Practice Test for NMAT - 5 - CAT MCQ

30 Questions MCQ Test - Practice Test for NMAT - 5

When people react to their experiences with particular authorities, those authorities and the organizations or institutions that they represent often benefit if the people involved begin with high levels of commitment to the organization or institution represented by the authorities. First, in his studies of people's attitudes toward political and legal institutions, Tyler found that attitudes after an experience with the institution were strongly affected by prior attitudes. Single experiences influence post experience loyalty but certainly do not overwhelm the relationship between pre-experience and post experience loyalty. Thus, the best predictor of loyalty after an experience is usually loyalty before that experience. Second, people with prior loyalty to the organization or institution judge their dealings with the organization's or institution's authorities to be fairer than do those with less prior loyalty, either because they are more fairly treated or because they interpret equivalent treatment as fairer.

Although high levels of prior organizational or institutional commitment are generally beneficial to the organization or institution, under certain conditions high levels of prior commitment may actually sow the seeds of reduced commitment. When previously committed individuals feel that they were treated unfavourably or unfairly during some experience with the organization or institution, they may show an especially sharp decline in commitment. Two studies were designed to test this hypothesis, which, if confirmed, would suggest that organizational or institutional commitment has risks, as well as benefits. At least three psychological models offer predictions of how individuals' reactions may vary as a function of (1) their prior level of commitment and (2) the favorability of the encounter with the organization or institution. Favorability of the encounter is determined by the outcome of the encounter and the fairness or appropriateness of the procedures used to allocate outcomes during the encounter. First, the instrumental prediction is that because people are mainly concerned with receiving desired outcomes from their encounters with organizations, changes in their level of commitment will depend primarily on the favorability of the encounter. Second, the assimilation prediction is that individuals' prior attitudes predispose them to react in a way that is consistent with their prior attitudes.

The third prediction, derived from the group-value model of justice, pertains to how people with high prior commitment will react when they feel that they have been treated unfavorably or unfairly during some encounter with the organization or institution. Fair treatment by the other party symbolizes to people that they are being dealt with in a dignified and respectful way, thereby bolstering their sense of self-identity and self worth. However, people will become quite distressed and react quite negatively if they feel that they have been treated unfairly by the other party to the relationship. The group-value model suggests that people value the information they receive that helps them to define themselves and to view themselves favorably. According to the instrumental viewpoint, people are primarily concerned with the more material or tangible resources received from the relationship. Empirical support for the group-value model has implications for a variety of important issues, including the determinants of commitment, satisfaction, organizational citizenship, and rule following. Determinants of procedural fairness include structural or interpersonal factors. For example, structural determinants refer to such things as whether decisions were made by neutral, fact finding authorities who used legitimate decision making criteria. The primary purpose of the study was to examine the interactive effect of individuals (1) commitment to an organization or institution prior to some encounter and (2) perceptions of how fairly they were treated during the encounter, on the change in their level of commitment. A basic assumption of the group-value model is that people generally value their relationships with people, groups, organizations, and institutions and therefore value fair treatment from the other party to the relationship. Specifically, highly committed members should have especially negative reactions to feeling that they were treated unfairly, more so than (1) less-committed group members or (2) highly committed members who felt that they were fairly treated.

The prediction that people will react especially negatively when they previously felt highly committed but felt that they were treated unfairly also is consistent with the literature on psychological contracts. Rousseau suggested that, over time, the members of work organizations develop feelings of entitlement, i.e., perceived obligations that their employers have toward them. Those who are highly committed to the organization believe that they are fulfilling their contract obligations. However, if the organization acted unfairly, then highly committed individuals are likely to believe that the organization did not live up to its end of the bargain.

The hypothesis mentioned in the passage tests at least one of the following ideas.

When people react to their experiences with particular authorities, those authorities and the organizations or institutions that they represent often benefit if the people involved begin with high levels of commitment to the organization or institution represented by the authorities. First, in his studies of people's attitudes toward political and legal institutions, Tyler found that attitudes after an experience with the institution were strongly affected by prior attitudes. Single experiences influence post experience loyalty but certainly do not overwhelm the relationship between pre-experience and post experience loyalty. Thus, the best predictor of loyalty after an experience is usually loyalty before that experience. Second, people with prior loyalty to the organization or institution judge their dealings with the organization's or institution's authorities to be fairer than do those with less prior loyalty, either because they are more fairly treated or because they interpret equivalent treatment as fairer.

Although high levels of prior organizational or institutional commitment are generally beneficial to the organization or institution, under certain conditions high levels of prior commitment may actually sow the seeds of reduced commitment. When previously committed individuals feel that they were treated unfavourably or unfairly during some experience with the organization or institution, they may show an especially sharp decline in commitment. Two studies were designed to test this hypothesis, which, if confirmed, would suggest that organizational or institutional commitment has risks, as well as benefits. At least three psychological models offer predictions of how individuals' reactions may vary as a function of (1) their prior level of commitment and (2) the favorability of the encounter with the organization or institution. Favorability of the encounter is determined by the outcome of the encounter and the fairness or appropriateness of the procedures used to allocate outcomes during the encounter. First, the instrumental prediction is that because people are mainly concerned with receiving desired outcomes from their encounters with organizations, changes in their level of commitment will depend primarily on the favorability of the encounter. Second, the assimilation prediction is that individuals' prior attitudes predispose them to react in a way that is consistent with their prior attitudes.

The third prediction, derived from the group-value model of justice, pertains to how people with high prior commitment will react when they feel that they have been treated unfavorably or unfairly during some encounter with the organization or institution. Fair treatment by the other party symbolizes to people that they are being dealt with in a dignified and respectful way, thereby bolstering their sense of self-identity and self worth. However, people will become quite distressed and react quite negatively if they feel that they have been treated unfairly by the other party to the relationship. The group-value model suggests that people value the information they receive that helps them to define themselves and to view themselves favorably. According to the instrumental viewpoint, people are primarily concerned with the more material or tangible resources received from the relationship. Empirical support for the group-value model has implications for a variety of important issues, including the determinants of commitment, satisfaction, organizational citizenship, and rule following. Determinants of procedural fairness include structural or interpersonal factors. For example, structural determinants refer to such things as whether decisions were made by neutral, fact finding authorities who used legitimate decision making criteria. The primary purpose of the study was to examine the interactive effect of individuals (1) commitment to an organization or institution prior to some encounter and (2) perceptions of how fairly they were treated during the encounter, on the change in their level of commitment. A basic assumption of the group-value model is that people generally value their relationships with people, groups, organizations, and institutions and therefore value fair treatment from the other party to the relationship. Specifically, highly committed members should have especially negative reactions to feeling that they were treated unfairly, more so than (1) less-committed group members or (2) highly committed members who felt that they were fairly treated.

The prediction that people will react especially negatively when they previously felt highly committed but felt that they were treated unfairly also is consistent with the literature on psychological contracts. Rousseau suggested that, over time, the members of work organizations develop feelings of entitlement, i.e., perceived obligations that their employers have toward them. Those who are highly committed to the organization believe that they are fulfilling their contract obligations. However, if the organization acted unfairly, then highly committed individuals are likely to believe that the organization did not live up to its end of the bargain.

