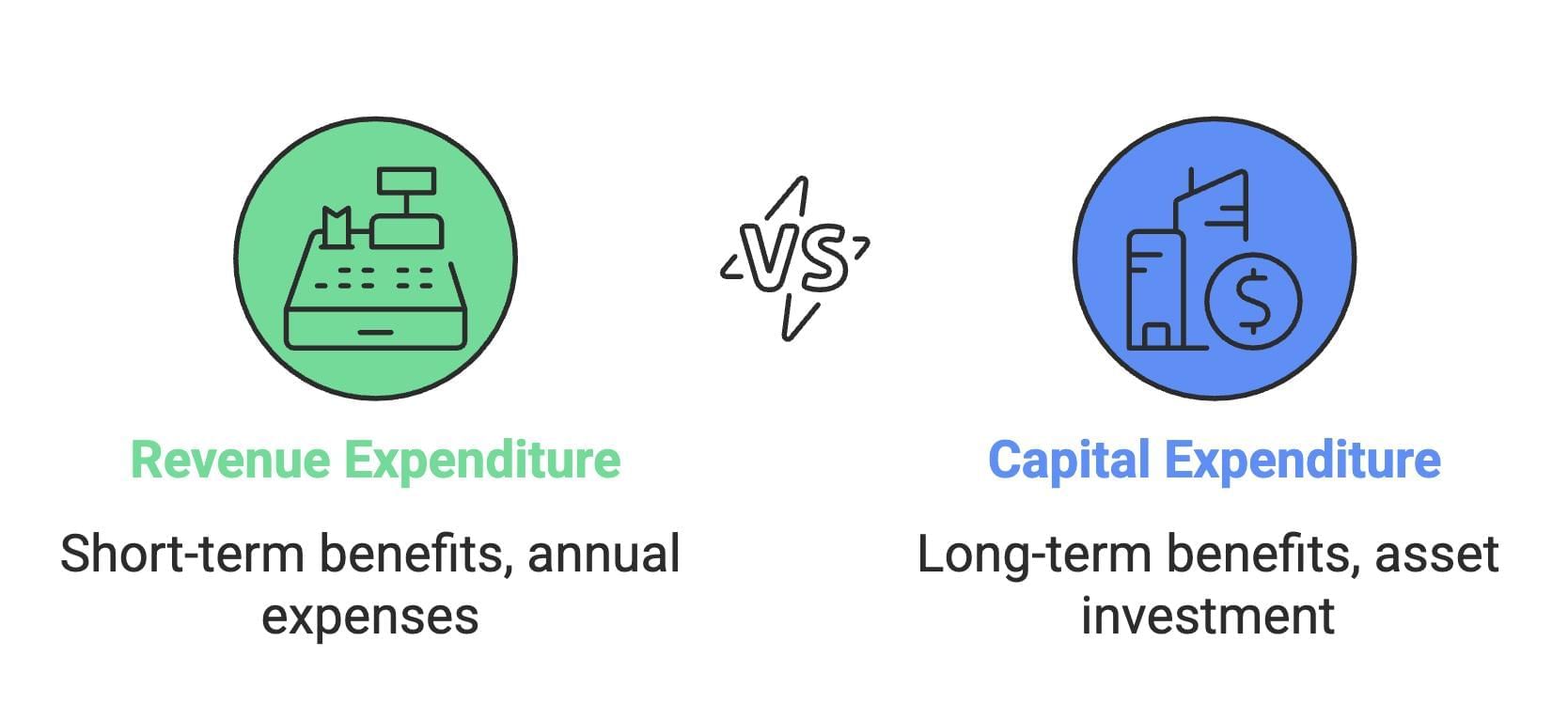

Ans: The concept of Going Concern assumes that a business will continue its operations indefinitely. This assumption is important as it allows for the distinction between revenue expenditure, which pertains to the current year, and capital expenditure, which provides benefits over a longer period of time. For instance, if machinery costs Rs 1,00,000 and is expected to have a lifespan of 10 years, it would be considered a capital expenditure since its benefits extend beyond one year. On the other hand, the annual depreciation expense of the machinery, let's say Rs 10,000, would be classified as revenue expenditure.

