NCERT Solution: Cash Flow Statement -3 | Accountancy Class 12 - Commerce PDF Download

Numerical Questions:

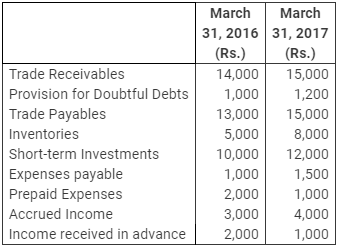

Question 5: Compute cash from operations from the following figures:

(i) Profit for the year 2016-17 is a sum of Rs. 10,000 after providing for depreciation of Rs. 2,000.

(ii) The current assets of the business for the year ended March 31, 2016 and 2017 are as follows:

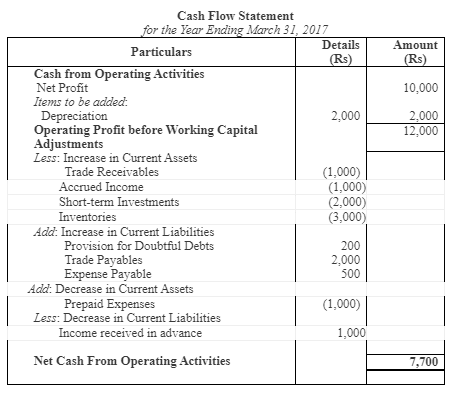

Answer:

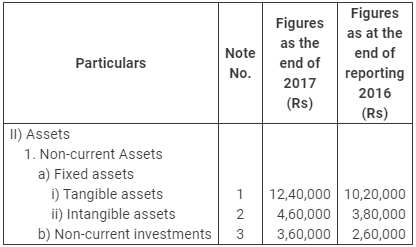

Question 6: From the following Particulars of Bharat Gas Limited, calculate Cash Flows from Investing Activities. Also show the workings clearly preparing the ledger accounts:

| Notes | 1 | Tangible assets = Machinery |

| 2 | Intangible assets = Patents |

Notes

| Figures of current year | Figures of previous year |

|

|

|

1. Tangible Assets |

|

|

Machinery | 12,40,000 | 10,20,000 |

2. Intangible Assets |

|

|

Goodwill | 3,00,000 | 1,00,000 |

Patents | 1,60,000 | 2,80,000 |

| 4,60,000 | 3,80,000 |

3. Non-current Investments |

|

|

10% long term investments | 1,60,000 | 60,000 |

Investment in land | 1,00,000 | 1,00,000 |

Shares of Amartex Ltd. | 1,00,000 | 1,00,000 |

| 3,60,000 | 2,60,000 |

Additional Information:

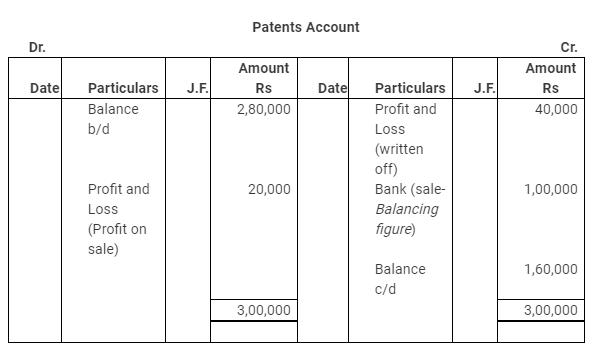

(a) Patents were written-off to the extent of Rs. 40,000 and some Patents were sold at a profit of Rs. 20,000.

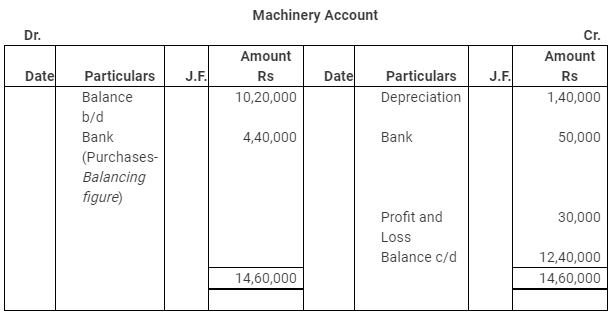

(b) A Machine costing Rs. 1,40,000 (Depreciation provided thereon Rs. 60,000) was sold for Rs. 50,000. Depreciation charged during the year was Rs. 1,40,000.

