NCERT Solution (Part - 2) - Bank Reconciliation Statement | Accountancy Class 11 - Commerce PDF Download

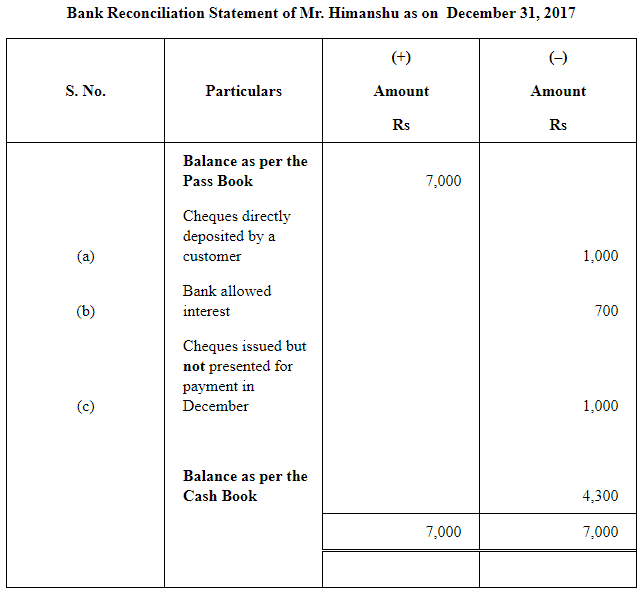

Question 6: Prepare bank reconciliation statement as on December 31, 2017. On this day the passbook of Mr. Himanshu showed a balance of Rs 7,000.

(a) | Cheques of Rs 1,000 directly deposited by a customer. |

(b) | The bank has credited Mr. Himanshu for Rs 700 as interest. |

(c) | Cheques for Rs 3,000 were issued during the month of December but of these cheques for Rs 1,000 were not presented during the month of December. |

Answer:

Note: As per the NCERT book the answer is Rs 3,300. However, the correct answer is Rs 4,300.

Page No 183:

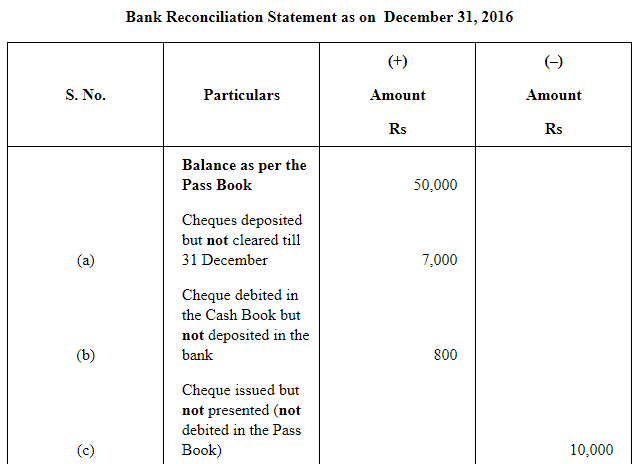

Question 7: From the following particulars prepare a bank reconciliation statement showing the balance as per cash book on December 31, 2016.

(a) Two cheques of Rs 2,000 and Rs 5,000 were paid into bank in October, 2016 but were not credited by the bank in the month of December.

(b) A cheque of Rs 800 which was received from a customer was entered in the bank column of the cash book in December 2016 but was omitted to be banked in December, 2016.

(c) Cheques for Rs 10,000 were issued into bank in November 2016 but not credited by the bank on December 31, 2016.

(d) Interest on investment Rs 1,000 collected by bank appeared in the passbook.

Balance as per Passbook was Rs 50,000

Note: (1) In question No. 7 there is a mistake in statement (c). In place of 'credited' it should be 'debited'.

Question 8 : Balance as per passbook of Mr. Kumar is 3,000.