Q2: When should revenue be recognised? Are there exceptions to the general rule?

Ans: Revenue recognition occurs when a business has completed a sale transaction, either through cash or credit, and has established the right to receive income from that transaction. It is important to note that revenue is not recognised when income or payment is received in advance or when payment is received from debtors. For instance, if Mr. A sells goods in January and receives payment in February, the revenue is recognised in January. However, if Mr. A receives cash in advance, such as in December, and the goods are sold in January, the revenue is recognised in January and not in December.

The exceptions to this rule are given below.

1) Hire purchase- When goods are sold on the hire-purchase system, the amount received in instalments is treated as revenue.

2) Long-term construction contract- Long-term projects like the construction of dams, highways, etc., have a long gestation period. Income is recognised on a proportionate basis of work certified and not on the completion of the contract.

Q3: What is the basic accounting equation?

Ans: The accounting equation is a crucial aspect of the balance sheet that serves as the foundation for the bookkeeping method of double entry.

Every debit must be matched by an equal credit, according to the basic accounting equation. It can be expressed as:

Assets = Capital + Liabilities

As a result, the company's total assets equal the shareholders' funds plus all other obligations.

Q4: The realization concept determines when goods sent on credit to customers are to be included in the sales figure to compute the profit or loss for the accounting period. Which of the following tends to be used in the practice to determine when to include a transaction in the sales figure for the period, when the goods have been:

a) Dispatched,

b) Invoiced,

c) Delivered,

d) Paid for

Give your reasons.

Ans: Option B, i.e., invoiced, is the correct answer.

According to the realisation concept, revenue should be recognised once it is realisable or realised, whichever comes first. Therefore, invoicing can be used by an organisation to determine and acknowledge a transaction, as it implies that ownership of the items has been properly transferred. After invoicing, the concerned firm does not need to retain the payment.

Q5: Complete the following worksheet:

(i) If a firm believes that some of its debtors may ‘default’, it should act on this by making sure that all possible losses are recorded in the books. This is an example of the ___ concept.

Ans: conservatism

(ii) The fact that a business is separate and distinguishable from its owner is best exemplified by the __________ concept.

Ans: business entity

(iii) Everything a firm owns, it also owns out to somebody. This coincidence is explained by the _________ concept.

Ans: dual aspect

(iv)The ___________ concept states that if the straight-line method of depreciation is used in one year, then it should also be used in the next year.

Ans: consistency

(v) A firm may hold stock that is heavily in demand. Consequently, the market value of this stock may be increased. Normal accounting procedure is to ignore this because of the _____________

Ans: conservatism

(vi) If a firm receives an order for goods, it would not be included in the sales figure owing to the ____________

Ans: realisation

(vii) The management of a firm is remarkably incompetent, but the firm’s accountants cannot take this into account while preparing a book of accounts because of ____________concept.

Ans: measurement

Long Question Answer

Q1: The accounting concepts and accounting standards are generally referred to as the essence of financial accounting. Comment.

Ans:

- Financial accounting involves the preparation of financial statements and providing financial information to accounting users.

- It follows basic accounting concepts such as Business Entity, Money Measurement, Consistency, Conservatism, etc.

- These concepts allow different approaches to be taken for treating the same transaction, such as different methods for calculating stock and depreciation.

The existence of multiple approaches can lead to inconsistency and incomparability of financial results among different business entities.

To address this issue, accounting standards are issued by the Institute of Chartered Accountants of India.

Accounting standards help in removing ambiguities and inconsistencies, bringing uniformity to the preparation of financial statements.

Accounting standards and accounting concepts are considered essential components of financial accounting.

Q2: Why is it important to adopt a consistent basis for the preparation of financial statements? Explain.

Ans:

- Financial statements are drawn to provide information about the growth or decline of business activities over a period of time or comparison of the results, i.e. intra-firm (comparison within the same organisation) or inter-firm comparisons (comparison between different firms).

- Comparisons can be performed only when the accounting policies are uniform and consistent.

- According to the Consistency Principle, accounting practices once selected should be continued over a period of time (i.e. year after year) and should not be changed very frequently.

