NCERT Solution (Part - 2) Recording of Transactions-II | Accountancy Class 11 - Commerce PDF Download

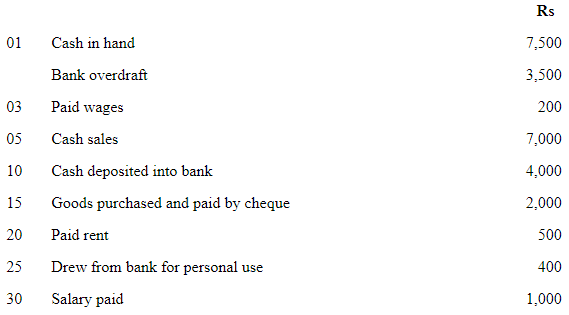

Question 7: Prepare double column cash book from the following information for July 2017 :

Answer:

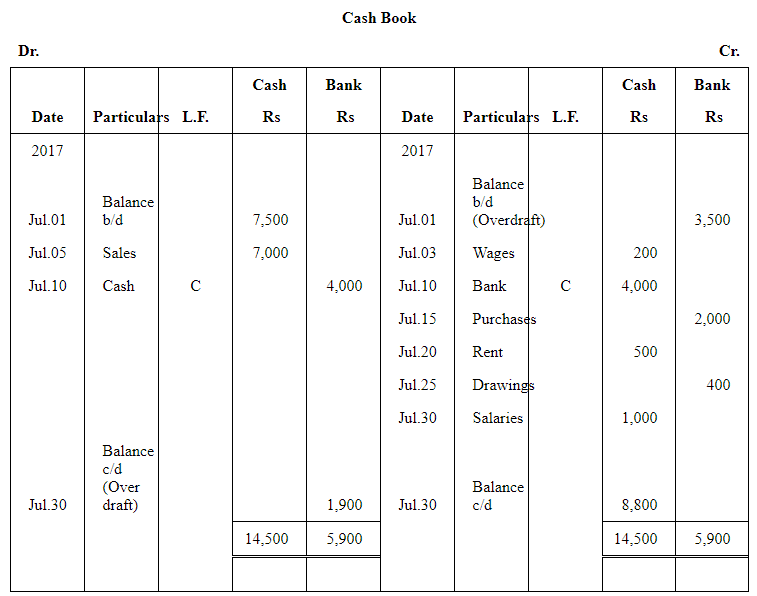

Question 8: Enter the following transaction in a double column cash book of M/s Mohit Traders for January 2017:

Answer:

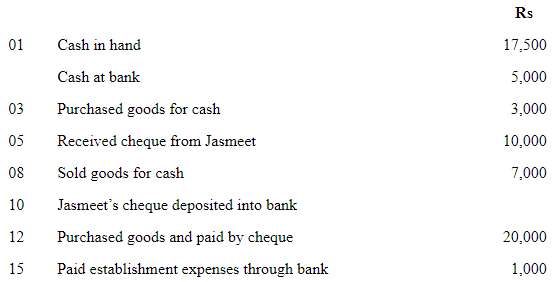

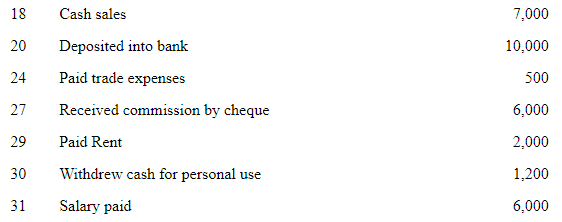

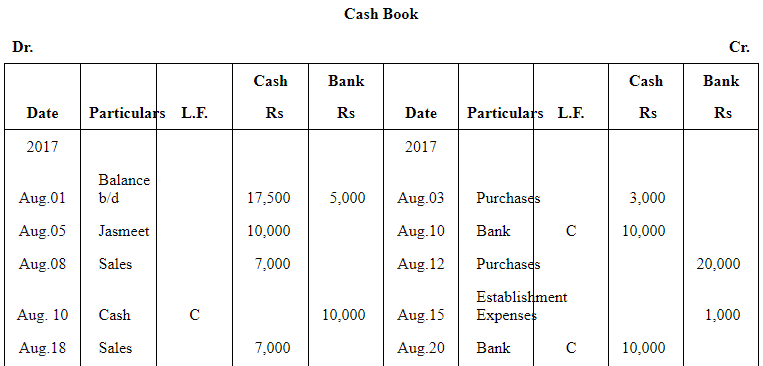

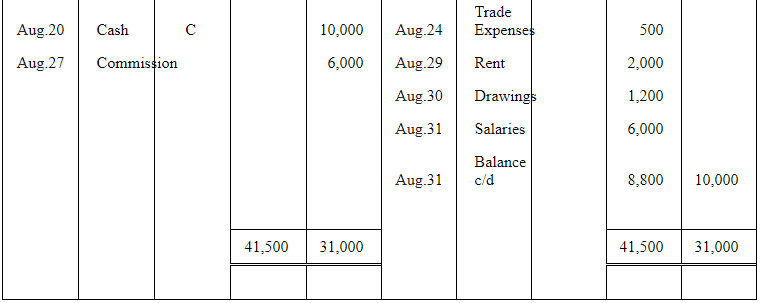

Question 9: Prepare double column cash book from the following transactions for the year August 2017:

Answer:

[[S]]

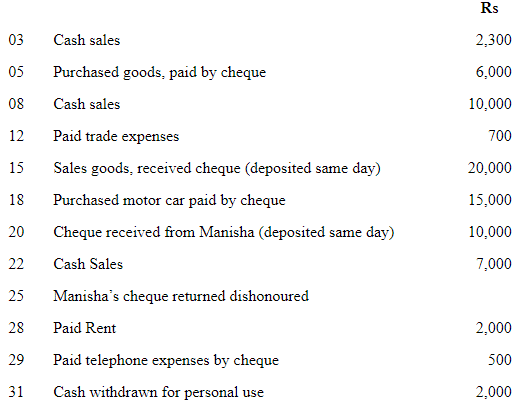

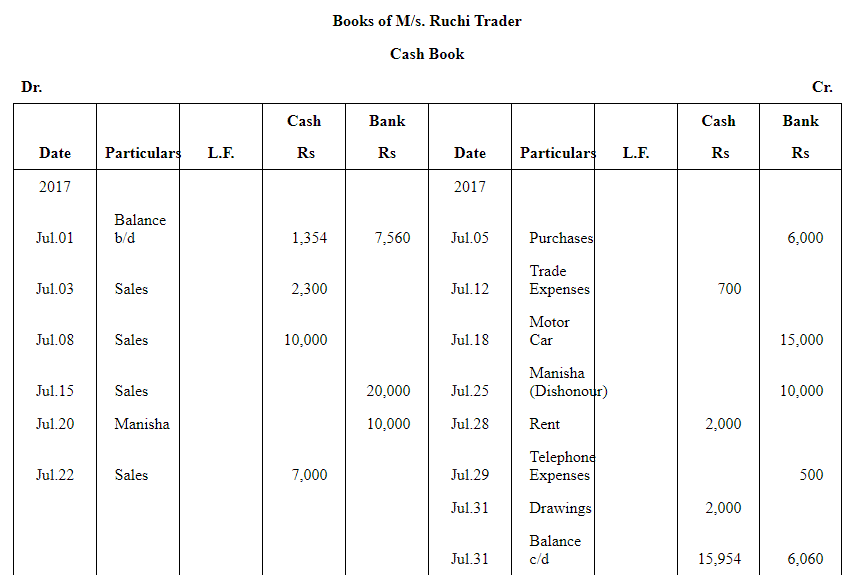

Question 10: M/s Ruchi trader started their cash book with the following balances on Dec. 01 2005 : cash in hand Rs 1,354 and balance in bank current account Rs 7,560. He had the following transaction in the month of July, 2017

Prepare bank column cash book

Answer:

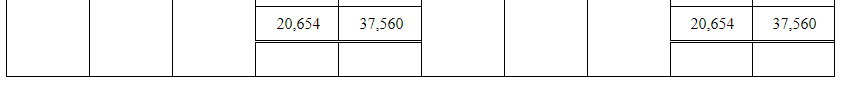

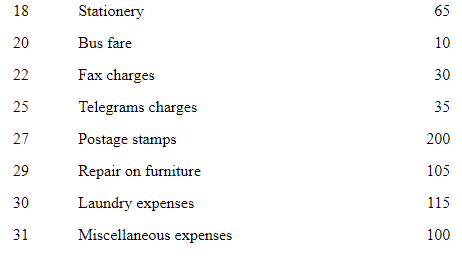

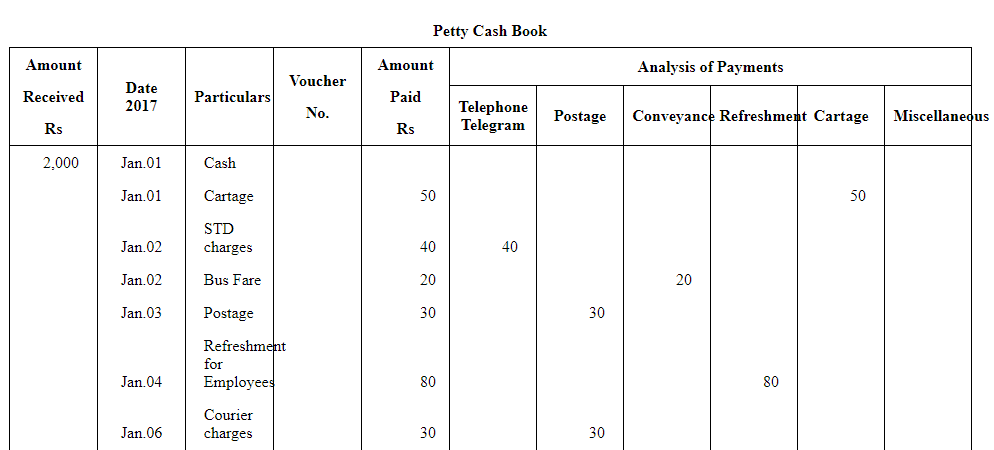

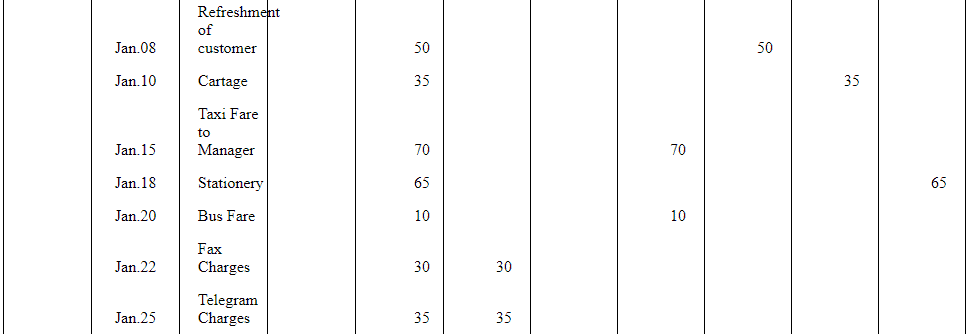

Question 11: Prepare petty cash book from the following transactions. The imprest amount is Rs 2,000.

Answer:

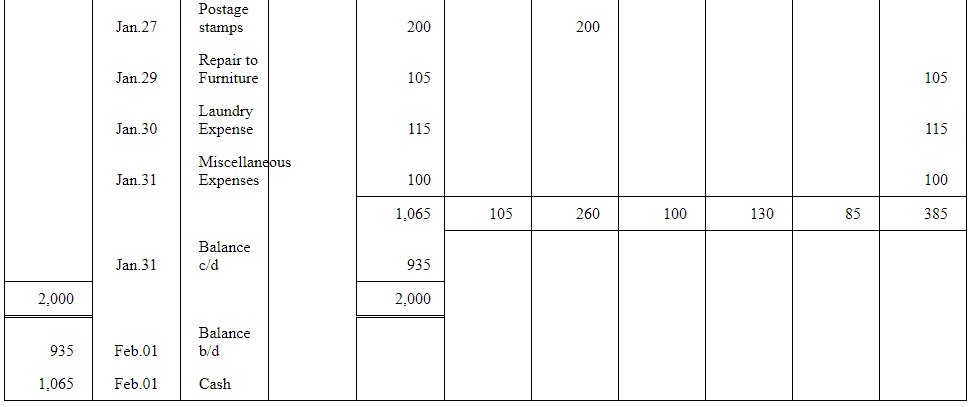

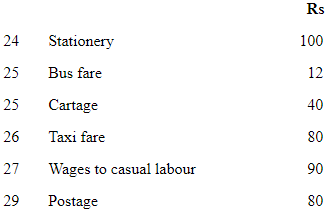

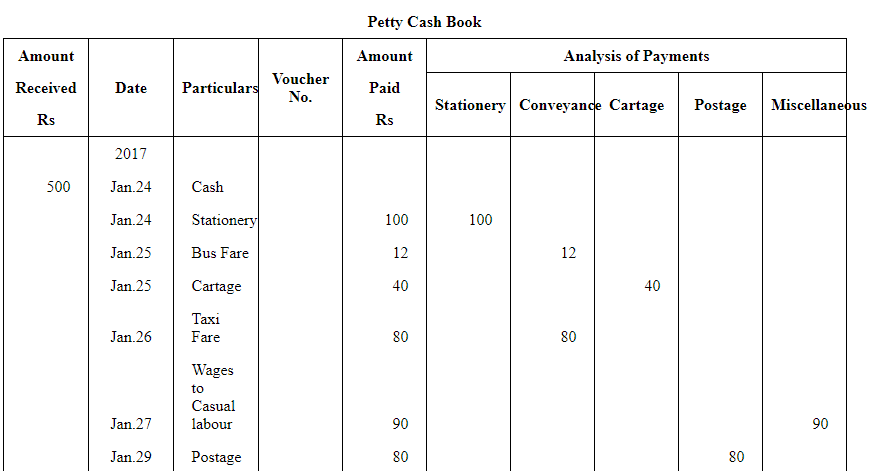

Question 12: Record the following transactions during the week ending January. 30, 2017 with a weekly imprest Rs 500

Answer:

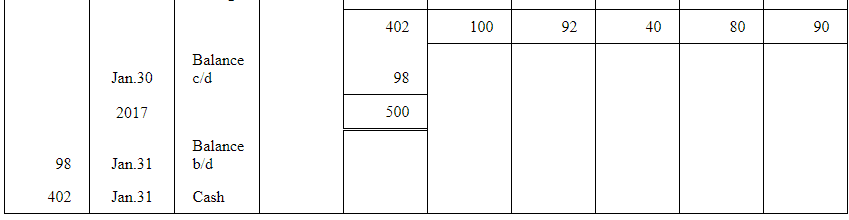

Question 13: Enter the following transactions in the Purchase Journal (Book) of M/s Gupta Traders of July 2005:

01 Bought from Rahul Traders as per invoice no. 20041

40 Registers @ Rs 60 each

80 Gel Pens @ Rs 15 each

50 note books @ Rs 20 each

Trade discount 10%.

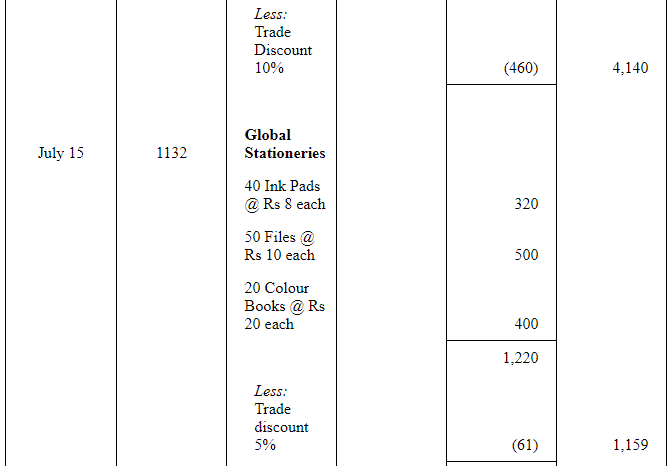

15 Bought from Global Stationers as per invoice no. 1132

40 Ink Pads @ Rs 8 each

50 Files @ Rs 10 each

20 Color Books @ Rs 20 each

Trade Discount 5%

23 Purchased from Lamba Furniture as per invoice no. 3201

2 Chairs @ 600 per chair

1 Table @ 1,000 per table

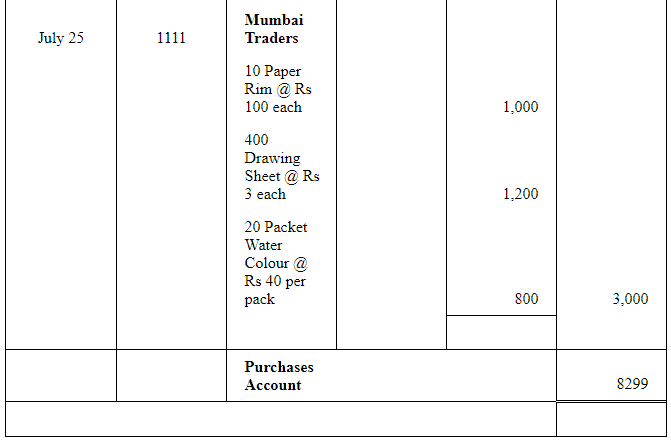

25 Bought from Mumbai Traders as per invoice no. 1111

10 Paper Rim @ Rs 100 per rim

400 drawing Sheets @ Rs 3 each

20 Packet water colour @ Rs 40 per packet

Answer:

Note: Furniture purchased from Lamba Traders will not be recorded in the Purchases Book as furniture is not to be considered as goods for the M/s Gupta Trader. This is because as per the transactions M/s. Gupta traders deals in stationery and not in furniture.