(a) | Cheque paid into bank but not yet cleared |

| Ram Kumar Rs 1,000 |

| Kishore Kumar Rs 500 |

(b) | Bank Charges Rs 300 |

(c) | Cheque issued but not presented |

| Hameed Rs 2,000 |

| Kapoor Rs 500 |

(d) | Interest entered in the passbook but not entered in the cash book Rs 100 |

Prepare a bank reconciliation statement.

Answer :

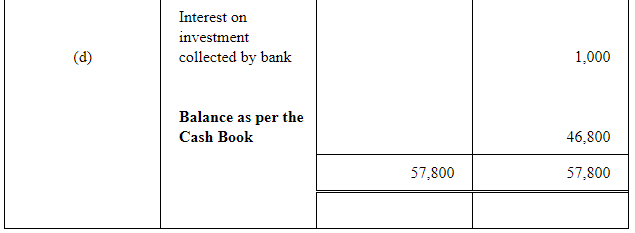

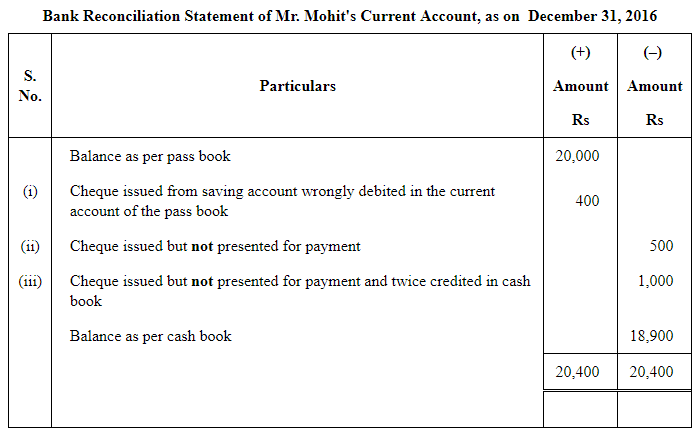

Question 9 : The passbook of Mr. Mohit current account showed a credit Balance of Rs 20,000 on dated December 31, 2016. Prepare a Bank Reconciliation Statement with the following information.

(i) A cheque of Rs 400 drawn on his saving account has been shown on current account.

(ii) He issued two cheques of Rs 300 and Rs 500 on of December 25, but only the Ist cheque was presented

(iii) One cheque issued by Mr. Mohit of Rs 500 on December 25, but it was not presented for payment where twice in the cash book.

Answer :

Note: In the question item (i), it is not given whether it is the current account of Pass Book or the current account of Cash Book. In the solution, we have assumed that it is the current account of the Pass Book.

Page No 184:

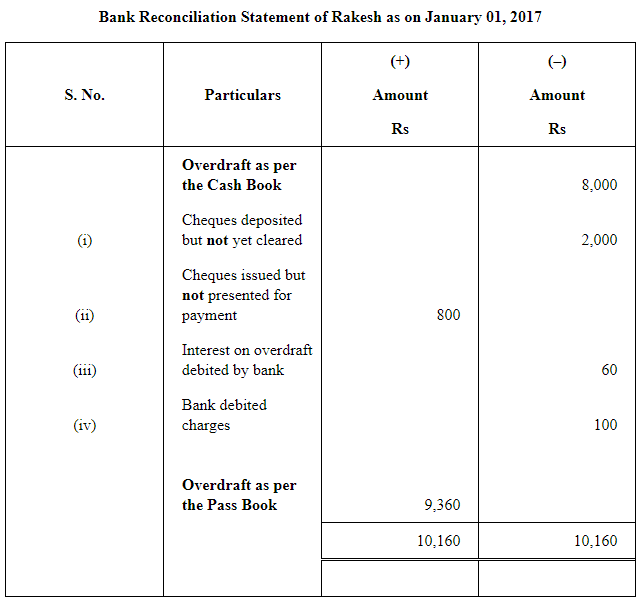

Question 10: On Ist January 2017, Rakesh had an overdraft of Rs 8,000 as showed by his cash book. Cheques amounting to Rs 2,000 had been paid in by him but were not collected by the bank by January 01, 2017. He issued cheques of Rs 800 which were not presented to the bank for payment up to that day. There was a debit in his passbook of Rs 60 for interest and Rs 100 for bank charges. Prepare bank reconciliation statement for comparing both the balance.