- These help in a better understanding of the financial statements and thus make comparisons easy.

- For example, if a firm is following FIFO method for recording stock and switches over to the weighted average method, then the results of this year cannot be compared to those of the previous years.

- Although consistency does not prevent change in the accounting policies, but if change in the policies is essential for better presentation and better understanding of the financial results, then the firm must undertake change in its accounting policies and must fully disclose all the relevant information, reasons and effects of those changes in the financial statements.

Q3: Discuss the concept based on the premise ‘do not anticipate profits but provide for all losses’.

Ans:

- According to the Conservatism Principle, profits should not be anticipated; however, all losses should be accounted for (irrespective of whether they occurred or not).

- It states that profits should not be recorded until they are recognised; however, all possible losses, even though they may happen rarely, should be provided. For example, stock is valued at cost or market price, whichever is lower.

- If the market price is lower than the cost price, a loss should be accounted for; whereas, if the former is more than the latter, then this profit should not be recorded until the stock is sold.

- There are numerous provisions that are maintained based on the conservatism principle, like provision for discount to debtors, provision for doubtful bad debts, etc.

- This principle is based on common sense and depicts pessimism. This also helps the business to deal with uncertainty and unforeseen conditions.

Q4: What is the matching concept? Why should a business concern follow this concept?

Ans:

- Matching Concept states that all expenses incurred during the year, whether paid or not, and all revenues earned during the year, whether received or not, should be taken into account while determining the profit of that year.

- In other words, expenses incurred in a period should be set off against its revenues earned in the same accounting period for ascertaining profit or loss. For example, insurance premium paid for a year is Rs1200 on July 01 and if accounts are closed on March 31, every year, then the insurance premium of the current year will be ascertained for nine months (i.e. from July to March) and will be calculated as, Rs 1200 - Rs 900 = Rs 300

- Thus, according to the matching concept, the expense of Rs 900 will be taken into account and not Rs 1200 for determining profit, as the benefit of only Rs 900 is availed in the current accounting period.

- The business entities follow this concept mainly to ascertain the true profit or loss during an accounting period. It is possible that in the same accounting period, the business may either pay or receive payments that may or may not belong to the same accounting period.

- This leads to either overcasting or undercasting of the profit or loss, which may not reveal the true efficiency of the business and its activities in the concerned accounting period. Similarly, there may be various expenditures like, purchase of machinery, buildings, etc.

- These expenditures are capital in nature, and their benefits can be availed over a period of time. In such cases, only the depreciation of such assets is treated as an expense and should be taken into account for calculating the profit or loss of the concerned year.

- Thus, it is very necessary for any business entity to follow the matching concept.

Q5: What is the money measurement concept? Which factor makes it difficult to compare monetary values across years?

Ans:

- The money Measurement Concept states that only those events that can be expressed in monetary terms are recorded in the books of accounts.

- For example, 12 television sets of Rs 10,000 each are purchased, and this event is recorded in the books with a total amount of Rs 1,20,000. Money acts as a common denominator for all the transactions and helps in expressing different measurement units into a common unit, for example, rupees.

- Thus, the money measurement concept enables consistency in maintaining accounting records. But on the other hand, the adherence to the money measurement concept makes it difficult to compare the monetary values of one period with those of another.

- It is because of the fact that the money measurement concept ignores the changes in the purchasing power of the money, i.e. only the nominal value of money is considered and not the real value.

- What Rs 1 could buy 10 years back cannot buy today; hence, the nominal value of money makes comparison difficult. The real value of money would be a more appropriate measure as it considers the price level (inflation), which depicts the changes in profits, expenses, incomes, assets and liabilities of the business.

|

61 videos|226 docs|39 tests

|

FAQs on NCERT Solution - Theory Base of Accounting - Accountancy Class 11 - Commerce

| 1. What is the theory base of accounting? |  |

| 2. Why is the accounting equation important in accounting? |  |

| 3. What are the key accounting concepts that every student should know? |  |

| 4. How does the double-entry system work in accounting? |  |

| 5. What is the significance of the matching principle in accounting? |  |