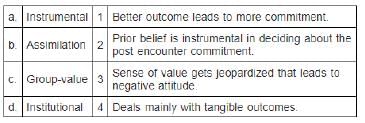

There is only one term in the left column which matches with the options given in the second column. Identify the correct pair from the following table:

When people react to their experiences with particular authorities, those authorities and the organizations or institutions that they represent often benefit if the people involved begin with high levels of commitment to the organization or institution represented by the authorities. First, in his studies of people's attitudes toward political and legal institutions, Tyler found that attitudes after an experience with the institution were strongly affected by prior attitudes. Single experiences influence post experience loyalty but certainly do not overwhelm the relationship between pre-experience and post experience loyalty. Thus, the best predictor of loyalty after an experience is usually loyalty before that experience.

Second, people with prior loyalty to the organization or institution judge their dealings with the organization's or institution's authorities to be fairer than do those with less prior loyalty, either because they are more fairly treated or because they interpret equivalent treatment as fairer.

Although high levels of prior organizational or institutional commitment are generally beneficial to the organization or institution, under certain conditions high levels of prior commitment may actually sow the seeds of reduced commitment. When previously committed individuals feel that they were treated unfavourably or unfairly during some experience with the organization or institution, they may show an especially sharp decline in commitment. Two studies were designed to test this hypothesis, which, if confirmed, would suggest that organizational or institutional commitment has risks, as well as benefits. At least three psychological models offer predictions of how individuals' reactions may vary as a function of (1) their prior level of commitment and (2) the favorability of the encounter with the organization or institution. Favorability of the encounter is determined by the outcome of the encounter and the fairness or appropriateness of the procedures used to allocate outcomes during the encounter. First, the instrumental prediction is that because people are mainly concerned with receiving desired outcomes from their encounters with organizations, changes in their level of commitment will depend primarily on the favorability of the encounter. Second, the assimilation prediction is that individuals' prior attitudes predispose them to react in a way that is consistent with their prior attitudes.

The third prediction, derived from the group-value model of justice, pertains to how people with high prior commitment will react when they feel that they have been treated unfavorably or unfairly during some encounter with the organization or institution. Fair treatment by the other party symbolizes to people that they are being dealt with in a dignified and respectful way, thereby bolstering their sense of self-identity and self worth. However, people will become quite distressed and react quite negatively if they feel that they have been treated unfairly by the other party to the relationship. The group-value model suggests that people value the information they receive that helps them to define themselves and to view themselves favorably. According to the instrumental viewpoint, people are primarily concerned with the more material or tangible resources received from the relationship. Empirical support for the group-value model has implications for a variety of important issues, including the determinants of commitment, satisfaction, organizational citizenship, and rule following. Determinants of procedural fairness include structural or interpersonal factors. For example, structural determinants refer to such things as whether decisions were made by neutral, fact finding authorities who used legitimate decision making criteria. The primary purpose of the study was to examine the interactive effect of individuals (1) commitment to an organization or institution prior to some encounter and (2) perceptions of how fairly they were treated during the encounter, on the change in their level of commitment. A basic assumption of the group-value model is that people generally value their relationships with people, groups, organizations, and institutions and therefore value fair treatment from the other party to the relationship. Specifically, highly committed members should have especially negative reactions to feeling that they were treated unfairly, more so than (1) less-committed group members or (2) highly committed members who felt that they were fairly treated.

The prediction that people will react especially negatively when they previously felt highly committed but felt that they were treated unfairly also is consistent with the literature on psychological contracts. Rousseau suggested that, over time, the members of work organizations develop feelings of entitlement, i.e., perceived obligations that their employers have toward them. Those who are highly committed to the organization believe that they are fulfilling their contract obligations. However, if the organization acted unfairly, then highly committed individuals are likely to believe that the organization did not live up to its end of the bargain.

For summarizing the passage, which of the following is most appropriate:

People are continually enticed by such "hot" performance, even if it lasts for brief periods. Because of this susceptibility, brokers or analysts who have had one or two stocks move up sharply, or technicians who call one turn correctly, are believed to have established a credible record and can readily find market followings. Likewise, an advisory service that is right for a brief time can beat its drums loudly. Elaine Garzarelli gained near immortality when she purportedly "called" the 1987 crash. Although, as the market strategist for Shearson Lehman, her forecast was never published in a research report, nor indeed communicated to its clients, she still received widespread recognition and publicity for this call, which was made in a short TV interview on CNBC. Still, her remark on CNBC that the Dow could drop sharply from its then 5300 level rocked an already nervous market on July 23, 1996. What had been a 40-point gain for the Dow turned into a 40-point loss, a good deal of which was attributed to her comments.

The truth is, market-letter writers have been wrong in their judgments far more often than they would like to remember. However, advisors understand that the public considers short-term results meaningful when they are, more often than not, simply chance. Those in the public eye usually gain large numbers of new subscribers for being right by random luck. Which brings us to another important probability error that falls under the broad rubric of representativeness. Amos Tversky and Daniel Kahneman call this one the "law of small numbers.". The statistically valid "law of large numbers" states that large samples will usually be highly representative of the population from which they are drawn; for example, public opinion polls are fairly accurate because they draw on large and representative groups. The smaller the sample used, however (or the shorter the record), the more likely the findings are chance rather than meaningful. Yet the Tversky and Kahneman study showed that typical psychological or educational experimenters gamble their research theories on samples so small that the results have a very high probability of being chance. This is the same as gambling on the single good call of an advisor. The psychologists and educators are far too confident in the significance of results based on a few observations or a short period of time, even though they are trained in statistical techniques and are aware of the dangers.

Note how readily people over generalize the meaning of a small number of supporting facts. Limited statistical evidence seems to satisfy our intuition no matter how inadequate the depiction of reality. Sometimes the evidence we accept runs to the absurd. A good example of the major overemphasis on small numbers is the almost blind faith investors place in governmental economic releases on employment, industrial production, the consumer price index, the money supply, the leading economic indicators, etc. These statistics frequently trigger major stock- and bond-market reactions, particularly if the news is bad. Flash statistics, more times than not, are near worthless. Initial economic and Fed figures are revised significantly for weeks or months after their release, as new and "better" information flows in. Thus, an increase in the money supply can turn into a decrease, or a large drop in the leading indicators can change to a moderate increase. These revisions occur with such regularity you would think that investors, particularly pros, would treat them with the skepticism they deserve. Alas, the real world refuses to follow the textbooks. Experience notwithstanding, investors treat as gospel all authoritative-sounding releases that they think pinpoint the development of important trends. An example of how instant news threw investors into a tailspin occurred in July of 1996. Preliminary statistics indicated the economy was beginning to gain steam. The flash figures showed that GDP (gross domestic product) would rise at a 3% rate in the next several quarters, a rate higher than expected. Many people, convinced by these statistics that rising interest rates were imminent, bailed out of the stock market that month. To the end of that year, the GDP growth figures had been revised down significantly (unofficially, a minimum of a dozen times, and officially at least twice). The market rocketed ahead to new highs to August l997, but a lot of investors had retreated to the sidelines on the preliminary bad news. The advice of a world champion chess player when asked how to avoid making a bad move. His answer: "Sit on your hands . But professional investors don't sit on their hands; they dance on tiptoe, ready to flit after the least particle of information as if it were a strongly documented trend. The law of small numbers, in such cases, results in decisions sometimes bordering on the inane. Tversky and Kahneman's findings, which have been repeatedly confirmed, are particularly important to our understanding of some stock market errors and lead to another rule that investors should follow.