ANSWER:

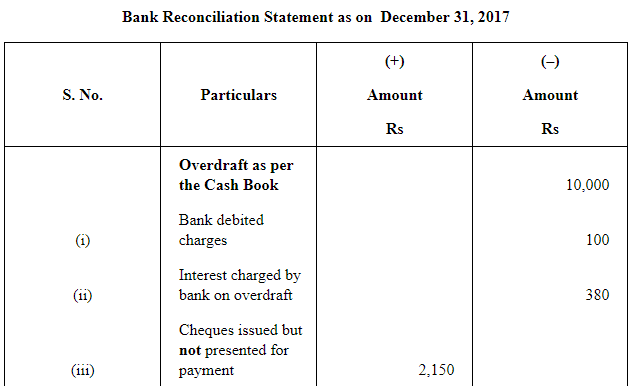

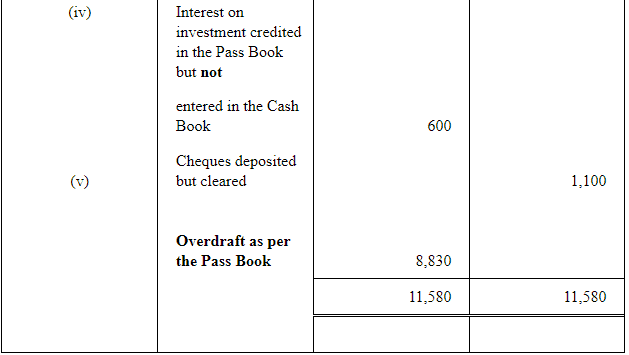

Question 11: Prepare bank reconciliation statement.

(i) | Overdraft shown as per cash book on December 31, 2017 Rs 10,000. |

(ii) | Bank charges for the above period also debited in the passbook Rs 100. |

(iii) | Interest on overdraft for six months ending December 31, 2017 Rs 380 debited in the passbook. |

(iv) | Cheques issued but not incashed prior to December 31, 2017 amounted to Rs 2,150. |

(v) | Interest on Investment collected by the bank and credited in the passbook Rs 600. |

(vi) | Cheques paid into bank but not cleared before December, 31 2017 were Rs 1,100. |

ANSWER:

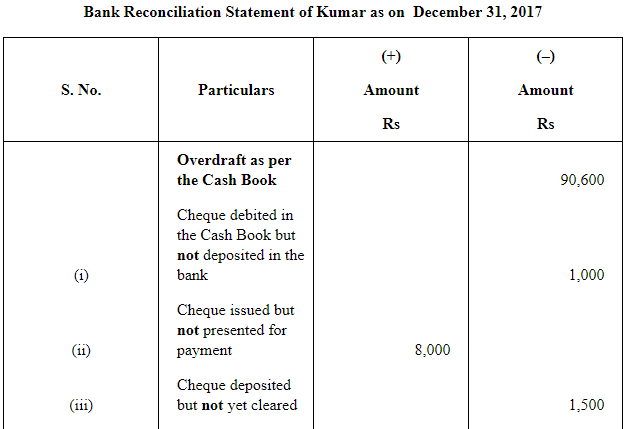

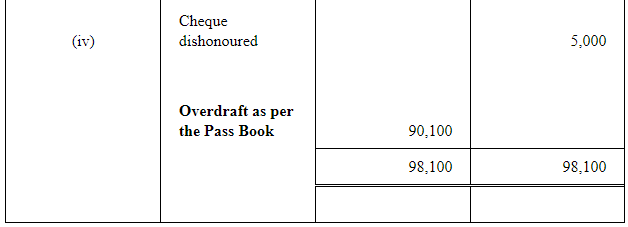

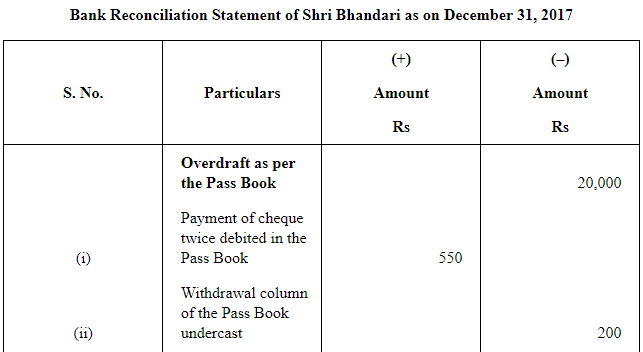

Question 12: Kumar find that the bank balance shown by his cash book on December 31, 2017 is Rs 90,600 (Credit) but the passbook shows a difference due to the following reason:A cheque (post dated) for Rs 1,000 has been debited in the bank column of the cash book but not presented for payment. Also, a cheque for Rs 8,000 drawn in favour of Manohar has not yet been presented for payment. Cheques totaling Rs 1,500 deposited in the bank have not yet been collected and cheque for Rs 5,000 has been dishonoured.

ANSWER:

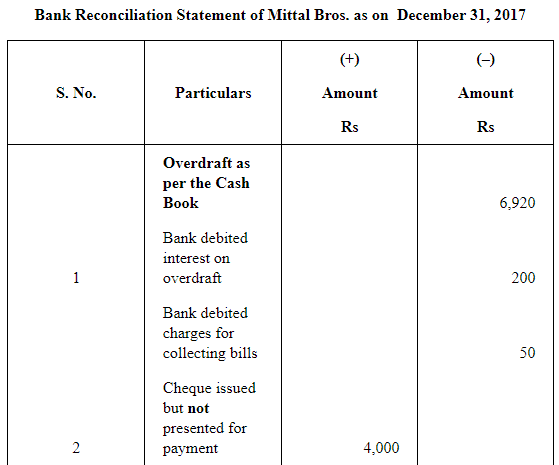

Question 13: On December 31, 2017, the cash book of Mittal Bros. Showed an overdraft of Rs 6,920. From the following particulars prepare a Bank Reconciliation Statement and ascertain the balance as per passbook.

(1) | Debited by bank for Rs 200 on account of Interest on overdraft and Rs 50 on account of charges for collecting bills. |

(2) | Cheques drawn but not encashed before December, 31 2017 for Rs 4,000. |

(3) | The bank has collected interest and has credited Rs 600 in passbook. |

(4) | A bill receivable for Rs 700 previously discounted with the bank had been dishonoured and debited in the passbook. |

(5) | Cheques paid into bank but not collected and credited before December 31, 2017 amounted Rs 6,000. |

ANSWER:

Page No 185:

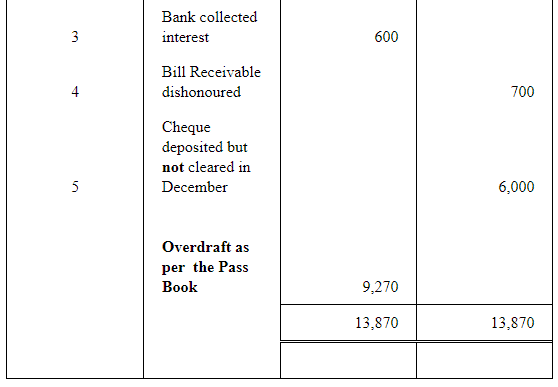

Question 14: Prepare bank reconciliation statement of Shri Bhandari as on December 31, 2017

(i) The Payment of a cheque for Rs 550 was recorded twice in the passbook.