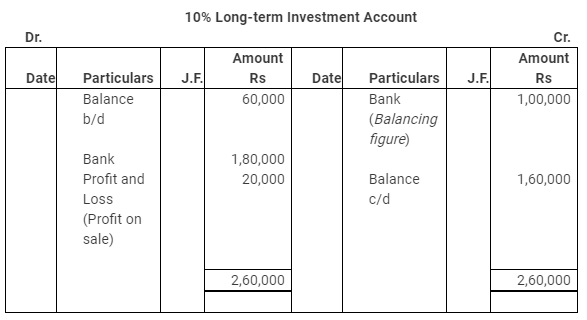

(c) On March 31, 2016, 10% Investments were purchased for Rs. 1,80,000 and some Investments were sold at a profit of Rs. 20,000. Interest on Investment was received on March 31, 2017.

(d) Amartax Ltd. paid Dividend @ 10% on its shares.

(e) A plot of Land had been purchased for investment purposes and let out for commercial use and rent received Rs. 30,000.

Answer:

Cash Flow from Investing Activities | ||||

Particulars | Amount Rs | Amount Rs | ||

Cash Inflow |

|

| ||

| Proceeds from Sale of Patents | 1,00,000 |

| |

| Proceeds from Sale of Machinery | 50,000 |

| |

| Proceeds from Sale of 10% Long-term Investment | 1,00,000 |

| |

| Interest received on 10% Long-term Investment | 6,000 |

| |

| Dividend Received from Amartax Ltd. | 10,000 |

| |

| Rent Received | 30,000 | 2,96,000 | |

Cash Outflow |

|

| ||

| Purchase of Goodwill | (2,00,000) |

| |

| Purchase of Machinery | (4,40,000) |

| |

| Purchase of 10% Long-term Investment | (1,80,000) | (8,20,000) | |

Net Cash used in Investing Activities |

| (5,24,000) | ||

|

|

|

|

|

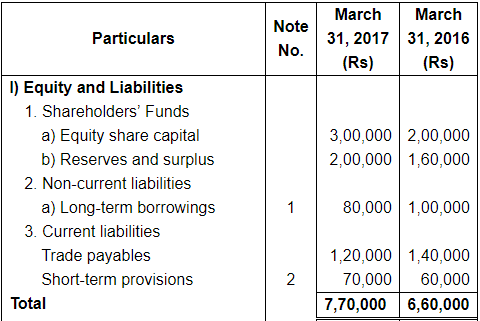

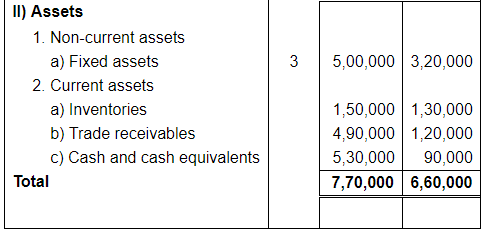

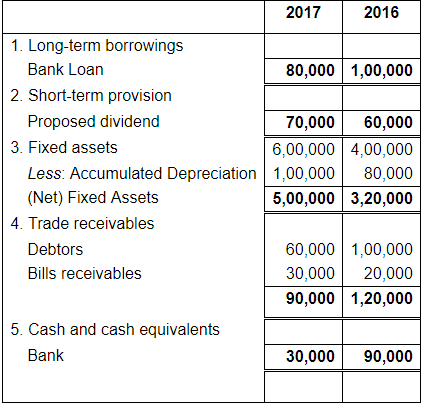

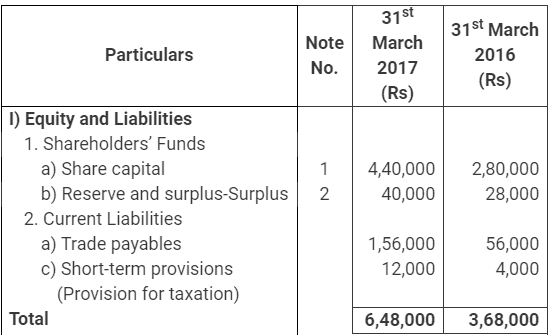

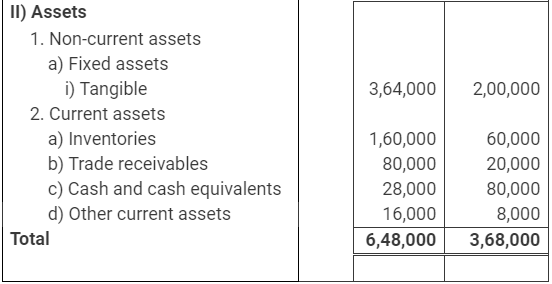

Question 7: From the following Balance Sheet of Mohan Ltd. Prepare cash flow Statement:

Balance Sheet of Mohan Ltd.

as at 31 Mar. 2016 and 31 Mar. 2017

Notes

Additional Information:

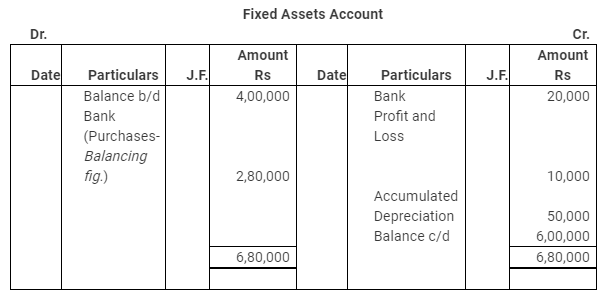

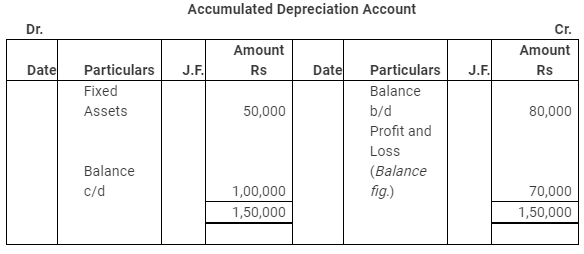

Machine Costing Rs. 80,000 on which accumulated depreciation was Rs. 50,000 was sold for Rs. 20,000.

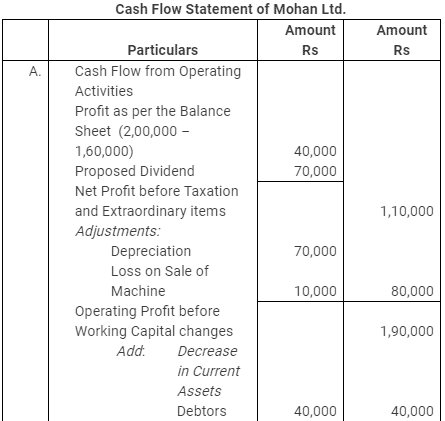

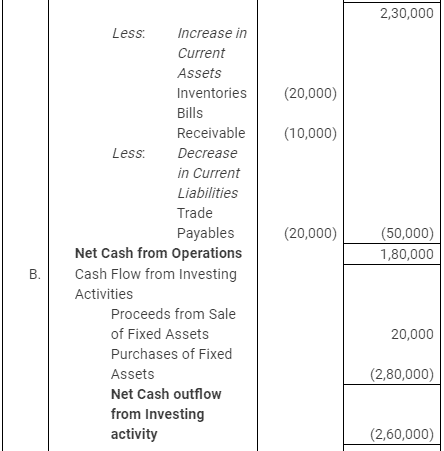

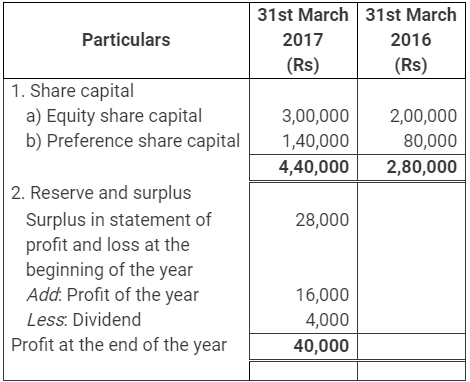

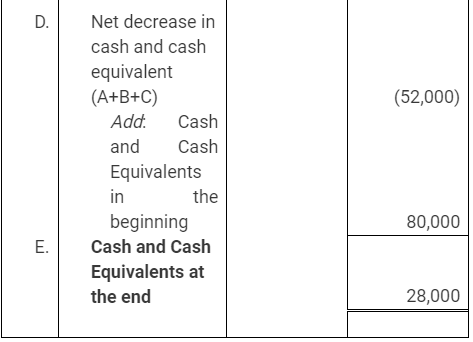

Answer:

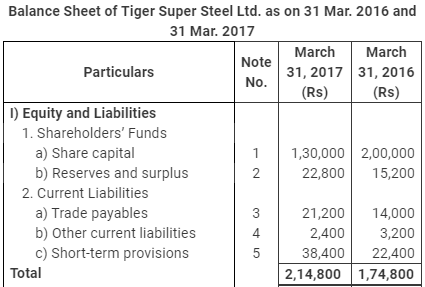

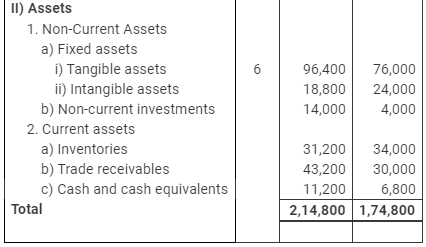

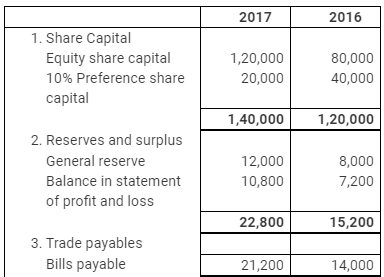

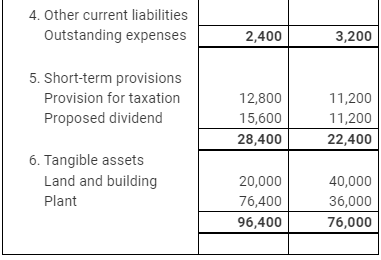

Question 8: From the following Balance Sheets of Tiger Super Steel Ltd., prepare Cash Flow Statement:

Notes on Accounts

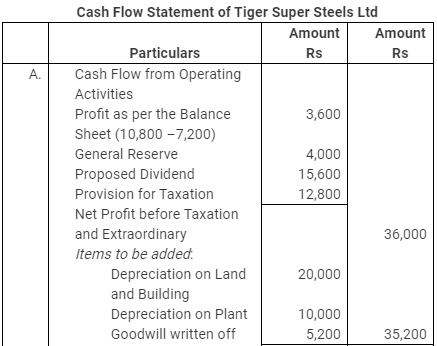

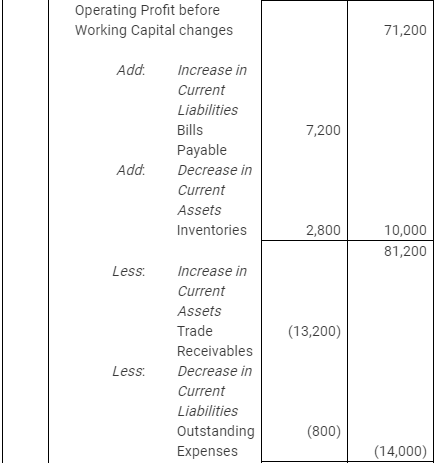

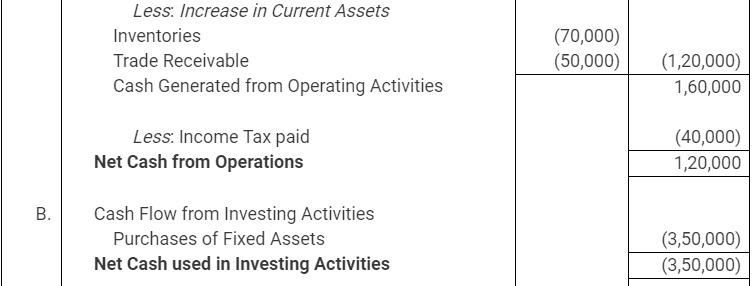

Answer:

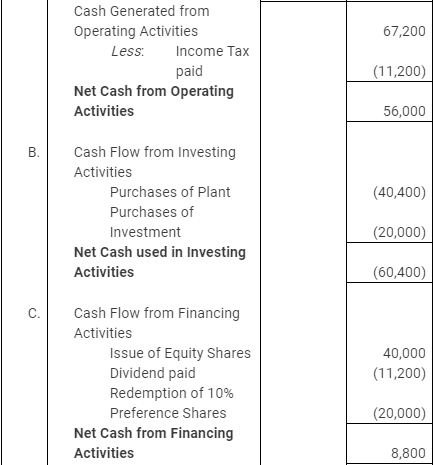

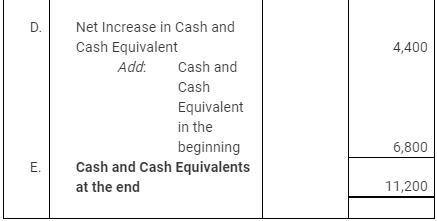

Working Notes:

1.