Note: Slight change in the Performa of subsidiary book is done. Here 'Details' column has been added in Purchase Book.

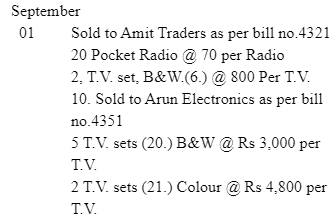

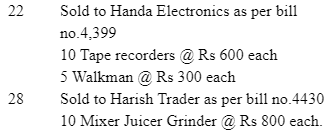

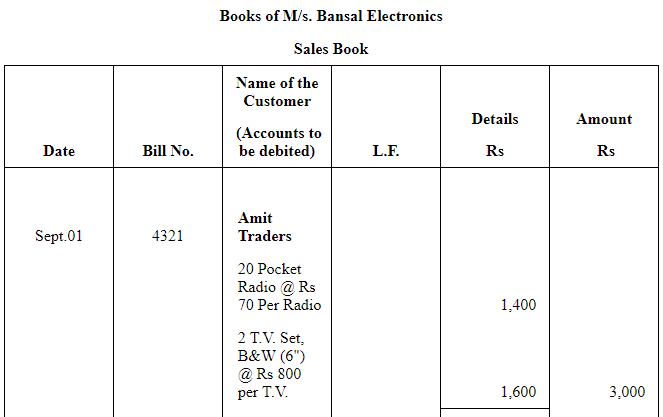

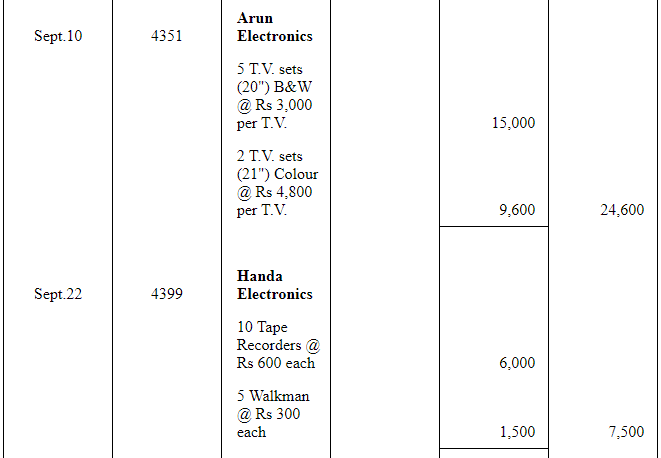

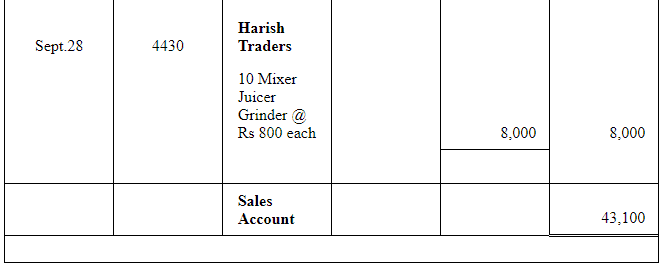

Question 14: Enter the following transactions in sales (journal) book of M/s. Bansal electronics:

Answer:

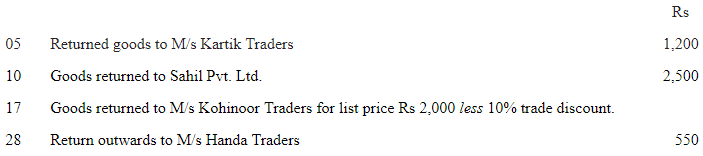

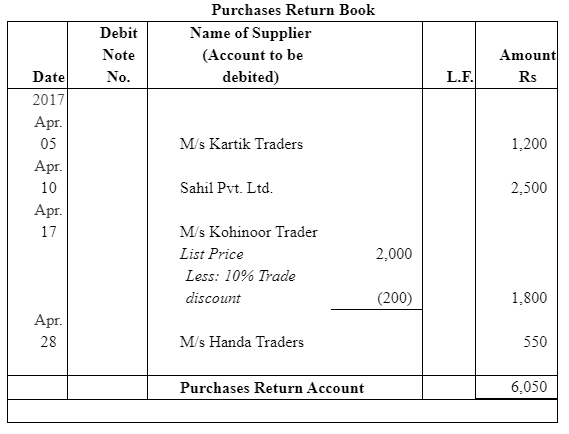

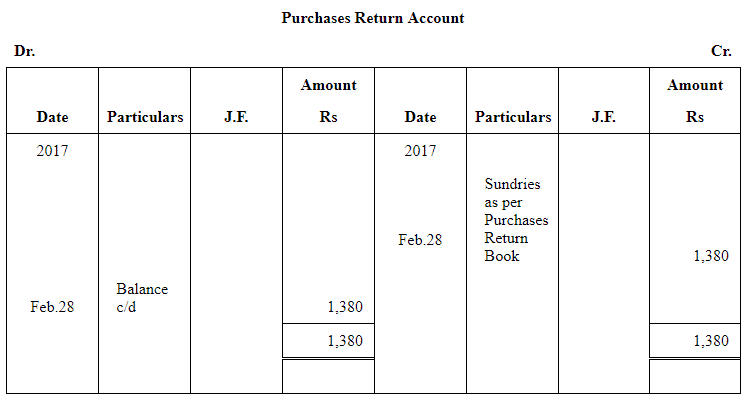

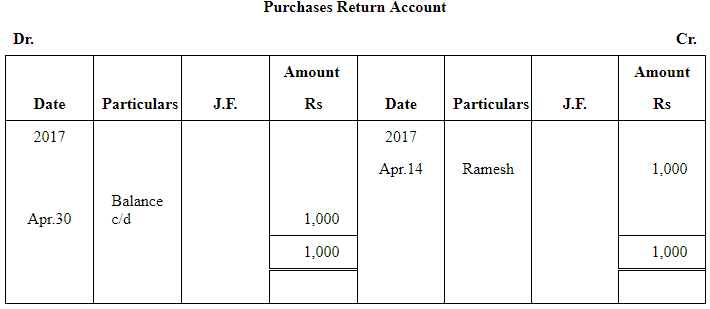

Question 15: Prepare a purchases return (journal) book from the following transactions for April 2017

Answer:

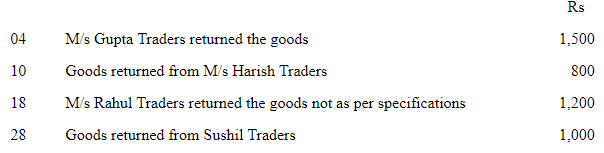

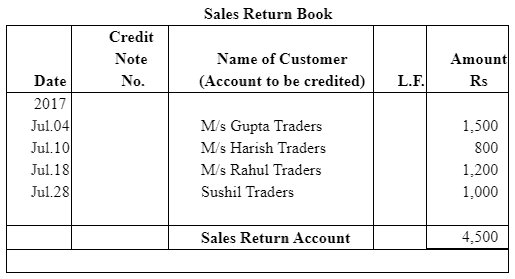

Question 16: Prepare Return Inward Journal (Book) from the following transactions of M/s Bansal Electronics for July 2017:

Answer:

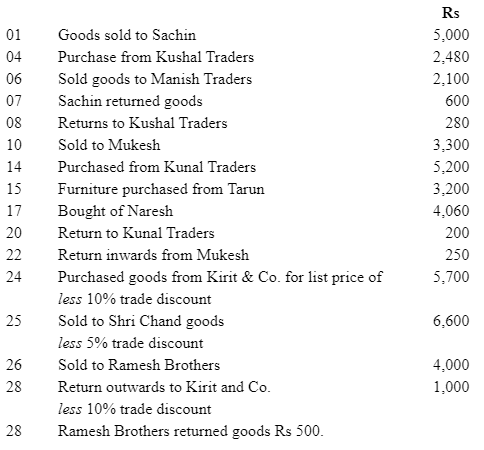

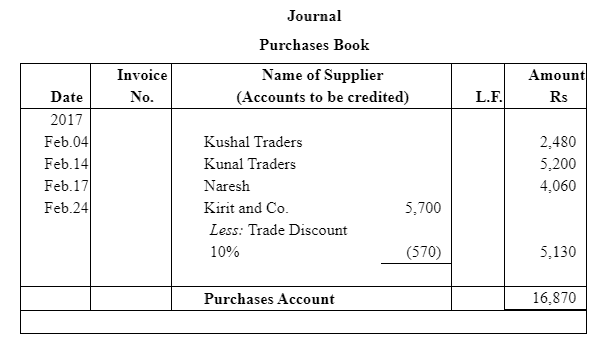

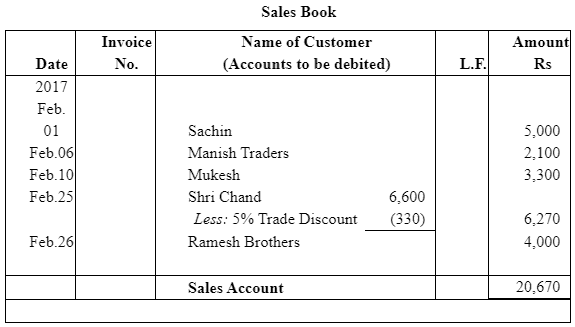

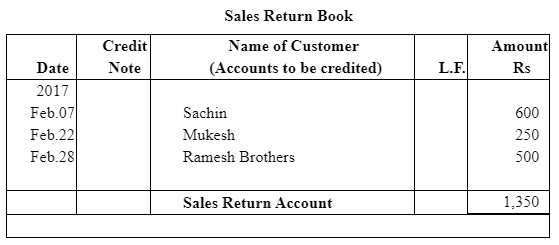

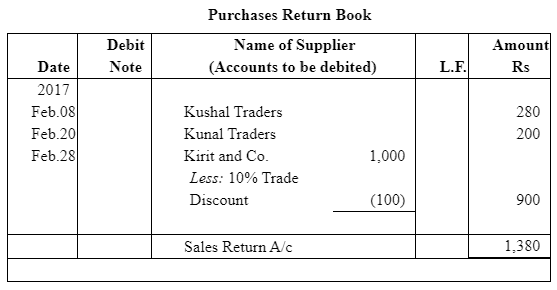

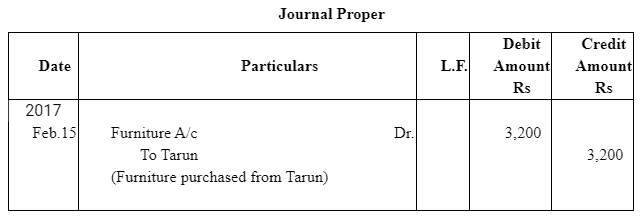

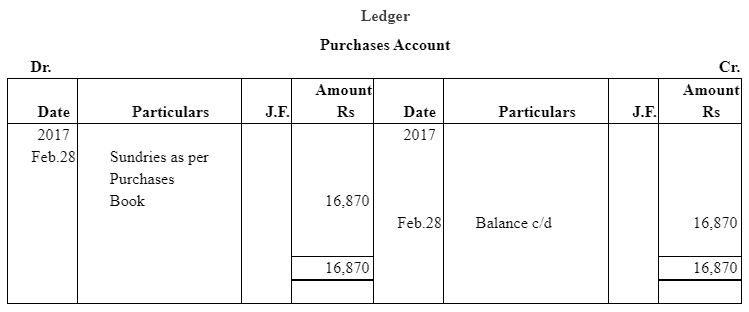

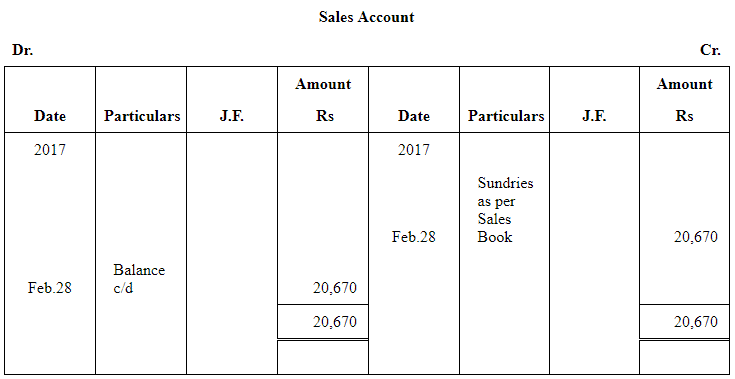

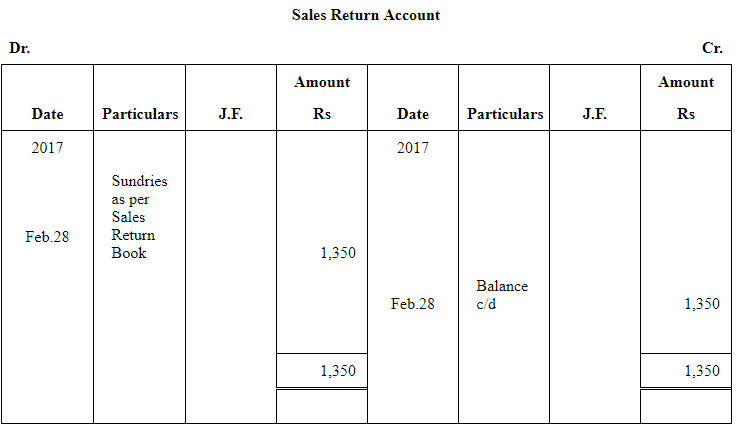

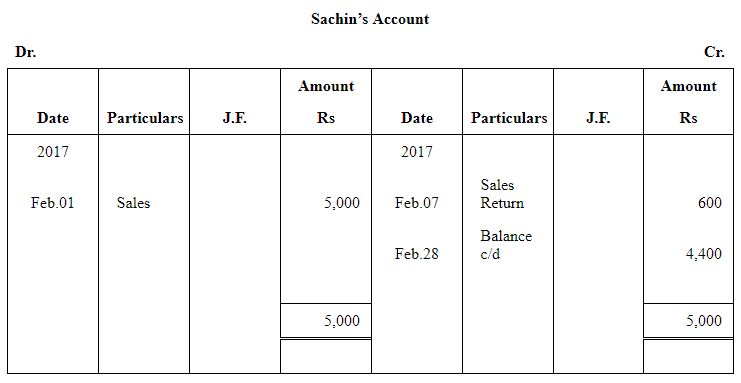

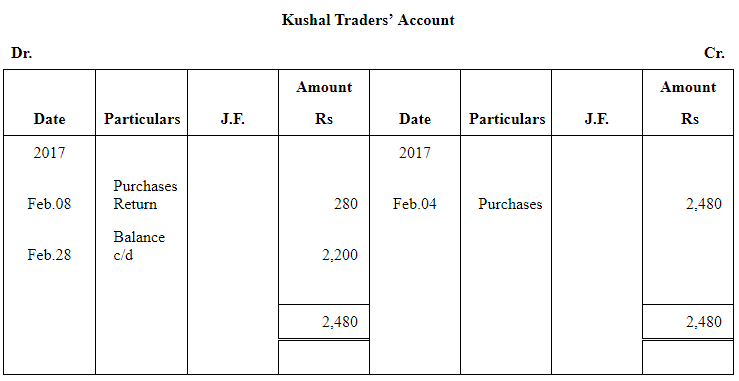

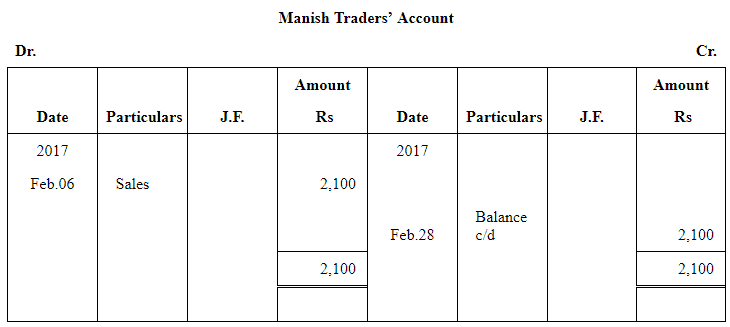