(ii) Withdrawal column of the passbook under cast by Rs 200

(iii) Cheque of Rs 200 has been debited in the bank column of the Cash Book but it was not sent to bank at all.

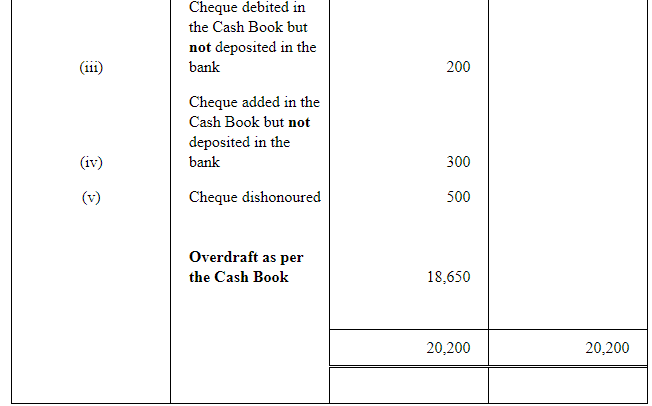

(iv) A Cheque of Rs 300 debited to Bank column of the cash book was not sent to the bank.(v) Rs 500 in respect of dishonoured cheque were entered in the passbook but not in the cash book. Overdraft as per passbook is Rs 20,000.

ANSWER:

Note: 1) The answer given in the book is Rs 21,350; however, it should be Rs 18,650.

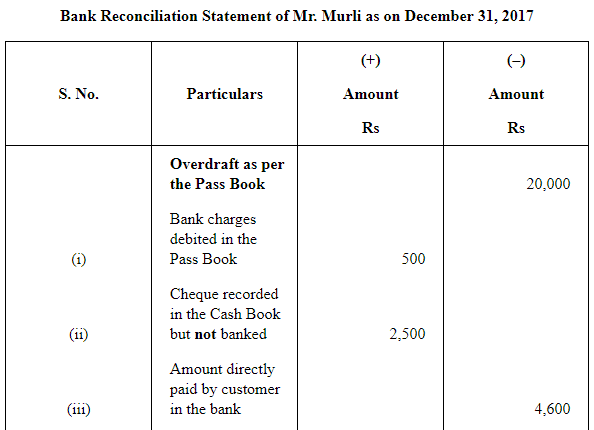

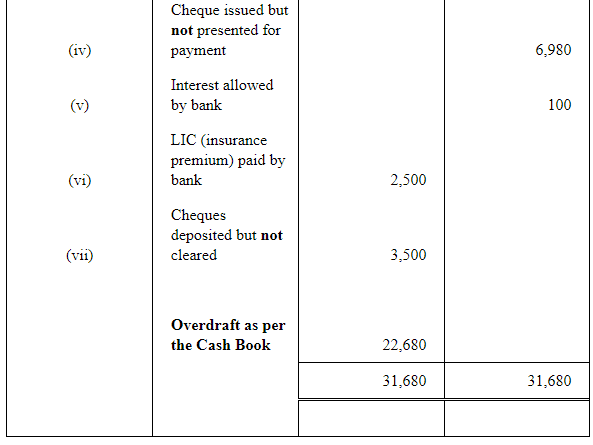

Question 15: Overdraft shown by the passbook of Mr. Murli is Rs 20,000. Prepare bank reconciliation statement on dated December 31, 2017.

(i) Bank charges debited as per passbook Rs 500.

(ii) Cheques recorded in the cash book but not sent to the bank for collection Rs 2,500.

(iii) Received a payment directly from customer Rs 4,600.

(iv) Cheque issued but not presented for payment Rs 6,980.

(v) Interest credited by the bank Rs 100.

(vi) LIC paid by bank Rs 2,500.

(vii) Cheques deposited with the bank but not collected Rs 3,500.