2.

Net Profit before Tax | 3,600 | |

Profit and Loss Account | 12,800 | |

Less: | Provision for Tax | 16,400 |

|

|

|

Note: As per the solution, the Net Cash from Operating Activities, net Cash from Investing Activities and Net Cash from Financing Activities are Rs 56,000, Rs (60400) and Rs 8,800 respectively. However, as per the answer given in the book, the Net Cash from Operating Activities, net Cash from Investing Activities and Net Cash from Financing Activities are Rs 34,800, Rs (50,400) and Rs 20,000 respectively.

Page No. 287

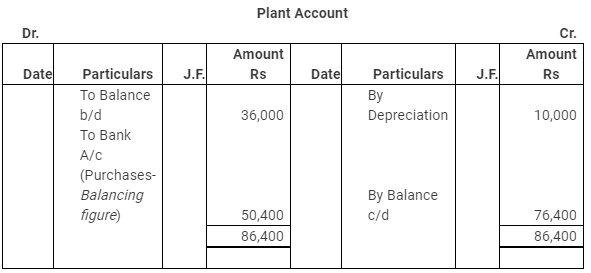

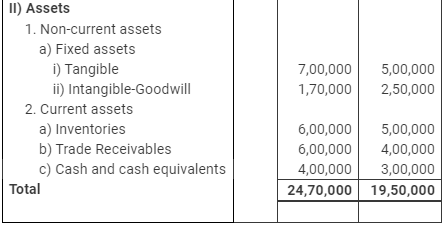

Question 9: From the following information, prepare cash flow statement:

Additional Information:

Additional Information:

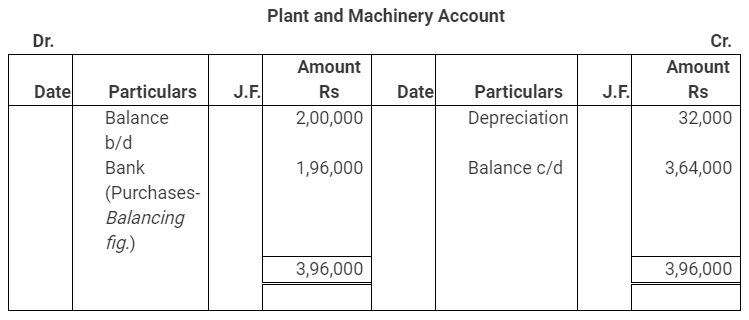

Depreciation Charge on Plant amount to Rs. 80,000.

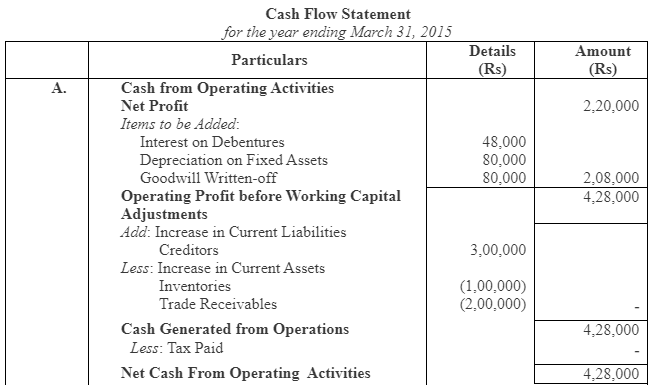

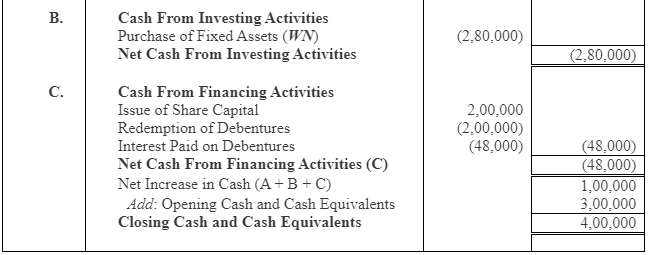

Answer:

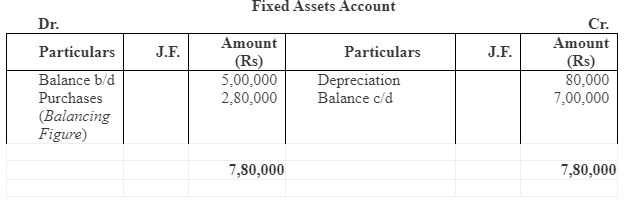

Working Note:

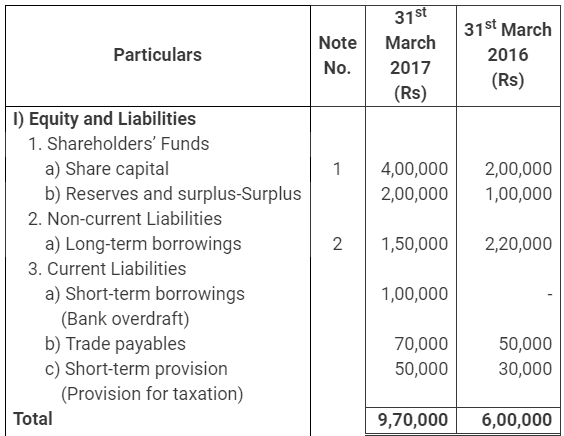

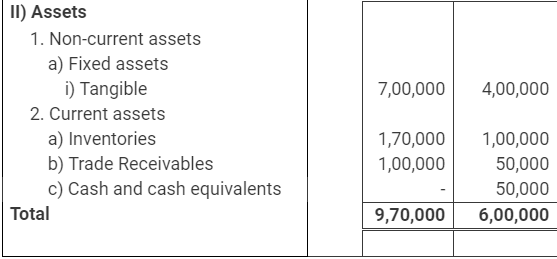

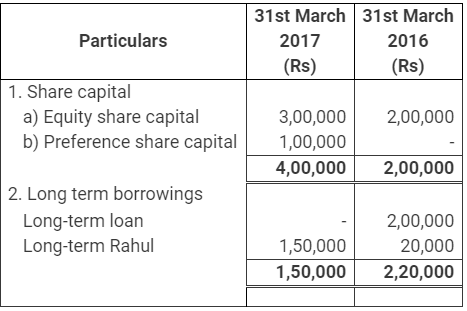

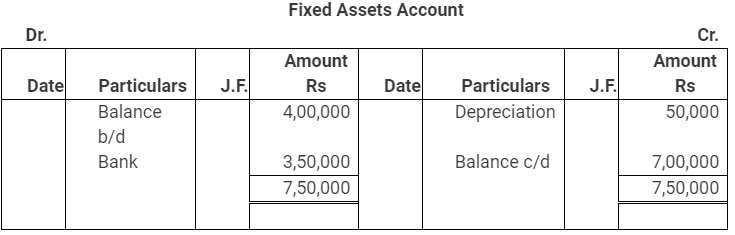

Question 10: From the following Balance Sheet of Yogeta Ltd., prepare cash flow statement:

Notes to Accounts

Additional Information:

Net Profit for the year after charging Rs. 50,000 as Depreciation was Rs. 1,50,000. Dividend paid on Share was Rs. 50,000, Tax Provision created during the year amounted to Rs. 60,000.

Answer:

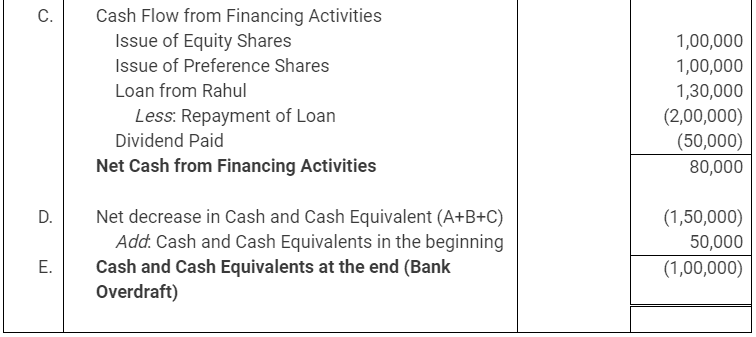

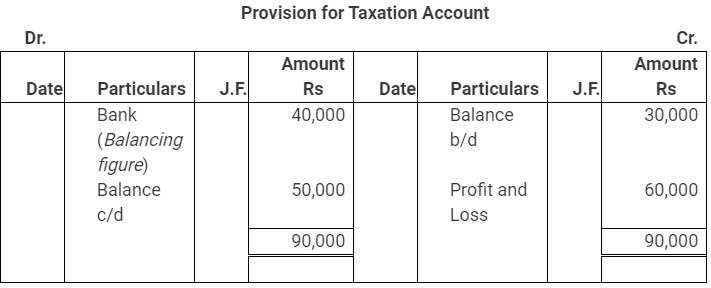

Working Notes:

1.