Which statement does not reflect the true essence of the passage?

I. Tversky and Kahneman understood that small representative groups bias the research theories to generalize results that can be categorized as meaningful results and people simplify the real impact of passable portrayals of reality by a small number of supporting facts.

II. Governmental economic releases on macroeconomic indicators fetch blind faith from investors who appropriately discount these announcements which are ideally reflected in the stock and bond market prices.

III. Investors take into consideration myopic gain and make it a meaningful investment choice and fail to see it as a chance of occurrence.

IV. Irrational overreaction to key regulators expressions is the same as intuitive statistician stumbling disastrously when unable to sustain spectacular performance.

People are continually enticed by such "hot" performance, even if it lasts for brief periods. Because of this susceptibility, brokers or analysts who have had one or two stocks move up sharply, or technicians who call one turn correctly, are believed to have established a credible record and can readily find market followings. Likewise, an advisory service that is right for a brief time can beat its drums loudly. Elaine Garzarelli gained near immortality when she purportedly "called" the 1987 crash. Although, as the market strategist for Shearson Lehman, her forecast was never published in a research report, nor indeed communicated to its clients, she still received widespread recognition and publicity for this call, which was made in a short TV interview on CNBC. Still, her remark on CNBC that the Dow could drop sharply from its then 5300 level rocked an already nervous market on July 23, 1996. What had been a 40-point gain for the Dow turned into a 40-point loss, a good deal of which was attributed to her comments.

The truth is, market-letter writers have been wrong in their judgments far more often than they would like to remember. However, advisors understand that the public considers short-term results meaningful when they are, more often than not, simply chance. Those in the public eye usually gain large numbers of new subscribers for being right by random luck. Which brings us to another important probability error that falls under the broad rubric of representativeness. Amos Tversky and Daniel Kahneman call this one the "law of small numbers.". The statistically valid "law of large numbers" states that large samples will usually be highly representative of the population from which they are drawn; for example, public opinion polls are fairly accurate because they draw on large and representative groups. The smaller the sample used, however (or the shorter the record), the more likely the findings are chance rather than meaningful. Yet the Tversky and Kahneman study showed that typical psychological or educational experimenters gamble their research theories on samples so small that the results have a very high probability of being chance. This is the same as gambling on the single good call of an advisor. The psychologists and educators are far too confident in the significance of results based on a few observations or a short period of time, even though they are trained in statistical techniques and are aware of the dangers.

Note how readily people over generalize the meaning of a small number of supporting facts. Limited statistical evidence seems to satisfy our intuition no matter how inadequate the depiction of reality. Sometimes the evidence we accept runs to the absurd. A good example of the major overemphasis on small numbers is the almost blind faith investors place in governmental economic releases on employment, industrial production, the consumer price index, the money supply, the leading economic indicators, etc. These statistics frequently trigger major stock- and bond-market reactions, particularly if the news is bad. Flash statistics, more times than not, are near worthless. Initial economic and Fed figures are revised significantly for weeks or months after their release, as new and "better" information flows in. Thus, an increase in the money supply can turn into a decrease, or a large drop in the leading indicators can change to a moderate increase. These revisions occur with such regularity you would think that investors, particularly pros, would treat them with the skepticism they deserve. Alas, the real world refuses to follow the textbooks. Experience notwithstanding, investors treat as gospel all authoritative-sounding releases that they think pinpoint the development of important trends. An example of how instant news threw investors into a tailspin occurred in July of 1996. Preliminary statistics indicated the economy was beginning to gain steam. The flash figures showed that GDP (gross domestic product) would rise at a 3% rate in the next several quarters, a rate higher than expected. Many people, convinced by these statistics that rising interest rates were imminent, bailed out of the stock market that month. To the end of that year, the GDP growth figures had been revised down significantly (unofficially, a minimum of a dozen times, and officially at least twice). The market rocketed ahead to new highs to August l997, but a lot of investors had retreated to the sidelines on the preliminary bad news. The advice of a world champion chess player when asked how to avoid making a bad move. His answer: "Sit on your hands . But professional investors don't sit on their hands; they dance on tiptoe, ready to flit after the least particle of information as if it were a strongly documented trend. The law of small numbers, in such cases, results in decisions sometimes bordering on the inane. Tversky and Kahneman's findings, which have been repeatedly confirmed, are particularly important to our understanding of some stock market errors and lead to another rule that investors should follow.

The author of the passage suggests the anomaly that leads to systematic errors in predicting the future. Which of the following statements does not best describe the anomaly as suggested in the passage above?

I. The psychological pressures account for the anomalies just like soothsayers warning about the doomsday and natural disasters and market crashes.

II. Contrary to several economic and financial theories investors are not good intuitive statisticians, especially under difficult conditions and are unable to calculate the odds properly when making investments choices.

III. Investors are swamped with information and they react to this avalanche of data by adopting shortcuts or rules of thumb rather than formally calculating odds of a given outcome.

IV. The distortions produced by subjectively calculated probabilities are large, systematic and difficult to eliminate even when investors are fully aware of them.

People are continually enticed by such "hot" performance, even if it lasts for brief periods. Because of this susceptibility, brokers or analysts who have had one or two stocks move up sharply, or technicians who call one turn correctly, are believed to have established a credible record and can readily find market followings. Likewise, an advisory service that is right for a brief time can beat its drums loudly. Elaine Garzarelli gained near immortality when she purportedly "called" the 1987 crash. Although, as the market strategist for Shearson Lehman, her forecast was never published in a research report, nor indeed communicated to its clients, she still received widespread recognition and publicity for this call, which was made in a short TV interview on CNBC. Still, her remark on CNBC that the Dow could drop sharply from its then 5300 level rocked an already nervous market on July 23, 1996. What had been a 40-point gain for the Dow turned into a 40-point loss, a good deal of which was attributed to her comments.

The truth is, market-letter writers have been wrong in their judgments far more often than they would like to remember. However, advisors understand that the public considers short-term results meaningful when they are, more often than not, simply chance. Those in the public eye usually gain large numbers of new subscribers for being right by random luck. Which brings us to another important probability error that falls under the broad rubric of representativeness. Amos Tversky and Daniel Kahneman call this one the "law of small numbers.". The statistically valid "law of large numbers" states that large samples will usually be highly representative of the population from which they are drawn; for example, public opinion polls are fairly accurate because they draw on large and representative groups. The smaller the sample used, however (or the shorter the record), the more likely the findings are chance rather than meaningful. Yet the Tversky and Kahneman study showed that typical psychological or educational experimenters gamble their research theories on samples so small that the results have a very high probability of being chance. This is the same as gambling on the single good call of an advisor. The psychologists and educators are far too confident in the significance of results based on a few observations or a short period of time, even though they are trained in statistical techniques and are aware of the dangers.