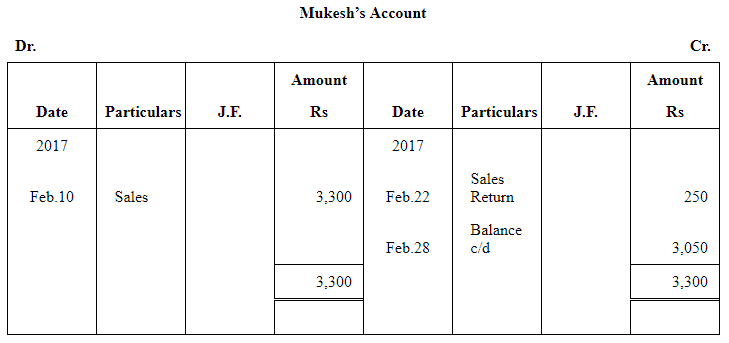

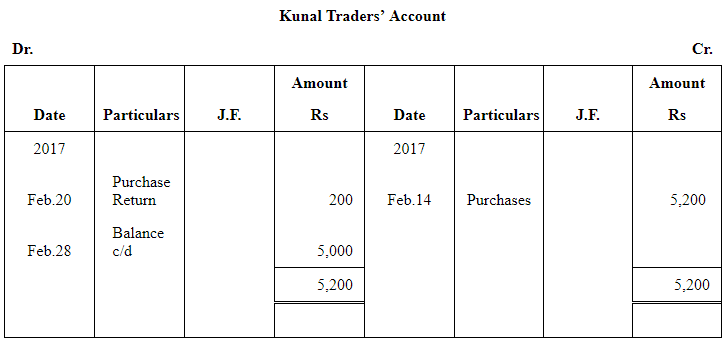

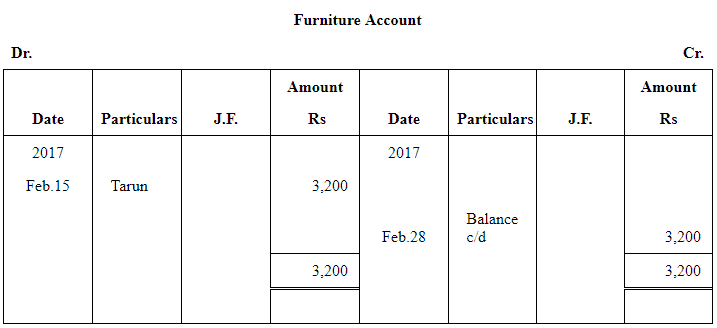

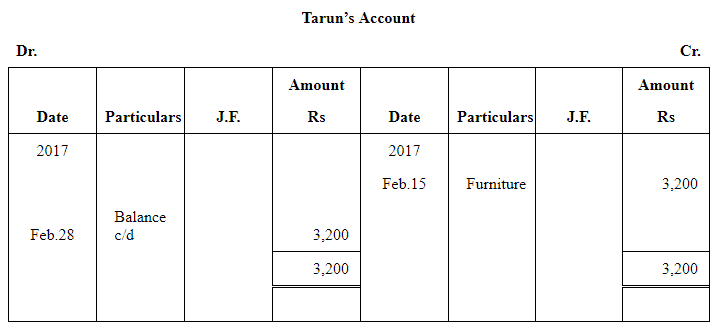

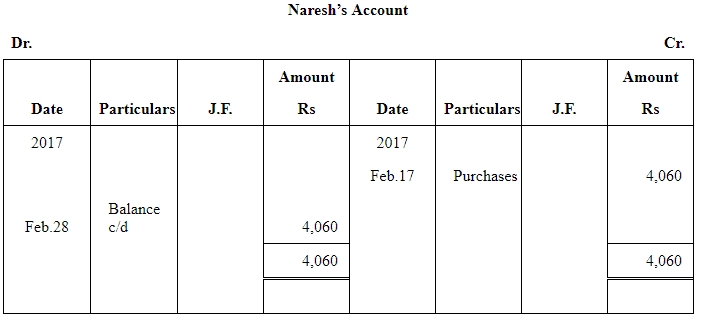

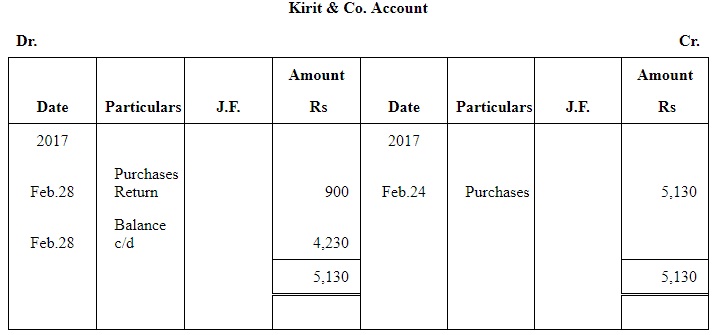

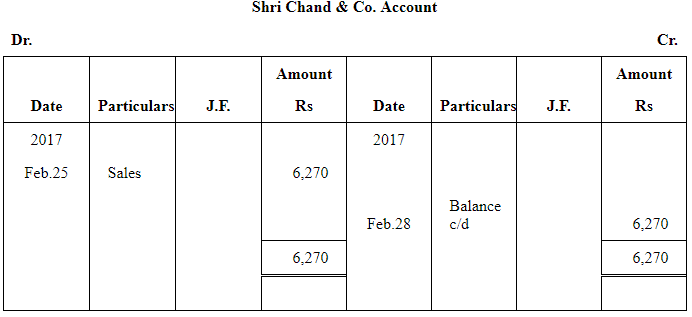

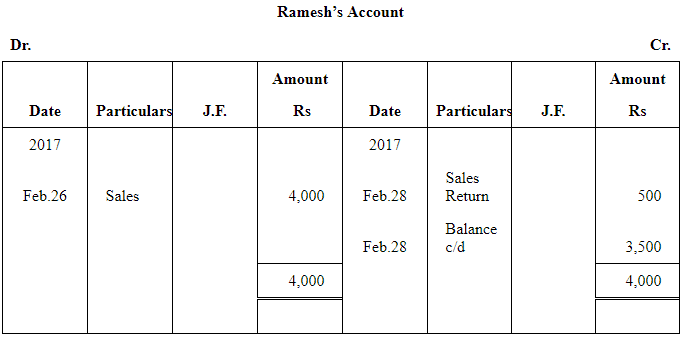

Question 17: Prepare proper subsidiary books and post them to the ledger from the following transactions for the month of February 2017:

Answer:

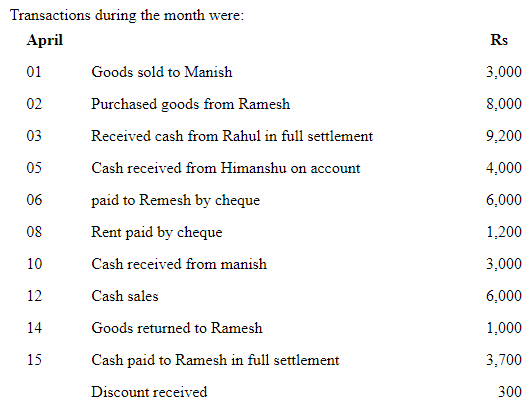

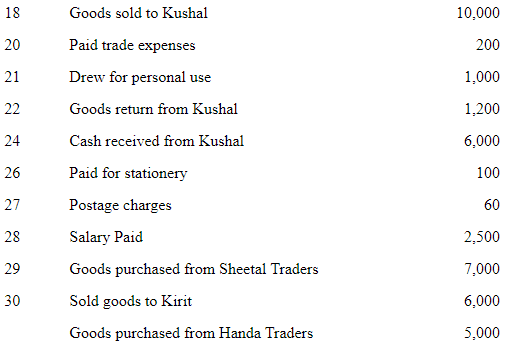

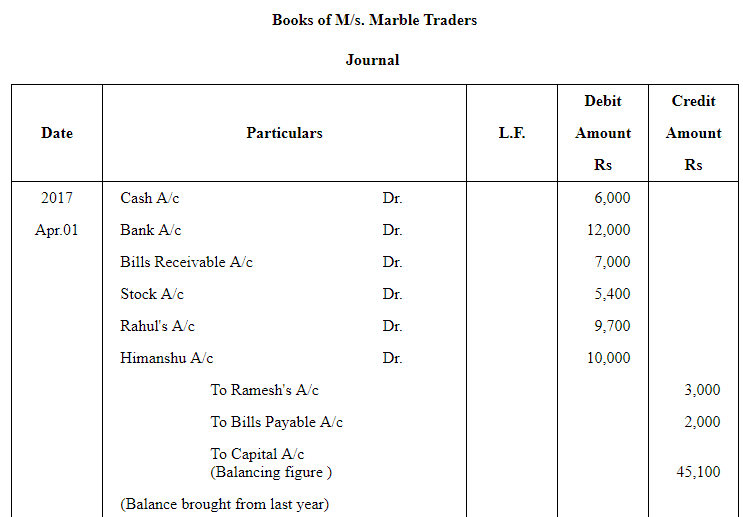

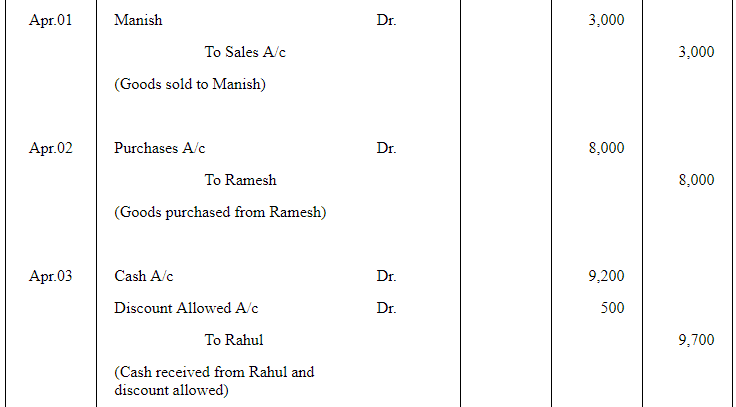

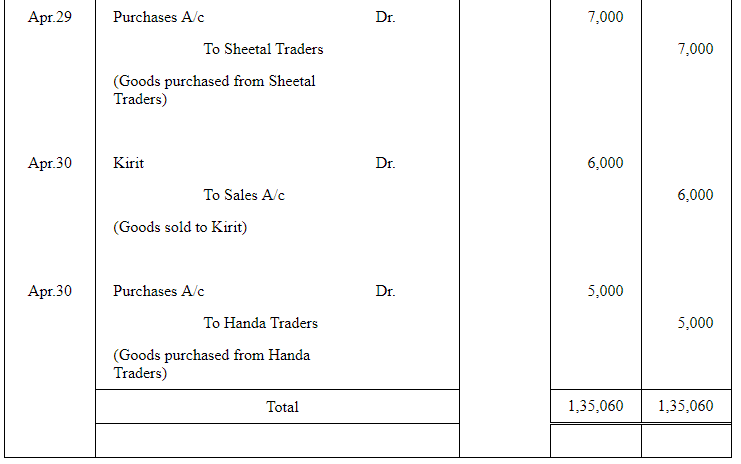

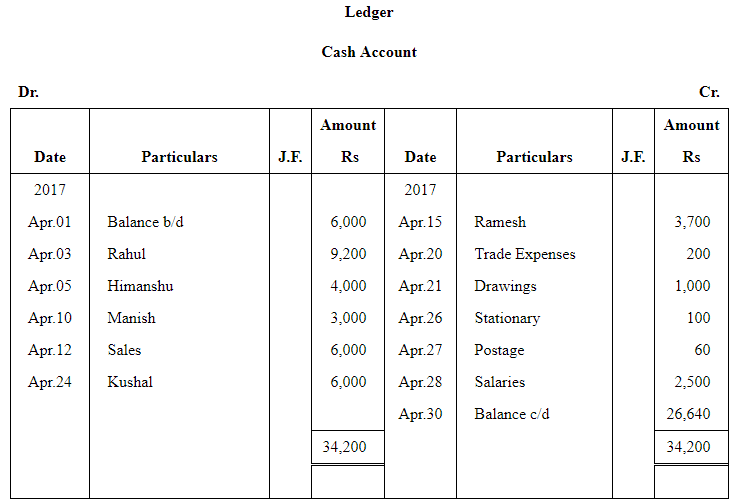

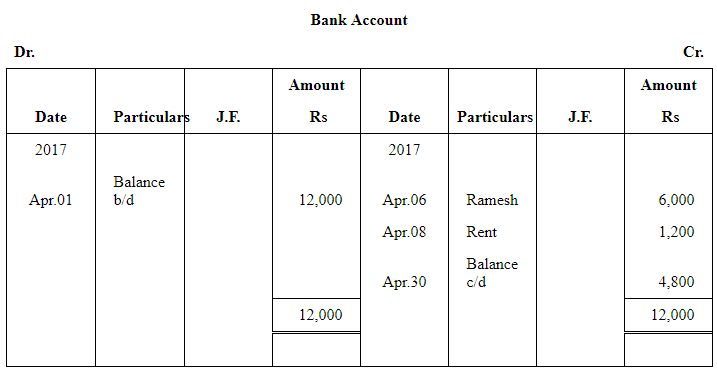

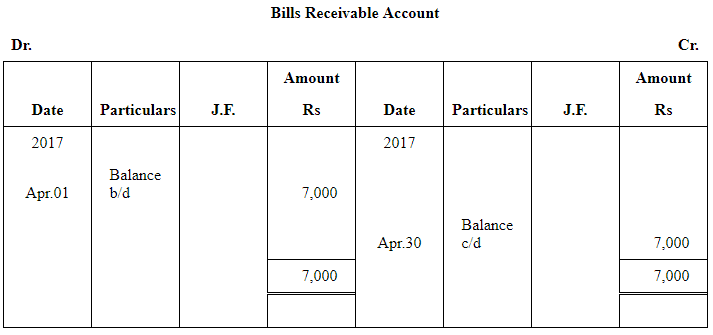

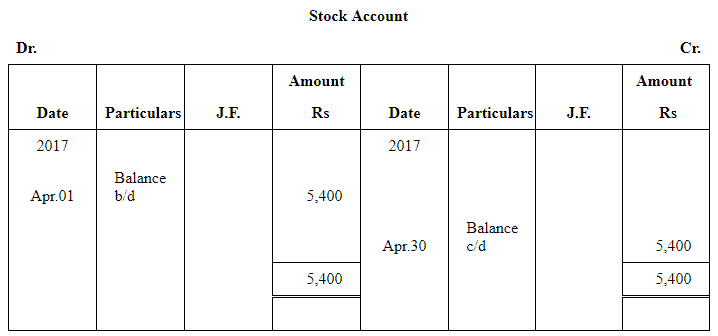

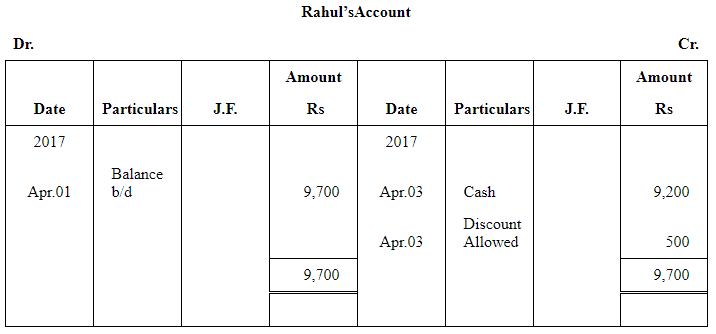

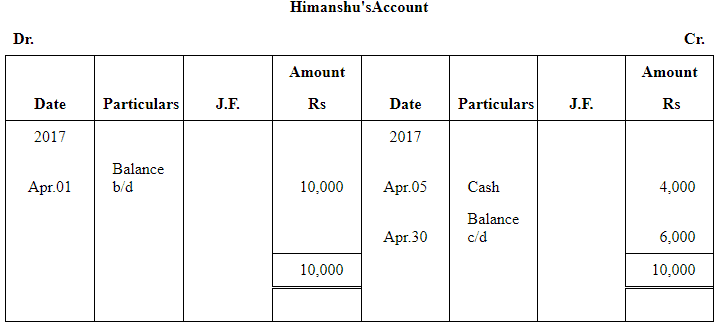

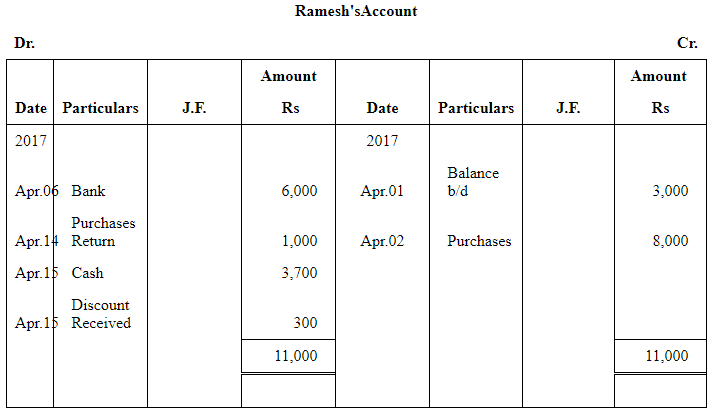

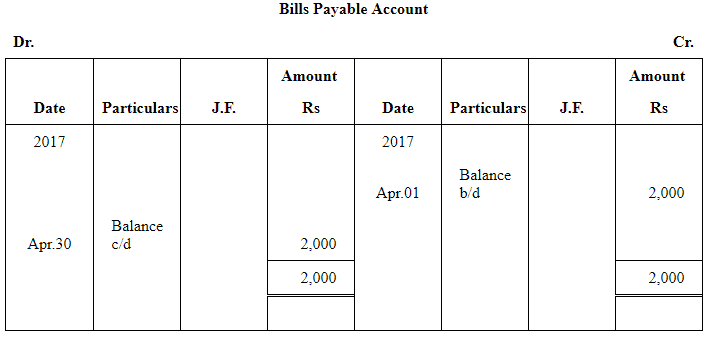

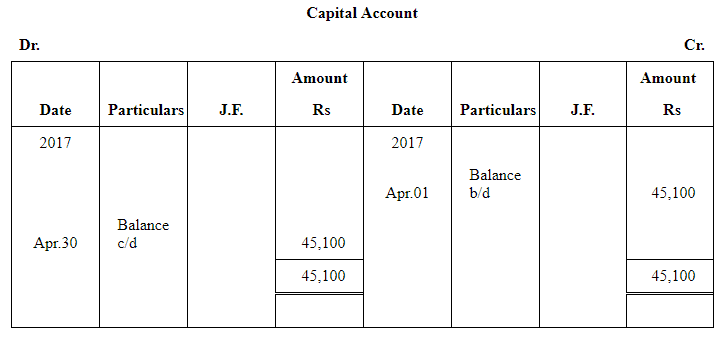

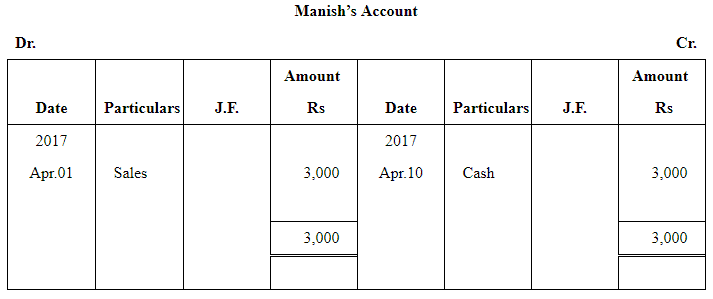

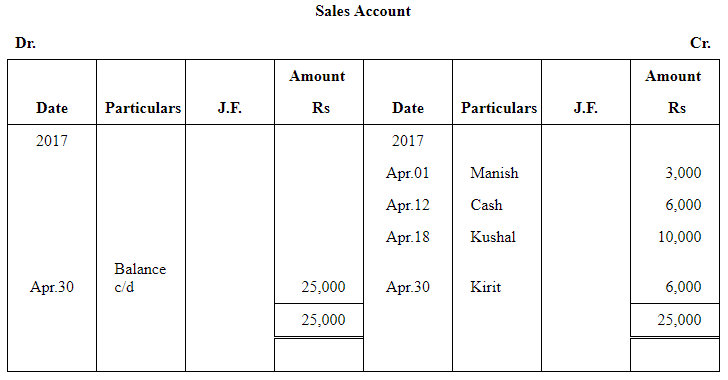

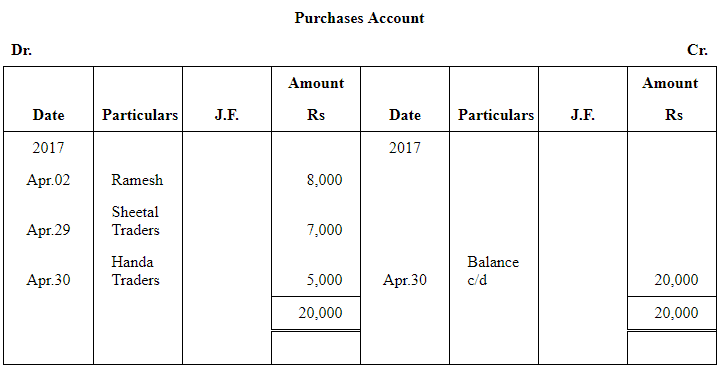