ANSWER:

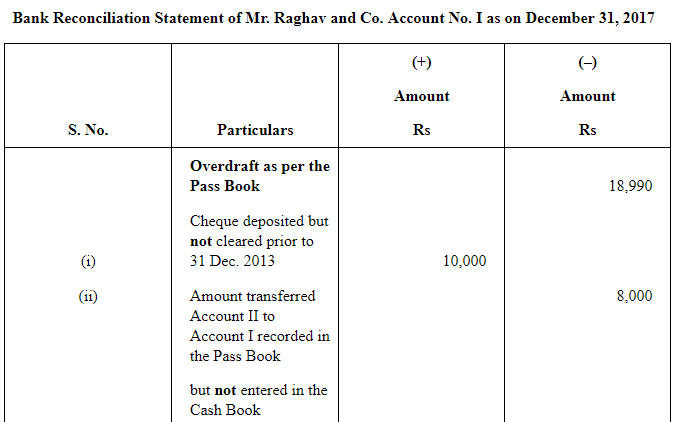

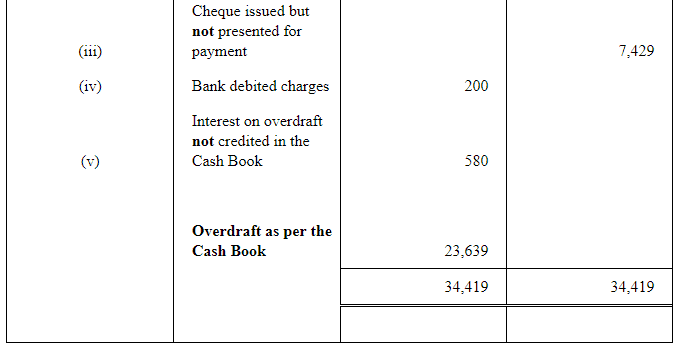

Question 16: Raghav & Co. have two bank accounts. Account No. I and Account No. II. From the following particulars relating to Account No. I, find out the balance on that account of December 31, 2017 according to the cash book of the firm.

(i) | Cheques paid into bank prior to December 31, 2017, but not credited for Rs 10,000. |

(ii) | Transfer of funds from account No. II to account no. I recorded by the bank on December 31, 2017 but entered in the cash book after that date for Rs 8,000. |

(iii) | Cheques issued prior to December 31, 2017 but not presented until after that date for Rs 7,429. |

(iv) | Bank charges debited by bank not entered in the cash book for Rs 200. |

(v) | Interest Debited by the bank not entered in the cash book Rs 580. |

(vi) | Overdraft as per Passbook Rs 18,990. |

ANSWER:

Page No 186:

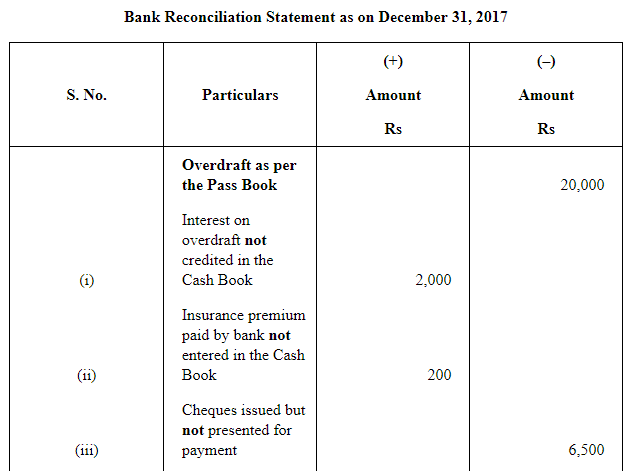

Question 17: Prepare a bank reconciliation statement from the following particulars and show the balance as per cash book.