2.

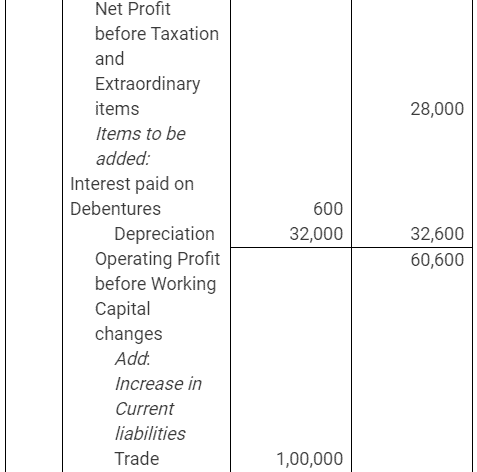

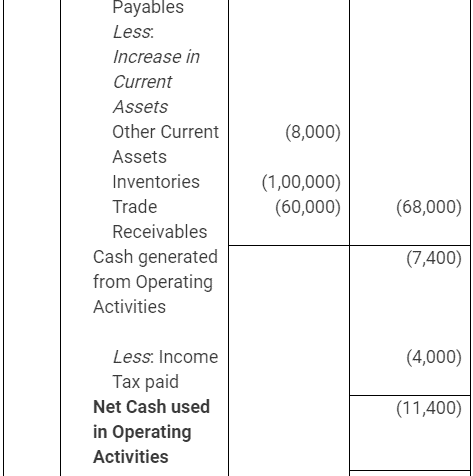

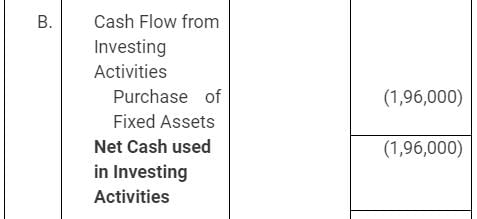

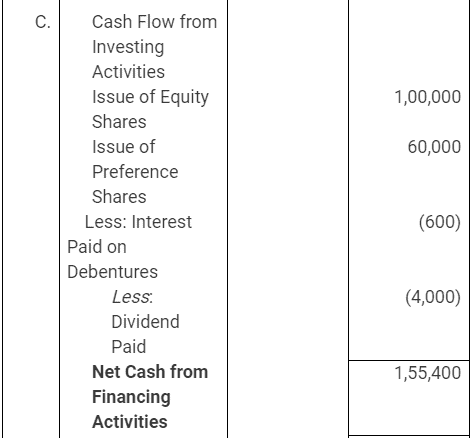

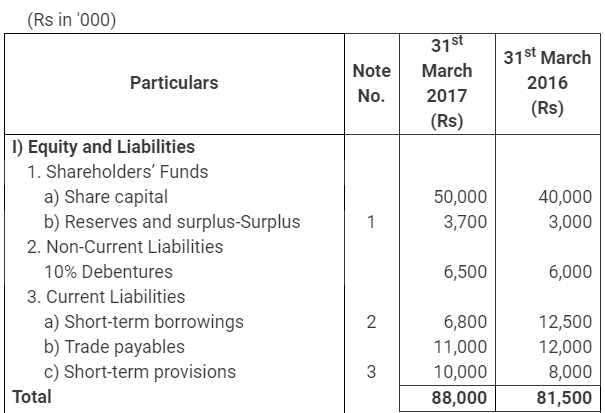

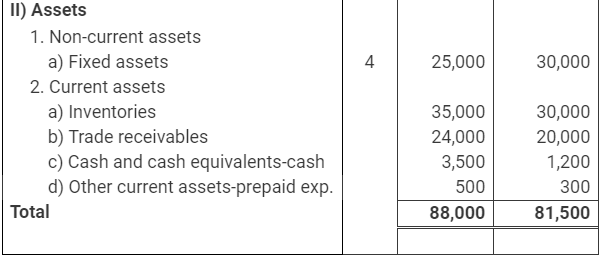

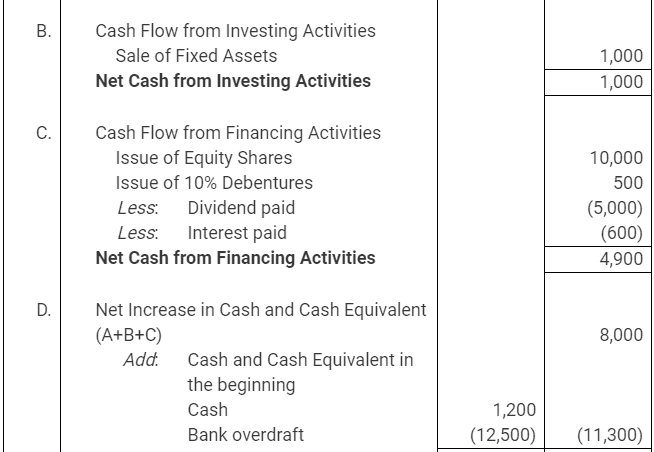

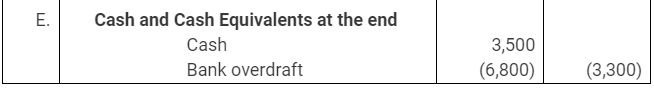

Question 11: Following is the Financial Statement of Garima Ltd., prepare cash flow statement.

Notes to Accounts

Additional Information:

- Interest paid on Debenture Rs 600

- Dividend paid during the year Rs 4,000

- Depreciation charged during the year Rs 32,000

Answer:

Working Notes:

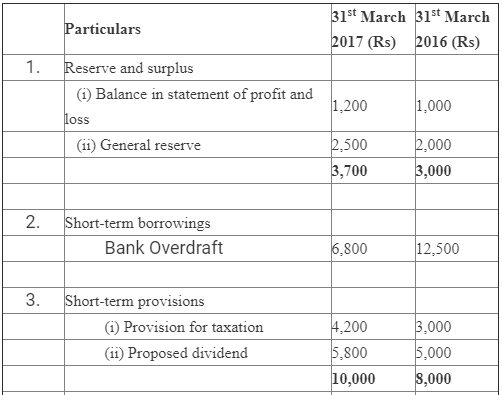

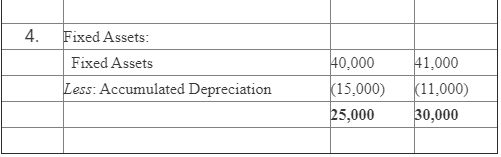