Note how readily people over generalize the meaning of a small number of supporting facts. Limited statistical evidence seems to satisfy our intuition no matter how inadequate the depiction of reality. Sometimes the evidence we accept runs to the absurd. A good example of the major overemphasis on small numbers is the almost blind faith investors place in governmental economic releases on employment, industrial production, the consumer price index, the money supply, the leading economic indicators, etc. These statistics frequently trigger major stock- and bond-market reactions, particularly if the news is bad. Flash statistics, more times than not, are near worthless. Initial economic and Fed figures are revised significantly for weeks or months after their release, as new and "better" information flows in. Thus, an increase in the money supply can turn into a decrease, or a large drop in the leading indicators can change to a moderate increase. These revisions occur with such regularity you would think that investors, particularly pros, would treat them with the skepticism they deserve. Alas, the real world refuses to follow the textbooks. Experience notwithstanding, investors treat as gospel all authoritative-sounding releases that they think pinpoint the development of important trends. An example of how instant news threw investors into a tailspin occurred in July of 1996. Preliminary statistics indicated the economy was beginning to gain steam. The flash figures showed that GDP (gross domestic product) would rise at a 3% rate in the next several quarters, a rate higher than expected. Many people, convinced by these statistics that rising interest rates were imminent, bailed out of the stock market that month. To the end of that year, the GDP growth figures had been revised down significantly (unofficially, a minimum of a dozen times, and officially at least twice). The market rocketed ahead to new highs to August l997, but a lot of investors had retreated to the sidelines on the preliminary bad news. The advice of a world champion chess player when asked how to avoid making a bad move. His answer: "Sit on your hands . But professional investors don't sit on their hands; they dance on tiptoe, ready to flit after the least particle of information as if it were a strongly documented trend. The law of small numbers, in such cases, results in decisions sometimes bordering on the inane. Tversky and Kahneman's findings, which have been repeatedly confirmed, are particularly important to our understanding of some stock market errors and lead to another rule that investors should follow.

"Tversky and Kahneman's findings ... lead to another rule that investors should follow". Which rule is the author talking about?

I. Not to be influenced by the short term and occasional record of a money manager, broker, analysts, or advisor, no matter how impressive.

II. To accept cursory economic or investment news without significant substantiation but supported by statistical evidence even if limited in data sufficiency.

III. In making decisions we become overly immersed in the details of a particular situation and consider all the outcomes of similar experience in our past.

IV. None of the above.

People are continually enticed by such "hot" performance, even if it lasts for brief periods. Because of this susceptibility, brokers or analysts who have had one or two stocks move up sharply, or technicians who call one turn correctly, are believed to have established a credible record and can readily find market followings. Likewise, an advisory service that is right for a brief time can beat its drums loudly. Elaine Garzarelli gained near immortality when she purportedly "called" the 1987 crash. Although, as the market strategist for Shearson Lehman, her forecast was never published in a research report, nor indeed communicated to its clients, she still received widespread recognition and publicity for this call, which was made in a short TV interview on CNBC. Still, her remark on CNBC that the Dow could drop sharply from its then 5300 level rocked an already nervous market on July 23, 1996. What had been a 40-point gain for the Dow turned into a 40-point loss, a good deal of which was attributed to her comments.

The truth is, market-letter writers have been wrong in their judgments far more often than they would like to remember. However, advisors understand that the public considers short-term results meaningful when they are, more often than not, simply chance. Those in the public eye usually gain large numbers of new subscribers for being right by random luck. Which brings us to another important probability error that falls under the broad rubric of representativeness. Amos Tversky and Daniel Kahneman call this one the "law of small numbers.". The statistically valid "law of large numbers" states that large samples will usually be highly representative of the population from which they are drawn; for example, public opinion polls are fairly accurate because they draw on large and representative groups. The smaller the sample used, however (or the shorter the record), the more likely the findings are chance rather than meaningful. Yet the Tversky and Kahneman study showed that typical psychological or educational experimenters gamble their research theories on samples so small that the results have a very high probability of being chance. This is the same as gambling on the single good call of an advisor. The psychologists and educators are far too confident in the significance of results based on a few observations or a short period of time, even though they are trained in statistical techniques and are aware of the dangers.

Note how readily people over generalize the meaning of a small number of supporting facts. Limited statistical evidence seems to satisfy our intuition no matter how inadequate the depiction of reality. Sometimes the evidence we accept runs to the absurd. A good example of the major overemphasis on small numbers is the almost blind faith investors place in governmental economic releases on employment, industrial production, the consumer price index, the money supply, the leading economic indicators, etc. These statistics frequently trigger major stock- and bond-market reactions, particularly if the news is bad. Flash statistics, more times than not, are near worthless. Initial economic and Fed figures are revised significantly for weeks or months after their release, as new and "better" information flows in. Thus, an increase in the money supply can turn into a decrease, or a large drop in the leading indicators can change to a moderate increase. These revisions occur with such regularity you would think that investors, particularly pros, would treat them with the skepticism they deserve. Alas, the real world refuses to follow the textbooks. Experience notwithstanding, investors treat as gospel all authoritative-sounding releases that they think pinpoint the development of important trends. An example of how instant news threw investors into a tailspin occurred in July of 1996. Preliminary statistics indicated the economy was beginning to gain steam. The flash figures showed that GDP (gross domestic product) would rise at a 3% rate in the next several quarters, a rate higher than expected. Many people, convinced by these statistics that rising interest rates were imminent, bailed out of the stock market that month. To the end of that year, the GDP growth figures had been revised down significantly (unofficially, a minimum of a dozen times, and officially at least twice). The market rocketed ahead to new highs to August l997, but a lot of investors had retreated to the sidelines on the preliminary bad news. The advice of a world champion chess player when asked how to avoid making a bad move. His answer: "Sit on your hands . But professional investors don't sit on their hands; they dance on tiptoe, ready to flit after the least particle of information as if it were a strongly documented trend. The law of small numbers, in such cases, results in decisions sometimes bordering on the inane. Tversky and Kahneman's findings, which have been repeatedly confirmed, are particularly important to our understanding of some stock market errors and lead to another rule that investors should follow.

According to the passage which statement written below is farthest in explaining the meaning of the passage above?

I. Market letter writers have been wrong in their judgments many times but they continue to express their opinion as dramatic predictions and well-times calls result in huge rewards to analysts, journalists and popular writers.

II. Public opinion polls are fairly accurate because they are based on randomly selected diminutive representative groups and hence are more meaningful than intuitive statistics of an outcome.

III. People generally limit the need for hefty statistical evidence as it satisfies their intuition without reflecting the reality.

IV. None of the above.

Read the following passage carefully and answer the questions given at the end.