(i) | Balance as per passbook on December 31, 2017 overdrawn Rs 20,000. |

(ii) | Interest on bank overdraft not entered in the cash book Rs 2,000. |

(iii) | Rs 200 insurance premium paid by bank has not been entered in the cash book. |

(iv) | Cheques drawn in the last week of December, 2017, but not cleared till date for Rs 3,000 and Rs 3,500. |

(v) | Cheques deposited into bank on November, 2017, but yet to be credited on dated December 31, 2013 Rs 6,000. |

(vii) | Wrongly debited by bank Rs 500. |

ANSWER:

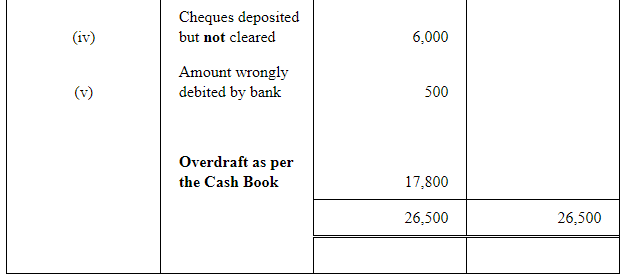

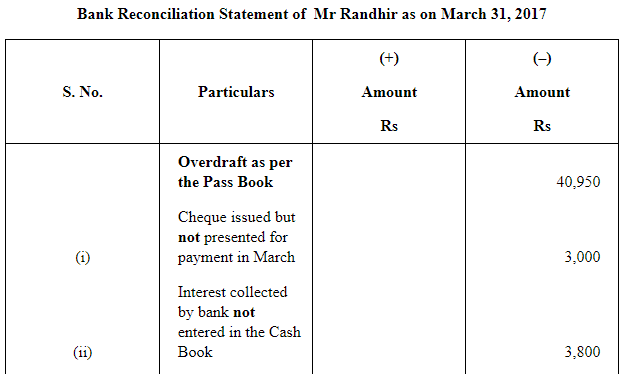

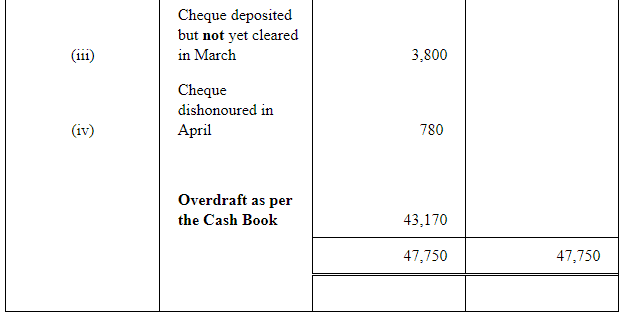

Question 18: The passbook of Mr. Randhir showed an overdraft of Rs 40,950 on March 31, 2017.Prepare bank reconciliation statement on March 31, 2017.

(i) | Out of cheques amounting to Rs 8,000 drawn by Mr. Randhir on March 27, a cheque for Rs 3,000 was encashed on April 11. |

(ii) | Credited by bank with Rs 3,800 for interest collected by them, but the amount is not entered in the cash book. |

(iii) | Rs 10,900 paid in by Mr. Randhir in cash and by cheques on March, 31 cheques amounting to Rs 3,800 were collected on April, 07. |

(iv) | A Cheque of Rs 780 credited in the passbook on March 28 being dishonoured is debited again in the passbook on April 01, 2017. There was no entry in the cash book about the dishonour of the cheque until April 15 |

ANSWER:

Note: The answer given in NCERT is Rs 36,350, which should be Rs 43,170.

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solution (Part - 2) - Bank Reconciliation Statement - Accountancy Class 11 - Commerce

| 1. What is a Bank Reconciliation Statement? |  |

| 2. What is the purpose of preparing a Bank Reconciliation Statement? |  |

| 3. How often should a Bank Reconciliation Statement be prepared? |  |

| 4. What are the steps involved in preparing a Bank Reconciliation Statement? |  |

| 5. What are the consequences of not preparing a Bank Reconciliation Statement? |  |