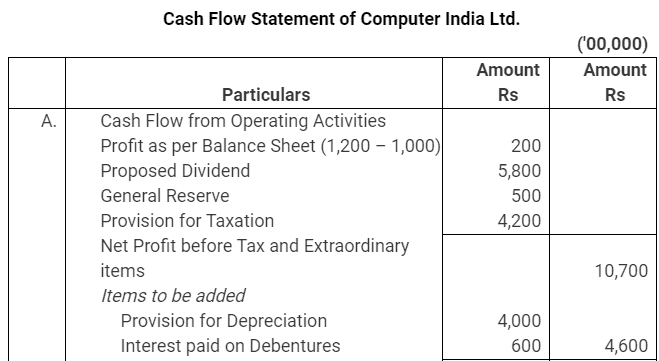

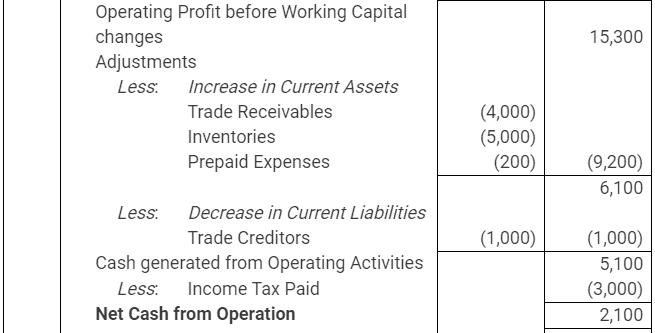

Question 12: From the following Balance Sheet of Computer India Ltd., prepare cash flow statement.

Notes to Accounts

Additional Information:

Interest paid on Debenture Rs. 600

Answer:

|

42 videos|199 docs|43 tests

|

FAQs on NCERT Solution: Cash Flow Statement -3 - Accountancy Class 12 - Commerce

| 1. What is a cash flow statement? |  |

| 2. Why is a cash flow statement important? |  |

| 3. What is the difference between cash flow statement and income statement? |  |

| 4. How is a cash flow statement prepared? |  |

| 5. What are the limitations of a cash flow statement? |  |