Before the internet, one of the most rapid changes to the global economy and trade was wrought by something so blatantly useful that it is hard to imagine a struggle to get it adopted: the shipping container. In the early 1960s, before the standard container became ubiquitous, freight costs were I0 per cent of the value of US imports, about the same barrier to trade as the average official government import tariff. Yet in a journey that went halfway round the world, half of those costs could be incurred in two ten-mile movements through the ports at either end. The predominant 'break-bulk' method, where each shipment was individually split up into loads that could be handled by a team of dockers, was vastly complex and labour-intensive. Ships could take weeks or months to load, as a huge variety of cargoes of different weights, shapes and sizes had to be stacked together by hand. Indeed, one of the most unreliable aspects of such a labour-intensive process was the labour. Ports, like mines, were frequently seething pits of industrial unrest. Irregular work on one side combined with what was often a tight-knit, well -organized labour community on the other.

In 1956, loading break-bulk cargo cost $5.83 per ton. The entrepreneurial genius who saw the possibilities for standardized container shipping, Malcolm McLean, floated his first containerized ship in that year and claimed to be able to shift cargo for 15.8 cents a ton. Boxes of the same size that could be loaded by crane and neatly stacked were much faster to load. Moreover, carrying cargo in a standard container would allow it to be shifted between truck, train and ship without having to be repacked each time.

But between McLean's container and the standardization of the global market were an array of formidable obstacles. They began at home in the US with the official Interstate Commerce Commission, which could prevent price competition by setting rates for freight haulage by route and commodity, and the powerful International Longshoremen's Association (ILA) labour union. More broadly, the biggest hurdle was achieving what economists call 'network effects': the benefit of a standard technology rises exponentially as more people use it. To dominate world trade, containers had to be easily interchangeable between different shipping lines, ports, trucks and railcars. And to maximize efficiency, they all needed to be the same size. The adoption of a network technology often involves overcoming the resistance of those who are heavily invested in the old system. And while the efficiency gains are clear to see, there are very obvious losers as well as winners. For containerization, perhaps the most spectacular example was the demise of New York City as a port.

In the early I950s, New York handled a third of US seaborne trade in manufactured goods. But it was woefully inefficient, even with existing break-bulk technology: 283 piers, 98 of which were able to handle ocean-going ships, jutted out into the river from Brooklyn and Manhattan. Trucks bound for the docks had to drive through the crowded, narrow streets of Manhattan, wait for an hour or two before even entering a pier, and then undergo a laborious two-stage process in which the goods foot were unloaded into a transit shed and then loaded onto a ship. 'Public loader' work gangs held exclusive rights to load and unload on a particular pier, a power in effect granted by the ILA, which enforced its monopoly with sabotage and violence against competitors. The ILA fought ferociously against containerization, correctly foreseeing that it would destroy their privileged position as bandits controlling the mountain pass. On this occasion, bypassing them simply involved going across the river. A container port was built in New Jersey, where a 1500-foot wharf allowed ships to dock parallel to shore and containers to be lifted on and off by crane. Between 1963 - 4 and 1975 - 6, the number of days worked by longshoremen in Manhattan went from 1.4 million to 127,041.

Containers rapidly captured the transatlantic market, and then the growing trade with Asia. The effect of containerization is hard to see immediately in freight rates, since the oil price hikes of the 1970s kept them high, but the speed with which shippers adopted; containerization made it clear it brought big benefits of efficiency and cost. The extraordinary growth of the Asian tiger economies of Singapore, Taiwan, Korea and Hong Kong, which based their development strategy on exports, was greatly helped by the container trade that quickly built up between the US and east Asia. Ocean-borne exports from South Korea were 2.9 million tons in 1969 and 6 million in 1973, and its exports to the US tripled.

But the new technology did not get adopted all on its own. It needed a couple of pushes from the government -both, as it happens, largely to do with the military. As far as the ships were concerned, the same link between the merchant and military navy that had inspired the Navigation Acts in seventeenth-century England endured into twentieth-century America. The government's first helping hand was to give a spur to the system by adopting it to transport military cargo. The US armed forces, seeing the efficiency of the system, started contracting McLean's company PanAtlantic, later renamed Sea-land, to carry equipment to the quarter of a million American soldiers stationed in Western Europe. One of the few benefits of America's misadventure in Vietnam was a rapid expansion of containerization. Because war involves massive movements of men and material, it is often armies that pioneer new techniques in supply chains.

The government's other role was in banging heads together sufficiently to get all companies to accept the same size container. Standard sizes were essential to deliver the economies of scale that came from interchangeability - which, as far as the military was concerned, was vital if the ships had to be commandeered in case war broke out. This was a significant problem to overcome, not least because all the companies that had started using the container had settled on different sizes. PanAtlantic used 35-foot containers, because that was the maximum size allowed on the highways in its home base in New Jersey. Another of the big shipping companies, Matson Navigation, used a 24-foot container since its biggest trade was in canned pineapple from Hawaii, and a container bigger than that would have been too heavy for a crane to lift. Grace Line, which largely traded with Latin America, used a foot container that was easier to truck around winding mountain roads.

Establishing a US standard and then getting it adopted internationally took more than a decade.

Indeed, not only did the US Maritime Administration have to mediate in these rivalries but also to fight its own turf battles with the American Standards Association, an agency set up by the private sector. The matter was settled by using the power of federal money: the Federal Maritime Board (FMB), which handed out public subsidies for shipbuilding, decreed that only the 8 x 8-foot containers in the lengths of l0, 20, 30 or 40 feet would be eligible for handouts.

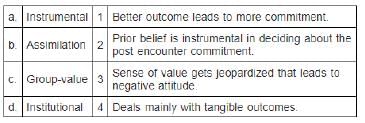

Identify the correct statement:

Read the following passage carefully and answer the questions given at the end.

Before the internet, one of the most rapid changes to the global economy and trade was wrought by something so blatantly useful that it is hard to imagine a struggle to get it adopted: the shipping container. In the early 1960s, before the standard container became ubiquitous, freight costs were I0 per cent of the value of US imports, about the same barrier to trade as the average official government import tariff. Yet in a journey that went halfway round the world, half of those costs could be incurred in two ten-mile movements through the ports at either end. The predominant 'break-bulk' method, where each shipment was individually split up into loads that could be handled by a team of dockers, was vastly complex and labour-intensive. Ships could take weeks or months to load, as a huge variety of cargoes of different weights, shapes and sizes had to be stacked together by hand.

Indeed, one of the most unreliable aspects of such a labour-intensive process was the labour. Ports, like mines, were frequently seething pits of industrial unrest. Irregular work on one side combined with what was often a tight-knit, well -organized labour community on the other.

In 1956, loading break-bulk cargo cost $5.83 per ton. The entrepreneurial genius who saw the possibilities for standardized container shipping, Malcolm McLean, floated his first containerized ship in that year and claimed to be able to shift cargo for 15.8 cents a ton. Boxes of the same size that could be loaded by crane and neatly stacked were much faster to load. Moreover, carrying cargo in a standard container would allow it to be shifted between truck, train and ship without having to be repacked each time.