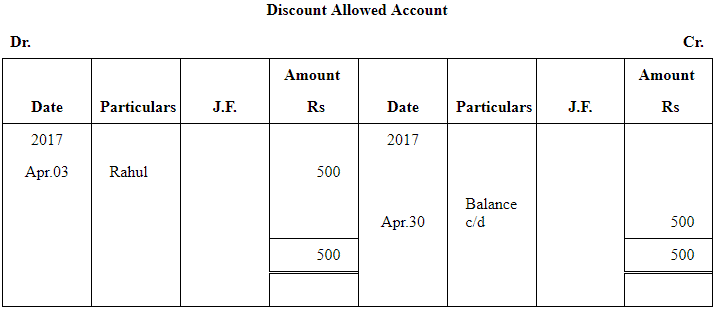

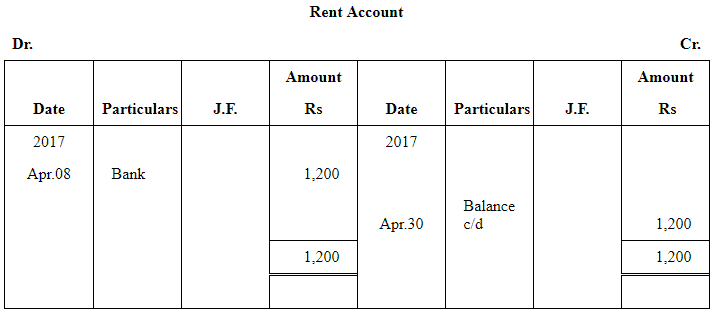

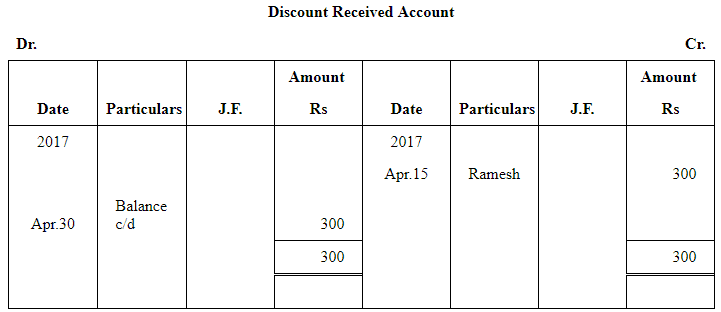

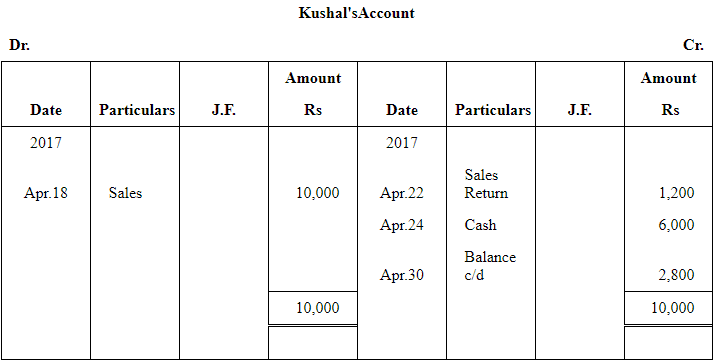

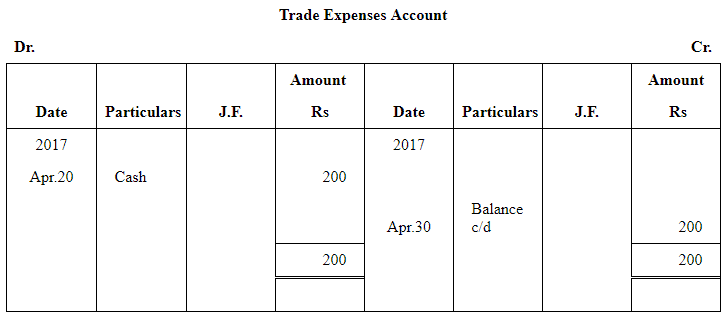

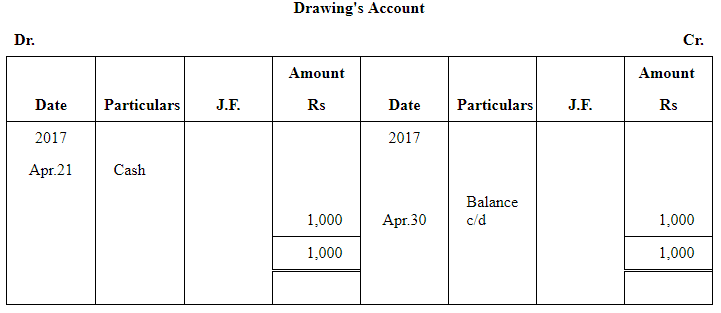

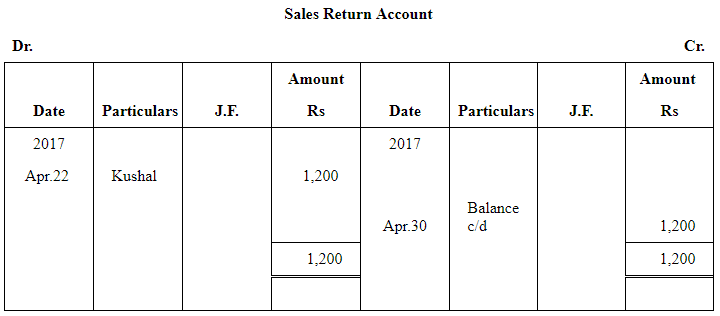

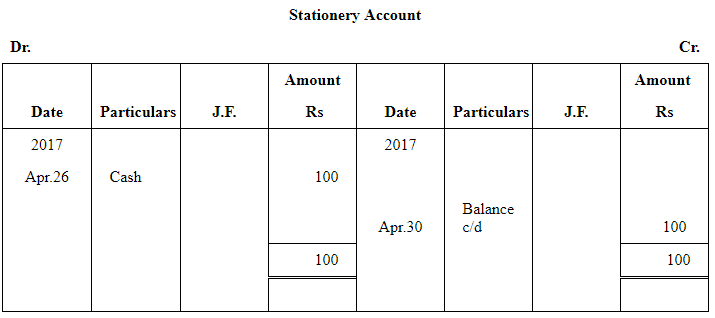

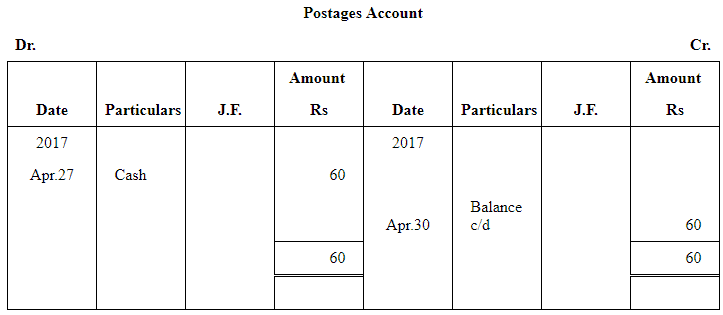

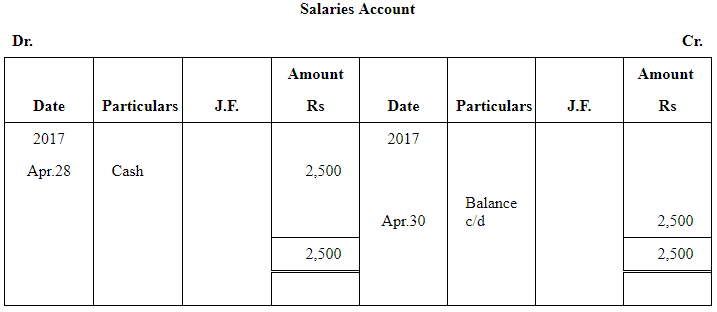

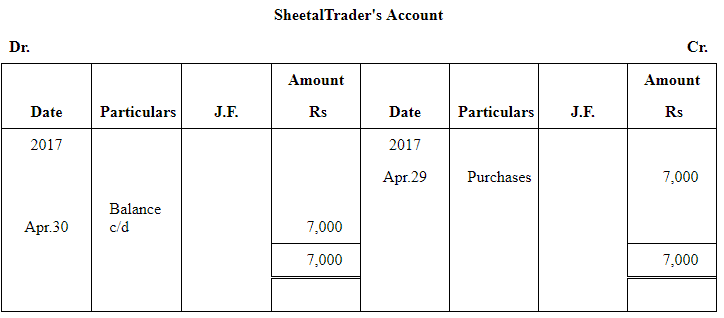

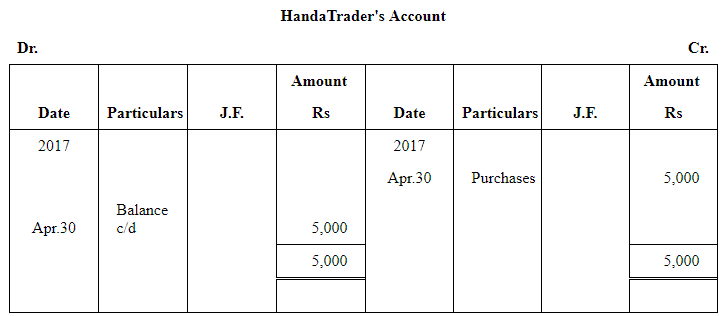

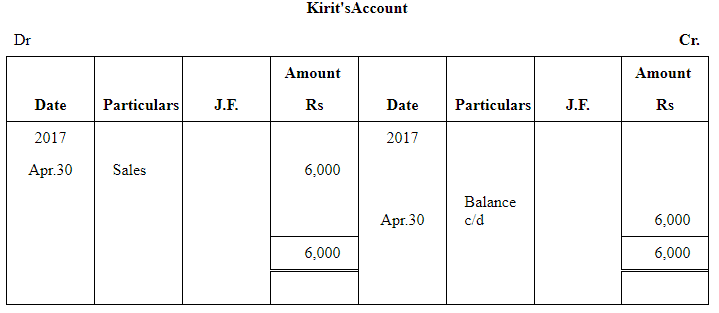

Question 18: The following balances of ledger of M/s Marble Traders on April 01, 2017

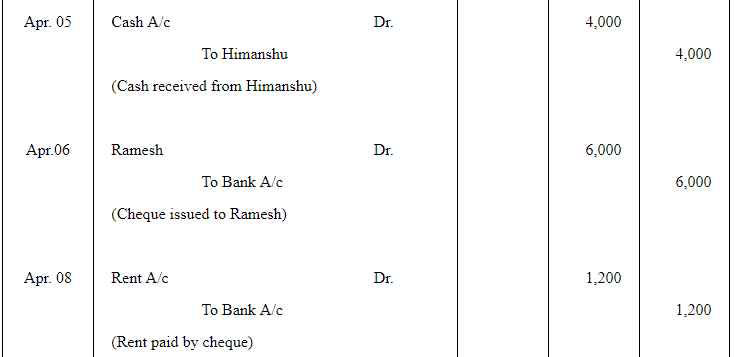