But between McLean's container and the standardization of the global market were an array of formidable obstacles. They began at home in the US with the official Interstate Commerce Commission, which could prevent price competition by setting rates for freight haulage by route and commodity, and the powerful International Longshoremen's Association (ILA) labour union. More broadly, the biggest hurdle was achieving what economists call 'network effects': the benefit of a standard technology rises exponentially as more people use it. To dominate world trade, containers had to be easily interchangeable between different shipping lines, ports, trucks and railcars. And to maximize efficiency, they all needed to be the same size. The adoption of a network technology often involves overcoming the resistance of those who are heavily invested in the old system. And while the efficiency gains are clear to see, there are very obvious losers as well as winners. For containerization, perhaps the most spectacular example was the demise of New York City as a port.

In the early I950s, New York handled a third of US seaborne trade in manufactured goods. But it was woefully inefficient, even with existing break-bulk technology: 283 piers, 98 of which were able to handle ocean-going ships, jutted out into the river from Brooklyn and Manhattan. Trucks bound for the docks had to drive through the crowded, narrow streets of Manhattan, wait for an hour or two before even entering a pier, and then undergo a laborious two-stage process in which the goods foot were unloaded into a transit shed and then loaded onto a ship. 'Public loader' work gangs held exclusive rights to load and unload on a particular pier, a power in effect granted by the ILA, which enforced its monopoly with sabotage and violence against competitors. The ILA fought ferociously against containerization, correctly foreseeing that it would destroy their privileged position as bandits controlling the mountain pass. On this occasion, bypassing them simply involved going across the river. A container port was built in New Jersey, where a 1500-foot wharf allowed ships to dock parallel to shore and containers to be lifted on and off by crane. Between 1963 - 4 and 1975 - 6, the number of days worked by longshoremen in Manhattan went from 1.4 million to 127,041.

Containers rapidly captured the transatlantic market, and then the growing trade with Asia. The effect of containerization is hard to see immediately in freight rates, since the oil price hikes of the 1970s kept them high, but the speed with which shippers adopted; containerization made it clear it brought big benefits of efficiency and cost. The extraordinary growth of the Asian tiger economies of Singapore, Taiwan, Korea and Hong Kong, which based their development strategy on exports, was greatly helped by the container trade that quickly built up between the US and east Asia. Ocean-borne exports from South Korea were 2.9 million tons in 1969 and 6 million in 1973, and its exports to the US tripled.

But the new technology did not get adopted all on its own. It needed a couple of pushes from the government -both, as it happens, largely to do with the military. As far as the ships were concerned, the same link between the merchant and military navy that had inspired the Navigation Acts in seventeenth-century England endured into twentieth-century America. The government's first helping hand was to give a spur to the system by adopting it to transport military cargo. The US armed forces, seeing the efficiency of the system, started contracting McLean's company PanAtlantic, later renamed Sea-land, to carry equipment to the quarter of a million American soldiers stationed in Western Europe. One of the few benefits of America's misadventure in Vietnam was a rapid expansion of containerization. Because war involves massive movements of men and material, it is often armies that pioneer new techniques in supply chains.

The government's other role was in banging heads together sufficiently to get all companies to accept the same size container. Standard sizes were essential to deliver the economies of scale that came from interchangeability - which, as far as the military was concerned, was vital if the ships had to be commandeered in case war broke out. This was a significant problem to overcome, not least because all the companies that had started using the container had settled on different sizes. PanAtlantic used 35-foot containers, because that was the maximum size allowed on the highways in its home base in New Jersey. Another of the big shipping companies, Matson Navigation, used a 24-foot container since its biggest trade was in canned pineapple from Hawaii, and a container bigger than that would have been too heavy for a crane to lift. Grace Line, which largely traded with Latin America, used a foot container that was easier to truck around winding mountain roads.

Establishing a US standard and then getting it adopted internationally took more than a decade.

Indeed, not only did the US Maritime Administration have to mediate in these rivalries but also to fight its own turf battles with the American Standards Association, an agency set up by the private sector. The matter was settled by using the power of federal money: the Federal Maritime Board (FMB), which handed out public subsidies for shipbuilding, decreed that only the 8 x 8-foot containers in the lengths of l0, 20, 30 or 40 feet would be eligible for handouts.

Identify the false statement:

Read the following passage carefully and answer the questions given at the end.

Before the internet, one of the most rapid changes to the global economy and trade was wrought by something so blatantly useful that it is hard to imagine a struggle to get it adopted: the shipping container. In the early 1960s, before the standard container became ubiquitous, freight costs were I0 per cent of the value of US imports, about the same barrier to trade as the average official government import tariff. Yet in a journey that went halfway round the world, half of those costs could be incurred in two ten-mile movements through the ports at either end. The predominant 'break-bulk' method, where each shipment was individually split up into loads that could be handled by a team of dockers, was vastly complex and labour-intensive. Ships could take weeks or months to load, as a huge variety of cargoes of different weights, shapes and sizes had to be stacked together by hand. Indeed, one of the most unreliable aspects of such a labour-intensive process was the labour. Ports, like mines, were frequently seething pits of industrial unrest. Irregular work on one side combined with what was often a tight-knit, well -organized labour community on the other.

In 1956, loading break-bulk cargo cost $5.83 per ton. The entrepreneurial genius who saw the possibilities for standardized container shipping, Malcolm McLean, floated his first containerized ship in that year and claimed to be able to shift cargo for 15.8 cents a ton. Boxes of the same size that could be loaded by crane and neatly stacked were much faster to load. Moreover, carrying cargo in a standard container would allow it to be shifted between truck, train and ship without having to be repacked each time.

But between McLean's container and the standardization of the global market were an array of formidable obstacles. They began at home in the US with the official Interstate Commerce Commission, which could prevent price competition by setting rates for freight haulage by route and commodity, and the powerful International Longshoremen's Association (ILA) labour union. More broadly, the biggest hurdle was achieving what economists call 'network effects':

the benefit of a standard technology rises exponentially as more people use it. To dominate world trade, containers had to be easily interchangeable between different shipping lines, ports, trucks and railcars. And to maximize efficiency, they all needed to be the same size. The adoption of a network technology often involves overcoming the resistance of those who are heavily invested in the old system. And while the efficiency gains are clear to see, there are very obvious losers as well as winners. For containerization, perhaps the most spectacular example was the demise of New York City as a port.

In the early I950s, New York handled a third of US seaborne trade in manufactured goods. But it was woefully inefficient, even with existing break-bulk technology: 283 piers, 98 of which were able to handle ocean-going ships, jutted out into the river from Brooklyn and Manhattan. Trucks bound for the docks had to drive through the crowded, narrow streets of Manhattan, wait for an hour or two before even entering a pier, and then undergo a laborious two-stage process in which the goods foot were unloaded into a transit shed and then loaded onto a ship. 'Public loader' work gangs held exclusive rights to load and unload on a particular pier, a power in effect granted by the ILA, which enforced its monopoly with sabotage and violence against competitors. The ILA fought ferociously against containerization, correctly foreseeing that it would destroy their privileged position as bandits controlling the mountain pass. On this occasion, bypassing them simply involved going across the river. A container port was built in New Jersey, where a 1500-foot wharf allowed ships to dock parallel to shore and containers to be lifted on and off by crane. Between 1963 - 4 and 1975 - 6, the number of days worked by longshoremen in Manhattan went from 1.4 million to 127,041.

Containers rapidly captured the transatlantic market, and then the growing trade with Asia. The effect of containerization is hard to see immediately in freight rates, since the oil price hikes of the 1970s kept them high, but the speed with which shippers adopted; containerization made it clear it brought big benefits of efficiency and cost. The extraordinary growth of the Asian tiger economies of Singapore, Taiwan, Korea and Hong Kong, which based their development strategy on exports, was greatly helped by the container trade that quickly built up between the US and east Asia. Ocean-borne exports from South Korea were 2.9 million tons in 1969 and 6 million in 1973, and its exports to the US tripled.

But the new technology did not get adopted all on its own. It needed a couple of pushes from the government -both, as it happens, largely to do with the military. As far as the ships were concerned, the same link between the merchant and military navy that had inspired the Navigation Acts in seventeenth-century England endured into twentieth-century America. The government's first helping hand was to give a spur to the system by adopting it to transport military cargo. The US armed forces, seeing the efficiency of the system, started contracting McLean's company PanAtlantic, later renamed Sea-land, to carry equipment to the quarter of a million American soldiers stationed in Western Europe. One of the few benefits of America's misadventure in Vietnam was a rapid expansion of containerization. Because war involves massive movements of men and material, it is often armies that pioneer new techniques in supply chains.

The government's other role was in banging heads together sufficiently to get all companies to accept the same size container. Standard sizes were essential to deliver the economies of scale that came from interchangeability - which, as far as the military was concerned, was vital if the ships had to be commandeered in case war broke out. This was a significant problem to overcome, not least because all the companies that had started using the container had settled on different sizes. PanAtlantic used 35-foot containers, because that was the maximum size allowed on the highways in its home base in New Jersey. Another of the big shipping companies, Matson Navigation, used a 24-foot container since its biggest trade was in canned pineapple from Hawaii, and a container bigger than that would have been too heavy for a crane to lift. Grace Line, which largely traded with Latin America, used a foot container that was easier to truck around winding mountain roads.

Establishing a US standard and then getting it adopted internationally took more than a decade.

Indeed, not only did the US Maritime Administration have to mediate in these rivalries but also to fight its own turf battles with the American Standards Association, an agency set up by the private sector. The matter was settled by using the power of federal money: the Federal

Maritime Board (FMB), which handed out public subsidies for shipbuilding, decreed that only the 8 x 8-foot containers in the lengths of l0, 20, 30 or 40 feet would be eligible for handouts.

The emergence of containerization technology in early seventies resulted in:

Read the following passage carefully and answer the questions given at the end.

Before the internet, one of the most rapid changes to the global economy and trade was wrought by something so blatantly useful that it is hard to imagine a struggle to get it adopted: the shipping container. In the early 1960s, before the standard container became ubiquitous, freight costs were I0 per cent of the value of US imports, about the same barrier to trade as the average official government import tariff. Yet in a journey that went halfway round the world, half of those costs could be incurred in two ten-mile movements through the ports at either end. The predominant 'break-bulk' method, where each shipment was individually split up into loads that could be handled by a team of dockers, was vastly complex and labour-intensive. Ships could take weeks or months to load, as a huge variety of cargoes of different weights, shapes and sizes had to be stacked together by hand. Indeed, one of the most unreliable aspects of such a labour-intensive process was the labour. Ports, like mines, were frequently seething pits of industrial unrest. Irregular work on one side combined with what was often a tight-knit, well -organized labour community on the other.

In 1956, loading break-bulk cargo cost $5.83 per ton. The entrepreneurial genius who saw the possibilities for standardized container shipping, Malcolm McLean, floated his first containerized ship in that year and claimed to be able to shift cargo for 15.8 cents a ton. Boxes of the same size that could be loaded by crane and neatly stacked were much faster to load. Moreover, carrying cargo in a standard container would allow it to be shifted between truck, train and ship without having to be repacked each time.

But between McLean's container and the standardization of the global market were an array of formidable obstacles. They began at home in the US with the official Interstate Commerce Commission, which could prevent price competition by setting rates for freight haulage by route and commodity, and the powerful International Longshoremen's Association (ILA) labour union. More broadly, the biggest hurdle was achieving what economists call 'network effects': the benefit of a standard technology rises exponentially as more people use it. To dominate world trade, containers had to be easily interchangeable between different shipping lines, ports, trucks and railcars. And to maximize efficiency, they all needed to be the same size. The adoption of a network technology often involves overcoming the resistance of those who are heavily invested in the old system. And while the efficiency gains are clear to see, there are very obvious losers as well as winners. For containerization, perhaps the most spectacular example was the demise of New York City as a port.

In the early I950s, New York handled a third of US seaborne trade in manufactured goods. But it was woefully inefficient, even with existing break-bulk technology: 283 piers, 98 of which were able to handle ocean-going ships, jutted out into the river from Brooklyn and Manhattan. Trucks bound for the docks had to drive through the crowded, narrow streets of Manhattan, wait for an hour or two before even entering a pier, and then undergo a laborious two-stage process in which the goods foot were unloaded into a transit shed and then loaded onto a ship. 'Public loader' work gangs held exclusive rights to load and unload on a particular pier, a power in effect granted by the ILA, which enforced its monopoly with sabotage and violence against competitors. The ILA fought ferociously against containerization, correctly foreseeing that it would destroy their privileged position as bandits controlling the mountain pass. On this occasion, bypassing them simply involved going across the river. A container port was built in New Jersey, where a 1500-foot wharf allowed ships to dock parallel to shore and containers to be lifted on and off by crane. Between 1963 - 4 and 1975 - 6, the number of days worked by longshoremen in Manhattan went from 1.4 million to 127,041.

Containers rapidly captured the transatlantic market, and then the growing trade with Asia. The effect of containerization is hard to see immediately in freight rates, since the oil price hikes of the 1970s kept them high, but the speed with which shippers adopted; containerization made it clear it brought big benefits of efficiency and cost. The extraordinary growth of the Asian tiger economies of Singapore, Taiwan, Korea and Hong Kong, which based their development strategy on exports, was greatly helped by the container trade that quickly built up between the US and east Asia. Ocean-borne exports from South Korea were 2.9 million tons in 1969 and 6 million in 1973, and its exports to the US tripled.

But the new technology did not get adopted all on its own. It needed a couple of pushes from the government -both, as it happens, largely to do with the military. As far as the ships were concerned, the same link between the merchant and military navy that had inspired the Navigation Acts in seventeenth-century England endured into twentieth-century America. The government's first helping hand was to give a spur to the system by adopting it to transport military cargo. The US armed forces, seeing the efficiency of the system, started contracting McLean's company PanAtlantic, later renamed Sea-land, to carry equipment to the quarter of a million American soldiers stationed in Western Europe. One of the few benefits of America's misadventure in Vietnam was a rapid expansion of containerization. Because war involves massive movements of men and material, it is often armies that pioneer new techniques in supply chains.