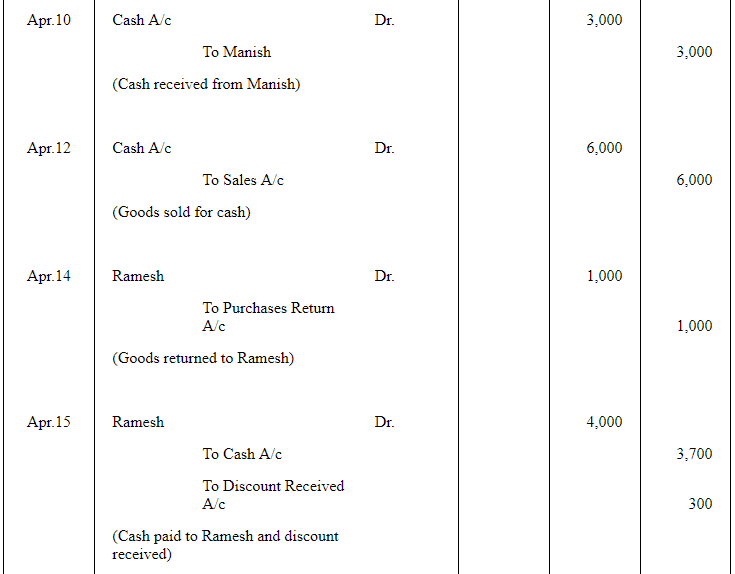

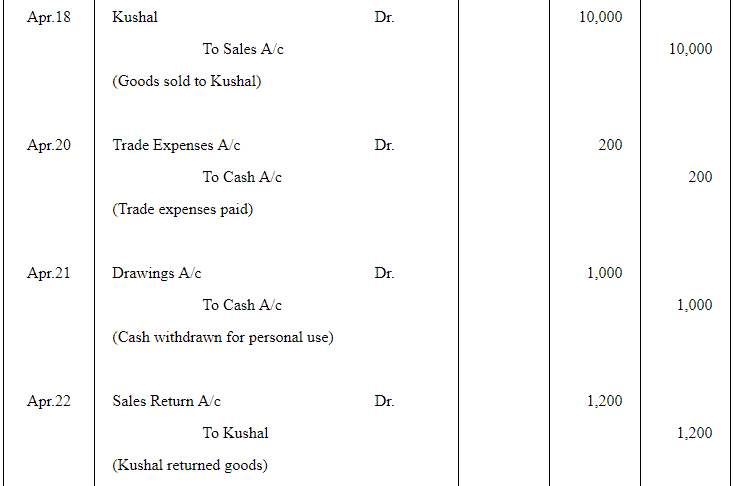

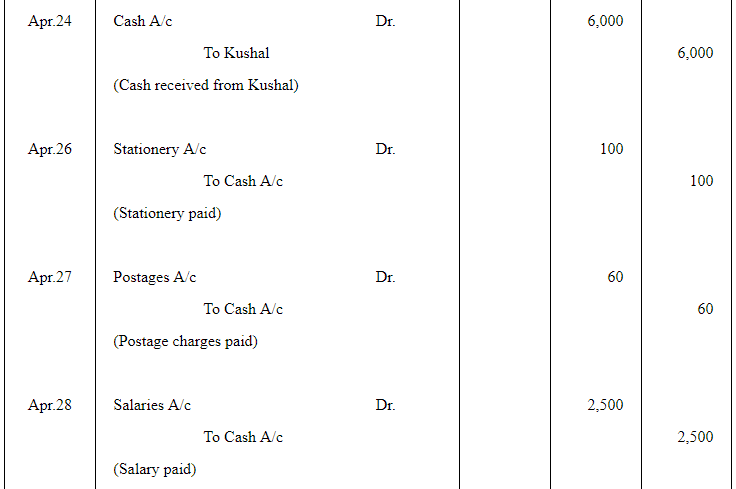

Journalise the above transactions and post them to the ledger.

Answer:

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solution (Part - 2) Recording of Transactions-II - Accountancy Class 11 - Commerce

| 1. What is the purpose of recording transactions in accounting? |  |

| 2. What are the different methods of recording transactions? |  |

| 3. What are some common examples of transactions that need to be recorded? |  |

| 4. How can errors in recording transactions be rectified? |  |

| 5. Why is it important to maintain proper documentation for recorded transactions? |  |