The government's other role was in banging heads together sufficiently to get all companies to accept the same size container. Standard sizes were essential to deliver the economies of scale that came from interchangeability - which, as far as the military was concerned, was vital if the ships had to be commandeered in case war broke out. This was a significant problem to overcome, not least because all the companies that had started using the container had settled on different sizes. PanAtlantic used 35-foot containers, because that was the maximum size allowed on the highways in its home base in New Jersey. Another of the big shipping companies, Matson Navigation, used a 24-foot container since its biggest trade was in canned pineapple from Hawaii, and a container bigger than that would have been too heavy for a crane to lift. Grace Line, which largely traded with Latin America, used a foot container that was easier to truck around winding mountain roads.

Establishing a US standard and then getting it adopted internationally took more than a decade.

Indeed, not only did the US Maritime Administration have to mediate in these rivalries but also to fight its own turf battles with the American Standards Association, an agency set up by the private sector. The matter was settled by using the power of federal money: the Federal Maritime Board (FMB), which handed out public subsidies for shipbuilding, decreed that only the 8 x 8-foot containers in the lengths of l0, 20, 30 or 40 feet would be eligible for handouts.

Match the following

Choose the option that is CLOSEST in meaning to the capitalized words.

TUMESCENT

Choose the option that is CLOSEST in meaning to the capitalized words.

TWADDLE:

Choose the option that is CLOSEST in meaning to the capitalized words.

STIMULUS

Each question below has blanks, each blank indicating that something has been omitted. Choose the set of words for each blank which best fits the meaning of the sentence as a whole.

Recently, global attention was focussed ____ these two items ____ India argued that the adoption of the protocol on trade facilitation should be postponed till a permanent solution ____ public stockholding for food security had been worked out.

Each question below has blanks, each blank indicating that something has been omitted. Choose the set of words for each blank which best fits the meaning of the sentence as a whole.

There is no doubt that India needs to equip its youth ____ greater work skills. At present, the country churns ____ a mostly semi-literate workforce without the requisite marketable skills ____ a globalised world

Each question below has blanks, each blank indicating that something has been omitted. Choose the set of words for each blank which best fits the meaning of the sentence as a whole.

There has been a slight decrease in agriculture growth ____ 3.8 per cent ____ 4 per cent a year ago

Each question below has blanks, each blank indicating that something has been omitted. Choose the set of words for each blank which best fits the meaning of the sentence as a whole.

That was the chronic shortage _____ specie, particularly ____ the years before the gold discoveries in Portuguese Brazil in 1693

Arrange the sentences A, B, C, and D from a logical sequence between sentences 1 and 6

1. The success of any unit in a competitive environment depends on prudent management sources.

2. In this context it would have been more appropriate if the concept of accelerated depreciation, together with additional incentives towards capital allowances for recouping a portion of the cost of replacements out of the current generations, had been accepted.

3. Added to this are negligible retention of profits because of inadequate capital allowances and artificial disallowance of genuine outflows.

4. One significant cause for poor generation of surpluses is the high cost of capital and its servicing cost.

5. The lack of a mechanism in India tax laws for quick recovery of capital costs has not received its due attention.

6. While this may apparently look costly from the point of view of the exchequer, the ultimate cost of the Government and the community in the form of losses suffered through poor viability will be prohibitive.

Arrange the sentences A, B, C, and D from a logical sequence between sentences 1 and 6

1. Count Rumford is perhaps best known for his observations on the nature of heat.

2. He undertook several experiments in order to test the theories of the origin of frictional heat.

3. According to the calorists, the heat was

produced by the "caloric" squeezed out of the chips in the process of separating them from the larger pieces of metal.

4. Lavoisier had introduced the term "caloric" for the weightless substance heat, and had included it among the chemical elements, along with carbon, nitrogen and oxygen.

5. In the munitions factory in Munich, Rumford noticed that a considerable degree of heat developed in a brass gun while it was being bored.

6. Rumford could not believe that the big amount of heat generated could have come from the small amount of dust created.

Arrange the sentences A, B, C, and D from a logical sequence between sentences 1 and 6

1. The idea of sea-floor spreading actually preceded the theory of plate tectonics.

2. The hypothesis was soon substantiated by the discovery that periodic reversals of the earth's magnetic field are recorded in the oceanic crust.

3. In its original version, it described the creation and destruction of the ocean floor, but it did not specify rigid lithospheric plates.

4. An explanation of this process devised by F.J. Vine and D.H. Mathews of Princeton is now generally accepted.

5. The sea-floor spreading hypothesis was formulated chiefly by Harry H. Hess of Princeton University in the early 1960's.

6. As magma rises under the mid-ocean, ferromagnetic minerals in the magma become magnetised in the direction of the geomagnetic field.

In the following passage there are blanks, each of which has been numbered. These numbers are printed below the passage and against each, five words are suggested, one of which fits the blanks appropriately. Find out the appropriate word in each case.

The world's climate has always changed and species have evolved accordingly to survive it. The surprising fact about the (A) between evolution and global warming is that it is not linear. (B) temperatures alone are not (C) of evolution.

Evolution is also the, (D) of seasonal changes.

In the following passage there are blanks, each of which has been numbered. These numbers are printed below the passage and against each, five words are suggested, one of which fits the blanks appropriately. Find out the appropriate word in each case.

The world's climate has always changed and species have evolved accordingly to survive it. The surprising fact about the (A) between evolution and global warming is that it is not linear. (B) temperatures alone are not (C) of evolution. Evolution is also the, (D) of seasonal changes.

In the following passage there are blanks, each of which has been numbered. These numbers are printed below the passage and against each, five words are suggested, one of which fits the blanks appropriately. Find out the appropriate word in each case.

The world's climate has always changed and species have evolved accordingly to survive it. The surprising fact about the (A) between evolution and global warming is that it is not linear. (B) temperatures alone are not (C) of evolution. Evolution is also the, (D) of seasonal changes.

In the following passage there are blanks, each of which has been numbered. These numbers are printed below the passage and against each, five words are suggested, one of which fits the blanks appropriately. Find out the appropriate word in each case.

The world's climate has always changed and species have evolved accordingly to survive it. The surprising fact about the (A) between evolution and global warming is that it is not linear. (B) temperatures alone are not (C) of evolution. Evolution is also the, (D) of seasonal changes.

Each question is a sentence broken into four parts. Select that part which has an error.

Each question is a sentence broken into four parts. Select that part which has an error.

Each question is a sentence broken into four parts. Select that part which has an error.

Each question is a sentence broken into four parts. Select that part which has an error

In the following set of questions, a word in capital is followed by four options. From the options, find the appropriate word that reflects the Opposite / Contradictory meaning (Antonym) to the given word.

OPPROBRIUM